Scroll to:

TRANSITION TO SUSTAINABILITY: AN EMPIRICAL ANALYSIS OF FACTORS MOTIVATING INDUSTRIAL COMPANIES TO IMPLEMENT ESG PRACTICES

https://doi.org/10.17747/2618-947X-2021-3-262-272

Abstract

Currently, more and more companies follow the principles of sustainable development and implement ESG practices in corporate strategies. At the same time, a number of Russian companies experience barriers to implementing ESG practices and do not have the necessary competencies to build work on the implementation of sustainable development practices. In this context, it is important to understand the factors contributing to the implementation of ESG practices in Russian industrial companies.

The research presented in the article is based on the data of a survey of 167 industrial companies. The results obtained allow us to speak about a variety of factors influencing the implementation of environmental, social and managerial initiatives. Thus, new technologies, consumer expectations, companies’ work on international markets, and regulatory requirements are the key factors in the implementation of environmental practices by industrial companies. Costs of current operations, the presence of a division and/or manager responsible for achieving sustainability goals, investment attractiveness, profitability of operations and operational efficiency improvements are drivers for the introduction of social practices by industrial companies. The implementation of management practices is most influenced by the factors of having units responsible for achieving sustainability goals, consumer expectations, companies’ performance in international markets, investment attractiveness and costs of current operations.

The results of the study lead to conclusions about the need to create specialized units responsible for the implementation of sustainable development goals, to introduce new technologies, to pay attention to employee development and their social security in order to successfully achieve sustainable development goals.

Keywords

For citations:

Lisovsky A.L. TRANSITION TO SUSTAINABILITY: AN EMPIRICAL ANALYSIS OF FACTORS MOTIVATING INDUSTRIAL COMPANIES TO IMPLEMENT ESG PRACTICES. Strategic decisions and risk management. 2021;12(3):262-272. https://doi.org/10.17747/2618-947X-2021-3-262-272

Introduction

Currently, the theme of sustainable development (SD) is one of the most popular and cited in the research literature. In practice, over time, more and more companies follow the principles of sustainable development and implement ESG practices in corporate strategies. At the same time, according to a study by Accenture1, 34% of Russian companies do not set goals for the transition to sustainable development, and another three-quarters do not understand how to work on the implementation of sustainable development practices. At the same time, companies point to such barriers as lack of internal competencies in the field of SD (61%), lack of support from the state (57%), lack of demand from the market and consumers (45%), complexity of transformation processes (44%)2.

At the same time, there are many studies confirming a positive correlation between companies' investments in ESG practices and financial performance (see, for example, [Amba, 2014; Ararat et al., 2017; Alshehhi et al., 2018]).

In addition, studies by other authors show that companies that implement ESG practices are (1) much more competitive [Byus et al., 2010; Duque-Grisales, Aguilera-Caracuel, 2019], (2) have more resources for development in the long term [Endrikat et al., 2014; Flammer, 2015], (3) have more efficient operational strategies [Garcia et al., 2017].

Thus, the relevance of the topic of sustainable development is in the focus of attention of researchers and practitioners, but at the same time, there are very few works devoted to the study of the development and impact of ESG on a particular industry. For example, there are no Russian studies showing what factors encourage companies to implement ESG practices.

The purpose of this work is to study what factors influence the implementation of management in accordance with the principles of ESG in industrial companies.

This work sets the following tasks:

1) to analyze studies on the influence of factors on the implementation of ESG practices for industrial companies;

2) to study the implementation of ESG practices in Russian industrial companies and identify the main difficulties and opportunities in achieving their competitiveness;

3) to formulate hypotheses for analyzing the impact of ESG practices implementation factors on the competitiveness of industrial companies and propose a model for analyzing this relationship.

-

Theoretical review of the literature

In the foreign literature, unlike the Russian one, a lot of empirical studies of the factor influence on the implementation of ESG practices have been accumulated.

Earlier studies [Ozcelik et al., 2014; Kara et al., 2015; Rizwan et al., 2016; Miroshnychenko et al., 2017] tested the relationship between the implementation of ESG practices and the financial performance of companies, and most of the results showed a positive impact. Also, a study conducted by Bank of America3, shows that between January 2007 and August 2019 alone, the ratio of capitalization and profits of American and Western European companies that follow the principles of sustainable development has doubled. The financial performance of European companies that adhere to the principles of SD improved by 20% compared to others4.

Studies over the past three years point to the increased importance of non-financial factors, such as an increase in the market share of companies [Xie et al., 2019], an increase in brand value (goodwill) [Miralles-Quir et al., 2018], an increase in the value of intangible assets [Saygili et al., 2018]. In addition, studies [Alshehhi et al., 2018; Duque-Grisales, Aguilera-Caracuel, 2019] show that companies with low ESG risks become more attractive to investors, improve financial performance and competitiveness [Garcia, Orsato, 2020]. It has been proven that the trend towards socially responsible investment affects the increase in stock returns [Verbeeten et al., 2016].

In addition, a relationship was found between the degree of disclosure of information about a company's sustainable development and its value in the market [Velte, 2017]. In [Hussain et al., 2018], data from Australian companies show the impact of implementing ESG practices on financial indicators such as ROA and ROE.

However, there are a number of studies that do not confirm this relationship. For example, [Qiu et al., 2016] did not reveal the relationship between ESG performance and market value, while [Rahdari, 2016] recorded the negative impact of ESG on financial performance. However, most research confirms that there is a positive relationship between ESG scores and financial performance, not a negative one.

Thus, these studies show a positive relationship between the implementation of ESG practices and production (operational) performance and market value.

In the scientific literature and among practitioners, a clear understanding is being created that sustainable development is expedient not only to achieve the goals of the state, society and individual companies, but also necessary for the harmonious development of man and nature. However, in Russian research there is a gap on the factors behind the implementation of ESG practices in companies in specific industries.

