Scroll to:

DIGITAL TRANSFORMATION OF ECONOMY AND TECHNOLOGICAL REVOLUTIONS: CHALLENGES FOR THE CURRENT PARADIGM OF MANAGEMENT AND CRISIS MANAGEMENT

https://doi.org/10.17747/2618-947X-2019-4-330-341

Abstract

The digital transformation of the economy leads to dramatic changes in business and society and requires the reconfiguration of all socio-economic institutions. Such radical changes include economic science and management, challenging the traditional economic laws and management tools that were formed in the “digital era”. The purpose of the study is to identify the key challenges of the digital transformation of the economy for economic science, management and business, as well as the main directions of development of crisis management of companies in the era of the digital economy.

The study identified the main factors of digital transformation of the economy that affect the methods and conditions of doing business, and the challenges of digitalization for business. The necessity of developing a new crisis toolkit for companies of the “digital” and “non-digital” eras is substantiated, for which a comparative analysis of the characteristics of such companies and key indicators of their financial and economic status is carried out. In addition author defined several economic paradoxes that the author called the “scissor effect” (a gap in the dynamics of the capitalization of digital and non-digital companies) and the “paradox of profitability” (growth in the capitalization of digital companies against the backdrop of chronic loss-making activities).

Author used various methods of scientific research: deduction and induction when conducting an empirical analysis of the activities of digital and non-digital companies, analytical methods and historical analysis.

The results of the study will contribute to the development of the theory of management and crisis management in the era of the digital economy, and also will determine the future directions of theoretical and practical development of these scientific disciplines.

Keywords

For citations:

Kochetkov E.P. DIGITAL TRANSFORMATION OF ECONOMY AND TECHNOLOGICAL REVOLUTIONS: CHALLENGES FOR THE CURRENT PARADIGM OF MANAGEMENT AND CRISIS MANAGEMENT. Strategic decisions and risk management. 2019;10(4):330-341. https://doi.org/10.17747/2618-947X-2019-4-330-341

1. RELEVANCE AND PROBLEMATICS OF RESEARCH

Currently, a new digital technological revolution is rapidly developing, with dramatic changes in all socio – economic institutions, and sometimes even with formation of new ones. Сurrent technological changes bring certain challenges to economic science when the earlier, formed in the pre-digital era theoretical concepts cease to work. These challenges are now formed for management as a direction of economic science, including crisis management. Practice shows the need to form a new anti-crisis toolkit, as the existing one does not ensure the survival of companies in modern conditions, crisis phenomena in the economy are preserved.

At the same time today, the theory lags behind practice: there are still no systemic scientific-theoretical studies defining the main directions of transformation of the theory of management in the conditions of digital economy. All existing research on the transformation of management in the digital economy in Russia and abroad [Trachuk et al., 2018; Alexandrova, 2019; Sheve et al., 2019] mainly focus on attention to the fourth industrial revolution (“Industry 4.0”), not considering the main directions of change of management theory and being more focused on practical implementation in the sectors of the economy of digital technologies. The first attempts to understand the need to change the theory of anticrisis management in the conditions of digitalization of the economy are presented in the work [Kochetkov, 2020].

A significant scientific problem from the point of view of research on the phenomenon of digital economy is the absence of a single theoretical basis of digital economy. At the moment there are isolated works on theoretical understanding of this phenomenon from the perspective of neoclassical and new institutional economic theory [Moazed, Johnson, 2016; McAfee, Brynjolfsson, 2019]. From the perspective of economic theory in general, there are a number of methodological problems, such as the lack of established terminology in the field of digital economics and approaches to periodization and definition the essence of technological revolutions. This can be confirmed by the fact that there is now a lack of understanding whether the current digitization of the economy is a new technological revolution or this is the “golden age” of development of the last information and telecommunication technological revolution.

Nevertheless, the digital economy is already a reality, and the successful functioning and survival of the business in the new environment requires a reconfiguration of the theoretical management concepts, its tools. Therefore, it is necessary to identify the main challenges and directions of digital transformation for management and crisis management in the era of digital economy.

2. FACTORS OF DIGITAL TRANSFORMATION OF THE ECONOMY: INFLUENCE ON WAYS OF DOING BUSINESS

As a theoretical basis of our research we will use the theory of technological revolutions and technical-economic waves [Peres, 2013]. According to this theory, in the world there is constantly a consistent change of technological revolutions, which have certain periods and phases of development. At the same time, the periods of formation and deployment of the technological revolution (the so-called Big Wave) are accompanied by the change of the old techno-economic paradigm of the preceding technological revolution to a new one. This paradigm shift involves massive and fundamental economic, institutional and technological changes, including the transformation of traditional Big Wave organizing methods and doing business.

