Scroll to:

INDUSTRY CORPORATE INNOVATION RISKS: ЕMPIRICAL RESEARCH RESULTS

https://doi.org/10.17747/2618-947X-2021-1-82-91

Abstract

In the article, a review of Russian and foreign literature was carried out, which allowed to consider the main standards of risk management and quantitative methods of risk assessment. The correlation-regression analysis of risks revealed the most significant risks affecting the efficiency of corporate innovation implementation in industrial companies. These include: misunderstanding the importance of innovation for the company; lack of financial resources for innovation; low level of support for the company’s top management for the introduction of innovative processes. A regression model of the impact of risks on the effectiveness of corporate innovation was built, which will predict the degree of impact of risks on the effectiveness of corporate innovation. Recommendations on improving the risk management system for various levels of innovative development of industrial companies are proposed, which are aimed at increasing the efficiency of introducing corporate innovations in industrial companies and ensuring a high level of competitiveness of companies.

Keywords

For citations:

Kuznetsova M.O. INDUSTRY CORPORATE INNOVATION RISKS: ЕMPIRICAL RESEARCH RESULTS. Strategic decisions and risk management. 2021;12(1):82-91. https://doi.org/10.17747/2618-947X-2021-1-82-91

1. INTRODUCTION

In the context of ever-increasing competition, it becomes necessary to introduce innovations into the production processes of industrial companies, which makes it possible to raise the efficiency of their activities. The growing competition in the market is one of the most important prerequisites for organizing innovative activities in companies. It is important to note that industrial enterprises often have all the necessary resources to implement innovative activities, however, there may be an insufficiently developed culture of entrepreneurship within the company, which is also an important prerequisite for introducing corporate innovations [Corporate Innovation, 2017].

An important prerequisite for the introduction of corporate innovations is also the company's awareness of the need to change the existing business model, its transformation in order to improve the efficiency of companies' functioning. The company's search for opportunities to improve its market position by increasing the speed of ongoing business processes and reducing the cost of the processes for introducing new technologies is also a driver for introducing corporate innovations [Corporate Innovations, 2017].

At the same time, various barriers and risks have a significant impact on the efficiency of introducing corporate innovations.

The purpose of this article is to build a regression model, which is designed to identify the most significant risks that influence the efficiency of the implementation of corporate innovations in industrial companies.

The article begins with a review of the actual literature - here are the current risk management standards and the main quantitative risk assessment methods that are used in modern risk management practice for industrial companies. Further, a methodological review and description of the obtained regression model is carried out, taking into account the research results and recommendations. The conclusions show the main directions for further research and possible limitations of the obtained regression model.

2. THEORETICAL BASIS OF THE RESEARCH

In modern risk management practice, it is customary to standardize and unify the area of risk management. In world practice, there are several basic standards of risk management (Table 1), each of which gives different definitions of the categories of "risk" and "risk management".

Table 1

Risk management standards

Sources: D.V. Domashchenko, Yu.Yu. Finogenova. (2015). Risk management in the context of fi nancial instability. M .: Master; INFRA-M; Domashchenko D.V., Finogenova Yu.Yu. (2016). Modern approaches to corporate risk management: methods and tools M .: Master; SIC INFRA; [Topical issues of risk management, 2018].

The presented risk management standards [Bansal, DesJardine, 2014; Salci, Jenkins, 2016; Terzic, Milojevic, 2016; Topical issues .., 2018; European risk .., 2018;] are generally consistent with the general risk management algorithm below.

1. Risk identification (qualitative risk assessment).

2. Quantitative risk assessment.

3. Formation of a risk management program.

4. Control and monitoring of the risk management system.

5. Assessment of the effectiveness of the risk management system.

The introduction of an integrated risk management system in industrial companies is aimed at increasing the efficiency of companies' activities and their competitiveness. The comprehensive risk management system and the overall risk management policy of the company largely depend on the company's risk appetite, on what level of risk the company is ready to take to achieve its goals [Birch, 2018; Tărăbîc, 2018; Bonciani, Ricci, 2020].

The level of risk that a company is willing to accept in its activities depends on the company's business strategy. Organizations that follow a conservative strategy tend to avoid risk. Liberal business strategists are more risk averse. These businesses focus on maximizing profits and are willing to accept a higher level of risk than those of a conservative business strategy. A number of factors influence the level of the company's risk appetite and, consequently, the organization's risk management policy [Birch, 2018; Gollier, 2018; Tărăbîc, 2018; Bonciani, Ricci, 2020]:

- stage of the life cycle of an industrial organization (its opportunities and threats, strengths and weaknesses at this stage of development);

- interests of the main stakeholders of the company, especially shareholders and managers of the company, who may have different views on the level of risk appetite of the organization;

- legislative restrictions on the level of risk acceptance for certain industries;

- external economic factors, for example, the level of economic development in the country (income level of the population, growth, recession, etc.);

- various internal factors in the company.

