Scroll to:

DIGITAL TRANSFORMATION STRATEGY: ASSESSMENT OF DIGITAL MATURITY OF THE RUSSIAN ELECTRIC POWER INDUSTRY

https://doi.org/10.17747/2618-947X-2022-3-234-244

Abstract

Based on the analysis of domestic and foreign experience of digital transformation and the conducted expert survey, the authors conclude that Russia, in comparison with other countries, does not have a leading position in the implementation of digital technologies. At the same time, the electric power industry being the basic sector of the economy which is responsible for its safe and sustainable development, in terms of digitalization is on the sidelines, yielding to retail, the banking industry, telecommunications and the manufacturing industry. At the same time, digitalisation is a promising direction and can have a significant positive impact on the electric power industry. The purpose of the study is to assess the current level of digital maturity of the electric power industry in Russia, identify the main barriers to digital transformation and develop proposals in order to overcome them.

The article uses generalisation, comparative analysis, analyses empirical data of digitalisation in Russia and abroad, conducts a survey of experts in the electric power industry about its digital maturity.

For citations:

Khobotova L.V., Neprintseva E.V., Shubin S.A. DIGITAL TRANSFORMATION STRATEGY: ASSESSMENT OF DIGITAL MATURITY OF THE RUSSIAN ELECTRIC POWER INDUSTRY. Strategic decisions and risk management. 2022;13(3):234-244. https://doi.org/10.17747/2618-947X-2022-3-234-244

Introduction

Digitalisation in modern conditions is becoming one of the priority areas for the development of companies and states. So, in 2021, approximately 56% of CEOs around the world planned to increase the share of digital technology use1. And a number of countries, such as Germany and the UK, have already achieved significant results in digital transformation [International Digital Experience.., 2020].

In Russia, digital transformation in 2020 is defined as one of the national development goals2. At the same time, the internal costs of domestic organisations for the creation, distribution and use of digital technologies and related products and services in 2020 increased by 15.8% compared to the pre-Covid 2018 [Tsifrovaya ekonomika.., 2022]. To what extent such growth is explained by closer attention to this issue on the part of the state is a separate issue. An expert assessment of such an impact will be presented below. It seems that the understanding of the companies themselves had a greater effect, that digital transformation has become a necessary condition for maintaining competitiveness and the key to their development in the long term.

At the same time, the level of use of digital technologies by Russian companies is generally inferior to foreign competitors - the pace of implementation of individual digital initiatives is 5–10 years behind [Digital transformation of industries.., 2021]. Although there are pleasant exceptions, for example, Yandex, Mail.Ru, Tinkoff, Sberbank, 1C, Rostelecom, some of which can even compete with international companies both in the domestic and foreign markets.

As for the electric power industry, it came to digitalisation much later. It is only increasing its potential, yielding to industries that already use a large number of solutions, such as retail, banking, telecommunicationsand manufacturing. It should be understood that in such an area as digitalisation, one can very quickly become a leading industry from a lagging one, especially when using the positive and taking into account the negative experience accumulated by other industries.

The introduction and development of digital technologies in the electric power industry is usually associated with the possibility of companies reaching a new scientific, technological and industrial level, increasing the stability of the energy system as a whole and ensuring the accelerated implementation of the main economic trends in electrification, decarbonisation and decentralisation. Some experts estimate the potential growth in revenues of energy companies from digital transformation only in the short term by 3-4% per year [Khitrykh, 2021].

In order to build an effective digital transformation strategy for the electric power industry, it is important to understand the current level of its digital maturity, the main obstacles that companies face when implementing digital solutions, and their readiness for digital transformation.

