Scroll to:

HEURISTIC MODEL OF “EFFECTIVE INTERPRETER” IN PORTFOLIO INVESTMENT IN HIGH-TECH COMPANIES

https://doi.org/10.17747/2618-947X-2022-2-116-128

Abstract

The last fifteen years are characterized by a sharp increase in the share of high-tech companies in terms of attracting investment resources in the world's leading stock markets. High-tech companies over this period significantly outpaced value stocks in terms of return on investment. On the one hand, what is happening is a natural process, since in the face of accelerating industry changes, both in traditional sectors and in sub-sectors of the new economy, there are more opportunities for the emergence of companies with disruptive innovations. High market capitalizations of such companies are a natural metric of fundamental shifts in the economy. On the other hand, the very nature of investment decision-making is changing, since an objective assessment of the intrinsic value of the business of high-tech companies is becoming vaguer, more controversial, dependent on future scenarios, and subject to interpretations. And these interpretations, according to the theory of reflexivity, are increasingly having a feedback effect on fundamentals, especially in high-tech companies.

The purpose of this article is to conceptualize a new heuristic model of the “effective interpreter”, which, in the conditions of high reflexivity and narrative contexts of the stock market, has significantly diverged across a number of key attributes from the traditional model of the “rational investor”. The author compares the two models. The process of divergence of the two models occurs under the influence of a number of behavioral heuristics and cognitive biases. At the same time, the author emphasizes that a high narrative component in the value of companies does not always and necessarily mean the predominance of irrationality. Here it is more correct to assume some correlation between the rise of narrative decision contexts and the cognitive challenges of investment decision makers.

As one of the possible directions for further research, the author notes the systematization of the main factors of cognitive biases, which seem to make switching to the “effective interpreter” model in portfolio investments in high-tech companies irreversible in the current conditions.

Keywords

For citations:

Ilkevich S.V. HEURISTIC MODEL OF “EFFECTIVE INTERPRETER” IN PORTFOLIO INVESTMENT IN HIGH-TECH COMPANIES. Strategic decisions and risk management. 2022;13(2):116-128. https://doi.org/10.17747/2618-947X-2022-2-116-128

Introduction

In the last decade and a half, despite the previous collapse of the dot-com bubble in 2000-2003, there has been a steady trend towards high market expectations of stock market participants towards high-tech companies, the so-called growth companies. This is a generally understandable phenomenon in terms of the fundamental principles of company valuation in the context of both the emergence and development of new sectors of the economy (for example, marketplaces, biotechnology, the commercial space launch industry), and the general innovative restructuring and digital transformation of many traditional sectors of the economy.

The emergence of companies with disruptive business models allows us to hope for a snowball effect in terms of their future market capitalisation. In addition, if we take the statistics of the American stock market, the last 14 years, starting from 2008, turned out to be the first significant period in terms of duration when the average investment in growth companies significantly outpaced the so-called value investment, which refers to investment in undervalued companies predominantly in traditional industries [Lev, Srivastava, 2019]. Such positive statistics further fueled interest in high-tech companies, among which there are many more the so-called disruptors, by definition, than among companies in traditional industries.

Moreover, in a study by A. Sorescu and colleagues, it was found out that over the past 200 years, radical innovations were accompanied by large bubbles in the capitalisation of those companies that were leaders in these innovations; this happened in 73% of cases. It was also found out that the size of bubbles increased with the radicalness of innovation, the magnitude of indirect network effects, and also responded positively to the public visibility of companies during periods of commercialisation of radical innovations. Companies also actively raised new equity capital during bubble periods, but due to increased productivity in the economy, long-term investors, on average, did not suffer losses from investments, despite the formation of their portfolios at local extremes [Sorescu et al., 2018].

As P. Lynch emphasised in the golden era of investing (1980-1990s) in the context of companies from predominantly traditional industries, the amazing nature of the stock market is that an investor does not need to be right at all even for outstanding results (at least in some sense) in more than 50% of cases. Even if a long-term investor turns out to be right only in two or three cases out of ten, but the selected companies turn out to be so-called multibaggers (at least so-called tenbaggers, that is, they increase their capitalisation 10 times from the moment of purchase within a decade), this will be enough for a market participant in order to outperform the average market rates of return, taking into account dividends for long periods of investment. In this sense, according to Lynch, it is actually not so difficult for a thoughtful retail investor to be better than professional fund managers on Wall Street [Lynch, Rothchild, 2012].

The last three decades have been a new spiral in the evolution of the search for multibaggers, as the natural progression of business development in high-tech companies is even more conducive to the perception of them as tenbaggers and even hundredbaggers. It is one thing for companies such as Walmart and Coca-Cola to build business value over decades gradually, although even in such cases, from time to time, the reflection of the increase in business value in market quotations can occur somewhat abruptly. It is a completely different matter when high-tech companies, especially on the effect of low initial capitalisation, can have a really explosive increase in value within just a few years by dozens of times. This fundamental prerequisite largely determines that many investors are in constant search of the next big thing (the next big story). It also means that because of their fascination with narratives about future success, they suffer with some inevitability from the “survivor bias”, since projecting already established, highly successful so-called big techs onto startups is too tempting.

The last two years (spring 2020 - 2022) have been a period of unprecedented outstripping growth in the value of companies in new sectors of the economy. This recent growth was largely induced by the acute phase of the coronavirus epidemic, as a result of which demand for information technology has skyrocketed and forecasted revenue, margins, and cash flows of companies have increased. However, it is important to emphasise that the capitalisation of many companies has grown many times more and more significantly than the increase in the above indicators. According to many experts, international stock markets (especially US markets) have moved increasingly into a stage of irrational optimism, exuberance [Shiller, 2000] and investor overconfidence.

