Scroll to:

Potential of decentralized interbank settlements using blockchain

https://doi.org/10.17747/2078-8886-2018-2-22-25

Abstract

Digital currency became a relevant topic lately, with the central banks contemplating the idea of issuing their own virtual currencies. Central banks may issue their virtual currencies to simplify interbank cross-border settlements and make them cheaper. In order to achieve this, both commercial and central banks recognize these virtual currencies as means of payments. In these projects blockchain could be used to store information about the digital currencies, instead of fiat money. We have identified the risks associated with the virtual currencies issued by the central banks: conversion and volatility risks. We have looked at different approaches to the distributed ledger, principles for decentralized virtual currencies, possibility of these technologies being used by the central banks, various risks and their mitigation strategies. We also formulated the technological and legal principles that may guide the issuance of the digital currency by the central banks. And reviewed the practicability of issuing virtual currencies by the central banks, based on exogenous and endogenous factors.

Keywords

For citations:

Dostov V.L., Shust P.M., Khorkova A.A. Potential of decentralized interbank settlements using blockchain. Strategic decisions and risk management. 2018;(2):22-25. https://doi.org/10.17747/2078-8886-2018-2-22-25

INTRODUCTION

Interest in virtual currencies appeared immediately after the crisis of 2008, and until now they have attracted close attention (see, for instance: [Trachuk A.V., Kornilov G.V., 2013; Savinsky S.R, 2017; Sazhina M.A., Kostin S.V., 2018, TrachukA., Linder N., 2017]). State authorities, central banks and researchers around the world are carefully studying the implications of the use of digital currencies for the economy, the financial system and regulators [Volodin S.N., Agalakova A.A., 2017; Dubyanskii A.N., 2017; Trachuk A.V., Golembiovsky D.Yu., 2012].

Central banks are interested in issues related to the possible regulation of decentralized crypto-currencies, such as bitcoin, the prospects for issuing their own digital currencies. The purpose of this article is to consider the essence of the cryptocurrency and to assess the appropriateness for central banks to use this tool.

CRYPTO-CURRENCIES: THEIR TYPES, PECULIARITIES AND LEGAL REGULATION

A crypto currency is a special challenge for regulation, as the existing legal system, as a rule, does not provide for the issue of a private currency and its wide (including cross-border) turnover. Therefore, the search for optimal ways of regulating decentralized currencies, issued by private individuals, continues. There are three points of view:

- total ban (Vietnam, Ecuador);

- free circulation of crypto currency of any private issuer on an equal basis with the national currency (Japan, Switzerland) [Legal status of Bitcoin, 2017];

- issuance by the national central bank of its own virtual crypto currency and a ban on circulation of other countries' crypto currencies.

The main risk of circulation of private virtual currencies is the restriction of the monopoly of central banks on the issue of money [Loginov E.A., Kuznetsov V.A., 2016b], which means a decrease in the manageability of macroeconomics. In our opinion, this risk seems to be insignificant: the turnover of private virtual currencies is not very large, and they are used mainly for financial speculation and do not replace the state currency in calculations.

The growth of interest in digital currencies since the beginning of 2010 is due to the emergence of decentralized crypto-currencies. The most famous is bitcoin, it has more than 200 analogues, among them there are lightcoin, ethereum, peercoin, etc.

A distinctive feature of decentralized crypto-currencies is their decentralized emission and decentralized confirmation of operations with the help of a blockchain, which is a distributed registry technology. Decentralized emission of virtual currency implies that users themselves generate "coins". The rate of emission is fixed in advance, which differs from the traditional approach to the issue of money. There is no central issuer that could suspend or, conversely, increase emissions. The users themselves also check sufficiency of the sender's funds (confirmation of transactions), fix the transaction and put it into their copy of the register of all transactions performed in the network. Thus, a high degree of trust is achieved: operations are confirmed collectively, therefore, unlike in traditional centralized systems, an intruder can not deceive the system by gaining control over the central counterparty. The reliability of the decentralized scheme is that there is no vulnerability, like in card systems, where an accident at the processing center actually stops all cards operations. For obvious reasons, financiers are trying to transfer these benefits of distributed registries to the regulated financial sector. In particular, commercial financial institutions are testing technology to record transactions at the securities market [Fiveways, 2017]. The central banks also show interest in it, trying to understand whether it can optimize their functions of issuers and payment system operators somehow.

