Scroll to:

THE REACTION OF INDUSTRIAL COMPANIES TO CRISIS: CHANGES IN BUSINESS-MODEL AND STRATEGIC SUSTAINABILITY

https://doi.org/10.17747/2078-8886-2018-3-114-125

Abstract

Nowadays the changes in the geopolitical situation significantly affect the conditions for doing business in Russia. The article reviews the peculiarities of the development of Russian industrial companies and the subsidiaries of foreign companies, operating in Russia, in difficult economic conditions. The contemporary consequences of global financial crisis of 2008 with respect to the industrial sector of the economy are also reviewed. The author performed an empirical study of the question of whether the companies' sustainable survival in 2014–2016 was affected by the change in the business model and whether these changes were caused by the experience of the previous crisis. The study considered the differences in the behavior of foreign and Russian companies, and the strategies, that reduce the risk of default, are defined.

Keywords

For citations:

Stepanyan A.V. THE REACTION OF INDUSTRIAL COMPANIES TO CRISIS: CHANGES IN BUSINESS-MODEL AND STRATEGIC SUSTAINABILITY. Strategic decisions and risk management. 2018;(3):114-125. https://doi.org/10.17747/2078-8886-2018-3-114-125

INTRODUCTION

Nowadays the changes in the geopolitical situation significantly affect the conditions for doing business in Russia. Aunid such phenomena there is a decrease in the level of market capitalization and the appraised value of the assets of the companies, the fluctuation of prices for electricity and raw materials at the macro level. Given that companies operating in Russia are constantly facing different market and economic changes, including those of negative nature, it is necessary to examine the impact of previous crisis experience on the company reorganization in difficult economic conditions in terms of business model changes. In addition, it is important to determine the possibility of occurred crisis changes to help companies in surviving during the next economic downturn.

The research objective is to identify linkages between the restoration process of Russian and foreign companies in difficult economic conditions, changes in business model and the experience received by companies. We should note some limitations of the conducted research. Firstly, some changes in the business model characteristics are mutually reinforcing and cannot be considered in isolation. Secondly, the applied characteristics used to analyse the business model changes are only tentative. Thirdly, business model changes are only one of the innovation measures in the global strategic approach of the company.

THEORETICAL ASPECTS OFTHE RESEARCH AND FORMULATION OF HYPOTHESES

Economic downturns represent cyclical developments in the world economy and significantly affect the competitive landscape (Srinivasan R., Lilien G. L., Sridhar S., 2011; Trachuk A.V., 2011). Since economic downturns cause permanent changes in the dynamics of the industry, in order to survive the companies should adapt their activity through substantial reconfiguration of a business model. (Kuratko D. F., Audretsch D. B., 2013; Basu S., Wadhwa A., 2013; Chindooroy et al., 2007).

Companies typically face multiple crises during their activity. It is therefore necessary to examine the effects of previous negative phenomena in order to cope with further shocks better.

In the literature the main characteristic of the business model allowing the company to survive in difficult economic conditions is called dynamic capacity, i.e. the abilities of companies to change a business model taking into account the environment [George G., Bock A. J., 2011; Trachuk A.V., 2014 a], and in another paper it is stressed that the research results of the business model dynamism could potentially constitute a particularly valuable source of information about how the corporate characteristics and strategies of the company are interrelated in order to adapt to the environmental external changes. [Casadesus-Masanell R., Ricart J. E., 2010]. A study of business models and especially the interaction of their elements is one of the most promising directions to explain the sources of the company competitiveness. [Zott C., Amit R., 2007; 2008; Teece D. J., 2010]. Onthe basis of empirical data the characteristics of dynamic business models are described that enable companies not only to survive in difficult economic conditions, but also to be leaders: entrepreneurial orientation, continuous process of searching the means to achieve the customer loyalty, organizational learning, continuous monitoring of trends and adapting to them, a wide range of ways to advance, rapid response to consumer demand, continuous process of the development of electronic services, optimization and automation of processes, development of a mobile application, innovative activity or innovations in a business model [Trachuk A.V., Linder N.V., Ubeyko N.V., 2017]. At the same time, the innovations in a business model are identified as steps to change the company activity system, directed towards using new opportunities [Cucculelli M., Bettinelli C., 2015; Trachuk, Linder, 2016 a), creating a new value [Morris M., Schindehutte M., Allen J., 2005; Trachuk A.V., Linder N.V., Antonov D.A., 2014) and searching for business opportunities (George G., Bock A. J., 2011; Schneider S., Spieth R, 2013; Cucculelli M., Bettmelh C., 2016; Trachuk A. V., 2014 6].

Business model change has a positive effect on survival after the crisis [George G., Bock A. J., 2011; Grewal R., Tansuhaj R, 2001; Trachuk A.V., 2012]. In this article it is noted that the transformation of a business model is defined as the process of modifying the existing business model, associated with innovation implementation, and aimed at ensuring the long-term activity. As previously noted, business model changes may be the previous crisis result; therefore a two-stage analysis method is applied to study the question of whether the post-crisis survival of firms affected the change of a business model of companies and whether the business model changes were caused by previous negative results, which means through training.

THE REACTION TO CRISIS: CHANGES IN BUSINESS MODEL AND STRATEGIC SUSTAINABILITY

Among the academic studies of how companies respond to crisis, the dominant works are those evaluating the effects of different management models on the performance of the company during the economic downturn [Leung S., Horwitz B., 2010; Liu C., Uchida K., Yang Y, 2012; Trachuk A.V., Vorobyov A. A., 2011]. The reaction of companies to crisis with the benefit of the analysis of the transformation of business models and business opportunities becomes the subject of research quite rarely [Smith D., Elliott D., 2007; Latham S., 2009; Marsen, 2014; Belyayeva T.V, Shyrokova G.V., Gafforova YB., 2017; TrachukAV., Linder N. V., 2015a],

Another line of research is the creation of innovative strategies for companies in crisis. So, for example, there offered two contradictory hypotheses about the correlation between innovations and business cycles [Archibugi D., Filippetti A., Frenz M., 2013]. According to the cycle hypothesis the investments of companies in innovation are increasing in the periods of growth and declining during economic crises because of low profit margin and overall pessimistic sentiment in downturns [Freeman C., ClarkJ., SoeteL., 1982]1. Inaccordancewiththecontracycle hypothesis the innovation (novelty) is usually contra cyclical, as most companies tend to "play it safe" in times of economic expansion, using the existing opportunities and have to introduce innovations only when such opportunities are becoming fewer (as during economic downturns) [Mensch G., 1979]. Not all Russian companies are ready to invest in research and development in conditions of liquidity constraints, however, those companies who carry out investment activities, “the investment amount does not depend on the access to liquidity. This is because when making decisions about research and development investing in companies, the availability of own funds is more important than the possibility of lending” [Trachuk A.V., Linder N.V., 2016 6]. Also there noted “the effect of availability of great surplus funds in large companies that facilitates the research and development, and also innovation financing.”

Consequently, the company's ability to update and change its competitive profile can serve as an advantage in difficult economic conditions, because probably there will be a need to get rid of unprofitable products (this process is defined as “the cleansing effect of recession”) [Caballero R. J., Hammour M. L., 1996]). On the other hand, this renewal may be limited by the strategic temporal effect, which forces companies to introduce new products only when the market recovers [Stiglitz J. E., 1993; Barlevy G., 2004).

