Scroll to:

THE CONSUMER BEHAVIOR AND THE FORMATION OF VALUE IN THE RUSSIAN MARKET OF WINE PRODUCTS

https://doi.org/10.17747/2618-947X-2021-4-322-334

Abstract

The purpose of this article is to analyze consumer behavior and the formation of value proposition in the market of wine products. The analysis of sales of wine products, as well as the analysis of preferences in the choice of alcoholic beverages in Russia has been carried out. The analysis was based on a survey of 372 Russian consumers of wine products, as well as 47 wine companies from six Russian regions. The survey showed that the most valuable characteristics for wine producers and consumers are the following: taste and price, price-quality ratio, aesthetics (design and packaging), composition, brand, possibility to taste and country of production. At the same time, it is possible to distinguish a number of different features between the value for consumers and the formation of the value proposition wine companies and consumers distinguish. The results of this study were the conclusions that wine producers should consider in the formation of the value proposition: the appearance of packaging, product disclosure, discounts and promotions.

Keywords

For citations:

Khachatryan A.A. THE CONSUMER BEHAVIOR AND THE FORMATION OF VALUE IN THE RUSSIAN MARKET OF WINE PRODUCTS. Strategic decisions and risk management. 2021;12(4):322-334. https://doi.org/10.17747/2618-947X-2021-4-322-334

Introduction

In recent decades, one of the priority sectors in the Russian economy has become wine industry. Products of wineries are in high consumer demand, providing cash flow to the regional and federal budgets.

In the Soviet Union, there were more than 200 thousand hectares of vineyards. The anti-alcohol campaign of 1985-1987 caused enormous damage to the Soviet wine industry, led to a reduction in the area of vine plantations and a decline in production. The newest round of development in Russian winemaking occured only in the early 2000s, but the industry still needs significant investment and innovative development.

In the current conditions, Russian market is facing a number of unfavorable factors leading to a high level of uncertainty, dynamism and hostility, which requires companies to form a strategy that ensures long-term competitiveness and business success.

Wine production in Russia is only 7% of the total output of alcoholic beverages in volume terms (80% is beer, 8% is vodka). Viticulture and winemaking is a rather expensive business with a longer investment cycle, higher capital intensity and a longer payback period (about 5 years from planting a vine to selling wine) than the production of vodka or beer. Nevertheless, a revival of winemaking can be expected, since, despite the pandemic and the decline in incomes of the population, a culture of alcohol consumption is developing in Russia. The preferences of Russians are shifting from strong drinks towards still (+3% in 2020) and sparkling (+4.1%) wines, as well as beer (+4.2%).

The analysis of wine sales in Russia shows the following situation. According to the Rosstat report (Table 1), 88.8 million decaliters (dL) of wine products were sold in the Russian Federation in 2020, excluding sparkling wines and champagne, which is 5.8% less than in 2019.

If we consider only wine, sales in the country, on the contrary, increased by 3% to 55 million dL. The volume of sales of sparkling wines and champagne amounted to 17.8 million dL, it increased by 4.1%.

Table 1

Sale of alcoholic beverages to the population of Russia

|

Product |

2020 |

2019 |

||

|

Mln dL |

% by 2019 |

Mln dL |

% by 2019 |

|

|

Vodka and liquors |

84.8 |

101.9 |

83.2 |

99.9 |

|

Cognac |

11.8 |

98.3 |

12.0 |

104.3 |

|

Wine products (without sparkling wines and champagnes) |

88.8 |

94.2 |

94.3 |

98.8 |

|

Including wine |

55.0 |

103.0 |

53.4 |

102.3 |

|

sparkling wines and champagnes |

17.8 |

104.1 |

17.1 |

101.2 |

|

Beer and beer drinks |

751.1 |

104.2 |

721.8 |

98.5 |

Source: compiled by the author based on: Rosstat. Socio-economic situation in Russia, 2021: https://rosstat.gov.ru/compendium/document/50801.

Over the past two decades, Russian winemakers have faced a number of economic, social and political challenges. These include changing global patterns of production and consumption of wine products, growing competition, as well as tightening legal regulation. In addition, the industry is characterized by high barriers to entry and sophisticated consumers. This makes it relevant to study consumer behavior and create new value for consumers, which allows them to derive the greatest benefit from an unfavorable economic environment.

The purpose of this article is to study consumer behavior and the formation of a value proposition by wine companies in Russia.

-

Formation of customer value: a theoretical review

The formation of the value proposition concept began in the 1980s and was marked by the works of M. Bower and R. Garda [Bower, Garda, 1986]. Scientists introduced the concept of a value delivery system and introduced the concept of "differentiating benefits". According to the findings of the researchers, there is a difference between the traditional (physical) approach to the process of creating a product (physical process sequence), which includes only the stages of production and sale, and the value approach (through the value delivery system), which consists of the stages of selection, provision and communication of value.

An article written by M. Lanning and E. Michaels, McKinsey’s consultants, [Lanning, Michaels, 1988] provided a more detailed analysis of the value delivery system. The value proposition consisted of several theses which answer the question: "Why should customers buy the company's products and services?" Lanning and Michaels pointed out that the main components of this concept are "benefit or advantage provided to a certain group of customers at a certain price at a certain level of costs." The researchers also gave a definition of consumer value, the key aspects of which were stated values (benefits provided) and the total cost of the product (total cost for a product). The work discussed in detail the previously mentioned stages of choosing, providing and communicating value (in particular, it was mentioned that at the stage of choosing a value proposition, customer needs are identified and value is positioned). In the work of [Lanning, Michaels, 1988] examples of successful value propositions were given, and such a tool as a value map was also mentioned for the first time. Of particular note is the fact that the article emphasized the importance of each segment on the value map - a topic that was ignored in the most subsequent work on value propositions.

Lanning's later work focused more on the managerial aspect. The author emphasized that the success of a value proposition depends not only on its choice, but also on "the thoroughness, originality and innovativeness with which it is presented and communicated."

Lanning's next work, co-authored with L. Phillips [Lanning, Phillips, 1992], revised the early concept of customer value, with an emphasis on identifying and generating a range of benefits that are of value to existing and potential users. This article emphasized the need to create value propositions in all key market segments that are in the focus of the company.

While some scholars have studied value propositions from a theoretical point of view, trying to clarify the concept and its elements, others have focused on works that are empirical in nature. Among such studies, one should note the work on the so-called value disciplines, the authors of which were prominent American scientists M. Tracy and F. Wiersema [Treacy, Wiersema, 1993]. It should be noted that the concepts of value disciplines and value propositions are interrelated, but not identical. The undeniable value of the work of Tracey and Wiersam lies in raising the general level of awareness of the above listed concepts in the management environment. The researchers noted that enterprises must choose one of three value disciplines (ways to provide a particular value to the consumer):

1) operational excellence: providing the consumer with a reliable product (or service), ensuring its delivery, cost-effective and with minimal inconvenience;

2) proximity to the consumer (customer intimacy): point segmentation of markets and adaptation of goods (or services) to meet specific consumer needs;

3) product leadership: offering the most modern (innovative) product (or service) to the end consumer, often carried out in the context of a dynamically developing marketing campaign (emphasis on the timing of the product, its design, etc.).