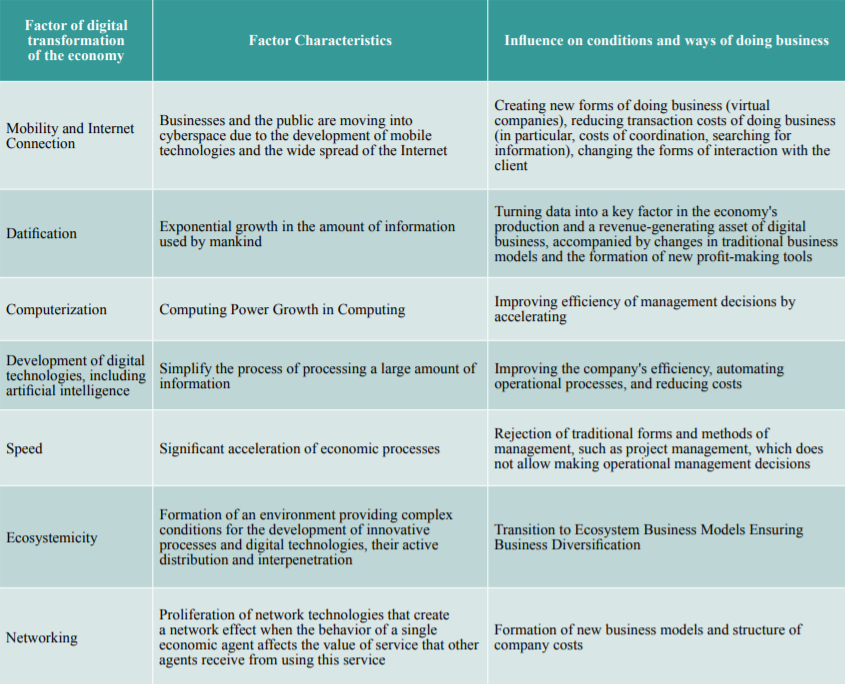

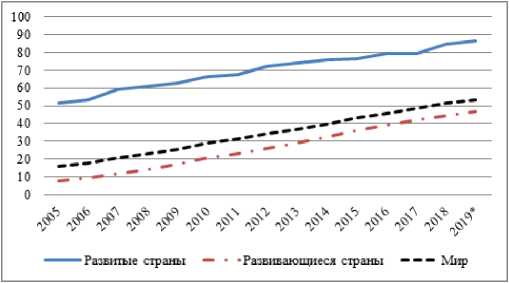

To prove this claim, consider the main factors and key changes in the digitalization of the economy [Moazed, Johnson, 2016; Maltsev, 2019] that have significantly affected the conditions and ways of doing business (Table 1). The basic factor is the rapid spread of the Internet (Fig. 1), including through mobile communications, and the growth in the level of connection to it (today the Internet penetration rate in the whole world has exceeded 50 %, and in developed countries it has reached almost 90 %). This has led to exponential growth in the amount of information collected and processed by businesses, making data a key asset in the digital economy. All other factors of digitalization in one way or another are related to the formation and processing of data about consumers, business processes.

Table 1. Key factors of digital transformation of the economy

* 2019 data is preliminary.

Source: according to the information base Statista. URL: https://www.statista.com.

Development of mobile internet at a shock pace has led to key changes affecting companies' business strategies: (1) the availability of computing power and cloud services, which essentially means formation of information infrastructure necessary for development in the context of widespread digitalization; (2) cheaper cost of transmission and storage of information and, as a result, the disappearance of barriers to entering business, reducing data storage and transfer costs, developing network effects; (3) increasing economies of scale in data analysis, resulting in huge extraction potential came from data analysis.

Thus, basis of business in digital economy is data, around which all business processes are built and on the basis of which new business models and ecosystems are formed, involving interaction of economic agents in cyberspace. In turn, introduction of digital technologies allows companies to significantly reduce both transaction and transformational costs for businesses, as well as become client-oriented, forming customized services and products.

But in addition to data, there is another factor that causes specific economic effects for digital businesses – the network revolution, which led to a dramatic economic and social transformation. Network effects basis of new digital business based on platform business model [Popov, 2019].

3. CHALLENGES OF DIGITAL TRANSFORMATION ECONOMY FOR BUSINESS

Digital transformation of economy has led to challenges for economic science, including for management, which can be conditionally divided into following groups (Figure 2):

- changing business economy;

- changing business model;

- changing business value factors.

Key Challenges of Digital Transformation Economy for Business

As a result, theoretical concepts that determine the development of companies in pre-digital era have ceased to work with regard to new digital business. Let us consider each challenge more.

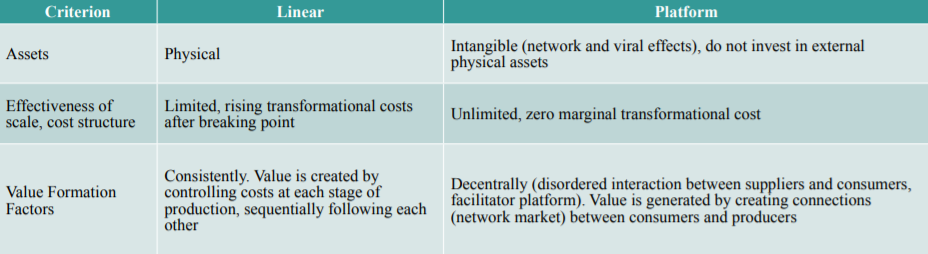

One of the key challenges to digitalization of social and economic processes for business is to change its economy. Network revolution radically changed the cost structure of business, and therefore the mechanism of profit formation. The fact is that spread of the Internet, use of digital technologies lead to a significant reduction in transaction costs for information search, conclusion of deals, sale of goods and services. In addition, it also provides zero marginal transformational costs of business, because the creation of copies of digital goods, their distribution on the Internet is almost free of charge [Moazed, Johnson, 2016; McAfee, Brynjolfsson, 2019]. Scaling up of digital business, accordingly, is accompanied by a rise in profits. If earlier the efficiency of company was associated with the costs of production (improvement of process of organization of work) and sales of products (formation of demand), now the Internet has reduced the cost of output to new markets, business creation by reducing transaction costs.