The author reviewed the business model transformation of companies in crisis conditions and in difficult economic conditions. This process forces the company management to take new actions to achieve a competitive position in the market. There are two possible guidelines that should be considered when there is a change in business model: how the company changed its state compared with the previous one, and to what extent the transformation was carried out in line with the industry standards. [Kuratko D. F., Audretsch D. B., 2013]. Even if the specific changes in business model are not innovative for the industry, they may be new to the business associated with the simultaneous search for opportunities [Ireland R D., Hitt M. A., Srnnon D. G., 2003].

Business models can both contribute to and limit the company survival and growth [Amit R., Zott C., 2001; Morris M., Schindehutte M., Allen J., 2005; Trachuk A.V., Linder N.V, 2015 6]. Changes in business model allow succeeding when they are ready for innovations: “Innovations in building the business models are a key to the firm performance» [Zott C., Amit R., Massa L., 2011: ЮЗЗ'; Trachuk A.V., Linder N.V., 2017]. However, the CEOs are not always able to recognize hidden opportunities for changes of business models [Bouchikhi H., Kimberly J. R., 2003; ChesbroughH., 2010]. It’s empirically demonstrated that business models are closely interrelated with the strategies for the company productivity and competitiveness, as well as they are a source of a long-term strategic sustainability of the company by themselves. [Acs Z. J., Amorys J. E., 2008; Zott C., Amit R., 2008]. Changes in business model increase the survival rate of new companies operating in capital-intensive and high-tech industries, but they are not relevant to companies operating in more stable low-technology industries [Andries R, Debackere K., 2007]. This trend is typical for Russian companies [Trachuk A. V., Linder N.V., 2018].

Changes in business model are also considered as a way to take advantage of the new opportunities and adapt to changes in the company life cycle [Franke N., Gruber M., Harhoff D. et al., 2008; George G., Bock A. J., 2011; Markides С. C., 2013]. Inthis sense, innovations in a business model can be seen as a way of a meaningful renovation [Demil B., Lecocq X., 2010; Ireland R. D., Hitt M. A., Sirmon D. G., 2003; Johnson M. W., Christensen С. , Kagermann H., 2008; Sosna M., Trevinyo-Rodriguez R. N., Velamuri S. R., 2010], innovation and ensuring the strategic sustainability [Perlow L. A., Okhuysen G. A., Repenning N. P., 2002; Thoma G., 2009], and also as a way of obtaining longterm results [George G., Bock A. J., 2011; Grewal R., Tansuhaj P., 2001] especially in conditions of high competition, risk and uncertainty, as in times of economic downturns.

Considering the above given theoretical bases, and taking into account the situation in the Russian economy, liable to the negative effects of the imposition of sanctions, we can formulate the following hypotheses of the study:

- Hypothesis I. With the changes in the level and structure of consumption, as well as in connection with the declining purchasing power, the foreign companies less related to the Russian economy, are likely to withdraw from the market, while domestic companies will remain and try to conquer the vacant niche.

- Hypothesis 2. The survival rate of companies under sanctions (difficult economic conditions) was affected by the transformation of the business model of companies, occurred during the economic crisis of 2008. Those companies that had optimized their business models have better adapted to business under sanctions.

- Hypothesis 3. The management adoption of the strategies to reduce default risk depends on the previous crisis experience, at that gaining of the experience (learning) during the crisis depends on various corporate characteristics.

CHANGE IN BUSINESS MODEL IN TIMES OF CRISIS AND DIFFICULT ECONOMIC CONDITIONS

Since the economic crisis of 2008 there appeared many studies about how the previous crises affect the survival rate of companies in the new crisis conditions. Whether the knowledge, work and survival experience in previous crises affect the survival of the company, if the next economic recession happens? For example, it is showed how public announcements about business failures affect the organizational learning of companies in terms of a new experience of failures [Desai V. M., 2014]. New information sources (forums and networks of small and mediumsized businesses) can be significant in shaping the learning process [Herbane B., 2014]. It is studied how the organizational learning and the characteristics of the executive affect the firm's reaction to the economic downturn [Cucculelli M., Bettinelli C., 2016]. In general, the empirical studies indicate that the earlier negative events have an impact on the companies, management actions and decision-making process. Consequently, the firms facing economic shocks are more likely to use the response strategies during the next crisis.

The ability to draw conclusions on the experience of the previous crisis can also depend on the specific characteristics of the companies, in particular on the form of ownership and branch market. For example, it is shown in the work that firms located in the industrial districts, where there are a lot of micro- and small enterprises, which competitiveness is determined also by intercompany relationships, are more likely to adapt to changes in the market conjuncture [Arregle J. L., Hitt M. A., Sirmon D. G. et al., 2007]. This is due to their similarity, common behavior, optimal exchange of necessary information [Baffigi A., 2000]. In the industrial districts the implicit knowledge and values are accumulated for a long time and spread in a wider community because it promotes coordination, efficiency and competition regulation. Similarly, during economic downturns the firms operating in the industrial districts may be more prone to survival and training in crisis due to their ability to emulate more efficient companies [Menzel M. P., Fomahl D., 2009].

The purpose of our analysis is to empirically prove that the experience of the previous crisis (2008) affects the company reorganization in difficult economic conditions (since 2014) in terms of business model changes; to determine how the transformation of a business model enabled companies to survive during the economic downturn (after 2014), which strategies are used by the companies to reduce the risk of default.

Empirical two-stage analysis

Empirical analysis is conducted on a sample of 31 manufacturing companies, operating in various industries and regions of Russia. The initial sampling represents 100 % of population (table I). For a more detailed comparative analysis of the behavior of foreign and Russian companies the author selected 18 enterprises of oil-and-gas and pharmaceutical industries from the initial sampling (table 2). The given industries are of a great research interest because the companies of oil-and-gas sector suffered the negative consequences of imposition of sanctions to a greater extent in connection with access restriction to foreign technologies, and also sufficient slide in oil prices (from 113 dollars in June 2014 to 50 dollars in January 2015). These factors lead to the worsening of financial position of companies operating in oil-and-gas and oil-and-service industries. Moreover, this industry development was complicated by the financial and economic crisis of 2008-2009, when the oil companies sharply reduced the volume of work, which resulted in price cutting for the output of oil-and-service companies. Because of price cutting the Russian companies had to withdraw from the market, their place was taken by contractors of a lower level of proficiency and experience. According to the survey conducted in November 2015 by the company “Ernst and Young” most survey participants planned some investment activity reducing (which corresponded to the worldwide trend) and revision of work conditions with oil- and-service companies without waiting for oil market recovery.

In the conditions of imposition of sanctions the pharmaceutical industry companies considered the possibility of their potential adaptation within the framework of government import substitution programs. At all that a number of foreign companies implemented the localization of production in Russia yet before the imposition of sanctions, which allowed taking more stable stands in new difficult economic conditions.

LLC Weatherford (Weatherford Worldwide Holdings GmbH, Switzerland2). InAugust 2007 the company purchased the allotment (less than 30 %) in the Russian group “Borets” (production and service of oil-production equipment), has branches in Russia (Moscow, St. Petersburg, Astrakhan, Izhevsk, Noyabrsk, Usinsk, Samara, Orenburg, Nizhnevartovsk, Lukhovitsy, Yuzhno-Sakhalinsk, Neftejugansk, Buzuluk, Krasnoyarsk, Irkutsk, Nyagan, Pyf-Yakh, Bugulma, Ufa). Amid the coolness of relationships between Russia and the West in August 2014 PJSC «Rosneft» bought back the Russian and Venezuelan assets of Weatherford International, Inc. in the field of well boring and repair. Weatherford International, Inc. Is one of five largest oil-and-service companies in the world, the annual income exceeds $ 2 billion [Weatherford, [б.г.]].