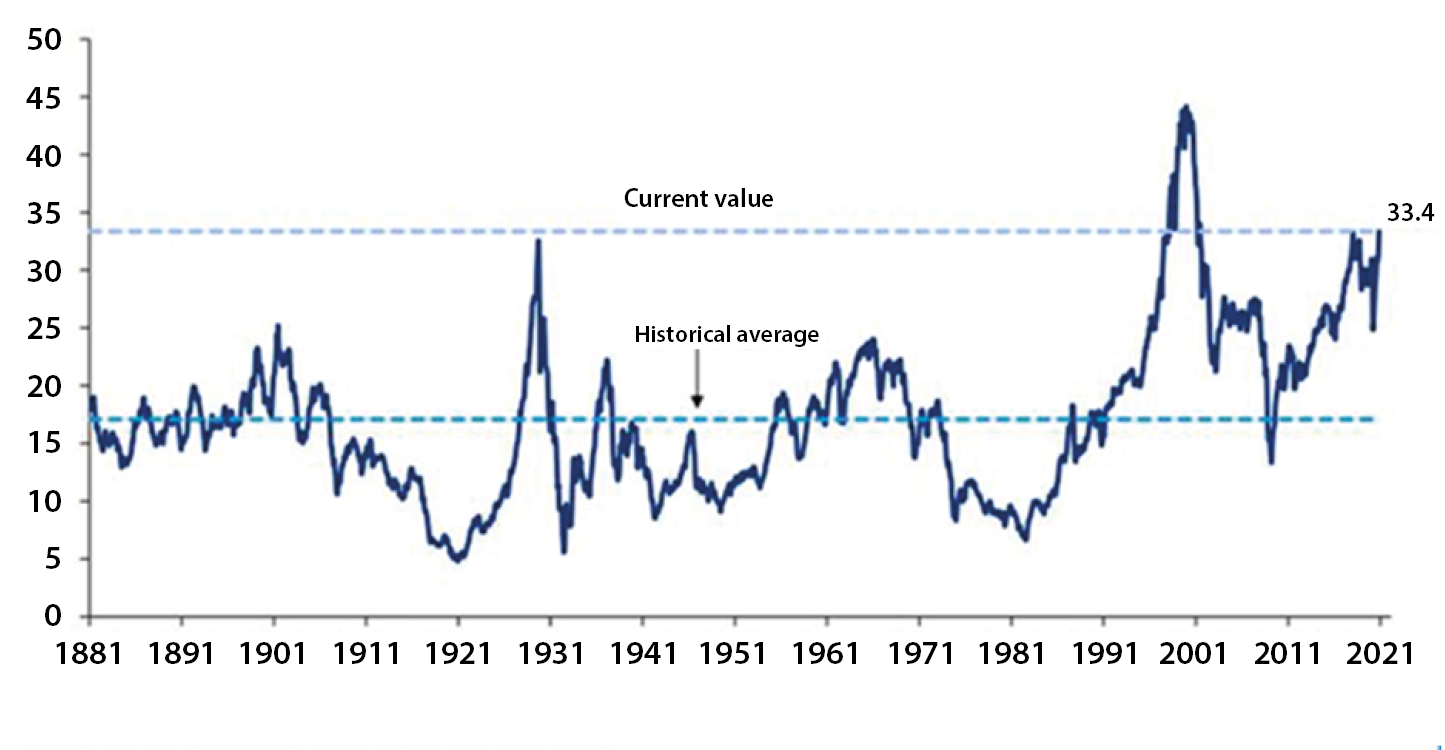

These phenomena, of course, did not arise for the first time. Stock markets are, by their very nature, a phenomenon of mass psychology with alternating phases of greed and fear, and most of the time in the market investors spend in one of these extreme moods. In order to feel this, it is enough to look, for example, at P / E charts or even Schiller's ten-year smoothed P / E, PACE - for decades they resemble a cardiogram. Apparently, the economic and psychological nature of the market pulse is the case. However, the overbetting of many investors on high-tech companies now seems more than ever to be inextricably linked to the issue of cognitive biases. The “cognitive landscape” itself in interpreting business models of companies and portfolio investment in them has become much more complex and multidimensional, therefore, in order to interpret reality and make predictions about the future, investors must use cognitive shortcuts. Cognitive shortcuts are automatic thought patterns that are used to somewhat improve decision making under high stress, time constraints, and complex decision contexts. However, cognitive labels have a significant drawback: by simplifying and speeding up decision-making, they make it less informed and more irrational, their use carries the risk for the investor to suffer from unproductive “mind games” and lose essential threads of contact with the reality [Munger, 1995].

The conflict between rationality and behavioral biases (cognitive biases) in investors essentially means that no investor is completely rational or completely irrational (subjective-behavioral) at all times. The investor is faced with a certain continuum between completely irrational and completely rational behavioral positions. Moving towards rationality is a choice, but being completely rational is costly, it requires serious cognitive abilities, mental calculations, as well as self-reflection about one’s cognitive distortions, prejudices [Mukherjee, De, 2019]. Satisfied decision-making when investing in the context of the need to interpret the business potential of high-tech companies is becoming less and less homogeneous. There are more and more interpretations of business models in various sectors, and it is less and less clear at what point in the accumulation of information and analysis of interpretations one can speak that the investor makes a fairly balanced decision close to a relatively rational one.

The noted problems intersect with a conglomerate of cognitive and behavioral factors, among which aspects of irrationality can be noted: short-term thinking (short termism, although this is a debatable factor, in a recent study by M. Roh demonstrated that the capital expenditures of European and Japanese companies that do not face any American-style quarterly stock markets or aggressive investor-activists shrink faster than in American companies) [Roe, 2021], rely on irrational cognition and intuition [Kudryavtsev et al., 2013], investor neuroticism [Niszczota, 2014], gambling [Chen et al., 2021].

This, in turn, creates a new level of threats and risks, which can give rise to systemic and long-term problems with the sustainability of the development of high-tech companies and even broader socio-economic consequences.

First of all, it is necessary to dwell in detail on what exactly has changed in the behavioral heuristics of equity capital market participants and why - at least in part of high-tech companies - it can be argued that a model of an "efficient interpreter" different from the "reasonable investor" model has formed.

-

Shift of behavioral heuristics to the “efficient interpreter” model

Financial theories such as modern portfolio theory [Markowitz, 1952], the arbitrage principle [Modigliani and Miller, 1958], and the efficient market hypothesis [Malkiel and Fama, 1970] assume that capital markets are perfectly efficient, since all investors are rational in their actions. However, prospect theory [Kahneman, Tversky, 1979] argues that investors' decisions and choices are based on their perception of their own utility, and they do not use all available information [Wang, 2017] – and this leads to irrational decision making.

As complexity and volatility increase, the behavioral effects and heuristics of equity market participants in valuing the business of high-tech companies make it less and less realistic to apply approaches based on the efficient market hypothesis. Research results show that market sentiment, overconfidence, overreaction, and herding behavior influence investment decisions [Nareswari et al., 2021]. Even a weak version of the efficient market hypothesis seems to lose its explanatory power in the new realities. Many are familiar with the apt statement of J.M. Keynes as a general warning to speculators: "Markets can remain irrational much longer than you can remain solvent" [Keynes, 1936]. A feature of the markets of the last three decades is that the phases of irrational exuberance and investor overconfidence can and do last for a long time - up to a decade.