The main purpose of this study is to empirically test the drivers for the adoption of ESG practices by industrial companies.

-

Research methodology

2.1. Sample Description

The empirical analysis is based on the study of the data collected between January and May 2021.

For the analysis, 548 public enterprises of industrial sectors with more than 250 employees were selected, having in their strategies the achievement of sustainable development goals. Questionnaires were tested during in-depth interviews with representatives of 18 industrial enterprises in order to clarify the ambiguous interpretation of the checklists. Further, electronic questionnaires were sent to the selected enterprises. The respondents were senior management and those responsible for strategic development. A total of 184 respondents from 167 companies gave answers, the response was 30.5% (167/548).

The companies included in the sample belong to the following industries: food industry - 12%, chemical and petrochemical industry - 17%, production of building materials - 21%, ferrous and non-ferrous metallurgy - 13%, mechanical engineering - 10%, forestry, woodworking and pulp and paper industry - 8%, light industry - 7%, others - 12%. More than half of the surveyed companies have been operating in the market for more than 10 years, the age of the sample companies varies from 6 to 54 years and averages 24 years.

2.2. Research variables

Due to the fact that the main goal of the study is to assess the influence of factors on the implementation of ESG practices, it was decided to use the indicators of the implementation of the most significant initiatives for companies - environmental, social, and managerial - as a dependent variable.

At the same time, an assessment was made of the number of references to the initiatives introduced into the practice of companies (Table 1).

As can be seen from the table, the most frequently used practices are aimed at reducing emissions into the atmosphere (36%), reducing waste generated (38%), developing their staff (44%), improving employee welfare (38%), ensuring health and safety of company employees (37%), implementation of CSR principles 36%), anti-corruption and development of a culture of ethical business conduct (32%).

To analyze various aspects of the implementation of ESG practices in the activities of industrial companies, the following indicators were used, the choice of which is determined by the previously reviewed studies:

- company size (х1t) – studies show both positive and negative impact on innovation activity. Large companies have better access to resources, including financial ones, and therefore have more opportunities to finance sustainable development projects. Smaller companies are more agile to market and consumer demands and can outperform large companies in creating value based on the achievement of the sustainable development goal (measured as the logarithm of the number of employees);

- the company's age (х2t) – just like size, it can have both positive and negative effects. The age of the company reflects the experience and well-established business processes, which facilitates the implementation of ESG practices. At the same time, young companies have fresh ideas, have flexibility and are able to take a leading position in achieving ESG goals through innovation (measured as the logarithm of the number of years the company has been in operation);

- having its own division responsible for the implementation of projects related to the achievement of ESG goals (х3t),– own division or person responsible for the implementation of ESG projects conduct research aimed at finding solutions to achieve ESG goals and develop the competencies of employees. The results of successful projects stimulate further investment in sustainable development (dummy variable equal to 1 if the company has its own divisions or a responsible person, and 0 if not);

- investment attractiveness of the company (х4t) – investors not only choose sustainable companies, but are also ready to invest in green projects, provide transitional bonds (dummy variable equal to 1 if the company has investments due to its transition to sustainable development, and 0 if not );

- total costs of current activities (х5t) – this indicator is related to the financial capabilities of the company, which also affects the implementation of ESG practices in the company's activities (measured as the logarithm of the volume of current investments);

- costs of acquiring new technologies to achieve sustainable development goals (х6t),– the acquisition of new technologies contributes to the achievement of goals, especially in the field of environmental initiatives (measured as the logarithm of the costs connected with acquiring such technologies);

- consumer demand and expectation (х7t) – consumers believe that companies should be involved in solving social and environmental problems faced by society. This judgment is especially widespread among representatives of generation Z, 94% of whom believe in responsible business. This also affects their consumer habits – 81% plan to buy more environmentally friendly products over the next five years. According to Harvard Business Review, citing a study by the Stern Business School at New York University5, from 2013 to 2018, sales of "ethical goods" grew five times faster than sales of ordinary goods (measured as the logarithm of sales of "ethical goods");

- the behavior of competing companies (х8t) – leading companies set the pace for the market, taking their business to a new level and meeting the expectations of stakeholders, which affects the strategies of other companies in the industry (dummy variable equal to 1 if the company is under pressure from competitors, forcing it to sustainable development, and 0 if not);

- international activity (х9t) – studies show the positive impact of the company's international activities on setting and achieving sustainable development goals, which is explained by the current trend and high competition in international markets (dummy variable equal to 1 if the company has export earnings, and 0 otherwise);

- requirements of Russian and international regulators (х10t) – more and more countries introduce regulatory restrictions in order to reduce the negative impact on the environment and solve accumulated social problems (a dummy variable estimating regulatory pressure on a company equal to 1 if the company experiences such pressure, and 0 - if not);

- Improvement in operational efficiency (х11t) – studies identify such effects for improving operational efficiency as cost reduction through the creation of sustainable supply chains, cost reduction through more careful use of resources and the transition to a circular economy (dummy variable equal to 1 if the company aims to achieve operational efficiency by achieving sustainable development goals, and 0 otherwise);

- employee expectations (х12t) – research shows that most employees are more likely to choose working for a company with a strong sustainable agenda (a dummy variable equal to 1 if the company aims to meet employee expectations by achieving sustainable development goals, and 0 in otherwise);

- joining the United Nations Global Compact (х13t) – – joining the UN GC means that the company will support human rights, integrate sustainable development goals into business and implement ambitious initiatives to achieve them. The UN Global Compact is currently the largest international sustainability initiative with over 9,500 participating companies (dummy variable of 1 if a company aims to join the UNGC and 0 otherwise);

- introduction of a carbon cross-border tax (х14t) – companies that believe that they will be affected by the introduction of a carbon cross-border tax from 2023 by the EU and will lead to a decrease in profits (dummy variable equal to 1 if the company believes that the introduction of a carbon cross-border tax will affect its activities, and 0 otherwise);

- stakeholder expectations – studies show that companies which achieve sustainable development goals and implement ESG practices meet the expectations of key stakeholders better and more easily achieve the company's strategic development goals (dummy variable equal to 1 if a company implements ESG practices to better interact with stakeholders in the process of their development, and 0 if not). The following stakeholders are highlighted and analyzed:

○ consumers (х15t),

○ suppliers (х16t),

○ partners (х17t),

○ state-owned companies and development institutions (х18t),

○ universities and scientific organizations (х19t);

- operating profitability (х20t) – many studies show that companies implementing ESG practices are more profitable and have higher financial performance (dummy variable equal to 1 if the company believes that the implementation of ESG practices allows it to achieve more high financial results, and 0 otherwise).