LLC «Technological company «Schlumberger» (Schlumberger B.V., Netherlands). The company has been working in all the oil-production regions in Russia, Azerbaijan, Kazakhstan, Uzbekistan and Turkmenistan for more than 25 years. The company offers the services mix and quality and well-timed service. Corporate standards of Schlumberger B.V. management adapt taking into account the regional specific character. Development strategy is based primarily on investing in local personnel, infrastructure and technology to create optimal proposals for the market. [«Schlumberger», [б.г.]; Balyuk L., 2017].

LLC «STEP Oiltools» (STEP Oiltools B.V., Netherlands). As an independent company with great experience both on offshore projects and land drilling, the company continuously develops and improves the product line, operates in 14 countries and is planning a further active growth. In 2018 the company entered into a contract with PJSC "Bashneft" to work on well- cementing.

LLC «BLTRSERVIS» (Halliburton Company, USA). In Russia and the Caspian region approximately 2500 specialists are working, 95% of them are trained at the production company bases, training centers in the United States, Great Britain, the Middle East and Russia. The company continues to invest in new equipment, power and infrastructure to provide world- class services. In November 2009 the special purpose entity of Sperry Drilling opened a new shop for repair and maintenance in Nizhnevartovsk. The largest company base in Russia is situated there, owing to which the company has improved its customer service. The location of maintenance bases as close as possible to conducting the works allows Sperry more promptly and efficiently to deliver equipment and services. Among the customers of all major Russian and international oil and gas industry companies: OJSC “Gazprom’,NC “Gazpromneft”, OJSC “LUKOIL”, OJSC NC “Rosneft”, Exxon Mobil, Shell, Total, etc. The company actively cooperates with small and medium-sized oil-and-gas production enterprises [Elalliburton in Russia, [б.г];

JSC «Baker Hughes» (Baker Hughes Inc., USA). One of the largest oil and gas companies in the world carries out extensive works on identifying oil and gas deposits, develops cutting-edge technology for their production. Total number of personnel is about 30 thousand persons operating worldwide. Subsidiary divisions deliver equipment for drilling and development not only to the parent company, but also to partners in more than 120 countries. The company offices are located in Tyumen, Orenburg, Moscow, Nizhnevartovsk, Noyabrsk [Baker Elughes, [s.a.]].

JSC «Siberian service company» (CJSC «NSG», Russia). The main activities are: prospecting and exploratory and production drilling of oil and gas wells, directional drilling, well maintenance and workover, selection of formulas, drilling- mud development and maintenance, technological maintenance services of directional drilling. Combination of application of hi-tech equipment, latest technology and experienced personnel are the competitive advantages of the company. Crews and specialists are multiple winners of competitions of professional skills at various levels, branch-wise and government awards3.

CJSC JV “ME ΚΑΜΙΝΕ FT” (OJSC “SN-MNG”, Russia). Among the service companies in the West Siberian region of Russia, providing services to oil-producing complexes in the area of recoverable oil enhancing, one of the leading places is taken by CJSC JV «MeKaMineft». Powerful production and technical base, highly skilled personnel, modem methods, technology, equipment, corresponding to the world standards, allow carrying out a wide range of works on secondary effects on a layer in order to improve its productivity [MeKaMineft [б.г]].

LLC “NPP BURINTEKH”. Eligh-tech oil service company operates in 28 constituent entities of the Russian Federation. Products are exported to CIS countries, Middle East, North Africa, Europe and North America. The main activities are: development, production, service and delivery of high-quality instrument, reagents for drilling and workover. The company has powerful high-tech equipment, its own scientific-research base [BURINTEKH, [б.г.]]

OJSC «RU-Energy Group». In 2010-2011 JSC «RU- Energy Group» acquired oilfield assets of PJSC “Gazprom Neff ’ for borrowed funds. Previously, 4 of 6 companies constituting the holding were owned by LLC "GPN-Nefteservis” and became 100% subsidiaries of OJSC "RU-Energy Group" from July the 18th, 2011 till January the 18th, 2012. According to the website of the company, the biggest customers of the holding were OJSC “Gazprom”, OJSC “Gazprom Neft”, «Baker Hughes», «Schlumberger», «Halliburton», OJSC «NC «Rosneft», OJSC «Lukoil» [Zubova Y., Abakumova M., 2016]. The head of the holding OJSC “RU-Energy Group” subsequently was recognized as insolvent (bankrupt).

JSC "AK“Corvette”". The company manufactures equipment for organization of oil and gas fields, as well as the pipeline shut- off and control valves. Quality of products is guaranteed by the integrated ISO management system, the compliance with the Russian and international standards is confirmed by valid certificates. Over the past ten years a complete reconstruction of the plant and its retrofitting is carried out. [AK “Corvette’, [б.г]].

JSC «Bayer» (Bayer AG, Germany). Innovative company occupies key positions in health care and agriculture worldwide. The company has offices in 35 cities of Russia. The division «Pharmaceuticals» specializes in medications used in oncology, hematology, cardiology, women's health, ophthalmology and radiology. A wide range of OTC drugs is offered. Bayer pays particular attention to research; innovation is a key factor in the growth of the company [Names, [б.г.]].

LLC «Lilly Pharma» (Eli Lilly and Company, USA). The company conducts clinical research in 55 countries around the world, has research laboratories in 8 countries, manufacturing facilities in 13 countries. Theproductsofcorporationare soldin 120 countries. In Russia the international innovative pharmaceutical company offers more than 20 products for the treatment of diabetes, cancer, osteoporosis and mental disorders. The company directs investment in research and scientific development, educational programs for health professionals and patients, transferring of production technologies. [Basic facts [б.г.]].

LLC «Novartis Pharma» (Novartis AG, Switzerland). The group of companies ‘Novartis” in Russia offers solutions in healthcare to meet the new needs of society and patients. The company occupies a leading position in the Russian market in the production of innovative drugs, high-quality generics and OTC medicines, surgical equipment and drugs to protect eyesight. In December 2010 “Novartis” group of companies announced a strategic investment programme with a volume of 500 million dollars in order to provide the organization of the local production, cooperation in scientific research. [Our strategy [б.г.]]

JSC «SIA International Ltd.». The company is a national distributor of pharmaceuticals. In 2007 in the framework of the company activities a holding company "Pharm-Center" was created, which is composed of three major domestic plant producers of medicines of OJSC "Biokhimik" (Saransk), OJSC "Sintez" (Kurgan), CJSC "Biokom" (Stavropol). The company is actively embracing new ways for development, relying on its huge accumulated experience. The relations are settled with more than 60 suppliers, the restructuring of debts to creditor banks is complete, the accounts receivable of the company are reduced, and the payments from clients-non-payers are resumed. The financing of Bank VTB is received in the amount of 5.4 billion. Rub. [About the company [б.г]].

