Scroll to:

INVESTMENT PROGRAM OF POWER GRID COM PANIES: CHECK ALL CAN NOT BE SELECTED

https://doi.org/10.17747/2078-8886-2018-4-42-47

Abstract

Starting in 2017, the carrying out of technological and price audit of investment programs (projects of investment programs) and reports on their implementation has been secured as the necessary measures for the electric grid companies of Russia in the framework of approval procedures and approval of investment programs and oversee their implementation.

Realization of technological and price audit requires to review large set of information in short period of time, which is limited by investment program validation procedures. Forming representative sample (which describes general population accurately) as an object of analysis could increase audit efficiency. The approach shown in the article is based on mathematical methods of analysis.

On the example of the project of the investment program of PJSC "MOESK" the authors made an attempt to apply the described technique. This technique made it possible to perform the main task - the formation of a sample of investment projects, which allows without loss of quality and complexity of the investment program materials to preserve the validity and objectivity of the formed conclusion based on the results of technological and price audit.

Keywords

For citations:

Karle V.A., Zolotova L., Kechin S.A. INVESTMENT PROGRAM OF POWER GRID COM PANIES: CHECK ALL CAN NOT BE SELECTED. Strategic decisions and risk management. 2018;(4):42-47. https://doi.org/10.17747/2078-8886-2018-4-42-47

INTRODUCTION

In 2015 the changes in the Rules of confirmation of the electric power engineering entities investment programs were made as well as in the Standards of information disclosure by the entities of the electricity wholesale and retail markets [Regulation, 2015]: it was determined necessary to perform a technological and price audit of investment programs (IP) and IP projects for the power grid companies and their implementation reports. Technological and price audit (TPA) is used in order to improve the efficiency of the IP formation and to increase the resulting quality of their performance.

In the course of the IP (IP project) TPA carrying out the expert organization investigates the package of the IP (IP project) materials and the documents, grounding the materials on an investment project-by-investment project basis. The IP of the power grid companies contains a big number of titles (it reaches about a few thousand investment projects), consequently, a 100% examination of the set of documents and the grounding materials (each IP title may contain up to several dozens of documents, which are subject to analysis) becomes ineffective from the point of view of the TPAgoals achievement within accessible time resource.

The authors set a task to find the best method of the data selection and analysis, which will on the one hand improve the effectiveness of the TPA carrying out and will on the other hand solve the crucial task of the IP (IP project) comprehensive checkout and preparing of a reasonable conclusion by the expert organization.

THE MAIN PRINCIPLES OF THE IP TPA AND PECULIARITIES OF ITS CARRYING OUT

For realization of the measures, established by the TPA, Methodological recommendations upon performance of the TPA of the IP (IP projects) and their their implementation reports were confirmed [Ordinance, 2016].

Flerewith procedure and content differ significantly from the large investment projects with public ownership specified in terms of the public TPA. The public technological and price audit of some specific investment projects was conducted by the power grid companies as well before making changes in the “Rules of confirmation of the electric power engineering entities investment programs” in 2015. In the meantime in terms of the IP coordination and confirmation procedure the power grid companies began to present the first conclusions according to the results of the TPA in the framework of materials to the IP projects.

In contrast to conclusions for the specific large investment projects in terms of the public TPA of the projects with public ownership, in terms of the IP (IPprojects) TPAthe analysis should be performed as well as conclusions should be made for all titles, included in the IP (IP project), for the following purposes:

- to check the IP (IP project) compliance with Law requirements of the Russian Federation, applicable to the investment activity of the grid companies;

- to check the necessity and sufficiency of the investment projects, which are to be implemented in terms of the IP (IP project) for achievement of the target and plan values of the IP quantitative indexes;

- to check carrying out of the Russian Federation legislation requirements to the price and (or) cost indexes of the investment projects, including with regard to non-ex- ceedence of the announced financing in reference to the amount of financing, determined in accordance with enlarged price standards (EPS) of the typical technological solutions of the electricity generation facilities capital construction;

- to prepare change proposals to the IP (IP project) according to results of conducted audits and completed evaluations.