A year after the release of Tracey and Wiersam's work, the concept of value proposition has been further developed. In particular, it should be noted the popularization of value maps, the ideas of which were formulated earlier in McKinsey. Thus, in the work of American researchers from New York University A. Kambil, A. Ginsberg and M. Bloch [Kambil et al., 1996], the first definitions and examples of the use of the concepts of "value map" and "value frontier”). Under the value map, scientists understood a schematic representation of “the positions of companies in the same industry in terms of efficiency and costs for the client,” and the value boundary was “the maximum possible efficiency for the company at a given cost (for the client) in the current conditions.” This study also argued that high-growth companies often focus on the consumer rather than the product (or service) or technology, and thereby create a distinctive value proposition for their customers. Moreover, the authors assessed how customers perceive value at each of the four stages of interaction with a product (or service) - purchase (buy), use, transfer and co-creation of products and services. The interaction at the stage of co-creation of a product (or service) was subsequently refined, as a result of which two main types of this interaction were identified: when the client creates value together with the company (actually co-creates) and when the client combines the product and its additions, which, in turn creates value for it (integrates).

Further exploration of the value proposition concept is also associated with Lanning's name: in this work [Lanning, 1998] he suggested that enterprises define the key parameters of value propositions based on the experience of consumption and use of a product (or service) by customers. In Lanning's new definition of value proposition, the focus was on the considerations that a customer after consuming and using a product (or service), including those related to the price of the product (or service). To develop effective value propositions, the scientist advised companies to “become consumers” by conducting ethnographic research (studying consumers in the natural circumstances of everyday life, taking into account cultural and everyday characteristics).

Based on the ideas of Lanning, S. Smith and J. Wheeler developed the concept of focusing on the experience of consumption and use of a product (or service) in the formation of value propositions [Smith, Wheeler, 2002]. Scholars have argued that as organizations begin to aggregate customer experiences, it is necessary to strive to differentiate those experiences by creating memorable interactions—that is, branded customer experiences. It is this experience that is critical in shaping and delivering the best value proposition. The article emphasized the importance of a company's focus on customer experience design (i.e., managing the customer experience by analyzing how they interact with them) and delivering that experience (i.e., evaluating ways to achieve the outcome desired by customers) when defining the key characteristics of a value proposition.

The development of the value proposition concept in the early 2000s took place in several directions, among which the following can be distinguished:

1) further study of the forms and key elements of value propositions;

2) the study of value propositions in the context of the parties interested in this process (including the study of the process of joint value creation);

3) the study of social, environmental and ethical issues that arise in the formation of value propositions.

Let's take a closer look at each of these areas of research.

Within the framework of the first direction, the works of J. Anderson, J. Narus, V. Van Rossum on the forms of value propositions, as well as the works of T. Rintamaaki, H. Kuusela, L. Mitronen, J. Smith and M. Colgate on the components of the consumer values (customer value dimensions).

[Anderson et al., 2006] described a key shortcoming of the value proposition approach, which only lists what the company considers a customer benefit. In this case, according to scientists, the formation of the so-called brand assertion is not excluded, that is, a situation in which the claimed benefits can be useful, but not of value in solving a specific customer problem. The authors did not deny that the definition of favorable differences (favorable points of difference), that is, a comparative analysis of the company's advantages with competitors, can be one of the forms of value proposition. However, scientists pointed to the likelihood of the so-called presumption of value (value presumption) formation, that is, a situation in which all these advantages are presented as equally important for the client, although favorable differences may, on the contrary, have different values. The article proposed to form a value offer based on a resonating focus: a company needs to identify one or two competitive advantages of a product (or service) that have the highest value for selected customer segments, while the benefits offered may be different in these segments.

The study [Rintamaki et al., 2007], in turn, emphasized that the value proposition should include components that not only provide value to customers, but also ensure the achievement of the company's competitive advantages. The following was proposed as four main components of customer value used in the formation of a value proposition:

1) economic component (for example, saving electricity consumption);

2) functional component (for example, ease of use);

3) emotional component (for example, attractive design);

4) a symbolic component (for example, obtaining a certain status among the consumer's social circle).

The first two components often act as points of parity - associations that are common to all products or services of a certain type or several brands, and the last two components - as points of difference - unique brand associations that should be strong and supportive.

The authors of [Kozlenkova et al., 2014] specified the previously proposed components of consumer value and formulated them as follows:

1) functional value (functional / instrumental value) - the level to which the product is useful and allows the consumer to achieve the goals associated with its use;

2) empirical / hedonic value (experiential / hedonic value) - the level to which the product creates the corresponding experiences, feelings and emotions in the client;

3) symbolic / expressive value - the level to which customers determine the psychological significance of the product;

4) cost/sacrifice value - those costs and sacrifices that the consumer will associate with the use of the product.

Within the framework of the second line of research, it is necessary to single out works related to the concept of reciprocal value propositions. D. Ballantyne was one of the first scholars to formulate this idea [Ballantyne, 2003]. Building on earlier work that recognized the benefits of value propositions that imply value for both the firm and the customer, the scholar emphasized the two-way and reciprocal nature of value judgments. Further studies conducted by both Ballantyne and other authors confirmed the early conclusions of the scientist and supplemented them. In particular, N. Morgan in [Morgan, 2012] argued that if the participants in the value creation process recognize that their goals are complementary and convey this idea during negotiations, the value for both parties will thereby be enhanced. The value in this approach is not so much a strategy or a set of benefits for clients, but a comprehensive process in which the negotiation process plays an important role in creating value for each party.

Subsequently, the concept of mutual value propositions was transformed into the concept of co-created value propositions. This area was explored by such prominent scientists as S. Vargo and R. Lusch [Vargo, Lusch, 2004] who argued that value co-creation is a key component of the service-dominant business logic according to which any production of goods, services or hybrid products should be service-oriented. P. Frow and E. Payne [Payne, Frow, 2005] emphasized the exchange of benefits and sacrifices in the process of creating permanent relationships with clients; K. Kowalkowski et al. [Kowalkowski et al., 2012] suggested using practical observations in the formation of joint value propositions).

Separately, studies should be noted, the focus of which shifted towards a more thorough study of the stakeholders’ influence on the formulated value proposition. This thesis is present in the writings of Lanning, who emphasizes that an enterprise must work with other stakeholders in the value chain to provide an appropriate value proposition for the main player - the customer [Lanning, 2003]. Ballantyne argued that during the process of intra-company integration of resources, interaction with a wide range of stakeholders is inevitable, which, in turn, makes it possible to emphasize their active participation in the formation of a value proposition [Ballantyne, 2003]. J. Mish and D. Scammon stated that enterprises need to formulate for themselves the widest possible range of goals and objectives and, accordingly, involve as many stakeholders as possible in the process of creating a value proposition [Mish, Scammon, 2010].

