НАУКА

The crisis of the developers of science intensive defense articles concerns with the loss of the companies’ scientific-manufacturing potential during the reforms of the domestic economics. Restoration of the scientific-manufacturing potential of the developers of science intensive defense articles is complicated by some facts including that the state customer of the development employs organizational-economic approaches to the development funding that doesn’t correspond to the development features. Organizational-economic approaches to the development funding used by the state customer create the prerequisites for their low profitability and unprofitableness, i.e. are “crisis”. Organizational-economic approaches to the development funding are realized through the contract management system of the development on the setting of the state contracts funding volume. It means that the contract management system of the development regarding funding (and price formation) and setting of manufacturing-property conditions doesn’t correspond to the development as a managed object. That inconsistency is one of the most important prerequisites of current crisis state of the science intensive products developers. Crisis state of the science intensive products developers shows up primarily in the decline of the quality and low profitability of the science intensive defense articles. The article shows antirecessionary organizational-economic approaches to funding and establishment of manufacturing-property conditions of the defense articles development that correspond to the development features, provide state support of the scientific-manufacturing potential of the developers of science intensive defense articles, provide antirecessionary development management and should be reflected in the contract management system of the development.

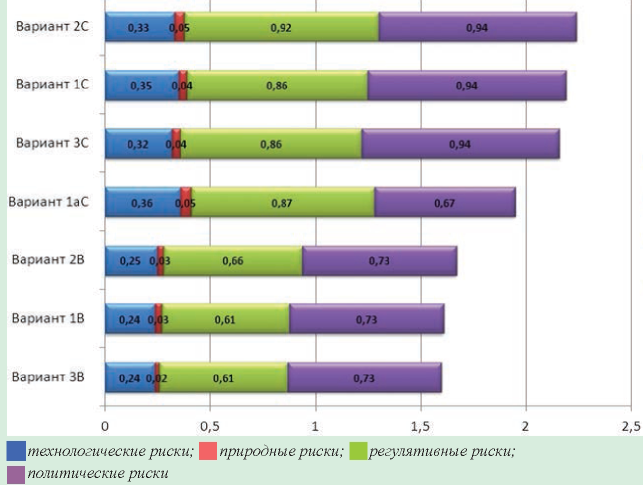

The article focuses on the identification, qualitative and quantitative risk assessment, make recommendations for non-insurance risk mitigation techniques, the development of the insurance program оbjects of the gas pipeline “South Stream”.

The influence of major factors on financial policy of the Russian companies is considered. The author researches process of change of an equity (recycling) in the conditions of financial con-straints. The given work tries to give the answer to a question - whether there is a redistribution of an equity in the company. The models considered in work are tested for a subject of a choice of the most adequate, from the point of view, forecasting. For each of models three kinds of specifications are estimated: pooled regression, regression with a random effect and regression with the fixed ef-fect. Task of the presented work is penetration into an essence of financial policy of the Russian companies: whether there is a dividend payout of shareholders in process an equity recycling or the received incomes go on development the companies (reinvesting). Novelty of the presented work consists in consideration an equity recycling as mechanism with which help the Russian companies direct the income of an equity on its shares repurchase and accumulations of profit for the reinvesting. Equity recycling gives the chance to reserve the companies certain level of a debt for the further use as a financing sources. Besides, influence of other sources of financing is considered in the conditions of financial constraints. The Russian companies resolve a problem of adverse selection (a choice of the cheapest sources of financing — profit). The author notices that low information asymmetry allows the companies to choose cheaper sources of financing. The mechanism an equity recycling gives the chance to the companies to regulate the debt level, actively correcting capital structure.

In the current economic conditions, characterized by high level of uncertainty, the need to achieve strategic financial goals of the company and ensuring its long-term financial stability is impossible without an effective system of strategic financial management, an integral part of which is a risk management strategy reduce financial stability. The author loss risk management strategy of financial stability, substantiated scientific and methodological tools of its creation, outlines the basic principles of implementation, performed updated list of the functions. In order to maximize approximation developed strategies to the needs of industrial enterprises and economic instability are highlighted and ordered typical violations of risk management process by the author. Generalizes the scheme proposed risk management strategy losing financial stability. Outlines the key steps in developing and implementing strategies under consideration with their detailed description.

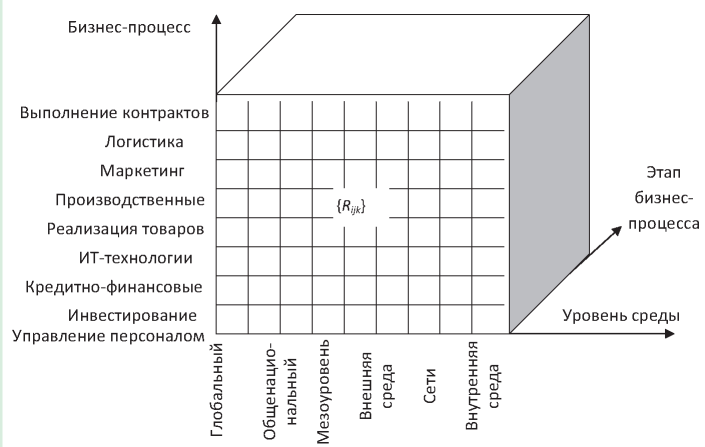

Multifaceted manifestations of uncertainty in the economy sometimes impossible task of putting her nomination universal definitions, concepts that could be generalized together all the cha-racteristics of ambiguity, inaccuracy and unpredictability. This problem is largely dictated by the requirements of the methodology of economic theory, where the construction of scientific concepts is in line with the conventionally known and established notions. The article focuses on the problem of categorization uncertainty. Disclosure of communications of uncertainty associated phenomena, i.e. manifestations of risk, economic security and stability. The basic determinants of un-certainty condition are summarized and supplemented. The article specifies the main function of uncertainty and systematizes its typical error.

ISSN 2618-9984 (Online)