Scroll to:

APPROACHES TO MANAGING INNOVATIVE RISKS OF INDUSTRIAL COMPANIES

https://doi.org/10.17747/2618-947X-2021-4-354-363

Abstract

The article reviewed the literature, which made it possible to identify groups of industrial companies in terms of sustainability and sensitivity to innovation risks. The conducted cluster analysis made it possible to single out four groups of Russian industrial companies according to the level of stability and sensitivity to innovation risks: leaders, innovators, conservatives and low-performing companies.

A study was also conducted to identify the level of risk appetite and the level of risk management culture for each cluster of industrial companies in terms of sustainability and sensitivity to innovative risks. As part of the study, approaches to risk management were identified for each cluster of industrial companies in terms of the level of sustainability and sensitivity to innovative risks. The article proposes measures to improve the risk management system of industrial companies. These activities will ensure the continuous development of industrial companies and increase their level of competitiveness.

Keywords

For citations:

Kuznetsova M.O. APPROACHES TO MANAGING INNOVATIVE RISKS OF INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2021;12(4):354-363. https://doi.org/10.17747/2618-947X-2021-4-354-363

Introduction

In the context of widespread robotization and digitalization, the influence of innovative risks on the development of industrial companies and their competitiveness is increasing. This is due to the processes of globalization, transformation and the emergence of new markets, changes in the level of demand, and the complication of technologies. Under the current conditions, it is important to ensure the ability of companies to withstand emerging threats and risks, which depends on many factors, including the level of risk management culture in the company, the risk management approach in it, as well as the level of risk appetite. Risk management is a reliable tool in the management of innovative risks due to modern conditions.

-

The level of resilience and risk sensitivity of industrial companies

The ability of Russian industrial companies to manage innovation risks depends on the level of sustainability and sensitivity to them. To ensure the competitiveness of industrial companies, the consulting company PWC proposed to follow two strategies at the same time: the creation of flexible and sensitive risk management systems that allow you to quickly adapt to emerging innovative risks; ensuring the stability of companies, which will minimize emerging risks. Ensuring sensitivity to risks will allow to use the capabilities of industrial companies for their long-term development, resistance to risks will help them to achieve their goals [A path to the goal .., 2016].

Based on a review of Russian and foreign literature, a matrix of sustainability and sensitivity to innovation risks was developed (Table 1). The matrix of stability and sensitivity to risks was taken as a basis, proposed by the consulting company PWC [Path to the goal.., 2016], which conducted a study in terms of the stability and sensitivity of companies to all types of risks. The author of this paper explores sustainability and sensitivity to innovation risks. Within the framework of this study, a matrix of the level of stability and sensitivity to innovation risks was constructed in terms of two parameters: the level of stability and the level of sensitivity to innovation risks. Risk resilience implies a company's ability to manage innovation risks through well-established business processes within the company, a strong corporate culture, and advanced risk management. Risk sensitivity implies the ability to adapt to emerging risks and the company's ability to be flexible [Way to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021]. In this regard, industrial companies can be divided into four groups according to the level of stability and sensitivity to innovation risks: leaders, innovators, conservatives, and low-performing companies.

Let us consider each group of industrial companies in terms of the level of sustainability and sensitivity to innovation risks in more detail.

Leaders include industrial companies that have a high level of risk tolerance and a high level of risk sensitivity. This means that leading companies are able to reflect the threats and innovative risks of the external environment due to the availability of the necessary resources, as well as quickly adapt to emerging innovative risks [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

Innovators are companies that have a high level of sensitivity to innovation risks, but a low level of resistance to them. Innovative companies may not have a sufficient level of internal strength to manage risks, but they are flexible and can quickly adapt to emerging environmental conditions [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al, 2021].

Conservatives include companies that have low sensitivity to innovation risks, but these companies are resistant to innovation risks. In this regard, industrial companies belonging to the category of "Conservatives" can manage innovation risks due to strong risk management and developed corporate culture [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

Low-performing industrial companies include those organizations that have a low level of resistance to innovation risks and a low level of sensitivity to innovation risks. These companies cannot effectively manage innovation risks either from the standpoint of flexibility or from the standpoint of having internal resources [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

-

Methodology for assessing industrial companies in terms of sustainability and sensitivity to innovation risks

The proposed resilience and risk sensitivity matrix has been tested. A cluster analysis was carried out, which made it possible to identify homogeneous groups of industrial companies in terms of sustainability and sensitivity to innovation risks, which helped to identify barriers and bottlenecks in the implementation of a risk management system for industrial companies.

