НАУКА

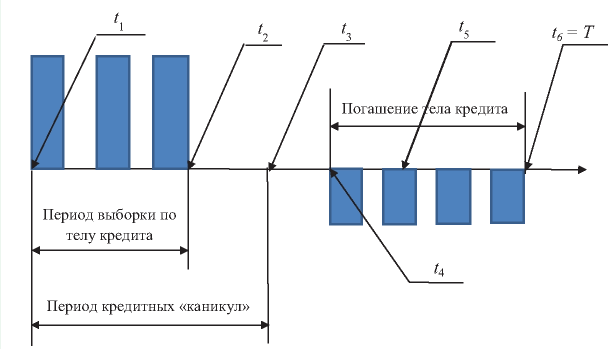

At this moment there are a lot of economic literature and methodical recommendations, including IAEA standards, where question of investment projects efficiency valuation are enough worked out, with conception description of how to take into account loans and financial leasing costs according to alternative methods being assumed. Nonetheless, it’s failed to address the issue to the capitalized costs informational block-schedule and methodical approach, allowing to module the loans and the financial leasing accounting parameters, with the capitalized costs being assumed on the design and the construction stage of the science-intensive projects (aircraft manufacturing, nuclear power engineering).

Also on the design and the construction stage it weren’t worked out the methodical recommendations, allowing to be assessed the influence of the capitalized costs and incurring losses by the tax expense from continuing operation calculation from the point of view of accounting standards and tax legislation on net present value and financial stability of project.

In this way the task to work out the methodical approaches and recommendations, allowing to model the loans and the financial leasing accounting parameters, and to carry out the assessment of the capitalized costs influence on the net present value and the financial stability of the project are current importance task. In the article authors stipulate that capitalized costs of the loans and the financial leasing and also the capitalized amortization & depreciation are the effective instrument of financial stability and net present value project managing.

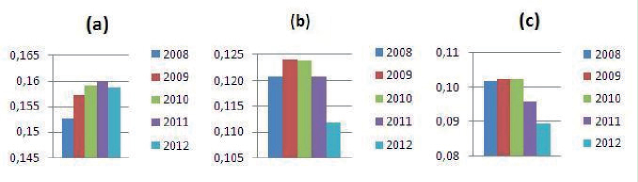

Features of influence of opportunity cost on the cash policy of the Russian companies are considered. The author analyzes relationship of cause and effect of escalating of cash. The author researched features of a choice the Russian companies of sources of financing. The author shows that availability of opportunity costs forces the companies to be reoriented on internal sources of financing. Opportunity costs are the indicator for a choice of optimum financing. The model (specification) presented in work is tested for determination of its adequacy, from the point of view of quality of forecasting. It is estimated three kinds of specifications: pooled regression, regression with a random effect and regression with the fixed effect. The purpose of work attempt to open cash puzzle of company disclosing of a puzzle. That is, to reduce opportunity costs for preserving of cash as the preventive motive, allowing to struggle with financial restrictions. Novelty of the presented work consists that the companies can rationally manage cash holdings, using negative shocks (signals) in the capital market, to expect them and without supposing the situations connected with financial restrictions.

ISSN 2618-9984 (Online)