Scroll to:

THE RELATIONSHIP OF FINANCIAL STRATEGIES AND DYNAMICS OF DEVELOPMENT OF INDUSTRIAL COMPANIES

https://doi.org/10.17747/2618-947X-2019-1-52-57

Abstract

Apattern of mutual independence of financial position of industrial companies and credit institutions was identified. The issues of development of industrial companies in difficult economic conditions, the causes and consequences of deterioration of credit institutions, the issues of control over the flow of funds from the real sector of the economy to the financial sector are studied as cause-effect relationships in development of industrial companies and the overall change in the macroeconomic environment.

Keywords

For citations:

Stepanyan A.V. THE RELATIONSHIP OF FINANCIAL STRATEGIES AND DYNAMICS OF DEVELOPMENT OF INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2019;10(1):52-57. https://doi.org/10.17747/2618-947X-2019-1-52-57

-

INTRODUCTION

In an unstable economic environment, the problem of financing real sector enterprises in Russia is particularly relevant (Trachuk, 2014; Trachuk, Linder, 2016).

Maintenance of investment activity of actors of real sector of economy and effective distribution of factors of production is closely connected with development of financial sector which stimulates economic growth. At the same time, the excessive depth of the financial sector development can be a factor of financial and, subsequently, macroeconomic destabilization, as it is associated with the risks of forming "financial bubbles" and the decline in the stability of the financial system. The consequences of the global financial crisis, among other things, set a new research task to determine the optimal depth of development of the financial sector, which would contribute to economic growth and maintain macroeconomic stability.

The report of the Bank of Russia (Report, 2018) provides an overview of the existing empirical research in the country-level perspective (Bezemer, Grydaki, Zhang, 2014), which does not give a clear answer to the effectiveness of the expansion of bank lending in terms of economic growth. According to the data of the several dozen of countries for a decade, there is a strong positive relationship of credit flows (bank lending rates) and the GDP, there is no significant positive influence of the aggregate volume of credit to non-financial entities on the GDP growth (Bezemer, Grydaki, Zhang, 2014). The correlations between lending and GDP growth were positive until the late 1990s, after which the relationship visibly weakened or disappeared, largely due to the inclusion of the global financial crisis into the study period (Levine, 2005).

According to several empirical studies (Arcand, Berkes, Panizza, 2012; Cecchetti, Kharroubi, 2012; Shen, Lee, 2006), it is possible to determine the threshold requirement of the ratio of loans to GDP, the excess of which affects economic growth negatively (too much finance effect). After the volume of bank lending reaches 80-100% of gross domestic product, the subsequent deepening of lending ceases to contribute the acceleration of economic growth in the long term and leads to a slowdown, as well as to an increase in the volatility of economic growth (Easterly, Islam, Stiglitz, 2000). The task of determining the optimum in the development of the financial sector does not have a universal solution, since the latter has significant country differences and historical features.

-

CHANGES IN THE FINANCIAL SECTOR OF THE RUSSIAN ECONOMY AND THE IMPACT ON THE REAL SEQOR OF THE ECONOMY

Since 2008, the banking sector has been increasingly exposed to negative phenomena and risks associated with the peculiarities of the formation of the Russian banking sector from the late 1980s to the early 2000s. For example, the peculiar captivity implies the bank's dependence on operations with the beneficiary and/or on its decisions concerning the bank's activity, such dependence can significantly affect financial stability. Banks financed projects of their owners, for example, in the form of creation or modernization of production complexes, participation in import substitution programs, and this led to a high concentration of credit risks. The involvement of banks in individual financial projects implemented by their owners, the inadequate evaluation of such projects and the absence of assets diversification were often the reasons for the banks bankruptcy and the cessation of industrial projects financing, which in turn led to the bankruptcy of the real sector.

The relation of the actual beneficiaries of the banks and funded enterprises was often hidden as a sign of financial fragility in the form of a circuit implementation of transactions, which allowed to demonstrate the compliance of prudential norms. The discovery by the Bank of Russia of such phenomena in the activities of banks required the introduction of appropriate legislative changes in the system of banking regulation.

The increase in the number of credit institutions, the main activity of which was to finance the owners' projects at the expense of borrowed funds, was the result of the "overheating" of the Russian banking sector, which has obvious negative consequences for the real sector of the economy. If the negative consequence for the credit institution is the concentration of credit risk and the absence of assets diversification, the enterprise becomes completely dependent on the credit institution, if the main and sometimes the only financing sources of enterprise economic activity are bank loans of the credit institution.