The study was carried out in two stages. At the first stage, a survey of Russian industrial companies was conducted in order to identify their level of sustainability and sensitivity to innovation risks. 200 questionnaires were sent out, with a response rate of 59% (117 industrial companies). At the second stage, a cluster analysis was carried out based on the results of the survey. Clustering of industrial companies was carried out using the Statistica software package.

The cluster analysis was carried out in three stages [Birch, 2015; Sharpe, 2018; Example of use.., 2020; Hallikas et al., 2020; Fraser et al., 2021].

- 1. Ten factors (variables) were selected for cluster analysis. Each variable reflects one of the evaluation parameters: the level of resistance to innovation risks or the level of sensitivity to innovation risks. Variables that were selected to reflect the parameter of the level of sensitivity to innovation risks: recognition of innovative opportunities for the company before competitors; applying business intelligence to recognize innovative opportunities; rapid realization of the company's growth opportunities through innovation; adaptation of the organizational structure for the implementation of innovative opportunities; timely adaptation to innovative changes in business. The variables that were selected to reflect the level of risk tolerance parameter are: mobilization of the company's internal resources to take effective measures in the field of innovation; prompt implementation of plans to ensure the continuity of the company's innovative activities after emerging threats; prompt instruction of the company's stakeholders about the measures taken in the field of innovation; timely attraction of external resources in the event of risks associated with innovation; timely financing of continuity risks of innovation activity [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

- As part of the second stage, standardization (normalization) of indicators was carried out in order to be able to compare the composition of the compared groups according to the formula (1) [Example of use .., 2020]:

, (1)

, (1)

where xsi – is the standardized value of the i factor, xi is the actual value of the i factor,  is the average value of the i factor, σi2 is the standard deviation of the i factor.

is the average value of the i factor, σi2 is the standard deviation of the i factor.

- At the third stage, cluster analysis was carried out using the k-means method.

-

The results of cluster analysis of industrial companies in terms of sustainability and sensitivity to innovation risks

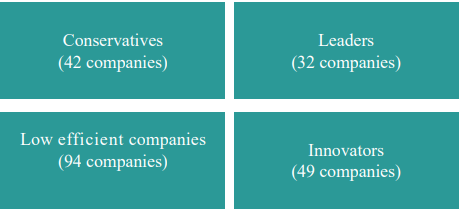

Based on the cluster analysis of industrial companies in terms of sustainability and sensitivity to innovation risks, four groups of companies were identified. The results of cluster analysis are shown in Fig.1.

Thus, four clusters of industrial companies were identified according to the level of sustainability and sensitivity to innovation risks.

The Leaders cluster includes industrial companies that have a high level of resistance to innovation risks. They are characterized by the mobilization of internal resources of the company to take effective measures in the field of innovation; prompt implementation of plans to ensure the continuity of the company's innovative activities after emerging threats; prompt informing the company's stakeholders about the measures taken in the field of innovation; timely attraction of external resources in the event of risks associated with innovation; timely financing of the risks related to continuity of innovation activity. Also, these companies have a high level of sensitivity to innovation risks: recognition of innovative opportunities for the company ahead of competitors; applying business intelligence to recognize innovative opportunities; rapid realization of the company's growth opportunities through innovation; adaptation of the organizational structure for the implementation of innovative opportunities; timely adaptation to innovative changes in business [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

The "Innovators" cluster includes industrial companies that have a high level of sensitivity to innovation risks: recognition of innovative opportunities for the company ahead of competitors; applying business intelligence to recognize innovative opportunities; rapid realization of the company's growth opportunities through innovation; adaptation of the organizational structure for the implementation of innovative opportunities; timely adaptation to innovative changes in business. However, such industrial companies have a low level of resistance to innovation risks: mobilization of the company's internal resources to take effective measures in the field of innovation; prompt implementation of plans to ensure the continuity of the company's innovative activities after emerging threats; prompt informing the company's stakeholders about the measures taken in the field of innovation; timely attraction of external resources in the event of risks associated with innovation; timely financing of the risks related to continuity of innovation activity [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