JSC «R-PHARM» is a vertically integrated pharmaceutical company. Main activities: research, development and production of drugs of different therapeutic groups. On October the 1st, 2014 “R-Pharm” acquired a large industrial technology center (Illertissen, Germany). The company is one of the founders of the modem pharmaceutical complex “Hayat Pharm” (Azerbaijan) [The company’s history, [б.г]].

JSC «Pharmstandart» (Augment Investments Ltd, Cyprus). The company develops and produces modem, high quality, affordable drugs. Five modem factories produce more than 1.7 billion packages of medicines per year [Pharmstandart, [б.г]]. The basic directions of the company's strategy are: further localization of the production of drugs in joint projects with foreign pharmaceutical companies; massive participation of the company in the state program of import substitution; automation of the processes of production planning with a view to the efficient management of processes and increase in control of costs; development and introduction of new products, expanding the range of dosage forms and dosages of medications produced; increase in the percentage of high margin medicinal drugs in the company's portfolio.

CJSC «Biocad» (Biocad Holding LTD, Cyprus). The innovative company is a research-and-development center of the world level, state of the art pharmaceutical and biotechnological manufacturing, where pre-clinical and international clinical surveys are taken, corresponding to modem standards. Full production cycle of medicines is provided: from molecule search to mass production and marketing support. Dmgs are intended for the treatment of complex diseases. The company employs over 1400 people, including more than 650 scientists and researchers. Offices and representative offices of the company are located in the United States, Brazil, China, India, and other countries. The company is heading the national ranking of the fastest growing high-tech companies "TekhUspekh" 2016. In 2002 the Research Center was established on the basis of the Soviet Institute of engineering immunology, also a research and production center was created in the special economic zone "Neudorf' — a unique infrastructure facility where drugs pass the whole life cycle: from design to commercial production and distribution [Biocad, [б.г.]]

OJSC «YUGAPHARM» (Tyumenskaya Oblast') (Khanty- Mansiysk PPF, JSC). The plant for the production of the specialties built with the participation of Yugoslav firms "Hemopharm", "Energoproekt holding» and «Opart». Imported technological equipment enables the production of high-quality products tailored to GMP and GLP requirements. This was the only pharmaceutical company beyond the Urals, built in a strict accordance with the requirements of the international quality standards (GMP). The company was acknowledged insolvent in 2015 [And failed again, 2011].

For the analysis the registration information and financial indicators for 2012-2016 are collected:

- registration information (Table 1):

о registration number;

о short title;

о address (location);

о registration date;

о age of company;

о disposal date;

о status (active/in the process of disposition/disposed);

о registration region;

о region of activity;

о code of economic activity (OKVED)

о business form;

о form of property (private property/ownership of foreign legal persons/joint private and foreign property);

о company size (large-scale / medium-sized/ small-scale enterprise);

о authorized capital stock.

- accounting data (table 2, fig. 1-4).

о net assets;

о intangible assets;

о fixed assets;

о revenue;

о cost of sales;

о executive expenses;

о sundry expense;

о net profit (negative profit) [Federal agency, [б.г.]]

Table 1

Information about the companies on initial sample

|

Company |

Registration date |

Age of company |

Legal status of legal entity |

Size of company |

Number *, persons |

|---|---|---|---|---|---|

|

Russian companies Oil-and-gas (oil-and-service) industry |

|||||

|

JSC "AK “Corvette"" (Kurganskaya Oblast') |

16.03.1992 |

26 |

active |

large-scale |

1001-5000 |

|

LLC “NPP BURINTEKH" (Bashkortostan) |

16.06.1999 |

19 |

active |

large-scale |

1001-5000 |

|

OJSC «Plant “NEFTEPROMMASH"» (Moscow) |

07.12.1999 |

19 |

In the process of disposition (05.11.2014) |

large-scale |

н/д |

|

JSC «Plant “SNGM"» (Tyumenskaya Oblast') |

18.12.1992 |

26 |

In the process of disposition (15.08.2016), Message of the creditor's intention to seize the court with the bankruptcy petition of 01.10.2015 |

N/A |

н/д |

|

JSC «NG-MENEDZHMENT» (Moscow) |

26.08.2009 |

9 |

In the process of disposition (27.12.2017) |

N/A |

16-50 |

|

JSC «NGO “NPM"» (Tyumenskaya Oblast') |

30.06.2004 |

14 |

active |

N/A |

0-5 |

|

LLC «NUBK» (Tyumenskaya Oblast') |

29.07.1997 |

21 |

active |

large-scale |

1001-5000 |

|

OJSC «RU-Energy Group» (Moscow) |

31.08.2009 |

9 |

Declared as bankrupt 30.05.2015 |

N/A |

н/д |

|

CJSC JV “MEKAMINEFT" (Tyumenskaya Oblast') |

03.09.1997 |

21 |

active |

large-scale |

1001-5000 |

|

JSC "SSK" (Moscow) |

24.12.1999 |

19 |

active |

large-scale |

> 5000 |

|

JSC«YAMALPROMGEOFIZIKA» (Tyumenskaya Oblast') |

04.11.2002 |

16 |

active |

medium-sized |

251-500 |

|

JSC«GIDROMASHSERVIS» (Moscow) |

18.01.1993 |

26 |

active |

N/A |

151-200 |

|

Textile Product Mills |

|||||

|

OJSC «Murmansk sewing plant» (Moscow) 25.03.1994 24 Declaredasbankrupt 04.12.2014 N/A N/A |

|||||

|

Manufacture of general-purpose machinery and equipment |

|||||

|

CJSC«SEVERELEKTROSETSTROY» (Tyumenskaya Oblast') |

24.04.1998 |

20 |

Declaredasbankrupt 23.12.2017 |

small-scale |

51-100 |

|

Manufacture of metal doors and windows |

|||||

|

JSC «VOZDUKHOTEKHNIKA» (Moscow) 28.01.1993 26 active small-scale 251-500 |

|||||

|

Production of sawn timber, building woodwork and joinery |

|||||

|

OJSC «Timber mill №3» (Arkhangel'skaya Oblast') |

06.10.1992 |

26 |

Declared as bankrupt 11.07.2015 |

N/A |

N/A |

|

Manufacture of other plastic products |

|||||

|

LLC «INTERPAK» (Moscow oblast') 25.06.1996 22 active small-scale 101-150 |

|||||

|

Energy production |

|||||

|

LLC "SOLOVKI ELEKTROSBYT" (Arkhangel'skaya Oblast') |

28.02.2011 |

7 |

Declared as bankrupt 23.07.2018 |

medium-sized |

251-500 |

|

Pharmaceutical industry |

|||||

|

CJSC «Biocad» (St.Petersburg) |

25.06.2001 |

17 |

active |

large-scale |

501-1000 |

|

JSC «R-PHARM» (Moscow) |

17.08.2001 |

17 |

active |

large-scale |

1001-5000 |

|

JSC«SIAInternational Ltd." (Moscow) |

16.02.1995 |

23 |

active |

large-scale |

501-1000 |

|

JSC «Phannstandart» (Moscow Oblast'.) |

05.05.2006 |

12 |

active |

large-scale |

501-1000 |

|

OJSC «Yugraphann» (Tyumenskaya Oblast') |

24.04.2001 |

17 |

Declared as bankrupt 06.10.2011 |

N/A |

N/A |

|

Subsidiary divisions of foreign companies in Russia Pharmaceutical industry |

|||||

|

JSC «BAYER» (Moscow) |

06.10.1994 |

24 |

active |

large-scale |

1001-5000 |

|

LLC «Novartis Pharma» (Moscow) |

27.12.2006 |

12 |

active |

large-scale |

N/A |

|

LLC «Lilly Pharma» (Moscow) |

19.05.1998 |

20 |

active |

large-scale |

251-500 |

|

Oil-and-gas (oil-and-service) industry |

|||||

|

JSC «Baker Hughes» (Moscow) |

05.01.1993 |

26 |

active |

large-scale |

N/A |

|

LLC «Burservis» (Komi Republic |

05.06.2000 |

18 |

active |

medium-sized |

11-15 |

|

LLC «Weatherford» (Moscow) |

04.06.2007 |

11 |

active |

large-scale |

1001-5000 |

|

LLC «Step Oiltools» (Moscow) |

17.09.2010 |

8 |

active |

small-scale |

16-50 |

|

LLC «Technological company Schlumberger» (Tyumenskaya Oblast') |

20.03.2003 |

15 |

active |

large-scale |

501-1000 |

* Average number of employees as of 2017.