As part of the third area of research, the attention of scientists was focused on social, environmental and ethical issues related to the formation of a value proposition. One of the first works on this topic was written by J. Emerson [Emerson, 2003], and it dealt with the social and environmental aspects of value proposition formation, regardless of whether the organization that forms such an offer is commercial or non-commercial. This topic was further developed in the article [Spickett-Jones et al., 2004], which showed the importance of the ethical component of value propositions. M. Müller brought the problem of non-economic components in value propositions to a new level. He proposed to consider manufactured products and services from two points of view - in relation to the concept of sustainable development (the transition of society from an irrational way of using resources to a rational one) and to innovation (development of a tool to create innovative products that meet the needs of people and are favorable for the environment, the economy and society) [Müller, 2012]. S. Patala and a group of co-authors [Patala et al., 2016] finally formulated the concept of a sustainable value proposition: it was defined as “the promise of economic, environmental and social benefits that a firm offers to consumers and society as a whole, taking into account the receipt of short-term profits and the achievement of long-term sustainable development.

Modern sholars consider value propositions and its components through the prism of innovation and intrapreneurship (intra-company entrepreneurship). In such studies, the case study method is often used. In this regard, the work of J. Lindic and K. M. da Silva and [Lindic, Marques da Silva, 2011] who argued that the value proposition is “a catalyst for customer-centric innovation”, should be noted. The study systematically examined the innovations created at Amazon. As a result, the authors decomposed the value proposition into five key elements: performance, ease of use, reliability, flexibility and the degree of emotionality (affectivity), thereby forming the concept of PERFA. However, it should be noted that a significant limitation of this work was that within the framework of the named article, a study was not conducted on the influence of the identified elements of the value proposition on each other, and the degree of relevance of these elements in various contexts was not determined (for example, within the product life cycle) or customer life cycle). Nevertheless, the work of da Silva and Lindich provides insight into how companies can unlock unique, innovative value propositions and create potential demand in untapped market niches.

The idea of developing tools for decomposing value propositions in order to stimulate organizations to improve their competitive positions can also be traced in the work of Payne and Frow [Payne, Frow, 2014]. Its value lies in two aspects. First, the authors carried out work to identify the key elements that affect the value proposition, using the example of a healthcare organization (hospitals). Secondly, the method formulated by scientists to determine the components of a value proposition was successfully applied within an organization from another field of activity (a large insurance and investment firm). Separately, it should be noted that the researchers included the concept of value-in-use in the developed methodology, thereby emphasizing not only the importance of learning in the process of improving value propositions, but also the interactive and recursive nature of such learning.

A deep analysis of the relationship between value propositions and the success of intra-company organizational formations of innovative activity that formulate them was carried out by a team of authors led by J. Covin [Covin et al., 2015]. After examining the data from almost one hundred and fifty corporate innovative enterprises, scholars came to the conclusion that the success of such structures depends on their ability to:

- Anticipate the needs of consumers in potential (target) markets for which the formulated value propositions may be of interest;

- adjust these value propositions as the enterprise evolves;

- use the full range of relevant knowledge available to the parent corporation.

According to the authors, in-house innovation entities whose value propositions showed moderate evolution were more successful than those, whose value propositions showed little or no evolution at all.

One of the latest works in which value propositions are viewed through the prism of service-dominant logic is the work of the team of authors led by P. Skaalen [Skålén et al., 2015]. Assuming that a value proposition in the context of service innovation is a combination of several different practices (“routine activities and evaluation systems used to integrate resources into value propositions”) and resources, the researchers further identified ten key practices and formed them into three groups: provision practices, a representational practices group, management and organizational practices group. Moreover, the article argues that the process of creating service innovations can be equated with creating new value propositions by evolving existing practices, creating new practices and/or resources and integrating them in new ways. The value of the work also lies in the presence of a classification of service innovations. Thus, the innovations themselves were divided into adaptation, resource, methodological (based on the practices mentioned above) and combined. Thus, the authors emphasize the fact that successful service innovations are not only about the availability of the necessary practices and resources, but also how they are integrated into the value proposition formulated by the company.

Thus, despite the fact that the concept of a value proposition is at the center of attention of the academic community, research on this issue has often been carried out in different directions, which has given rise to a large number of interpretations of this concept. In this regard, the research question of this study is the understanding of value by Russian wine companies, as well as how their creation of consumer value corresponds to the preferences of Russian consumers.

-

Research methodology

To answer the research question, the preferences of Russian consumers in the wine market were analyzed, as well as the understanding of key elements and the formation of consumer value by companies in wine industry.

The study was conducted between January and May 2021. Electronic questionnaires were sent out to collect consumer opinions. Responses were received from 372 Russian consumers of wine products from 12 Russian regions. Characteristics of consumers are presented in Table 2.

In-depth interviews based on a semi-structured guide were used to collect the opinions of representatives of wine companies regarding key components and value creation. Empirical analysis included several stages: guide development, interviews, content analysis of the data obtained.

At the first stage, based on the results of the theoretical analysis, a guide was developed for conducting in-depth interviews. The purpose of the interview was to collect opinions on building value for customers in their companies. The protocol included questions that related to the definition of value for customers and value-oriented management, as well as the formation of a value proposition in the company.

At the second stage, in-depth interviews were conducted with 47 managers of Russian wine companies representing customer service, sales, innovation, strategic management, marketing, brand managers, etc. The companies are located in six Russian regions (Table 3). The average interview time was about 30 minutes.

Table 2

Characteristics of consumers in the sample

|

Number of respondents in the sample (people) |

Percentage of respondents (%) |

|

|

Women |

197 |

53 |

|

Men |

175 |

47 |

|

Age of respondents |

||

|

18–30 |

67 |

18 |

|

31–45 |

126 |

34 |

|

46–60 |

134 |

36 |

|

60+ |

45 |

12 |

|

Education |

||

|

Higher |

219 |

59 |

|

Secondary professional |

123 |

33 |

|

Secondary |

30 |

8 |

|

Average monthly income |

||

|

Up to 50 000 rub |

115 |

31 |

|

50 000–100 000 rub |

101 |

27 |

|

100 000–200 000 rub |

93 |

25 |

|

200 000–300 000 rub |

48 |

13 |

|

More than 300 000 rub |

15 |

4 |

|

Type of employment |

||

|

employee, specialist |

104 |

28 |

|

management staff |

45 |

12 |

|

entreprener |

60 |

16 |

|

service sector |

45 |

12 |

|

worker, driver |

48 |

13 |

|

housewife |

33 |

9 |

|

pensioneer |

22 |

6 |

|

other |

15 |

4 |

|

Place of residence |

||

|

Federal cities |

108 |

29 |

|

cities with a population of more than 1 million people |

82 |

22 |

|

cities with a population of 500–999 thousand people |

63 |

17 |

|

cities with a population of 300–499 thousand people |

41 |

11 |

|

cities with a population of 100–299 thousand people |

33 |

9 |

|

cities with a population of 100 thousand people |

26 |

7 |

|

Rural settlement |

19 |

5 |

Source: compiled by the author.