The performance of enterprises can vary significantly depending on the affiliation to a particular industry, so the indicator of industry affiliation was used as a control variable. To take into account differences in industry affiliation, binary variables were used that indicate the affiliation of an enterprise to a particular industry sector (1 - belongs, 0 - does not): food industry, chemical and petrochemical industry, production of building materials, ferrous and non-ferrous metallurgy, mechanical engineering, forestry , woodworking and pulp and paper, light industry, others.

2.3. Data analysis procedure

To assess the reliability, Cronbach alpha coefficients were calculated, which corresponded to the recommended level of at least 0.75 (Table 2). Next, a factor analysis was carried out using the method of principal components (varimax) for fifteen questions describing eleven factors. The analysis confirmed the presence of eleven factors with values above one in accordance with the Kaiser criterion. In general, the presented factors explain 74.3% of the variation in the answers to the questions (this result corresponds to the recommended value of at least 70%) (Table 2). Similarly, factor analysis was used by the method of principal components (varimax) for indicators of the implementation of ESG practices - environmental, social and managerial. The analysis confirmed these three initiatives, which in general described 71.9% of the variation in questions (Table 2).

The values of the obtained factors for the implementation of ESG practices and the effectiveness of ESG initiatives on industrial enterprises were further used in the regression analysis with the use of a mathematical model:

Yik = β0 + βi Хij +…+ βi INDi + εi (1),

where Y1k is the implementation of environmental initiatives, Y2k is the implementation of social initiatives, Y3k – implementation of management initiatives, Хij – implementation factors of ESG practices; INDi is the branch of industry.

Standardized and non-standardized coefficients were obtained using the maximum likelihood method, while the standardized coefficients were used to determine the influence of factors on the resulting indicator, and the non-standardized coefficients were used to test the research hypotheses.

-

Research results

Table. 3-5 shows the results of the regression analysis, reflecting the influence of various factors on the implementation of ESG practices: environmental, social and managerial for industrial enterprises. Models based on equation (1) were able to explain 35% of the variations in environmental initiatives, 42% in social initiatives, and 28% in managerial ones.