EMPIRICAL ANALYSIS, DEFINITION OF VARIABLES

Sumivability of the firm The legal status of the companies is mentioned as «Active», «In the process of disposition», « Declared as bankrupt». This categorization was introduced to identify the companies that have not survived the recession in 2014. The frequency of such companies in the sample is quite low (table 1).

Table 2

Information on the financial performance of subsidiaries of foreign companies and Russian companies, thous. rub. (by the final sample)

|

Company |

|

|

Revenue |

|

|

|

Net profit (negative profit) |

|

||

|

2012 |

2013 |

2014 |

2015 |

2016 |

2012 |

2013 |

2014 |

2015 |

2016 |

|

|

Oil-and-gas (oil-and-service) industry Subsidiaries of foreign companies |

||||||||||

|

LLC «Weatherford» |

8239 208 |

8877 883 |

10893 054 |

17019 831 |

15 524 357 |

208 478 |

(351 833) |

(463 000) |

296 864 |

243 941 |

|

LLC «Technological company Schlumberger» |

7574 796 |

12377 279 |

22512 716 |

25260 810 |

21617 333 |

224 190 |

509 448 |

4555 108 |

1847 244 |

(3617444) |

|

LLC «Step Oiltools» |

593 944 |

600 116 |

433 556 |

491 119 |

342 190 |

39 225 |

5 534 |

(242 684) |

(125 981) |

(25 590) |

|

LLC «Burservis» |

46 797 |

11 502 |

66 565 |

1695 415 |

1186 217 |

(90 388) |

30 422 |

54 463 |

9 799 |

(9 183) |

|

JSC «Baker Hughes» |

11 777 |

54 954 |

873 747 |

5 808 056 |

8159 786 |

(5 529) |

7510 |

(15 140) |

147 515 |

112 034 |

|

Russian companies |

||||||||||

|

JSC "SSK" |

21982209 |

22757 702 |

27470 911 |

28517710 |

28970 319 |

899 984 |

819 931 |

1522 884 |

1696 292 |

1126 999 |

|

PTSP TV “MEKAMINEFT'’ |

13765 617 |

8192 871 |

9015 254 |

11712 293 |

10758 799 |

44 932 |

504 158 |

(30 449) |

528 921 |

64 115 |

|

LLC “NPP BURINTEKH” |

4147 146 |

5198 715 |

5956 181 |

6556 436 |

6735 036 |

575 053 |

763 454 |

607 988 |

398 914 |

291 442 |

|

OJSC «RU-Energy Group» |

3 836 291 |

3592 207 |

1120 477 |

— |

— |

58 200 |

1422 893 |

758 378 |

(4110 263) |

(I 375) |

|

JSC "AK “Corvette”" |

3710 597 |

4250 714 |

4466 489 |

4323 060 |

3976 072 |

198 647 |

307 238 |

172 499 |

108 256 |

15 072 |

|

Pharmaceutical industry Subsidiaries of foreign companies |

||||||||||

|

JSC «BAYER» |

24806 852 |

28216 490 |

33811 590 |

41126 165 |

48037 241 |

(174 222) |

(102 126) |

616 408 |

507 950 |

1626 768 |

|

LLC «Lilly Pharma» |

4824 823 |

4619 304 |

5706 275 |

5982 143 |

6354 182 |

237 901 |

80 990 |

190 181 |

(37 994) |

119 774 |

|

LLC «Novartis Pharma» |

Н/д |

Н/д |

13663 066 |

15097 403 |

13790 640 |

Н/д |

н/д |

(96 605) |

97 049 |

(545 255) |

|

Russian companies |

||||||||||

|

JSC «SIA International Ltd." |

81537 641 |

75098 748 |

98495 963 |

59438 184 |

46619 351 |

240 386 |

248 344 |

143 950 |

(3111 114) |

(2823 069) |

|

JSC «R-PHARM» |

41869 155 |

46123 221 |

55918 779 |

62204 014 |

62964 431 |

4453 578 |

6437 174 |

7680 624 |

8608 010 |

6711 880 |

|

JSC «Pharmstandart» |

20109 093 |

22557 604 |

15216 586 |

15212 225 |

25980 744 |

6788 736 |

7301 605 |

3307 143 |

6045 168 |

6605 626 |

|

CJSC «Biocad» |

2945 294 |

2992 625 |

8387 819 |

8914 174 |

11477 324 |

938 522 |

927 591 |

4803 406 |

4349 471 |

5050 906 |

|

OJSC «YUGAPHARM» |

199 502 |

147 290 |

124 997 |

— |

— |

(883 323) |

6 345 |

(63 369) |

— |

— |

The evaluation results Below there are the empirical results obtained by a two- stage model described above. In particular, there are the results related to the impact of changes in business model on post-crisis survival of firms (hypothesis 2) by defining strategies that reduce the risk of default. Further the results of the experience obtaining hypothesis are described, showing whether the business model changes resistant to crisis were adopted as a result of the previous crisis experience, and the regional affiliation role in the process of experience obtaining (hypothesis 3).

According to the analysis it is revealed that the very fact of companies’ withdrawal from the market is not necessarily a negative phenomenon. "Cycle" of companies (economic subjects) is an integral part of the restructuring process in the context of a competitive economy and leads to "creative destruction" [Schumpeter J.A., 1936].

