Scroll to:

ENTREPRENEURSHIP IN SPORTS INDUSTRY: DIRECTIONS, INNOVATIONS AND SUPPORT

https://doi.org/10.17747/2618-947X-2021-3-252-261

Abstract

Within the framework of this article, the authors analyze the following areas of entrepreneurial activity in sports industry: sports and health services, including fitness clubs, sports clubs, schools and academies; managing the competitions (leagues); corporate sports; media resources; bookmakers, e-sports. As part of the work, positive examples of entrepreneurship in sports industry were noted, as well as the role, interests and tasks of the state. The directions of innovative development within each of the identified blocks are considered separately. The authors also systematized support measures for development entrepreneurship (small and medium enterprises – SME) and identified its features for the sports industry. Following directions for further research are proposed: analysis of individual markets for entrepreneurship in the sports industry; development and testing of methods for assessing the effectiveness of support measures for SME in sports industry; development of professional training of entrepreneurs for the sports industry.

Keywords

For citations:

Lednev V.A., Solntsev I.V. ENTREPRENEURSHIP IN SPORTS INDUSTRY: DIRECTIONS, INNOVATIONS AND SUPPORT. Strategic decisions and risk management. 2021;12(3):252-261. https://doi.org/10.17747/2618-947X-2021-3-252-261

Introduction

Among the values of physical culture and sports contained in the Strategy for the Development of Physical Culture and Sports until 2030, there is sustainable economic development - the desire for innovation, support for competition and private initiative, as well as the development of forms of proportionally combined budgetary and non-budgetary financing of sports. At the same time, such a concept as “entrepreneur” is not even mentioned in the Strategy.

Among Russian scientists systematically dealing with the development of entrepreneurial activity in Russia and competition in it, it is necessary to single out Yu.B. Rubin [Rubin, 2021], which proves that entrepreneurship is a specific type of labor activity.

V.A. Lednev [Lednev, Bratkov, 2019; Lednev, 2020; 2021] in his works showed the interest of the state in the development of entrepreneurial activity in the sports industry. The author outlined the main trends in the development of entrepreneurship in mass sports, showed how the club system can influence the involvement of various categories of Russian citizens in sports.

V.V. Kudryavtsev [Kudryavtsev, 2019] analyzes the role of the state and the business community in the development of physical culture and sports, and also proposes a number of measures to stimulate private initiatives including tax incentives (partly already implemented in Russia), the creation of information Internet portal system that would be able to unite the state, sports organizations, athletes, entrepreneurs and consumers of sports services, as well as the provision of affordable loans, low rental rates, “especially where it is possible to create bicycle, sports, cross-country, ski and mountain ski tracks, where it is possible to organize sports schools, clubs, to hold sports events. Also, the author [Kudryavtsev, 2017] identifies four areas where entrepreneurial activity in the field of sports can be carried out:

- preparation, organization and holding of sports events and provision of sports and health services;

- training of athletes, production of sports equipment, information and advertising support;

- construction of sports facilities, security, provision of transport, household, information technology and other services;

- Mass media, betting companies, etc.

This classification seems to be somewhat confusing - some activities can be assigned to several groups at once, and the principle of attributing to a particular area is not described accurately enough. It is also doubtful to classify such structures as entrepreneurial, such as:

- all-Russian and regional physical culture and sports organizations (federations, unions, associations) in various sports;

- public physical culture and sports societies;

- defense sports and technical organizations.

Finally, entrepreneurship in the sports industry can hardly be of a non-commercial nature, since the primary goal of any entrepreneur, regardless of the field of activity, is to make a profit.

- Ishchenko and S.I. Izaak [Ishchenko, Izaak, 2017] refer to sports industry entrepreneurs as sports goods manufacturers, sports TV channels, radio stations, websites, professional clubs, sports shops, sports facilities, fitness clubs, infrastructure facilities, bookmakers. At the same time, the authors emphasize the importance of using innovative technologies that allow optimizing the use of budgetary and non-budgetary sources of funding, improving sports results, involving the general population in sports, and improving the quality of sports services.

This study will present the author's approach to structuring entrepreneurship in the sports industry, consider the areas of innovation in this area, as well as relevant support measures.

-

State and entrepreneurship

The state today is extremely interested in the development of entrepreneurship in sports. First of all, this applies to mass sports. Very ambitious tasks have been set in Russia to attract various categories of Russian citizens to go in for sports. As part of the national goals, it is necessary to reach the involvement of various categories of citizens in sports up to 55% by 2024. As part of the Strategy for the Development of Physical Culture and Sports until 2030, this figure should be increased up to 70%. It is quite obvious that the state bodies responsible for the development of physical culture and sports (federal and regional levels) cannot cope with such tasks on their own. Therefore, it is necessary to attract private business to do it systematically and in all regions of the Russian Federation. Of course, today entrepreneurship in the sports industry is already developing, there is certain success and achievements. But still, there is not enough long-term and systematic support for this activity on the part of the state. As positive examples of the development of entrepreneurial activity in sports, one can name the long-term development of the fitness industry, the emergence of a large number of marathons, the development of private corporate leagues and the emergence of private sports clubs and schools. These are very important phenomena that are already becoming sustainable.

Therefore, we can say that the interests of the state and business finally coincide, and it is very good that we are talking about national goals and the implementation of indicators of the Strategy for the Development of Physical Culture and Sports.

If we talk about different categories of Russian citizens, then we must remember that many go in for sports at the place of study, work and residence. Further, it will be shown how individual segments are developing today, in particular the fitness industry, corporate sports and mass sports in various forms of their development.

