Scroll to:

INFLUENCE OF INFORMATION SIGNALS ON THE FUTURE EARNINGS

https://doi.org/10.17747/2078-8886-2018-4-92-97

Abstract

It is considered of information signals on the future earnings of the Russian companies. Information signals can influence behaviour of investors at an estimation of the future earnings. Indicators of internal growth and shock can influence on earnings in the future. The shock indicator allows to consider a situation when the company will pass from debt financing to internal sources of financing to lower the wastage rate of assets connected with influence of shocks. Internal financing is performed at the expense of the cheapest source - earnings. It allows to reduce level of debt risk by means of capital structure adjustment (repayment of a part of amount of debt). Indicators of shock and internal growth for investors are the information indicator of prospects of development of the company.

Keywords

For citations:

Lutsenko S.I. INFLUENCE OF INFORMATION SIGNALS ON THE FUTURE EARNINGS. Strategic decisions and risk management. 2018;(4):92-97. https://doi.org/10.17747/2078-8886-2018-4-92-97

Market fluctuations (external shocks), possibility of financial crises are circumstances (informational signals for investors) that arise systematically, and their prediction is the essence of business risk and management planning.

Management possesses independence and wide discretion when making decisions in the field of business. Due to the risky nature of business activities, there are objective reasons for management to make business mistakes [Resolution, 2004]. In other words, decisions of the company's management body are protected by a rule that allows to guarantee management an immunity (protection against property liability) when making business mistakes from shareholders' attacks.

When the company's management implements an economic strategy, it is unacceptable to consider decisions in isolation from other operations (outside the economic strategy), since profit is often postponed in time. In order to obtain maximum profit in the longterm period, such operations are acceptable, as a result of which profit will decrease or a loss will occur in the short-term period. If at the time of making any management decision there was a probability of receiving both profit and loss and the decision was made in the acceptable risk range, then it should be considered reasonable and there are no grounds to impose property penalties for a negative result due to the above explanations, the manager is under the protection of the rules of business decisions [Resolution, 2017].

At the same time, effective management of the company (including reducing the risk associated with the loss of a part of the share price due to external shocks in the stock market) allows building trust management relationships with shareholders and potential investors.

Informationaltransparency isthe fundamental principle of functioning of the modem stock market, which guarantees protection of the rights of investors who invest in securities, and above all the owners of securities themselves in relation to receiving dividends [Definition, 2000].

The key indicator characterizing the final financial result of operations is the net profit that comes at the full disposal of the company. Dividends are paid from it, funds are directed to the formation of reserve and other funds, as well as to the growth of the organization’s capital. The size of dividends is determined by the management body of the company based on the amount of net profit based on the results of the reporting period; long-term financial policy, short-term structural policy with respect to company assets [Resolution, 2018].

Commercial discretion of the company and financial stability depend on the work of the management bodies (management, board of directors), their duties fulfillment and exercise of the rights granted to them for profit. Shareholders who receive dividends from net profit are interested in stable profitability and commercial liquidity of a joint stock company [Resolution, 2016].

We take the shock indicator and the level of dividend payments as information signals that may affect future profits and investor behavior. Payment of dividends should not lead to the fact that the company will have to attract additional debt financing (to bear the costs associated with finding sources of financing), curtail investment programs, sell all the assets necessary for the organization’s activities and sustainability [Resolution, 2018; Resolution, 2007].

The company's assets directly depend on the stock price and affect the dividend payout ratio. In its turn, the share price depends on the efficiency, stability of functioning and development prospects of the company. Due to poor management, shareholders may lose part of the assets value (risk of depreciation of shares due to management errors), since a reduction of share price is identical to depriving shareholders of their property [Case, 2014; Final decision, 2002].

The need to take into account the company's development prospects is also consistent with the position of good corporate management practices set forth by the Central Bank of the Russian Federation: “Corporate management should be based on the principle of sustainable development of the company and increasing return on equity investments in the long term” [letter from the Bank of Russia, 2014, introduction, p. 4]. Effective management will allow shareholders and investors to have a management roadmap in front of them to see and control the actions of the management body.