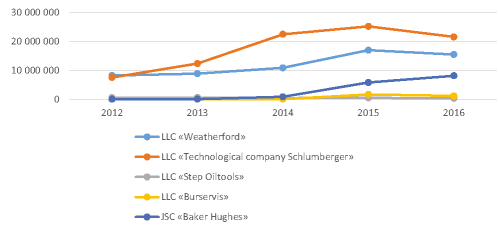

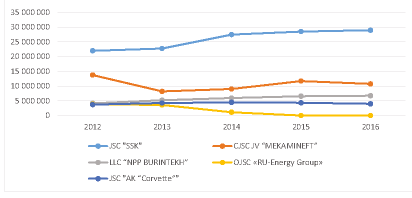

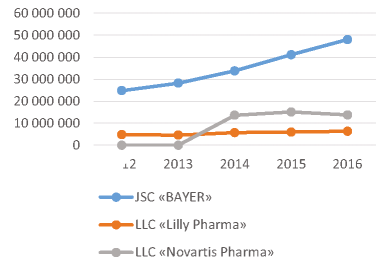

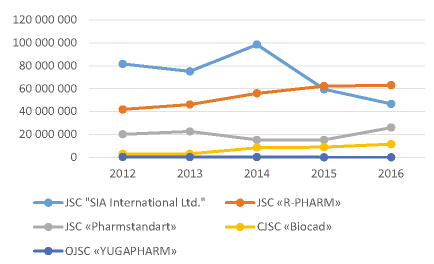

It should be noted that in respect of nine companies the decision was made on the recognition of being insolvent (bankrupt) (see table I). In doing so, there was a gradual deterioration in the key financial indicators in the companies’ activity during 2012-2015 (unprofitable activity, revenue decrease, disposal of fixed assets), the financial condition worsening was observed in the companies, employed in oil and gas industry. At the end of 2013 the Russian gas servicing industry companies experienced economic difficulties due to the high competition of foreign companies with more modem equipment and offering services at lower prices. The dynamics of financial indicators of companies is represented in table 2 and fig. 1-4.

Changes in business model mid sustainable survival

Overall, the data suggest that companies increasing investment in intangible assets during the period from 2003 to 2008 had a lower probability of default after recession in 2014. At the same time changing the business model significantly affect the post-crisis survival of the firm. In particular, the default probability of companies is reducing at the decreased vertical integration, simplification of the business model and increased investment in intangible assets. Thus these three dimensions can be defined as strategies resistant to crisis.

Strategies of Russian andforeign compmiies

In the conditions of rapid political and economic changes in the framework of the implementation of development strategies, Russian companies have the following tasks:

- reducing the costs and increasing the operational efficiency;

- entering new geographical markets to ensure internal growth;

- acquisition of assets and increase in market share;

- mastering the conceptually new technologies, changing “the game rules” on the market, releasing new products to the market;

- accurate and realistic assessment of the timing and costs at the stage of making the final investment decision, compliance with the approved plan.

The consequence of the imposed restrictions for Russian companies was a deficit of available funds. Russian companies experience financing difficulties and consequently pay more attention to financial performance. Optimization of the supply chain and increase of the effectiveness of operational activities are conducted considering the importance of reducing the costs. At that the subsidiaries of foreign companies are able to receive intercompany loans, including from the parent companies, which receive revenue on the foreign markets.

Orientation of Russian companies toward the financial results is also reflected in the approach to innovation. The main mechanisms of innovative development of a company are increasing the volume of investment in R&D and the search for an optimal balance between costs and benefit. This approach, due to the financial aspects, fundamentally distinguishes the Russian business from the foreign players, who believe they first and foremost need creative employees for development. Unlike foreign competitors for the managers of Russian companies the supply chain optimization, the efficiency improving of operating activities and the introduction of new technologies are relatively more important than bringing the qualified staff.

CONCLUSIONS

Recently the current geopolitical situation had a major impact on the business climate in Russia, in this regard, both domestic and foreign companies present on the Russian market have to act more cautiously and more carefully treat the investment programmes and development strategies.

Russia remains one of the most attractive and profitable markets in terms of sales and profit, most foreign companies retain their willingness to work in Russia and demonstrate the continued stability or positive dynamics of financial results, thus, hypothesis I is confirmed only in part. Russian companies are really willing to occupy the vacant niche, previously occupied by the foreign sector; however, this phenomenon takes place sporadically. It should be noted that the presence of foreign companies in the Russian market is very important. At the state level measures are being taken to improve the investment climate and to create an enabling environment for enterprise development in the long term, including the development of the railway transport infrastructure, construction of roads and bridges, implementation of projects to develop infrastructure of electricity, water and gas supply. The cumulative effect of such infrastructure changes consists in productivity improving, which constitutes one of the main objectives of companies operating in Russia.

Fig. 1. Dynamics of the revenues of the subsidiaries of foreign companies in oil and gas sector, thous. rub.

Fig. 2. Dynamics of the revenues of the Russian companies in oil and gas sector, thous. rub.

Fig. 3. The dynamics of the net profit (negative profit) of the subsidiaries of foreign companies in pharmaceutical industry, thous. rub

Fig. 4. The dynamics of the net profit (negative profit) of the subsidiaries of the Russian companies in pharmaceutical industry, thous. rub.

The analysis of 31 industrial companies suggests that the changes in business model influenced the post-crisis sustainable survival. As it is showed by the study of the process of the experience (learning) obtaining from crisis and its role in the company's ability to adapt its business model to the new competitive landscape, the changes in business model were not directly related to the experience of the previous crisis. The strategies, previously used by the companies, appeared less effective in reducing the probability of default in the changed economic conditions.

In case the companies do not profit by the previous crisis experience, the impact of economic downturns on the subsequent recovery of the economy may be exacerbated. Even counterbalance mechanism that restores stability after the crisis might not be sufficient, since companies must adjust their behaviour and learn from previous experience. In the opposite case, if learning (the crisis experience) is limited, self-regulatory systems can be only partly effective [Thomsen S., 1999].

In general, the data show that the experience obtaining had a limited effect on change in strategic approach. Since the strategy adoption to reduce the default risk only slightly depends on the previous crisis, hypothesis 2 is only partially confirmed.

Analysis of the changes in business model revealed that the probability of default (disposition or bankruptcy) of a company increases with the business model complexity, and the strategies of companies demonstrating relatively better results are aimed at the organizational complexity reducing. Thus, at the firm level it’s suggested to avoid complications and vertical integration as strategic opportunities to provide survival after the crisis.

References

1. JCS «Corvette». Brief information about the company [б.г.] // АК «Корвет». URL: http://www.korvet-jsc.ru/files/catalogues/PF.ru.pdf.

2. Balyuk L. (2017) Oil and gas service company «Baker Hyghes» // fb.ru. URL: http://fb.ru/article/368372/neftegazovaya-servisnaya-kompaniya-beyker-hyuz-baker-hughes-prezident-kompanii.

3. Belyayeva T.V., Shyrokova G.B., Gafforova Y.B. (2017) The results of the firm’s activity during the economic crisis period: the role of strategic orientations and financial capital // Russian journal of managment Vol. 15. № 2. p.p. 131–162.

4. BURINTEKH [б.г.].URL: http://burintekh.ru.

5. Zubova Y., Abakumova M. (2016) Citizen-bankrupt: 15 main debtors of Russia // Forbes. URL: http://www.forbes.ru/rating-photogallery/322897-grazhdanin-bankrot-15-glavnykh-dolzhnikov-rossii.

6. And failed again to sell «YugraPharm» (2011) // URL: https://gmpnews.ru/2011/10/i-vnov-ne-udalos-prodat-yugrafarm/.

7. Names. Figures. Facts [б.г.] // Bayer. URL: https://www.bayer.ru/about/profile-and-organization/.

8. The company’s history ([б.г.]) // Р-Фарм. URL: http://r-pharm.com/ru/page/company_development.

9. MeKaMineft [б.г.]. URL: http://www.mecamineft.com.

10. Our strategy [б.г.]// Novartis. URL: https://www.novartis.ru/about-us/our-strategy.

11. Our strategy [б.г.]// СИА Групп. URL https://siamed.ru/company.

12. Basic facts [б.г.] Lilly. URL: https://lilly.ru/public/ContentPageLeftNav.aspx?LinkID=3.

13. Trachuk A. V. (2012) Innovation as a condition for the long-term sustainability of the Russian industry // Effective crisis management. №6 (75). p.p. 66–71.