-

Research methodology

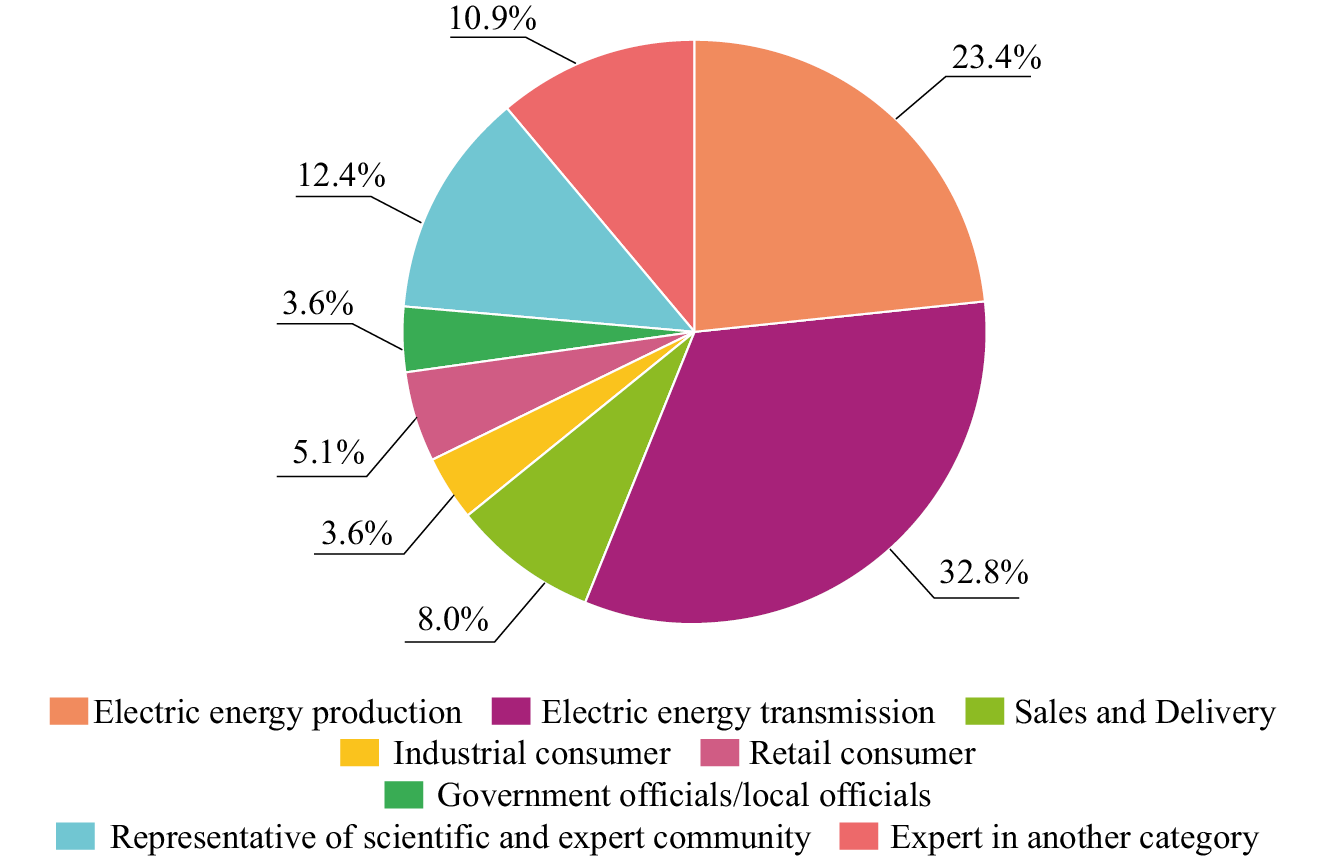

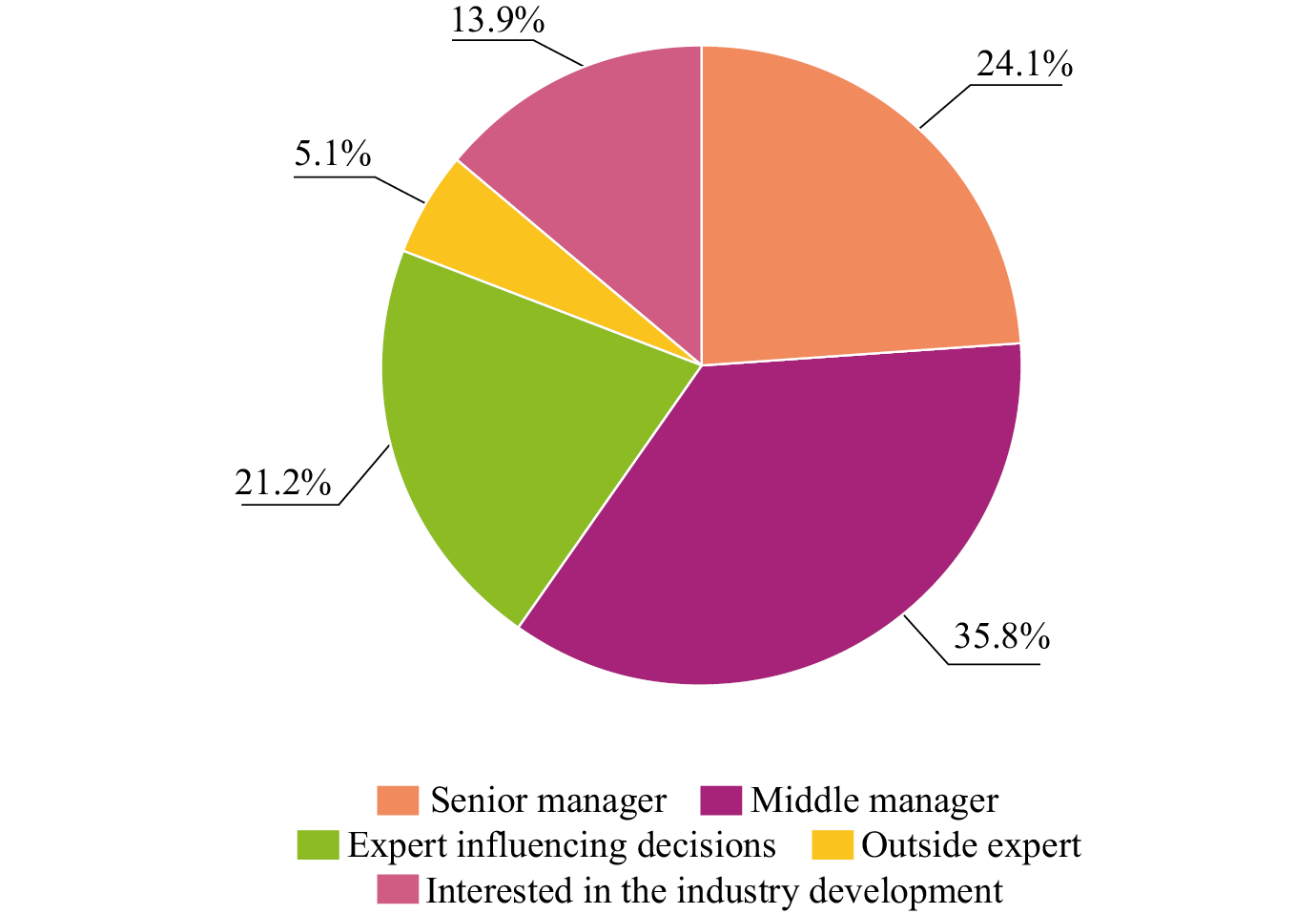

In order to assess the digital maturity of the electric power industry in Russia, the main barriers that companies face when implementing digital solutions and readiness for digital transformation, an expert survey was conducted in April-May 2022, in which 135 respondents took part (anonymously). The characteristic of respondents is presented on Fig. 1 and 2. An important criterion for selecting respondents was expertise and/or experience in the electricity industry. For the correct interpretation of the results, empty answers were excluded from the number of answers.

The expert survey addressed four blocks of questions:

– the need for digitalisation of the electric power industry and the current level of digitalisation;

– key advantages and prospects of digitalisation in the electric power industry;

– internal and external barriers that impede digitalisation;

– readiness of domestic electric power companies for digitalisation.

The study will be useful for company owners and managers at various levels - both those already implementing digitalisation and / or digital transformation projects, and those who are just making a decision on the implementation of such projects.

Fig. 1. Respondents’ sphere of activity (%)

Fig. 2. Respondent’s position in the company (%)

-

The level of digitalisation in Russia compared to other countries

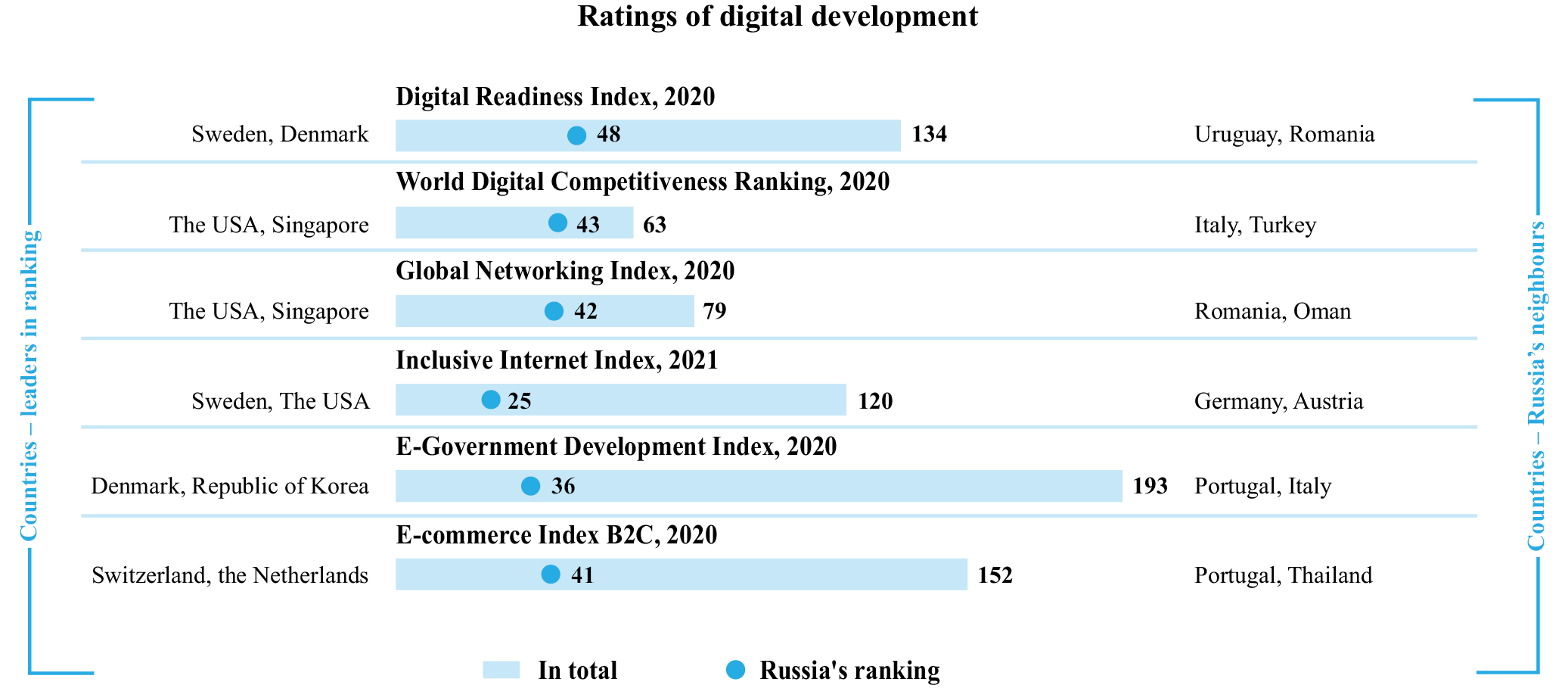

According to most indicators of the consolidated Digital Development Ranking prepared by the National Research University Higher School of Economics [Indicators of the Digital Economy.., 2021], Russia occupies an average position (Fig. 3). The main indicators of this rating included:

− Index of Readiness for the Networked Society3 (Institute Portolans, 2020), which reflects the level of progress of digital technologies and their impact on the economic development of countries;

− The World Digital Competitiveness Ranking4 (International Institute for Management Development, 2020), which allows to assess the intensity of the development and application of digital technologies by the country, leading to the transformation of public administration, business models and society as a whole;

− Global Networking Index5 (Huawei, 2020), which characterises the relationship between the level of digitalisation in a country and economic growth;

− The Inclusive Internet Index6 (analytical department of The Economist, 2021), characterising the degree of Internet penetration in 100 countries;

− E-Government Development Index (United Nations Department of Economic and Social Affairs, 2020), reflecting the readiness of countries to implement e-government services [E-Government survey.., 2020];

− B2C e-commerce index (UN Conference on Trade and Development, UNCTAD, 2020), which characterises the ability of countries to conduct e-commerce in business for the consumer [The UNCTAD B2C.., 2020].

Of particular interest are data on the effectiveness of research and development in the field of information and communication technologies (ICT), reflecting the country's potential in this area and independence from imported technologies, as well as its promising place in the world market.

So, in 2020, the number of publications of Russian authors in the field of ICT in scientific journals indexed in Scopus amounted to about 18.4 thousand (or 3.44% of the global number of publications in the field of ICT) [Digital economy.., 2022]. According to this indicator, Russia is among the top ten countries and takes an honorable 8th place [Indicators of the digital economy.., 2021]. At the same time, the number of publications of the leaders of the rating is as follows: China - more than 120 thousand, the USA - about 72 thousand and India - about 44 thousand publications. In terms of patent applications for inventions in the field of ICT, Russia is already in the second ten countries with an indicator of 2.4 thousand (or 0.29% of the global number of patent applications for inventions in the field of ICT). It is significantly behind such leaders as China with more than 346 thousand applications, the USA - more than 154 thousand and Japan - more than 105 thousand applications.