The next challenge is changing business models. Network revolution has led to formation of a new business model – a platform-networking one that differs dramatically from traditional linear business model. The first reason for this model was the new cost structure in digital economy. These changes led to the formation of a new type of economic entities, representing unification of the main features of organizations (hierarchical structures) and market – platform. Education data are, in fact, decentralized networks. It would seem that a new type of economic entity could completely displace traditional companies. However, they continue to live. There are several reasons here. First, decentralized networks do not form and grow independently, it requires a company (to be more precise – a person). Secondly, according to transaction cost theory, companies as an economic entity will not disappear even in the digital economy (era of decentralized structures) due to the inability to create complete contracts due to future uncertainties, limited people rationality and residual control rights [McAfee, Brynjolfsson, 2019]. As a result, today the economy operates not fully decentralized systems, but platform companies based on a platform-network business model.

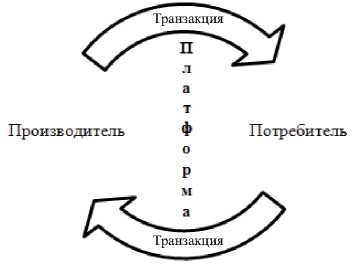

Mechanism of working platforms differs from activities of traditional companies (Table 2), due to the structure of assets and costs, factors of value formation. Platforms do not invest in external resources (physical assets, human resources, for example Uber does not have drivers and taxi parks in its staff, and Airbnb does not own properties), generating value of business by creating connections (network market) between consumers and producers.

Table 2. Comparison of linear and platform business models

The latest challenge is the transformation of business value factors. If the value of traditional companies is created in the production process, the platform companies focus around the development of networks (connections) between consumers and producers, so called transactions. New platform companies have evolved from production centers to centers of exchange and communication between consumers and manufacturers. The main factors of business value formation were concentrated in the field of network and transaction management, as a result of which the traditional consistent chain of values began to disintegrate into separate constituents. In a digital economy, the linear value chain is no longer an aggregator of value of digital business, such a function has moved to a network ecosystem. Thus, new platform companies do not fit into the paradigm of business value creation, which holds that the value of business is generated by cash flows, assets generated [Brealey, Myers, 2008]. The value of traditional companies is measured through their physical assets, but by these criteria it is impossible to directly determine the value of a platform business because its value lies in facilitating transactions between economic agents. Until now, corporate finance and accounting theories have failed to translate network effects and the resulting transactions into the language of value factors and accounting categories.

4. TRADITIONAL ECONOMIC LAWS HAVE STOPPED WORKING IN DIGITAL ECONOMY

The changes considered have caused some economic laws to stop working in the environment of digitalization. Entire theoretical basic building of economics and management was formed in the last century under the conditions of the previous technological revolution and is focused on the theoretical basis of patterns of development and functioning of industrial capital-intensive companies with linear business models (of course, economic science was not limited to these issues). Network Revolution destroyed basic assumptions that formed the basis of economies of scale, value chains and Michael Porter's model of five competitive forces [Moazed, Johnson, 2016; McAfee, Brynjolfsson, 2019; Blommaert et al., 2019]. The basic assumptions of immutable laws, on the basis of which business strategy and economic theory were built, proved obsolete as technology progressed.

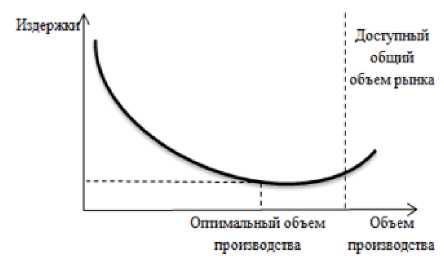

In the digital environment, the scale of business has ceased to play an important role,

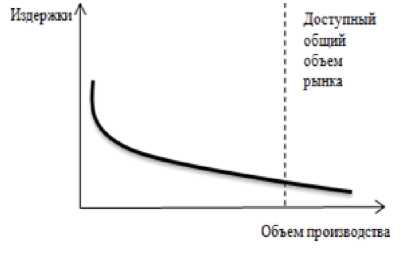

and in many sectors of the economy this effect has become leveled. Scale effect occurs when higher output reduces the average cost of production (minimum value of long-term total transformational costs) (Figure 3). However, the positive scale effect of linear business is not constant, after the transition of a certain point, production can grow more slowly than resource costs (with the growth of output, average total transformational costs increase), – there is a negative economies of scale [Pettinger, 2019]. The line business is growing by investing in physical assets and attracting new employees. Therefore, in order to scale the linear business invests in physical assets, human resources.