By purchasing shares, the owners receive the right to participate in management and to receive dividends in the future. Transformation of the participants' funds into shares and into subsequent obligations of the company to the shareholders occurs [Resolution of the Presidium of the Supreme Arbitration Court, 2000]. Shareholder activity is predetermined by the ownership of shares and obliges, together with the governing bodies, to develop an economic business strategy [Resolution, 2010]. It should be noted that investors interpret the change in dividend payments in connection with the revision of their management policies with respect to future profit prospects [Miller M., Modigliani F., 1961]. Other authors conclude that dividends are a signal to investors [Brav A., Graham J., Flarvey C. et al., 2005]. The increase in dividend payouts is a reliable information signal regarding the prospects for future profits. Dividends are closely related to the level of future profits [Flam et al., 2017].

Flowever, there is an opposite point of view: changes in dividend payments do not contain information about future profits [Allen F., Michaely R., 2003].

In the Miller M., Modigliani F., (1961) model, management and external investors have the same information about future investments and cash flows. Such informational differences are likely to influence investor responses to dividend changes.

There is also an assumption that the increase in dividend payments reflects a reduction in risk [Grullon G., Michaely R., 2002].

Dividend changes are strongly associated with the company's profitability in the current or past financial periods [Benartzi S., Michaely R., Thaler R, 1997]. Flowever, an increase in dividend payments does not correlate with an increase in profitability in subsequent periods of time, while a reduction in dividend payments actually increases the company's profitability (because, instead of paying dividends, part of the cash is reinvested in the company’s capital to generate profit in the future). To date, scientific research (including studies by the above authors) regarding the influence of information signals on future profits does not consider certain important factors that are significant in relation to future profits.

This article proposes to somewhat expand the angle of research of factors affecting future profits by including not only dividend payments, but also indicators of internal growth and shock (external signal), which are considered as key indicators. Thanks to these indicators, it is possible to analyze in more detail the influence of management policies (their contribution, the quality of corporate mnagement) and the shock on future profitability, the behavior of investors and shareholders in assessing management decisions. There is a kind of separation of key factors affecting future profits, on the internal (policy and management's contribution to the financial result) and external (the impact of shocks on the financial result) parts. Thus, it is possible to build an economic strategy of the company, taking into account its internal potential.

The indicator of internal growth makes it possible to estimate precautionary motive (the hypothesis of precautionary savings is a kind of buffer from negative influences (shocks) from external capital markets)) - the company's willingness to "switch" to domestic sources of financing (saving money for domestic investment). The company creates an internal cash reserve in order to cope with lower losses associated with shocks affecting the profit level.

RESEARCH METHODOLOGY AND SAMPLE DESCRIPTION

In our model, the dependent variable is company profitability. Internal growth g, shock, level of dividend payments, investments and tangibility of assets were chosen as independent (explanatory) variables.

To assess the impact of the explanatory variables on future profits, 24 public Russian companies were selected from 10 industries: agriculture (production, processing and marketing of agricultural products), oil and gas complex (oil and gas industry), food industry (malt and beer production), black and non-ferrous metallurgy, mechanical engineering (production of parts and accessories for cars and engines), electric power industry, construction (production of general construction works), trade (wholesale trade of metals and metal ores), transportation (pipe transportation, sea transport), telecommunications. The sample consisted of large companies with a total income of more than 2 billion rubles, and assets of more than 100 million rubles. [Order of the Federal Tax Service of Russia, 2007]. When selecting, a mandatory condition was the availability of reporting under international financial reporting standards. Shares of the company must be quoted on the stock market (a condition that allows evaluating the external signal - shock). Information on commercial organizations was obtained from annual financial reports, reports of issuers, data on corporate sites were involved. The period of 2013-2017 was selected. The number (value) of observations (quantitative characteristic) for each company varies (for some companies - 2013-2016, for others - 2015-2017), therefore the data is unbalanced. Econometric calculations were performed using the statistical package Stata.

VARIABLE DESCRIPTION

In assessing the regression, a key independent indicator was used - the level of dividend payments (considered as an information signal for investors) and the relationship between dividends and future changes in profits [Ham C., Kaplan Z., Leaiy T., 2017].

In addition, we include the following independent variables in the regression: steady growth, shock, investment, tangibility of assets (повтор, то же самое уже было сказано выше, где-то стоит убрать) in order to assess the contribution of management to the financial result, the impact of external shocks to choice of a source of funding.

Return on assets (profitability) (ROA), %, is defined as the ratio of after-tax profit (net profit) to total assets. By their economic nature, net profit and retained earnings are identical.