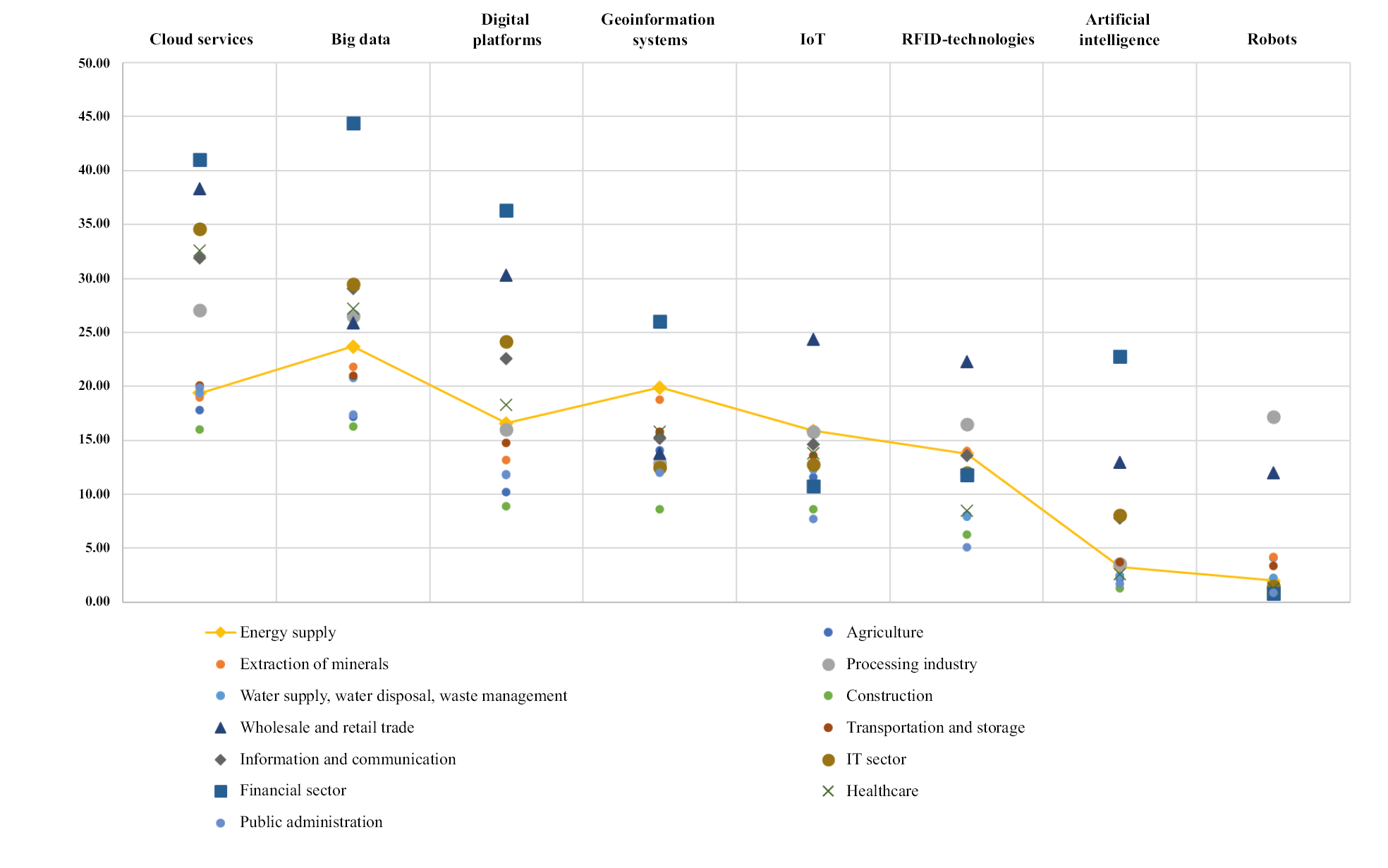

Having considered the position of the energy industry in the use of digital technologies in comparison with other industries in Russia, it can be stated that the energy industry does not belong to the list of leading industries for this indicator (Fig. 4), yielding to such sectors of the economy as industrial production, wholesale and retail trade, the information technology industry and the financial sector.

Analysing the indicators of “green digitalisation” [Turovets et al., 2021] (the share of smart meters in the total number of meters and the share of electric vehicles in the total number of cars in the country) in different countries, it can be seen that the share of smart meters in Russia and the share of electric vehicles in the total the number of cars is very small – 10% and 0.014%, respectively (for comparison: 99% and 0.94%, respectively, in China) (Table 1). Compared to India and the USA, Russia has a good level of uninterrupted power supply - the average duration of a power outage is 120 minutes. The level of losses is quite high - 11%. Infrastructure for electric vehicles is not enough: 1,612 gas stations in Russia compared to 80,800 in China or 26,000 in the USA.

Fig. 3. Russia’s position in international ratings of digital development

Source: [Digital Economy Indicators.., 2021].

Table 1

Indicators of “Green Digitalization”

|

Indicator |

China |

The USA |

India |

Russia |

Japan |

Canada |

Germany |

France |

Spain |

|

Share of smart meters in the total number of meters (%) |

99 (2018) |

57 |

1 (2019) |

10 (2018) |

67 (2018) |

80 (2019) |

15 |

22.2 (2018) |

93.1 (2018) |

|

Share of electric vehicles in the total number of vehicles in the country (%) |

0.94 (2018) |

1.9 (2019) |

0.3 (2019) |

0.014 (2020) |

1 (2019) |

0.14 (2019) |

2.96 |

2.7 |

1.31 |

|

Average power cut duration (min.) |

— |

348 (2018) |

317 (2018) |

120 (2019) |

21 |

— |

— |

— |

— |

|

Average share of electricity losses (%) |

5.8 (2019) |

5 |

33 |

11 (2019) |

4 |

9 |

4.46 (2018) |

6.41 (2018) |

8.93 (2018) |

|

Number of filling stations with charging function electric vehicles (pcs.) |

80 800 (2019) |

26 000 (2019) |

250 (2019) |

1 612 (2019) |

7 900 (2019) |

5 000 (2019) |

27 459 (2019) |

24 950 (2019) |

5 209 (2019) |

Fig. 4. Use of digital technologies in organisations by type of economic activity, 2020 (% of the total number of organisations)

Source: compiled by the authors after [Digital economy.., 2022].

-

Survey results

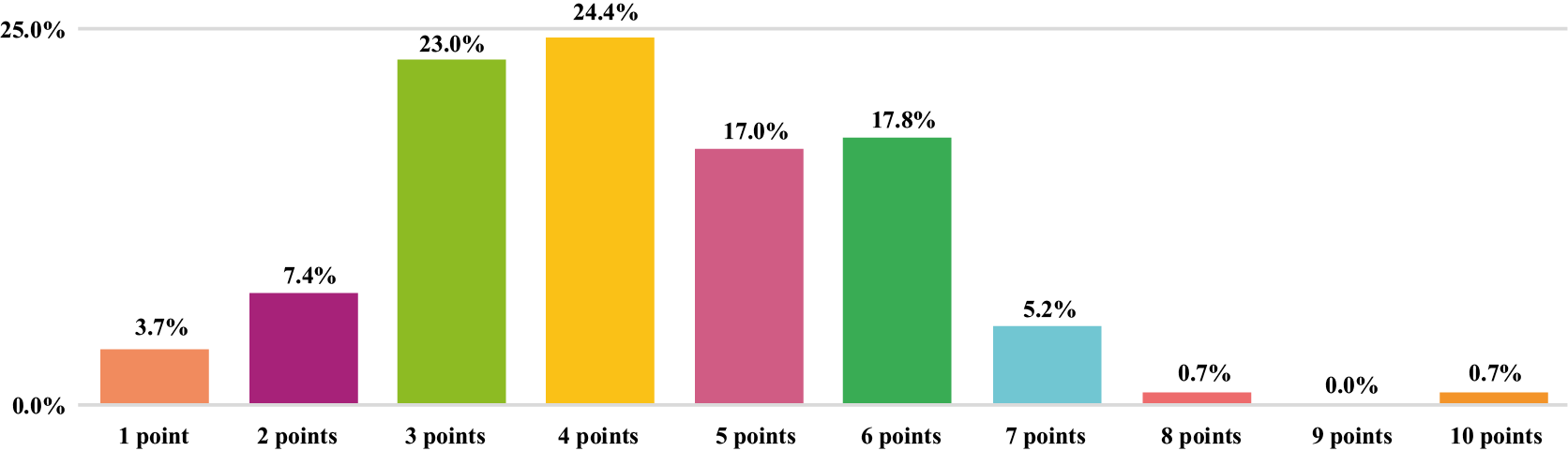

At the same time, estimates of the digitalisation level in the electric power industry in Russia are insignificant, but differ by sector. Thus, representatives of the sphere of energy sales activities assess the level of digitalisation at an average of 4.6 out of 10 points, the production of electrical energy - by 4.16, and the transmission of electrical energy - by 3.6 points. Some of the most optimistic estimates of the digitalization level in the electric power industry were received from officials - 5.2.