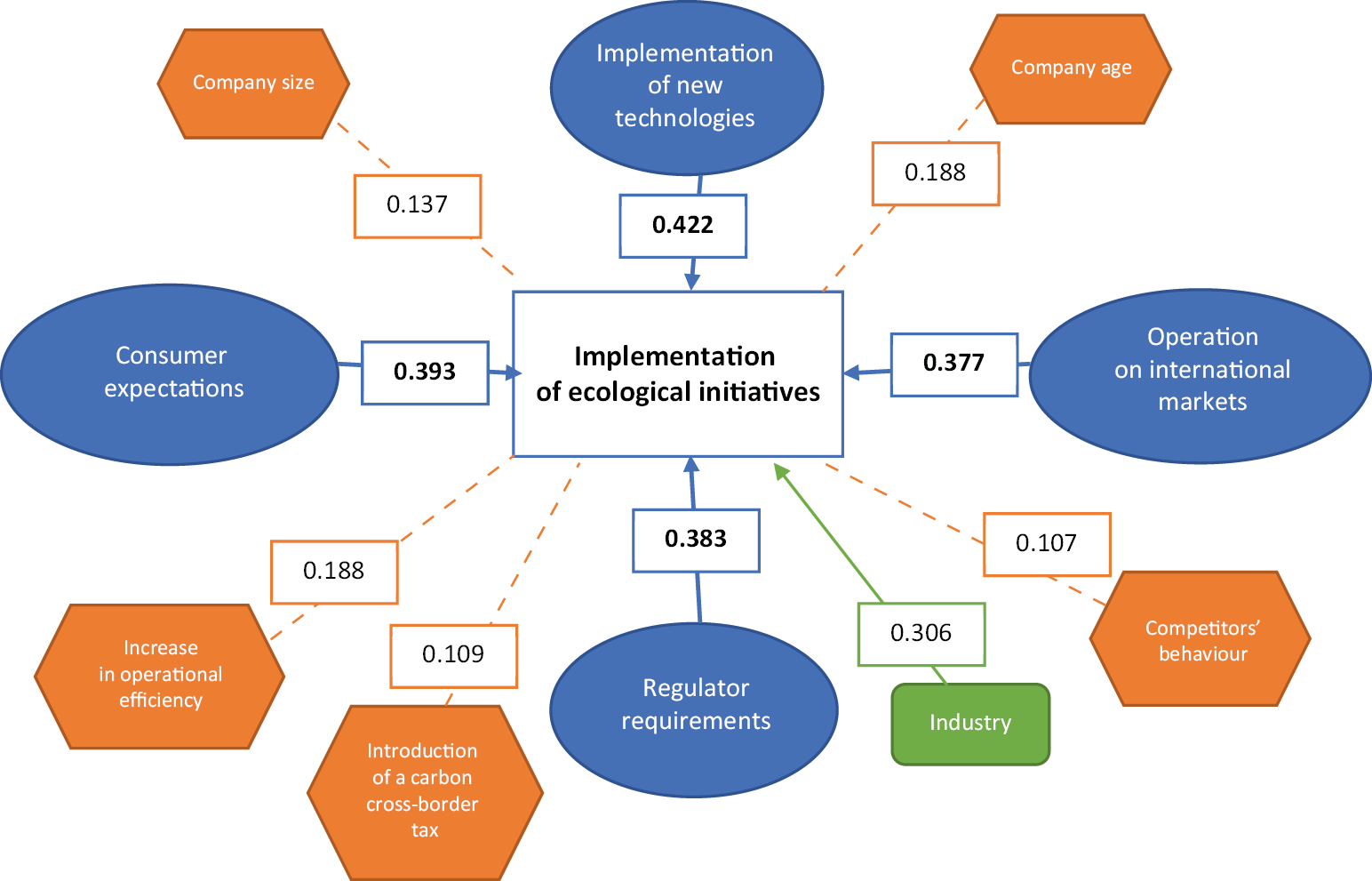

When analyzing the factors for the implementation of environmental initiatives by industrial companies (Table 3), it turned out that the transition of an enterprise to new technologies (β = 0.422, p < 0.01), demand and consumer expectations (β = 0.398, p < 0.01), the total costs of the enterprise for current activities (β = 0.327, p < 0.01), the company's work in international markets (β = 0.377, p < 0.01) and the requirement of Russian and international regulators (β = 0.383, p < 0.01). influence positively. In addition, factors of possible investment attractiveness (β = 0.269, p < 0.01) and the presence of a subdivision and/or manager responsible for achieving sustainable development goals (β = 0.217, p < 0.01) have an influence.

Factors such as company size (β = 0.137, p < 0.01), age (β = 0.188, p < 0.01), competitor behavior (β = 0.107, p < 0.01), introduction of a carbon cross-border tax (β = 0.109, p < 0.01), increased operational efficiency (β = 0.159, p < 0.01), have a very weak impact on the implementation of environmental initiatives by Russian industrial enterprises, unlike foreign ones.

Stakeholder expectations and profitability factors do not have a significant impact on the implementation of environmental initiatives by Russian industrial enterprises.

Industry variables (β = 0.306, p < 0.05) significantly affect the implementation of environmental initiatives by enterprises: the most active enterprises were engineering, chemical and petrochemical industries, ferrous and non-ferrous metallurgy. Thus, new technologies, consumer expectations, the work of companies in international markets, the requirements of the regulator are the key factors in the implementation of environmental practices by companies in the sample studied (Fig. 1).

