Scroll to:

THE INFLUENCE OF INTERCOMPANY RELATIONS ON THE INNOVATION PERFORMANCE: АN EMPIRICAL STUDY OF RUSSIAN INDUSTRIAL COMPANIES

https://doi.org/10.17747/2618-947X-2022-2-108-115

Abstract

The interaction of companies in the innovation process is the basis for successful innovative development, as it allows industrial companies to reduce the time to market new products, cut production costs, increase operating profit. At the same time, an optimal choice of key partners is necessary to succeed in achieving the overall goals of innovative development. Currently, there are no studies that would answer the questions: is the interaction of companies implementing different models of innovative behavior effective? Will innovative companies earn a positive return from interaction with imitation companies? What models of interaction can be optimal between innovative companies and imitation companies?

The purpose of this study is to determine how the structure of the partnership, membership and characteristics influence the innovative performance of industrial companies. The study was conducted on a sample of 270 large Russian industrial companies. An econometric model based on the Cobb - Douglas production function was used for the analysis.

For citations:

Trachuk A.V., Linder N.V. THE INFLUENCE OF INTERCOMPANY RELATIONS ON THE INNOVATION PERFORMANCE: АN EMPIRICAL STUDY OF RUSSIAN INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2022;13(2):108-115. https://doi.org/10.17747/2618-947X-2022-2-108-115

Introduction

Many modern studies confirm the importance of building relationships with partners in the process of innovation, in particular, it is shown that partnerships allow companies to ensure an effective transfer of knowledge and technologies, share scarce resources and obtain a synergetic effect by supplementing their own resources, knowledge and skills with the resources of partner companies. [Linder, 2021]. The interaction of companies in the innovation process allows them to reduce the time to market for new products by 15-25% [Jiang et al., 2016], reduce production costs by up to 15% [Berger et al., 2015], increase profits from the sale of new products by 60% [Zakrzewska-Bielawska, 2018]. Such effects are achieved through easier transfer of knowledge and technology through partnerships [Palmatier et al., 2006], resource sharing [Holmlund, 2008], greater opportunities to interact with customers and create more value for them [Park, Trần, 2020]. [Hilbolling et al., 2020] shows how the type of partnership and the engagement of partners in the innovation process affects the achievement of innovation development goals.

However, there are no studies on how partnership structure and characteristics can affect innovation performance. The novelty of this study lies in the analysis of the impact of the partnership structure, the composition of its participants and characteristics on the effectiveness of innovative activities of industrial companies.

-

Literature review

To date, the research literature has accumulated a wealth of evidence for the key role of partnerships in enhancing the effectiveness of innovation. Existing research examines the role of partnerships in the innovation process in several ways. One of them is the selection of the most effective stages of the innovation process for the involvement of partners [Dhanarag, Parkhe, 2006]. In [O'Sullivan, Dooley, 2009] it is shown that the first stage of the innovation process, the generation of ideas, is the most important for the involvement of partners. According to the authors of these studies, it is the interaction at the first stage that leads to the emergence of completely new ideas - disruptive innovations. Other researchers, on the contrary, believe that the involvement of partners only at the first stage is possible only for incremental innovations, and the success depends on the introduction of innovations and, accordingly, the commercialisation of innovations, so it is necessary to attract partners at this stage. [Gök, Peker, 2017 ]. [Taherparvar et al., 2014; Yavarzadeh et al., 2015] states that the effectiveness of innovation depends not only on the development and commercialisation of innovations, but also on the introduction of new production methods, technologies, productivity improvements and can only be achieved by involving partners at all stages of the innovation process.

Another line of research looks at what types of partnerships are most effective in innovating. Some authors consider strategic alliances to be the most effective [Elis, 2011], others consider innovation networks [Soltani et al., 2013], while evidence has been obtained of the effectiveness of both business networks in the innovation process [Slotte-Kock, Coviello, 2010] and social networks. It is shown that sooner or later social contacts turn into business ones, for example, in [Havila, Wilkinson, 2002; Story et al., 2008; Elis, 2011]. At the same time, researchers note that business partnerships that have grown out of friendly relationships are stronger and characterised by greater commitment and trust between partners. This, in turn, affects the effectiveness of innovation activity [Von Krogh et al., 2003]. Some studies analyse links between the duration of relations in the innovation process and the novelty of the innovations being created (whether they will be incremental, radical or disruptive) [David, Shapiro, 2008].