However, in case of sharp swings in market sentiment (from prolonged euphoria to prolonged depression and despair, when investors completely lose faith in the possible growth of companies) in the context of traditional industries, investors can at least hope for a long-term planning horizon and the so-called margin of safety, according to B. Graham). The latter refers to the purchase of shares at the lower bound of their intrinsic value, well below the long-term growth path of the business. Margin of safety is a measure of the extent to which an asset is sold at a discount compared to its intrinsic value. According to Graham, permanent or long-term capital losses periodically arise due to the purchase of low-quality securities, far exceeding their tangible value [Graham, 2003]. Therefore, investment risk can be largely avoided by buying quality securities at low prices, that is, by adopting the safety margin principle. Research over many decades confirms that investors with a margin of safety were able to combine low investment risk with high inflation-adjusted returns [Klerck, 2020]. Careful analysis allows the investor to get an estimate of the intrinsic value of the asset, and buying a company with a significant margin of safety ultimately increases the average future return. At the level of the broad market, this is statistically confirmed by the values of the Shiller-CAPE index over many decades. Since intrinsic value is difficult to accurately calculate, a margin of safety provides protection against poor investment decisions [Otuteye, Siddiquee, 2015].

In Graham's definition, "a reasonable investor is a realist who sells stocks to optimists and buys from pessimists", which, even with significant short-term dips in the value of the portfolio due to a collapse in the market, eventually over a long distance (15-20 years) allows you to even out the position and increase portfolio value. In addition, with regular value investment, including in the conditions of long-term downward phases of markets (in the so-called bear market), the positions of long-term investors are regularly averaged at the price of acquiring positions. With a really long investment horizon, this approach in some sense often ends up working on the principle of “it would not be good luck, but misfortune helped,” since even a bear market can be perceived as an opportunity to gradually create a low average cost of acquiring assets. Unlike a situation where the market is full of optimism and quality stocks are especially expensive. According to many well-known practitioner investors, the main money and fortunes are made not from the growth of the market as such, but from the opportunity to buy good companies at a cheap price. Conversely, the likelihood of future abnormally low returns over long-term investment horizons is disproportionately high when stock markets are trading at extremely high valuation levels.

This is why it is so important for investors to “manually” or algorithmically detect irrational exuberance in financial markets, as they are most often followed by abnormally low returns [Viebig, 2020].

However, even in this seemingly very encouraging position of a conservative, long-term investor it is important to note that today's more dynamic business environment, the current and even more so the future landscape in many industries undermines to a certain extent this classical philosophy (in a sense, the "gold standard") of smart investment. Even 50 years ago, the average lifespan of a Fortune 500 company was 70 years, so a well-founded initial market participant's investment thesis had a good chance of remaining relevant even after years of temporary business difficulties. Today, the survival time has decreased to 15 years, which makes the prospects of waiting for the situation to improve even in fundamentally promising companies less obvious and probable. So-called disruptive innovations can rapidly change the industry landscape and simply immediately “cancel” the leading company, which until then experienced, it would seem, only temporary, opportunistic difficulties and only because of this was cheap and very attractive for long-term value investors on financial ratios, for reasons of "margin of safety".

Practical application of the investment philosophy of B. Graham, W. Buffett, C. Munger in terms of the statement that the best company is the one whose shares will never have to be sold (since it was bought with a good “margin of safety”, and the further business growth trajectory only multiplies the initial success of the purchase), in the face of more dynamic shifts and restructuring in industries, it becomes increasingly difficult. Historically, value stocks have outperformed growth stocks; however, since 2008, value stocks have performed relatively poorly, creating an investment "value trap". The term "value trap" refers to a situation that, on the face of it, offers an investor the opportunity to acquire significant assets and/or profits relative to the market price, promising a chance of above-average returns in the future, but such expectations turn out to be illusory due to many factors. Value traps can appear for a variety of reasons, including a change in the ability of a firm or even an entire industry to generate cash flows, alternating peak earnings in cyclical industries with rapid declines, and cash flow problems despite a good situation with income.

To evaluate the business of high-tech companies, the reflexivity theory of George Soros is more relevant, according to which, from the point of view of the stakeholder and investment perception of building a business, it is important for companies to get into a favorable development spiral. A positive perception of a company leads to better fundamentals (through better funding opportunities, profitable partnerships, and a more motivated and skilled workforce), which then reinforces the initial narrative of the company's success and business model. The result is a self-fulfilling prophecy effect. In modern conditions, in many respects, it is the narrative and perception of stakeholders that shape not only the fate of the company's product, but also its investment assessment. It is amazing, but true: Soros’ book The Alchemy of Finance [Soros, 2015], first published back in 1987, not only debunks the efficient market hypothesis, but surprisingly accurately describes the main investment mechanism of business models of the modern economy, especially high-tech.

Companies such as Amazon, Netflix, Uber are vivid examples of the phenomenon when investors, despite not only losses, but also high and even extremely high burn-out rates during a sharp scaling (blitz scaling) of the business, for many years (almost decades) were ready to wait for companies to reach profitability.

And at least one study [Carpentier et al., 2018] demonstrates that high market valuations of unprofitable IPO companies are not investor irrationality. The high valuation of unprofitable firms is not always explained by behavioral factors. Using a sample of small Canadian listed firms, this study showed that both individual investors and underwriters value losing firms more than winning firms, all other things being equal. However, it turned out that, as a result, the backlog in development, business scaling within 3 years after the IPO does not statistically differ between unprofitable and profitable companies. This means that investors behave irrationally for all firms, but their higher degree of irrationality regarding the perception of loss-making firms is not at all obvious.

It is important to understand that narratives, by their nature and economic role in the modern economy, are not part of some black and white picture in terms of rational and irrational stock market pricing and investment. It would be a reductionist approach to say that narratives are some 100% irrational component that only makes it difficult to evaluate businesses at their objective and fair value. The investment attractiveness of a high-tech company, by definition, lies to a lesser extent in current financial ratios and market position, and to a much greater extent in a bright future story, storytelling, and narrative. However, no one can know the future for sure, so the main criterion for evaluating narratives is their plausibility. In a sense, this is double-edged sword.

However, the worst that can happen is if the narrative component takes on a life of its own, and mass psychology and cognitive distortions lead to a large gap between expectations and the fundamental value of companies - value in terms of their productivity, technology, products, innovative performance. In addition, narratives are the plane in which it is easier to build various kinds of market manipulations, including the so-called pump and dump cycle, which is a fraudulent activity that is difficult to prove, when a positive narrative about a company is immediately “stuffed”, the share price rises sharply - and the initiators of the “stuffing” sell their shares to interested investors and speculators. Later it turns out that the scale of positive news and assumptions was not true [Loa et al., 2020].