In turn, platform costs as opposed to line business as platforms grow and develop typically shrink and have no reverse effect. With platform development, if it passes critical mass (when the value of using a platform to agents exceeds the cost of connecting to it), the costs are logarithmically aligned (Figure 4). This feature of economies of scale for platform companies is due to a number of reasons. First, the specific cost structure of a platform business allows it to not have huge physical assets and provide higher returns on investment compared to a line business. Second, digital infrastructure results in low marginal transformational costs. Third, network effects increase profits with growth in scale: profits rise faster than costs. Fourth, profit growth is not achieved by reducing unit costs, but by personalization, customization of products, increasing the speed of delivery of products to the consumer.

The idea of a value chain is based on a consistent combination of different activities to create maximum value with minimal cost – reducing the cost of production and sales products (Figure 5). Platform business model assumes a different mechanism for creating value: it is not generated by consistently reducing costs at each stage of operating cycle, but by providing interaction of economic agents within the framework of formed network ecosystem (Figure 6) Thus, platform value formation factors are not arranged sequentially behind each other.

5. TRANSFORMATION OF THE ROLE OF CRISIS MANAGEMENT IN DIGITAL ECONOMY

We have considered common challenges for economics in general and management in particular. Are these challenges relevant for crisis management as a special type of management? Why is anti-crisis management necessary in the new conditions? To answer these questions, we will identify the main factors and key changes in the economy, indicating the need for crisis management.

The first factor is the strengthening of the dependence of the world economy on deleveraging, which is manifested in the annual growth of the debt load of the corporate and public sectors (according to the results of 2019, the level of load exceeded 80 % of world GDP [Information base “Statista”, 2020]) amid the slowdown in the economy. Borrowed capital is a key element of the crisis management system. Inefficient servicing of borrowed capital always threatens to intensify creditors' debt claim activities and the possible threat of loss of property to the debtor.

The second factor in the digitalization of the economy, traditional industrial companies of the pre-digital age are increasingly facing crises, due to the discrepancy business models of these companies to new economic conditions. Many firms with nearly a century history of existence, formerly once industrial giants (General Electric, Ford, Nike, Lego, Procter&Gamble [Davenport, Westerman, 2018]), failed to adapt to the conditions of digital economy and face crisis situations during the course of failed digital transformation due to a lack of understanding of complexity of process and ignoring factors of external environment. Key anti-crisis tool for such companies should be digital transformation, which will involve restructuring of all business subsystems.

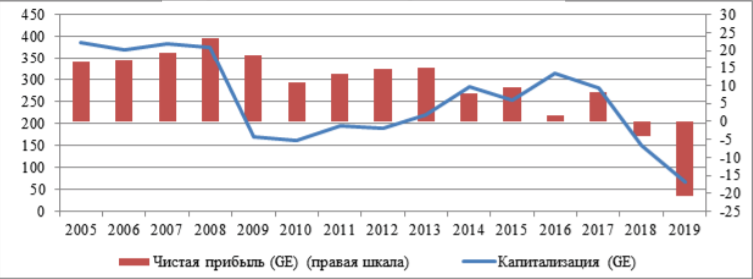

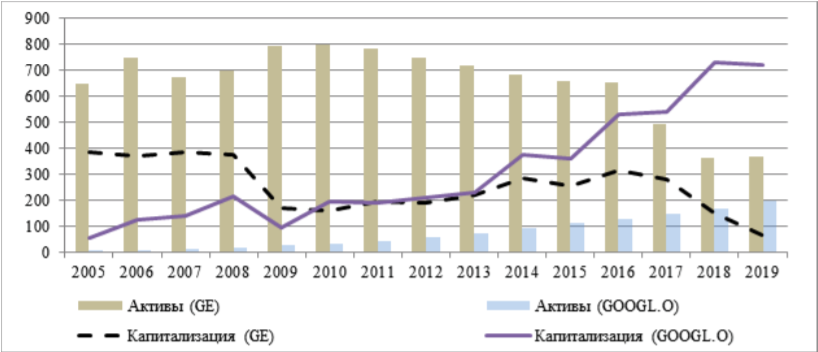

General Electric Corporation was affected most acutely by the crisis. It was unable to effectively restructure assets under new changing conditions, resulting in almost all of its areas unprofitable (at the end of 2019, a net loss in amounting to about $ 21 billion USD), capitalization decreased by almost 80 % in 2019 compared to 2016 (Figure 7). According to analysts, the large-scale unprofitability of General Electric

Corporation's operations could have led to its bankruptcy1.

Source: according to the information and analysis database Thomson

Reuters. URL: https://www.thomsonreuters.com.

The third factor of emergence of new economic entities (socalled digital companies), financial and economic features of functioning of which do not fit in current paradigm of economic science [Kochetkov, Romanova, 2018]. If we measure the performance of these companies through traditional metrics, most of them are in crisis due to chronic unprofitability. Key problem in this case is the lack of new anti-crisis tools adapted to the peculiarities of digital companies, because the existing tools and management institutions are formed in the pre-digital era and are mainly focused on capital-intensive industrial companies.

