Scroll to:

THE TARGET INDICATORS OF THE ELEVATION OF COMPETITIVENESS OF MANUFACTURING BRANCHES IN RUSSIAN FEDERATION

https://doi.org/10.17747/2078-8886-2018-3-10-15

Abstract

The elevation of competitiveness of the Russian manufacturing is of the key problems of the long-term national economic development. Further to this the “The Development and the Enhance of Competitiveness of the Industry” State Program of Russian Federation has been accepted and is executing. The paper analyses the changes of competitiveness indicators for various branches of manufacturing after the Program. It arguments their loose relationship with the competitiveness elevation objectives and provides an alternative approach of the authors to apprise the competitiveness of Russian manufacturing sectors and a classification of commodity groups of industrial goods basis their foreign market competitiveness.

For citations:

Abdikeev N.M., Bogachev Yu.S., Moreva E.L., Teplyakov A.Yu. THE TARGET INDICATORS OF THE ELEVATION OF COMPETITIVENESS OF MANUFACTURING BRANCHES IN RUSSIAN FEDERATION. Strategic decisions and risk management. 2018;(3):10-15. https://doi.org/10.17747/2078-8886-2018-3-10-15

CRITICAL ANALYSIS OF TARGET INDICATORS OF THE STATE PROGRAM

В современном мире конкурентеспособ- HocIn the modem world, the competitiveness of the national economy in the global market is a key factor in the sustainability of the country's socio-economic development, ensuring the high quality of life of the population, its defense capability and geopolitical positioning of the state. The concept of " competitiveness " has received many different interpretations. Thus, according to M. Porter, the company's competitiveness is “an opportunity to compete in the global market with a global strategy ”, lawmakers associate it with a positive foreign trade balance, and some economists have low production costs per unit of output that are adjusted to the exchange rate [ Porter M ., 2016 ]. In the economic literature and political discourse competitiveness means as presence of product advantages in the market, based on an assessment ratio " price - quality ". [2]

Currently, for the executive branch, the basic working document coordinating the efforts of the state to increase the competitiveness of domestic industrial production is the state program of the Russian Federation “ Development of industry and increasing of its competitiveness ”. This document presents a special thematic block “ Target Indicators and Program Indicators ” to assess the effectiveness of the activities declared in the program and quantify their expected results. In the program “ Development of the industry and increase of its competitiveness ” there is no clear definition of the concept “ competitiveness ”. In this capacity, we can consider the formulation of the goal : "... the creation in the Russian Federation of a competitive, sustainable, structurally balanced industry <...> capable of effective self-development based on integration into the global technological environment, the development and application of advanced industrial technologies aimed at the formation and development of new markets for innovative products that effectively solve the task of providing economic development of the country ’’[Resolution, 2014]. The authors of this document are aware of the relationship of the competitiveness of national industrial products with its positioning in the market. Nevertheless, such an important property of competitiveness as the presence of market advantages is missed. Apparently, this is precisely why the program contains target indicators that allow only indirectly assess the success of the domestic industrial sector in increasing the competitiveness of its products.

YU. S. BOGACHEV

Doctor of Physical and Mathematical Sciences, Senior Researcher, Institute for Industrial Policy and Institutional Development, Financial University under the Government of the Russian Federation. Research interests: macroeconomic problems of Russian and global economy, innovation mechanisms and sustainable economic development factors, human capital reproduction problems, the diagnostics of the economic systems of various levels, organizational problems of the science and education development.

E-mail: YUSBogachev@fa.ru

E. L. MOREVA

PhD of Economics, Associate Professor of the Department of Corporate Finance and Corporate Management, Financial University under the Government of the Russian Federation. Research interests: social economic systems, development economy, innovation economy, intangibles, international competitiveness, international economic integration.

E-mail: YUSBogachev@fa.ru

A. YU. TEPLYAKOV

PhD in Economics, Associate Professor of the Department of Economics, Financial University under the Government of the Russian Federation. Research interests: economic systems, industrial policy, economic transformation.

E-mail: ayuteplyakov@fa.ru

Among the basic target indicators and indicators in the program there are:

- production index by type of economic activity “Manufacturing Production” in relation to the previous year;

- labor productivity index by type of economic activity “Manufacturing Production” in relation to the previous year;

- index of the physical volume of investments in fixed capital by type of economic activity “Manufacturing Production” in relation to the previous year;

- increase in high-performance jobs by type of economic activity "Manufacturing Production" in relation to the previous year;

- energy intensity of manufacturing industries to the base year 2011;

- internal expenses for research and development within the framework of the program at the expense of budget funds;

- internal expenses for research and development within the framework of the program at the expense of extrabudgetary sources.

