Scroll to:

STRATEGIC MANAGEMENT IN ECOSYSTEMS: ANALYSIS OF THE RUSSIAN EXPERIENCE

https://doi.org/10.17747/2618-947X-2021-3-242-251

Abstract

Ecosystems as new organizational forms of business, whose activity generates changes in the theory and practice of management, have become a significant phenomenon of the modern economy. The article discusses the features of the strategy development of ecosystems based on digital platforms, the typology of strategies and the directions of classical approaches transformation to the strategic development of ecosystem players. The research methodology includes the analysis of scientific approaches within the framework of the emerging ecosystem theory as well as the systematization of the national digital ecosystems’ practice based on the analysis of real situations from various spheres of Russian business. As a result of the analytical study, the multi-vector strategies of Russian ecosystems are described; the dominant directions of development in transaction ecosystems and decision ecosystems are identified and systematized on the basis of the Ansoff matrix. The directions of transformation of traditional methods and tools of strategic management in a broad context are revealed from the standpoint of market and intra-ecosystem interactions. The obtained results contribute to the urgent scientific discussions concerning the prospects and limitations of the digital ecosystems development, changes in the nature and models of competition, as well as the problems of traditional management methods transformation in the digital economy.

For citations:

Markova V.D., Kuznetsova S.A. STRATEGIC MANAGEMENT IN ECOSYSTEMS: ANALYSIS OF THE RUSSIAN EXPERIENCE. Strategic decisions and risk management. 2021;12(3):242-251. https://doi.org/10.17747/2618-947X-2021-3-242-251

Introduction

In the digital economy, the trend of the formation of ecosystems as new organizational forms and business growth mechanisms is actively developing. Modern ecosystems are becoming “digital superpowers” that can control critical bottlenecks, extract additional value, and upset the global competitive balance [Yansiti, Lakhani, 2021. p. 225]. By erasing traditional industry boundaries and networking previously disparate industries, offering consumers a variety of services in a seamless experience, the owners of well-known ecosystems (Apple, Microsoft, Amazon, Alphabet, Facebook, Tencent, Alibaba) are strengthening their role in the economy. Russian companies that develop an ecosystem approach are still significantly inferior to world leaders, but five companies (Yandex, Mail.ru, 1C, Tinkoff, Wildberries) entered the top 100 technology companies in the developing countries in 2020 - applicants for technological leadership, according to BCG consulting company1.

However, the development of ecosystems is changing not only the global business landscape, but also the business model of companies, shifting the focus from internal development to working with partners, networking and digital business transformation. These changes actualize the search for new mechanisms of strategic management based on the analysis of best practices and their scientific generalization.

The purpose of the study is to identify the features and directions of transformation of classical approaches to the development of strategies for companies that form ecosystems based on their digital platforms.

To achieve this goal, based on a comparative analysis of the strategies of Russian ecosystem companies, the following tasks were solved:

1) generalization of theoretical and methodological approaches to the study of ecosystems and development of research design using the BCG ecosystem typology;

2) identification of vectors for the development of two ecosystem types and their systematization based on the Ansoff matrix;

3) determination of the main development aspects of strategic management in the world of ecosystems and digital platforms.

-

Ecosystems: theoretical and methodological foundations of the research

Borrowed from biology, the term "ecosystem" was introduced into business circulation by J. Moore, who suggested that the ecosystem would become a new important organizational form of business in the world of rapidly developing technologies [Moore, 2006]. Indeed, the world's dominant ecosystems are largely shaped by high-tech companies based on digital platforms. Currently, within the framework of the emerging theory, several areas or ecosystem concepts have been identified: innovative and entrepreneurial, a business ecosystem, an ecosystem based on digital platforms [Jacobides et al., 2018; Hein et al., 2020], transaction and decision ecosystems [Pidun et al., 2019]. In the article, we consider ecosystems based on digital platforms (since the most developed ecosystems in Russia belong to this type), dividing them into ecosystems of transactions and decisions.

A digital platform is defined as a set of components (software and hardware, service modules, etc.) and rules for the interaction of participants [Eisenmann et al., 2011], which are organized by the platform owner. As the technical infrastructure of ecosystems, digital platforms tend to have a modular architecture that includes a relatively stable core and flexible periphery [Tiwana, 2018], creating competitive advantages through the scale and matching supply and demand [Thomas et al., 2014; Constantinides et al., 2018]. Along with the architecture of a digital platform, many researchers identify such structural elements as activities and actors [Adner, 2017; Kapoor, 2018; Hein et al., 2020]. The platform owner organizes interactions between actors, thereby forming an ecosystem within which transactions are facilitated, innovation processes are accelerated, and additional opportunities are provided in terms of analytics, joint value creation and development of participants. The rules for the organization and interaction of actors within an ecosystem are determined by the ownership status [Gawer, Cusumano, 2015; Tiwana, 2018]. Based on this, A. Hein and co-authors propose the following definition: a digital platform ecosystem includes a platform owner who, through management, facilitates the mechanisms for creating value on the platform within the interaction of the owner, independent ecosystem complementizers and consumers [Hein et al., 2020. P. 90] .