-

Entrepreneurship market in the sports industry

If we objectively evaluate the level of entrepreneurship in the Russian sports industry, it should be noted that there are still very few real examples of private initiative in professional sports. Now the main tasks are a gradual departure from the use of budget funds, the widespread use of marketing tools to earn money and a phased transition to self-sufficiency models. We can definitely say that these are long-term tasks. A modest share of private clubs testifies to the low entrepreneurial activity in professional sports [Solntsev, 2020]. For example, in the Russian Premier League (RPL), only Krasnodar can be called fully private. At the same time, its owner Sergei Galitsky does not consider football a business1. Spartak Moscow does not disclose its full ownership structure and is also heavily affiliated with the Lukoil oil company, while CSKA ceased to be private after being taken over by the state-owned VEB. Positive dynamics has emerged in other football leagues: the number of private clubs in the FNL and FNL-2 is gradually growing, but none of them can boast of stable and positive financial results so far. Club owners also do not perceive sports as a business. In support of this, one can cite a quote from the shareholder of the Veles football club Evgeny Shilenkov: “Football is not a business for me, it does not bring money”2.

In mass sport, or, as they say abroad, sport for everybody, in Russia there are quite a few successful examples of entrepreneurial activity development. Let us consider the main ones.

- The Russian fitness industry is today an obvious leader in entrepreneurship activity. This is a full-fledged and independent segment of the sport industry with an established infrastructure. There are almost eight thousand fitness clubs, fitness centers and fitness studios in Russia. This activity, under certain conditions, can be investment-attractive in the market, even though the coronavirus pandemic has greatly affected the income of fitness clubs.

- Mass sports today provide many successful examples of entrepreneurial projects. A large number of competitions in various sports are regularly held (marathons and half marathons, bike rides, triathlon competitions, cross-country skiing, etc.). All this, as a rule, is a private initiative and private business. Very often such competitions gather thousands of solvent participants.

- In recent years, a real boom has begun in the creation of private sports clubs, schools, academies and centers. This is applicable to both game and individual sports: football, hockey, boxing, MMA, e-sports, skateboarding, figure skating, diving, gymnastics, synchronized swimming. This explains only one thing: the client wants to play sports and is ready to pay money for a qualitative service.

- For many years, various corporate leagues have been developing, which offer their customers the opportunity to participate in competitions on a regular basis. Once it all started with football, but today there are leagues that are not even for team sports. It is very important for clients when the leaders of these leagues take on numerous problems in organizing competitions, and clients pay registration fees for participation and just enjoy it.

- Sports media today are represented not only by state publications – there are a number of successful projects created by private entrepreneurs. One of the criteria for success is mergers and acquisitions worth millions of dollars.

- The betting business has been and remains one of the most closed, but the role of private investors in its development is obvious. None of the areas of the sports business shows such growth rates. The state continues to restrict the promotion of gambling, while the admission of betting companies to the professional sports market has created a stable source of income and even helped many clubs to survive.

- E-sports can compete with bookmakers in terms of turnover growth, and traditional sports in terms of the number of participants involved. For many fans of computer games, this direction has become not just a hobby, but also a profitable business, which has a rather low entry threshold in terms of initial investment.

All these trends show that private business has studied the potential desires of customers well and is ready to provide a diverse range of products and services today.

-

Fitness industry

When we talk about entrepreneurial activities in the sports industry, we can recognize that the fitness industry is today its most dynamically developing and commercially attractive sector. If we take 1990-1991 as a reference, when the first fitness clubs appeared in Russia, then the domestic fitness industry has achieved excellent results in less than 30 years.

To be fair, it must be remembered that in the early stages of its development, the state practically did not notice this phenomenon. The Ministry of Sports of the Russian Federation often said that fitness clubs are commercial enterprises and they have nothing to do with sports at all. Then the situation began to change gradually, as the state authorities responsible for the development of physical culture and sports began to set the task of attracting Russian citizens to sports. It turned out that the interests of the state and the entire fitness industry coincide.

Today the situation has changed – government authorities and the fitness industry are working together. In 2019, historic amendments were made to the Federal Law “On Physical Culture and Sports in the Russian Federation”, and fitness centers became full-fledged subjects in the field of physical culture and sports. Now the Russian Ministry of Sports regulates the fitness industry in a certain way.

If we analyze the scale of the fitness industry development, it is better to refer to official statistics. The data on the dynamics of the development of the fitness industry are given in Table 1.

Table 1

Development dynamics of fitness industry in 2015–2020

|

Indicators |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Number of fitness clubs (thousands) |

5355 |

6069 |

6308 |

7065 |

7593 |

7812 |

|

Number of people involved in fitness clubs, million people. |

3413 |

3992 |

5230 |

5399 |

6268 |

6674 |

Another important innovation was a tax deduction that can be issued when paying for sports and recreation services from 2022. You can return 13% of the costs for the subscription, but not more than 15,600 rubles.

The official statistics included only those fitness clubs that submit official reports. The actual number of clubs may be higher. However, in any case, the general dynamics of the development of the fitness industry is impressive – after all, 30 years ago everything started from scratch.

If we analyze the structure of fitness clubs, then we must admit that they differ in terms of the available infrastructure, the range of sports and recreational services, and the number of people involved. There are already quite a few networks of fitness clubs, both federal and regional. Despite these differences, they share several important features.

Among the main features of the Russian fitness industry are the following.

All fitness clubs were originally created as commercial enterprises, as someone's specific private business, immediately focused on making a profit.

- At the origins of each fitness club were private investors who relied solely on themselves and their capabilities, including financial ones. They did not count on the help of the state at all.

- In order to make money on the provision of sports and fitness services, it was necessary to master quickly and effectively the entire set of various marketing tools for working with each client of a fitness club. It must be remembered that when clients pay their own money for services, they are very hypercritical about the price / quality ratio.