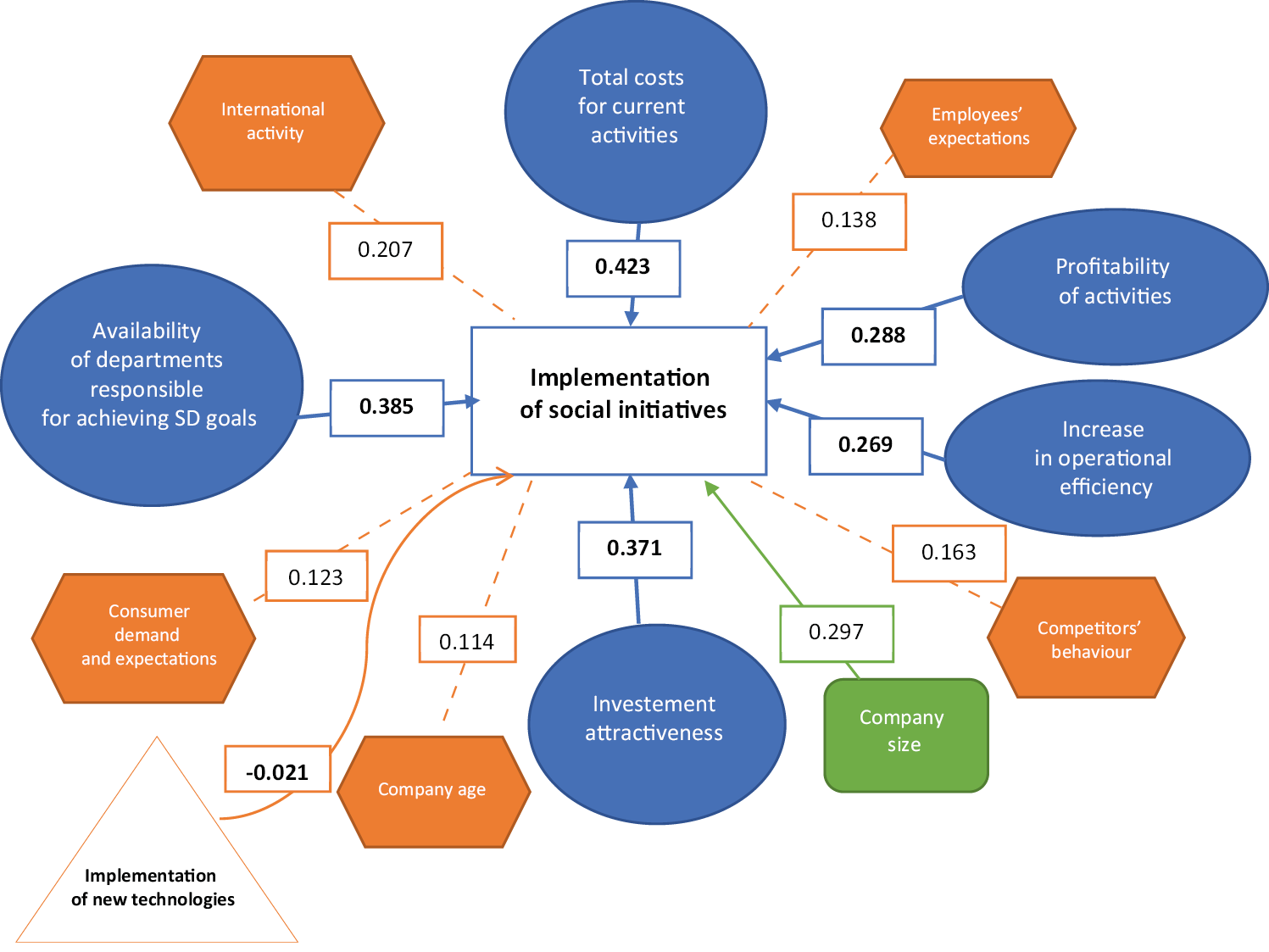

An analysis of the factors for the implementation of social initiatives by industrial companies (Table 4) showed that such factors as the total costs of current activities (β = 0.423, p < 0.05), the presence of a subdivision and/or a manager responsible for achieving goals in the field of sustainable development (β = 0.385, p < 0.05), investment attractiveness (β = 0.371, p < 0.05), profitability of operations (β = 0.288, p < 0.05) and increase in operational efficiency (β = 0.269, p < 0.01). have more influence. In addition, the larger the enterprise, the more likely it will implement social initiatives (β = 0.297, p < 0.01). Factors of international activity (β = 0.207, p < 0.01), behavior of competing companies (β = 0.163, p < 0.05), employee expectations (β = 0.138, p < 0.05), demand and consumer expectations (β = 0.123, p < 0.01), company age (β = 0.114, p < 0.05) have less influence.

It is noteworthy that, unlike environmental practices, the introduction of new technologies has a negative impact on the introduction of social practices (β = –0.021, p < 0.05). Probably, this effect can be explained by the limited financial resources and the choice between investments in new technologies or social initiatives.

Just as in the case of the introduction of environmental practices, the following factors did not influence the introduction of social practices: the company's accession to the UN Global Compact (β = 0.083, p < 0.05), stakeholder expectations, the introduction of a carbon cross-border tax (β = 0.007, p < 0.05), requirements of Russian and international regulators (β = 0.013, p < 0.05).

The industry sector (β = 0.103, p < 0.05) does not have a significant impact on the introduction of social practices (Fig. 2).

And, finally, the analysis of the factors for the implementation of management initiatives (Table 5) showed that the presence of a unit and / or manager responsible for achieving sustainable development goals (β = 0.424, p < 0.01), the total costs of current activities (β = 0.423, p < 0.01), investment attractiveness (β = 0.371, p < 0.01), consumer demand and expectation (β = 0.336, p < 0.01), behavior of competing companies (β = 0.369, p < 0.01) and international activities (β = 0.377, p < 0.10) positively influence the implementation of management practices by industrial companies.

Factors such as the cost of acquiring new technologies aimed at achieving sustainable development goals (β = 0.223, p < 0.05), increasing operational efficiency (β = 0.283, p < 0.05), requirements of Russian and international regulators (β = 0.153, p < 0.05), company size (β = 0.264, p < 0.05) and stakeholder expectations, have a less significant impact on the implementation of management practices. Factors such as company age (β = 0.122, p < 0.05), employee expectations (β = 0.119, p < 0.05), company accession to the UN Global Compact (β = 0.065, p < 0.05), the introduction of a carbon cross-border tax (β = 0.029, p < 0.05),the profitability of an enterprise (β = 0.174, p < 0.05)and the industry (β = 0.134, p < 0.05), do not have a significant impact on introduction of management initiatives by industrial companies (Fig. 3).

Thus, the presence of subdivisions responsible for achieving sustainable development goals, consumer expectations, the work of companies in international markets, investment attractiveness and costs for current activities are the key factors in the implementation of management practices by industrial companies in the studied sample.

Table 1

ESG practices implemented by industrial companies, %

|

Questions about the implementation of ESG practices by industrial companies |

Percentage of mentions |

|

|

Ecological initiatives (Е) |

||

|

1 |

The company cares about reducing emissions into the atmosphere |

36 |

|

2 |

The company reduces the waste produced and moves to a circular economy model |

38 |

|

3 |

The enterprise reduces resource consumption |

22 |

|

4 |

The company uses clean energy |

2 |

|

5 |

The company is looking for solutions in the field of climate resilience |

3 |

|

Social initiatives (S) |

||

|

1 |

The company uses advanced labor practices |

21 |

|

2 |

The company educates its employees |

44 |

|

3 |

The company aims to improve the social security of employees |

38 |

|

4 |

The company cares about ensuring the health and safety of all employees. |

37 |

|

5 |

The company participates in charitable programs and the development of social entrepreneurship |

9 |

|

Managerial initiatives (G) |

||

|

1 |

The company implements CSR principles in its activities |

35 |

|

2 |

The enterprise is aimed at combating corruption and developing a culture of ethical business conduct |

32 |

|

3 |

The company implements a policy of responsible attitude to procurement not only in the company, but also together with suppliers |

8 |

Source: compiled by the author.