When analyzing the best practices for developing ecosystems, researchers study the problems of innovation [Evans, 2016; Eferin et al., 2019], interaction with the external environment [Demil et al., 2018], the impact of the complexity of the digital platform on the transition of participants to competing ecosystems [Ozalp et al., 2018], the interaction of ecosystem actors based on the roles they play [Alstein et al., 2017; Adner, 2017; Jacobides et al., 2018], monetizing the activities of ecosystem participants [Williamson, de Meyer, 2019].

A significant part of the work is devoted to strategic analysis and development of an ecosystem strategy, which R. Adner defines as a method that a central firm uses to coordinate the actions and interests of partners while maintaining its role in a competitive ecosystem [Adner, 2017; Xing et al., 2017]. It should be noted that, despite the huge potential of the ecosystem approach, not all companies have managed to create a successful platform, let alone form a developing ecosystem based on it [Yoffie et al., 2019; Zhu, Iansiti, 2019]. The complexity of forming an ecosystem strategy as a dynamic group of largely independent actors is due to the fact that, on the one hand, it must determine the general vector of ecosystem development, and, on the other hand, ensure coordination of actions and a balance of values and interests of its participants. The difficulties are exacerbated by the fact that platform companies are becoming inverted in nature [Parker et al., 2017; Alstyne, 2019], focused on enabling users to meet diverse cross-sectoral needs in a seamless experience [Pidun et al., 2019]. As a result, approaches to strategic management are being transformed in the ecosystem world [McIntyre, Srinivasan, 2017; Jacobides, 2020; Yansity, Lahani, 2021], the analysis of which determines the relevance of the presented study from the standpoint of theory and practice.

-

Study design

The Central Bank of Russia lists six companies as creators of ecosystems in our country: Sberbank, VTB, Tinkoff, MTS, Yandex and Mail.ru2. To understand whether there are other contenders for creating ecosystems we analyzed the 10 most expensive Runet companies at the beginning of 2021, according to Forbes (capitalization is more than 1 billion rubles), based on the following features: the presence of a digital platform, the variety of services and goods offered, independence (the company is not included in the above ecosystems)3. There were six such companies, but Yandex and Mail.ru Group (MRG) are already on the list of the Central Bank of the Russian Federation, respectively, Wildberries, Ozon, Avito and 1C are added to the potential creators of ecosystems. There are other platform companies in the Forbes rating, but some of them have already been absorbed by other ecosystems (these are Delivery Club, Aliexpress Russia, Citymobil, Okko, Goods, 2GIS); the scale of other companies’ business is still small.

As a result, the list of companies selected for analysis included 10 representatives of different businesses, and most importantly, different types of platforms on which the ecosystem is formed. Further, using the methodological approach of the BCG consulting company [Pidun et al., 2019], we identified transaction and decision ecosystems.

The group of transaction ecosystems includes three companies: Wildberries, Ozon and Avito, which belong to the type of aggregator platforms, providing data aggregation and transaction implementation. The remaining seven companies form solution ecosystems. These are Yandex and MRG, which are high-tech diversified holdings and, in fact, are national digital diversified ecosystems. 1C Company has formed a specialized ecosystem of technological solutions for automating management and accounting at enterprises in various industries. Three banks (Sberbank, VTB, Tinkoff) and the telecommunications company MTS also announce the formation of ecosystems and transformation into high-tech IT companies.

Then, based on available open information, the specifics of growth strategies in each group of Russian ecosystems were determined within the framework of two main vectors of ecosystem development: vertical and horizontal [Chung et al., 2020].

When moving vertically, ecosystem organizers focus their efforts on the development of key technologies and products based on the platform core, remaining within industry boundaries, but striving to increase their influence or even dominate at touch points in the customer journey.

The horizontal vector of ecosystem formation involves expanding the value proposition and diversifying the product portfolio, often accompanied by crossing traditional industry boundaries, entering new areas of activity and expanding the pool of participants.

As they move vertically and horizontally, ecosystem organizers bring together various links in the value chain, forming customer-centric value propositions, providing an end-to-end (seamless) experience with a wide range of services through a single access (ID or superapp4). However, the ways and mechanisms for bringing together ecosystem participants differ; we highlight partnership and investment mechanisms, as well as the organic growth of the ecosystem through the internal resources of the organizing company.