The average level of assessment of the digitalisation of their company by survey participants was 4.41 points out of 10, which indicates a low level of digitalisation of Russian electric power companies. The majority of respondents (20%) rated the level of digitalisation in their company as 5 points out of 10 (Fig. 6).

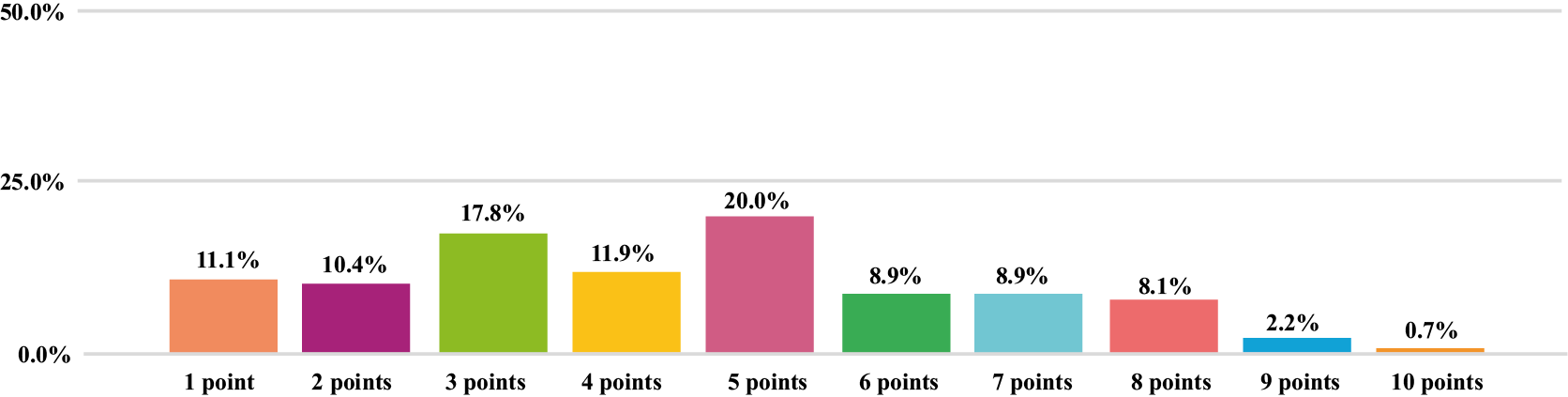

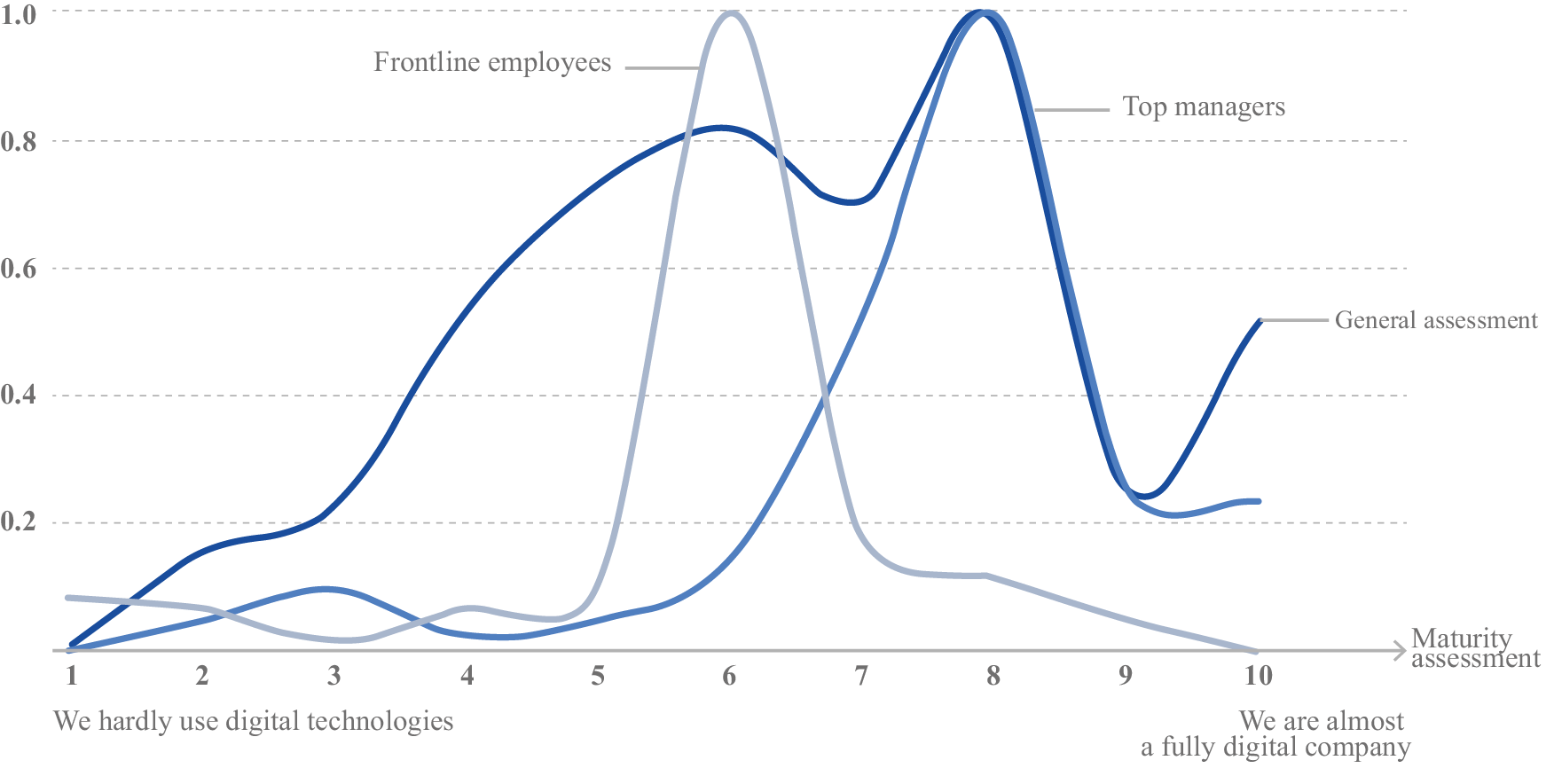

Interestingly, in the KMDA study [Digital transformation in Russia.., 2020], there was a rather serious gap between the perception of digital maturity on the part of top managers and ordinary employees (Fig. 7). The following factors were attributed to the reasons for this gap: earlier transformations at the top management level, reassessment of the actual level of digitalisation by top management, top management’s lack of all information about problems on the ground (bunker effect), insufficient awareness of ordinary employees about the strategy, projects and plans for digital transformation.

For the electric power industry, such a gap is either practically not observed, or it has a diametrically opposite character. Thus, for the electricity generation sector, top managers rate the level of digitalisation of their company at 3.1 points out of 10, while middle managers and experts - at 5 points. Senior managers in companies engaged in the transmission of electric energy rate the level of digitalisation of their company at an average of 3 points, and middle managers and experts at 3.7 points. In sales companies, the average rating of top managers corresponds to 5.3 points, middle managers and experts - 5.6 points.