Target indicators of industry subprograms for the most part reproduce the logic of the above list, partly duplicating it, partly expanding it. These indicators, of course, have some value for assessing the dynamics of competitiveness of both individual sectors and the national economy as a whole. You can reduce the energy intensity of production, increase costs in research and development, increase labor productivity and even increase output, but at the same time lose competitiveness, losing market share or “ becoming isolated ” on the national economy through the establishment of high protectionist barriers. In other words, the program includes indirect indicators of national (sectoral) competitiveness. For the formation of targets that are adequate to the needs of the long-term of socio-economic development of Russia in the modem world, we need direct indicators directly reflecting the demand for manufactured industrial products on the global market.

The European approach to the assessment of competitiveness as an aspect of industrial policy can be described as “pro-market”. Thus, in the EU industrial development concept paper “Industrial policy as a way to sustainable economic growth”, one of the most important economic problems of the European macro-region is “the loss of market share by industrialized countries in favor of manufacturers from developing countries who “ invade” an increasing number of sectors, not limited to traditional expansion in labor-intensive industries". According to the authors of this document, the high level of innovation spending in the United States and, as a result, a high level of productivity do not lead to solving the problem of unprecedented trade deficit. The European Union as a whole has a balanced foreign trade, but there is no significant increase in labor productivity. Against this background, emerging markets are showing significant success, “ increasing the market share in both these regions”. In such conditions, “ it is necessary to follow the markets, ” stimulating “ types of economic activity and the business sector in the broad sense of the word, ” rather than “ growing champions, ” as was done in the postwar decades [Aiginger K., 2014] .

An objective quantitative assessment of national competitiveness claim annual "Global Competitiveness Report " published by the World Economic Forum [5]. At first glance, it may seem that the concept of competitiveness is blurring here, since the task has been set to cover 12 factors: institutions, infrastructure, macroeconomic environment, healthcare and primary education, higher education and vocational training, efficiency of commodity markets, labor market efficiency, financial market development, level of technologies used, market size, entrepreneurial experience and innovation. Ultimately, however, the contribution of each of these factors is determined by the share of commodities (or the share of final products) in national exports. Thus, in the current international practice in solving the problem of improving the competitiveness of the industrial sector, the main targets are the final (market, commercial) results, rather than intermediate (scientific, technical, production).

In the state program of the Russian Federation “ Development of industry and increase of its competitiveness ” we can find indicators focused on the “ commercial development ” of the market, including the global one. Flowever, they are represented haphazardly. Thus, among the target indicators and indicators of the program as a whole and subprogramme I in particular, they do not exist, and in subprogramme 2 they predominate: the volume of shipped goods of own production, the volume of exports of means of production the number of produced and sold import-substituting means of production, the volume of shipped import-substituting means of production.

In addition, to solve the problem posed, not absolute, but relative indicators are more important. In the program, they are presented sporadically and vary from subprogram to subprogram. For example, in subprogramme 3, it is possible to detect the share of Russian products on the market. For subprogramme 4, the share of imports in the structure of consumption of products of the chemical complex of deep processing in the total amount of products of the chemical complex and the share of exports in the output structure of the chemical complex of deep processing in the total amount of domestic production are typical.

In other words, the target indicators and indicators formulated in the program can directly or indirectly indicate technological, economic, institutional, infrastructural and budgetary changes related to the functioning of individual industries. Flowever, it is necessary to recognize that they do not provide an adequate systematic assessment of the competitiveness of the domestic industry, as the name of the state program itself “requires”.

Table 1

The level of competitiveness of industrial products in the domestic market for some product groups (2011-2015), according to [ Current materials, [b.g.] ; Russian, 2017]

|

Products |

2011 |

2012 |

2013 |

2014 |

2015 |

|---|---|---|---|---|---|

|

Products of textile, clothing, leatlier and footwear industry |

29 |

27 |

28 |

28 |

27 |

|

Chemical products |

51 |

51 |

50 |

49 |

48 |

|

Metallurgical products |

80 |

79 |

79 |

80 |

83 |

|

Machinery, equipment and vehicles |

49 |

49 |

51 |

50 |

50 |

SUGGESTED TARGET INDICATORS FOR IMPROVING THE COMPETITIVENESS OF MANUFACTURING INDUSTRIES

Claiming the need to assess competitiveness exclusively from pro-market positions, we introduce the following basic indicators of the competitiveness of domestic products in the domestic and foreign markets.