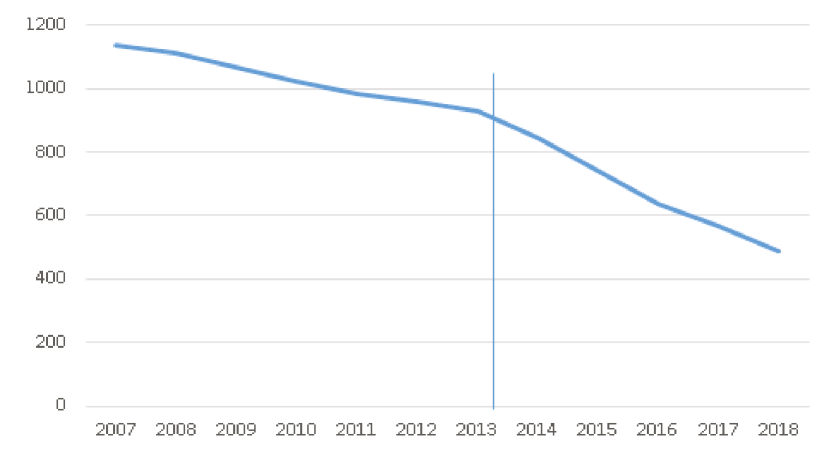

Since the fourth quarter of 2013, the Central Bank of the Russian Federation has been systematically improving the banking sector. As a result, the number of operating banks decreased more than twice — from 1092 at the beginning of 2008 to 517 banks at the end of 2017.

We compared the events that took place during the conditionally defined "overheating" of the Russian banking sector, and the events of the global financial crisis of 2008- 2009 (table. I). The prerequisites for the global financial crisis were the "bubble" in the mortgage market in the United States and the subsequent inseparable economic interdependence of the subjects of the formed market as a result of the transformation of a standard banking product (mortgage loan) into a security (derivative financial instrument).

Taking into account the results of the above empirical studies, revealed similar signs indicate that the deepening of the financial sector/lending in the absence of adequate regulatory base, including in terms of monitoring of banking operations and abuse by market participants, has a negative impact on the activities of all economic actors.

-

ANALYSIS OF LEGAL ENTITIES BANKRUPTCY DYNAMICS

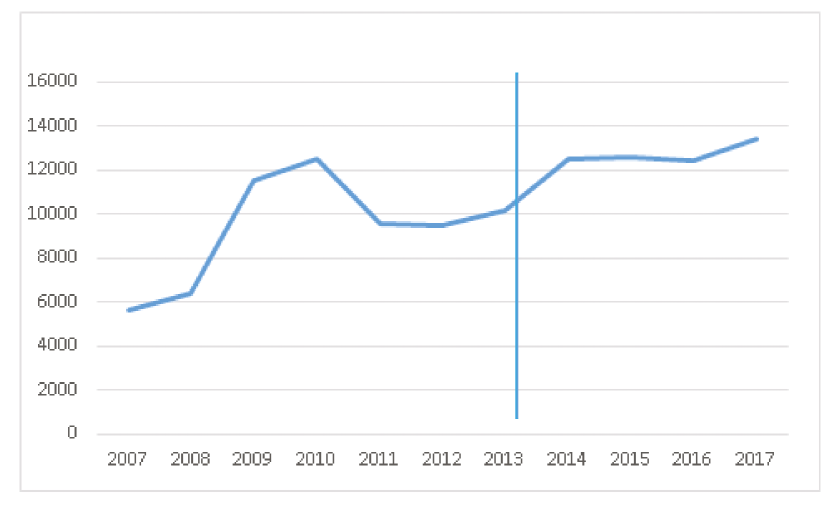

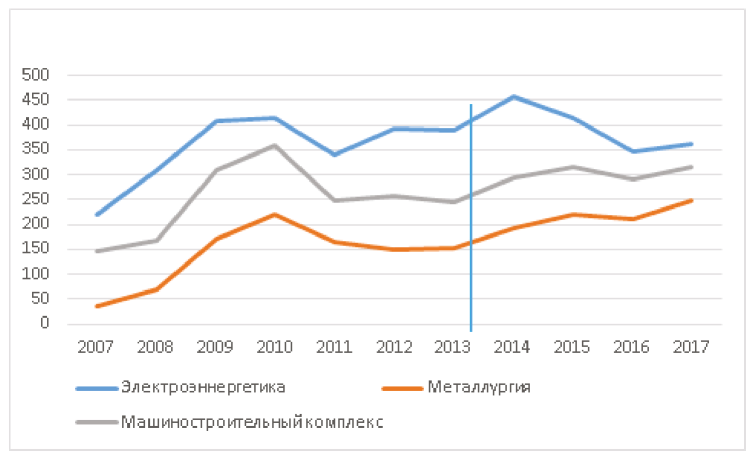

Fig. I presents data on the number of companies recognized by arbitration courts as insolvent (bankrupt) from 2007 to 2017, when the Russian banking sector underwent significant transformation changes. As noted above, the transition to the recovery of the banking sector, conducted by the Bank of Russia on a systematic basis, began in the fourth quarter of 2013. Dynamics of bankruptcy of industrial sector companies (Unified state register) (Fig. 2) indicates that the growth in the number of bankrupt companies coincided with the growth in the number of banks whose licenses were revoked by the Bank of Russia (Reference book on credit institutions) (Fig. 3).