6. ANTI‑CRISIS MANAGEMENT OF DIGITAL COMPANIES: EFFECT OF SCISSORS, PARADOX OF PROFITABILITY, SUBVERSIVE INNOVATIONS

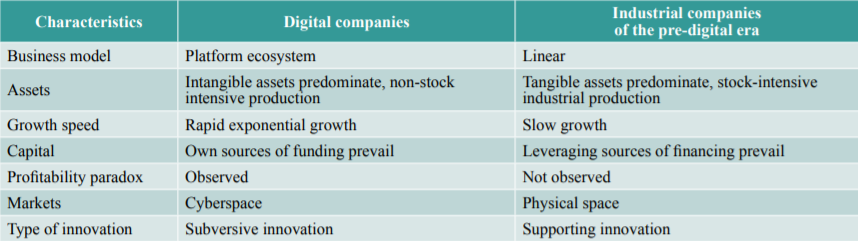

Digital companies differ significantly from industrial companies (Table 3). Among the key differences we can note platform business model and rapid growth (in the scientific world for such companies there were special terms – “exponential organizations” [Ismail and others. 2017], “blitz scaling” [Hoffman, Yeh, 2019]), provided largely by own funds.

Table 3. Comparative characteristics of digital and non-digital companies

Companies of the digital age can be conditionally divided into two groups: (1) profitable large companies (for them already created a scientific term – “technological titans” (tech titans [How to name…, 2018]); (2) non-profitable small companies (most of these are former start-ups) whose operations are sometimes incompletely based on a platform business model.

Digital companies of the first group today became leaders not only in the digital sector, but in the whole economy, redistributing world wealth to their advantage. The main financial and economic indicator, reflecting the scale and efficiency of digital companies compared to their industrial predecessors, is capitalization. Today, seven out of ten capitalization leaders companies are digital and high-tech companies (Microsoft, Amazon, Apple, Google, Facebook, Alibaba, Tencent)2. In the history of the existence of legal entities, the first company in the world with a capitalization of over 1 trillion. UDS became Apple Corporation (as of August 2018), increasing its capitalization in 12 years by a factor of 17 and rising from 116th place.

At the same time, the economic foundation of digital companies (available assets) is much smaller compared to the industrial giants. A study of capitalization dynamics of corporations General Electric and Google shows a significant outperformance of the size of digital company's capitalization (at the end of 2019, the excess was 11 times), then as the value of Google's assets is significantly less than that of General Electric (in 2019‑2 times less, in 2011, when Google's capitalization first overtook that of General Electric, – 7 times less) (Figure 8). This phenomenon, of the gap between the volume of capitalization of digital and industrial companies for a long time, is not yet well researched. It appears that it may be given the name “scissors effect”.

Source: according to the information and analysis database Thomson

Reuters. URL: https://www.thomsonreuters.com.

Among the key features of the second group's digital companies are the following: (1) exponential business growth (the growth rate is double digit numbers), based on the use of subversive innovation and a threat to traditional companies of the pre-digital age; (2) growth is accompanied by systematic loss and constant increase in the value (capitalization) of the business.

The main paradox of such new digital companies is completely different, which does not fit into the modern scientific financial and economic paradigm mechanism of their functioning and development: continuous growth the value of such companies despite the “eating” of capital and the lack of profit.

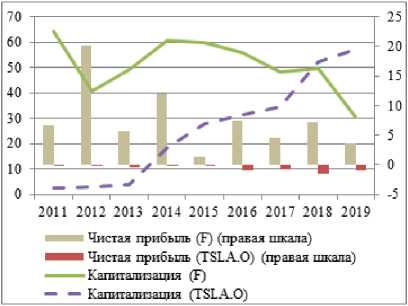

Among the notable examples of public digital companies of the second group with a long period of existence we can mention Tesla (IPO of the company took place in 2010) and Twitter (went to IPO in 2013). The entire period of operation of these companies is accompanied by an increase in capitalization against the background of unprofitable activities (Figure 9, 10). This same trend is confirmed for digital companies that went to IPO in 2019: all 14 digital start-ups at the time of the IPO had high offer prices, despite the preceding chronic loss (most companies have almost twice the expenses)3. For example, Uber has reached a capitalization of over 80 billion USD, before IPO, a net loss of 1.8 billion on revenue of 3 billion USD4.

Source: according to the information and analysis database Thomson Reuters. URL: https://www.thomsonreuters.com

According to the existing management paradigm formed in the pre-digital era, the profitability of the company is seen as a key indicator and factor of performance. In the theory of crisis management, profit is always seen as an indicator, evidently showing no signs of crisis [Anti-crisis management…, 2016]. Moreover, the existing theory of corporate finance, focused primarily on industrial companies of past technological revolutions, sees profits as a key factor in growth fundamental business value of such companies [Brealey, Myers, 2008].