14. Trachuk A. V. (2011) A comprehensive approach to provide the company’s business continuity // Effective crisis management. № 6. p.p. 18–21.

15. Trachuk A. V. (2014 а). The concept of dynamic capabilities: in search of microbases // Economic science in modern Russia. № 4(67). p.p. 39–48.

16. Trachuk A. V. (2014 b). Business models for the hyperconnected world // Management science in modern Russia. Vol. 1, № 1. p.p. 20–26.

17. Trachuk A. V., Vorobyov А. А. (2011) Crisis management in the modern organization in the context of strategic and project management // Actual problems of socio-economic development of Russia. Vol. 4. p.p. 26–37.

18. Trachuk A. V., Linder N.V. (2015 а) The transformation of business models in electronic business in the conditions of unstable environment // Effective crisis management. №2. p.p. 58–71.

19. Trachuk A. V., Linder N.V. (2015 b) The transformation of business models in electronic business in the conditions of unstable environment // Management of sustainable development. St.Petersburg: The real economy. p.p. 203–224.

20. Trachuk A. V., Linder N.V. (2016 а) Adaptation of Russian firms to environmental changes: the role of e-business tools // Management sciences. № 1. p.p. 61–73.

21. Trachuk A. V., Linder N.V. (2016 b) The effect of liquidity constraints on industrial companies' investments in research and development and innovation performance // Effective crisis management. №1. p.p. 80–89.

22. Trachuk A. V.., Linder N.V. (2017) Innovation and productivity of Russian industrial companies // Innovations. № 4 (222). p.p. 53–65.

23. Trachuk A. V., Linder N.V.., Antonov D. A. (2014). The impact of information and communication technologies on the business models of modern companies // Effective crisis management. № 6. p.p. 60–68.

24. Trachuk A. V.., Linder N.V., Ubeyko N.V. (2017) Formation of dynamic business models of e-commerce companies // Manager. №4 (68). p.p. 61–74

25. Pharmstandart [б.г.]. URL: https://pharmstd.ru/page_159.html.

26. Federal agency ([б.г.]) // URL: http://www.gks.ru.

27. «Schlumberger» in Russia and Central Asia countries ([б.г.]) http://www.slb.ru/about/schlumberger_russia_and_central_asia/.

28. Acs Z. J., Amorуs J. E. (2008) Entrepreneurship and competitiveness dynamics in Latin America // Small Business Economics. Vol. 31, N 3. P. 305–322.

29. Akgun A. E., Lynn G. S., Yılmaz C. (2006) Learning process in new product development teams and effects on product success: A socio-cognitive perspective // Industrial Marketing Management. Vol. 35, N 2. P. 210–224.

30. Amit R., Zott C. (2001) Value creation in e-business // Strategic Management Journal. Vol. 22, N 6–7. P. 493–520.

31. Andries P., Debackere K. (2007) Adaptation and performance in new businesses: Understanding the moderating effects of independence and industry // Small Business Economics. Vol. 29, N 1–2. P. 81–99.

32. Archibugi D., Filippetti A., Frenz M. (2013) Economic crisis and innovation: Is destruction prevailing over accumulation? // Research Policy. Vol. 42, N 2. P. 303–314.

33. Arregle J. L., Hitt M. A., Sirmon D. G. et al. (2007) The development of organizational social capital: Attributes of family firms // Journal of Management Studies. Vol. 44, N 1. P. 73–95.

34. Azadegan A., Dooley K. J. (2010) Supplier innovativeness, organizational learning styles and manufacturer performance: An empirical assessment // Journal of Operations Management. Vol. 28, N6. P. 488–505.

35. Baffigi A. (2000) Lo sviluppo locale: un'indagine della Banca d'Italia sui distretti industriali / Ed. L. F. Signorini. Meridiana libri.

36. Baker Hughes [s.a.]. URL: https://www.bhge.com.

37. Bapuji H., Crossan M. (2004) From questions to answers: reviewing organizational learning research // Management Learning. Vol. 35, N 4. P. 397–417.

38. Barlevy G. (2004) The cost of business cycles under endogenous growth // The American Economic Review. Vol. 94, N 4. P. 964–990.

39. Basu S., Wadhwa A. (2013) External venturing and discontinuous strategic renewal: An options perspective // Journal of Product Innovation Management. Vol. 30, N 5. P. 956–975.

40. Bhatnagar J. (2007) Predictors of organizational commitment in India: strategic HR roles, organizational learning capability and psychological empowerment // The International Journal of Human Resource Management. Vol. 18, N 10. P. 1782–1811.

41. Biocad ([б.г.]). URL: https://biocad.ru.

42. Bouchikhi H., Kimberly J. R. (2003) Escaping the identity trap // MIT Sloan Management Review. Vol. 44, N 3. P. 20.

43. Caballero R. J., Hammour M. L. (1996). On the timing and efficiency of creative destruction // The Quarterly Journal of Economics. Vol. 111, N 3. P. 805–852.

44. Carroll G. R., Hannan M. T. (1995). Resource partitioning // Organizations in industry: Strategy, structure and selection / Eds. G. R. Caroll, N. T. Hannan. New York: Oxford University Press. P. 215–221.

45. Casadesus-Masanell R., Ricart J. E. (2010) From strategy to business models and onto tactics // Long Range Planning. Vol. 43, N 2. P. 195–215.

46. Chindooroy R., Muller P., Notaro G. (2007) Company survival following rescue and restructuring State aid // European Journal of Law and Economics. Vol. 24, N 2. P. 165–186.

47. Chesbrough H. (2010). Business model innovation: opportunities and barriers // Long Range Planning. Vol. 43, N 2. P. 354–363.

48. Cucculelli M., Bettinelli C. (2016) Corporate governance in family firms, learning and reaction to recession: Evidence from Italy // Futures. Vol. 75. P. 92–103.

49. Cucculelli M., Bettinelli C. (2015) Business models, intangibles and firm performance: evidence on corporate entrepreneurship from Italian manufacturing SMEs // Small Business Economics. Vol. 45, N 2. P. 329–350.

50. Cyert R. M., March J. G. (1963). A behavioral theory of the firm. Englewood Cliffs, NJ: Prentice Hall.

51. Demil B., Lecocq X. (2010) Business model evolution: in search of dynamic consistency // Long Range Planning. Vol. 43, N 2. P. 227–246.

52. Desai V. M. (2014) Does disclosure matter? Integrating organizational learning and impression management theories to examine the impact of public disclosure following failures // Strategic Organization. Vol. 12, N 2. P. 85–108.

53. Franke N., Gruber M., Harhoff D. et al. (2008) Venture Capitalists' Evaluations of Start-Up Teams: Trade-Offs, Knock-Out Criteria, and the Impact of VC Experience // Entrepreneurship Theory and Practice. Vol. 32, N 3. P. 459–483.

54. Freeman C., Clark J., Soete L. (1982) Unemployment and technical innovation: a study of long waves and economic development. London: Burns & Oates.

55. George G., Bock A. J. (2011) The business model in practice and its implications for entrepreneurship research // Entrepreneurship Theory and Practice. Vol. 35, N 1. P. 83–111.

