Scroll to:

INFLUENCE OF A NEWS BACKGROUND ON COMPANY COST: REVIEW OF LITERATURE AND DIRECTION OF FUTURE RESEARCHES

https://doi.org/10.17747/2078-8886-2018-4-98-103

Abstract

Information factor of influence on company capitalization is considered. The researches revealing mutual influence between share prices and a news background of the organization (positive, negative or neutral) are analysed. Influence the fake of news on the market cost of the company and possibility of restoration of reputation after influence the fake news is analysed. The conclusion that a news background, first of all his quality, is a disputable factor of influence on company cost became result. He demands bigger attention and bigger number of researches, introduction of new models of his analysis and correlation with company capitalization. Further researches have to be devoted to the analysis of influence of pessimistic, optimistic and neutral news on dynamics of capitalization of the companies. Having studied a number of the companies, it will be possible to draw a conclusion on what group of branches is more subject to influence of information background. Further it will be possible to formulate behavior model which is preferable to the company, seeking to increase the capitalization and to reduce risks of volatility of the actions.

For citations:

Vladimirova O.A. INFLUENCE OF A NEWS BACKGROUND ON COMPANY COST: REVIEW OF LITERATURE AND DIRECTION OF FUTURE RESEARCHES. Strategic decisions and risk management. 2018;(4):98-103. https://doi.org/10.17747/2078-8886-2018-4-98-103

INTRODUCTION

The securities market is a complex and dynamic system that is constantly changing, including changings under the influence of ongoing shocks, which are difficult to explain and predict even to experienced analysts. In a short period of time, the market can significantly transform independent driving forces, including the information flow.

In the modem world, the possession of information can both lead a company to financial well-being, as well as serve in the struggle with strategically significant competitors. The study of the influence of the news background on the value of companies began several decades ago, during which time its significance for the global market was proved.

THEORETICAL APPROACHES TO EXPLAINING THE NEWS BACKGROUND IMPACT

Investigating whether there exists a relationship between the value of a company in the stock market and the news background that is created around the company and affects it. First of all, they studied the dynamics of the value of shares of companies under the influence of news [DeBondt W. F. M., Thaler R., 1985]. Securities portfolios are divided into “winners” (Winner portfolio) and “losers” (Loser portfolio), each of which consisted of 35 stocks; their dynamics were analyzed within 36 months after the formation. Most people "overreact" to unexpected and dramatic news events. However, at the market level, in general, the portfolios of the “losers”, as it turned out, surpassed the portfolios of the “winners” by 25%, the latter risking significantly less [DeBondt W.F.M., Thaler R., 1985].

The identification of new factors that change the price of a company's stock was considered taking into account whether there is an impact of macroeconomic news, and how to explain the deviation of this factor in some cases; how the stock market reacts to information, in particular, the study of market movements that coincide with major political and world events [Cutler D. M., Poterba J. M., SummersL. H., 1988]. Analysis of monthly stock returns from 1925 to 1985 was carried out using the vector autoregression index. Macroeconomic news explains only about 20% of stock price changes. Most macroeconomic news influenced stock returns and yield forecasts with statistically significant coefficients. Over the entire sampling period, a positive one percent dividend unexpectedly raises the price of shares by about 0.1%, while an increase in industrial production by 1% increases the price of shares by about 0.4%. Both inflation and market volatility have a negative impact on stock returns. The analysis does not take into account news about projected macroeconomic events, and therefore does not have a predictive component.

The study further focuses on the most important international news from the last 50 years until 1988. A sample of events over 50 years (until 1988) was formed on the basis of the business column of the New York Times, the leading periodical of those times. Atotal of 49 global news were allocated, they correlated with the change in the 500-Stock Standard & Poor’s index, expressed as a percentage. Some of the events are clearly associated with significant changes in the aggregate market. For example, on Monday after Eisenhower’s heart attack in September 1955, the market fell by 6.62%. Monday after the Japanese attack on Pearl Harbor witnessed a market decline of 4.37%. The transfer of presidential power after the assassination of President Kennedy coincided with a market growth of 3.98%, while the actual news of his murder led to a decrease in the value of the shares by almost 3%. Revealed and resonant news, which, however, had little effect on the stock market. In about 50% of cases, changes in stock prices are difficult to explain, based on published news. The researchers warned that perhaps not all types of news were considered, which theoretically largely determined the level of change. The hypothesis that stock prices are influenced by news tracked by market participants is irrefutable, but the authors are skeptical about this information. The news that led to significant fluctuations in the demand for corporate stocks are likely to be reflected in such quality in both official economic statistics and in the media, reports on market movements [Cutler D. M., Poterba J. M., Summers L. H., 1988].