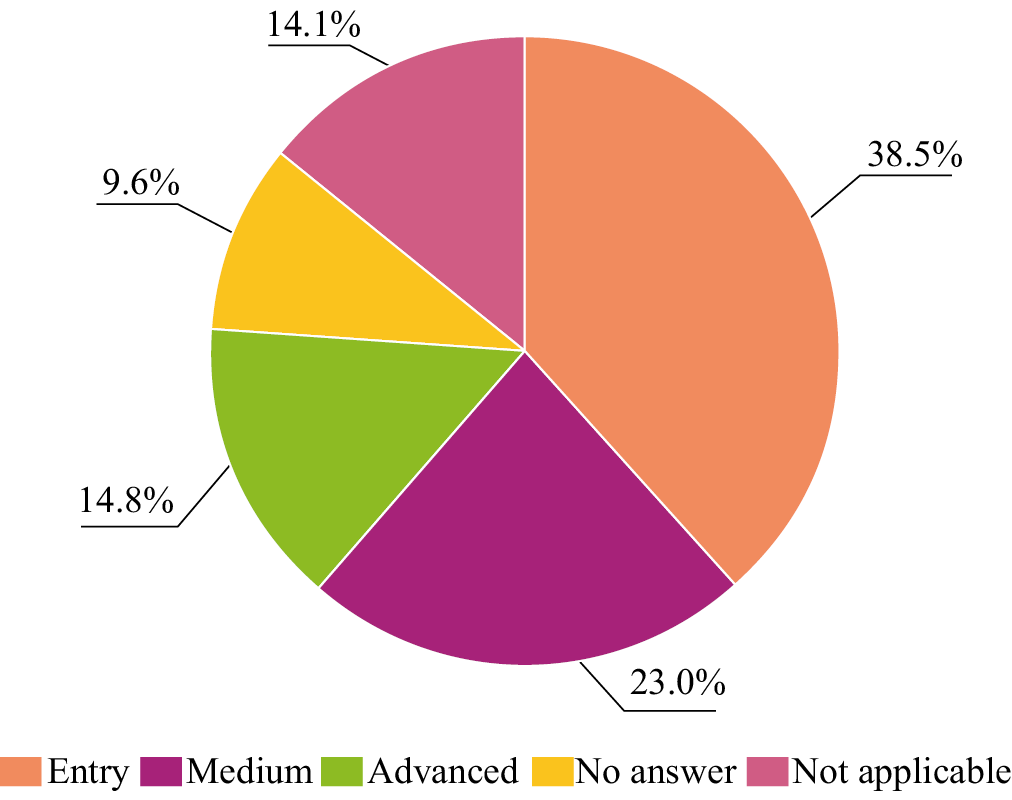

The results of the survey of respondents regarding the stage of digitalisation at which their company is located also confirmed previous data on the low level of digitalisation of electric power companies. 39% of respondents (52 out of 135) indicated that their companies are at the initial stage of digitalisation, 23% - at the middle stage, and only 15% believe that their companies are at an advanced level of digitalisation (Fig. 8). At the same time, the initial stage of digitalisation was understood as the position of the company, when only the processes of interaction with partners and customers are digitalised in it; middle stage - supporting processes (HR, marketing, finance) are digitalised; advanced stage - product creation and key processes are digitalised.

Looking at the sectors, 60% of the surveyed representatives of grid companies, 32% of representatives of generating companies and 27% of representatives of supply companies believe that their companies are at the initial stage of digitalisation.

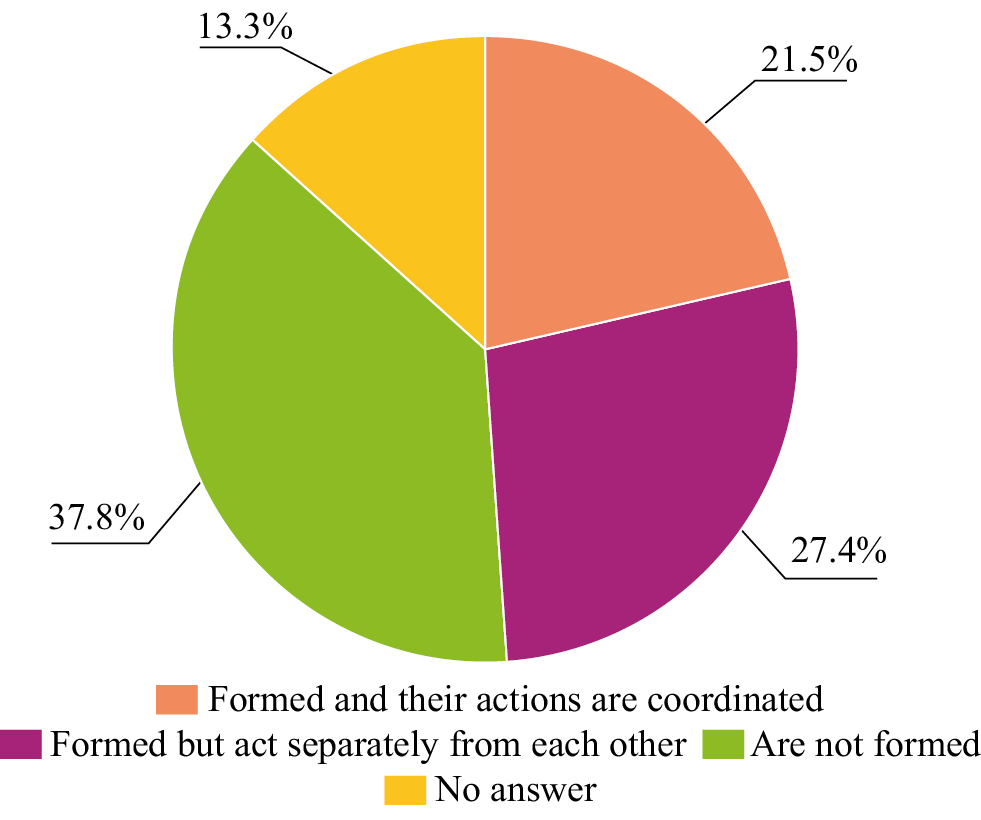

Only 22% of respondents (29 out of 135) said that teams responsible for digitalisation processes have been formed and coordinated in their company. In 65% of cases, such teams are not formed or coordinated and operate in isolation from each other (Fig. 9).

As the most significant positive effects from the digitalisation of the electric power industry, the interviewed experts identified the following: improving the quality of mode control and optimising the load at power plants - 68%, increasing the level of transparency of processes - 67%, identifying non-contractual and unmetered consumption - 50%, increasing the reliability and stability of the power system - 44%, improvement of customer experience - 40% (Table 2).

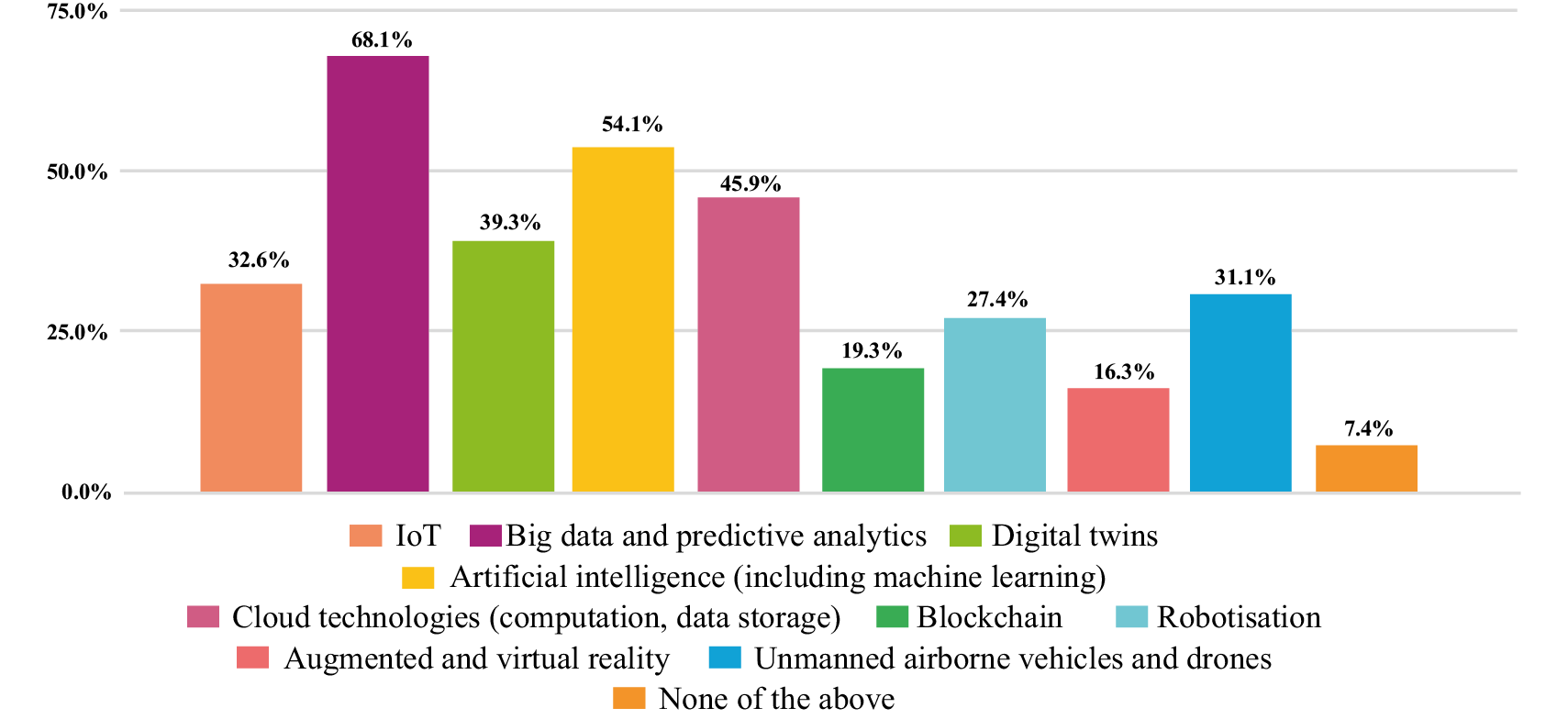

The most promising technologies for implementation and development, according to respondents, are big data and predictive analytics - 68%, artificial intelligence - 54%, cloud technologies - 46% and digital twins - 39% (Fig. 10).