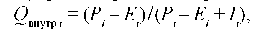

Share of the cost of domestic products of a particular product group in the total value of these products sold on the domestic market. Indicator characterizes the level of competitiveness of domestic products in the domestic market and is defined as:

where Qdom.i - is the share of the cost of domestic products of the i product group in the total cost of products sold on the domestic market; Pi - is the domestic production of i commodity group; Ei - is export of domestic products of i product group; Ii - is import of products of i product group. By grouping indicator values by product groups produced by the relevant manufacturing industry, one can get an aggregated characteristic of the competitiveness of the industry and the manufacturing industry as a whole.

Indicator may be a quantitative characteristic of the level of competitiveness of products of the sector (industry) of the manufacturing industry in the domestic market (Table I). Values range from 0 (absolute dependence on imports) to 100% (absolute independence from imports).

So, for 2015 we can state:

- serious problems with competitiveness in the textile, clothing, leather and footwear industry (27%);

- the need for control by the regulator in the production of chemical products (48%), machinery, equipment and vehicles (50%);

- relatively high competitive position of the metallurgical industry in the domestic market (83%).

The level of competitiveness of products in the domestic market is undoubtedly an important target benchmark of the state industrial policy. At the same time, in the context of sustainable (in essence, long-term) economic development, the presence or absence of competitive advantages of products in the external (global) market is much more important.

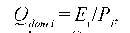

The share of the value of export products of a specific commodity group of the manufacturing industry in the total value of these manufactured products. Indicator characterizes the level of competitiveness of domestic production in the domestic market and is defined as:

where Qdom.i - is the share of the value of export products of a specific commodity group of the manufacturing industry in the total value of these manufactured products.

This indicator quantitatively characterizes the level of competitiveness of export products of the sector (industry) of the manufacturing industry in the foreign market (Table 2). Indicator can take values from 0 (absolute dependence on imports) to 100% (absolute independence from imports).

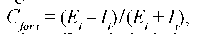

Index of foreign trade turnover of domestic products in the foreign market. Calculated as follows:

where Cfor i - is the index of foreign trade turnover of domestic products of the i product group in the foreign market. Index characterizes the position of domestic products in the global market and is calculated as the ratio of the difference in the values of exports and imports to the volume of trade, characterized by their sum. For clarity, this ratio is expressed as a percentage. This indicator is indicative, since its value can vary in the range from -100% (absolute noncompetitiveness) to 100% (absolute competitiveness) (Table 3) .

As of 2016, commodity sectors and sectors with a low degree of industrial processing remain stably competitive:

- fuel and energy products (98%);

- mineral products (96%);

- precious stones and metals, as well as articles thereof (91 %);

- wood and pulp and paper products (49%);

- metals and articles thereof (+43%).

Key manufacturing industries, by contrast, proved to be uncompetitive. For example, in textile and footwear production, we can state a situation close to absolute noncompetitiveness (—85%). The situation is slightly better in the production of leather raw materials, furs and products thereof (-51%), comparatively better in the chemical industry (—24%). “Confidently” noncompetitive in the foreign market is the production of machinery, equipment and vehicles (—56%), the classic core of the manufacturing industry. Connection between the low competitiveness of industries in the foreign market (see Tables 2 and 3) and the similar situation in the domestic market (see Table I) looks quite natural.

Table 2

Share of export products of manufacturing industries in the total volume of their production,%, according to [ Current materials, [b.g.] ; Russian, 2017]

| Industry |

2014 |

2015 |

|---|---|---|

| High-tech industry | ||

|

Phamiaceutical production Manufacture of office equipment and computing equipment Manufacture of electronic components, equipment for radio, television and communications Manufacture of medical products; measuring instruments, control, management and testing; optical devices, photo and film equipment, watches Production of aircraft, including space Total |