Shock is calculated as the ratio of after-profit to market capitalization. The indicator is lagged. A lag is one year. Shock (external market externalities) is an indicator of the choice of a source of financing, taking into account the costs of adjustment (activity of regulating the capital structure). This indicator is a guideline for the company in relation to the accumulation of profits. In addition, the indicator affects the behavior of investors in assessing future profits.

Table 1 Descriptive statistics

|

Variable |

Average |

Standard deviation |

Minimum value |

Maximum value |

|---|---|---|---|---|

|

Return on assets (profitability) |

2,340 |

13,254 |

-54,4 |

28 |

|

Shock |

3,890 |

21,936 |

-53 |

40,8 |

|

Internal growth rate g |

-0,005 |

0,294 |

-0,63 |

0,6 |

|

General level of dividend payments |

0,025 |

0,042 |

0 |

0,25 |

|

Investments |

0,082 |

0,047 |

0,01 |

0,24 |

|

Tangibility of assets |

0,507 |

0,191 |

0,07 |

0,81 |

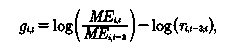

Internal growth rate g. This indicator allows you to eliminate external influences (erroneous market estimates, macroeconomic factors). It represents the internal part of growth of the company's value and makes it possible to evaluate the real contribution of management to market capitalization [Daniel K., Titman S., 2006]. This indicator is calculated as follows:

where ME is market capitalization; r is a logarithm of average stock returns. The Russian stock market is volatile, the long-term period is regarded as three years or more. This period allows us to take into account negative shocks (signals) that may affect the stock return. The indicator is lagged. Lag is one year.

The overall level of dividend payments (Divide) is calculated as the ratio of the value of dividends to total assets. The indicator affects the behavior of investors. The indicator is lagged. Lag is one year.

Investments are defined as the ratio of the value of the acquisition of fixed assets and intangible assets to the total value of assets. The indicator is lagged. Lag is one year.

Tangibility of assets (PPE/A) is calculated as the ratio of fixed assets to the total value of assets, allows us to estimate the level of property support of the company when it resorts to financing through debt. Besides, it is associated with information asymmetry and allows you to identify the price of capital. The indicator is lagged. Lag is one year.

Statistics are presented in Table. I. On average, dividend payments are 2.5 kopecks for each ruble of total assets, the external shock value is 3.9 percentage points of market capitalization; profit is 2.34 percentage points of total assets. In other words, in external shocks conditions, Russian companies lose some of their assets (an average of 3.9 percentage points annually).

MODEL EVALUATION AND ANALYSIS

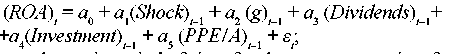

A model that considers the influence of information signals on the future value of profit:

where t is period of time for the company; a0 is a free term regression equation; a1 , a2, a3 , a4 , a5 are regression coefficients; e is an error regression equation.

Table 2

A model that considers the influence of information signals on the future value of profit

|

|

Regression |

|||||

|---|---|---|---|---|---|---|

|

Model |

end to end |

with random effect I |

with fixed effect |

|||

|

|

Coefficient |

Stand, mistake |

Coefficient |

Stand, mistake |

Coefficient |

Stand, mistake |

|

Shock |

0,231 (4,05 )* |

0,057 |

0,231 (4,05) |

0,057 |

0,174 (2,52) |

0,069 |

|

Internal growth rate g |

11,765 (2,69) |

4,372 |

11,765 (2,69) |

4,372 |

12,219 (2,59) |

4,718 |

|

General level of dividend payments |

64,561 (2,06) |

31,267 |

64,561 (2,06) |

31,267 |

70,584 (1,82) |

38,758 |

|

Investments |

-54,363 (-1,65) |

32,856 |

-54,363 (-1,65) |

32,856 |

-57,088 (-1,20) |

47,496 |

|

Tangibility of assets |

6,300 (0,80) |

7,896 |

6,300 (0,80) |

7,896 |

-7,403 (-0,52) |

14,107 |

|

Constant |

1,143 (0,32) |

3,613 |

1,143 (0,32) |

3,613 |

8,382 (1,38) |

6,054 |

|

Nmnber of observations |

86 |

- |

86 |

— |

86 |

— |

|

Coefficient of determination R2, % |

30,23 |

- |

— |

— |

23,95 |

— |

|

F-stati sties |

6,93 |

- |

|

— |

4,47 |

— |

|

Wald statistics |

— |

- |

34,67 |

— |

— |

— |

|

* In parentheses there is a |

t(z)-statistics, which shows the level of significance of the model parameters. |