Due to the constant information noise prevailing in the markets, it is not surprising that in many situations distorted pricing is found, even when the forecasts were completely opposite, and therefore prices directly react to the news. The literature covers a wide range of specific news events, reveals a pattern: positive news causes a positive reaction in the market, which persists for some time, the same goes for negative news.

“Finance is about how a continuous stream of news is included in prices. But not all news has such an influence”[Somette D., Malevergne Y., Muzy J.-F., 2002]. The greatest impact on the stock market is attributed to exogenous shocks, this is unexpected news, big shocks that dramatically change the prices on the stock market and provoke strong fluctuations in volatility. Probably, the causes of these events were known to a limited circle of people who could take targeted actions, which may have partially affected the prices of the stock market. Endogenous shock is the result of the cumulative effect of many small negative news that is relatively neutral in itself, but their cumulative effect causes endogenous shock. It turns out that a volatile trajectory of the news background is created, which leads to a sharp change in the value of the company's shares on the stock market. As a result, the relationship between the quality of the news background and the value of the shares was confirmed [ Somette D., Malevergne Y., Muzy J.-F., 2002].

In terms of risk management, the company's reputation is important: firms with a strong positive reputation are perceived as providing bigger value. Their customers are more loyal and acquire a wide range of products and services [Eccles R. G., Newquist S. S., Schatz R., 2007]. Moreover, in an economy where from 70 to 80% of market value generates intangible assets such as brand, intellectual capital and reputation, organizations are especially vulnerable to everything that turns out to be a strong negative factor [Goel S., Anderson A., Elofman J. et al., 2015].

Effective reputational risk management begins with the recognition that reputation is a matter of perception. The overall reputation depends on the positioning of the company, how its stakeholders perceive it: investors, customers, suppliers, employees, etc. The strong positive reputation of the company among the stakeholders will lead to a strong positive reputation of the company as a whole, and hence to an increase in the capitalization of the organization.

There are various methods for assessing a company's reputation: media analysis, stakeholder surveys (customers, employees, investors), focus groups and public surveys. Although all of them are useful, the aspect of covering the company's activities in the media is particularly important, since the media influences the perception and expectations of all stakeholders.

According to the research of the MediaTenor Institute for Media Analysis (Switzerland), the formation and maintenance of a positive reputation depends on several factors or practices [MediaTenor, [S.a.]]. The company should remain visible to the public: the amount of news about the company should be above the minimum level of references in the leading media, the latter varies from company to company depending on the industry, country and market in which the company operates. At least 20% of information about the company in the leading media should show it in a positive way, no more than 10% of negative information is acceptable, the rest of the information should be neutral. If this requirement is met, some positive news about the company has a beneficial effect on reputation; it remains stable, even if negative stories appear. If there is little information about the company as a whole, most news stories are negative, even positive events will not change the situation, and bad news will reinforce its negative reputation. Regardless of the size of the company should take care to stay on hearing with the audience of stakeholders. Even if a small company has a very strong reputation among a small group of key investors or customers, its reputation is vulnerable if only such topics as earnings and the identity of the CEO are reflected in the media [Flynn, DJ, Nyhan, B., & Reifler, J., 2016].

Studies by MediaTenor show that the company must have at least 35% of messages mentioning the company in the information flow, which it itself generates in order to reduce the proportion of negative stories to a minimum in normal time. Strong relationships and stakeholder confidence are crucial for achieving a significant proportion of messages that are purposefully formed, and are especially important during a crisis, when companies really need to widely demonstrate their point of view. At such times, the proportion of management messages should be at least 50% so that company critics do not prevail [Eccles R. G., Newquist S. S., SchatzR., 2007].