-

Ecosystems of transactions

In the digital economy, ecosystems are formed by platform-type companies, and since aggregator platforms that operate in bilateral markets initially appeared and became most widespread in practice, it is natural that a large number of ecosystems are formed on the basis of aggregator companies in the process of their evolutionary development [Lee, 2013 ; Trabucchi, Buganza, 2020]. Moreover, such an ecosystem can remain vertically oriented or gradually diversify, as, for example, the Alibaba ecosystem [Tan et al., 2016].

The leader among Russian aggregators is the Wildberries marketplace (second place in the list of the most expensive Runet companies, according to Forbes), the main characteristics of which are given in Table. 1. Created in 2004, the Wildberries online store has turned into a marketplace operating on a commission business model: partners independently form the range of goods for sale through the marketplace, and can also determine the warehouse policy. Wildberries provides the e-commerce platform, logistics of goods and receives a commission based on the results of sales. The emphasis in the business model is on the rapid delivery of goods to the regions, for which the networks of its own distribution centers in large cities and points of issue of orders with the possibility of trying on goods (more than 7 thousand points) are expanding. In 2021, Wildberries bought Standard-Credit Bank to settle accounts with suppliers and create loyalty programs on its basis.

In general, the Wildberries multi-vector strategy is a strategy of organic growth and market expansion within the marketplace business model, the hallmarks of which are dynamism, a quick response to changing market conditions, the ability to change partnership models with suppliers and working conditions with consumers quickly.

The second place goes to Ozon, founded in 1998 as a service for selling books. The business model of Ozon, unlike Wildberries, is a hybrid one, it includes its own online store and marketplace (Table 1). Ozon's strong point is its multi-channel delivery system, including parcel lockers and pick-up points, supported by a developed IT infrastructure based on its own technological platform. The company is unprofitable and is developing at the expense of investors investing in logistics and the creation of distribution centers. To expand financial services in May 2021, the company acquired a bank renaming it into Ozon Bank.

Overall, Ozon's multi-vector strategy is one of aggressive growth and market expansion within a hybrid business model with an emphasis on multi-channel delivery.

The third major aggregator is Avito company, created in 2007, which implements the business model of the classified, or bulletin boards from individuals and legal entities. In terms of popularity and the number of ads, Avito takes the first place in Russia, every month it is visited by about 50 million people. Avito development tools are organic growth, acquisitions, various forms of partnership. Avito provides entrepreneurs with a convenient tool for creating online stores where they can post information about their products. Neural network technologies make it possible to recognize and identify a product based on a photo, simplifying the procedures for sorting and placing products on the site. Strategic plans are related to business transformation: Avito plans to turn into an online marketplace while operating on the basis of a combination of marketplace and classified business models.

Comparative characteristics of the activities of aggregator companies, systematized in Table 1 show that they are focusing on their core business and business model development, realizing the vertical development vector of their ecosystems.

Moreover, if Ozon initially functioned as an online store, and Avito as a classified one, then over time they created marketplaces as a way to grow through an affiliate network, thereby changing the strategy for creating value for consumers. This similarity of strategies and the convergence of business models turned the considered companies into direct competitors, which forces them to look for new strategic development alternatives aimed at vigorous expansion into the regions and rapid adaptation to regional specifics based on the use of platform advantages, retaining customers and partners, and encouraging them exclusively use one platform.

In general, the main aspects of the transformation of approaches to the strategic management of transaction ecosystems are the multi-vector strategies (commodity and market expansion, the internal development of platform technologies as a factor in supporting dynamic market behavior), the desire to enter the financial sector to provide new strategic initiatives, the creation of additional value for consumers for partnership account, search for new alternatives for linking participants to the ecosystem.

So far, the development plans of the reviewed companies do not include statements about possible business diversification, which is apparently explained by the competition between them and other marketplaces for Russian consumers.

Table 1

Comparative characteristics of Russian aggregator companies in 2020

|

Company parameters |

Money turnover, billion rub |

Growth compared to 2019, % |

Capitalization, billion USD. |

Number, thousand people |

Business model |

Financial partners |

|

Wildberries |

437.2 |

96 |

14.5 |

More than 20 |

Marketplace |

Bank |

|

Ozon |

197.4 |

144 |

10.6 |

12 |

Internet shop + marketplace |

«Ozon bank» |

|

Avito |

29.0 |

20 |

4.9 |

2.1 |

Classified + marketplace (plan) |

Naspers Foundation |

Table 2

Comparative characteristics of Russian diversified ecosystems of solutions in 2020