Let's call this economic phenomenon as the “paradox of profitability.” Is a company that has chronic unprofitability, but is growing at a high rate of capitalization, crisis, is it necessary to apply to it anti-crisis tools, if so, what? Obviously, for now, science doesn't provide answers to these questions. If we consider this phenomenon from the perspective of the existing scientific paradigm, on the one hand, we can argue that these companies are in a crisis situation and inefficient activity. On the other hand, the simultaneous rapid growth of capitalization of such companies (and thus the growth of wealth of stakeholders, including creditors) refutes this claim, because the growth of fundamental business value is also one of the key criteria for the absence of signs of crisis [Blank, 2006].

Until now, the paradox of profitability has not been fully studied by economic science or even articulated. There are first attempts at understanding this phenomenon and explaining its causes [Kochetkov, 2019]. It is obvious that the capitalization of digital companies is influenced by other factors, among which profitability is not significant. The main reasons for the exponential growth of capitalization are as follows: significant potential and growth prospects for commercialized digital technology; peculiarities of investments in intangible assets of digital companies due to their intangible nature (non-refundable costs (sunk cost) – expenses that have already been incurred and cannot affect the company's operating results); minor investments in tangible assets; specific properties of intangible assets (scalability, duplicability, synergy [Haskel, Westlake, 2018]); features of digital technologies and infrastructure of the digital economy.

There is a more radical view explaining the existing paradox of profitability for digital companies. This phenomenon is due to the discrepancy of the existing accounting institution with the specifics of new digital companies. Current accounting rules were formed in the era of past technological revolutions, so they are focused on taking into account the peculiarities of traditional industrial companies of the pre-digital period [Govindarajan et al., 2018]. The practice of functioning of some digital companies does not fit into established theoretical accounting concepts: standard approaches to valuation of value, business efficiency do not work (for example EBITDA is not applicable to fast-growing companies that all revenue generated invest in growth), traditional metrics used also cannot describe the features of the activity such companies because they do not take into account the ecosystem effects of offering free digital services to consumers and compensating them at the expense of other digital platforms.

The growth of digital companies is driven by investments in intangible assets (management competencies, digital technologies, network effects), which cannot always be capitalized on the balance sheet. Some of these investments relate to current costs, reducing profits, some are difficult to reflect in general (for example, intangible assets are assumed to depreciate over time due to depreciation charges, but investments in digital technologies, conversely, only become more valuable over time due to network effects). Given that the intangible assets of digital companies are their main strategic asset requiring significant investments, losses are generated. The next key feature of digital companies in the second group is the use of disruptive innovations that destroy established industries and pose a threat to traditional players. History knows quite a few examples of industrial giants (Xerox, Polaroid, Kodak, Nokia, AT&T) in a moment found themselves in a severe crisis situation because of ignoring subversive innovations [Pisano, 2020]. Kodak, whose history is more than a century5, did not realize the threats to itself in the development of the digital camera market. At the same time, it invented the digital camera and rejected its production. The development of new technologies was so rapid that the company simply did not have time to repurpose its production.

Sometimes subversive innovations are so successfully commercialized by new companies that they become monopolists not only in their niche, but also in traditional sectors. As a result, new markets can be formed, poking the consumer and “killing” old markets. Practice so far gives us the only striking example of such a situation – the company Tesla.

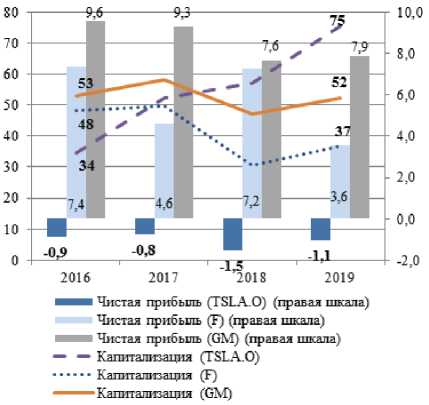

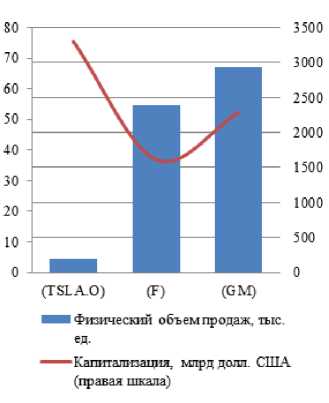

This example is notable for several reasons. First, it is a unique case where annual growth in uncovered losses is accompanied by a growth in company capitalization over 10 years (Figure 10). Its capitalization has already exceeded 70 billion USD, however, during the entire existence of the company never finished the year with a net profit – the loss for 2019 amounted to more than 1 billion USD. Secondly, this company has formed a new market for electric cars, which is competitive to the fuel car market, ahead of its main competitors of the pre-digital era – Porsche Corporation, Jaguar, Avtovaz – by volume of production6. Third, the company has overtaken the level of capitalization of the traditional largest automotive players in the world – Ford, General Motors – on the back of losses unlike its competitors: at the end of 2019 Tesla's capitalization was twice that of Ford and one and a half by General Motors (Figure 11). At the same time, Tesla vehicle unit sales are nearly fifteen times smaller than those of Ford or General Motors (Figure 12).