It is wrong to forget a certain function of narratives as a productive economic coordinating mechanism: through it, the stakeholders of a progressive company build their future and really embody a certain common vision of all stakeholders, which led and constantly leads to the construction of great companies that revolutionised entire industries. In the beginning there was the Word. Or rather, narrative.

Consider, for example, Tesla, which has been a particularly heated and even quasi-religious controversy. Many exchange practitioners and some academic researchers, speaking about the extremely high capitalisation of the company, make conclusions and statements about irrational pricing, a bubble and similar categories. It is difficult to fully agree with such a degree of categoricalness, since, it seems, an inappropriate terminological apparatus is used. In the case of Tesla, we reliably have one of the brightest and at the same time large-scale cases of storytelling, narrative and high reflexivity. What is the future scenario for Tesla by 2025 or 2030 is a really big question. The risks that this will be undershooting are great, but there are even the likelihood of overshooting scenarios - we are dealing with a company that is a powerful technological disruptor.

It is more neutral and correct to say that companies like Tesla are largely driven by narrative. And the narrative, in principle, can be either predominantly irrational and manipulative, or realistic and relatively rational, despite the high level of ambition. We can say that Tesla pricing is irrational only if we establish that investors are in the grip of cognitive biases. In other words, a high narrative component in the value of a share does not equal irrationality. It is necessary to avoid situations where we would confuse soft and warm. To some extent, we can generally say that most highly narrative business projects are high-risk and often end sadly for investors in the later stages of the company acquisition, since the high, “overclocked” share price was not worth it. One might even advise risk-intolerant investors to generally avoid such companies if there is evidence of high overheating (this paper joins this kind of call for caution).

Storytelling, combined with the complexity of the modern financial system, especially in the context of high-tech companies, influences the economic behavior of investors. N. Taleb argues that people are “fooled by randomness”, making a narrative error in which they invent narrative explanations for random phenomena [Taleb, 2001; 2007]. All this does not allow us to say with accuracy that a certain company N is a bubble based on irrational perception. Its narrative can either be plausible or have a distribution of scenarios, some of which can be over-successful in terms of future capitalisation estimates.

However, speaking about future scenarios for the development of a promising company, it is important to note that the connection between narrative and irrationality can occur within the framework of the following cognitive distortion. Scenario thinking not only provides new opportunities for investors to assess the situation, but, according to a number of studies, leads to bias. Investors often make forecasts that take into account only the most likely scenario, rather than taking into account the full range of scenarios and possibilities [Johnson et al., 2020].

-

Is it possible to measure or evaluate the narrative (reflexive) component of business value in an ordinal way?

A regular question arises: what metrics can be used to assess the reflexive (or, as another terminological option, narrative) component in the business value of a certain company, especially a high-tech one? A somewhat simplified, but already quite indicative marker, a measure of positive reflexivity level of a company is the ratio of the company's capitalisation to its annual revenue, or P/S. Of course, none of the metrics alone is sufficient to determine the fair value of a business (and, accordingly, isolate its reflexive, narrative component), it is necessary to compare at least several basic financial ratios. For example, S. Penman and F. Reggiani recommend using profit-to-price and book price ratio multipliers together. If profit and book value express value in an accounting sense, then the ratio of profit to price and to book value signal the risk and the expected return from this risk. Higher growth in the context of a high book value is risky, as stocks with a high book value are subject to stronger shocks [Penman, Reggiani, 2018]. It is also worth noting that many practitioners and analysts prefer to use the ten-year Shiller P/E ratio - Shiller CAPE (Fig. 1) to assess the potential for future stock returns (Fig. 1), especially since in 2021 it almost caught up with the record 1999, which predicts a lower stock returns over the next decade [Lechner, 2021].

However, the ratio of a company's capitalisation to its annual income (P/S) seems to be especially important to understand as a general, preliminary estimate of the expression. Over the course of decades, for the US stock market, the normal value (for example, according to the SP500 index) for this indicator was the range from 1 to 2, including for the last 30 years, as shown in Fig. 2. This industry average is both "healthy", clear and user-friendly even at household level. In simpler terms, we can say that if there is some average business in terms of operational and financial parameters that has already passed the filters of industry competition to one degree or another, then the investor can “outbid” in value in his favor from previous owners of the generated flow of profit according to the average historical calculation 1, 5 dollars of his so far passive money for 1 dollar of profit generated by an already sold and growing business. The investor's money thus moves, figuratively speaking, into a kind of "business-active" state.

Here, of course, it is necessary to make a reservation that the range noted above is applicable to developed financial markets with successful implementation of corporate governance principles, protection of minority shareholders, stable dividend policies, strict prosecution of insider transactions and other institutions. It is easy to see that, for example, the Russian market is characterised by a situation where in many sectors (for example, in oil and gas, electric power, retail, telecommunications, banks), profitable companies often stand at P/S 0.5 or even lower. This ratio might have pleased Graham at first: one of the parameters of his method was to target companies that cost around 0.3 P/S. However, as unique domestic practice shows (in this case, unique - in a sad sense), companies can be greatly undervalued for decades, primarily due to the impact of adverse institutional factors.

At the same time, it is necessary to understand that P / S at the level of 1-2 on the SP500 index is just a kind of average historical value. Over the past decades, as you know, there have been periods of crises of various origins (including acute liquidity crises) - and then quality companies cost less than 1 and even less than 0.7 in terms of P / S ratio. At the same time, in the case of high levels of marginality and/or rapid business growth and/or product uniqueness, coefficients for individual industries and sectors can traditionally be significantly higher than industry and historical averages. For example, the P / S ratio of stock exchanges (as a type of business) and companies - leaders in the development of computer and mobile games for the last 10 years has been in the range of 3-7, since stock exchanges have very high margins and often a monopoly position in many market instruments, while companies are famous for high business growth rates and a relatively protected oligopolistic market structure as the main characteristics of their investment attractiveness.

Fig. 1. Shiller CAPE value for the S&P500 index

Source: https://www.thinkadvisor.com/2020/12/01/stocks-prices-not-as-absurd-as-some-think-shiller/.

Fig. 2. P/S value for the S&P500 index

Source: https://seekingalpha.com/article/4327204-enormous-stock-market-bubble-and-future-financial-and-economic-consequences.

-

A selection of companies with the highest level of narrative value (maximum reflexivity)

As can be assumed from the data in Tables 1 and 2, the “stratospheric” levels of capitalisation of the most “narrative”, “reflexive” companies are served to investors and a wider range of stakeholders (in particular, partners, suppliers, consumers, current and future employees) as confirmation of the exclusivity of companies.