- Today in the Russian fitness industry there is a certain competition for the client, and this will certainly lead to an increase in the overall level of quality of sports and recreation services. As a result, unscrupulous players will leave the market.

For the effective development of the fitness industry, related industries are also very important, which include manufacturers of sports equipment. Domestic players are still inferior to such international companies as Technogym or Peloton, but they have already achieved unconditional success. For example, Kenguru builds sports grounds all over the world: beyond the Arctic Circle, on the coast of the Sea of Japan and in Australia. Today, Kenguru's official representative offices operate in 21 countries. The same can be said about equipment manufacturers. Russian companies such as Forward, Zasport and Bosco cannot yet compete with Nike, Adidas and Puma, but they already occupy a certain market share and can count on growth.

Therefore, now, even despite the coronavirus pandemic, the Russian fitness industry has good opportunities for further development, taking into account the coincidence of interests with the state, bearing in mind national goals for the development of a healthy lifestyle and involvement in sports.

-

Grassroots sports

Recently, quite a lot of mass competitions in various sports have been held in Russia. The pandemic affected their number, but to a certain extent, it also provided pent-up demand for the future. Among the most popular are marathons and half marathons, triathlon competitions, bike rides, cross-country skiing. Tens of thousands of people take part in each such competition. What do these competitions have in common? The vast majority of them are carried out by organizers for whom this is a private business. Therefore, it can be argued that today there is a great interest for entrepreneurship in mass sports.

Probably, as a positive example, it is best to name the dynamics of the development of marathon distances in our country. In 2013, the Moscow Marathon was held for the first time. The mass consumer immediately showed interest in this event. Just a few years later, the organizers decided to create the "Running Community" of the Moscow Marathon and now offer their customers more than ten different events. For example, the Fast Dog cross, the April race, the Night Run, the Krylatsky trail, the Lisya Gora cross, etc., that is, a large number of competitions of interest and depending on physical fitness. In addition, the organizers have created a running club where you can train regularly and prepare for competitions.

Given the fact that interest in running today is observed throughout the country, in 2015 the National Running Community was created in Russia, which organizationally and methodically unites today more than 200 marathons and half marathons throughout Russia. The organizers aim to increase their target audience to 2 million people by 2022 in 80% of the Russian Federation subjects. Of course, this is a very ambitious task.

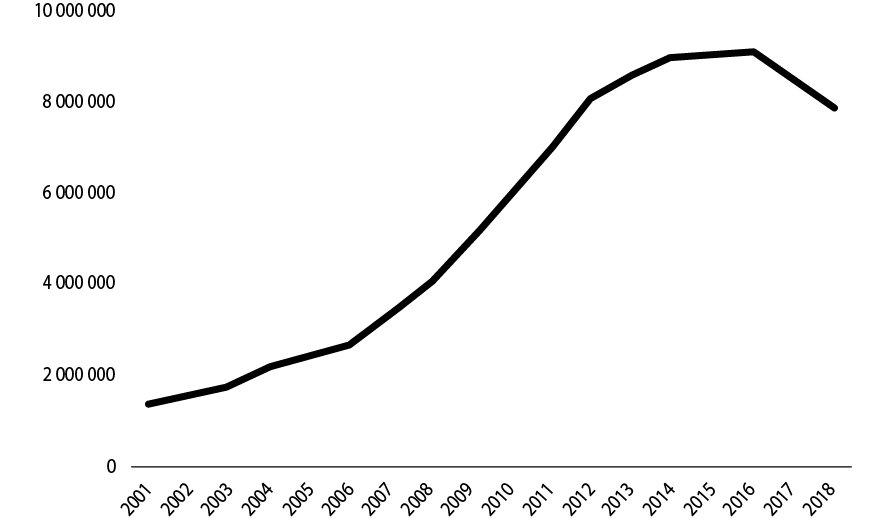

Despite the explosive growth in the popularity of running marathons, its decline should be noted (Fig. 1), which nevertheless leaves the room for the development.

So far, the Moscow Marathon remains one of the most popular in Russia, in which more than 22,000 people took part in 20203. In 2021, the event was canceled due to the difficult epidemiological situation. So far, the demand for Russian races is seriously lagging behind the world leaders. For example, for the London Marathon (which is part of the so-called The World Marathon Majors, which unites Boston, Chicago, New York, Berlin, London and Tokyo) in 2020, 457,861 applicants were registered - more than 10% more than in 2019 . Of these, only 17,500 were accepted (mostly due to the pandemic)4. The biggest marathons have a solid prize pool, ranging from $313,000 in London to $825,000 in New York. The first place winners receive approximately $100,000 each (2018 data).

In Russia, the cost of a race for 1000 people on average starts from 2–2.5 million rubles. (excluding prize money). At the same time, mass city launches with street closures cost more than 100 million rubles. As a rule, a significant part is financed by local authorities.

Part of the money can be compensated by contributions from participants. Abroad, they can account for half of the costs, in Russia this figure does not exceed 20%5. The main source of income comes from sponsors, and with proper organization and favorable market conditions, it allows you to count on payback and low profitability. It is important to note that almost every marathon or other mass race is a private business, which confirms the steady interest in entrepreneurial activity in the running industry.

Fig. 1. Total number of people participating in running marathons in the World

Source: The state of running. 2019. URL: https://runrepeat.com/state-of-running.

-

Private sports clubs, schools and academies

In the last few years there has been a boom in the creation of private clubs, schools and academies in different regions of Russia. Moreover, this phenomenon is becoming quite stable. Private clubs and schools are created both in popular and commercially attractive sports (football, MMA, figure skating, boxing, etc.) and not yet the most popular ones (gymnastics, skating, diving, etc.). Many chess and e-Sports clubs have been created.