Tabulation 1

Comparative analysis of the peculiarities of foreign and Russian financial sector development

|

The Global Financial Crisis of 2008-2009 |

"Overheating" of the Russian banking sector |

|---|---|

|

Prerequisites |

|

|

Demand stimulation and excessive consumer mortgage lending in the United States market Transfonnation of a standard banking product (mortgage loan) into a security (derivative financial instrument) Absence of legal mechanisms for proper regulation of the financial market |

Increase in the number of credit institutions since the early 1990s Financing of projects of credit institutions owners and concentration of credit risk Absence of legal mechanisms to regulate the banking sector |

|

Consequences |

|

|

Continuous economic interdependence of participants of mortgage- backed securities market (cross-border level) Securities default as a result of improper asset quality assessment Significant deterioration in the financial standing of financial institutions Abuse of financial market entities (concealment of the assets real value) |

Continuous economic interdependence of the results of the financed enterprise and the financial standing of the credit institution Loans default as a result of improper assessment of asset quality (projects in the real sector of the economy) Significant deterioration in the financial standing of credit institutions Abuse of the management of credit institutions (concealment of the assets real value, withdrawal of assets) |

|

Result |

|

|

Reduction in the number of financial institutions as a result of bankruptcy State support of systemically important financial institutions Changes in financial market regulation |

Reduction in the number of financial institutions as a result of license revocation, bankruptcy State support for systemically important financial institutions (creation of the Fund for the consolidation of the banking sector in 2017 by Bank of Russia) Changes in the system of banking regulation |

Based on the data of the Central Bankof the RussianFederation (Results, 2018), we studied the activities of 10 credit institutions, whose licenses were revoked from 2014 to 2016. [Reference book on credit institutions]. These credit institutions have been operating in the market since the first half of the 1990s, mainly engaged in corporate lending. The largest share of assets were loans to legal entities and to a lesser extent to individuals. The reason for such a measure was the failure to comply with Federal laws regulating banking activities and regulations of the Bank of Russia, the value of the adequacy ratio of own funds (capital) below 2 %, the reduction in the amount of own funds (capital) below the minimum value of the authorized capital established on the date of state registration of the Bank, repeated application within one year of measures provided by law (Federal law, 2002).

Fig. 1. Dynamics of legal entities bankruptcy The vertical line shows the beginning of the banking sector recovery

Fig. 2. Dynamics of legal entities bankruptcy by industries The vertical line shows the beginning of the banking sector recovery

-

FINANCIAL STRATEGY AND IMPACT ON THE FINANCIAL STANDING OF THE ENTERPRISE

An integral part of the overall corporate development strategy is the financial strategy: ways to attract financial resources, the formation of a centralized financial Fund and its further distribution according to the needs of the enterprise. In turn, one of the directions of the financial strategy of an economic entity is to attract sources of financing in the form of bank loans.

The analysis of financial and economic activity of the companies is carried out on the basis of data of accounting (financial) statements of legal entities (Federal state statistics service; The unified Federal register]) and media data. The gradual deterioration of key financial indicators was revealed:

- significant reduction in revenue and primecost, indicating a significant drop in production volumes;

- loss-making activities;

- a significant reduction in or a negative value of the net assets;

- significant growth of receivables and payables;

- disposal of non-current assets.

The debt burden is related to the capital structure, which is the ratio between equity capital and debt. Determination of the optimal capital structure and factors influencing the decision-making on the capital structure is considered in detail in the scientific literature. A significant leverage increases financial stability risks and can have a limiting impact on the company's development.