Another area of research considers the involvement of partners in relationships and the effectiveness of innovative activities. At the same time, the level of involvement is measured by the intensity of interaction [Ozman, 2009]. The more intense the interaction of partners is, the more trusting relationships become and the more effective they achieve common goals [Gunday et al., 2011]. There are also studies that determine the optimal ratio of the number of stakeholders involved in innovation activity and its effectiveness. Stakeholders are divided into external and internal. For example, in a study [Rebyazina, Smirnova, 2011], conducted on the data of 160 Russian companies, it was revealed that the main criterion for choosing partners is their financial condition, and companies use a selective approach to building relationships and planning interaction.

At the same time, companies can implement various innovative strategies and models of innovative behavior [Linder, 2020]. There are no studies in the literature that answer the following questions: is the interaction of companies implementing different models of innovative behavior effectively? Will innovating companies benefit from interaction with imitating companies? What models of interaction between innovators and imitators can be optimal?

The object of this study is the structure of partnerships and its impact on the effectiveness of innovation.

-

Study sample

Empirical data for this work were collected in 2022 during the study “Scenario modeling of the socio-economic effect of stimulating the acceleration of industrial technological development and increasing labor productivity, and specifically based on digitalisation”. The sample included 270 Russian industrial enterprises. To conduct the study, a stratified sample was used, formed on the basis of a certain type of innovative behavior implementation: innovator companies and imitator companies.

The cluster of innovative companies included industrial companies implementing an innovative strategy aimed at creating and developing new products, improving operating activities and, accordingly, introducing process and technological innovations. Innovation spending mainly consists of investment in research and development, new technologies, equipment and infrastructure improvements.

The cluster of imitation companies includes companies that do not independently create and distribute new knowledge and products on the market. The basis of the strategy of such companies - borrowings. At the same time, the companies included in the sample implemented three types of imitation strategies: copying entire products - a small proportion of the surveyed companies (18%); copying certain technical parameters, design and brand elements, borrowing innovative solutions (technologies, patents, knowledge, business processes, management principles and business models) - 44% of the surveyed companies. The rest of the companies used the strategy of creative imitation, which consists in making changes to the original innovation or finding a new application, as a result of which a new product, process or technology is created - 38% of the surveyed companies.

The data were collected through both personal interviews and questionnaires. The ratio of innovators and imitators was 42% and 58%, respectively. All selected companies were large industrial enterprises with more than 500 employees. The age of the companies ranges from 7 to 204 years, with an average of 32 years.

-

Modeling Data Analysis

To conduct a quantitative study, we used the methodology proposed by [Linder, 2021]. To model the efficiency of an industrial enterprise, non-linear Cobb-Douglas production functions are used, which are more flexible than linear functions. The Cobb-Douglas model allows the construction of hierarchical equations to exchange R&D results for production, in which the production functions for each partnership enterprise are Cobb-Douglas production functions. Based on this model, various schemes for building a partnership management model and options for sharing R&D results have been developed, depending on whether the partnership enterprises are built into the production model or practically independent organisations. Based on the scheme of total factor productivity reflecting the results of long-term technological changes in partners, we can consider an optimisation model that maximises the efficiency of all enterprises of the partnership at the same time. As a result, it becomes possible to study the dynamics of the system.

To this end, an econometric model has been constructed that reflects the influence of factors on the efficiency and innovative activity of industrial enterprises. R&D expenditures are taken as an indicator of innovation activity, and it is shown that the direction of transfer of research and development (R&D) is most effective in the direction from partner-innovators to partner-simulators. This can be explained by the fact that innovators can offer new products based on the results of R&D, while imitators are mainly focused on adapting products created by innovators to the requirements of the local market.