|

Ecosystem indicators |

Technological background (basic business) |

Share in incomes of the basic business, %, |

Number of services (assessment) |

Single point of entry |

Strategic positioning |

Strengths |

|

«Yandex» |

Search platform |

50 |

More than 90 |

Superapp «Yandex GO» |

Customer oriented Ecosystem |

Technology and engineering |

|

Mail.ru Group |

Post service /Social networks and games |

≈ 70 |

30–40 |

Common ID (plan) |

Ecosystem of ecosystems for man and his needs |

Audience Leadership |

|

«Sber» |

Banking platform (Platform V) |

≥ 99 |

More than 80 |

SberID |

A universe of useful services for life and business development |

Financial resources |

|

«Tinkoff» |

Fintex |

76 |

More than 20 |

Superapp |

Lifestyle banking |

Internet bank |

|

MTS |

Telecom |

81 |

More than 30 |

No |

Product ecosystem |

Data centers and communication channels countrywide |

Note. The table does not include VTB, where the process of ecosystem formation is at an early stage.

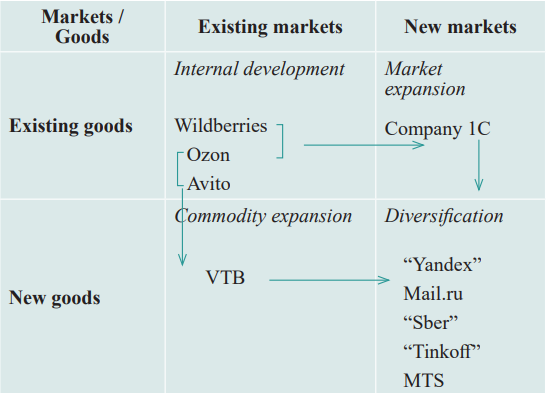

Fig. 1. The Ansoff Matrix for the strategies of Russian ecosystem players

-

Ecosystems of solutions

Seven large Russian ecosystems are based on solutions to various customer problems: an information retrieval system (Yandex), a mail service (Mail.ru), banking (Sberbank, Tinkoff Bank, VTB) and telecommunications services (MTS), automation of management and accounting at enterprises (company 1C). Moreover, only the 1C company solves the problems of customers in the B2B market, the rest of the companies work simultaneously in the B2B and B2C markets.

Researchers note that companies, which have succeeded in creating a critical mass of client, can use this asset to enter many different markets and form new networks that mutually reinforce each other's positions [Yansity, Lahani, 2021]. Having formed extensive client bases in the consumer market, the named domestic companies (with the exception of 1C) have engaged in horizontal development, forming new networks and diversifying their activities. The related diversification of the 1C company is apparently due to the fact that it operates in the B2B market, where, unlike consumer markets with massive same-type demand, the needs of companies are differentiated and depend on many specific factors. Attempts by other ecosystems to create solutions for B2B markets are still limited (SberB2B wholesale marketplace).

For a comparative analysis of the diversification level of solution ecosystems, the authors identified the most common categories of services in Russian practice that can be available to consumers:

- information and reference services (search, maps, mail, analytics);

- electronic commerce;

- offline services (delivery, taxi, car sharing, etc.);

- media services, entertainment, communications (news, cinema, music, video, games, social networks, etc.);

- classifieds - sites of ads from individuals and companies;

- financial services (payment systems, banking, insurance services, discount programs);

- health, education, children;

- new technologies (cloud storage, voice assistants, identification systems).

Also, to assess the level of diversification of various ecosystems, we estimated, according to financial statements, the share of the income of the organizing company from the underlying business.

The leader in the development of a national diversified ecosystem focused on the widest possible range of services for customers is Yandex, founded in 2000. In 2019, Yandex entered the top 100 fastest growing companies in the world, according to Fortune, ranking 24th. In 2020, the company's revenue amounted to 218.3 billion rubles, an increase of 24%. The capitalization of the company at the beginning of 2021, according to Forbes, is $ 22.98 billion, this is the most expensive company on Runet. However, experts note that with an increase in turnover, the company's profit grows slowly, since many new types of businesses are low-margin. Yandex's key business remains its search engine (about 60% share in Russia), which is constantly evolving based on artificial intelligence technology. In 2018, the share of Yandex's R&D expenses was 17.7% of revenue, which is higher than that of Amazon.com (12.7%) and Alphabet (14.6%)5.

In the process of diversifying the ecosystem, more than 90 Internet services for users have been created, which cover all the categories we have identified. These are information retrieval services, e-commerce, media and entertainment, education (Yandex.Textbook and the School of Data Analysis), health, finance (Yandex Pay, BCS Investments), new technologies (Alice voice assistant, Yandex.Browser ”, “Yandex.Disk”, drones). For a long time, the majority of the company's revenue was generated by the advertising model of search, but as new services develop, the share of their income is approaching half.