Fig. 3. Number of operating credit institutions The vertical line shows the beginning of the banking sector recovery

Tabulation 2

Interrelation of global financial crises, as well as complex economic conditions and dynamics of bankruptcy

|

Stage 1 (March 2014 — March 2015) |

Stage 2 (April 2015 — October 2015) |

Stage 3 (November 2015 — December 2016) |

Stage 4 (January 2017 — December 2017) |

|

|---|---|---|---|---|

|

Factors (drivers) |

||||

|

Closure of external financial markets. Exchange rate volatility growth Increase in interest rates (due to the increase in the key rate of the Central Bank) Deterioration of refinancing conditions for companies |

Exchange rate volatility Reduction of interest rates (due to reduction of the key rate of the Central Bank) Improvement of refinancing conditions for companies |

Stagnation of fixed capital investment |

Slow recovery of investment demand |

|

|

Period of stability in interest rates Period of stability in interest rates |

Policy of conservative reduction of the key rate Policy of conservative reduction of the key rate Policy of conservative reduction of the key rate |

|||

|

Decline of enterprises profitability Reduction in aggregate demand

|

Increase in enterprises profitability Reduction in aggregate demand

|

Increase in enterprises profitability Protracted decline in real disposable income

|

||

|

Stagnation of solvent consumer demand

|

||||

| Effect | ||||

|

Growing number of bankruptcies in the economy |

Decrease in the bankruptcies intensity |

Stabilization of the intensity of bankruptcies, but above the precrisis level |

The rise of a new wave of bankruptcies: return to crisis values |

|

In addition, it is possible to identify the main drivers of enterprises bankruptcy associated with financial factors (marked in color in the table. 2), especially in the period of the greatest number of bankruptcies, which also indicates a significant interdependence of the financial and real sectors of the economy (Rybalka, Salnikov, 2018). The increase in the number of bankruptcies coincides with the onset of crisis phenomena in the global and national markets (stages I and 4).

-

THE RESULTS OF THE SURVEY OFTHE BANK OF RUSSIA

With the aim of exploring the expectations of the enterprises for 2018 and the planned increase in the output, the Bank of Russia conducted a survey of producers of industrial and agricultural products (236 respondents):

- Most companies did not plan to reduce the volume of investment in fixed assets: 45% of companies planned to increase them, to leave at the same level — 38%.

- Only 17% of respondents say that in 2018 they plan to reduce investment plans.

- Exporters' average expected change in fixed capital investment is significantly higher than at enterprises not engaged in export activities (35% vs. 19%). Thus, capacities for production of new, competitive in the world market are created.

- Large enterprises employing more than 1,000 people in a greater degree increase investments (average of 42.2%) Smaller companies are planning a much smaller increase or even a reduction in investment (Enterprises, 2018).

-

MAIN CONCLUSIONS

The Russian banking sector is characterized by captivity, which is often expressed in lending to individual projects of the bank's owners in the real sector of the economy (industry) without proper assessment of the quality of financed projects and entails corresponding negative consequences for both parties. Given the mutual dependence of credit institutions and enterprises of the real (industrial) sector of the economy, the bankruptcy of the former may entail the bankruptcy of the latter and vice versa.

The debt burden of companies has a negative impact on the dynamics of investment activity in crisis and post-crisis periods. The main systemic risks of the banking sector are associated with the deterioration of the solvency of borrowers and the threat of accumulation of assets of inadequate quality, the accumulation of credit risks negatively affects the stability of the banking system.

Also, the systematic influence of the Bank of Russia on the management of lending to industrial enterprises is studied, which in turn has an impact on economic growth and development of the banking sector, the stability of which reflects the state of the national economy.

Thus, there is a whole range of financial factors that influence the management of industrial enterprises development from the point of view of sustainable and stable functioning in difficult economic conditions, which is a particularly urgent research task at the present time.

References

1. Edinyj gosudarstvennyj reestr yuridicheskikh lic. ([b.g.]). [Unified State Register of Legal Entities. ([s.a.]). (In Russ.).].https://egrul.nalog.ru.

2. Edinyj federal'nyj reestr svedenij o bankrotstve. ([b.g.]). [Unified Federal Register of Bankruptcy Information ([s.a.]). (In Russ.).]. https://bankrot.fedresurs.ru.

3. Itogi desyatiletiya 2008–2017 godov v rossijskom bankovskom sektore: tendencii i faktory (2018). № 31. Iyun // Central'nyj bank Rossijskoj Federacii. [The results of the decade 2008–2017 in the Russian banking sector: trends and factors. 2018. № 31. June. The Central Bank of the Russian Federation. (In Russ.).]. https://www.cbr.ru / Content / Document / File / 43933 / wps31.pdf.

4. Kartoteka arbitrazhnykh del. ([b.g.]). [The database of arbitration cases. ([s.a.]). (In Russ.).]. http://kad.arbitr.ru.