Table 2

Factor analysis: questionnaire questions, factor load and reliability check (Cronbach’s alpha coefficient)

|

Questionary |

Sum of squared factor loadings |

Model 1 for ecological initiatives (Е) |

Model 2 for social initiatiatives (S) |

Model 3 for managerial initiatives (G) |

|

|

Factors (Cronbach alpha coefficient = 0.86) |

|||||

|

1 |

Our company has its own division responsible for the implementation of projects related to the achievement of ESG goals |

0.723 |

0.726 |

0.721 |

0.673 |

|

2 |

Our enterprise implements ESG practices in order to increase attractiveness for potential investors |

0.694 |

0.638 |

0.664 |

0.796 |

|

3 |

Our company introduces new technologies that contribute to the achievement of sustainable development goals |

0.724 |

0.733 |

0.129 |

0.247 |

|

4 |

Our company's customers expect us to achieve sustainability goals |

0.725 |

0.521 |

0.441 |

0.546 |

|

5 |

Our company's competitors are adopting ESG practices, so we have to follow these trends to stay competitive |

0.719 |

0.198 |

0.124 |

0.298 |

|

6 |

Our company operates in the international market, and in order to remain competitive, we need to implement ESG practices |

0.783 |

0.737 |

0.289 |

0.367 |

|

7 |

Our company must implement ESG practices in order to comply with the requirements of Russian and international regulators |

0.741 |

0.754 |

0.218 |

0.192 |

|

8 |

Our company plans to join the UNGC, which means that the company will support human rights, integrate sustainable development goals into business and implement ambitious initiatives to achieve them |

0.698 |

0.214 |

0.271 |

0.233 |

|

9 |

Our company will be affected by the introduction of the EU carbon cross-border tax from 2023 and will lead to a decrease in profits, in this regard, we already need to implement ESG practices |

0.732 |

0.363 |

0.259 |

0.195 |

|

10 |

For our company, it is important to meet the expectations of stakeholders in achieving sustainable development goals |

||||

|

10.1 |

○ consumers |

0.569 |

0.215 |

0.262 |

0.321 |

|

10.2 |

○ suppliers |

0.553 |

0.173 |

0.309 |

0.307 |

|

10.3 |

○ partners |

0.548 |

0.204 |

0.251 |

0.166 |

|

10.4 |

○ state companies and development institutions |

0.563 |

0.173 |

0.302 |

0.307 |

|

10.5 |

○ Universities and scientific organizations |

0.571 |

0.104 |

0.151 |

0.166 |

|

11 |

The introduction of ESG practices contributes to an increase in the financial performance of our company |

0.734 |

0.722 |

0.599 |

0.691 |

|

Resulting indicators |

|||||

|

12 |

Ecological indicators (Cronbach alfa coefficient = 0.73) |

||||

|

12.1 |

Reduction of emissions into the atmosphere |

0.829 |

0.804 |

0.251 |

0.478 |

|

12.2 |

Waste reducing and moving to a circular economy |

0.793 |

0.621 |

0.239 |

0.564 |

|

12.3 |

Reducing resource consumption |

0.814 |

0.793 |

0.303 |

0.383 |

|

13 |

Social initiatives (Cronbach alpha = 0.78) |

||||

|

13.1 |

Employee development programs |

0.748 |

0.824 |

0.311 |

0.676 |

|

13.2 |

Improving social security |

0.884 |

0.728 |

0.254 |

0.896 |

|

13.3 |

Ensuring the health and safety of employees |

0.821 |

0.733 |

0.329 |

0.747 |

|

14 |

Manerial initiatives (Cronbach alpha = 0.76) |

||||

|

14.1 |

Implementation of CSR principles |

0.649 |

0.587 |

0.473 |

0.528 |

|

14.2 |

Anti-Corruption and developing a culture of ethical business conduct |

0.704 |

0.624 |

0.388 |

0.692 |

Source: compiled by the author.

Table 3

The influence of various factors on the implementation of environmental initiatives by industrial enterprises

|

Independent indicators |

Non-standardized coefficients |

Standardadized coefficients |

|

Constant (β0) |

0.615 (0.113) |

|

|

Company size (х1t) |

0.137*** (0.025) |

0.126*** |

|

Company age (х2t) |

0.188** (0.066) |

0.175** |

|

Availability of a unit (manager) responsible for achieving sustainable development goals (х3t) |

0.217*** (0.082) |

0.214*** |

|

Investment attractiveness of the company (х4t) |

0.269** (0.091) |

0.278** |

|

Total costs for current activities (х5t) |

0.327*** (0.094) |

0.324*** |

|

Costs for the acquisition of new technologies aimed at achieving sustainable development goals (х6t) |

0.422** (0.167) |

0.438** |

|

Consumer demand and expectations (х7t) |

0.393*** (0.068) |

0.404*** |

|

Behavior of competing companies (х8t) |

0.107** (0.016) |

0.124** |

|

International activities (х9t) |

0.377*** (0.075) |

0.369*** |

|

Requirements of Russian and international regulators (х10t) |

0.383** (0.059) |

0.381** |

|

Improving operational efficiency (х11t) |

0.159*** (0.048) |

0.162*** |

|

Employee expectations (х12t) |

0.092** (0.047) |

0.098** |

|

Accession of the company to the UN global compact (х13t) |

0.083** (0.047) |

0.098** |

|

Introduction of a carbon cross-border tax (х14t) |

0.109*** (0.014) |

0.104*** |

|

Stakeholder expectations: |

||

|

○ consumers (х15t) |

0.023*** (0.009) |

0.026*** |

|

○ suppliers (х16t) |

0.048** (0.029) |

0.035** |

|

○ partners (х17t) |

0.062** (0.037) |

0.068** |

|

○ state companies and development institutions (х18t) |

0.139*** (0.012) |

0.141*** |

|

○ universities and scientific organizations (х19t) |

0.004** (0.107) |

0.008** |

|

Profitability of the enterprise (х20t) |

0.073** (0.029) |

0.082** |

|

Industry (INDi) |

0.306** (0.049) |

0.308** |

|

Adjusted R2 |

0.35 |

|

|

Number of observations |

184 |

|

Note. * – p < 0,10, ** – p < 0,05, *** – p < 0,01. Standard errors are given in parentheses.

Source: compiled by the author.

Fig. 1. Factors of implementation of environmental initiatives by industrial companies

Source: compiled by the author.

Fig. 2. Factors of introduction of social initiatives by industrial companies

Source: compiled by the author.