The choice of new directions for the company is based on constant experimentation with creative ideas for the development of technologies and finding integration and synergy between services within the ecosystem. In the process of creating an ecosystem, a wide range of growth mechanisms was used: acquisitions, alliances, organic growth through internal entrepreneurship. In April 2021, Akropol Bank was purchased, which will contribute to the development of financial services for consumers of the Yandex ecosystem.

In general, Yandex's diversified growth strategy is aimed at expanding the range of services provided while maintaining the dominant role of the key search business and constantly developing technologies.

The creator of another national diversified ecosystem, Mail.ru Group (MRG), declares an ambitious goal - to become the country's largest ecosystem - and characterizes its business model as an ecosystem of ecosystems. In 2020, the company's revenue grew by 21.2%, amounting to 107.4 billion rubles. However, with a turnover of about twice less than that of Yandex, Mail.ru is estimated by the market at 3.8 times cheaper.

The key business and origin of the company was the mail service and search engine, but now it accounts for approximately 1% of Russian search. MRG focuses on communication and entertainment services, expanding the value proposition through development in complementary areas. The company's portfolio includes social networks (VKontakte, Odnoklassniki), which brought almost half of the company's revenue in 2020, and multiplayer online games. As part of the diversification, the Yula ad service, the Skillbox educational service, the Health and All Pharmacies services, the Marusya voice assistant, VK Pay and Money mail.ru financial services, entered the ecosystem as joint ventures. food delivery aggregators Delivery Club and Samokat, taxi service Citymobil, etc. In other words, following the competitors, MRG develops all categories of services, but at the same time places a strong emphasis on partnership and multi-brand, which has come into conflict with the development of the ecosystem as single seamless space for consumers. In October 2021, the company rebranded and introduced a single VK umbrella brand for all the company's services and projects6.

Overall, MRG's diversified growth strategy is based on developing partnerships and redefining the core business, combined with rebranding.

A comparative analysis of two national ecosystems created on the basis of IT companies shows that, despite their pronounced individuality, the strategies for forming the ecosystems of Yandex and MRG show much in common:

- Ecosystems rely on large amounts of user data accumulated after the use of the underlying technology;

- the main priority of the company's development is customer orientation and strive to implement a single sign-on to meet the diverse needs of users (the principle of superapps);

- Strategies distinguish between vertical and horizontal vectors of development. But if approximate parity between key and additional services has been achieved in the Yandex ecosystem, then in the Mail.ru ecosystem the share of the key service is steadily declining, and the main contribution is made by communication and entertainment services;

- ecosystems are structures managed and coordinated by a central firm (hub), which determines the rules for entry and behavior of participants;

- the desire to form a portfolio of services that cover the majority of human needs leads, as expected in [Srnichek, 2019], to the gradual convergence of initially different ecosystems, which become direct competitors.

Commercial banks and telecommunications firms have also accumulated large amounts of customer data, which are facing growth challenges and threats from high-tech companies, forcing them to go down the path of creating digital ecosystems.

The undisputed leader is Sberbank, which since 2017 has been building an ecosystem outside the banking sector. After rebranding in 2020, Sber brought together under this name dozens of products that form a “universe of useful services for life and business development” that save the most valuable thing – customer time (the Sber ecosystem includes more than 50 companies). However, despite significant investments in non-financial business, its contribution to the total revenue of Sberbank in 2020 remained at the level of less than 1%. In the future, it is planned to increase the share of this sector to 20–30%, in particular, Sber expects to become one of the top three leaders in the Russian e-commerce market.

The digital ecosystem of Sberbank is being created mainly through the acquisition of companies, which can be explained by the bank's powerful financial resources. So, in 2019, Sberbank bought a 46.5% stake in the Rambler Group holding (includes Okko online cinema, Rambler.ru search engine and mail service, Gazeta.ru, Lenta.ru, etc.), in 2020 75% stakes of 2GIS was acquired, which allowed Sber to fill a gap in information and reference services. In April 2021, the creation of a joint venture between Sberbank and Rostelecom, Digital Identification Technologies was announced. Along with business diversification, Sber is actively developing its technologies, combining various services into a single ecosystem7. At present, Sber ecosystem is only slightly inferior to the Yandex ecosystem in terms of the variety of services offered, covering all the categories of services we have identified.