In 2008, a study was conducted to investigate whether bad news has an effect on the value of a company's stock regarding its ethical behavior [Varol O., Ferrara E., Davis C.A. et al., 2017]. This effect can affect the stock price both positively and negatively. On the one hand, companies can behave immorally if they see any benefit from it. Consequently, it is possible that after bad news financial indicators are growing. On the other hand, bad news usually suffers from bad news. The loss of reputation can lead to financial losses that are difficult to quantify: the company's reputation is an intangible asset, it is very difficult to estimate, it is possible that not all possible losses will be taken into account. Using a variable derived from news analysis, the authors sought to substantiate how reputation is related to news. The idea was that a large sample of news should allow analyzing the nature of its impact on the economic situation of the company. The analysis was based on an assessment of weekly price quotes by the end of the week for certain securities. To establish the ethical news criterion, the Reputational Risk Index (RRI) was used.

As a result, an RRI matrix was formed for 364 companies, a portfolio of companies with the highest high RRI was assembled, it was compared with a reference portfolio formed at historically simulated prices for 12, 24, 32 and 40 weeks. Over intervals of more than 24 weeks, indicators of the benchmark portfolio turned out to be better than experimental ones: a higher yield in 33 of 46 cases. As a result, the experimental portfolio would bring losses to its owner. Tests show that for several periods of more than 20 weeks, the experimental portfolio lagged behind the market [Kolbel J., 2008].

In 2007, an attempt was made to describe the relationship between the content of messages in the media and the company's daily activities in the stock market, focusing on the direct impact of news on the state of the Wall Street Journal on the US stock market [Tetlock P. C., 2007]. The heading publishes data that reflects investor sentiment. To date, the daily financial news of the Wall Street Journal is of interest to 2 million readers in the United States, have a high reputation among investors. Electronic publications remain accessible to readers longer than the texts of any other column on the stock market. Content analysis is used to analyze the daily changes in the column for 1984-1999. Daily newspaper data was sampled using word counting. Then it records the possible dispersion of indicators of the company's news background. Since this is the only media factor that is strongly associated with pessimistic words in a newspaper column, this is called pessimism in the following. Next, we consider the sensitivity of the results to the point of time of information and the use of various measures to overcome the level of pessimism.

The high level of pessimism in the media seriously puts pressure on market prices. Unusually high and low levels of pessimism in the media predict a high trading volume on the market. Low market profitability leads to pessimism in the media [Tetlock P. C., 2007].

STUDY OF THE FAKE NEWS EFFECT ON THE VALUE OF COMPANIES

Research on the impact of fake news on the changing position of companies has recently become very popular [Ratkiewicz, J., Conover, M., Meiss M. et al., 2011]. So, only in 2017, a study was conducted of the effect of fake news on the market for health care [Berinsky, A., 2017], the policy [Baum M. A., Groeling T., 2008; Swire B., Berinsky A. J., Lewandowsky S. et al., 2017], industries [Tambuscio M., Ciampaglia G.L., Oliveira D.F.M. et al., 2017]. However, the most striking example of the influence of fake news can be seen in the example of PepsiCo. In the runup to the US presidential election, Trump supporters called for a boycott of PepsiCo products due to the fake speech attributed to the PepsiCo CEO against the presidential candidate.

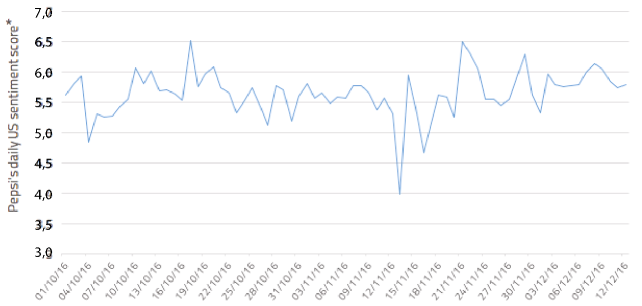

Since the specific fake news turned out to be quite resonant, the researchers analyzed its direct impact on the PepsiCo state. [How does Fake News affect, 2017]. In the fourth quarter of 2016, the average consumer sentiment index1 for PepsiCo was slightly above neutral (5.5). Consumers positively perceived the company, with a sharp decline on November 13 directly correlated with the publication of fake news (Fig. I). The incident turned out to be dangerous for PepsiCo's reputation in the United States; in the fourth quarter, a 35% reduction in share value was recorded. Alva's algorithm calculates sentiment estimates from 10, where a score of 5.50 is considered neutral. The algorithm takes into account the volume, influence, popularity and relevance of mentions in real time from 80,000 news sources, more than three blogs and forums, more than 100 social network accounts. A score above 6.00 is considered strong, and a score below 5.00 is considered weak.