Why is this happening? There are several main reasons.

- A fairly large number of Russian citizens are ready to actively and regularly go in for sports, and do it in good conditions and under the supervision of coaches. Many are not satisfied with the prices and services of fitness clubs. In addition, discerning and trained clients want to train in specialized clubs, for example, only in running or skiing ones.

- Sports schools and academies appeared as a kind of alternative to the already existing state ones. There are at least two advantages to private schools. They take almost everyone who wants it – after all, the client pays money. Parents don't always want their children to be Olympic champions. Motive two: children should play sports for health, and they are under the supervision of coaches and in comfortable conditions. In addition, very often in private schools and academies there is a more individual approach to each child, taking into account his characteristics, both physical and psychological.

- Potential entrepreneurs have realized that there is a fairly large demand for such sports and recreation services, which means that this can become a good and long-term business. So, for example, the network of football schools "Championika" has 170 franchisees teaching children in 750 points in more than 150 regions. In the most successful year for the company in 2019, the network's revenue amounted to 77.9 million rubles excluding VAT, and net profit - 16.4 million rubles.6

Recently, there has been another trend in the creation of private clubs, schools and academies. Quite a few well-known athletes and coaches have decided to try their luck and hand at entrepreneurship. They are trying to use their popularity, stardom and recognition in the sports world and among the fans. By the way, this is a common practice in the world, and it is very good that Russian athletes do it. Here are some of them as an example7:

- ski academy of Nikita Kryukov - Olympic champion in cross-country skiing;

- Gymnastics Academy Anton Golotsutskov - Olympic medalist in artistic gymnastics;

- Ekaterina Lobysheva's school of champions - Olympic medalist in speed skating;

- Gleb Galperin's FlyDiving school - Olympic medalist in diving;

- "Academy of Champions" by Nikita Nagorny - Olympic champion in artistic gymnastics.

We believe that this is a very good practice, because we have a huge number of champions in various sports and just star athletes. When they create their own business in the sports industry, this gives them a great opportunity, while remaining in sports, to benefit themselves, their clients and, ultimately, the state.

-

Corporate sports

In corporate sports, private sports clubs and leagues have appeared, and corporate leagues have become a mass phenomenon. This is not about leagues created by large companies and banks (Sberbank, Rosneft, Gazprom, Rostec, etc.), corporate leagues are created as a private business in various sports: football, volleyball, basketball. Moreover, there are leagues for non-game sports. They offer their clients to participate in competitions on a regular basis, form the list of participants themselves, develop a calendar and conditions, and resolve issues of organizing competitions, from sports facilities to judging. Clients are only required to give their consent and pay the registration fee. More often, teams of the same holding participate in such leagues. It depends on the ability to assemble the right team. Sometimes the organization pays for participation in such leagues, but most often the team members pay the registration fee jointly. These teams train and participate in competitions, that is, they play their favorite sport for their own money and have fun. The owners of these already quite numerous leagues are trying to do their job qualitatively, expanding their target audience, knowing well that the success of their own business depends on this.

-

Media

The growth of the sports media market is confirmed by mergers and acquisitions. So, at the end of February 2021, the sports.ru portal changed its owner, the majority shareholder of which was Tkachenko, the president of the consulting company ProSport Management German. The buyer was Aleksey Nechaev, the founder and main shareholder of Faberlic, the initiator of the Captains educational program aimed at military-patriotic education and teaching the basics of doing business. Nechaev is also part of the central headquarters of the All-Russian People's Front movement, created at the initiative of the President of Russia, and in 2020 he created the New People political party, which received 15 seats in the State Duma in the 2021 elections. According to RAS, the revenue of the parent Sports.ru LLC in 2019 amounted to 416.5 million rubles, net profit – 17.5 million rubles. The amount of the transaction has not been officially disclosed, but market participants estimate it at approximately $25 million.8

Another promising deal, which was announced in June 2021, is the possible purchase by Sberbank of Telesport, which owns the rights to show several tournaments, including the Russian Football Cup.

However, despite the growth of private players in the sports media market, it is quite difficult for them to compete with state-owned companies. This was clearly demonstrated by the deal for the sale of television rights to show matches of the Russian Premier League. Initially, it was planned to hold a competition among Match-TV (Gazprom-Media), Yandex, as well as video services Start (the main owner is MegaFon) and Okko (Sberbank). However, in the end, the rights were sold to Match-TV without a tender. In the seasons 2022/23 and 2023/24, the league will receive 6.6 billion rubles each, in the seasons 2024/25 and 2025/26 - 7.7 billion rubles each.9 At the same time, the parties to the agreement did not officially confirm these amounts. Also, the structure of the deal is not disclosed, in particular, it is not clear whether the said amounts include the cost of content production (“production”). Nevertheless, this example shows the emergence of competition in the market and the strengthening of the role of private entrepreneurs.