Source: according to the information and analysis database

Thomson Reuters. URL: https://www.thomsonreuters.com.

Source: according to the information and analysis database Thomson

Reuters. URL: https://www.thomsonreuters.com.

Source: according to the information and analysis database Thomson

Reuters. URL: https://www.thomsonreuters.com.

7. CONCLUSION

Digital transformation of the economy leads to challenges for economic science and management, in particular, as there is a dramatic change in social and economic institutions of society, conditions and ways of doing business under the influence of technological changes in the economy. These challenges are that traditional economic laws (economies of scale, value chain) cease to work and new economic entities (digital companies) emerge in the economy, whose activities do not fit into traditional efficiency metrics and business models and sometimes pose a threat to pre – digital age companies. Digital companies have grown into global tech giants, ahead in strength of the economic might of their industrial predecessors. In addition, the issue of anti-crisis management of economic entities is acute in the conditions of digitalization of economy. Both industrial giants of the pre-digital age face crises in the course of their existence, leading their operations on the brink of bankruptcy, and digital companies. However, in the current context, crisis management practices have been in a quandary: the existing toolkit does not work effectively for companies in the pre-digital age or in regarding digital companies.

In the first case it is necessary to adapt such tools to new economic conditions, in the second case, to form a new toolkit that takes into account the peculiarities of digital companies.

If for traditional companies practice such a tool is formed – digital transformation (however, it requires improvement), for new companies such tools by the scientific community and practitioners are not formed. The task of formation of new anti-crisis tools and adaptation of existing ones will be solved by the scientific community in the near future. Perhaps such tools will be formed in the course of practice, but this requires the creation of a fundamental theoretical basis of economic science and management explaining new regularities economic development under the influence of technological changes.

1. General Electric launches global crisis//RIA Novosti. URL: https://ria.ru/20181116/1532897838.html (reference date: 16.11.2018).

2. A visual history of the largest companies by market cap (1999-Today) // Visual Capitalist. URL: https://www.visualcapitalist.com/a-visual-history-of-the-largest-companies-bymarket-cap-1999-today/ (reference date: 13.02.2020).

3. Pestov I. What happened in the IPO market for the year: about going to the exchange Uber, Lyft, WeWork and others. URL: https://vc.ru/finance/96497-chto-proizoshlo-na-rynkeipo-za-god-o-vyhode-na-birzhu-uber-lyft-wework-i-drugih (reference date: 10.01.2020).

4. Uber barely raised $8.1bn in IPO. This is 1.5 times worse than forecasts//Secret firm. URL: https://secretmag.ru/news/uber-ele-ele-podnyala-usd8-1-mlrd-na-ipo-10-05-2019 (reference date: 10.05.2019).

5. Karimova A. Life after bankruptcy: five companies returned from that world//Kontur. 26.12.2013. URL: https://kontur.ru/articles/441 (Reference date: 18.08.2019).

6. Berezin A. Surviving a nightmare: how Tesla kills the world car industry//Forbes. 17.10.2018. URL: http://www.forbes.ru/tehnologii/368133-ozhivshiy-koshmar-kak-tesla-ubivaetmirovoy-avtoprom (reference date: 06.03.2019).

References

1. Alexandrova T.V. (2019). Tsifrovizatsiya kak sovremennyy trend razvitiya menedzhmenta proizvodstvennykh organizatsiy [Digitalization as a modern trend in the development of management of industrial organizations]. Bulletin of SUSU. Series “Economics and Management”, 13 (3), 137–144.

2. Ryakhovskaya A.N., Kovan S.E. (eds.). Antikrizisnoe upravlenie kak osnova formirovaniya mekhanizma ustoychivogo razvitiya biznesa [Crisis management as the basis for the formation of a mechanism for sustainable business development] (2016). Moscow, INFRA-M.

3. Blank I. A. (2006). Antikrizisnoe finansovoe upravlenie predpriyatiem [Crisis financial management of the enterprise]. Kiev, Nika Center, Elga.

4. Bloommart T., van den Brook S., Koltof E. (2019). Четвертая промышленная революция и бизнес: Как конкурировать и развиваться в эпоху сингулярности [The fourth industrial revolution and business: how to compete and develop in an era of singularity]. Moscow, Alpina Publisher.

5. Brailly R., Myers S. (2008). Printsipy korporativnykh finansov [Principles of corporate finance]. Moscow, Olimp-Biznes.

6. Govindarajan V., Rajgopal S., Srivastava A. Milliardy bez otcheta [Billions without a report]. Harvard Business Review Russia, 08.10.2018. URL: https://hbr-russia.ru / biznes-i-obshchestvo / ekonomika / 777919 (date of access: 08 / 18 / 2019).

7. Davenport T., Westerman J. Tsifrovoy proval [Digital failure]. Harvard Business Review, 04.11.2018. URL: https://hbr-russia.ru / innovatsii / trendy / p26701 (date of access: 01 / 22 / 2019).