In general, the Cobb-Douglas function is expressed by the dependence:

Υ= γΤ Lα Kβ, (1)

where γΤ is a coefficient that takes into account the technological development of the industry in time Т, Lα is labor costs, α is the elasticity coefficient for labor costs, Kβ is capital costs, β is the coefficient of elasticity for capital costs.

Since the purpose of this article is to analyse the economic impact of the transfer of innovations from innovator companies to imitator companies, the Cobb-Douglas function will be the production function of the i-th company not investing into R&D in the time period Τ. In addition, we will introduce two more variables, СА and СР , which reflect investments in R&D by innovators. By A we will mean companies that do not invest in R&D, Р – companies that invest in R&D, ℇ reflects the so-called Solow residual, which is responsible for those changes in production volumes that are not caused by labor, capital and innovation cost factors, α, β, φ are the elasticity coefficients of the corresponding input factors.

Thus, the Cobb-Douglas function will take the form expressed by the formula:

Υι = γΤ Lα Kβ САφ СРφ ℇ. (2)

Let us test the following hypotheses:

Hypothesis 1. An increase in investment in R&D at enterprises ploughing into R&D has a positive effect on the productivity not only of themselves, but also of enterprises that do not invest in R&D. Therefore, in order to increase the effectiveness of the entire partnership, it is necessary to stimulate the innovative activity of enterprises and create effective mechanisms knowledge and technology transfer to partner enterprises not engaged in R&D.

Hypothesis 2. Knowledge and technologies developed by imitator enterprises and transferred to partnership innovators have a significant impact on the performance of innovative activities of both innovators and the entire partnership.

Hypothesis 3. The greatest effect, expressed in the growth rate of profit from sales of innovative products, will be observed in vertically integrated partnerships (as a result, having the greatest integration into the production system of the partnership).

To prove the first hypothesis, based on equation (2), we linearise the Cobb-Douglas production function and obtain the productivity gain of the i-th imitator company and the innovator company in partnership, represented by the equation:

(3)

(3)

At the same time, the influence of the R&D investment factor can be expressed by the equation:

(4)

(4)

This formula is applicable both for innovator companies Р and imitators А, i.e. S = А, Р.

Due to the fact that the estimation of the production function is significantly complicated by many factors that affect it. By introducing a stable time invariant, we can mitigate this problem. The equation will take the form:

(5)

(5)

Where  – annual investment in R&D, Q is the marginal rate of return of partnership enterprises from sales of innovative products. Transforming equation (3), we obtain:

– annual investment in R&D, Q is the marginal rate of return of partnership enterprises from sales of innovative products. Transforming equation (3), we obtain:

(6)

(6)

Where QА and QР are profit rates from sales of the innovative product of partnership enterprises, respectively, ηιΤ – a new value of random error.

Using the concept of total factor productivity, including the accumulated knowledge and technologies used, DTFP = ∆γ – αΔc – βΔl, introducing the assumption that (α + β = 1), we transform equation (4) and obtain:

(7)

(7)

To assess the quality of the model and the reliability of the obtained coefficients for the main indicators of the model, we used the least squares method with a confidence level of 95%.