One of the promising areas of applying distributed registries is implementation of interbank settlements, including cross-border settlements [Nurmukhametov R.K., Stepanov P.D., Novikova T.R., 2017].

As a rule, the current model of internal and cross-border settlements is rather cumbersome and inefficient. Banks that do not trust each other are forced to use services of a central counterparty, and in cross-border settlements, a whole chain of correspondent accounts. This makes transfers long and relatively expensive. It is assumed that distributed registry technology will be able to eliminate these drawbacks [New paper examines 2017].

Introduction of distributed registry technology into the banking system implies that banks will exchange not ordinary money, but their digital equivalent, over a distributed network. Since central banks are often also operators of payment systems, centralized emission will remain the same, but the calculations will be partially or completely decentralized.

The central bank becomes the operator of a "closed" block- chain. According to the contract, banks get access to the block- chain (for comparison: anyone who wants to join the system providing the turnover of bitcoin can do that). Each participant gets access not to the full copy of the registry, but only to the data that he needs in accordance with his role. For example, participating banks have access only to information on balances on correspondent accounts of counterparties and their own history of operations. The central bank has access to the full version of the registry, may reserve the right to make changes to the operations register if, for example, an error or illegal transaction occurred. In transactions with private virtual currencies, no participant can make such changes, i.e. operations are irrevocable.

A distributed register is essentially an alternative to a system of correspondent accounts. Like an electronic account, information on the account balance will be kept not by the central bank, but by each participant in the system. Unlike classical correspondent accounts, not fiat currency is taken into account, but special virtual money issued for this purpose. To organize such an accounting, central banks could issue their own virtual currencies, exchange them at the request of banks for ordinary money, at the rate one to one, at a constant exchange rate, take and bear the obligation of reverse exchange. These digital units can only be used in a distributed network and will not be available for individuals. Such a mechanism will allow banks to quickly exchange virtual units and, if necessary, turn them into fiat money [ThieleC.-L., 2017] (see the Figure below).

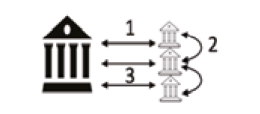

Interbank settlements using the distributed registry:

1 - banks - participants of the "closed" blockchain purchase virtual currency of the central bank - the issuer of the currency; 2 - banks use the virtual currency of the central bank to seamlessly perform the necessary operations within the distributed network; 3 - if necessary, commercial banks can also freely sell virtual currency back to the central issuing bank.

Let's consider the similarities and differences between virtual currencies and the money issued by central banks and the planned virtual currency of the central bank (see Table). In order to perform interbank settlements using the blockchain account, the payer's bank sends the transaction to all participants who confirm it and enter the relevant information to their copy of the register or do not confirm it (if the participant does not have enough virtual currency) and reject it. When carrying out cross-border settlements, both parties can use one digital unit, subsequently exchanging it for the required currency, for example, from the central bank. This will reduce their need for guarantee deposits, will allow for calculations in a mode close to the real one [Fantatsini D., Nigmatullin E.M., Sukhanovskaya V.N. and others, 2017].

USE OF CENTRALIZED VIRTUAL CURRENCIES IN INTERBANK SETTLEMENTS

The issuance of a virtual currency by the central bank is fraught with risks. The central bank becomes the emitter of electronic money, therefore participants of the system should be sure that they can exchange digital money for a currency at a fixed rate, if necessary, and transactions recorded as decentralized, will have legal force. The central bank will need to ensure the confidence of the new system on the part of banks. As an issuer, he will have to develop an order of replenishment and return of funds from a correspondent account. The ability of the central bank to issue electronic money on demand is practically unlimited. Therefore, banks will need to maintain the necessary level of liquidity, as they now maintain liquidity on correspondent accounts. Participating banks will need to convert their own virtual currency in 24/7 mode so that its circulation is under constant control.