-

Bookmakers

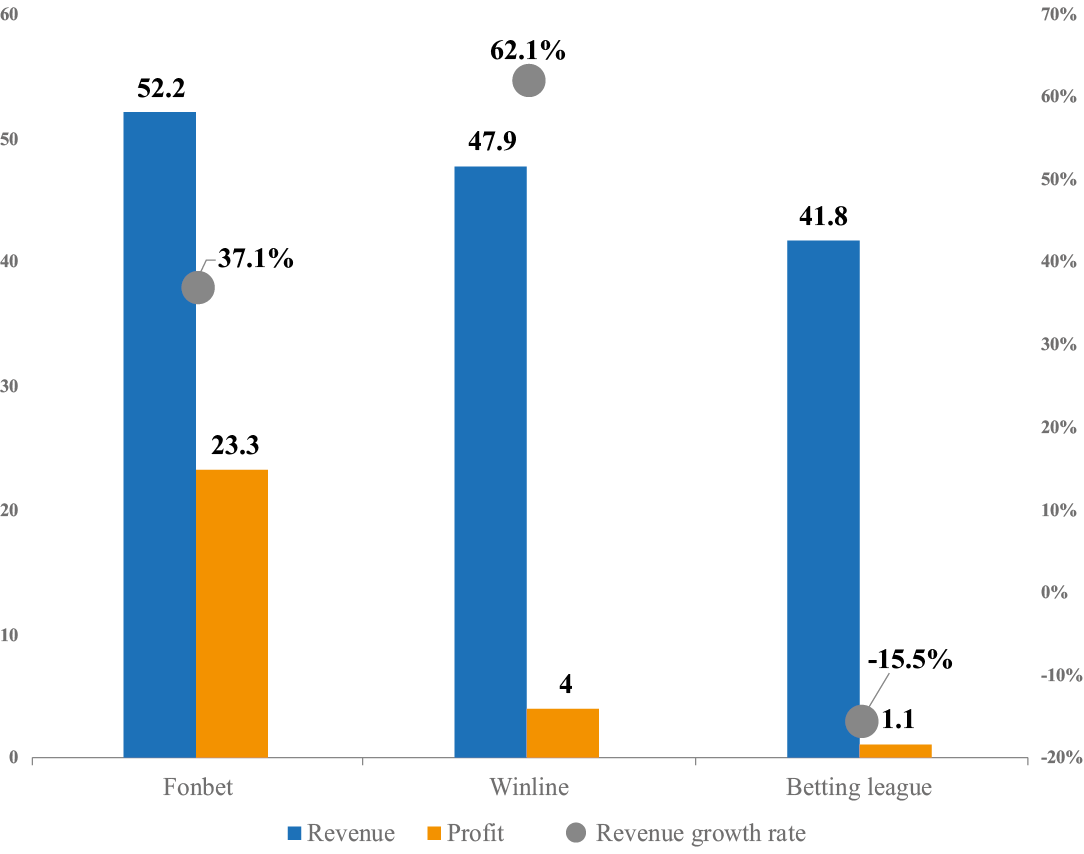

By the end of 2021, the legal betting market in Russia may grow to about 295 billion rubles. This is 25% more than in 2020 and 40% more than in 2019. In 2020, the market growth was 13%. In total, in 2020, legal bookmakers earned 238 billion rubles.10 Foreign companies are also showing growth. For example, the Entain international group of companies, which includes bookmakers Bwin, Ladbrokes, BetMGM, Sportingbet, gambling companies PartyPoker, CasinoClub, etc., announced an 11% increase in revenue in the first half of 2021. The figures of the market leaders are presented in Fig. 2. It is interesting that the leaders of the Russian bookmaker market showed such impressive results during the period of the general decline for the country's key companies.

However, these growth rates may slow down. In Russia, new legislation will have a significant impact: from September 2021, bookmakers pay a percentage of revenue not to leagues, but to a single regulator, and the deductions themselves will increase significantly. This will reduce the margins of the business, but, taking into account the turnover in the market, it will still allow you to get a decent profit.

Fig. 2. Financials of Russian betting companies leading in the market

Source: 600 largest companies in Russia 2021. URL: https://www.kommersant.ru/appsgroup/462?regionid=77.

-

E-sports

In mid-October 2021, the Russian group Team Spirit won the tenth world championship in Dota 2 – The International, the prize fund of which amounted to $40 million. During the period of pandemic restrictions, e-Sports not only did not suffer, but also received a new impetus for the development. This was made possible by the intersection of two directions at once, which have grown with the onset of the COVID-19 pandemic: technological services and systems, as well as entertainment content that can be consumed without leaving home.

According to the research company NewZoo, the audience of e-Sports competitions in the world in 2020 grew by almost 10%, amounting to 436 million people. NewZoo predicts that the average growth in the coming years will be 7.7% and by 2024 the number of viewers will reach 577 million people. The revenue of the e-Sports market in 2020 decreased by 1.1% – to $947 million. However, the growth by 14.5% is already expected in 2021. On average, until 2024, it will grow by 11.1% per year11.

In 2020, there were 664 transactions related to the gaming industry in the world. Of these, 359 were directly related to games, 149 to platforms and technologies, 103 to e-Sports, and 53 to other segments. The total volume of transactions was $33.6 billion. $24.5 billion was spent on gaming companies, $7 billion on platforms and technologies, $614 million on e-Sports companies, and $1.4 billion on the rest. Most often, transactions were concluded in the United States, then - China12.

The largest player in the Russian e-Sports market can be recognized as Esforce, which is part of the Mail.ru Group and unites the e-Sports Virtus.pro; RuHub, a Russian-language e-Sports broadcasting studio; e-Sports media Cybersport.ru; tournament organizer Epic E-sports Events and e-Sports and entertainment complex Yota Arena. However, so far this asset does not bring financial returns to the shareholder: according to the annual report of Mail.ru, for 2020 Esforce brought losses in the amount of 425 million rubles. The asset depreciation loss amounted to 1.3 billion rub. Earlier, at the end of 2019, the holding had already written off 4.5 billion rubles due to Esforce repricing. That is, in total, Mail.ru Group wrote off losses in the amount of 5.8 billion rubles due to Esforce, and the fair value of the e-Sports holding decreased 12 times - to 500 million rubles.13 At the same time, the number of new projects in e-Sports is growing, forming a promising direction for private capital even in the context of a pandemic.