Table 3

Geographic distribution of the sample wineries

|

Number of sample companies |

Share of companies in the sample (%) |

|

|

Region |

||

|

Crimea (Republic of Crimea and Sebastopol) |

11 |

23 |

|

Republic of Dagestan |

8 |

17 |

|

Stavropol Territory |

9 |

19 |

|

Rostov Region |

7 |

15 |

|

Kabardino-Balkar Republic |

8 |

17 |

|

Volgograd Region |

4 |

9 |

|

Company size |

||

|

Small and Medium Business Companies |

30 |

63 |

|

Major companies |

17 |

37 |

|

Company age |

||

|

Less than 5 years old |

8 |

16 |

|

5–15 years old |

10 |

22 |

|

15–25 years old |

15 |

32 |

|

More than 25 years old |

14 |

30 |

Source: compiled by the author.

-

Research results. The value of wine to consumers

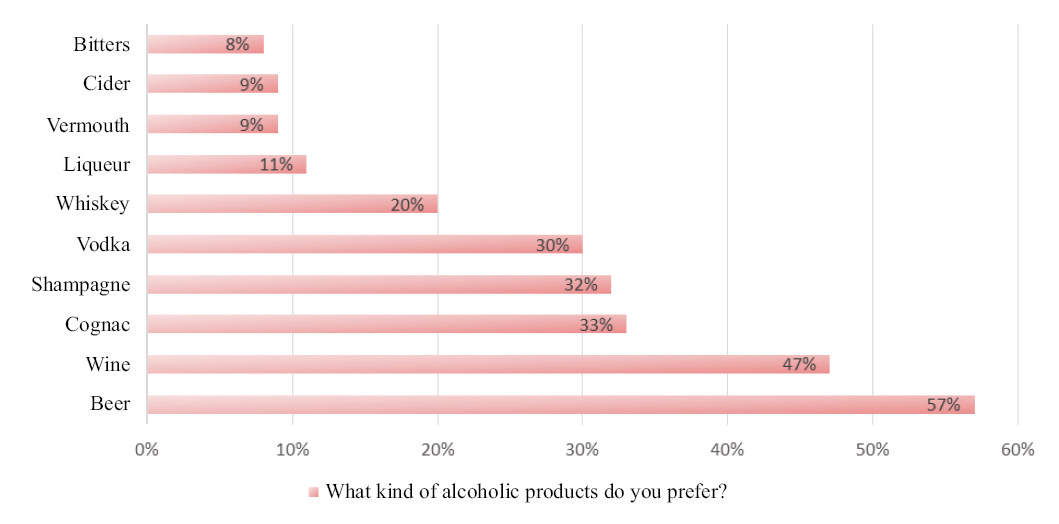

The analysis of preferences in the choice of alcoholic beverages shows that Russians prefer such drinks as beer (57%) and wine (47%) (Fig. 1).

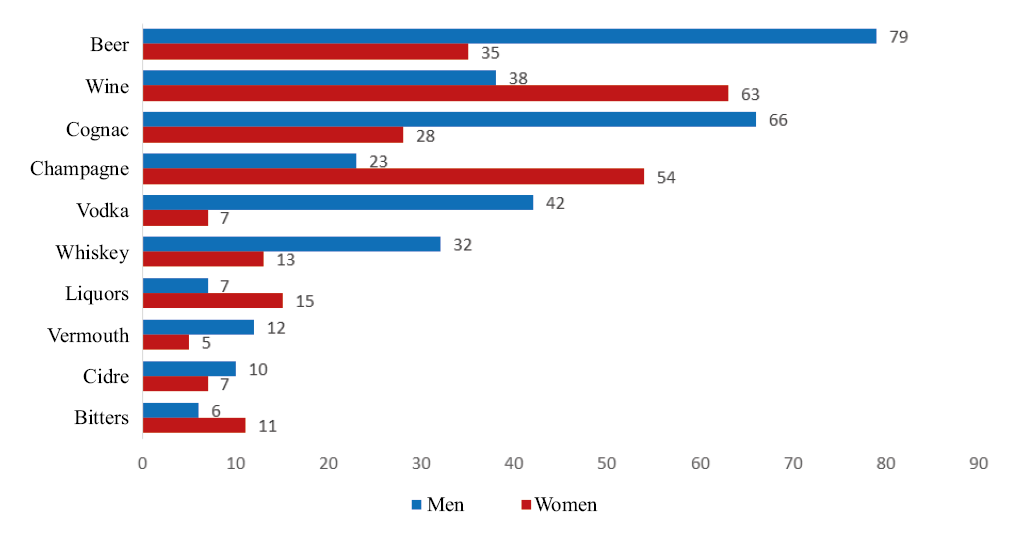

At the same time, men and women have different preferences in the choice of drinks (Fig. 2).

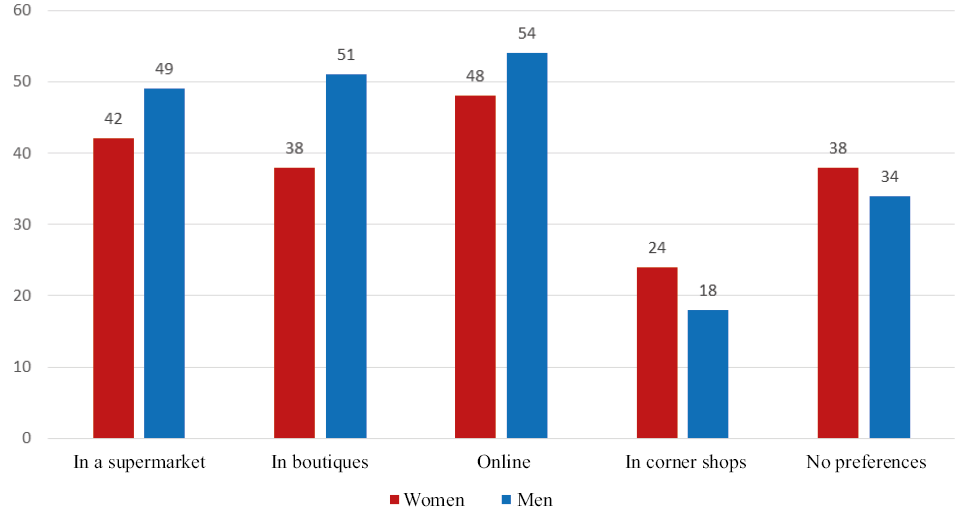

Also, most Russians prefer online wine purchases (Fig. 3). In the second place in popularity there is shopping in the supermarket and special boutiques. It is interesting that a third of the respondents have no preferences.