Implementation of settlements using distributed registers also updates questions related to the confidentiality of information [Fantatsini D., Nigmatullin E.M., Sukhanovskaya V.N. and others, Ivliev S. V., 2016]. The essence of settlements between banks is a subject to commercial and banking secrecy. Accordingly, it is necessary to establish levels of access to information, so that each participant only gets access to the data that he needs. In particular, the essence of blockchain is in the openness of data on correspondent accounts (within the system).

Similarities and differences between the private virtual currency and the currency issued by the central bank [WalterEngert, BenFung, 2017]

|

Parameter |

Private virtual currency |

Central bank issue |

|

|---|---|---|---|

|

Money (cash / non-cash) |

Virtual currency |

||

|

Legal circulation |

Depends on the country (in most countries of the world - no) |

Yes |

Yes |

|

Use as a Settlement Currency |

No |

Yes |

Yes |

|

Amount |

Depends on the system (for example in bitcoin is limited) |

Limited |

Limited |

|

Stability of exchange rate |

No |

Yes |

Yes |

|

Settlement rules |

24/7 |

Depends on the global payment system |

24/7 |

Today, there is no developed regulatory framework governing financial transactions conducted with the help of distributed registry [Kuznetsov V.A., Yakubov A.V., 2016; Loginov E.A., Kuznetsov V.A., 2016a], In order to form it, central banks need to know and take into account all the nuances of blockchain functioning in the banking sector. Flowever, it is impossible to do this without preliminary testing. In this regard, central banks can create a special regime for testing (the so-called regulatory sandbox) with special conditions for its participants, where it will be possible to test new innovative technologies without the risk of violating financial legislation. Thus, planning to issue a virtual currency, the central bank will be able to assess all possible risks, and most important, start developing the regulatory framework to make that all future actions legitimate.

Technology of the distributed registry is used by technology companies (R3, IBM) [Manning J., 2017]. In 2016, Ripple launched the "Global Payment Management System", the first interbank blockchain system for global payments. To date, Rip- pleNet members are the world's largest banks: MUFG, Bank of America, CreditAgricole, etc. [Marquer S., 2017]. Ripple issues its own currency XRP (as of March I, 2018, its price is $ 0.9020), which is circulating within the RippleNet network.

It is very important to note that the existing payment methodology still remains unchanged and under the control of central banks. Consequently, the expediency of issuing virtual currencies by central banks for circulation on a broad market is not always justified: a new technology is needed where existing mechanisms and procedures do not allow achieving the necessary indicators of speed and quality of operations. Therefore, it may be relevant for specific purposes, for instance, for interbank settlements. Flowever, in order to use new methods of settlement between banks, it is necessary to develop rules and procedures, as payments that will pass through the distributed registry are subject to risks of breach of confidentiality and security of personal information. So, if the central and private banks of the world are going to work with the platform on distributed register technology, then states should ensure compliance with the regulatory requirements that will be developed for the implemented technologies that are not dependent on third parties.

CONCLUSIONS

Central banks issue their own virtual currency only in order to facilitate and reduce the cost of interbank cross-border settlements. For this, commercial and central banks of countries must recognize this currency. By issuing a virtual currency, central banks may face the need to convert and ensure a stable exchange rate for this currency. Central banks need to commit themselves to providing a fixed rate of virtual currency to fiat money I: I. In the blockchain, only information on the digital currency, not on fiat money, would be stored.

References

1. Володин С. Н., Агалакова А. А. (2017) Криптовалюты: сушность, влияние на мировые финансовые системы и особенности правового регулирования // Аудит и финансовый анализ. № 3–4. С. 204–208.

2. Дубянский А. Н. (2017). Теории происхождения денег и криптовалюты // Деньги и кредит. № 12. С. 97–100.

3. Кузнецов В. А., Якубов А. В. (2016) О подходах в международном регулировании криптовалют (Bitcoin) в отдельных иностранных юрисдикциях // Деньги и кредит. 2016. № 3. С. 20–29.

4. Логинов Е. А., Кузнецов В. А. (2016 а) К вопросу о сущности и нормативном регулировании электронных денег: зарубежный опыт // Деньги и кредит. 2016. № 4. С. 28–33.