8. Ismail S., Malone M., Geest J. Vann, Diamandis P. (2017). Vzryvnoy rost: pochemu eksponentsial’nye organizatsii v desyatki raz produktivnee vashey (i chto s etim delat’) [Explosive growth: Why exponential organizations are ten times more productive than yours]. Moscow, Alpina Publisher.

9. Kochetkov E.P. (2019). Tsifrovaya transformatsiya ekonomiki: protivostoyanie “starykhˮ industrial’nykh i “novykhˮ tsifrovykh kompaniy (aspekty antikrizisnogo upravleniya) [Digital transformation of the economy: the confrontation of the “old” industrial and “new” digital companies (Aspects of crisis management)]. Journal of Economic Research, 4, 63–70.

10. Kochetkov E.P. (2020). Transformatsiya antikrizisnogo upravleniya v usloviyakh tsifrovoy ekonomiki: obespechenie finansovo-ekonomicheskoy ustoychivosti vysokotekhnologichnogo biznesa: monografiya [Transformation of crisis management in the digital economy: Ensuring the financial and economic sustainability of a high-tech business: a monograph]. Moscow, Prospekt.

11. Kochetkov E.P., Romanova K.V. (2018). Finansovo-ekonomicheskie osobennosti vysokotekhnologichnykh kompaniy: aspekty antikrizisnogo upravleniya [Financial and economic features of high-tech companies: aspects of crisis management]. Journal of Management Studies, 4, 1.

12. McAfee E., Brignolfson E. (2019). Mashina, platforma, tolpa. Nashe tsifrovoe budushchee [Machine, platform, crowd. Our digital future]. Moscow, Mann, Ivanov i Ferber.

13. Maltsev V. A. (2019). Karl Marx i bol'shie dannye [Karl Marx and Big Data]. Moscow, Rodina.

14. Perez K. (2013). Tekhnologicheskie revolyutsii i finansovyy kapital. Dinamika puzyrey i periodov protsvetaniya [Technological revolutions and financial capital. The dynamics of bubbles and periods of prosperity]. Moscow, Delo.

15. Pettinger T. (2019). Vzlamyvaya ekonomiku [Hacking the economy]. Moscow, AST.

16. Pisano G. (2020). Kreativnoe sozidanie: Sistemnyy podkhod k innovatsiyam v krupnykh kompaniyakh [Creative creation: A systematic approach to innovation in large companies]. Moscow, Alpina Publisher.

17. Popov E.V. (2019). Setevye ekonomicheskie vzaimodeystviya: monografiya [Network economic interactions (A monograph)]. Moscow, Yurayt.

18. Trachuk A.V., Linder N.V., Tarasov I.V., Nalbandyan G.G., Khovalova T.V. Kondratyuk T.V., Popov N.A. (2018). Transformatsiya promyshlennosti v usloviyakh chetvertoy promyshlennoy revolyutsii: monografiya [Industrial Transformation in the Fourth Industrial Revolution (A monograph)]. Trachuk A.V. (ed.). Saint Petersburg, Realnaya ekonomika.

19. Hoffman R., Ye K. (2019). Blits-masshtabirovanie: Kak sozdat’ krupnyy biznes so skorost’yu sveta [Blitz-scaling: How to create a large business at the speed of light]. Moscow, Alpina Publisher.

20. Sheve G., Khuzig S., Gumerova G.I., Shaimieva E.Sh. (2019). Menedzhment tsifrovoy ekonomki. Menedzhment 4.0: monografiya [Management of the digital housekeeper. Management 4.0 (A monograph)]. Moscow, KnoRus.

21. Haskel J., Westlake S. (2018). Capitalism without capital: The rise of the intangible economy. New Jersy, Princeton University Press.

22. How to tame the tech titans: The dominance of Google, Facebook and Amazon is bad for consumers and competition. The Economist, 18.01.2018. URL: https://www.economist.com / leaders / 2018 / 01 / 18 / how-to-tame-the-tech-titans (date of access: 06.03.2019).

23. Moazed А., Johnson N.L. (2016). Modern monopolies: what it takes to dominate in 21st-century economy. New York, St. Martin’s Press.

24. Statista. Information base. URL: https://www.statista.com (date of access: 01 / 10 / 2020).

25. Thomson Reuters. Information and analytical base. URL: https://www.thomsonreuters.com / (date of access: 01 / 10 / 2020).

About the Author

E. P. KochetkovРоссия

Candidate of Economic Sciences, head of the organizational and analytical direction of the project office for the implementation of the national program “Digital Economy of the Russian Federationˮ Analytical Center under the Government of the Russian Federation, Associate Professor of the Department of Management of the Financial University under the Government of the Russian Federation. Research interests: crisis management, bankruptcy, financial and economic sustainability of the company, venture capital, innovation, digital economy.

Review

For citations:

Kochetkov E.P. DIGITAL TRANSFORMATION OF ECONOMY AND TECHNOLOGICAL REVOLUTIONS: CHALLENGES FOR THE CURRENT PARADIGM OF MANAGEMENT AND CRISIS MANAGEMENT. Strategic decisions and risk management. 2019;10(4):330-341. https://doi.org/10.17747/2618-947X-2019-4-330-341

JATS XML