The conclusion is made generally for the IP (IP project) in conjunction with the investment projects, but carrying out of a check according to methodological recommendations range of points requires a detailed examination of some specific IP titles parameters. Indeed, for instance, in terms of the IP (IP project) TPAreasonability of the financial needs for investment projects implementation is checked within particular objects. Within the present check an auditor should evaluate content of the materials, supporting the investment projects cost:

- for investment projects with confirmed project documentation: list of expenses, summary estimate, explanatory note to the estimate documentation, developed as a part of the confirmed project documentation, a copy of decision of the project documentation confirmation;

- for investment projects which are at the design stage: costing calculation of the investment project implementation value and copies of the documents, used as sources of the pricing for the costing preparation (excluding enlarged costing standards)1.

A detailed examination of the particular IP titles parameters within IP (IP project) TPA requires time, but it is limited in view of the approval procedure of the power grid companies IP.

According to the Methodological recommendations [Ordinance, 2016], the term for preparation and disposal of conclusion upon the results of the IP (IP projects) TPA carrying out by the expert organization to the power grid company should be not less than 30 calendar days, and herewith provide an opportunity to publish information about the performed TPA on open access on the appropriate internet resources within a fixed timeframe [Regulation, 2004; Regulation 2011].

Taking into account the time needed for the IP projects preparation by the power grid company, by virtue of the received comments and suggestions, within intermediate stages of the approval procedure, an auditor has got not so much time left for an audit report preparation - approximately 15-20 days per each of the stages.

Various power grid companies possess various IP (IP project) titles quantity (the number of titles may be up to 15 000 and more), even less time remains for analysis of the particular investment projects, sometimes a detailed checkout of the materials becomes impossible. Time limitation presses the auditor to look for the optimal ways for meeting the requirements of the Methodological recommendations, to collect the data and to carry out the TPA. During performing of the technological and price audit of the IP (IP project) the auditor should use reliable data and apply scientifically proven methods of their analysis and processing. Fle/she is given a right to independently define the selection methods of data which are the subject to checkout for achievement of the TPAtarget results.

At the same time under that logic the auditor cannot reduce the quantity of the examined IP forms, he/she should check the whole set of the grounding documents, necessary and sufficient for achievement of the TPA results, and cannot make conclusions only on the basis of its part.

Applying the selection methods of the data, which are the subject to checkout for generation of the conclusion on the IP (IP project) on the whole, within the TPA it is allowed to change only the analyzed list of the IP titles. For the checkout the auditor should select the IP in such a way that they introduce a representative sample, and conclusions on the basis of its analysis can be reasonable extended to the whole IP (IP project). For carrying out of the power grid companies IP (IP projects) TPA generation of the representative sample of the IP titles is suggested as a selection method of the data, which are the subject to checkout for achievement of the TPAtarget results.

REPRESENTATIVE SAMPLE FORMATION METHODS

Representative sample is a finite sample, where all main properties of the entire population are introduced approximately by the same factor of proportionality or with the same frequency, with which the present property is presented within this entire population [4]. Representation defines the extent to which it’s possible to generalize the sample analysis results to the whole entire population.

First of all, one should find out, which quantity of the objects of the sample is necessary and sufficient. For that purpose it’s possible to build, for instance, a confidential interval of the entire population expected mean. The present approach allows to define to the specified accuracy the borders within which a sample mean differs from the true average (expected mean) of the entire population. The method is applicable upon availability of a normal distribution of the entire population. If the given condition is followed, to find the representative sample scope one should take into account an allowable value of the sampling error and set a confidence level: A standard deviation from the average value of the random variable is also an important factor.

For calculation of the representative sample scope a formula of finding the confidential interval for the expected mean is used (average value of the random variable) [Borovkov A. A., 1984; Levm D. M., 2004]:

where X - sample average; Z - quantile of a standard normal distribution; σ - standard deviation from the entire population; n - sample scope; μ - true expected mean (average of the entire population). Addend and subtrahend with respect to X correspond to a half of the confidential interval length. The present value identifies measure of inaccuracy of the estimate, occurring as a result of a sampling error e:

Knowing the constituents of the present congruence, one can define the sample scope n

Taking into account the initial random variable irregularity in the distribution within the entire population division into districts and clustering are used. The given approaches allow to distinguish uniform groups according to the specified criteria. Flereafter in light of the necessary and sufficient scope of the representative sample in conjunction with all clusters by random drawing (for instance, applying special algorithms sort of Random) particular elements inside of the uniform groups are selected, which introduce a representative sample of the entire population (district/cluster). Within distinguished clusters an analyzed property may be distributed not according to the normal law of distribution, that will require using of some other representative sample formation methods.