5. Логинов Е. А., Кузнецов В. А. (2016 б). К вопросу о сущности и нормативном регулировании электронных денег: российский опыт // Деньги и кредит. 2016. № 8. С. 37–42.

6. Нурмухаметов Р. К., Степанов П. Д., Новикова Т. Р. (2017) Технология блокчейн: сущность, виды, использование в российской практике // Деньги и кредит. № 12. С. 101–103.

7. Правовой статус биткоина в разных странах (2017)//Unichange.me. URL: https://unichange.me / ru / articles / legal_status_of_bitcoin.

8. Савинский С. П. (2017) Криптовалюты и их нормативно-правовое регулирование в КНР // Деньги и кредит. № 7. С. 65–67.

9. Сажина М. А., Костин С. В. (2018) Криптовалюта: триумф желаний над действительностью // Вестник Московского университета. Сер. 21: Управление (государство и общество). № 1. С. 32–45.

10. Трачук А. В., Голембиовский Д. Ю. (2012) Перспективы распространения безналичных розничных платежей // Деньги и кредит. № 7. С. 24–32.

11. Трачук А. В., Корнилов Г. В. (2013) Анализ факторов, влияющих на распространение безналичных платежей на розничном рынке // Вестник Финансового университета. № 4 (76). С. 6–19.

12. Фантаццини Д., Нигматуллин Э. М., Сухановская В. Н. и др. (2016) Все, что вы хотели знать о моделировании биткоина, но боялись спросить. Ч. 1 // Прикладная эконометрика. № 4 (44). С. 5–24.

13. Фантаццини Д., Нигматуллин Э. М., Сухановская В. Н. и др. (2017) Все, что вы хотели знать о моделировании биткоина, но боялись спросить. Ч. 2 // Прикладная эконометрика. № 1 (45). С. 5–28.

14. Engert W., Fung B. (2017) Central Bank Digital Currency: Motivations and Implications//Bank of Canada Staff Discussion Paper.URL: https://www.bankofcanada.ca / 2017 / 11 / staff-discussion-paper-2017–16 / .

15. Five ways banks are using blockchain (2017)//FT.com. URL: https://www.ft.com / content / 615b3bd8-97a9-11e7‑a652‑cde3f882dd7b.

16. Manning J. (2017) How Blockchain is changing the banking industry // International Banker. URL: https://www.internationalbanker.com / banking / blockchain-changing-banking-industry / .

17. Marquer S. (2017) The World’s Biggest Banks Lead the Blockchain Charge // Ripple.com URL: https://www.ripple.com / insights / the-worlds-biggest-banks-lead-the-blockchain-charge /

18. New paper examines central bank digital currency models (2017) //Central banking.com URL: https://www.centralbanking.com / central-banks / currency / digital-currencies / 3225036 / new-paper-examines-central-bank-digital-currency-models.

19. Thiele C.‑L. (2017) From Bitcoin to digital central bank money – still a long way to go//Bank of International Settlements (BIS). URL: https://www.bis.org / review / r170921d.htm.

20. Trachuk A., Linder N. (2017) The adoption of mobile payment services by consumers: an empirical analysis results // Business and Economic Horizons. 2017. Vol. 13, № 3. P. 383–408.

About the Authors

V. L. DostovRussian Federation

Candidate of Physical and Mathematical Sciences, Chairman of REMA (Russian Electronic Money Association) Council. Area of expertise: banking, payment systems, financial technologies, cryptography, innovative financial regulation.

P. M. Shust

Russian Federation

Candidate of Political Sciences, Executive Director of REMA (Russian Electronic Money Association). Area of expertise: banking, payment systems, financial technologies, anti-money laundering, innovative financial regulation.

A. A. Khorkova

Russian Federation

Student of the Banking, Financial Market and Insurance Academic Department in the FSBEI of HE “Saint Petersburg State Economic University”. Area of expertise: banking, payment systems, financial technologies.

Review

For citations:

Dostov V.L., Shust P.M., Khorkova A.A. Potential of decentralized interbank settlements using blockchain. Strategic decisions and risk management. 2018;(2):22-25. https://doi.org/10.17747/2078-8886-2018-2-22-25