8 7 4 7 26 14 |

8 3 5 6 33 17 |

|

Medium tech industry High level |

||

| Chemical production |

40 |

42 |

|

Manufacture of machinery and equipment |

5 |

6 |

|

Manufacture of electrical machinery and electrical equipment |

4 |

4 |

|

Manufacture of cars, trailers and semi-trailers |

4 |

5 |

|

Manufacture of other vehicles |

5 |

4 |

|

Total |

16 |

19 |

|

Low level |

||

|

Production of coke and petroleum products |

50 |

44 |

|

Manufacture of rubber and plastic products |

4 |

4 |

|

Manufacture of other non-metallic mineral products |

4 |

4 |

|

Metallurgical production |

35 |

35 |

|

Manufacture of finished metal products |

4 |

6 |

|

Construction and repair of ships |

16 |

12 |

|

Total |

36 |

34 |

|

Low-tech industry |

||

|

Food production, including drinks |

3 |

5 |

|

Textile production |

18 |

5 |

|

Manufacture of clothing, dressing and dyeing of fur |

2 |

3 |

|

Manufacture of leather, leather goods and footwear |

10 |

16 |

|

Wood processing and manufacture of wood and cork products, except furniture |

40 |

40 |

|

Total |

9 |

9 |

We consider it appropriate to supplement the program block “ Target indicators and indicators of the program ” with the competitiveness indicators, which are used in their reports by the authoritative international United Nations Industrial Development Organization (UNIDO):

- share of value added created in the high-tech manufacturing sectors in the total value added created in the manufacturing industry as a whole;

- share of value of products of high-tech sectors in the total value of exports.

Thus, the application of our proposed target indicators of competitiveness in the industrial sector will contribute to a more adequate assessment of its competitiveness, which, in turn, is crucial for the implementation of an effective industrial policy.

Table 3

Index of foreign trade turnover of domestic products in the foreign market by main product groups (2011-2016),% , according to [ Current materials, [b.g.] ]

|

Customs Union Commodity Classification of Foreign Economic Activity Code |

Product group |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

|---|---|---|---|---|---|---|---|

|

01-24 |

Food products and agricultural raw materials (except textiles) |

-52 |

-42 |

-45 |

-36 |

-24 |

-19 |

|

25-26 |

Mineral products |

95 |

96 |

96 |

96 |

96 |

96 |

|

27 |

Fuel and energy products |

97 |

98 |

98 |

98 |

97 |

98 |

|

28-40 |

Chemical products, rubber |

-17 |

-20 |

-24 |

-23 |

-14 |

-24 |

|

41—43 |

Leatlier raw materials, furs and products thereof |

-60 |

-52 |

-43 |

-51 |

-45 |

-51 |

|

44-49 |

Wood and pulp and paper products |

25 |

24 |

25 |

33 |

46 |

49 |

|

50-67 |

Textiles, textile products and shoes |

-89 |

-92 |

-90 |

-87 |

-85 |

-85 |

|

71 |

Precious stones, precious metals and articles thereof |

89 |

90 |

88 |

82 |

86 |

91 |

|

72-83 |

Metals and articles thereof |

36 |

33 |

30 |

35 |

47 |

43 |

|

84-90 |

Machinery, equipment and vehicles |

-70 |

-71 |

-68 |

-68 |

-53 |

-56 |

|

68-70, 91-97 |

Other goods |

-32 |

-40 |

-34 |

-29 |

-17 |

-12 |

|

|

Total |

26 |

25 |

25 |

27 |

31 |

22 |

CLASSIFIER OF BRANCHES OF INDUSTRIAL PRODUCTION IN THE RUSSIAN FEDERATION ВУ THE LEVEL OF COMPETITIVENESS OF PRODUCTS IN THE FOREIGN MARKET

Indicator “index of foreign trade turnover of domestic products on the foreign market” can be used as a criterion for the classification of industrial production sectors of the domestic economy according to their competitiveness. Depending on its value, we rank all branches of industrial production:

- uncompetitive industry: [-100%; -67%);

- mostly non-competitive industry: [-67%;-33%);

- moderately uncompetitive industry: [-33%; 0);

- moderately competitive industry: [0; 33%);

- mostly competitive industry: [33%; 67%);

- competitive industry: [67%; 100%].

We selected 83 out of 97 commodity items according to the code of the Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union related to export- import flows of industrial goods. Approximately 23% of them (19 positions) can be attributed to the production of high-tech or medium-tech products of high level.

Table 4 shows the distribution of commodity groups of industrial products to the level of their competitiveness in the foreign market.

