No 5 (2011)

НАУКА

60-69 2708

Abstract

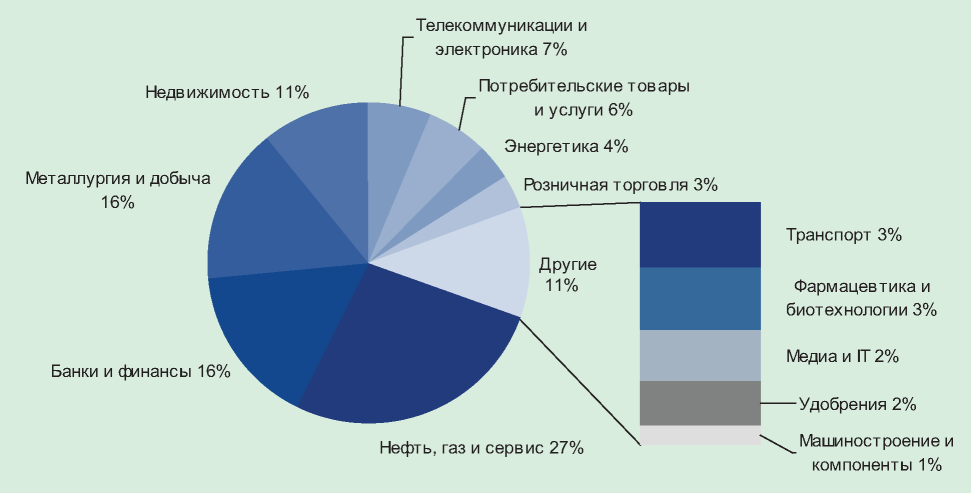

Global IPO markets achieved historical maximum in volumes in 2007 but as a result of the global financial crisis of 2008–2009 issuing activities substantially plummeted. However by the middle of 2009 capital markets began to revive. The paper provides the analysis of global IPO market trends and author’s view on the middle-term trends.

70-77 1886

Abstract

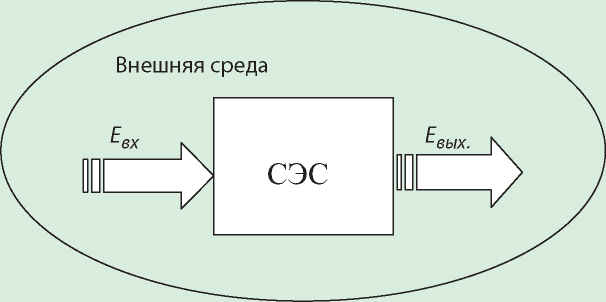

A model of resource and energy exchange of socio-economic systems (SES) to higher-level systems, which are external environment for them, has developed in this paper. The transformation of matter-and-energy resources in these systems includes processing resources of the external environment in output products, as well as the diversion of part of the resources for the development of the system. The resource balance and the overall scheme of resource exchange of SES with the external environment have built in this paper. Preconditions for the crisis arise in case of violation of balance of resources allocated for the holding of the production process and for the development of systems. Author also defined resource causes of crises socio-economic systems and determined that ensuring the balance between the available domestic material and energy resources, external resources attracted by SES, as well as the resources, that are being diverted to development, is the basic goals of crisis management of SES of any level.

78-84 1567

Abstract

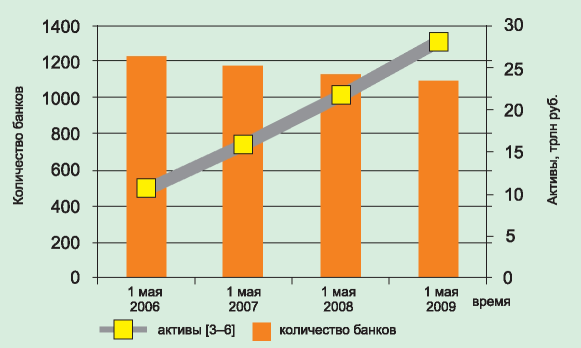

Paper is devoted to the method of increasing the banks through mergers and acquisitions. We propose a specific concept of merger. It is shown that this can be obtained economically significant results, including a substantial increase in capital and major key indicators of credit institutions.

86-92 2189

Abstract

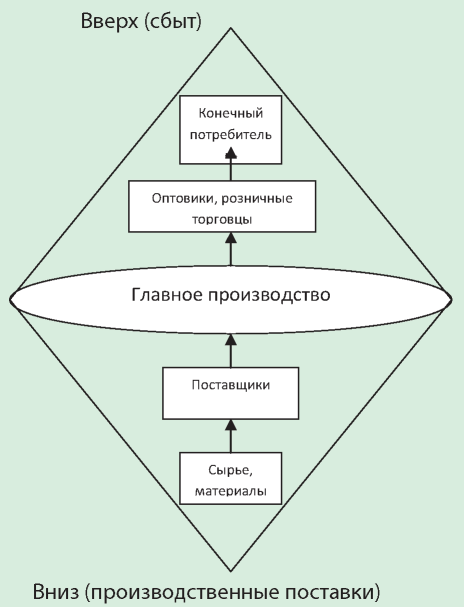

Formation and development of integrated corporate business structures is one of the indicators of the dynamics of growth and production efficiency. At the same time created a business structure must have not only efficiency, but also of strategic stability in the long run. Key strategies to achieve sustainability by corporate interests on the basis of an integration mechanism has been developed on practice.

SYSTEMS AND VALUE-BASED APPROACH SYNTHESIS IN THE PROCESS OF STRUCTURAL MODERNIZATION OF ENTERPRISES

94-97 1414

Abstract

The article analyzed the dynamics of stock prices in five years and identified the factors most market capitalization growth OJSC “AvtoVAZ” and OJSC “KamAZ”. Reviewed the concept of structural modernization of the enterprise as a tool to implement its strategy. It is the structural modernization of enterprises is an effective tool of improving their fair value and market capitalization in the medium and long term period.

98-101 1388

Abstract

In the article the system of indicators of economic analysis of integration processes in crisis management company is considered. Substantiates the proposed method approach to evaluating the effectiveness of integration, which is being finalized by the author to the theory of crisis management. The focus is on evaluating the effectiveness of integration synergies. Analysis of the integration of enterprises should be seen as a joint investment project, which provides an increase of market value.

102-105 3325

Abstract

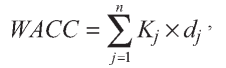

As a rule there are significant changes in the capital structure due to mergers and takeovers that's why the management task at the prediction stage is a correct evaluation of these changes influence on the cost of the future company. This article contains methods of evaluating the capital structure influence on the company cost within different evaluation approaches and the most detailed description of the methods used within the income approach. Here is a method of calculating a weighted average cost of capital based on the capital asset pricing model (CAPM) and restrictions connected with this model use. It is defined whether there is a necessity to correct the predicted cost of attracting own or borrowed assets.

ISSN 2618-947X (Print)

ISSN 2618-9984 (Online)

ISSN 2618-9984 (Online)