Table 4

The influence of various factors on the implementation of social initiatives by industrial enterprises

|

Independent indicators |

Non-standard coefficients |

Standardized coefficients |

|

Constant (β0) |

0.459 (0.086) |

|

|

Company size (х1t) |

0.297*** (0.055) |

0.296*** |

|

Company age (х2t) |

0.114** (0.032) |

0.115** |

|

Availability of a unit (manager) responsible for achieving sustainable development goals (х3t) |

0.385*** (0.033) |

0.384*** |

|

Investment attractiveness of the company (х4t) |

0.371** (0.063) |

0.374** |

|

Total costs for current activities (х5t) |

0.423*** (0.087) |

0.424*** |

|

Costs for the acquisition of new technologies aimed at achieving sustainable development goals (х6t) |

–0.021** (0.007) |

–0.018** |

|

Consumer demand and expectation (х7t) |

0.123*** (0.028) |

0.124*** |

|

Behavior of competing companies (х8t) |

0.163** (0.022) |

0.164** |

|

International activities (х9t) |

0.207*** (0.052) |

0.209*** |

|

Requirements of Russian and international regulators (х10t) |

0.013** (0.008) |

0.011** |

|

Improving operational efficiency (х11t) |

0.269*** (0.055) |

0.264*** |

|

Employee expectations (х12t) |

0.138** (0.041) |

0.136** |

|

Accession of the company to the UN Global Compact (х13t) |

0.083** (0.047) |

0.098** |

|

Introduction of a carbon cross-border tax (х14t) |

0.007*** (0.004) |

0.003*** |

|

Stakeholder expectations: |

||

|

○ consumers (х15t) |

0.023*** (0.009) |

0.026*** |

|

○ suppliers (х16t) |

0.048** (0.029) |

0.035** |

|

○ partners (х17t) |

0.062** (0.037) |

0.068** |

|

○ state companies and development institutions (х18t) |

0.124*** (0.023) |

0.131*** |

|

○ universities and scientific organizations (х19t) |

0.004** (0.107) |

0.008** |

|

Profitability of the enterprise (х20t) |

0.288** (0.047) |

0.287** |

|

Industry (INDi) |

0.103** (0.049) |

0.108** |

|

Industry R2 |

0.42 |

|

|

Number of observations |

184 |

|

Note. * – p < 0.10; ** – p < 0.05; *** – p < 0.01. Standard errors are given in parentheses.

Source: compiled by the author.

Table 5

The influence of various factors on the implementation of management initiatives by industrial enterprises

|

Independent indicators |

Non-standardized coefficients |

Standardized coefficients |

|

Constant (β0) |

0.319 (0.073) |

|

|

Company size (х1t) |

0.264*** (0.055) |

0.266*** |

|

Company age (х2t) |

0.122** (0.032) |

0.119** |

|

Availability of a unit (manager) responsible for achieving sustainable development goals (х3t) |

0.424*** (0.029) |

0.384*** |

|

Investment attractiveness of the company (х4t) |

0.371** (0.063) |

0.374** |

|

Total costs for current activities (х5t) |

0.423*** (0.087) |

0.424*** |

|

Costs for the acquisition of new technologies aimed at achieving sustainable development goals (х6t) |

0.223** (0.035) |

0.219** |

|

Consumer demand and expectations (х7t) |

0.336*** (0.028) |

0.338*** |

|

Behavior of competing companies (х8t) |

0.369** (0.022) |

0.367** |

|

International activities (х9t) |

0.377*** (0.048) |

0.379*** |

|

Requirements of Russian and international regulators (х10t) |

0.153** (0.039) |

0.151** |

|

Improving operational efficiency (х11t) |

0.283*** (0.038) |

0.294*** |

|

Employees’ expectations (х12t) |

0.119** (0.043) |

0.124** |

|

Accession of the company to the UN Global Compact (х13t) |

0.065** (0.032) |

0.068** |

|

Introduction of a carbon cross-border tax (х14t) |

0.029*** (0.011) |

0.023*** |

|

Stakeholder expectations: |

||

|

○ consumers (х15t) |

0.223*** (0.032) |

0.226*** |

|

○ suppliers (х16t) |

0.241** (0.029) |

0.236** |

|

○ suppliers (х17t) |

0.192** (0.029) |

0.198** |

|

○ state companies and development institutions (х18t) |

0.244*** (0.038) |

0.241*** |

|

○ universities and scientific organizations (х19t) |

0.154** (0.107) |

0.159** |

|

Profitability of the enterprise (х20t) |

0.174** (0.042) |

0.181** |

|

Industry (INDi) |

0.134** (0.049) |

0.137** |

|

Adjusted R2 |

0.28 |

|

|

Number of observations |

184 |

|

Note. * – p < 0.10; ** p < 0.05; *** – p < 0.01. Standard errors are given in parentheses.

Source: compiled by the author.

Fig. 3. Factors of implementation of management initiatives by industrial companies

Source: compiled by the author.

Conclusion

Sustainable development has now become a key condition for the effective functioning of companies. Companies wishing to be competitive transform their business models and incorporate sustainable development goals into their strategies. At the same time, most Russian companies are still experiencing difficulties in implementing ESG practices, which requires a comprehensive study of the factors influencing the implementation of environmental, social and management initiatives.

In the work, a comprehensive study of the influence of various factors on the implementation of environmental, social and management practices was carried out based on a study of 167 industrial enterprises.

The survey made it possible to identify initiatives that industrial enterprises are working on:

- environmental, including projects to reduce emissions into the atmosphere, reduce waste and transition to a circular economy model, reduce resource consumption;

- social, including projects for the development of its employees and their social security, labor protection, health and safety of all employees;

- managerial, including the introduction of CSR principles into the company's activities, combating corruption and developing a culture of doing business.

At the same time, initiatives such as the use of clean energy, the search for solutions in the field of climate resilience, participation in charitable programs and the development of social entrepreneurship, the policy of responsible purchasing not only in the company, but also together with suppliers, are significantly underestimated by the respondents.