-

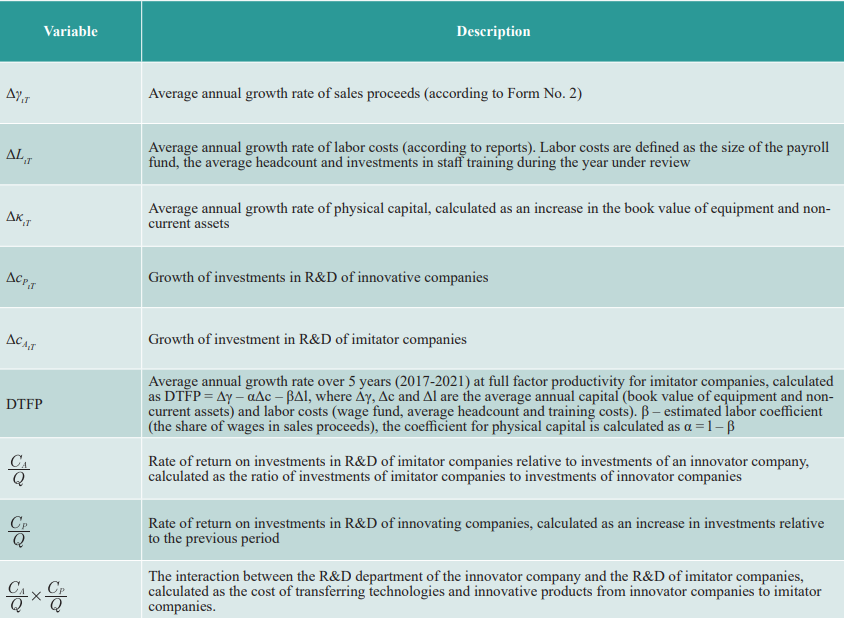

Measurement and variables

270 industrial enterprises under survey comprised 78 partnerships. The calculations were performed using the Matlab application program, the model variables are described in Table 1.

-

Research results

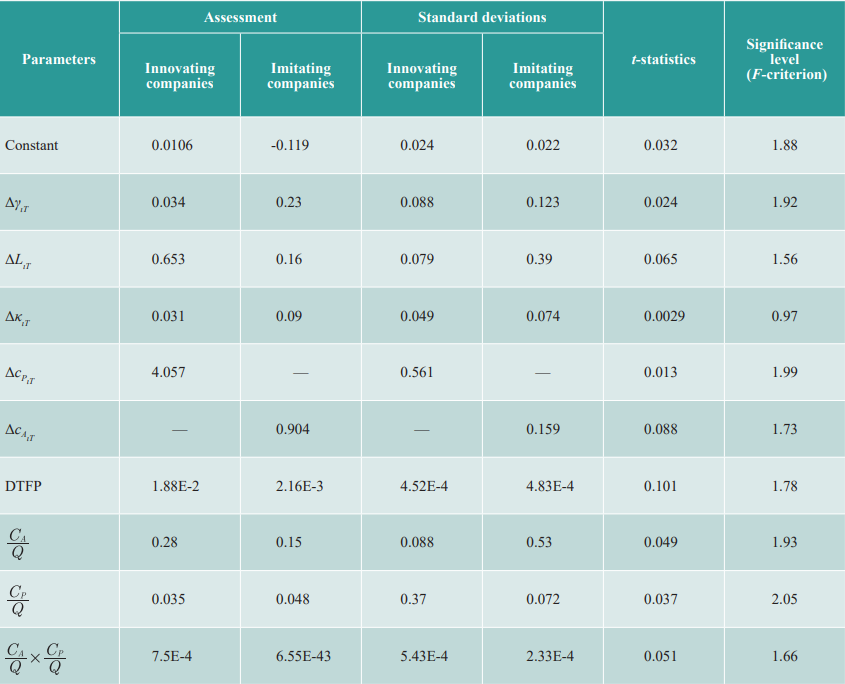

The results of the study are presented in Table 2 and 3.

The empirical model is valid as R2 = 95.1%. The factors of investment in R&D by innovating enterprises turned out to be more significant than labor factors. The cost factors of physical capital were not included in the empirical model and turned out to be insignificant. The main significant factor of investments in R&D was the factor of investments of innovating enterprises (2.971), that is, there is a direct relationship between the isolated investments of innovating enterprises in R&D and the growth in the total productivity of production factors at imitating enterprises in partnerships.

All labor indicators (0.653) turned out to be significant for innovation activity, including the number of employees. The indicator of investments in personnel training has the greatest significance.

However, according to the results in Table 3, isolated investments of imitator enterprises in R&D have an insignificant impact on the growth of profits of innovatory enterprises (0.875). Thus, 81% of the profit from innovation activities was provided by investments in R&D by innovating enterprises and 19% by imitating enterprises.