Against the background of these companies, Tesla, with a current P / S ratio of about 18, no longer looks so “irrationally” overvalued. I would like to emphasise once again that "irrationality" is an unfortunate term for even the most overheated companies. If Palantir Technologies is worth 18 annual revenues in June 2022, that's a lot, but it's not irrational. Investors believe that this developer of information analysis software and solutions for supporting many types of data (including unstructured, relational, geospatial) is on the verge of receiving major contracts from commercial and government customers, including the US CIA. It is possible that investors are mistaken in the probability of the most optimistic scenario or, as mentioned earlier, they do not sufficiently consider the probability of alternative scenarios, but this is very difficult to prove ex ante in a particular case. Theoretically, it would be possible to use the expert method ex ante to some extent as some kind of relative evidence, but this is not practically feasible.

Of particular interest is the question of how narratives are constructed in the modern investment ecosystem, what, in a sense, is the methodology for giving the narrative characteristics of plausibility. However, this issue is still poorly and fragmentarily addressed in the literature.

With this in mind, regarding the valuation of the business of high-tech companies, we can say that the stock markets live with expectations to a special extent. In such circumstances, investors are particularly dependent on narratives. And this, by definition, is a breeding ground for "mind games". As a result, portfolio investors in high-tech companies experience routinisation of decision-making under the influence of many behavioral factors.

-

The main distinguishing features of the "effective interpreter" model at the present stage

Undoubtedly, investors need to strive to become aware of cognitive distortions and reflect on them, because of this, by reducing risks and instability, both the participants themselves and the entire financial system would benefit from the point of view of long-term sustainability and real provision of high-tech companies with investment resources. At the same time, it must be admitted that the very model of making decisions about buying or selling shares has fundamentally changed. There has been a certain shift in the significance of investors' competencies from long-term financial orientations (the “reasonable investor” model) towards understanding the mass narrative, mass psychology, and one's own response to the behavior of other investors. Such a model can be called the “efficient interpreter” model. Narrative, perception and context have become a new plane in which participants in the equity capital market compete with each other. We are talking about a new qualitative state of the investment system.

This is consistent with the more general paradigm of the so-called narrative economy introduced as a conceptualisation by R. Schiller in 2017 [Shiller, 2017; Mackintosh and Schiller 2021]. According to Schiller, when shared among the public in the form of popular stories, ideas can go viral and move markets, be it the belief that technology stocks can only go up, that house prices never fall, or that some firms are too big to go bankrupt. Whether that be truth or a lie, stories like these, shared by word of mouth, the media and increasingly through social media, drive the economy, shaping our decisions about how and where to invest, how much to spend and save, and more. Narrative economics as a new conceptual field seeks to lay the groundwork for understanding how so-called storytelling and narratives help move forward economic processes.

Researchers have already begun to apply the principles of narrative economics to conceptualise and classify behavioral strategies in the investment community. The approach of S. Johnson and D. Tuckett seems to be innovative and productive. They propose to distinguish between three types of behavior in terms of making forecasts about the future value of shares: rational expectations from neoclassical economic theory (investors predict in accordance with neoclassical financial theory) and two types of psychological approaches to the formation of expectations: (1) behavioral expectation approach (investors understand empirical market anomalies and expect these anomalies to occur) and (2) narrative expectation approach (investors use narrative thinking to predict future prices) [Johnson, Tuckett, 2022]. It seems that the British colleagues raised an extremely interesting question regarding the possibility and expediency of distinguishing between behavioral and narrative expectations.

As part of Johnson and Tackett's literature review and experiments on investor decision-making under uncertainty, the authors focus on the usefulness of distinguishing between two psychological approaches. In particular, in the case of an unexpectedly high performance of the company being valued, investors with prevailing behavioral expectations are prone to a short-term increase in their perceptions the business value, but two weeks after, expectations normalise based on benchmarking and comparison with other companies. At the same time, investors who are guided by narrative expectations prefer images of the company's future, project both positive and negative trends into the future, and considerations of past reporting, benchmarking and comparisons do not affect the period of a positive or negative trend projection into the future. In other words, the narrative is decisive.

Importantly, the empirical findings of the study support the idea that people rely on narratives to predict the price paths of financial assets. Whereas participants with neoclassical rational expectations would predict asset prices to rise at a market rate of return, participants in the experiments clearly distinguish positive and negative surprises in the results, predicting sharply outperforming growth in the light of positive rather than negative news. This happened despite the fact that the predicted price changes were made relative to the price after the announcement of the news [Johnson, Tuckett, 2022].

Although this paper will further propose a unified (both behavioral and narrative) model of the "effective interpreter" based on the notions of strong mutual interweaving and influence of behavioral and narrative aspects and motives in investment decision making, this year's article by Johnson and Tuckett, will deservedly become fundamental in terms of laying the foundations of the research direction. Nevertheless, despite all the academic validity of the separation between two psychological types - behavioral and narrative, with regard to the scientific and practical applicability of such a categorical distinction, many difficulties can be expected. Since, analysing behavioral and narrative factors in the pricing of specific companies, it will be difficult to say where in its pure form a behavioral component is, and where - a narrative one.

As S. Mackintosh and R. Shiller point out, narratives about stock market bubbles are fueled by psychology, since stock prices are associated with general confidence [Mackintosh, Shiller, 2021]. At the same time, general trust is based on behavioral dynamics, including herd behavior. The circle "narrative - trust - behavior" is closed. One can envision a spiral where primarily herd behavior and other behavioral dynamics and cognitive biases (e.g. retrospective survivorship fallacy) are facilitators of narrative growth. The “survivor fallacy,” for example, is often used to draw analogies to already successful tech giants, reinforcing the narrative.

Another argument that can be raised against the practicality of separating behavioral and narrative aspects into two different decision-making models is the common practice of so-called momentum strategies. It would be incorrect to say that these strategies are based only on the narrative motives of investors. Momentum strategies have historically evolved as a behavioral phenomenon [Chan et al., 1996], although narrative is now of particular importance. As part of experiments on the formation of expectations and asset valuation, S. Homes and his colleagues in 2008 found that in most experiments, prices deviate from the foundation and bubbles occur endogenously. Research has shown that these bubbles are inconsistent with rational expectations and are caused by participants' behavior in chasing a trend or "expecting positive feedback." The participants in the experimental group, as a rule, coordinate their actions in relation to the overall forecasting strategy [Hommes et al, 2008].