The cluster "Conservatives" includes industrial companies that have a low level of sensitivity to innovation risks: recognition of innovative opportunities for the company ahead of competitors; applying business intelligence to recognize innovative opportunities; rapid realization of the company's growth opportunities through innovation; adaptation of the organizational structure in order to implement innovative opportunities; timely adaptation to innovative changes in business. At the same time, these industrial companies have a high level of resistance to innovation risks: mobilization of the company's internal resources to take effective measures in the field of innovation; prompt implementation of plans to ensure the continuity related to the company's innovative activities after emerging threats; promptly informing the company's stakeholders about the measures taken in the field of innovation; timely attraction of external resources in the event of risks associated with innovation; timely financing of the risks of continuity of innovation activity [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

The "Low-performing companies" cluster includes industrial organizations that have a low level of resistance to innovation risks: mobilization of the company's internal resources to take effective measures in the field of innovation; prompt implementation of plans to ensure the continuity of the company's innovative activities after emerging threats; prompt informing the company's stakeholders about the measures taken in the field of innovation; timely attraction of external resources in the event of risks associated with innovation; timely financing of the risks related to the continuity of innovation activity. At the same time, industrial companies of this cluster have a low level of risk sensitivity parameters: recognition of innovative opportunities for the company ahead of competitors; applying business intelligence to recognize innovative opportunities; rapid realization of the company's growth opportunities through innovation; adaptation of the organizational structure in order to implement innovative opportunities; timely adaptation to innovative changes in business [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

The cluster of industrial companies that belong to the group of low-performing companies turned out to be the most numerous (94 companies), which indicates a low level of innovation risk management culture, the inability to effectively implement a comprehensive risk management system. Such companies cannot develop effectively and have a low level of competitiveness.

To confirm the accuracy and efficiency of cluster analysis, an analysis of variance was carried out [Birch, 2015; Sharpe, 2018; Example of use.., 2020; Hallikas et al., 2020; Fraser et al., 2021], the results of which are presented in Table. 2. They confirm the high efficiency of the performed cluster analysis.

The reliability and effectiveness of the cluster analysis performed was confirmed by the following criteria [Birch, 2015; Sharpe, 2018; Example of use.., 2020; Hallikas et al., 2020; Fraser et al., 2021]:

- Inequality of F-criterion values. The hypothesis about the inequality of variances between clusters is confirmed. At the same time, the hypothesis about the inequality of dispersions within clusters was proved.

- Values of significance levels (p< 0,05) сindicate a low level of unreliability of the obtained research results in cluster analysis. Therefore, the allocation of four homogeneous groups of industrial companies in terms of sustainability and sensitivity to innovation risks is justified. Therefore, the results of the conducted cluster analysis are reliable and effective.

-

Research of risk management systems of industrial companies of various clusters in terms of sustainability and sensitivity to innovation risks

Within the framework of this article, a study was conducted to analyze risk management culture of each cluster of industrial companies regarding the level of sustainability and sensitivity to innovative risks.

Table 3 presents the results of a survey of 117 industrial companies that were asked to evaluate their risk appetite, that is, the maximum possible level of risk that an industrial company is ready to take [Birch, 2015; Risk Management.., 2018; Zhou et al., 2021].

Leading companies have a high level of risk appetite - this was noted by 78% of respondents. Only 19% of the leading companies said that they adhere to the average level of risk appetite in their activities. This is due to the fact that such industrial companies are quite flexible, that is, they can quickly adapt to the conditions of the external environment. At the same time, leading industrial companies have a sufficient reserve of resources, which makes it possible to ensure their sustainability.

Companies-innovators (63% of respondents) and conservatives (67% of respondents) are characterized by an average level of risk appetite. This means that such industrial companies pursue a moderate risky policy, but they are characterized by low resistance to innovation risks, as for innovators, or low sensitivity to innovation risks as for conservatives. In this regard, industrial companies cannot fully take high-risk decisions, as this can have detrimental consequences for them.

Low-performing industrial companies noted that they have a low level of risk appetite and are not ready to make high-risk decisions. This position is shared by 74% of the respondents. Only 11% of respondents noted that they are characterized by a high level of risk appetite, and 15% of respondents identified the average level of the company's risk appetite.