In Table. 3 to analyse the features we divided the indicators of the transfer of innovative products and technologies by enterprises-innovators and enterprises-imitators. At the same time, the share in percentage points of the change in DTFP due to the transfer of innovative products and technologies was calculated using the formula:

(8)

(8)

According to the obtained results, innovative enterprises are more willing to transfer innovative products (0.29 percentage points of DTFP growth) to imitator enterprises than technologies (0.13 percentage points of DTFP growth). If we consider the relations between indicators, then the correlation analysis of variables showed that there is a relationship between the level of wages at imitator enterprises and technology transfer: technology transfer occurs to a greater extent at imitator enterprises with higher labor costs. This, in turn, may indicate that the introduction of new technologies and processes at imitating enterprises requires a higher level of competence and this is a more difficult task than “enriching” imitating enterprises with a new product.

However, according to our calculations, the transfer of new technologies for imitator enterprises has a larger effect (1.42 p.p.) in terms of DTFP growth than the transfer of new products (0.72 p.p.).

If we analyse imitator enterprises that have the highest profit from the transfer of innovative products and technologies, then vertically integrated enterprises have the highest growth rate; this confirms the first hypothesis that technology transfer will be of particular importance if the imitator is highly integrated into the partnership production system. In this case a mechanism is needed to facilitate effective parent-subsidiary interfirm relations.

Table 1

Variables of the econometric model

Source: compiled by the authors.

Table 2

Results of multiple regression estimates of total factor productivity for partner companies

Note. R2 = 0.951 (95.1% confidence - significant).

Source: compiled by the authors.

Table 3

Transfer effect of innovative products and technologies

|

Partnership companies |

Change of DTFP |

Share of DTFP change through the transfer of innovative products |

Share of DTFP change due to technology transfer |

|

Partnership |

4.08 |

0.50 |

0.21 |

|

Innovating companies |

4.31 |

0.23 |

0.15 |

|

Imitating companies |

2.53 |

0.68 |

1.36 |

Source: compiled by the authors.

Conclusion

Thus, the studies confirmed our hypothesis that an increase in investments in R&D at partnership innovators has a positive effect on the productivity not only of themselves, but also of partnership imitators.

However, the second hypothesis - about the impact of innovations and technologies developed at imitating enterprises on the effectiveness of innovative activities of both innovating enterprises and the entire partnership - at a 5% significance level was not confirmed and can only be accepted at a 10% significance level.

The third hypothesis that the greatest effect, expressed in the growth rate of profit from sales of innovative products, will be observed in imitating enterprises that have the greatest integration into the partnership production system, has been fully confirmed.

References

1. Linder N.V. (2020). Exploring innovation modes of Russian Industrial Companies. Strategic decisions and risk management, 11(3): 272-285. https://doi.org/10.17747/2618-947X-2020-3-272-285. (In Russ.)

2. Linder N.V. (2021). Transformation of innovative behavior of Russian industrial enterprises in the conditions of the Fourth Industrial Revolution: thesis for a doctoral degree in econ. sci. Moscow, Financial University under the Government of the Russian Federation. (In Russ.)

3. Rebyazina V.A., Smirnova M.M. (2011). Interaction with partners as a factor of innovation development on the example of Russian industrial companies. Innovations, 7(153): 48-56. (In Russ.)

4. Berger R., Herstein R., Silbiger A., Barnes B.R. (2015). Can guanxi be created in Sino–Western relationships? An assessment of Western firms trading with China using the GRX scale. Industrial Marketing Management, 47: 166-174.

5. David P.A., Shapiro J.S. (2008). Community-based production of open-source software: What do we know about the developers who participate? Information Economics & Policy, 20(4): 364-398.

6. Dhanarag C., Parkhe A. (2006). Orchestrating innovation networks. Academy of Management Review, 31(3): 659-669.

7. Ellis P.D. (2011). Social ties and international entrepreneurship: Opportunities and constraints affecting firm internationalization. Journal of International Business Studies, 42: 99-127.

8. Gök O., Peker S. (2017). Understanding the links among innovation performance, market performance and financial performance. Review of Managerial Science, 11(3): 605-631.

9. Gunday G., Ulusoy G., Kilic K., Alpkan L. (2011). Effect of innovation type on firm performance. International Journal of Marketing, 133(2): 662-676.