|

||||

For the model, the analysis of panel data was carried out in order to evaluate three types of regressions: end to end regression, regression with a random effect and regression with a fixed (established) effect. When comparing regression based on end to end regression with a model with fixed effects, the Wald test was used; when comparing end to end regression with a model with random effects, the Broyesh - Pagan test; when comparing a model with random effects with the model with fixed effects - Hausman test was used. Testing was conducted to select the most adequate model in terms of forecast quality (table. 2, 3).

Using the results obtained, we can note that the most appropriate model in assessing the influence of information signals on future profits is the end to end model (individual effects are not associated with the selected independent variables).

In order to improve the accuracy of the forecast, we tested the regression model for adequacy, heteroscedasticity and multicollinearity (robustness). To test the model for adequacy, a Ramsey test was conducted at a significance level of 5%. In the process of testing, a significance level of 34.91% was clarified. This means that the main hypothesis about the correct specification of the original model is not rejected at the 5% significance level. Overall, the model is adequate.

Test for heteroscedasticity was performed using the White test. The level of significance was 7.11%. The main hypothesis of homoscedasticity is not rejected at the 5% significance level. The hypothesis of the presence of heteroscedasticity is rejected (the hypothesis of the presence of autocorrelation of residuals, leading to a decrease in the accuracy of the prediction, can be rejected). Regression residues are similar to “white noise” (values at different points in time are independent and equally distributed).

Finally, a test was carried out to establish the relationship between independent variables (multicollinearity - VIF (variance inflation factor) - a factor that increases the variance).

There is multicollinearity in the model, if for one of the independent variables the value of the coefficient VIF is > 10. In our case, the highest value is significantly below 10 (VIF = 1.55), on average, the value of VIF in all respects is 1.25. Multicollinearity is absent in the model (the multicollinearity hypothesis is rejected).

Indicators of shock, domestic growth and dividend payments are significant at the 5% significance level. The positive relationship between shock and future profit suggests an impact on financial policy. First of all, we are talking about the costs of adaptation, which force management to revise the capital structure, partially adjusting it [Leary M., Roberts M., 2005].

Under favorable conditions in the markets, the adjustment of the capital structure will be less costly for the company (the company will use internal sources of financing: retained earnings, depreciation and will not resort to additional emission of shares and, accordingly, will not incur costs associated with the emission campaign). To adjust its capital structure, a company can use the cheapest source - profit. A similar position of the author corresponds with the work [Frank M., Goyal V., 2014].

Table 3

Model selection for forecast adequacy

|

Indicator |

Wald test |

Breusch-Pagan test |

Hausman test |

|---|---|---|---|

|

Value statistics (p-value) |

0,95 (0,490) |

0,00 (1,000) |

6,30 (0,279) |

|

Conclusion |

End to end regression is preferable to fixed-effect regression |

End to end regression is preferable to a random effect regression |

Regression with a random effect is preferable to fixed-effect regression |

The positive relationship between the indicators of internal growth and future profits indicates a significant contribution from the management bodies to the final financial result. Management affects not only the share price, but also regulates the level of their risk, taking into account information signals from the markets (shock indicator). Moreover, management policy is selective with regard to the selection of investment projects (they are evaluated according to the degree of priority).

Unlike previous studies, where the authors could not confirm that dividends carry information about future profits (see, for example: [Allen F., Michaely R., 2003]), we proved that dividend payments along with indicators of internal growth and shock allow you to transmit a significant signal of profit to investors and shareholders of the company.

Thus, indicators such as shock, domestic growth and the level of dividend payments convey information about future profits to investors and shareholders. Participants (shareholders) can evaluate management actions from the point of view of a jointly developed economic business strategy.

CONCLUSION

Using the indicators “internal growth” and “shock”, it is possible to assess the role of management in making decisions within the framework of an economic business strategy. Along with dividend payments, domestic growth and shock carry information about future profits to shareholder investors.