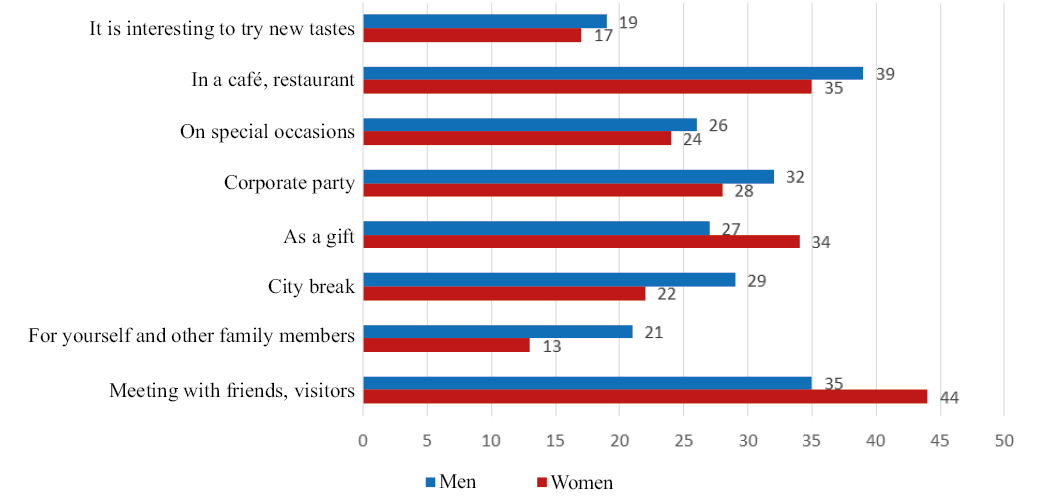

The purposes of buying wine by the respondents are presented in Fig. 4.

The survey showed that the most popular purposes for buying wine for both men and women are meeting with friends, guests, visiting a restaurant or cafe.

As you can easily see, most of the purposes of buying wine were related not to personal/family consumption, but to consumption of wine in a company (meeting with friends, guests, going out of town, as a gift, corporate party, on a special occasion).

It can be recalled that when promoting wine, the main emphasis is on the quality of the wine itself, aroma, vineyards, country of origin.

In our opinion, when promoting the wine market, it is necessary to use a different creative concept, focusing on the collective consumption, celebration, meeting, fun, relaxation.

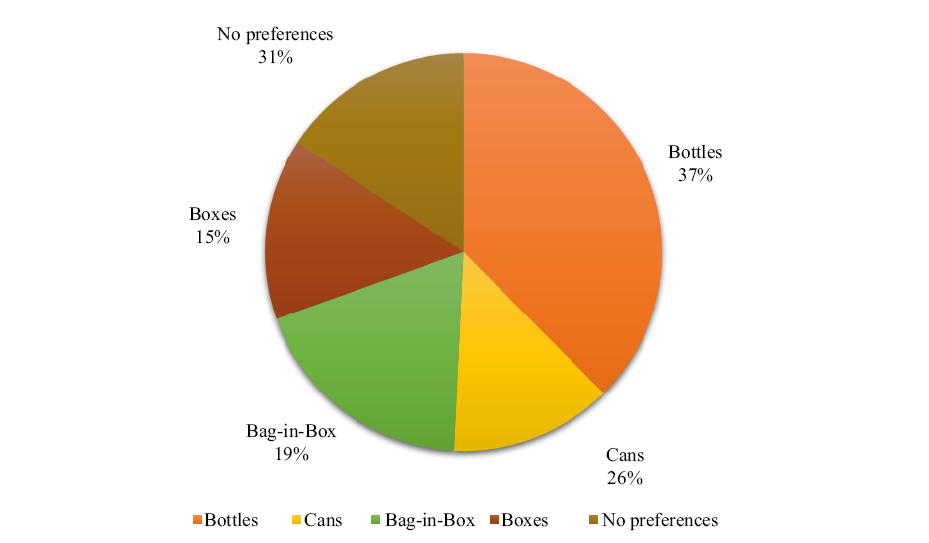

Consumer preferences in packaging are shown in fig. 5. Thus, the vast majority of respondents prefer bottles as packaging. In the second place in terms of preference there are waterskin bags placed in cardboard packages with a capacity of up to several liters – Bag-in-Box. According to respondents, this packaging has a lot of advantages: firstly, the Bag-in-Box does not break and is very convenient for transportation, and secondly, those who bought wine in such packaging do not need to look for a corkscrew. The “barrel” has a bottling valve with a one-way valve that does not allow air to enter the bag, so even when open, the wine does not lose its properties for at least three months. With this tap, wine can be poured into a decanter or directly into a glass. It is aesthetically pleasing and convenient, besides, buying wine in a package, you can win in price. At the same time, the quality level of bottled wine and wine in Bag-in-Box packaging is usually identical.