10. Havila V., Wilkinson I. (2002). The principle of the conservation of relationship energy: Or many kinds of new beginnings. Industrial Marketing Management, 31(3): 191-203.

11. Hilbolling S., Berends H., Deken F., Tuertscher P. (2020). Complementors as connectors: Managing open innovation around digital product platforms. R&D Management, 50: 18-30.

12. Holmlund M.A. (2008). Definition, model, and empirical analysis of business-to-business relationship quality. International Journal of Service Industry Management, 19(1): 32-62.

13. Jiang Z., Shiu E., Henneberg S., Naude P. (2016). Relationship quality in Business to Business relationships – Reviewing the current literatures and proposing a new measurement model. Psychology and Marketing, 33(4): 297-313.

14. O’Sullivan D., Dooley L. (2009). Applying innovation. Thousands Oaks, Sage Publications Inc.

15. Ozman M. (2009). Inter-firm networks and innovation: A survey of literature. Economics of Innovation and New Technology, 18(1): 39-67.

16. Palmatier R.W., Dant R.P., Grewal D., Evans K.R. (2006). Factors influencing the effectiveness of relationship marketing: A meta-analysis. Journal of Marketing, 70(10): 136-153.

17. Park J.H., Trần T.B.H. (2020). From internal marketing to customer - perceived relationship quality: Evidence of Vietnamese banking firms. Total Quality Management & Business Excellence, 31: 777-799.

18. Slotte-Kock S., Coviello N. (2010). Entrepreneurship research on network processes: A review and ways forward. Entrepreneurship: Theory & Practice, 34(1): 31-57.

19. Soltani S., Azadi H., Witlox F. (2013). Technological innovation drivers in rural small food industries in Iran. Journal of International Food & Agribusiness Marketing, 25(1): 68-83.

20. Story V., O’Malley L., Hart S., Saker J. (2008). The development of relationships and networks for successful radical innovation. Journal of Customer Behaviour, 7(3): 187-200.

21. Taherparvar N., Esmaeilpour R., Dostar M. (2014). Customer knowledge management, innovation capability and business performance: A case study of the banking industry. Journal of Knowledge Management, 18(3): 591-610.

22. Von Krogh G., Spaeth S., Lakhani K.R. (2003). Community, joining, and specialization in open source software innovation – A case study. Research Policy, 32(7): 1217-1241.

23. Yavarzadeh M.R., Salamzadeh Y., Dashtbozorg M. (2015). Measurement of organizational maturity in knowledge management implementation. International Journal of Economic, Commerce and Management, III(10): 318-344.

24. Zakrzewska-Bielawska A. (2018). The relationship between managers network awareness and the relational strategic orientation of their firms: Findings from interviews with Polish managers. Sustainability, 10: 2691-2699.

About the Authors

A. V. TrachukRussian Federation

Doctor of economic sciences, professor, dean of faculty “Higher School of Management”, Financial University under the Government of the Russian Federation; general director, “Goznak” JSC (Moscow, Russia). https://orcid.org/0000-0003-2188-7192. Research interests: strategy and management of the companyʼs development, innovation, entrepreneurship and modern business models in the financial and real sectors of the economy, dynamics and development of e-business, operating experience and prospects for the development of natural monopolies.

N. V. Linder

Russian Federation

Doctor of economic sciences, professor, head of Department of Management and Innovations, deputy dean of faculty “Higher School of Management”, Financial University under the Government of the Russian Federation (Moscow, Russia). http://orcid.org/0000-0002-4724-2344. Research interests: strategy and development management companies, formation of development strategy of industrial companies in the context of the fourth industrial revolution, innovation transformation of business models, dynamics and development of e-business development strategies of companies in the energy sector in the fourth industrial revolution, exit strategies of Russian companies on international markets.

Review

For citations:

Trachuk A.V., Linder N.V. THE INFLUENCE OF INTERCOMPANY RELATIONS ON THE INNOVATION PERFORMANCE: АN EMPIRICAL STUDY OF RUSSIAN INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2022;13(2):108-115. https://doi.org/10.17747/2618-947X-2022-2-108-115