AN EXAMPLE OFTHE REPRESENTATIVE SAMPLE FORMATION FORTHE TPA CARRYING OUT

Let’s consider application of the methodology with definition of the needed parameters for the representative sample formation using the example of the PJSC "MOESK" IP project. Let’s take the information about the PJSC "MOESK" IP project of 2015- 2022 yrs. as basic data [PJSC "MOESK" », [s.a.]].'

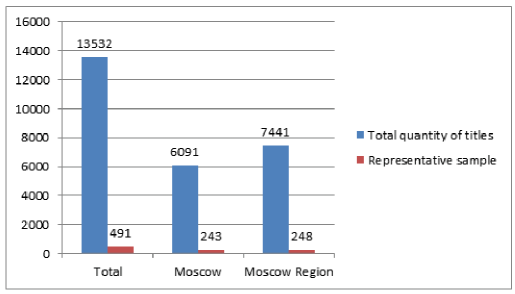

The PJSC "MOESK" IP project contains 13 532 separate titles, their total construction cost is 442,5 RUB bn according to the target prices of the relevant years. Investment projects of the PJSC "MOESK" are implemented on the territory of two constituents of the Russian Federation (Moscow and Moscow Region), consequently, IP of the power grid companies is divided into two parts, equal in structure.

For representative sample formation form 2 «Financing plan of the capital investments on investment projects» will function as a source [Ordinance, 2016, supplement 2]. It comprises a full structure and a list of IP titles, a necessary set of parameters, characterizing investment projects.

The crucial parameter of investment projects selection for the representative sample formation, which in this case is considered as a random variable, is an estimate of the total cost of the investment projects according to the target prices of the relevant years (column 18 of the form 2) (hereafter - a total cost of the investment project).

For formation of the investment projects uniform according to the random variable groups the titles are separated out of the general PJSC "MOESK" IP project structure within division into districts process, which refer to Moscow and Moscow Region. Segregated by districts titles are divided into clusters in accordance with investment projects groups based on their implementation directions.

The list of clusters consists of seven investment projects groups, corresponding to their implementation directions:

- technological connection of power receivers with power capacity exceeding 150 kW;

- reconstruction of the existing electricity supply network facilities for strengthening of the electrical network for the purpose of technological connection performing;

- reconstruction, modernization, technical upgrading of transforming and other sub-stations, distribution points;

- reconstruction of power lines;

- other new construction of the power supply network facilities;

- «other investment projects» group;

- projects, which are not included into the mentioned groups.

Considering availability of the IP titles referred to Moscow.

Region and implementing measures concerning modernization, technical upgrading of the power lines, an appropriate separate cluster is provided for the region.

Taking into account a great spread in values of the total investment projects cost, clusters distribution is not enough for the representative sample formation. Inside of the listed clusters of the investment projects additional clusters (subgroups) are generated. During an additional clustering carrying out the meaning of the random distribution formed in subgroups was taken into account.

Let’s consider a cluster of the «Reconstruction of the existing electricity supply network facilities for strengthening of the electrical network for the purpose of technological connection performing» investment projects, which refers to Moscow.

The examined cluster comprises 683 investment projects with the total cost starting from 0,01 mln. RUB to 4 295,47 mln. RUB. On the basis of the total investment projects cost range, three subgroups are distinguished within the cluster (see the table below).