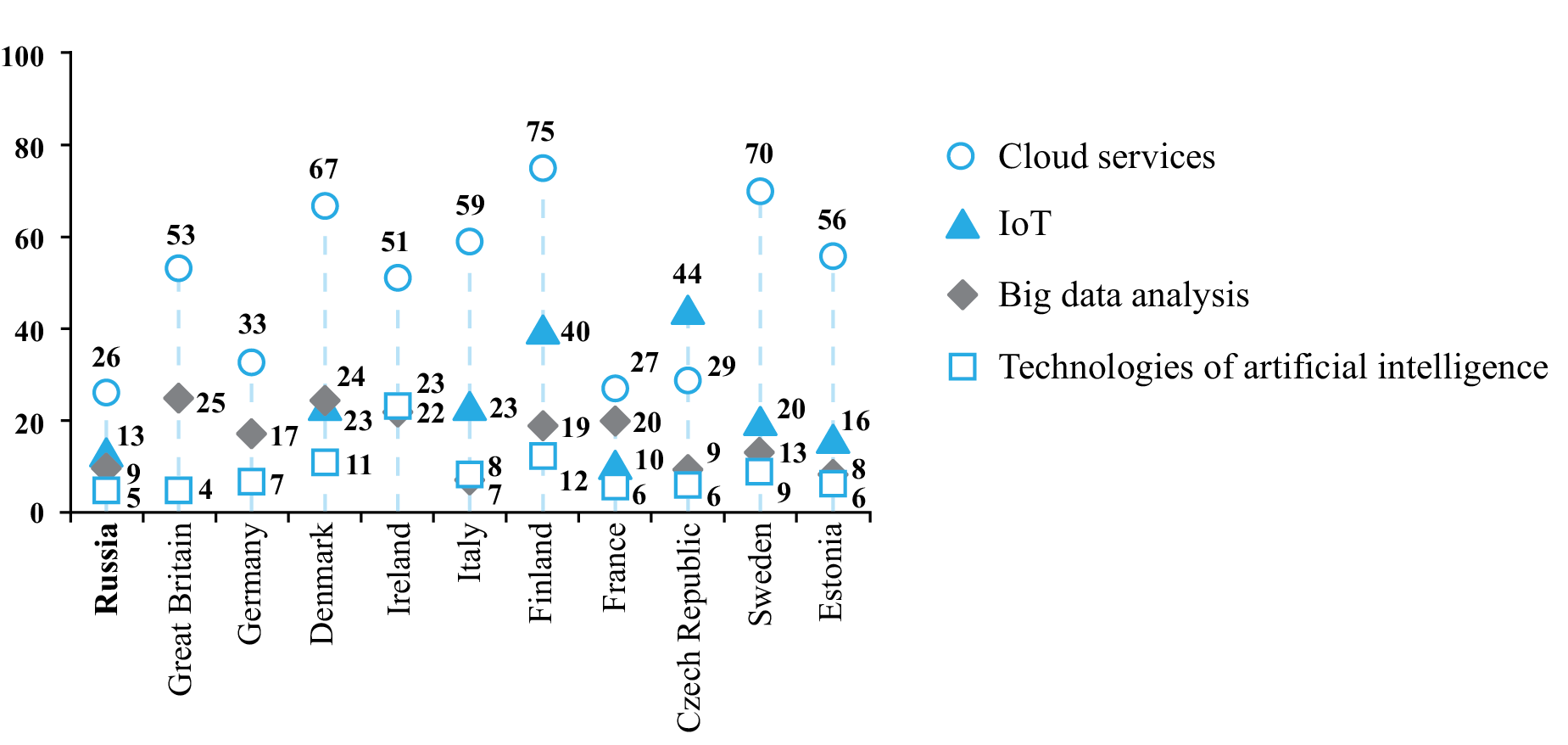

When comparing the use of digital solutions in the corporate sector by country, it can be seen that Russia lags far behind developed countries in a number of areas (Fig. 11). On the one hand, this indicates a certain level of digital underdevelopment, on the other hand, it indicates that even not the largest investments of companies aimed at introducing digital technologies can bring a tangible effect, which creates serious opportunities for the development of both individual companies and the economy as a whole.

As the most significant external barriers to digitalisation, experts identify the sanctions imposed on Russia and the lack of their own innovative solutions - 56%, the imperfection of the legal and regulatory framework - 40%, the presence of a digital inequality of the population and technological restrictions - 38% ( Table 3).

Among the most significant internal barriers to digitalisation, experts attributed the deterioration and obsolescence of the infrastructure of existing assets by 68% of respondents, the lack of competencies among staff and practical experience in implementing new technologies - 63%, lack of investment and financing - 66% and the failure to pay back projects - 51% (Table 4).

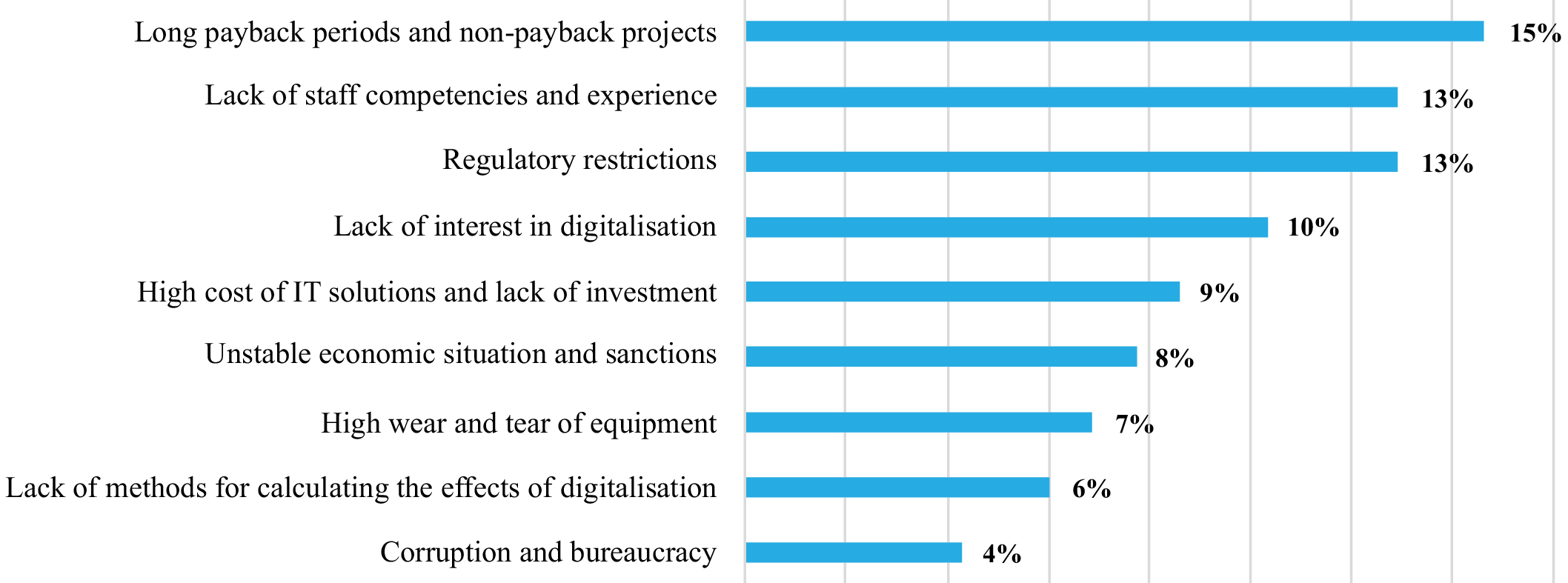

The most significant factors hindering the return on investment in digitalisation were named by experts as long payback periods or non-payback projects - 15%, lack of staff competencies and practical experience in implementing new technologies - 13%, regulatory restrictions and policy of curbing tariff growth - 13%, lack of interest - management in digitalisation due to the lack of economic incentives to improve efficiency - 10% (Fig. 12).

According to respondents, the return on investment is affected by the lack of a comprehensive assessment of these investments as part of production and business chains and the difficulty of identifying a specific effect from digitalisation, low investment activity, low management efficiency, and lack of understanding of the goals of digitalisation.