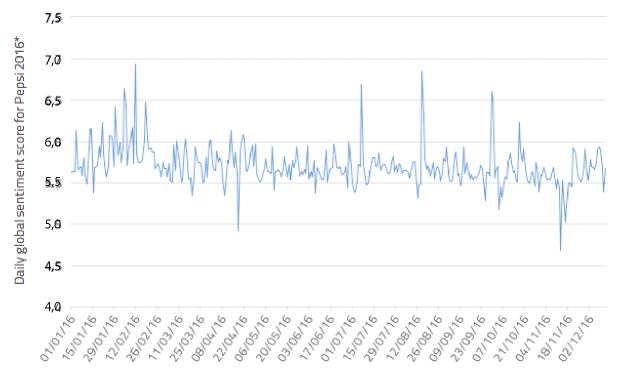

It can be concluded that there was a clear impact on PepsiCo's internal reputation in the United States. The negative impact of fake news persisted throughout 2016. It was compared with the news of April 18, when PepsiCo announced that sales were falling for the sixth consecutive quarter. However, it is worth considering how the problem affected the company's international reputation. As of November 13, globally, the negative impact was less than in the United States (Fig. 2). However, the lowest point in the year for PepsiCo was 19.5% lower than the average stock value in the industry.

So, fake news can not only affect the reputation, but also be the only and the biggest negative factor in relation to the company. For this reason, researchers consider the impact of these negative sentiments caused by the news on the price of the company's shares.

For a few weeks, PepsiCo’s share price averaged around $ 106.58, and on November 10, fake news began to spread. Over the next weekend, understated quotes were widely discussed in social media, which led to a further decline in quotations after the opening of the market on November 14. Within weeks of the low quotes caused by the fake news, there was a clear difference between PepsiCo’s real position and the price of its shares. Further, a fake news refutation was issued, and the reputation was restored quickly, within five days, and later the company's average reputation rating was higher than in previous months. Nevertheless, PepsiCo's share price continued to decline for almost three weeks, the recovery began only in early December. Even a month after the news was found false, PepsiCo’s share price was still lower than before the incident.

So, fake news can cause reputational and financial damage. If fake news is quickly disproved, they will inflict relatively little reputational damage, but achieving the previous level of quotes will take more time.

Therefore, companies must have the right resources that can filter out irrelevant content, highlight reliable sources of content, and also warn stock market players about the most influential and dangerous false news [Flow does Fake News affect, 2017].

Fig. 1. Daily PepsiCo Sentiment Assessment inside the country in 2016:

Fig. 2. Daily PepsiCo Sentiment Assessment worldwide in 2016

Fig.3. Comparing PepsiCo sentiment trends with stock prices on the NYSE

CONCLUSIONS

The news background, above all its quality, is a controversial factor influencing the value of the company. It requires more attention and more research, the introduction of new models of its analysis and correlation with the company's capitalization. The analyzed studies provide different answers to the question of the mutual influence of news and the capitalization of the organization. In different periods, this correlation took place, although in some cases only indirectly. The hypothesis is confirmed as partially [DeBondt W. F. M., Thaler R., 1985; Cutler D. M., Poterba J. M., Summers L. H., 1988; Kolbel J., 2008; Tetlock P. C., 2007], так и полностью [Ikenberry D. L., Ramnath S., 1999; Somette D., Malevergne Y., Muzy J.-F., 2002; Eccles R. G., Newquist S. C., Schatz R., 2007].

DIRECTIONS FOR FURTHER RESEARCH

This review is not an unequivocal proof of the fact that the news background influences the value of companies. In order to prove this hypothesis, in the future it is supposed to analyze the news that could affect the value of companies and selected according to certain criteria. To this end, it is planned to conduct an assessment of financial sector companies (mainly banks), mining and manufacturing companies, and to compare the strength of the impact of news on those and others. Pessimistic, optimistic and neutral news will be correlated with the dynamics of companies' capitalization. After examining a number of companies, it will be possible to conclude whether the news affects the value of the organization, which group of industries is more exposed to the background information. In the future, it will be possible to formulate a model of behavior that is preferable for a company seeking to increase its capitalization and reduce the risks of the volatility of its shares.

References

1. Cutler D. M., Poterba J. M., Summers L. H. (1988) What moves stock prices? // Massachusetts Institute of Technology. N 487. URL: https://dspace.mit.edu/bitstream/handle/1721.1/64351/whatmovesstockpr00cutl.pdf.