Econometric analysis confirmed that the implementation of ESG practices is influenced by various factors. Thus, the respondents most often associated the introduction of environmental practices with the introduction of new technologies, the desire to meet consumer expectations, the company's work in international markets, and the need to comply with the requirements of the regulator.

As part of the introduction of social practices, the most important are the costs of enterprises for current activities, the presence of a unit and / or manager responsible for achieving sustainable development goals, investment attractiveness, profitability of operations and improving operational efficiency.

The introduction of management practices is most influenced by the presence of departments responsible for achieving sustainable development goals, consumer expectations, the work of companies in international markets, investment attractiveness and the costs of current activities.

Low scores in the implementation of all types of ESG practices were received by the factors of employee expectations, the company's accession to the UN Global Compact, and the introduction of a carbon cross-border tax.

Thus, depending on the goals that the enterprise sets for itself, it is possible to combine investments in certain types of ESG practices and thereby achieve the goals set.

1. Heading towards sustainability: how Russian business becomes responsible. Sustainability Research 2021 // Accenture. URL: https://www.accenture.com/ru-ru/insights/strategy/sustainability-research.

2. Id.

3. How trade finance can join the dots on ESG. Bank of America. URL: https://business.bofa.com/content/dam/boamlimages/documents/articles/ID21_0612/trade_finance_ESG.pdf.

4. Id.

5. Actually, consumers do buy sustainable products: Research. Harvard Business Review.

References

1. Alshehhi A., Nobanee H., Khare N. (2018). The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability, 10(2): 494.

2. Amba S.M. (2014). Corporate governance and firms’ financial performance. Journal of Academic and Business Ethics, 8(1): 1-11.

3. Ararat M., Black B.S., Yurtoglu B.B. (2017). The effect of corporate governance on firm value and profitability: Time-series evidence from Turkey. Emerging Markets Review, 30: 113-132.

4. Byus K., Deis D., Ouyang B. (2010). Doing well by doing good: Corporate social responsibility and profitability. SAM Advanced Management Journal, 75(1): 44-55.

5. Duque-Grisales E., Aguilera-Caracuel J. (2019). Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. Journal of Business Ethics, 168: 315-334.

6. Endrikat J., Guenther E., Hoppe H. (2014). Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. European Management Journal, 32(5): 735-751.

7. Flammer C. (2015). Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Management Science, 61(11): 2549-2568.

8. Garcia A.S., Mendes-Da-Silva W., Orsato R.J. (2017). Sensitive industries produce better ESG performance: Evidence from emerging markets. Journal of Cleaner Production, 150: 135-147.

9. Garcia A.S., Orsato R.J. (2020). Testing the institutional difference hypothesis: A study about environmental, social, governance, and financial performance. Busines Strategy and the Environment, 29: 3261-3272.

10. Hussain N., Rigoni U., Cavezzali E. (2018). Does it pay to be sustainable? Looking inside the black box of the relationship between sustainability performance and financial performance. Corporate Social Responsibility and Environmental Management, 25(6): 1198-1211.

11. Kara E., Acar Erdur D., Karabiyik L. (2015). Effects of corporate governance level on the financial performance of companies: A research on BIST corporate governance index (XKURY). Ege Academic Review, 15(2): 265-274.

12. Miralles-Quir os M.M., Miralles-Quir os J.L., Valente Gonçalves L.M. (2018). The value relevance of environmental, social, and governance performance: The Brazilian case. Sustainability, 10(3): 574-589.

13. Miroshnychenko I., Barontini R., Testa F. (2017). Green practices and financial performance: A global outlook. Journal of Cleaner Production, 147: 340-351.

14. Ozcelik F., Ozturk B.A., Gursakal S. (2014). Investigating the relationship between corporate social responsibility and financial performance in Turkey. Ataturk Universitesi Iktisadi ve Idari Bilimler Dergisi, 28(3): 189-203.

15. Qiu Y., Shaukat A., Tharyan R. (2016). Environmental and social disclosures: Link with corporate financial performance.

16. The British Accounting Review, 48(1): 102-116.

17. Rahdari A.H. (2016). Developing a fuzzy corporate performance rating system: A petrochemical industry case study. Journal of Cleaner Production, 131: 421-434.

18. Rizwan M., Asrar H., Siddiqui N.A., Usmani W.U. (2016). The impact of corporate governance on financial performance:

19. An empirical investigation. International Journal of Management Sciences and Business Research, 5(9): 11-27.

20. Saygili E., Arslan S., Birkan A.O. (2018). Borsa Istanbul review environmental performance Index-EPI. Country Scorecard. URL: https://epi.yale.edu/sites/default/files/2018-tur.pdf.

21. Velte P. (2017). Does ESG performance have an impact on financial performance? Evidence from Germany. Journal of Global Responsibility, 80(2): 169-178.

22. Verbeeten F.H., Gamerschlag R., Moeller K. (2016). Are CSR disclosures relevant for investors? Empirical evidence from Germany. Management Decision, 54(6): 1359-1382.

23. Xie J., Nozawa W., Yagi M., Fujii H., Managi S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Business Strategy and the Environment, 28(2): 286-300.

About the Author

A. L. LisovskyРоссия

Candidate of economic sciences, the director general of “NPO Krypten” JSC. Research interests: sustainability management, ESG strategies, formation of strategy of development of the industrial companies, management of changes, transformation of industrial production.

Review

For citations:

Lisovsky A.L. TRANSITION TO SUSTAINABILITY: AN EMPIRICAL ANALYSIS OF FACTORS MOTIVATING INDUSTRIAL COMPANIES TO IMPLEMENT ESG PRACTICES. Strategic decisions and risk management. 2021;12(3):262-272. https://doi.org/10.17747/2618-947X-2021-3-262-272

JATS XML