It should be noted that, according to the results of the study, the higher the level of stability and sensitivity to innovative risks of industrial companies, the higher the level of their risk appetite and the more risky decisions they are ready to take.

Within the framework of this article, a study was also conducted in terms of the risks affecting the innovative activities of industrial companies of various clusters regarding the level of sustainability and sensitivity to innovative risks [Risk management.., 2018; Wang, Bi, 2020; Haar and Gregoriou 2021]. The results of a survey of 117 industrial companies are presented in Table 4.

Thus, low-performing companies are exposed to a high level of various risks. Respondents noted innovative, operational and market risks that affect various types of innovative activities of industrial companies.

For innovators and conservatives, the level of risks that pose a threat to their innovation activities is lower, but the impact of innovation risks is quite high.

According to the results of the survey, it was revealed that market risks are the most significant for leading companies and they should be treated with special attention.

The article also conducted a study of what programs and tools (technologies) are used by industrial companies of various clusters towards the level of sustainability and sensitivity to innovative risks in risk management [Risk Management.., 2018; Fujii, 2021; Jia et al., 2021]. The survey results are presented in Table. 5.

Leading companies are actively using digital technologies such as big data, cloud technologies and blockchain in their risk management activities. Also, at a fairly high level, artificial intelligence and virtual reality technologies are used.

Industrial innovators and conservatives are quite active in risk management when they use big data and cloud technologies, but to a lesser extent they use blockchain technologies, artificial intelligence and virtual reality.

Low-performing companies use only cloud technologies and big data in their risk management activities to a small extent.

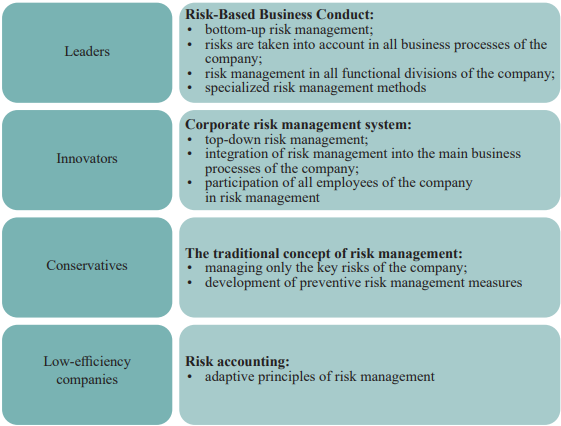

As part of this study, a survey of industrial companies was conducted in terms of identifying the risk management approach that companies adhere to. The research results are presented in Fig. 2.

Thus, based on a survey of industrial companies of various clusters in terms of sustainability and sensitivity to innovation risks, it was revealed that low-performance companies are characterized only by taking into account some risks, and their management is adaptive in order to eliminate the consequences of emerging risks. Conservative companies adhere to the traditional concept of risk management. This means that only certain risks are managed in an industrial company, and some preventive measures are being developed to manage them. Innovative companies adhere to the corporate risk management system. This means that risk management is integrated into the company's core business processes. At the same time, absolutely all employees of an industrial company are involved in risk management processes; risk management in this case acts as a tool for business planning; risk management is carried out on a top-down basis. Leading companies adhere to risk-based business conduct in risk management; risk management is carried out on a bottom-up basis. Risk management processes are integrated into all vertical and horizontal levels an industrial company management; special methods of risk assessment and management are also applied [Management of operational risks.., 2018; Kamiya et al., 2020; Yingfan et al., 2020; Elahi, 2022].

Thus, leading companies are characterized by the highest level of risk management. It is important for industrial companies of all clusters to achieve a risk-based business approach in their activities, which will ensure the continuous development of an industrial company and a high level of competitiveness.

Table 1

The matrix of sustainability and sensitivity to innovation risks

|

Low sensitivity to innovation risks |

High sensitivity to innovation risks |

|

|

High resistance to innovation risks |

Conservatives |

Liders |

|

Low resistance to innovation risks |

Low effective companies |

Novators |

Source: compiled by the author according to [A path to the goal.., 2016; Bai et al., 2020; Avagyan et al., 2021].

Fig. 1. Clusters of industrial companies by the level of sustainability and sensitivity to innovation risks

Source: compiled by the author.