Among other reasons, survey participants also named: lack of a statutory return on investment mechanism, lack of direct subsidies, weak government support measures (tax rates, complex regulatory framework), weak competition in the industry and the absence of independent regulators, high cost of technologies and insufficient elaboration of projects, high added value due to intermediary companies.

Some respondents noted that the digitalisation of Russian companies is hampered by the unpreparedness of state power industry regulators to liberalise energy markets and the large-scale emergence of new types of active consumers, while the need to restrain the growth of tariffs for the end consumer, regulatory and social restrictions hinder the implementation of new approaches.

Some respondents drew attention to a serious problem in the power grid complex. Within the framework of the existing tariff regulation and the actual liquidation of small territorial grid organisations (meaning the latest legislative innovations related to the exclusion of entrepreneurial profits from small TGOs and the tightening of quantitative criteria for TGOs in order to force the consolidation of electric grid assets), investments in digitalisation are possible only from PJSC Rosseti, its subsidiaries and affiliates. The rest of the TGOs are only interested in survival.

63% of respondents (85 out of 135) are sure that the lack of their own developments and import substitution will slow down the pace of digitalisation of the electric power industry. 13% believe that import substitution, on the contrary, will accelerate the pace of digitalisation of the electric power industry, and 17% are sure that import substitution will not affect the pace of digitalisation in any way.

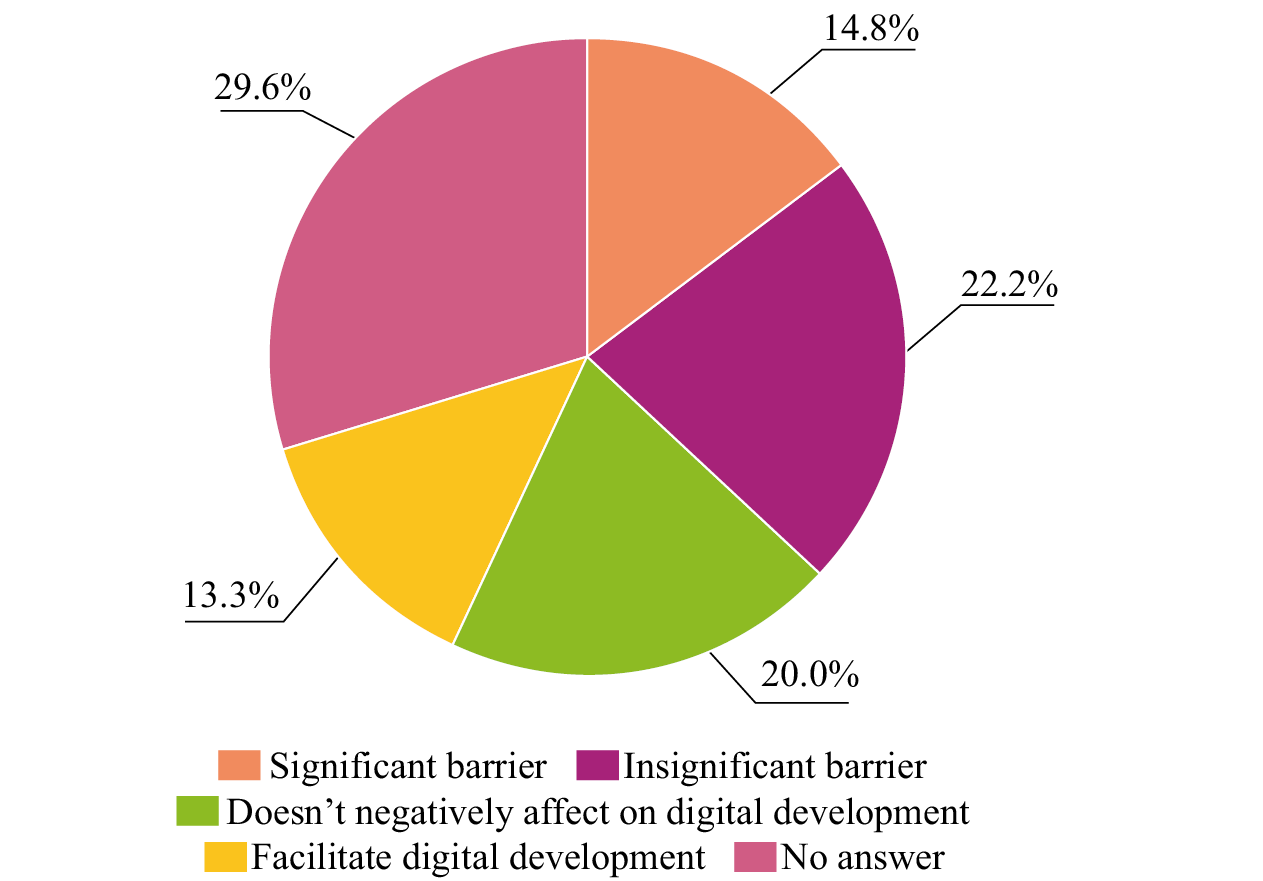

According to 37% of survey participants (50 out of 135), digitalisation legislation is a barrier to the digital development of companies in the electric power industry (Fig. 13).

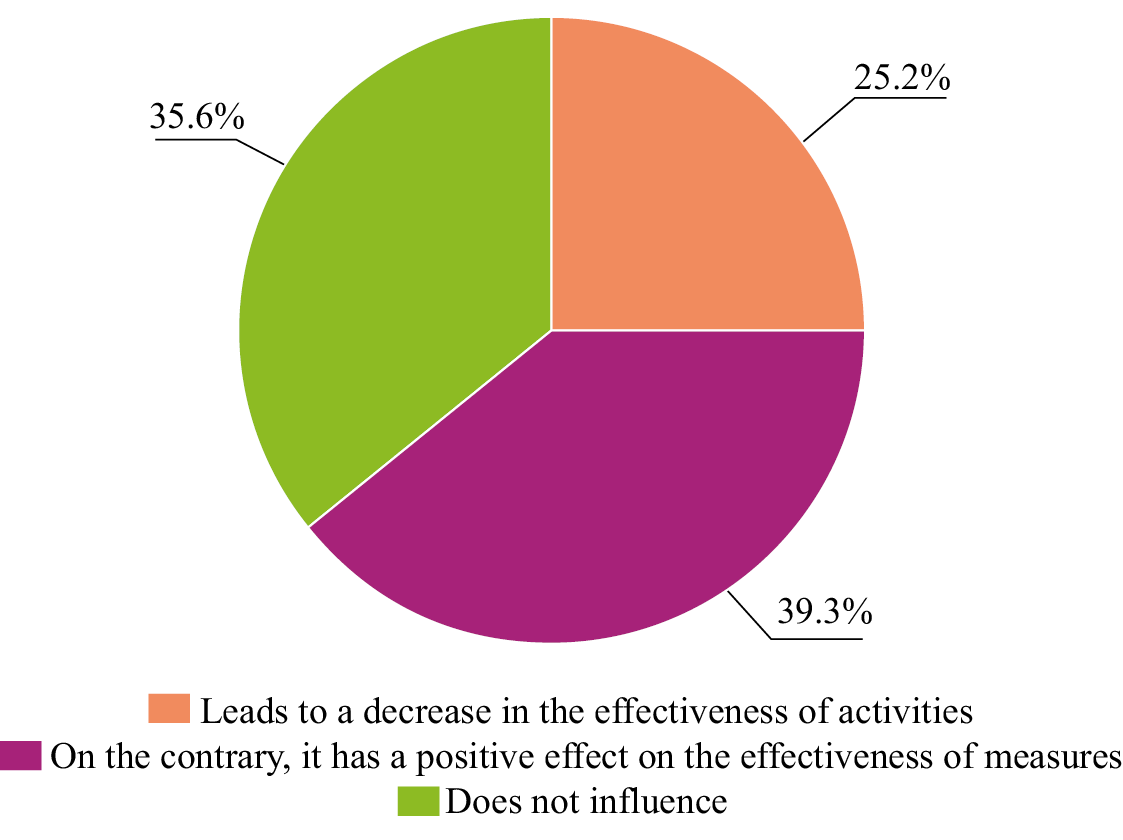

A quarter of respondents (34 out of 135) believe that the establishment of mandatory state programs for digitalization leads to a decrease in the effectiveness of measures, since companies are aimed at implementing the program “at any cost” (Fig. 14).

The majority of respondents (53%) rely on IT companies to develop and implement digital solutions, 44% do it on their own, and 42% plan to turn to research institutes/technoparks for help (Fig. 15).

