НАУКА

Scientific investigations and development of new technologies (ID) benefit society more than the profit the innovator derives. Thus innovation research key point is spillover effect consideration: as far as the other firms will also get off-the-shelf technology access (probably with temporary lag), innovator-enterprise doesn’t receive all the profit from the performed ID. Consequently, a lot of companies are inclined to limit investments in ID, particularly in case of liquidity shortage.

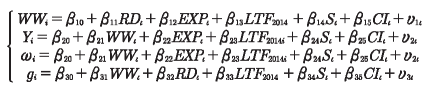

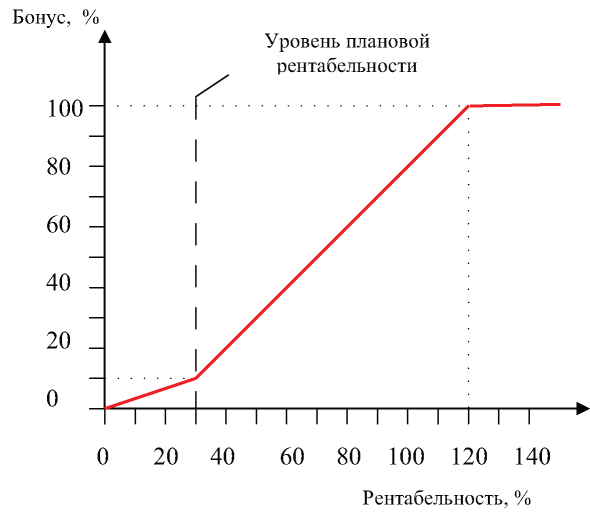

The article presents the results of investigation of liquidity limitation influence on the companies’ decision to invest in ID, the amount of investment and the effectiveness of innovative activity. Hard liquidity limitation happens to be, when the company doesn’t have access on capital markets (for example, in connection with financial downfall or property shortage for credit loan guarantee), soft – where feasible to obtain credit, but loanable funds price is higher than profitability of its activity. The direct indicator of credit restriction is used for analyzing, and the economic model which determines interrelation between companies’ decision to invest in ID, the amount of these investments and the effectiveness of innovative activity. Obtained results demonstrate that restrictive financial indicator has positive significant connection with the companies’ decision to invest in ID, and doesn’t influence the amount of these investments in case of positive decision. Thus far from every industrial company decide to invest in ID in virtue of liquidity limitation, but for those who invest the amount of investments doesn’t depend on liquidity limitation. It is explained with the fact that availability of own funds is more important than credit possibilities in accepting the companies’ decision of ID investment.

Cash effect is also proved, the effect when a big company has great available assets that makes ID and innovations financing easier, and inverse U-dependence is proved between the market level of competition and innovations.

It was concluded that small companies and companies of low-tech branches need investments which simplify imitation of off-the-shelf technologies from developed markets but not the ID intensity increasing.

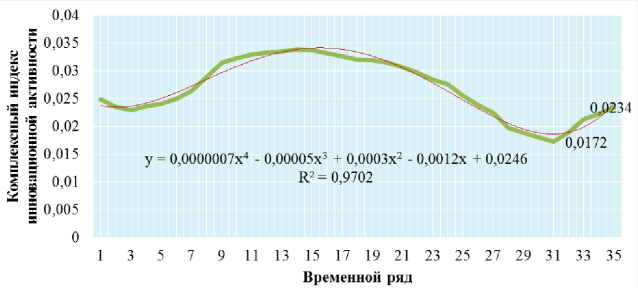

The developed method of multicriteria assessment of the level of innovative activity of the oil-producing companies, which can be used to form a strategy for sustainable development of the enterprise, industry; improve the management of innovative activity of oil companies. The use of this technique gives practical tools to improve the quality of decisions regarding the provision of state support for real innovation projects, which in turn contributes to a more effective spending of budgetary funds.

The article describes the algorithm of methodology for assessing the innovative activity of the oil-producing companies, which includes a series of sequential steps with the use of special software for statistical analysis of the Microsoft Excel 2013 and Statistica Advanced for Windows v.10.

ISSN 2618-9984 (Online)