Table 2

Results of the analysis of variance

|

Variables |

Dispersion analysis |

|||||

|

Dispersion between clusters |

Number of freedoms for interclass variance |

Intragroup dispersion |

Number of liberties for intragroup dispersion |

The value of the F-criterion for testing the hypothesis of inequality of variances between clusters within them |

Significance levels (p) |

|

|

Recognizing innovative opportunities for the company ahead of competitors |

18.88520 |

3 |

0.114796 |

16 |

877.394 |

0.000000 |

|

Using Business Intelligence to Recognize Innovation Opportunities |

18.93366 |

3 |

0.066341 |

16 |

1522.119 |

0.000000 |

|

Rapid realizing of company growth opportunities through innovation |

18.88555 |

3 |

0.114452 |

16 |

880.042 |

0.000000 |

|

Adaptation of the organizational structure to realize innovative opportunities |

18.93466 |

3 |

0.065336 |

16 |

1545.618 |

0.000000 |

|

Timely adaptation to innovative business changes |

18.91766 |

3 |

0.082338 |

16 |

1225.361 |

0.000000 |

|

Mobilization of the internal resources of the company to take effective measures in the field of innovation |

13.19407 |

3 |

5.805927 |

16 |

12.120 |

0.000217 |

|

Prompt implementation of plans to ensure the continuity of the company's innovative activities after emerging threats |

12.99625 |

3 |

6.003754 |

16 |

11.545 |

0.000281 |

|

Prompt informing of the company's stakeholders about the measures taken in the field of innovation |

13.40904 |

3 |

5.590959 |

16 |

12.791 |

0.000161 |

|

Timely attraction of external resources in the event of risks associated with innovation |

13.37311 |

3 |

5.626885 |

16 |

12.675 |

0.000170 |

|

Timely financing of innovation continuity risks |

13.05655 |

3 |

5.943445 |

16 |

11.716 |

0.000260 |

Source: compiled by the author.

Table 3

The level of risk appetite of industrial companies of various clusters in terms of sustainability and sensitivity to innovation risks

|

Company clusters |

Low level of risk appetite |

Middle level of risk appetite |

High level of risk appetite |

|||

|

Number of companies |

Share of companies in the cluster (%) |

Number of companies |

Share of companies in the cluster (%) |

Number of companies |

Share of companies in the cluster (%) |

|

|

Leaders |

1 |

3 |

6 |

19 |

25 |

78 |

|

Innovators |

8 |

17 |

31 |

63 |

10 |

20 |

|

Conservatives |

6 |

14 |

28 |

67 |

8 |

19 |

|

Low effective companies |

70 |

74 |

14 |

15 |

10 |

11 |

Source: compiled by the author according to [Birch, 2015; Risk Management.., 2018; Zhou et al., 2021].

Table 4

Risks affecting the innovative activity of industrial companies

|

Innovative activities |

Leaders |

Innovators |

Conservatives |

Low-efficiency companies |

|

Implementation of new technologies in production processes in order to improve existing products |

Market risks |

Innovation risks |

Operational risks |

Innovation risks, market risks, operational risks |

|

Introduction of new technologies into production processes in order to develop new products |

Market risks |

Innovation risks |

Market risks |

Innovation risks, market risks, operational risks |

|

Implementation of marketing innovations |

Market risks |

Market risks |

Market risks |

Market risks |

|

Innovations in IT sphere |

Innovation risks |

Innovation risks |

Innovation risks |

Инновационные риски |

|

Changes in the personnel model of the company |

Operational risks |

Operational risks |

Operational risks |

Operational risks |

|

Changes in the company's business model |

Innovation risks, market risks, operational risks |

Innovation risks, market risks, operational risks |

Innovation risks, market risks, operational risks |

Innovation risks, market risks, operational risks |

Source: compiled by the author according to [Risk management.., 2018; Wang, Bi, 2020; Haar and Gregoriou 2021].