The development of the ecosystem is proclaimed as its strategic goal by the financial corporation TCS Group Holding, Tinkoff brand. Established in 2006, Tinkoff Bank has developed a fintech area and positions itself as an ecosystem of financial and non-financial services for clients. It includes such segments as auto (car loans, insurance, rent), home (insurance, mortgage), travel (tickets, hotels, etc.), leisure and entertainment (movie tickets, theater tickets, etc.). The holding is interested in independent partners connecting to the platform through open programming interfaces (APIs). Although there were also purchases of businesses: a payment service and a share in the Kassir.ru service were bought.

The bank has already created a superapp that brings together more than 20 services of Tinkoff and its partners. The company is trying to diversify, but so far banking is the main source of income.

The vector of ecosystem development around its business also attracts other banks. In particular, VTB announces the formation of an open VTB ecosystem based on a partnership model, for which a digital platform has been developed and APIs have been opened. Priority areas for the development of the ecosystem have been identified: e-commerce, Internet and media, telecom and communications, housing and utilities, transport and logistics.

However, in order to reduce the risks of banking activities, the Central Bank of Russia proposes to limit the investments of credit institutions in ecosystems by setting a limit on investments in non-core (immobilized) assets, which may lead to a decrease in the attractiveness of the idea of forming banking ecosystems.

The players in the telecommunications sector are also following the course towards the formation of ecosystems. Thus, MTS announces a strategy for transforming into an IT company that is forming its own ecosystem. Telecommunications remains MTS's key business (81% of revenue in 2020), while other areas (media, e-sports, fintech, etc.) provided almost a third of the company's annual growth. According to the management, the main task of MTS is to fill the ecosystem with its own and partner applications and services while maintaining a focus on traditional business and ensuring synergy of services. It is planned to strengthen the presence in complementary markets with faster growth rates, implementing a diversification strategy.

Due to financial opportunities, the company uses various growth mechanisms: from organic growth and partnerships to acquisitions of other companies. Thus, the purchase of two ticket operators allowed MTS to become the leader in sales of theater and concert tickets in Russia (Ticketland.ru brand). In general, the MTS ecosystem is at the initial stage of formation, while there is no seamlessness in terms of access to services, there are no superapps, but more than 30 applications are available to customers.

Other telecommunications companies (Rostelecom, MegaFon) are only taking tentative steps towards creating ecosystems.

An analysis of the strategic goals and development trajectories of companies from the financial and telecommunications sectors (Table 2) allows us to conclude that the course towards the formation of ecosystems around key technologies is motivated by the struggle for customers, the desire for growth and, at the same time, business stability in the face of growing threats.

Note. The table does not include VTB, where the process of ecosystem formation is at an early stage.

The three recognized leaders occupy different positions in the market, which is reflected in their positioning and development strategies. Yandex has reached parity in terms of revenue from the core business and diversified services. Mail.Ru Group positions itself as an ecosystem of ecosystems, and in the process of developing the ecosystem, the basic business was redefined: from the mail service to communications and entertainment. Basic business dominates in Sberbank, and the regulator represented by the Central Bank of Russia may become a barrier to achieving the stated goal - bringing the share of income from non-financial services to 20-30%8.

Two other companies - Tinkoff and MTS, as well as VTB, Rostelecom, MegaFon, are followers, implementing catch-up strategies.

In general, the landscape of Russian diversified ecosystems is very mobile, they are dynamically developing vertically and horizontally, processes of convergence and copying of services are taking place (after the voice assistant Alice from Yandex, Marusya from Mail.Ru appeared, Oleg from Tinkoff), alliances are created and disintegrated (“Yandex” – “Sber”, “Sber” – Mail.Ru), acquisitions are underway, shares in competing ecosystems are being bought. All diversified ecosystems declare customer centricity as a core value and go in the direction of creating a seamless path for customers by creating superapps.

Aggregator companies develop core competencies and form networks of actors around their digital platforms that perform various activities, trying to attract both consumers and suppliers. The convergence of the business models of participants leads to increased competition and stimulates the development of differentiated competitive strategies aimed at creating unique value for consumers.

With regard to diversified solution ecosystems, it is necessary to note the clearly manifested process of their convergence, which also leads to direct competition of ecosystems, intensifying the struggle for customers. The prevailing mechanisms for the growth of such ecosystems turn them into centrally controlled conglomerate structures with common ownership and a minimum level of partnership. On the one hand, this creates financial risks for the core business and for new services, and on the other hand, it provides conditions for the development of new promising markets through cross-subsidization. The most important strategic task in this case is portfolio management, aimed at finding the potential for synergy between services and platforms within the ecosystem.

The partner network of 1C company allowed to develop the strategy of market expansion actively, while the hallmark of the partnership strategy is the inclusion of independent developers in the number of participants, making a significant contribution to the development of the basic product of the digital platform. An important strategic task in relation to such ecosystems is the formation of rules for the interaction of different actors within the ecosystem, ensuring a continuous flow of innovations.