Fig. 5. Estimates of digitalisation level of the electric power industry in Russia (% of respondents)

Fig. 6. Estimates of digitalisation level of companies (% of respondents)

Fig. 7. Assessment of the digital maturity of industrial enterprises by top managers and frontline employees

Source: [Digital transformation in Russia.., 2020].

Fig. 8. Digitalisation stage in the company (% of respondents)

Table 2

Positive effects of the digitalisation in the electric power industry and the extent of their impact (% of respondents)

|

Positive effects |

% of votes |

Degree of impact |

||

|

low |

average |

high |

||

|

Increasing the level of process transparency |

100 |

7 |

25 |

67 |

|

Improving the quality of mode control, optimising the load at power plants |

96 |

3 |

28 |

68 |

|

Reduced equipment maintenance costs |

96 |

38 |

40 |

22 |

|

Improved performance and security |

94 |

15 |

46 |

39 |

|

Reducing the time of connections to power plants |

93 |

44 |

37 |

19 |

|

Improving the reliability and stability of the power system |

92 |

13 |

43 |

44 |

|

Identification of non-contractual and unmetered consumption |

91 |

14 |

36 |

50 |

|

Improving customer experience |

91 |

22 |

38 |

40 |

|

Improving consumption efficiency |

90 |

18 |

42 |

40 |

|

Sustaining the environment and reducing CO2 emissions |

90 |

49 |

34 |

17 |

|

Accelerating the development of the electricity market |

88 |

26 |

39 |

34 |

|

Reducing the final price of electricity |

88 |

56 |

33 |

11 |

Fig. 9. The level of company team formation for the digitalisation process (% of respondents)

Fig. 10. The most promising technologies for the implementation and development of the electric power industry (% of respondents)

Table 3

External barriers to digitalisation (% of respondents)

|

External barriers |

% of votes |

Degree of impact |

||

|

low |

average |

high |

||

|

Sanctions and lack of own innovative solutions |

93 |

14 |

29 |

56 |

|

Imperfection of the legal and regulatory framework |

93 |

17 |

43 |

40 |

|

Presence of digital inequality of the population and technological limitations |

90 |

30 |

33 |

38 |

Fig. 11. Application of digital solutions in companies by country (% of the total number of companies)

Source: [Digital economy.., 2022].

Table 4

Internal barriers to digitalization (% of respondents)

|

Internal barriers |

% of votes |

Degree of impact |

||

|

low |

average |

high |

||

|

Lack of staff competencies and experience in the practical implementation of new technologies |

99 |

8 |

29 |

63 |

|

Depreciation and obsolescence of the infrastructure of existing assets |

96 |

7 |

25 |

68 |

|

Wary attitude to everything new and lack of understanding of the need |

96 |

22 |

42 |

36 |

|

Lack of investment and funding |

95 |

6 |

27 |

66 |

|

Non-recoupment of projects |

93 |

8 |

41 |

51 |

|

Lack of cooperation in the company on digitalisation issues |

91 |

8 |

46 |

46 |

Fig. 12. Factors that hinder return on investment in digitalisation (% of respondents)

Fig. 13. The impact of the legislation of the Russian Federation in the field of digitalisation on the digital development of companies in the electric power industry (% of respondents)

Fig. 14. The impact of mandatory government digitalisation programs on electric utilities (% of respondents)

Fig. 15. Who companies rely on most for the development and implementation of digital solutions (% of respondents)

Conclusion

The study of digital development level of the electric power industry allows us to formulate a number of main conclusions.

- Russia, in comparison with other countries, does not differ in leading positions in the field of digital technologies implementation and is at the average level.

- The electric power industry, being the basic sector of the economy responsible for its safe and reliable development, is in the background in terms of digitalisation, yielding to retail, the banking industry, telecommunications, and the manufacturing industry.

- The vast majority of respondents - 86% - believe that digitalisation in the electric power industry is necessary, but assess its current level as low - at 4.27 points out of 10.

- 62% of respondents believe that their companies are at the initial or middle stage of digitalisation. At the same time, in the power grid complex, 60% of respondents assess the level of digitalisation of their companies as initial.

- 65% of respondents noted that in their companies the teams responsible for digitalisation processes are not formed or coordinated and act separately from each other.

Thus, the results of the survey, as well as international indices, confirm rather low level of digitalisation of Russian electric power companies compared to foreign competitors.

At the same time, digitalisation is a promising direction and can have a significant positive impact on the electric power industry. The results of the expert survey indicate that the industry should focus on staff development, the development of innovative thinking and culture, as well as financial instruments for investing in digital technologies.

Companies, together with the state, need to eliminate or minimise the challenges that arise in the process of introducing digital technologies so that digital projects become more attractive to investors and can pay off. The development of programs for the return of investments in digitalisation and financial support for the renewal of worn-out and obsolete assets from the state will increase the interest of top management of companies in digitalisation and will make it possible to achieve payback for digital projects.

For successful digital transformation, companies need to increase the digital maturity and competence of employees, develop a corporate culture of innovation, and focus on the digitalisation experience of other leading companies.

1 Priorities for IT technology initiatives 2020–2021. https:// www.statista.com/statistics/1106032/top-priorities-it-technology-initia- tives.

2 Decree of the President of the Russian Federation of July 21, 2020 No. 474 "On the national development goals of the Russian Federation for the period up to 2030".

3 The network readiness index 2020: Accelerating digital transformation in a post-COVID global economy. https://enterprise.press/wp-content/uploads/2020/11/NRI-2020-Final-Report.pdf.

4 World Digital Competitiveness Ranking. https://www.imd.org/wcc/world-competitivenesscenter-rankings/world-digital-competitiveness-rankings-2020/.

5 Shaping the New Normal with Intelligent Connectivity. https://www.huawei.com/minisite/gci/assets/files/gci_2020_whitepaper_en.pdf?v=20201217v2.

6 The Inclusive Internet Index. https://theinclusiveinternet.eiu.com/explore/countries/performance.

References

1. Indicators of the digital economy: 2021: statistic collection (2021). Moscow, NRU HSE. (In Russ.)

2. International experience of digital transformation of the electric power industry (2020). Association of organizations for digital development of the industry “Digital Energy”. https://www.digital-energy.ru/wp-content/uploads/2020/06/doklad-rb-1.pdf. (In Russ.)

3. Khitrykh D. (2021). About digital transformation of the energy industry. https://energypolicy.ru/o-czifrovoj-transformaczii-energeticheskoj-otrasli/neft/2021/19/05/.(In Russ.)

4. Digital transformation in Russia-2020: Overview and recipes for success (2020). https://drive.google.com/file/d/1xVK4lSanDZSCN6kGAHXikrGoKgpVlcwN/view. (In Russ.)

5. Digital transformation of industries: starting conditions and priorities (2021). Moscow, NRU HSE. (In Russ.)

6. Digital economy: 2022: A short statistical collection (2022). Moscow, NRU HSE. (In Russ.)

7. E-government survey 2020. Digital government in the decade of action for sustainable development (2020). New York, United Nations. https://publicadministration.un.org/egovkb/Portals/egovkb/Documents/un/2020-Survey/2020%20UN%20E-Government%20Survey%20(Full%20Report).pdf.

8. The UNCTAD B2C E-commerce Index 2020 spotlight on Latin America and the Caribbean (2020). UNCTAD technical notes on ICT for development No 17, No 15. https://unctad.org/system/files/official-document/tn_unctad_ict4d17_en.pdf.

9. Turovets J., Proskuryakova L., Starodubtseva A., Bianco V. (2021). Green digitalization in the electric power industry. Foresight and STI Governance, 15(3): 35-51.

About the Authors

L. V. KhobotovaRussian Federation

Lead auditor of the IT Audit Department, “Sberbank of Russia” PJSC (Moscow, Russia). ORCID: 0000-0001-7042-3429. Research interests: electric power industry, information technology, audit.

E. V. Neprintseva

Russian Federation

Candidate of economic sciences, associate professor at the Department of Economics and Enterprise Management, Moscow State University of Technology“Stankin” (Moscow, Russia). ORCID: 0000-0002-6214-6406. Research interests: macroeconomics, industrial policy, antitrust regulation, electricity.

S. A. Shubin

Russian Federation

Candidate of economic sciences, associate professor at the Department of Management and Innovations, Financial University under the Government of the Russian Federation (Moscow, Russia). ORCID: 0000-0001-8777-1606. Research interests: electricity and power markets, heat supply and housing and public utilities, industrial policy, antimonopoly regulation.

Review

For citations:

Khobotova L.V., Neprintseva E.V., Shubin S.A. DIGITAL TRANSFORMATION STRATEGY: ASSESSMENT OF DIGITAL MATURITY OF THE RUSSIAN ELECTRIC POWER INDUSTRY. Strategic decisions and risk management. 2022;13(3):234-244. https://doi.org/10.17747/2618-947X-2022-3-234-244