56. Geroski P. A., Walters C. F. (1995) Innovative activity over the business cycle // The Economic Journal. Vol. 105, N 431. P. 916–928.

57. Grewal R., Tansuhaj P. (2001) Building organizational capabilities for managing economic crisis: The role of market orientation and strategic flexibility // Journal of Marketing. Vol. 65, N 2. P. 67–80.

58. Halliburton в России ([б.г.]) // Halliburton. URL: http://www.halliburton.com/ru-ru/about/halliburton-in-russia.page?node-id=igryifbr.

59. Herbane B. (2014). Information value distance and crisis management planning. SAGE Open. Vol. 4, N 2. P. 215–229.

60. Ireland R. D., Hitt M. A., Sirmon D. G. (2003) A model of strategic entrepreneurship: The construct and its dimensions // Journal of Management. Vol. 29, N 6. P. 963–989.

61. Jarillo J. C. (1995) Strategic networks: creating the borderless organization. Oxford: Butterworth Heinemann.

62. Johnson M. W., Christensen C. M., Kagermann H. (2008) Reinventing your business model // Harvard Business Review. Vol. 86, N 12. P. 57–68.

63. Kandemir D., Hult G. T. M. (2005) A conceptualization of an organizational learning culture in international joint ventures // Industrial Marketing Management. Vol. 34, N 5. P. 430–439.

64. Kuratko D. F., Audretsch D. B. (2013) Clarifying the domains of corporate entrepreneurship // International Entrepreneurship and Management Journal. Vol. 9, N 3. P. 323–335.

65. Latham S. (2009) Contrasting strategic response to economic recession in start-up versus established software firms // Journal of Small Business Management. Vol. 47, N 2. P. 180–201.

66. Leung S., Horwitz B. (2010) Corporate governance and firm value during a financial crisis. Review of Quantitative Finance and Accounting. Vol. 34, N 4. P. 459–481.

67. Lieberman M. B., Asaba S. (2006) Why do firms imitate each other? // Academy of Management Review. Vol. 3, N 2. P. 366–385.

68. Liu C., Uchida K., Yang Y. (2012) Corporate governance and firm value during the global financial crisis: Evidence from China // International Review of Financial Analysis. Vol. 21. P. 70–80.

69. Markides C. C. (2013) Game-changing strategies: How to create new market space in established industries by breaking the rules. London: John Wiley Sons.

70. Marsen S. (2014) “Lock the Doors” Toward a Narrative–Semiotic Approach to Organizational Crisis // Journal of Business and Technical Communication. Vol. 28, N 3. P. 301–326.

71. Mensch G. (1979) Stalemate in technology: innovations overcome the depression. Cambridge, MA: Ballinger.

72. Menzel M. P., Fornahl D. (2009) Cluster life cycles — dimensions and rationales of cluster evolution // Industrial and Corporate Change. Vol. 19. P. 205–238.

73. Miller D., Le Breton-Miller I. (2005) Managing for the long run: Lessons in competitive advantage from great family businesses. Cambridge, MA: Harvard Business Press.

74. Miller D., Le Breton-Miller I., Scholnick B. (2008) Stewardship vs. stagnation: An empirical comparison of small family and non-family businesses // Journal of Management Studies. Vol. 45, N 1. P. 51–78.

75. Morris M., Schindehutte M., Allen J. (2005) The entrepreneur's business model: toward a unified perspective // Journal of Business Research. Vol. 58, N 6. P. 726–735.

76. Perlow L. A., Okhuysen G. A., Repenning N. P. (2002) The speed trap: Exploring the relationship between decision making and temporal context // Academy of Management Journal. Vol. 45, N 5. P. 931–955.

77. Porter M. E. (1985) Competitive advantage: creating and sustaining superior performance. New York: FreePress.

78. Porter M. E. (1996) What is strategy? // Harvard Business Review. Vol. 74, N 6. P. 61–78.

79. Santos-Vijande M. L., Sanzo-Perez M. J., Alvarez-Gonzalez L. I. et al. (2005) Organizational learning and market orientation: interface and effects on performance // Industrial Marketing Management. Vol. 34, N 3. P. 187–202.

80. Schneider S., Spieth P. (2013) Business model innovation: Towards an integrated future research agenda // International Journal of Innovation Management. Vol. 17, N 1. P. 134–139.

81. Schumpeter J. A. (1936) Theory of economic development. Cambridge, MA: Harvard University.

82. Smith D., Elliott D. (2007) Exploring the barriers to learning from crisis: Organizational learning and crisis // Management Learning. Vol. 38, N 5. P. 519–538.

83. Sosna M., Trevinyo-Rodriguez R. N., Velamuri S. R. (2010) Business model innovation through trial-anderror learning: The Naturhouse case // Long Range Planning. Vol. 43, N 2. P. 383–407.

84. Srinivasan R., Lilien G. L., Sridhar S. (2011) Should firms spend more on research and development and advertising during recessions? // Journal of Marketing. Vol. 75, N 3. P. 49–65.

85. Stein A., Smith M. (2009) CRM systems and organizational learning: An exploration of the relationship between CRM effectiveness and the customer information orientation of the firm in industrial markets // Industrial Marketing Management. Vol. 38, N 2. P. 198–206.

86. Stiglitz J. E. (1993) Endogenous growth and cycles // NBER Working Paper no. 4286 / National Bureau of Economic Research. Cambridge, Mass.

87. Teece D. J. (2010) Business models, business strategy and innovation // Long Range Planning. Vol. 43, N 2. P. 172–194.

88. Thoma G. (2009) Striving for a large market: evidence from a general purpose technology in action // Industrial and Corporate Change. Vol. 18, N 1. P. 107–138.

89. Thomsen S. (1999) Corporate ownership by industrial foundations // European Journal of Law and Economics. Vol. 7, N 2. P. 117–137.

90. Trachuk A., Linder N. (2018) Innovation and Performance: An Empirical Study of Russian Industrial Companies // International Journal of Innovation and Technology Management. Vol. 15, N 3.

91. Tucker A. L., Nembhard I. M., Edmondson A. C. (2007) Implementing new practices: An empirical study of organizational learning in hospital intensive care units // Management Science. Vol. 53, N 6. P. 894–907.

92. Weatherford [б.г.]. URL: https://www.weatherford.com/ru/.

93. Williamson O. E. (1981) The economics of organization: The transaction cost approach. American Journal of Sociology. Vol. 87, N 3. P. 548–577.

94. Zott C., Amit R. (2008) The fit between product market strategy and business model: implications for firm performance // Strategic Management Journal. Vol. 29, N 1. P. 1–26.

95. Zott C., Amit R. (2007) Business model design and the performance of entrepreneurial firms // Organization Science. Vol. 18, N 2. P. 181–199.

96. Zott C., Amit R., Massa L. (2011). The business model: recent developments and future research. Journal of Management. Vol. 37, N 4. P. 1019–1042.

97.

About the Author

A. V. StepanyanРоссия

Manager at Ernst Young (CIS) B. V.

Research interests: strategy and management of development of the industrial companies.

Review

For citations:

Stepanyan A.V. THE REACTION OF INDUSTRIAL COMPANIES TO CRISIS: CHANGES IN BUSINESS-MODEL AND STRATEGIC SUSTAINABILITY. Strategic decisions and risk management. 2018;(3):114-125. https://doi.org/10.17747/2078-8886-2018-3-114-125

JATS XML