In the framework of the pre sented re search, it can be concluded that management of Russian companies strives to act according to the logic of a warning motive. That is, using the cheapest source of project financing, which is profit (accumulating and maintaining it under the influence of negative factors on capital markets).

References

1. Definition of the Constitutional Court of the Russian Federation from 02.03.2000 № 38-О // Consultant Plus. URL: https://clck.ru/DEJLm.

2. Letter from the Bank of Russia from 10.04.2014 № 06-52/2463 « About the Corporate Governance Code » // Consultant Plus. URL: https://clck.ru/DEKAg.

3. Resolution of the Twelfth Arbitration Court of Appeal from 12.02.2018 on case № А57-5322/2017 // Consultant Plus. URL: https://clck.ru/DEJev.

4. Resolution of the Ninth Arbitration Court of Appeal 27.11.2007 on case № А40-52519/06-132-330 // Consultant Plus. URL: https://clck.ru/DEJpB.

5. Resolution of the Constitutional Court of the Russian Federation 24.02.2004 № 3-П // Consultant Plus. URL: https://clck.ru/DEJ6b.

6. Resolution of the Presidium of Supreme Court of Arbitration of Russian Federation from 18.01.2000 № 4653/99 // Consultant Plus. URL: https://clck.ru/DEKCQ.

7. Resolution of the Presidium of Supreme Court of Arbitration of Russian Federation from 02.11.2010 № 8366/10 // Consultant Plus. URL: https://clck.ru/DEKCv.

8. Resolution of the Fifth Arbitration Court of Appeal from 29.06.2016 on case № А51-1545/2016 // Consultant Plus. URL: https://clck.ru/DEJic.

9. Resolution of the Seventeenth Arbitration Court of Appeal from 20.02.2017 on case № А60-19440/2015 // Consultant Plus. URL: https://clck.ru/DEJEG.

10. Order of the Federal Tax Service of Russia from 16.05.2007 № ММ-3-06/308@ // Consultant Plus. URL: https://clck.ru/DELZD.

11. Allen F., Michaely R. (2003) Payout Policy // Handbook of the Economics of Finance: Corporate Finance / Eds. G. Constantinides, M. Harris, R. Stulz. Amsterdam: North Holland. Vol. 1A. P. 337–430.

12. Benartzi S., Michaely R., Thaler R. (1997) Do Changes in Dividends Signal the Future or the Past? // The Journal of Finance. Vol. 52. P. 1007–1034.

13. Brav A., Graham J., Harvey C. et al. (2005) Payout Policy in the 21st Century // Journal of Financial Economics. Vol. 77. P. 483–527.

14. Case of OAO Neftyanaya kompaniya Yukos v. Russia (2014) // European Court of Human Rights. URL: https://clck.ru/DEJvc.

15. Daniel K., Titman S. (2006) Market reactions to tangible and intangible information // The Journal of Finance. Vol. 61. P. 1605-1643.

16. Final decision as to the admissibility of application by Olczak against Poland (2002) // European Court of Human Rights. URL: https://clck.ru/DEJzo.

17. Frank M., Goyal V. (2014) The Profits-Leverage Puzzle Revisited // Working Paper Carlson School of Management, University of Minnesota, Hong Kong University of Science and Technology. P. 1–52.

18. Grullon G., Michaely R. (2002) Dividends, share repurchases, and the substitution hypothesis // The Journal of Finance. Vol. 57. P. 1649–1684.

19. Ham C., Kaplan Z., Leary T. (2017) Do Dividends Convey Information About Future Earnings? // Working paper Washington University. P. 1–59.

20. Leary M., Roberts M. (2005). Do firms rebalance their capital structures? // The Journal of Finance. Vol. 60. P. 2575–2619.

21. Miller M., Modigliani F. (1961) Dividend policy, growth, and the valuation of shares // The Journal of Business. Vol. 34. P. 411-433.

22.

23.

About the Author

S. I. LutsenkoРоссия

Expert of the Corporate and Project Management Research Institute, Analyst of Institute for Economic Strategies of the Social Sciences Division of the Russian Academy of Sciences. Field of research: Corporate governance, financing companies.

Review

For citations:

Lutsenko S.I. INFLUENCE OF INFORMATION SIGNALS ON THE FUTURE EARNINGS. Strategic decisions and risk management. 2018;(4):92-97. https://doi.org/10.17747/2078-8886-2018-4-92-97

JATS XML