The exchange, speculative principle "buy on rumors - sell on facts" is a classic, it was popularised (both on the stock exchange and even in popular culture) back in the "roaring 1920s". Even D. Ricardo, one of the founders of economic theory, as you know, made a fortune on active stock speculation. There has always been strategic behavior and interdependence among equity capital market participants. Now the narrative and behavioral components of value in the context of modern economics have become much more significant. This is confirmed by the research, which found out that investors from the same country consciously and unconsciously follow each other. For example, a recent study used high-frequency intraday data to study the herding behavior of investors in the global market at the country level and found strong evidence of significant herding behavior at the country level. Country-level herding behavior is a combination of conscious and unconscious subtypes, with the effect of unconscious herding behavior being about five times greater. Notably, unaware herding behavior at the country level is affected by momentum trading, investment style, and market pressures [Chen, 2021].

Assessing the present and focusing on the unknown future, financial market participants create financial opportunities. At the heart of this process is the work of experts who claim to conduct "thorough analysis" of economic trends and market movements. There was even such a thing as narrative authority [Leins, 2022; Stolowy et al., 2022] due to the need to refine and broaden the understanding of building narrative authority in capital markets, as powerful media intermediaries increasingly influence markets. The lack of one's own reasonable idea of the fair value of high-tech businesses leads to exaggerated expertise of analysts.

Management rhetoric is also a very important component of narratives. Members of the investor community compete to understand better and interpret more realistically the messages of managers. A recent study found that the management narrative (in corporate reports on technology and innovation disclosures) is used as a critical investor communication channel through which managers convey information to the investment community, and is positively associated with risk fall in stock prices for the year ahead. Moreover, the positive association between managerial narrative and the risk of a stock price collapse is more pronounced for firms with powerful, more capable, younger CEOs. The negative impact of managerial narrative on future stock prices is predominant among firms that face high competition [Andreou et al., 2021].

Another study used computational linguistics tools to analyse the qualitative part of the annual reports of UK listed companies. The frequency of words associated with various language indicators was measured and used further to predict future stock returns. Several indicators, primarily reflecting the headings "activity" and "realism", predict subsequent price increases even after accounting for a wide range of factors. At the same time, the increase in these two linguistic variables was not accompanied by additional risks [Wisniewski, Yekini, 2014]. As a result of the mentioned works, the descriptive part of the annual/quarterly report and the presentations of managers contain valuable information that has not yet been included in prices.

One study also found that the positive tone of sentiment on Twitter is more pronounced for small and emerging market firms, consistent with the literature that says small firms are difficult to value and firms in emerging markets are characterised by high information asymmetries. Tan and Tas, 2021]. Therefore, as it follows from a number of studies, for investors it is beneficial to be inattentive to most news topics and their mood, if guided by a rational decision-making model [Uhl, Novacek, 2021]. Another thing is that such a conclusion may be somewhat incomplete, based on the fact that investors can be in a good way cynical about narratives realising their manipulative nature. Then the narratives become a separate behavioral dimension, where investors and speculators also compete with each other, as they do in connection to any financial and market information related to the activities of the issuer.

With regard to the narrative component of modern investing, the literature has also established that retail investors are "net buyers" of attention-grabbing stocks. One study found that factors such as financial experience, wealth, advice, and other individual characteristics that indicate investor sophistication explain differences in net buying decisions. Greater trading experience comes from net selling during months when stocks get a lot of attention and net buying during months when they get less attention. Investors who trade during the months of the least attention are more experienced, more involved in complex trading, richer and have a higher income than those who trade during the months that attract the most attention [Gavish et al., 2021]. This is a very intuitive result, but again, it seems necessary in modern realities to distinguish between traditional sector companies and high-tech businesses. For high-tech companies, attention and so-called hype is the necessary "fuel" for the growth of not only quotes, but also fundamental operating indicators, as it follows from the theory of reflexivity.

All of the above, therefore, means that investors, especially in high-tech companies, are shifting from the plane of the traditional “smart investor” model to the plane of the “efficient interpreter” model.

With regard to the characteristics in Table 3 ten comparative attributes for two heuristic models can be assumed as debatable. For example, for the “smart investor” model, it can be argued that during the boom and euphoria, many players have a strong tendency to believe that at any purchase price a little later, there will still be a “last fool”. After all, the famous "tulip mania" of 1636-1637 took place outside any context of advanced technologies and, accordingly, the complex narratives tied to them. In addition, Keynes, back in 1936, very accurately noted that the market is like a beauty contest, the purpose of which is not to evaluate the beauty of the participants, but to predict accurately the assessments of other judges [Keynes, 1936]. However, the degree of such a "fool" still differs in fundamental and qualitative characteristics in the two models.

In the traditional configuration (the “smart investor” model), someone can actually buy a company for two, three, and many times more than its fundamentals, still believing that this is not the last extreme on the stock price chart and can be resold after some time for a little more. In the case of the “efficient interpreter” model, however, the symptoms seem to be even more pronounced: until the bubbles burst, there are massive cohorts of investors, especially in relation to high-tech companies that overpay many times over for a business, having an extremely limited understanding of its processes and fundamental indicators. They bought a share of the company on a “black box” model on the basis of the formed narrative sentiment – and they are betting that the positive narrative, the so-called hype, will continue for some time.

Table 1

Top 10 companies with the highest P/S ratio with market caps over $ 10 billion

|

Large cap company |

Industry, sector |

Market capitalisation as of 07/01/2022 (billion dollars) |

Capitalisation ratio / annual revenue |

|

Lucid Group |

Automotive, electric cars |

28 |

337 |

|

Rivian Automotive |

Automotive, electric cars |

23 |

154 |

|

Argenx SE |

Biotechnologies |

20 |

55 |

|

The Liberty Braves Group |

Telecommunications and entertainment |

28 |

48 |

|

Aspen Technology |

Software |

25 |

36 |

|

Snowflake |

Software |

43 |

31 |

|

Datadog |

Software |

30 |

25 |

|

Crowdstrike Holdings |

Information security |

39 |

24 |

|

Texas Pacific Land Corporation |

Power economy |

12 |

22 |

|

Bill.Com Holdings |

Software |

11 |

22 |

Source: Compiled by the author based on finviz.com data.

Table 2

Top 10 companies with the highest P/S ratio with market caps from $ 2 billion to $ 10 billion

|

Mid cap company |

Industry, sector |

Market capitalisation as of 07/01/2022 (billion dollars) |

Capitalisation ratio / annual revenue |

|

Turning Point Therapeutics |

Biotechnologies |

3.8 |

613 |

|

Nuscale Power Corporation |

Renewable energy |

2.2 |

479 |

|

MSP Recovery |

Information services in healthcare |

6.8 |

349 |

|

Ascendis Pharma A/S |

Biotechnologies |

4.8 |

331 |

|

Eaton Vance Senior Floating Rate Trust |

Investment company |

2.4 |

322 |

|

Intellia Therapeutics |

Biotechnologies |

3.9 |

104 |

|

Karuna Therapeutics |

Software |

3.8 |

102 |

|

Nutex Health |

Information services in healthcare |

2.1 |

91 |

|

Legend Biotech Corporation |

Biotechnologies |

8.5 |

73 |

|

Appelis Pharmaceuticals |

Biotechnologies |

4.8 |

60 |

Source: Compiled by the author based on finviz.com data.