Table 5

The use of digital technologies related to robotics in the management of innovative risks of industrial companies

|

Digital instruments (programmes) |

Share of surveyed companies in the cluster (%) |

|

Leaders |

|

|

Artificial intelligence |

63 |

|

Cloud technologies |

88 |

|

Big data |

91 |

|

Blockchain |

64 |

|

Virtual reality |

61 |

|

Innovators |

|

|

Artificial intelligence |

53 |

|

Cloud technologies |

62 |

|

Big data |

64 |

|

Blockchain |

49 |

|

Virtual reality |

43 |

|

Conservatives |

|

|

Artificial intelligence |

57 |

|

Cloud technologies |

61 |

|

Big data |

65 |

|

Blockchain |

43 |

|

Virtual reality |

44 |

|

Low-efficiency companies |

|

|

Artificial intelligence |

0 |

|

Cloud technologies |

17 |

|

Big data |

3 |

|

Blockchain |

0 |

|

Virtual reality |

0 |

Source: compiled by the author according to [Risk management.., 2018; Fujii, 2021; Jia et al., 2021].

Fig. 2. Approaches to risk management of industrial companies, taking into account their level of resilience and sensitivity to innovative risks

Source: compiled by the author according to [Operational Risk Management.., 2018; Kamiya et al., 2020; Yingfan et al., 2020; Elahi, 2022].

-

Recommendations for risk management

To ensure effective management of innovation risks in all clusters of industrial companies in terms of sensitivity and resistance to innovation risks, it is necessary to provide a model of three lines of defense, which involves three levels of risk management [Management of operational risks.., 2018; Sakai, 2018; Niu et al., 2021]:

First line of defense. At this level, risk management should be carried out by heads of business functions in companies whose competencies include:

- Management of risks;

- introduction of risk management into the company's business processes;

- identification and assessment of risks.

Second line of defense. Risk management at this level should be carried out by the risk management service, whose functions are:

- description of risk management processes;

- taking into account risks when building the company's strategy;

- management, coordination and control of risks at all levels of management in an industrial company;

- building links between the first and third lines of defense;

- control over individual risk groups.

Third line of defense. At this level of risk management, an internal audit of an industrial company is carried out:

- providing communication with the company's management when it comes to risk management monitoring;

- ensuring systematization in risk assessment and reporting;

- providing control over the second line of defense in terms of the risk management process.

Building a model of three-line defense in innovation risk management will allow to create a comprehensive risk management system that will cover all vertical and horizontal levels of company management.

At the same time, to ensure comprehensive systemic risk management in industrial companies, it is necessary to adhere to the principles of Risk Intelligent [Risk under control.., 2017; Niu et al., 2021]:

- Ensuring a unified understanding and approach to risk management in all departments of the company and at all levels of management, which will ensure a unified vision of the company in this matter and eliminate contradictions as much as possible in the risk management process.

- It is important to adhere to a single risk management model for an industrial company within a certain risk management standard (COSO, CoCo, FERMA, CAS, AS/NZS, etc.). The chosen risk management model will allow building a comprehensive risk management system in an industrial company, adapting it to the specifics of the company.

- Ensuring those responsible for managing each risk in the company in all departments and at all levels of company management. This will ensure transparency and clarity in risk management, since each division is responsible for certain groups of risks.

- The adoption of risk management policy is one of the functions of the company's management. It is responsible for the adopted risk management policy, as well as for the risk management program implemented in the industrial company.

- It is important to ensure continuous monitoring and control of the functioning risk management system, which will correct bottlenecks and ensure continuous risk management.

Thus, providing a model of three lines of defense in risk management of industrial companies, taking into account the principles of Risk Intelligent, will allow the company to increase the level of resistance to all risks and the level of sensitivity to them, which will make the company more competitive.

-

Conclusions and results

The article presents the results of a cluster analysis of industrial organizations in terms of sustainability and sensitivity to innovation risks. Four groups of industrial companies have been identified according to the level of stability and sensitivity to innovation risks: leaders, innovators, conservatives and low-performing companies. The division of companies into four clusters made it possible to identify problems and bottlenecks in the management of innovative risks of industrial companies.

The article also conducted a study of risk management culture and the level of risk appetite. For each cluster of industrial companies, the level of risk appetite that the company is ready to take is determined. The study made it possible to determine the risks that affect various types of innovative activities of industrial companies of various clusters in terms of the level of sustainability and sensitivity to innovative risks. The approach to risk management of industrial companies, significant for each cluster, is also defined.

It should be noted that in order to ensure the development and competitiveness of industrial companies in various clusters in terms of sustainability and sensitivity to innovative risks, it is necessary to build a model of three-line defense in risk management, as well as adhere to the principles of Risk Intelligent. These measures will ensure a comprehensive risk management system.