Conclusion

Based on a comparative analysis of the development processes of leading Russian companies that form ecosystems based on their digital platforms, it is shown that all of them are dynamically changing in the struggle for customers, their time, money and transactions. However, the development strategies in this competitive struggle among companies differ significantly, as shown in the Ansoff matrix (Fig. 1).

The directions of transformation of classical approaches to the development of strategies for ecosystem players are identified:

- Strategies become multi-vector (implemented in a wide range of business areas) and multi-agent, including a variety of partners and interest groups;

- the object of strategic analysis is not the supply chain, but the partner network formed around the digital platform, within which value is created for consumers, while the network architecture ensures the achievement of synergy between the products and services of the ecosystem, and the migration of value goes towards a seamless customer experience;

- specific aspects of ecosystem strategies related to the interaction of its participants are being developed and aimed at balancing their interests and stimulating innovative activity (determining the rules for entering the ecosystem, the principles of pricing and distribution of added value, access to data). An integral characteristic of ecosystem development strategies is the acquisition (partnership) of a financial company;

- new strategic alternatives are being formed related to the retention of participants within the ecosystem (difficulty in their transition);

- Against the backdrop of increased competition and convergence of ecosystem activities, various forms of cooperation between ecosystems are developing, co-competition strategies are acquiring new features.

The directions of traditional methods and tools of strategic management development in the world of ecosystems identified as a result of the study are of interest to specialists in the field of strategic management. The landscape of Russian ecosystems formed on the basis of digital platforms and its development trends described in the article can be useful to practitioners, primarily managers of ecosystem organizers, as well as other business entities that can potentially join the ecosystem.

1 2020 BCG Tech Challengers, exeb. 3. URL: https://www.bcg.com/publications/2020/bcg-tech-challengers-thrive-in-emerging-markets.

2 Ecosystems: approaches to regulation. Public consultation report (2021). M.: Bank of Russia, April: 12-15.

3 URL: https://www.forbes.ru/biznes-photogallery/421235-30-samyh-dorogih-kompaniy-runeta-reyting-forbes.

4 ID - a single unique identifier. Superapp is an application with an extended set of functions (services) that keeps the user within the same ecosystem

5 URL: https://raex-rr.com/country/RAEX-600/innovative_companies.

6 URL: https://www.tatar-inform.ru/news/mailru-group-smenit-nazvanie-na-vk-5839465?utm.

7 At the beginning of 2020, Sberbank began to cross-link services with each other, forming package offers or bundles for customers (2020). Harvard Business Review - Russia. January February. p. 67.

8 Sberbank was reminded that it is still a bank (2021). Expert, 27:4.

References

1. Alstyne M. Van, Parker G., Choudary S. (2017). The network effect as a new driver of the economy. Harvard Business Review - Russia, June-July: 29-36. (In Russ.)

2. Eferin Ya., Rossoto K., Khokhlov Yu.E. (2019). Digital platforms in Russia: Competition between national and foreign multilateral platforms stimulates economic growth and innovation. Information Society, 1-2: 16-34. (In Russ.)

3. Kuznetsova S., Markova V. (2018). Problems of forming a business ecosystem based on a digital platform: The case of the company 1C. Innovation, 2: 55-60. (In Russ.)

4. Srnicek N. Platform capitalism. Moscow, HSE Publishing House. (In Russ.)

5. Williamson P., de Meyer A. (2019). Three main steps for monetization of ecosystem. Harvard Business Review - Russia, November. (In Russ.)

6. Jacobides M. (2020). The power of the ecosystem. Harvard Business Review - Russia, February: 55-63. (In Russ.)

7. Iansiti M., Lakhani K. (2021). Competing in the age of AI. Strategy and leadership when algorithms and networks run the world. Мoscow, Eksmo. (In Russ.)

8. Adner R. (2017). Ecosystem as structure: An actionable construct for strategy. Journal of Management, 43(1): 39-58. DOI:10.1177/0149206316678451.

9. Alstyne M. Van (2019). The opportunity and challenge of platforms. In: Platforms and ecosystems: Enabling the digital economy. Cologny, Geneva, World Economic Forum. URL: http://www3.weforum.org/docs/WEF_Digital_Platforms_and_Ecosystems_2019.pdf .

10. Chung V., Dietz M., Rab I., Townsend Z. (2020). Ecosystem 2.0: Climbing to the next level. McKinsey Quarterly, September. URL: https://mckinsey.com/business-functions/mckinsey-digital/our-insights/ecosystem-2-point-0-climbing-to-the-next-level.