-

Innovation driven by entrepreneurs in the sports industry

The last of the considered activity areas in the sports industry - e-sports in itself is an innovation that exists and is commercialized thanks to new technological solutions.

Innovations introduced in the fitness industry can be classified as follows:

- Transferring workouts online, developing specialized applications and manufacturing equipment that allows you to watch broadcasts, communicate with coaches and other participants, organize competitions (for example, Mirror and Peloton companies).

- The development of computer vision technologies, sensors and detectors that monitor a number of indicators and control the correctness of the exercises.

- Application of virtual reality technologies for training simulations.

Marathons during the pandemic were also transferred to the virtual space, which, of course, can be recognized as an innovative solution. In terms of new technologies projects for monitoring the condition of runners and skiers should be noted, which are implemented with the help of sensors in sneakers and insoles in ski boots and integrated with special applications that allows you to compete and communicate with other participants.

Sports media today work mainly in the Internet space, which is difficult to recognize as an innovation. At the same time, new technological solutions are used in broadcasting sports events, which are transferred to virtual reality, and allow to visit stadiums and museums of clubs. In addition, traditional shooting of matches is moving to a new level: the number of cameras, image quality is growing, and the use of 3D graphics in game analysis is increasing.

Modern betting companies are also becoming a high-tech area that requires a lot of IT solutions: collecting sports statistics, processing payments, fighting fraud, organizing broadcasts, ratio calculating, customer loyalty systems, developing a website, mobile application, Telegram bots. On average, IT spending in 2021 has risen by about 10% of a company's revenue14. For example, in the first half of 2021, Fonbet's total investment in software development and IT infrastructure amounted to more than 700 million rubles - 30% more than in the previous year. Investments in the development and online support of the betting line amount to more than 1 billion rubles for half a year. The main incentive for automation was the growth in the share of online bets: about 90% of bets are made online, the same is about the share of online in revenue. In addition, the need for IT resources is stimulated by the need to integrate with a single center for rate transfers.

Sports schools use digital solutions used by professional sports clubs, but due to limited financial resources, on a more modest scale. They are mainly related to monitoring the actions of athletes during games and training, as well as within the framework of medical support. As a rule, all these solutions are integrated into a mobile application that allows players to communicate with the coach and with each other.

Thus, today's entrepreneurs have a range of innovative solutions available to make training more effective and interesting, collect and process the necessary data, involve the maximum number of participants (athletes, fans, coaches) and, finally, expand the market and increase sales. It seems that the greatest potential in the sports industry in the face of ongoing restrictions may be virtual reality technologies.