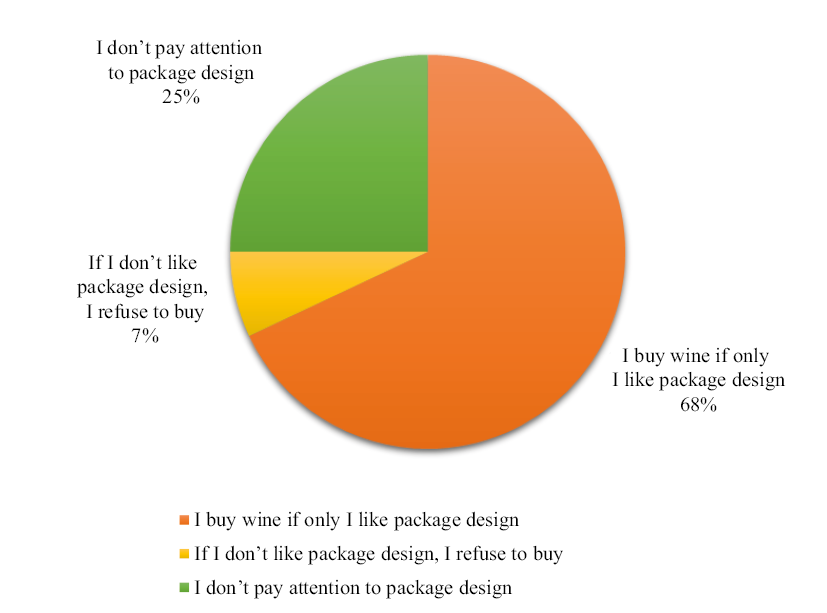

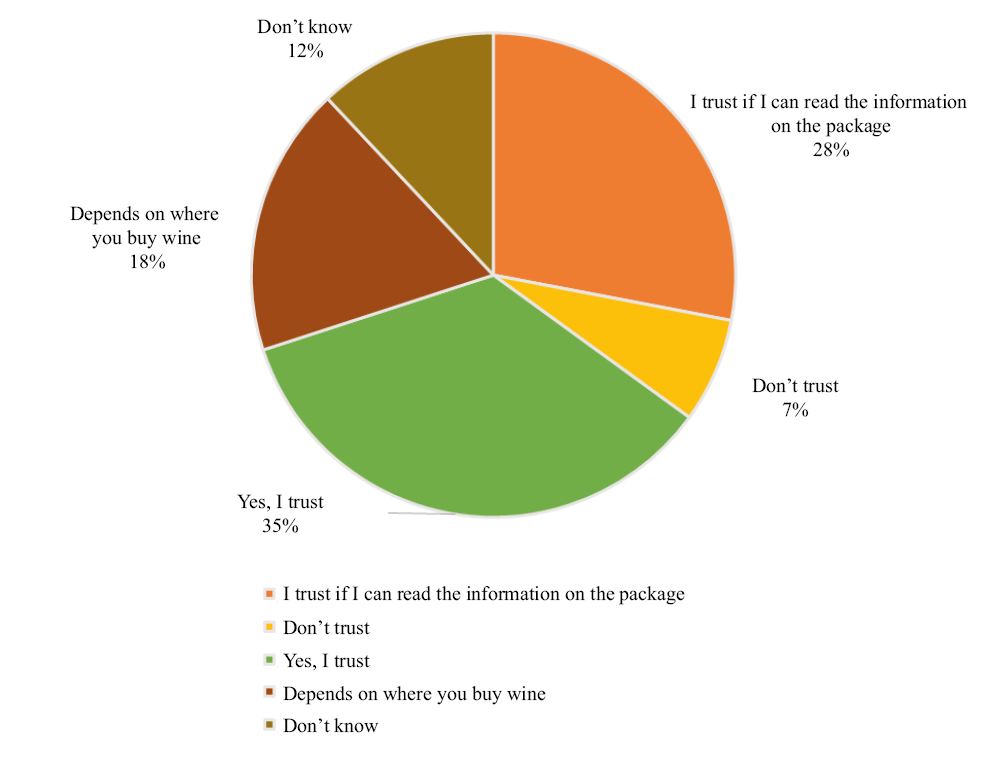

The attitude to the packaging of wine is shown in fig. 6. According to the survey, the vast majority of respondents make a purchase, evaluating not only the quality of wine, but also its packaging. The next question was devoted to trust in the information printed on the packaging of wine (Fig. 7). According to the survey, the majority of respondents trust the information on the packaging (35%) or trust if they can read the information (28%). For 18% of consumers, trust is associated with the place where wine is bought. The remaining respondents either do not trust this information (7%) or find it difficult to answer this question (12%).Also, as the information that the respondent refers to when buying wine, they mentioned the storage temperature, the place of bottling, and the design of the package.

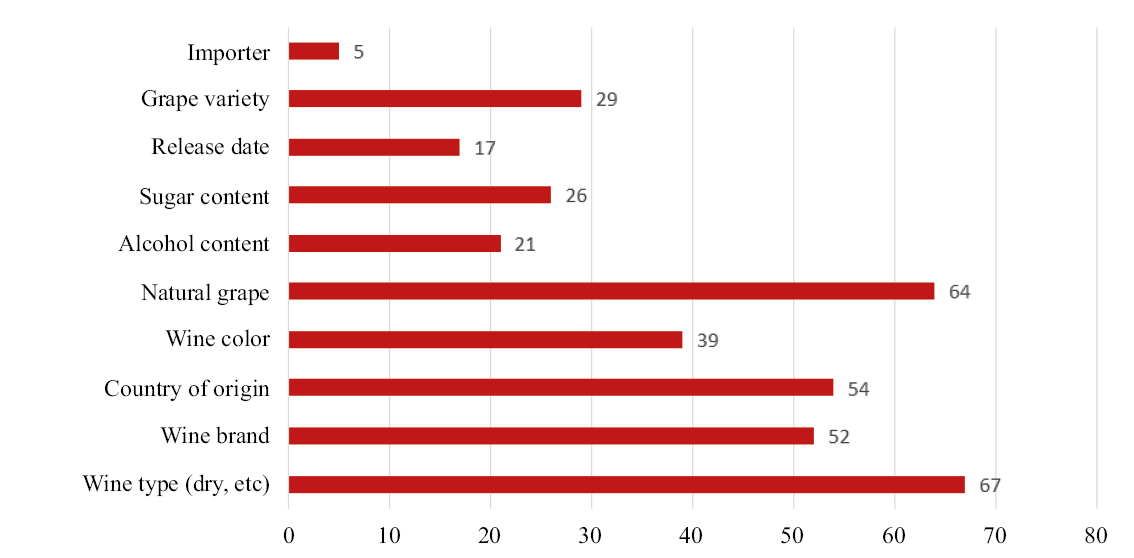

The following are the characteristics of wine that motivate buyers to buy it (Fig. 8). According to the survey, the most important characteristics when buying wine are type (67%) and brand (52%) of wine, country of origin (54%), naturalness (64%) and color (39%).

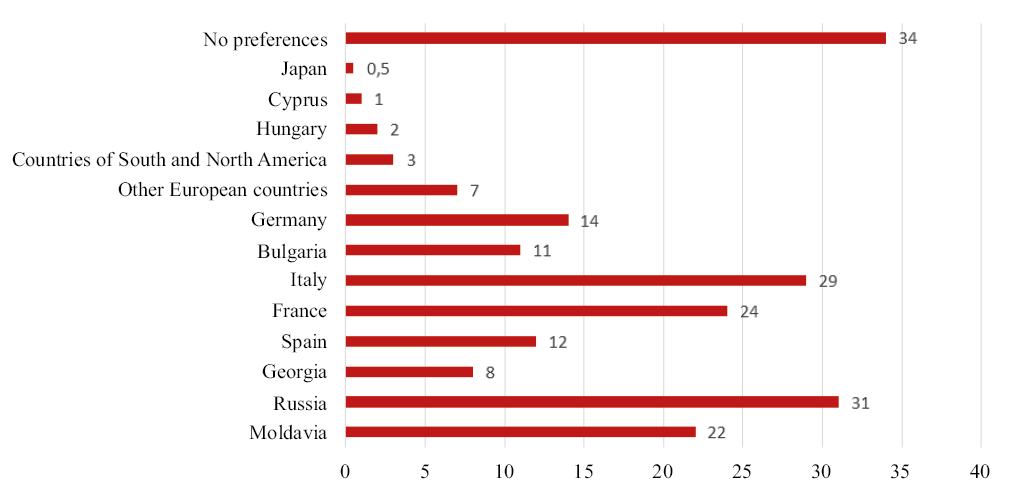

Consumer preferences by country of wine production are shown in Fig. 9. Currently, wines from Russia (31%), Italy (29%), France (24%), Moldova (22%) are the most popular among consumers, since there is an opinion that these countries have the highest quality budget-friendly wine. Note, that from time to time preferences in relation to the countries of wine production change. Thus, Georgian wines were previously considered to be of the highest quality, but the massive falsification of these wines has changed the opinion of consumers for the worse.

The lesser popularity of European and other foreign wines is due not to their poor quality, but to a higher price and the fact that the wines of these countries are less represented on the market, they are more difficult to find.

It should be noted that there is a fairly high percentage of those who have no preference for the country of wine production. Apparently, a third of buyers are guided by other factors when choosing wine.

Therefore, the reasons for choosing wine are analyzed below (Fig. 10). The most significant characteristics when choosing a wine are: taste (74%), optimal value for money (67%), proven quality (36%), brand awareness (24%).