Table 3

Comparison of the “rational investor” model and the “effective interpreter” model

|

Attribute |

“Rational investor” model |

“Effective interpreter” model |

|

Company valuation emphasis |

Profit, revenue, free cash flow, debt |

Opportunities for rapid scaling of revenue, building an ecosystem |

|

Narrative context in business perception |

Low (estimated to a greater extent by fundamental indicators). In conditions of nervousness - average. Market Sentiment Influences Decision Making |

High (positive narrative and perception about the company become decisive and may outweigh bad fundamentals even in the medium term) |

|

Business Development Forecasting Methodology |

Predominantly extrapolation |

Mostly scenarios and images of the future |

|

Codependency of investors (strategic behavior of players) |

Average (crowd psychology is applicable, but the last line of self-assessment of the market situation is the fundamental indicators of the business) |

High (most players have a complete focus on consensus opinion, the precariousness of their own perception due to the lack of their own formed position regarding the fundamental value of the business) |

|

Significance of analyst forecasts (share price per year) |

Average (indicators can be calculated by yourself, including forward ones) |

High (indicators depend on interpretations, the “fork” of estimates of forward indicators is wider) |

|

Willingness to endure business losses |

Low (1-2 years) |

High (unlimited subject to high revenue growth rates) |

|

Focus of speculative strategy |

“Buy on hearsay, sell on facts” |

Maximum emphasis on interpreting participants' behavior |

|

The degree of applicability of "the last fool" concept |

Low (booming – medium) |

High (even in the conditions of a strong “overbought” of the company, the players still have the expectation that the price will be even higher at the moment) |

|

Degree of applicability of momentum strategies |

Average (there is an expectation, supported by long-term statistics, that the market moves mainly by trends) |

High (based not only on long-term statistical observations, but also on the expectation of continued blitz-scaling of the business) |

|

The level of cognitive distortions among market participants |

Usual |

Advanced (cognitive biases are more varied due to greater complexity and uncertainty) |

Source: compiled by the author.

Conclusion

The democratisation of investing in financial markets (desktop and mobile brokerage applications), strengthened by new technical and technological solutions, was superimposed on a cultural transformation: investing and speculation have become part of mass culture. The orientation of businesses in many sectors towards rapid growth, scaling and breakthrough innovations has led to a decrease in the subjective significance of financial and economic indicators of efficiency and effectiveness in assessing the value of a business. As a result, everyone can feel like an interpreter of the future business development trajectory. For an individual “efficient interpreter”, such activity may end in different ways, but for a large social system of co-dependent interpreters, this may sooner or later end not just in a stock market panic, but also in wider socio-economic consequences.

The current period of irrational optimism in the stock markets may also be a factor in further widening socio-economic inequality, as retail investors from the middle and lower strata of society form their portfolios from the weakest possible positions not only from the point of view of the “rational investor” model, where their analytical capabilities are behind institutional investors on average. Only few retail investors follow Lynch's advice on how to bridge the analytics gap with institutional investors and professionals.

Within the framework of the "effective interpreter" model, retail investors are most dependent on behavioral effects and cognitive distortions. Of course, in the context of individual factors, this is not yet a fully explored area, although there are already many studies. However, there is the following general consideration: the role of retail investors in the chain of forming narratives of high-tech companies is more passive and they approach the narratives not critically enough and in a sense not cynical enough, in contrast to institutional investors, who, with their market “weight”, can induce or support “hypes" at earlier stages. As a result, retail investors enter the already “overclocked” stocks (the so-called rockets in exchange jargon, and even with the battle cry “To the Moon!”) of high-tech companies on average later, already at higher price levels of issuers - and are especially vulnerable to permanent or long-term loss of value. This is even if they do not try to speculate, which usually multiplies the losses even more. It should also be taken into account that high-tech companies in the market are characterised by deep corrections (sometimes called super-compensatory) after a sharp and unreasonable growth. The phenomenon of supercompensation seems to be of particular interest for empirical research: the collapse of the current narrative often causes such a strong correction, collapse, and the value of companies then turns out to be lower than it was before the appearance of the narrative.

Of particular interest may also be the systematisation of the whole variety of factors that, in current realities and developing trends, lead to an increase in behavioral effects and cognitive distortions within the framework of a new qualitative state of investor behavioral heuristics, which is formed in the “effective interpreter” model. Probably not all of them are completely new, but even some of the traditional factors are given a meaningful new momentum by the context of investing in high-tech companies.

In the next work on the cognitive aspects of the "effective interpreter" model, the author plans to continue study in this direction, assuming that we can talk about a dozen of factors.

References

1. Andreou P.C., Lambertides N., Magidou M. (2021). Stock price crash risk and the managerial rhetoric channel: Evidence from narrative R&D disclosure. SRRN, July 24. https://ssrn.com/abstract=3891736; http://dx.doi.org/10.2139/ssrn.3891736.

2. Carpentier C., Romon F., Suret J.-M. (2018). Are investors rational when valuing loss firms? Journal of Behavioral Finance, 19(2): 177-189. DOI: 10.1080/15427560.2017.1374277.

3. Chan L.K.C., Jegadeesh N., Lakonishok J. (1996). Momentum strategies. Journal of Finance, 51: 1681-1713. https://doi.org/10.1111/j.1540-6261.1996.tb05222.x.

4. Chen T. (2021). Does country matter to investor herding? Evidence from an intraday analysis. Journal of Behavioral Finance, 22(1): 56-64. DOI: 10.1080/15427560.2020.1716760.

5. Chen Y., Kumar A., Zhang C. (2021). Searching for gambles: Gambling sentiment and stock market outcomes. Journal of Financial and Quantitative Analysis, 56(6): 2010-2038. DOI: 10.1017/S0022109020000496.

6. Gavish L.R., Qadan M., Yagil J. (2021). Net buyers of attention-grabbing stocks? Who exactly are they? Journal of Behavioral Finance, 22(1): 26-45. DOI:10.1080/15427560.2020.1716360.

7. Graham B. (2003). The intelligent investor (revised ed.). New York, Harper Business.

8. Hommes C., Sonnemans J., Tuinstra J., van de Velden H. (2008). Expectations and bubbles in asset pricing experiments. Journal of Economic Behavior & Organization, 67: 116-133.