References

1. Birch K. (2015). Risk appetite: Don’t bite off more than you can swallow. https://www.cfin.ru/finanalysis/risk/Risk_Appetite.shtml. (In Russ.)

2. An example of using STATISTICA cluster analysis in auto insurance (2020). StatSoft. http://statsoft.ru / solutions / ExamplesBase / branches / detail. php?ELEMENT_ID=1573. (In Russ.)

3. Path to goal: Balancing resilience and risk sensitivity for success (2016). PWC. https://www.pwc.ru/ru/riskassurance/publications/assets/risk_in_review_2016_rus.pdf. (In Russ.)

4. Risk under control. Nine principles for building a Risk Intelligent organization (2017). Deloitte. https://www2.deloitte.com/content/dam/Deloitte/ru/Documents/risk/russian/risk-control.pdf. (In Russ.)

5. Enterprise operational risk management: current status and prospects (2018). KPMG. http://debaty.club/sites/default/files/od2018/od2018_13_korotezky.pdf. (In Russ.)

6. Managing risk for sustainable growth in an age of innovation (2018). PWC. https://www.pwc.ru/ru/riskassurance/publications/assets/pwc-2018-risk-in-review-russian.pdf. (In Russ.)

7. Avagyan V., Camacho N., Stremersch S. (2021). Financial projections in innovation selection: The role of scenario presentation, expertise, and risk. International Journal of Research in Marketing, October.

8. Elahi B. (2022). Chapter 6: Risk management standards. In: Safety risk management for medical devices. 2nd ed. Elsevier: 35-38.

9. Fraser J., Quail R., Simkins B. (2021). Questions that are asked about enterprise risk management by risk practitioners. Business Horizons, Febr. 25. DOI:10.1016/J.BUSHOR.2021.02.046.

10. Fujii S. (2021). Basic strategies for risk management to minimize total damage due to COVID-19. IATSS Research, 45(4): 391-394.

11. Haar L., Gregoriou A. (2021). Risk management and market conditions. International Review of Financial Analysis, 78.

12. Hallikas J., Lintukangas K., Kähkönen A.-K. (2020). The effects of sustainability practices on the performance of risk management and purchasing. Journal of Cleaner Production, 263.

13. Jia P., Guo T., Nojavan S. (2021). Risk-based energy management of industrial buildings in smart cities and peer-to-peer electricity trading using second-order stochastic dominance procedure. Sustainable Cities and Society, 77.

14. Kamiya S., Kang J.-K., Stulz R.M. (2020). Risk management, firm reputation, and the impact of successful cyberattacks on target firms. Journal of Financial Economics, 139(3).

15. Liu B., Ju T., Yu Ch.-F. (2020). Imitative innovation and financial distress risk: The moderating role of executive foreign experience. International Review of Economics & Finance, 71: 526-548.

16. Niu Y., Ying L., Sivaparthipan C.B. (2021). Organizational business intelligence and decision making using big data analytics. Information Processing & Management, 58.

17. Sakai Y. (2018). On the economics of risk and uncertainty: A historical perspective. Discussion Papers CRR Discussion Paper Series A: General 28, Shiga University.

18. Sharpe K. (2018). On risk and uncertainty, and objective versus subjective probability. The Economic Record, The Economic Society of Australia, 94(S1): 49-72.

19. Wang L., Bi X. (2020). Risk assessment of knowledge fusion in an innovation ecosystem based on a GA-BP neural network. Cognitive Systems Research, 66: 201-210.

20. Yingfan G., Na L., Changqing Y. (2020). A method for company-specific risk factors analysis in the view of cross analysis. Procedia Computer Science, 174: 375-381.

21. Zhou B., Li Yu., Zhou Zh. (2021). Executive compensation incentives, risk level and corporate innovation. Emerging Markets Review, 47.

About the Author

M. O. KuznetsovaРоссия

Senior lecturer, Department of Management and Innovation, Faculty «Higher school of management», Financial University under the Government of the Russian Federation (Moscow, Russia). Author ID: 831439; https://orcid.org/0000-0003-4403-3800. Research interests: strategic sustainability, risk management, strategic management.

Review

For citations:

Kuznetsova M.O. APPROACHES TO MANAGING INNOVATIVE RISKS OF INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2021;12(4):354-363. https://doi.org/10.17747/2618-947X-2021-4-354-363

JATS XML