11. Constantinides P., Henfridsson O., Parker G. (2018). Introduction - platforms and infrastructures in the digital age. Information Systems Research, 29(2): 381-400.

12. Demil B., Lecocq X., Warnier V. (2018). Business model thinking, business ecosystems and platforms: The new perspective on the environment of the organization. M@n@gement, 4(21): 1213-1228.

13. Eisenmann T., Parker G., Alstyne M. Van (2011). Platform development. Strategic Management Journal, 32(12): 1270-1285.

14. Evans N. (2016). Digital business ecosystems and platforms: 5 new rules for innovation. Management Innovation & Disruptive Technology, March. URL: https://www.cio.com/article/3045385/digital-business-ecosystems-and-platforms-5-new-rules-for-innovators.html.

15. Gawer A., Cusumano M. (2015). Platform leaders. MIT Sloan management review: 68-75.

16. Hein A., Schreieck М., Riasanow T., Soto Setzke D. (2020). Digital platform ecosystems. Electronic Markets, 30: 87-98.

17. Jacobides M., Cennamo C., Gawer A. (2018). Towards a theory of ecosystems. Strategic Management Journal, 39(8): 2255-2276. DOI:10.1002/smj.2904.

18. Kapoor R. (2018). Ecosystems: Broadening the locus of value creation. Journal of Organization Design, 7(1): 12.

19. Lee R. (2013). Vertical integration and exclusivity in platform and two-sided markets. American Economic Review, 103(7): 2960-3000.

20. McIntyre D., Srinivasan A. (2017). Networks, platforms, and strategy: Emerging views and next steps. Strategic Management Journal, 38(1): 141-160.

21. Moore J.F. (2006). Business ecosystems and the view from the firm. The Antitrust Bulletin, 51(3): 31-75.

22. Ozalp H., Cennamo C., Gawer A. (2018). Disruption in platform‐based ecosystems. Journal of Management Studies, 55(7): 1203-1241.

23. Parker G., Van Alstyne M., Jiang X. (2017). Platform ecosystems: How developers invert the firm. MIS Quarterly, 41(1): 255-266.

24. Pidun U., Reeves M., Schüssler M. (2019). Do you need a business ecosystem? URL: https://www.bcg.com/publications/2019/do-you-need-business-ecosystem.

25. Tan T., Tan B., Pan S. (2016). Developing a leading digital multi-sided platform: Examining it affordances and competitive actions in Alibaba. Communication of the AIS, 38(1): 739-760.

26. Tiwana A. (2018). Platform synergy: Architectural origins and competitive consequences. Information Systems Research, 29(4): 829-848.

27. Thomas L., Autio E., Gann D. (2014). Architectural leverage: Putting platforms in context. Academy of Management Perspectives, 28(2): 198-219. DOI:10.5465/amp.2011.0105.

28. Trabucchi D., Buganza T. (2020). Fostering digital platform innovation: From two to multi-sided platforms. Creativity and Innovation Management, 29(2): 345-358. DOI:10.1111/caim.12320.

29. Xing Wan, Cenamor J., Parker G., Alstyne M. Van (2017). Unraveling platform strategies: A review from an organizational ambidexterity perspective. Sustainability, 9. DOI:10.3390/su9050734.

30. Yoffie D., Gawer A., Cusumano M. (2019). A study of more than 250 platforms reveals why most fail. Harvard Business Review, May.

31. Zhu F., Iansiti M. (2019). Why some platforms thrive and others don’t. Harvard Business Review, 1: 118-125.

About the Authors

V. D. MarkovaРоссия

Doctor of economic sciences, professor, chief researcher, Institute of Economics and Industrial Engineering, Siberian Branch of the Russian Academy of Sciences (Novosibirsk, Russia). ORCID: 0000-0003-1646-8372, SPIN: 2526-6161, Scopus ID: 57194526992. Research interests: strategy and management of companies’ development, marketing of innovation, platform business models and digital economy ecosystems.

S. A. Kuznetsova

Россия

Candidate of technical sciences, associate professor, senior scientific officer, Institute of Economics and Industrial Engineering, Siberian Branch of the Russian Academy of Sciences (Novosibirsk, Russia). Scopus ID: 56526401700, ORCID: 0000-0002-0570-9380. Research interests: strategy and management of companies᾽ development, platform business models and digital economy ecosystems.

Review

For citations:

Markova V.D., Kuznetsova S.A. STRATEGIC MANAGEMENT IN ECOSYSTEMS: ANALYSIS OF THE RUSSIAN EXPERIENCE. Strategic decisions and risk management. 2021;12(3):242-251. https://doi.org/10.17747/2618-947X-2021-3-242-251

JATS XML