9. Johnson S.G.B., Merchant T., Keil F.C. (2020). Belief digitization: Do we treat uncertainty as probabilities or as bits? Journal of Experimental Psychology: General, 149: 1417-1434.

10. Johnson S.G.B., Tuckett D. (2022). Narrative expectations in financial forecasting. Journal of Behavioral Decision Making, 35(1), e2245. https://doi.org/10.1002/bdm.2245.

11. Kahneman D., Tversky A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47: 263-291. DOI: 10.2307/1914185.

12. Keynes J.M. (1936). The general theory of employment, interest, and money. London, UK, Macmillan.

13. Klerck S. (2020). The origins of value investing revisited. SSRN, Jan. 1. http://dx.doi.org/10.2139/ssrn.3425822.

14. Kudryavtsev A., Cohen G., Hon-Snir S. (2013). “Rational” or “intuitive”: Are behavioral biases correlated across stock market investors? Contemporary Economic Policy, 7: 31-53. DOI: 10.5709/ce.1897-9254.81.

15. Lechner G. (2021). Does the Shiller CAPE predict a crash of the S&P 500? SRRN, March 17. https://ssrn.com/abstract=3806507; http://dx.doi.org/10.2139/ssrn.3806507.

16. Leins S. (2022). Narrative authority: Rethinking speculation and the construction of economic expertise. Ethnos, 87(2): 347-364. DOI: 10.1080/00141844.2020.1765832.

17. Lev B.I., Srivastava A. (2019). Explaining the recent failure of value investing. NYU Stern School of Business. SRRN, Oct. 25. https://ssrn.com/abstract=3442539; http://dx.doi.org/10.2139/ssrn.3442539.

18. Loa S., Adam K., Santoso L. (2020). Stock prices manipulation: Pump and dump method. SSRN, Jan. 9. https://ssrn.com/abstract=3516458; http://dx.doi.org/10.2139/ssrn.3516458.

19. Lynch P., Rothchild J. (2012). One up on Wall Street: How to use what you already know to make money in. New York, Simon and Schuster.

20. Mackintosh S.P.M., Shiller R. (2021). Narrative economics: How stories go viral and drive major economic events. Business Economics, 56: 108-109. https://doi.org/10.1057/s11369-020-00206-z.

21. Malkiel B.G., Fama E.F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25: 383-417. DOI: 10.2307/2325486.

22. Markowitz H.M. (1952). Portfolio selection. Journal of Finance, 7: 77-91.

23. Modigliani F., Miller M.H. (1958). The cost of capital, corporation finance and the theory of investment. American, 1: 261-297.

24. Mukherjee S., De S. (2019). When are investors rational? Journal of Behavioral Finance, 20(1): 1-18. DOI: 10.1080/15427560.2018.1443936.

25. Munger C. (1995). The psychology of human misjudgement. Speech addressed at Harvard University, June 1. https://www.youtube.com/watch?v=IngHiWnmcSs.

26. Nareswari N., Salsabila Balqista A., Priyo Negoro N. (2021). The impact of behavioral aspects on investment decision making. Jurnal Manajemen Dan Keuangan, 10(1): 15-27. https://doi.org/10.33059/jmk.v10i1.3125.

27. Niszczota P. (2014). Neuroticism, uncertainty, and foreign investment. SSRN, March 31. https://ssrn.com/abstract=2431188 or http://dx.doi.org/10.2139/ssrn.2 431188.

28. Otuteye E., Siddiquee M. (2015). Overcoming cognitive biases: A heuristic for making value investing decisions. Journal of Behavioral Finance, 16(2): 140-149.

29. Penman S., Reggiani F. (2018) Fundamentals of value versus growth investing and an explanation for the value trap. Financial Analysts Journal, 74(4): 103-119.

30. Roe M.J. (2021). Looking for the economy-wide effects of stock market short-termism. Journal of Applied Corporate Finance, 33: 76-86. https://doi.org/10.1111/jacf.12480.

31. Shiller R.J. (2000). Irrational exuberance. Princeton, NJ, Princeton University Press.

32. Shiller R.J. (2017). Narrative economics. American Economic Review, 107: 967-1004.

33. Sorescu A., Sorescu S.M., Armstrong W.J., Devoldere B. (2018). Two centuries of innovations and stock market bubbles. Marketing Science, 37(4): 507-529. https://doi.org/10.1287/mksc.2018.1095.

34. Soros G. (2015). The alchemy of finance. John Wiley & Sons.

35. Stolowy H., Paugam L., Gendron Y. (2022). Competing for narrative authority in capital markets: Activist short sellers vs. financial analysts. Accounting, Organizations and Society, 100: 101334. https://doi.org/10.1016/j.aos.2022.101334.

36. Taleb N. N. (2001). Fooled by randomness. New York, NY, Random House.

37. Taleb N.N. (2007). The black swan. New York, NY, Random House.

38. Tan S.D., Tas O. (2021). Social media sentiment in international stock returns and trading activity. Journal of Behavioral Finance, 22(2): 221-234. DOI: 10.1080/15427560.2020.1772261.

39. Uhl M.W., Novacek M. (2021). When it pays to ignore: Focusing on top news and their sentiment. Journal of Behavioral Finance, 22(4): 461-479. DOI: 10.1080/15427560.2020.1821375.

40. Viebig J. (2020). Exuberance in financial markets: Evidence from machine learning algorithms. Journal of Behavioral Finance, 21(2): 128-135. DOI: 10.1080/15427560.2019.1663849.

41. Wang X. (2017). Investor attention strategy. Journal of Behavioral Finance, 18: 390-399. DOI: 10.1080/15427560.2017.1344674.

42. Wisniewski T.P., Yekini L. (2014). Predicting stock market returns based on the content of annual report narrative: A new anomaly. SSRN, July 30. https://ssrn.com/abstract=2474061; http://dx.doi.org/10.2139/ssrn.2474061.

About the Author

S. V. IlkevichRussian Federation

Candidate of economic sciences, associate professor, Department of Management and Innovation, Financial University under the Government of the Russian Federation (Moscow, Russia). ORCID: 0000-0002-8187-8290; Scopus ID: 56028209600; SPIN-code: 6655-7300. Research interests: innovations and business models, international business, digital transformation of industries, sharing economy, stock market, portfolio investment, experience economy, internationalization of education.

Review

For citations:

Ilkevich S.V. HEURISTIC MODEL OF “EFFECTIVE INTERPRETER” IN PORTFOLIO INVESTMENT IN HIGH-TECH COMPANIES. Strategic decisions and risk management. 2022;13(2):116-128. https://doi.org/10.17747/2618-947X-2022-2-116-128