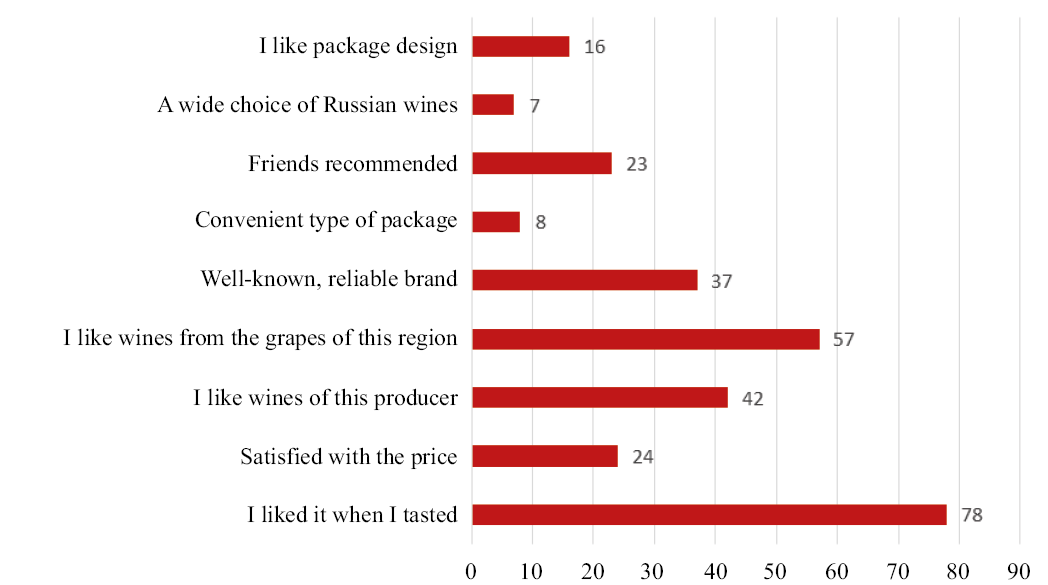

Next, the reasons for choosing wine from Russian producers were analyzed (Fig. 11). The reasons for the positive attitude towards wine of Russian producers lie primarily in the fact that almost 78% of consumers of Russian wines are satisfied with its taste. 57% of respondents like wines made from the grapes of the respective region. About a quarter of consumers (24%) are satisfied with its price, and 42% of respondents trust the manufacturer. A fifth of respondents noted that they are comfortable with the volume of packaging (8%) and its design (16%), which indicates the need to pay attention to the quality of not only the wine itself, but also its packaging.

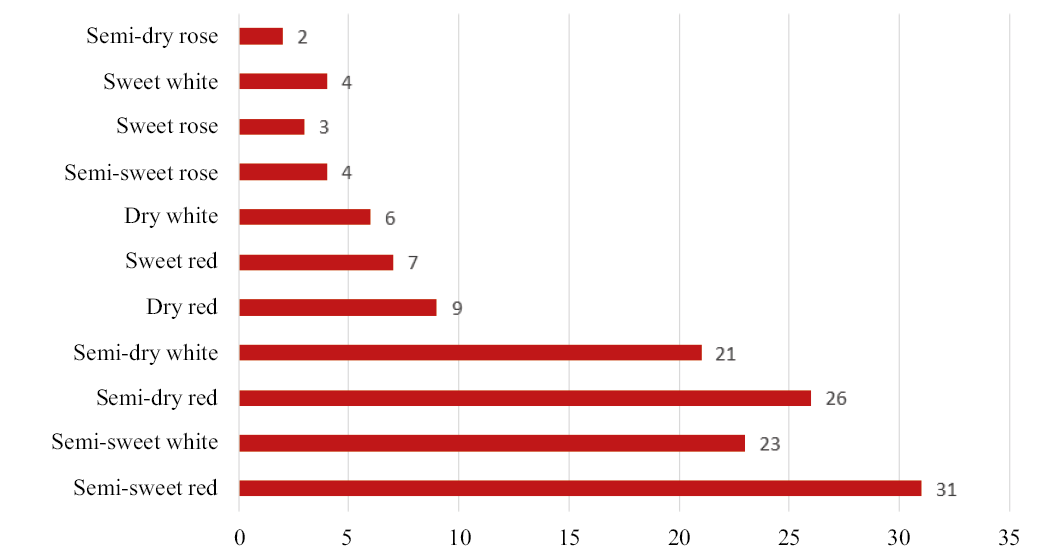

Consumer preferences by a type of wine are shown in Fig. 12.

An analysis of consumer preferences shows that the group of rosé wines enjoys very low popularity in the market, so it should be produced in very limited volumes. The most popular is red semi-sweet wine. Perhaps these preferences correlate more with the presence of this wine on the market than with the taste preferences of consumers. However, it can be unequivocally stated that semi-sweet and semi-dry wines are more preferable than dry ones, and red wines are more popular than white ones in any position.

Fig. 1. Respondents’ preference when choosing alcoholic beverages (% of respondents)

Source: compiled by the author.

Fig. 2. Preference of respondents when choosing alcoholic beverages among men and women (% of respondents)

Source: compiled by the author.

Fig. 3. Respondents’ choice of how to buy wine (% of respondents)

Source: compiled by the author.

Fig. 4. Purposes of wine purchase by respondents (% of respondents)

Source: compiled by the author.

Fig. 5. Respondents’ preferences for wine packaging (% of respondents)

Source: compiled by the author.

Fig. 6. Attitude towards wine packaging (% of respondents)

Source: compiled by the author.

Fig. 7. Attitude of respondents to the information indicated on the packaging of wine (% of respondents)

Source: compiled by the author.

Fig. 8. Characteristics of wine that stimulate its purchase (% of respondents)

Source: compiled by the author.

Fig. 9. Purchasing preferences by country of wine production (% of respondents)

Source: compiled by the author.

Fig. 10. Reasons for choosing wine (% of respondents)

Source: compiled by the author.

Fig. 11. Reasons for choosing wine from Russian producers (% of respondents)

Source: compiled by the author.

Fig. 12. Consumer preferences by type of wine (% of respondents)

Source: compiled by the author.

-

Formation of the value proposition by Russian wine producers

Next, it was investigated how consumer preferences in choosing wine correlate with the formation of a value proposition by Russian wine producers.

Respondents' answers in the analysis of value creation tools are presented in Table 4.

According to the respondents, the most significant value creation tools are quality, recognition and customer focus. At the same time, such tools as brand uniqueness are almost never used in the practice of Russian companies, which can be explained by the insufficient level of Russian personnel’s knowledge of the entire spectrum of creating a value proposition, and in particular, its most complex tools.

When asked about creating value together with their staff, most Russian companies admitted that they rarely involve staff in this process. In foreign companies, on the contrary, personnel is one of the key sources of value proposition formation.

When asked about co-creating value with customers, most companies admitted that they involve customers whenever possible, using mostly questionnaires and surveys that help learn about customer preferences, desires, and satisfaction. It is important to note that a greater variety of tools and methods of interaction with consumers is found in foreign companies. However, in recent years, Russian companies have increasingly focused on business development through interaction with customers.

At the same time, in the work of companies involving customers in the joint creation of value, the tools described in Table 5 are used more often.

-

Conclusions

Analyzing the signs of a successful value proposition for customers from the point of view of researchers and practitioners, it is also possible to identify differences, they are presented in Table. 6.

Analyzing the common and different features of a successful value proposition identified among wine producers and consumers, it can be noted that the main features of a successful value proposition for both buyers and producers are taste and price, as well as quality, price-quality ratio, aesthetics (design and packaging), the composition of the wine (most buyers carefully study the composition indicated on the packaging), the brand, the possibility of tasting, and the country of origin.