Subgroups of the cluster «Reconstruction of the existing electricity supply network facilities for strengthening of the electrical network for the purpose of technological connection performing»

Parameter |

1 | Subgroup 2 |

3 |

|---|---|---|---|

Total cost, mln. RUB | Less than 6 | from 6 to 17 | More than 17 |

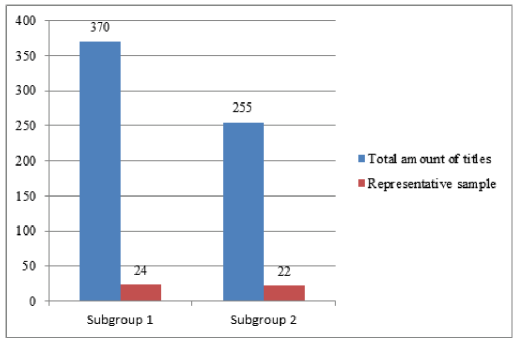

Quantity of the facilities in a subgroup, pcs. | 370 | 255 | 58 |

Random variable average value within a subgroup, mln. RUB. | 1,58 | 10,82 | 480,99 |

Random distribution in the subgroups I and 2 is close to a normal one (to define a distribution law diagrams of the empirical function of the random variable density were analyzed). Standard deviation of the random variable from the average value for a subgroup I was 1,49 mln. RUB, for a subgroup 2-2,48 mln. RUB.

To prove that a random variable within a distinguished subgroup is normally distributed, apart from the analysis of the diagram of the density empirical function, testing of statistical hypothesis is recommended, for example, by means of chi- squared test.

Within a scope of the statistical investigations during the random variable confidential interval formation, confidence levels from 90 to 99% are applied. We recommend a confidence level, which is not less than 95%, that is equivalent to the value of the quantile of a standard normal distribution: Z = 1,96.

In practice a sampling error of the entire population is defined by expertise. Considering the values of the random variable expected mean in the subgroups as well as the random variable standard deviations for record in the formula of the representative sample scope determination, applying of a sampling error not exceeding I mln. RUB is recommended for the groups with relatively low total investment project cost. The less the value of the expected mean is, the less the sampling error value should be. For a subgroup I we’ll take a tolerable error equal to 0,6 mln. RUB, for a subgroup 2-1,0 mln. RUB. Representative sample scope for the subgroup I equaled 24 investment projects, for the subgroup 2-22 investment projects (pic. I).

Pic. 1. Representative sample for the cluster «Reconstruction of the existing electricity supply network facilities for strengthening of the electrical network for the purpose of technological connection performing»

Random distribution in the subgroups I and 2 is close to a normal one, so the representative sample scope is calculated by formula (3). For such subgroups within a cluster particular investment projects, included into the representative sample and being subject to inspection under TPA, are defined by random sampling.

After distinguishing of the subgroups, for which a normal random distribution is typical, in most cases a large package of IP titles remains, for which such a distribution is not typical. For the latter it is suggested that additional subgroups with a random distribution close to the equal one should be provided, as well as the subgroups with the investment projects, for which a high total investment projects cost is typical (a far different value relatively to the biggest part (more than 90%) of the IP titles).

Within the examined cluster a subgroup 3 is distinguished with the investment projects, for which a high total investment projects cost is typical - more than 17 mln. RUB. Selection of the titles within such subgroups is recommended to be made by expertise. To define the quantity of the titles, included into the representative sample, it is recommended to focus on the percentage, formed on the basis of empirical analysis. Such a value is suggested by the authors within the present methodology. During determination of particular IP titles, which are subject to inspection under TPA, it is recommended to select the titles with the highest total and remaining investment projects financing value from the subgroups, for which a total investment projects cost is typical.

For the subgroups, where random distribution is close to an equal one, it is recommended to perform definition of the quantity of the investment projects, included into the representative sample, empirically (5—10 investment projects). For such subgroups selection of particular investment projects is fulfilled by random sampling. Within the present distribution a random sampling will allow to generate a sample average close to the true value of the whole subgroup average.

Formation results of the representative sample for the PJSC "MOESK" IP project are displayed on the pic. 2.

Pic. 2. Reduction of the scope of titles sample for examination within TPA through the example of PJSC "MOESK" investment program project

As a result of applying of the suggested approach towards investment projects selection for IP (IP projects) TPA fulfillment, the volume of analyzed investment projects was reduced more than by a factor of 20, that gives an opportunity to improve the efficiency and the quality of TPA procedures carrying out. Conclusions, generated concerning received sample, are well grounded for the entire population (of the investment program on the whole).