2. Berinsky A. (2017) Rumors and HealthCare Reform: Experiments in Political Misinformation // The British Journal of Political Science. Vol. 47, N 2. P. 241–262.

3. Baum M.A., Groeling T. (2008) Shot by the messenger: Partisan Cues and Public Opinion Regarding National Security and War // Political Behavior. Vol. 31.2. P. 157–186. URL; https://sites.hks.harvard.edu/fs/mbaum/documents/ShotByTheMessenger_POBH.pdf.

4. De Bondt W. F. M., Thaler R. (1985) Does the Stock Market Overreact? // The Journal of Finance. Vol. XL, N 3. URL: https://onlinelibrary.wiley.com/doi/full/10.1111/j.1540-6261.1985.tb05004.x.

5. Eccles R. G., Newquist S. C., Schatz R. (2007) Reputation and Its Risks // Harvard Business Review. Febr. URL: https://hbr.org/2007/02/reputation-and-its-risks.

6. Flynn D. J., Nyhan B., Reifler J. (2016). The Nature and Origins of Misperceptions: Understanding false and Unsupported Beliefs about Politics // Advances in Pol. Psych. Vol. 38, N S1. P. 127–150.

7. Goel S., Anderson A., Hofman J. et al. (2015) The Structural Virality of Online Diffusion // Management Science. Vol. 62, N 1. P. 180–196.

8. How does Fake News affect corporate reputation? (2017) // Alva Group. URL: http://www.alva-group.com/en/fake-news-affect-corporate-reputation/.

9. Ikenberry D. L., Ramnath S. (1999) Underreaction to Self-Selected News Events: The Case of Stock Splits // Rice. URL: http://www.ruf.rice.edu/~jgspaper/W_Ikenberry_underreactionv9.pdf.

10. Kolbel J. (2008) The effect of bad news on reputation and shareprice: An empirical survey // Swiss Federal Institute of Technology (ETH). URL: https://www.ethz.ch/content/dam/ethz/special-interest/mtec/chair-of-entrepreneurial-risks-dam/documents/dissertation/master%20thesis/Term_Paper_KoelbelJ_0508-Grade6.pdf.

11. Media Tenor ([s.a.]). URL: http://us.mediatenor.com/en/.

12. Ratkiewicz J., Conover M., Meiss M. et al. (2011) Detecting and tracking political abuse in social media // Proc. 5thInternational AAAI Conferenceon Weblogsand Social Media (ICWSM). P. 297–304.

13. Sornette D., Malevergne Y., Muzy J.-F. (2002) Volatility Fingerprints of Large Shocks: Endogeneous Versus Exogeneous. URL: https://arxiv.org/pdf/cond-mat/0204626.pdf.

14. Swire B., Berinsky A. J., Lewandowsky S. et al. (2017) Processing political misinformation: comprehending the Trump phenomenon // Royal Society Open Science. Vol. 4, N 3. URL: http://rsos.royalsocietypublishing.org/content/royopensci/4/3/160802.full.pdf.

15. Tetlock P. C. (2007) Giving Content to Investor Sentiment: The Role of Media in the Stock Market // The Journal of Finance. Vol. LXII, N 3. URL: https://www0.gsb.columbia.edu/faculty/ptetlock/papers/Tetlock_JF_07_Giving_Content_to_Investor_Sentiment.pdf.

16. Tambuscio M., Ciampaglia G. L., Oliveira D. F. M. et al. (2017) Modeling the competition between the spread of hoaxes and fact checking / George Washington University. [Washington].

17. Varol O., Ferrara E., Davis C.A. et al. (2017) Online human bot interactions: Detection, estimation, and characterization // Proceedings of the Eleventh International AAAI

18.

About the Author

O. A. VladimirovaRussian Federation

Analyst, JSC National Rating Agency.Research interests: methods and tools analytical analysis, influence of a news background on ratings and cost of the companies

Review

For citations:

Vladimirova O.A. INFLUENCE OF A NEWS BACKGROUND ON COMPANY COST: REVIEW OF LITERATURE AND DIRECTION OF FUTURE RESEARCHES. Strategic decisions and risk management. 2018;(4):98-103. https://doi.org/10.17747/2078-8886-2018-4-98-103