-

Measures to support entrepreneurs in the sports industry

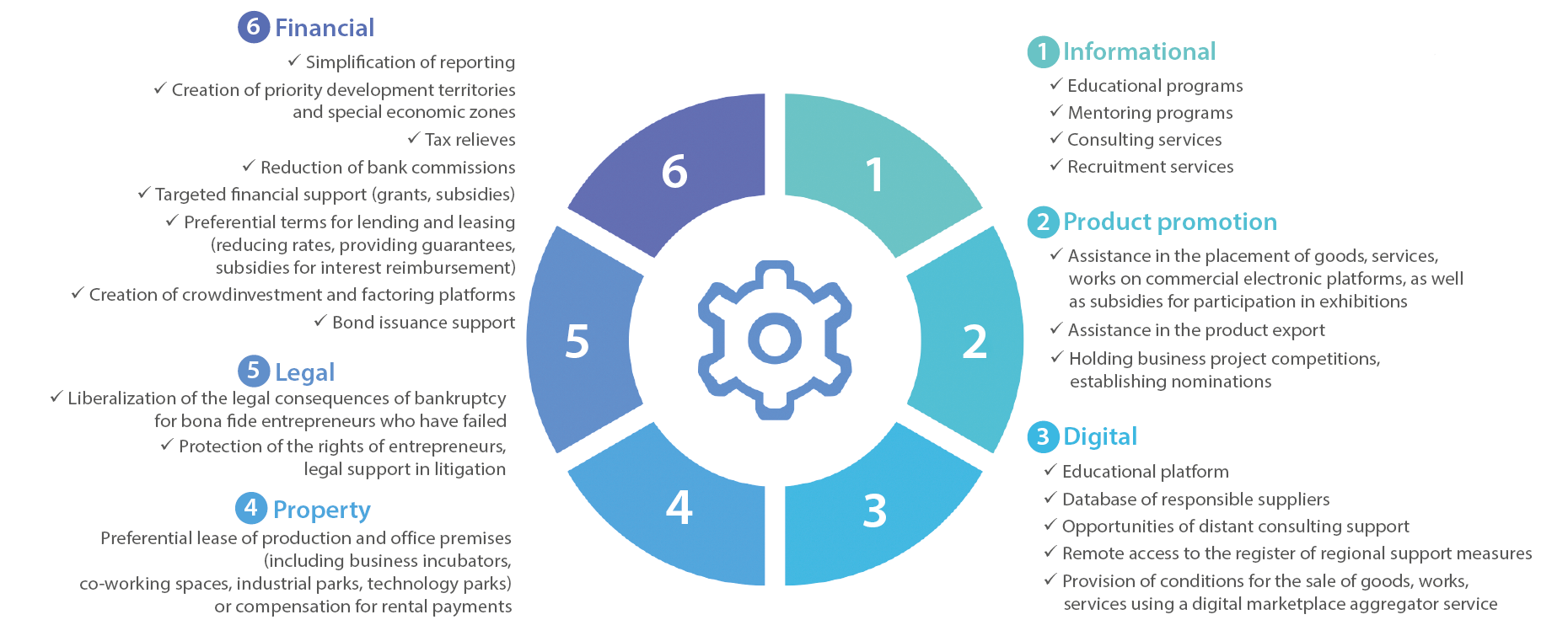

The topic of supporting the business community has become particularly relevant during the pandemic. The most complete list of support measures (classified according to a specific criterion) can be found in the OECD [Policy Responses to Coronavirus.., 2021] and the World Bank [Map of SME-Support.., 2020]. Among foreign and Russian authors who have studied the tools to support entrepreneurs, one can note [Watson et al., 1998; Storey, 2008; Mole et al., 2011; Vertakova et al., 2016; Zabolotskaya, 2019; Oguntoye and Quartey, 2020]. It is also worth noting the measures implemented in Moscow. Based on the analysis of these works, measures to support entrepreneurs can be systematized as follows (Fig. 3).

Of course, all these tools are relevant for the sports industry. It must be recognized that support in many of these areas is already underway. For example, a tax deduction was introduced for those involved in physical culture and sports. A number of preferences are provided to sports projects aimed at solving social issues, mechanisms of public-private partnership are being actively implemented. As one of the support measures, it can be proposed to create sports clusters (similar to special economic zones), which provide participants with comprehensive support in all selected areas. At first, such clusters can unite not only the sports business, but also all sectors of the creative economy, entertainment and tourism industries.

At the same time, it seems that state support should be provided not for the sector as a whole, but based on certain criteria that characterize the efficiency of entrepreneurs and the impact of their activities on the economy and the social sphere. Such criteria may include:

- creation of new jobs;

- tax deductions (prospective and for previous periods);

- assistance in achieving the indicators set in the national projects, as well as certain metrics set at the regional level (for example, increasing the number of people involved in physical culture and sports);

- Savings in budget expenditures, for example, the development of physical culture and sports can help reduce crime, improve health, achieve success in education, therefore, the state, by investing in the development of sports, will be able to reduce costs in other areas [Davies et al., 2021].

Further research can be devoted to the development and testing of methods for evaluating such criteria and effects.

Fig. 3. Tools aimed at entrepreneurs’ support

Source: compiled by the authors.

Conclusion

In the framework of this article, the authors tried to analyze the development of entrepreneurship in the sports industry, showing the specific features and trends for different areas of this already established phenomenon. It is very important to understand that the interests of the state coincide with the interests of private business. Moreover, there are quite a few areas of entrepreneurship in sports. There are business structures that provide sports and health services, such as fitness clubs, sports clubs, schools and academies. Various media resources are successfully operating, from websites and digital platforms to TV channels. Bookmakers directly finance various sports organizations (federations, leagues and clubs) as sponsors and expect to increase their target audience and get maximum profit through sports events.

So far, there are very few positive examples of entrepreneurship in professional sports. This is a matter of time, since the state has already outlined its interests and tasks. Funding from budgetary sources will be gradually reduced, which means that professional clubs will inevitably have to earn money themselves and reach self-sufficiency, so they will have to master various marketing tools and attract trained managers with the necessary professional competencies. But this is another topic, perhaps for future research.

An important feature of entrepreneurship that must be considered in any industry is the threshold for entering a business or the required amount of initial investment. In the sports industry, this threshold is quite low for private schools, leagues, corporate sports, online publications, where at first no serious investments are required and the primary is an accurate market analysis, choosing your niche, and quality of services. At the same time, the fitness industry and professional sports, on the contrary, are available only to a limited circle of investors with sufficient capital.

Based on the analysis, the authors can formulate the following directions for further research in this area:

- analysis of markets (directions) of entrepreneurship in the sports industry;

- development and testing of methods for evaluating the effectiveness of measures to support entrepreneurship in the sports industry;

- areas of professional training of entrepreneurs for the sports industry.

1 Sergei Galitsky: Is football a sport or a business? (2015). Sport-Express. URL: https://www.sport-express.ru/football/rfpl/reviews/896606/.

2 Iliev S. (2020). Evgeny Shilenkov: I want to create a project where the club is the face of a person. Like Galitsky. URL: https://news.sportbox.ru/Vidy_sporta/Futbol/Russia/1st_division/spbnews_NI1194078_Jevgenij_Shilenkov_Khochu_sozdat_takoj_projekt_gde_klub__lico_cheloveka_Kak_u_Galickogo.

3 Zabgaeva A. (2020). A new record and an ambiguous finish: how the Moscow Marathon 2020 went. URL:https://www.championat.com/lifestyle/article-4140361-rezultaty-moskovskogo-marafona-2020-kak-proshjol-zabeg.html.

4 Carter K. (2021). Everything you need to know about Running All 6 Abbott World Marathon Majors

from the hardest marathon to get into (it's not Boston) to the easiest course to run. URL: https://www.runnersworld.com/races-places/a28307813/world-marathon-majors-faq/.

5 Sinitsyna I. (2018). Who makes money running marathons. URL: https://www.vedomosti.ru/business/articles/2018/09/20/781538-kto-zarabativaet-marafonov.

6 Podtserob M. (2021). How two Moscow financiers developed children's football. URL: https://www.vedomosti.ru/management/articles/2021/05/24/871151-detskii-futbol.

7 Moreover, we deliberately do not take the so-called commercial sports (football, hockey, figure skating, boxing and others), but show not the most popular sports.

8 The ex-owner of Sports.ru spoke about the decision to sell the publication in 2020 (2021). RBC. URL: https://sportrbc.ru/news/6038f8749a79477afa017955?ruid=uUjlA15HqrZP34lwAxZuAg.