CONCLUSIONS

Through the example of the PJSC "MOESK" IP project it is displayed that the suggested methodology allows to significantly reduce time expenditure for the power grid companies IP (IP projects) TPA, to improve results rating, effectiveness of the inspection and to optimize it on the whole. Such an approach doesn’t break the methodological recommendations provisions on TPA carrying out. To follow representativeness during applying of the suggested methodology one should be scrupulous about investment projects division into districts and clustering while distinguishing of the uniform according to their features groups (clusters) of the investment projects, corresponding to the random distribution.

References

1. Borovkov А. А. (1984) Mathematical statistics. Estimate of parameters, hypothesis test. M.: Science. 472 p.

2. Levin D. M., Stefan D., Krebil T. S. and others. (2004) Statistics for managers. М.: Williams. 1312 p.

3. Lemeshko B. Y. (2014) Testing criteria of distribution deviation from a normal law: Directions for use. Novosibirsk: Novosibirsk state technical university. 160 p.

4. Manheim J. B., Rich R. K. (1997) Politology. Research methods / Translation from English; introduction. А.K. Sokolov. M.: The whole world. 544 p.

5. PJSC «MOESK» ([s.a.]) // Ministry of Energy of the Russian Federation.https://minenergo.gov.ru/node/4184.

6. RF Government Regulation dtd 16.02.2015 N 132 (edit from 17.02.2017) «Introduction of amendments into some acts of the Russian Federation Government concerning confirmation of the electric power industry entities investment programs and control over their implementation» // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_175479/.

7. RF Government Regulation dtd 21.01.2004 N 24 (edit from 07.06.2017) «Confirmation of the information disclosure standards by entities of the electricity wholesale and retail markets» (with amendments and additions, which came into force from 29.09.2017) // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_46197/.

8. RF Government Regulation dtd 28.11.2011 N 977 (edit from 30.06.2018) «Federal national information system “Unified system of identification and authentication in infrastructure, providing information technology cooperation of the information systems, applied for delivery of central and local government services in electronic form”» // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_122455/.

9. Minenergo of Russia (RF Ministry of Energy) order №380 dtd 05.05.2016 «Confirmation of the information disclosure forms by the power grid company about investment program (about investment program project and (or) draft modifications, added into the investment program) and its grounding materials, mentioned in paragraphs two-four, six, eight and ten of sub-paragraph «ж» of article 11 of the information disclosure standards by entities of the electricity wholesale and retail markets, confirmed by the RF Government Regulation dtd January, the 21st, 2004 № 24, fill-in instructions for the mentioned forms and requirements to the formats of the electronic documents disclosure by the grid company, which contain information about investment program (about investment program projects and (or) draft modifications, added into the investment program) and its grounding materials» // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_199581/.

10. RF Ordinance dtd 23.09.2016 N 2002-р «Confirmation of the methodological recommendations upon performance of the investment programs (investment programs projects) technological and price audit of the grid companies, referred to the list of electric power engineering entities, the investment programs of which are confirmed by Ministry of Energy of the Russian Federation and (or) executive government bodies of the constituent entities of the Russian Federation in charge of confirmation of the electric power engineering entities investment programs and their implementation reports» // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_205249/.

11. Chetyrkin E.M., Kalikhman I.L. (1982) Probability and statistics. М.: Finances and statistics. 319 p.

12.

About the Authors

V. A. KarleRussian Federation

Deputy Director of the Center of sectoral research and consulting of the Financial University under the government of the Russian Federation. Research interests: economy of the electric power industry, pricing, investment activity in the power industry, system of state regulation of natural monopolies

LYU. Zolotova

Russian Federation

Director of the Center of sectoral research and consulting of the Financial University under the government of the Russian Federation. Research interests: system of state regulation of natural monopolies, pricing, price forecasting models in power and infrastructure industries.

S. A. Kechin

Russian Federation

Analyst of Institute of Pricing and Regulation of Natural Monopolies, Higher School of Economics. Research interests: investment, pricing, economic modeling, energetic.

Review

For citations:

Karle V.A., Zolotova L., Kechin S.A. INVESTMENT PROGRAM OF POWER GRID COM PANIES: CHECK ALL CAN NOT BE SELECTED. Strategic decisions and risk management. 2018;(4):42-47. https://doi.org/10.17747/2078-8886-2018-4-42-47