No 3 (2016)

НАУКА

60-68 8790

Abstract

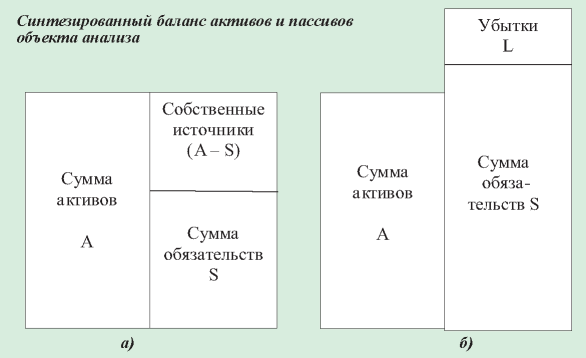

Currently, the crisis management felt the need to develop a methodology for analyzing the financial condition of persons who are not a standard financial statements. The paper was developed this technique and gives examples of its application. The technique can be used to analyze the financial condition of citizens in respect of which the action is pending bankruptcy.

70-77 2170

Abstract

The aim of the study was to determine the role of self-regulation as one of the key strategic elements in the reconstruction of the financial system in crisis. Approaches – including analysis of the causes and consequences of the global financial crisis in 2008, the monographic literature on the subject identified challenges and their solutions for implementation of self-Regulation of the financial sector (results of research). Social value – the current situation of the crisis of investor confidence in the financial sector requires substantial organizational restructuring. The confidence of investors in adjustable and adequate operation of the financial sector is key for ensuring long-term economic recovery in conditions of the ongoing financial crisis. Practical application of the results is justified practical necessity of establishing responsibility for regulating and minimizing systemic risk of financial firms, the establishment of the state strategy of generating and maintaining an effective method of state regulation and control, defining key goals of economic policy, and have oversight and control over the development of the system of self-regulation (compliance programs) promoted by the sector. The originality lies in the fact that in the scientific revolution introduced the theoretical conclusions, the modern practice of self-regulation of the financial services sector with strong governmental control.

78-81 2982

Abstract

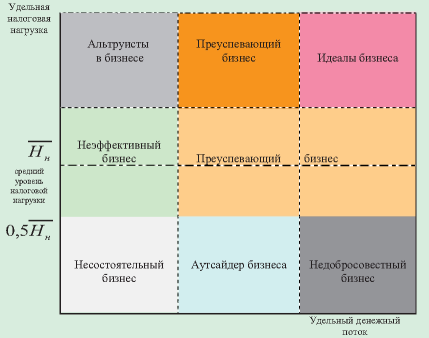

Below is the original author's approach to the companies' tax risks valuation based on the comparison of the tax and financial statements. Algorithm of the tax risks identification based on the criteria settled by the note of the Federal Tax Authority of Russian Federation from 17.07.2013 №АС-4-2/12722 "About tax authorities committees operation on legalisation of the tax base" is described. Model of the companies classification by tax risks based on the tax burden and specific cash flow is provided.

82-85 1274

Abstract

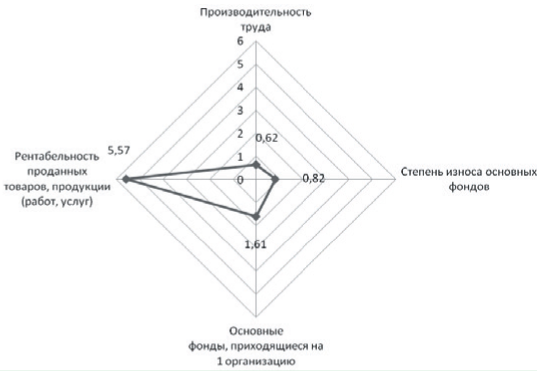

The problems faced by domestic textile enterprises are described. The basic indicators of textile industry of the Vladimir region by normalizing the values relative to the Ivanovo region, which occupies a leading position in the CFD. Despite the exceedance of the indicator of profitability of goods sold, in the Vladimir region is significantly below labour productivity, fixed assets of textile enterprises significantly worn. Stability analysis of reproduction processes of the textile industry of these regions allowed us to identify the relevant equation: labour productivity from time to time for Vladimir region and - the degree of wear of fixed assets from time to time for the Ivanovo. The need for technical renovation of enterprises, the industry, which needs investment and sectoral policies is conclused.

86-93 2718

Abstract

Non-cash payments provide a small part of total payment volume, but the usage of innovative products in named area is growing quite rapidly. The present study attempts to identify the factors determining consumers’ acceptance of payment innovation with the aim of developing a conceptual model of payment services acceptance. A research model that reflects economic, technological and socio-demographic factors are all important determinants for payment services adoption and use. Besides, there are specific correlation between them. To simulate the behavior of the consumer it was due to use parameters that reflect the actual level of awareness of innovation, the intention to use and real use of innovation. The result was the conceptual model developed in this research that focuses on factors determining consumers’ acceptance of payment services and their statement.

ISSN 2618-947X (Print)

ISSN 2618-9984 (Online)

ISSN 2618-9984 (Online)