9 The Match TV offer bribed the Premier League. What will change for clubs (2021). RBC. URL: https://sportrbc.ru/news/615c8fb69a79478c8e534f94.

10 Lebedeva V. (2021). The stakes have gone up, gentlemen. URL: https://www.kommersant.ru/doc/4997818.

11 Rozhdestvenskaya Ya (2021). Esports has captivated football players and investors. URL: https://www.kommersant.ru/doc/4739827.

12 Bespyatova E. (2021). InvestGame: in 2020, transactions worth $ 33.6 billion were carried out in the gaming industry. URL: https://app2top.ru/analytics/investgame-v-2020-godu-v-igrovoj-industrii-by-lo-provedeno-sdelok-na-33-6-mlrd-180269.html.

13 Mail.ru lost billions of rubles on eSports (2021). URL: https://www.cnews.ru/news/top/2021-04-29_mailru_poteryala_milliardy_rublej.

14 Lebedeva V. (2021). Bet on IT. Why bookmakers are increasing the cost of their IT infrastructure. URL: https://www.kommersant.ru/doc/5050994.

References

1. Ishchenko M.M., Izaak S.I. (2017). Innovation. Entrepreneurship. Sport. Economic Systems, 10, 3(38): 59-63. (In Russ.)

2. Kudryavtsev V.V. (2019). Development of sports: On the choice of priorities and areas of entrepreneurship. Bulletin of the Russian International Olympic University, 4(33): 22-27. (In Russ.)

3. Kudryavtsev V.V. (2017). The end determines the means. Factors for the development of entrepreneurship in the field of sports in Russia. Bulletin of the Russian International Olympic University, 2(23): 28-41. (In Russ.)

4. Lednev V.A. (2020). Entrepreneurship in sports: It is necessary to develop the club system. Modern Competition, 1(77): 106-117.

5. (In Russ.)

6. Lednev V.A., Bratkov K.I. (2019). Entrepreneurship in the sports industry: opportunities, expectations and results. Modern Competition, 13, 1(73): 120-130. (In Russ.)

7. Rubin Yu.B. (2021). Managing your own business. Moscow, University “Synergy”. DOI:10.37791/978-5-4257-0504-4-2021-1-1104. (In Russ.)

8. Solntsev I.V. (2020). Improving the financial stability of Russian football clubs. Economic Journal of the HSE, 24(1): 117-145.

9. (In Russ.)

10. Davies L.E., Taylor P., Ramchandani G., Christy E. (2021). Measuring the social return on investment of community sport and leisure facilities. Managing Sport and Leisure, 26: 1-2, 93-115. DOI:10.1080 /23750472.2020.1794938.

11. Map of SME-support measures in response to COVID-19 (2020). World Bank. URL: https://www.worldbank.org/en/data/interactive/2020/04/14/map-of-sme-support-measures-in-response-to -covid-19.

12. Mole K.F., Hart M., Roper S., Saal D.S. (2011). Broader or deeper? Еxploring the most effective intervention profile for public small business support. Environment and Planning, А, 43(1): 87-105. DOI:10.1068/a43268.

13. Oguntoye O., Quartey S.H. (2020). Environmental support programs for small businesses: A systematic literature review. Business Strategy and Development, 3(3): 304-317. DOI:10.1002/bsd2.96.

14. Policy responses to coronavirus (COVID-19). One year of SME and entrepreneurship policy responses to COVID-19: Lessons learned to “build back better” (2021). OECD. URL: https://www.oecd.org/coronavirus/policy-responses/one-year-of-sme-and-entrepreneurship- policy-responses-to-covid-19-lessons-learned-to-build-back-better-9a230220/.

15. Storey D. (2008). The blackwell handbook of entrepreneurship. Book Chapter: 176-193. DOI:10.1002/9781405164214.ch9.

16. Vertakova Y., Polozhentseva Y., Klevtsova M., Leontyev E. (2016). Government support tools for small business: Russian and foreign experience. Proceedings of the 27th International Business Information Management Association Conference - Innovation Management and Education Excellence Vision 2020: From Regional Development Sustainability to Global Economic Growth. IBIMA: 1134-1144.

17. Watson K., Hogarth-Scott S., Wilson N. (1998). Small business start‐ups: Success factors and support implication. International Journal of Entrepreneurial Behavior & Research, 4(3): 217-238. DOI:10.1108/13552559810235510.

18. Zabolotskaya V.V. (2019). Governmental programs of small business support in the USA. World Economy and International Relations, 63(12): 15-22. DOI:10.20542/0131-2227-2019-63-12-15-22.

About the Authors

V. A. LednevRussian Federation

Doctor of economic sciences, professor, vice-president of the Moscow Financial and Industrial University “Synergy”, scientific director of the Faculty of Sports Industry, head of Sports Management Department (Moscow, Russia). SPIN: 4542-3123, Author ID: 759923. Research interests: sport economics, sport management, sport entrepreneurship.

I. V. Solntsev

Russian Federation

Doctor of economic sciences, head of Management and Marketing in Sports Department of Financial University under the Government of the Russian Federation (Moscow, Russia). ORCID: 0000-0001-9562-8535, Researcher ID: C-5644-2013, Scopus ID: 56976343300, SPIN: 2618-0770, Author ID: 683561. Research interests: sport economics, sport management, finance and investments in sports, development strategies for sport entities.

Review

For citations:

Lednev V.A., Solntsev I.V. ENTREPRENEURSHIP IN SPORTS INDUSTRY: DIRECTIONS, INNOVATIONS AND SUPPORT. Strategic decisions and risk management. 2021;12(3):252-261. https://doi.org/10.17747/2618-947X-2021-3-252-261