Results of the ranking of commodity groups gives a kind of industry "cut" of competitiveness of domestic industrial production. So, only 15 out of 83 industries (18%) demonstrate more or less confident competitiveness (“mostly competitive” and “competitive”) in the international economic arena. By themselves, these figures would not yet be the basis for pessimistic conclusions, but only I of these 15 industries is high-tech, and that is also related to the production of military products (weapons and ammunition), not civilian. In other words, an analysis of the competitiveness of products manufactured by the high-tech manufacturing sector shows a low competitiveness of the sector.

Table 4

Classification of domestic industrial product groups by the level of competitiveness in the external market, according to [Current materials, [b.g.j ]

|

Уровень |

Number of industrial product groups |

Number of product groups of high-tech products and high-tech medium-level products |

||

|---|---|---|---|---|

|

Abs. number, units |

Rel. number, % |

Abs. number, units |

Rel. number, % |

|

|

Uncompetitive |

32 |

39 |

10 |

53 |

|

Predominantly uncompetitive |

16 |

19 |

3 |

16 |

|

Moderately uncompetitive |

11 |

13 |

2 |

11 |

|

Moderately competitive |

9 |

11 |

3 |

16 |

|

Predominantly competitive |

5 |

6 |

0 |

0 |

|

Competitive |

10 |

12 |

I |

5 |

|

Total |

83 |

100 |

19 |

100 |

Thus, the classification we have developed allows us to quickly assess the level of competitiveness of both the entire industrial complex of the Russian economy and individual industries in the foreign market. In this regard, we hope that this classification will be used as a tool in the development of public policies aimed at improving the competitiveness of domestic industrial production.

References

1. Mokronosov A. G., Mavrina I. N. (2014) Competition and Competitiveness: Study guide Yekaterinburg: Publishing house of Ural University. 194 p.

2. Porter M. (2016) International Competition. Competitive advantages of countries / Repub. I.V. Kvasyuk and others M .: Alpina Publisher. 947 p.

3. Resolution of the Government of the Russian Federation dated April 15, 2014 N 328 (ed. dated 30.03.2018) “On approval of the state program of the Russian Federation“ Development of industry and increasing its competitiveness ”” // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_162176/.

4. Russian statistical yearbook. 2017: Stat. (2017) / Rosstat. М. 686 p. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/science_and_innovations/science

5. Current materials of customs statistics ([b.g.]) // Federal Customs Service. URL: http://www.customs.ru/index.php?option=com_content&view=article&id=13858&Itemid=2095.

6. Aiginger K. (2014) Industrial Policy for a sustainable growth path // WWW for Europe. Policy Paper N 1. June.

7. Schwab K. (2016) The Global Competitiveness Report 2016–2017// World Economic Forum. URL: http://www3.weforum.org/docs/GCR2016-2017/05FullReport/TheGlobalCompetitivenessReport2016-2017_FINAL.pdf.

8.

About the Authors

N. M. AbdikeevRussian Federation

Doctor of Technical Sciences, Professor, Director of the Institute for Industrial Policy and Institutional Development, Financial University under the Government of the Russian Federation. Research interests: industrial policy, applied macroeconometric analysis and forecasting, neoindustrialization, innovation technologies, strategic planning, economic decision-making support system, cognitive technologies in economics and management

Yu. S. Bogachev

Russian Federation

Doctor of Physical and Mathematical Sciences, Senior Researcher, Institute for Industrial Policy and Institutional Development, Financial University under the Government of the Russian Federation. Research interests: macroeconomic problems of Russian and global economy, innovation mechanisms and sustainable economic development factors, human capital reproduction problems, the diagnostics of the economic systems of various levels, organizational problems of the science and education development.

E. L. Moreva

Russian Federation

PhD of Economics, Associate Professor of the Department of Corporate Finance and Corporate Management, Financial University under the Government of the Russian Federation. Research interests: social economic systems, development economy, innovation economy, intangibles, international competitiveness, international economic integration.

A. Yu. Teplyakov

Russian Federation

PhD in Economics, Associate Professor of the Department of Economics, Financial University under the Government of the Russian Federation. Research interests: economic systems, industrial policy, economic transformation /

Review

For citations:

Abdikeev N.M., Bogachev Yu.S., Moreva E.L., Teplyakov A.Yu. THE TARGET INDICATORS OF THE ELEVATION OF COMPETITIVENESS OF MANUFACTURING BRANCHES IN RUSSIAN FEDERATION. Strategic decisions and risk management. 2018;(3):10-15. https://doi.org/10.17747/2078-8886-2018-3-10-15