Signs such as discounts, promotions for temporary price reductions and the purpose of the purchase (reason for consumption) are important only for the consumer, who is interested in them: for example, buying one bottle, get the second as a gift or at half price. The manufacturer, on the contrary, does not like discounts and promotions, since a decrease in the initial cost of the goods, although it attracts buyers, negatively affects the brand image and occurs due to savings in the budget for advertising and promotion.

For the manufacturer, the assortment is important, allowing to differentiate and attract consumers with different tastes and preferences. Product display and a unique selling proposition allow you to offer the consumer those characteristics of the product, thanks to which it will differ from its competitors in the same category, which will allow you to build effective communications with the consumer and form their loyalty.

Table 4

Customer value proposition tools

|

Research |

Examples of respondents' answers |

Frequencies of mention |

|

|

unit. |

% |

||

|

Product/Service improvement |

|||

|

Quality |

Quality is a fundamental element in value creation; the consumer appreciates high-quality goods; we check the quality on ourselves - we use the products and eliminate the shortcomings |

14 |

30.1 |

|

Range |

A wide range (large product line) allows you to find an individualized approach to the client. |

4 |

8.7 |

|

Uniqueness |

We are creating a product that is not yet developed on the Russian market; formation of an order specifically for the client |

2 |

4.7 |

|

Product price reduction |

By reducing the price of goods, the contractor increases his chances of winning in the competitive purchase; discounts, promotions for goods are in great demand among buyers; we cannot talk about price reductions, but we try to keep them within reasonable limits |

3 |

6.9 |

|

Service improvement |

|||

|

Ease of choice |

A wide range, knowledge of proven brands significantly reduces the time to determine the choice |

1 |

2.6 |

|

Risk reduction |

Absence and minimization of abnormal spoilage and in rare cases of a low-quality batch - a complete replacement for a quality supply |

1 |

2.3 |

|

Ease of purchase |

The representation of the product in most retail chains affects recognition, increases sales; with the opening of sales via the Internet, the convenience of purchasing wine has increased significantly |

2 |

4.7 |

|

Ease of use |

Simplicity of technology, easy adaptation to it; the value of our products and services lies in the simplicity and easily assessable financial result |

1 |

2.1 |

|

Brand formation |

|||

|

Uniqueness |

Uniquness of brand positioning and our company on the whole |

1 |

2.1 |

|

Acknowledgment |

Brand recognition; we are professionals in our field, and we have good references from relevant companies that apply to us |

7 |

14.2 |

|

Stuff professionalism |

Employees must be professionals |

3 |

5.4 |

|

Relationship |

Setting up a long-term relationship with the client; relationship with the client - above all; they need to be properly formed, maintained. Their loyalty and affection need to be increased. |

2 |

3.4 |

|

Customer-oriented approach |

The company must be able to attract customers, hear them, provide feedback |

5 |

10.2 |

|

Personal qualities |

The personal qualities of the staff sometimes play a decisive role, influence the choice of the client |

1 |

2.6 |

Source: compiled by the author.

Table 5

Tools to engage customers in value co-creation

|

Research |

Examples of respondent’s answers |

Frequencies of mention |

|

|

unit. |

% |

||

|

Feedback: the consumer fills in a questionnaire developed by the company, the consumer writes a review on the Internet, etc. |

Questionnaires, online surveys, reading consumer reviews; the opinion of consumers has always been important to us, therefore, when creating a value proposition, in most cases we interact with customers (surveys, reviews, wishes); each client can call us at the phone number listed on the site, as well as at each retail outlet; questionnaires, online surveys, ratings of unscrupulous suppliers |

19 |

40.7 |

|

Co-production is characterized by the participation of the consumer in the joint creation of value with the company at the final stages of creating a service (service consumption) |

We involve clients in the process of discussing prepared reports and memorandums, adjust our own opinion and conclusions based on the client's comments; collaborative development of a product that would meet the needs of this particular customer contributes to the creation of a value proposition |

3 |

7.0 |

|

Service innovation |

Use of innovations, creation of integrated offers, expansion of services; quality service is the basis of our company, we pay close attention to training our employees in customer interaction techniques |

2 |

4.7 |

|

Customization |

The client is first offered a range of planned values, after which his opinion is listened to and something is added depending on the need; each problem is usually unique, and its solution is applicable to a specific object with given requirements |

4 |

8.1 |

|

The interaction of the consumer with the company, as well as his participation in promotions / events initiated by both the company and the consumer himself |

Participation of consumers in various events within the framework of event-marketing, promotions; companies willingly participate in our research, which we regularly conduct and then publish the results; monthly we carry out a large number of promotions, including digital campaigns, which involve more and more consumers and motivate them to try and buy our products more often |

10 |

20.9 |

|

Virtual brand community |

We have official accounts on social networks, where communication takes place mainly with potential future employees, but nevertheless their work, I think, can be called effective; in addition to the virtual reception, there are pages on social networks, where work is also being done to track complaints and suggestions; there are groups in social networks, as well as "crops" on the forums visited by the target audience |

9 |

18.6 |

Source: compiled by the author.

Table 6

Common and differing signs of a good value proposition highlighted among wine producers and consumers

|

Elements |

Consumers |

Producers |

|

General |

Tastiness |

|

|

Price |

||

|

Quality |

||

|

Ratio “price-quality” |

||

|

Aesthetics (design and package) |

||

|

Ingredients |

||

|

Brand |

||

|

Degustation |

||

|

Country of origin |

||

|

Different |

– |

Range |

|

Discounts, promotions for temporary price reductions |

– |

|

|

– |

product visibility and merchandising |

|

|

Purpose of purchase (reason for consumption) |

– |

|

|

– |

Unique selling points, USP |

|

|

– |

Customer loyalty |

|

Source: compiled by the author.

Conclusion

The past 30 years have seen an increase in the amount and complexity of academic and professional research focusing on customer value generation, reflecting the interest of researchers, manufacturers, and consumers in product value proposition strategies. A value proposition refers to the value a manufacturer promises to deliver to consumers if they decide to buy its product, it is also a declaration of intent or statement that introduces consumers to a company's brand by telling them what the company is, how it works and why it deserves their attention.

A successful value proposition must be compelling and help turn a potential customer into a paying customer. All effective value propositions are easy to understand and demonstrate concrete results for the consumer.

The wine market is considered difficult for consumers to make decisions, and wine marketing is informational. Forming a successful wine value proposition allows the producer to find out the distinctive features of his product from the products of competitors and inform the consumer about the value within a short period of time.

About the Author

A. A. KhachatryanRussian Federation

Senior lecturer of the Department of Management and Innovation of the Faculty of “Higher School of Management”, Head of Policy Implementation Support of the Directorate of Development Programs and Strategic Initiatives, Financial University under the Government of the Russian Federation (Russia). Scopus Author ID: 57211625263, Author ID: 627466. Research interests: strategies of industrial companies; changes in the market of wine products; value creation for consumers.

Review

For citations:

Khachatryan A.A. THE CONSUMER BEHAVIOR AND THE FORMATION OF VALUE IN THE RUSSIAN MARKET OF WINE PRODUCTS. Strategic decisions and risk management. 2021;12(4):322-334. https://doi.org/10.17747/2618-947X-2021-4-322-334