5. Predpriyatiya smotryat na 2018 god s umerennym optimizmom: rezul taty oprosa: Analiticheskaya zapiska Departamenta issledovanij i prognozirovaniya Banka Rossii. Yanvar 2018 g. // Central'nyj bank Rossijskoj Federacii. [The enterprises are looking at 2018 with a moderate optimism: the results of poll: Analytical note of the Research and Forecasting Department of the Bank of Russia, January 2018. The Central Bank of the Russian Federation. (In Russ.).]. https://www.cbr.ru / Content / Document / File / 33601 / analytic_note_180129_dip.pdf.

6. Rybalka, A. Sal'nikov V. (2018). Bankrotstva yuridicheskikh lic v Rossii: osnovnye tendencii IV kvartal 2017 / Centr makroekonomicheskogo analiza i kratkosrochnogo prognozirovaniya (CMAKP). [B.m.]. [Rybalka A., Salnikov V. (2018). Bankruptcy of legal entities in Russia: main trends IV quarter 2017 / Center for Macroeconomic Analysis and Short-term Forecasting. [S. l.]. (In Russ.).]. http://www.forecast.ru / _ARCHIVE / Analitics / PROM / 2017 / Bnkrpc-4–17.pdf.

7. Spravochnik po kreditnym organizaciyam ( [b.g.]) // Central'nyj bank Rossijskoj Federacii. [The database of credit organizations. The Central Bank of the Russian Federation. (In Russ.).]. http://www.cbr.ru / credit / main.asp.

8. Trachuk, A. V. (2014). Koncepciya dinamicheskikh sposobnostej: v poiske mikroosnovanij // Ekonomicheskaya nauka sovremennoj Rossii. 4(67):39–48 [Trachuk, A. V. (2014). The concept of dynamic capabilities: in search of micro bases. Economic science of modern Russia. 4(67):39–48. (In Russ.).].

9. Trachuk, A. V. Linder, N. V. (2016). Vliyanie ogranichenij likvidnosti na vlozheniya promyshlennykh kompanij v issledovaniya i razrabotki i rezul tativnost innovacionnoj deyatel nosti // Effektivnoe antikrizisnoe upravlenie. 1:80–89. [Trachuk, A. V., Linder, N. V. (2016). The impact of liquidity constraints on the investment of industrial companies in research and development and the effectiveness of innovation. Effective crisis management. 1:80–89. (In Russ.).].

10. Federal'naya sluzhba gosudarstvennoj statistiki ([b.g.]). [Federal State Statistics Service ([s.a.]). (In Russ.).]. http://www.gks.ru.

11. Federal'nyj zakon «O Central'nom banke Rossijskoj Federacii Banke Rossii» ot 10.07.2002 N 86 FZ // Konsul'tantPlyus [Federal Law «On the Central Bank of the Russian Federation (Bank of Russia)» dated July 10, 2002 No. 86 FZ. Konsul'tantPlyus. (In Russ.).]. http://www.consultant.ru / document / cons_doc_LAW_37570 / .

12. Arcand, J. L., Berkes, E., Panizza, U. (2012). Too Much Finance IMF Working Paper. 161. https://www.imf.org / en / Publications / WP / Issues / 2016 / 12 / 31 / Too-Much-Finance-26011.

13. Bezemer, D., Grydaki, M., Zhang, L. (2014). Is Financial Development Bad for Growth Groningen: University of Groningen, SOM research school. (SOM Research Reports; 14016 GEM).

14. Easterly, W., Islam, R., Stiglitz, J. (2000). Shaken and stirred: explaining growth volatility. In: B. Pleskovic, N. Stern (Eds.). Annual World Bank Conference on Development Economics. New Hampshire: World Bank Publications. 191–211.

15. Cecchetti, S. G., Kharroubi, E. (2012). Reassessing the impact of finance on growth. BIS Working Papers. 381. https://www.bis.org / publ / work381.pdf.

16. Levine, R. (2005). Finance and Growth: Theory and Evidence. In: Handbook of Economic Growth, ed. by P. Aghion, S. Durlauf. New York: Elsevier. 865–934.

17. Shen, C. H., Lee, C. C. (2006). Same financial development yet different economic growth: Why Journal of Money, Credit and Banking. 38(7):1907–1944. DOI: http://dx.doi.org / 10.1353 / mcb.2006.0095.

About the Author

A. V. StepanyanRussian Federation

Manager at Ernst Young (CIS) B. V., Moscow branch. Research interests: strategy and management of development of the industrial companies.

Review

For citations:

Stepanyan A.V. THE RELATIONSHIP OF FINANCIAL STRATEGIES AND DYNAMICS OF DEVELOPMENT OF INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2019;10(1):52-57. https://doi.org/10.17747/2618-947X-2019-1-52-57