Thus, the risk management policy in industrial companies, building a risk management system, applied methods of risk assessment and management will largely depend on what business strategy the organization stick to.

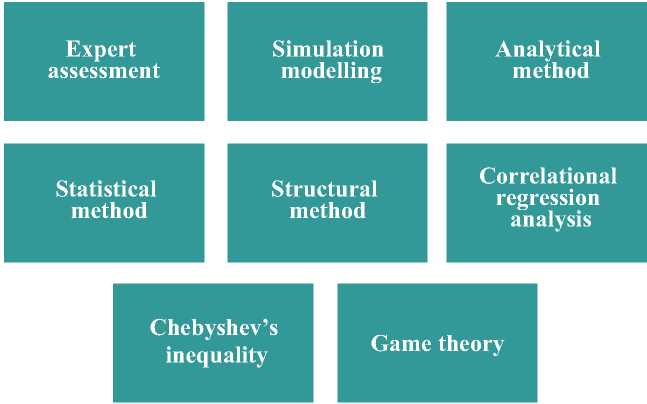

This article discusses the first two stages of the risk management process: qualitative and quantitative risk assessment. Qualitative risk analysis allows you to identify factors and threats, to form a single array of risks affecting the activities of industrial companies. Quantitative risk analysis is aimed at determining the degree of risk impactand the likelihood of their occurrence. The main quantitative methods for assessing risks are presented in Fig. 1.

Fig. 1. Quantitative risk assessment methods

Sources: compiled by the author based on [Purpura, 2007; Santos et al., 2016; Linder, Kuznetsova, 2020].

Methods for quantitative risk assessment are described in scientific papers [Purpura, 2007; Santos et al., 2016; Linder, Kuznetsova, 2020]:

- The method of expert assessment is a risk assessment based on the personal opinion of the expert group;

- The simulation method (Monte Carlo method) is based on a large array of statistical tests and information, after which the desired result is approximated;

- The statistical method involves modeling risks based on statistical data on the results of observing the values of random variables;

- The structural method involves modeling risk based on statistical data;

- Chebyshev's inequality makes it possible to assess the likelihood of risks;

- Game theory - mathematical modeling of optimal decision making in conditions of uncertainty.

As a quantitative method for assessing risks, the article uses correlation and regression analysis, which allows us to identify the most significant risks that influence the effectiveness of the implementation of corporate innovations.

3. RESEARCH METHODOLOGY

The main issue of the study was the assessment of risks that have a significant impact on the effectiveness of the implementation of corporate innovations by companies. The research was carried out in two stages: qualitative and quantitative stages [Drăghici, 2017; Christian, 2018].

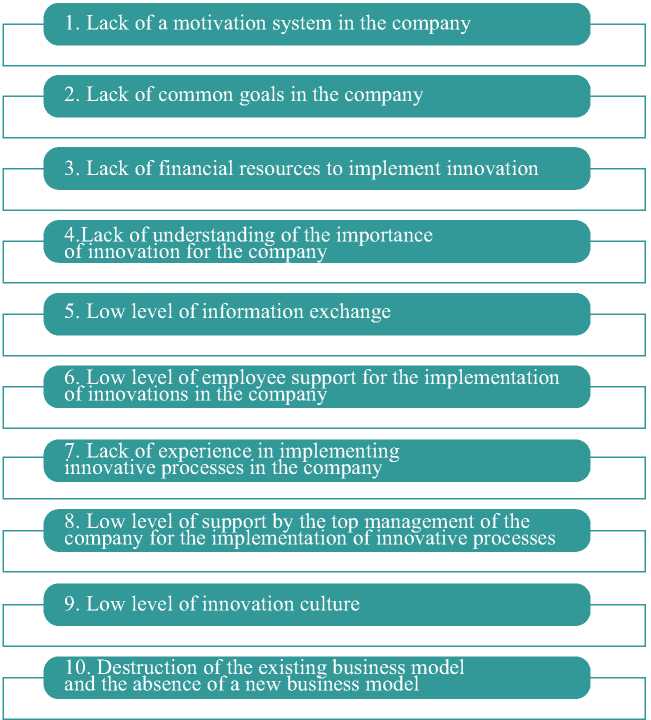

The report of the consulting company KPMG "Corporate Innovation, 2017" indicates the main risks and barriers [Corporate Innovation, 2017], which have a significant impact on the implementation of corporate innovations in domestic companies. The list of these risks is shown in Fig. 2.

Fig. 2. Risks that have a significant impact on the implementation of corporate innovations in Russian companies

Source: compiled by the author based on [Corporate Innovation, 2017]

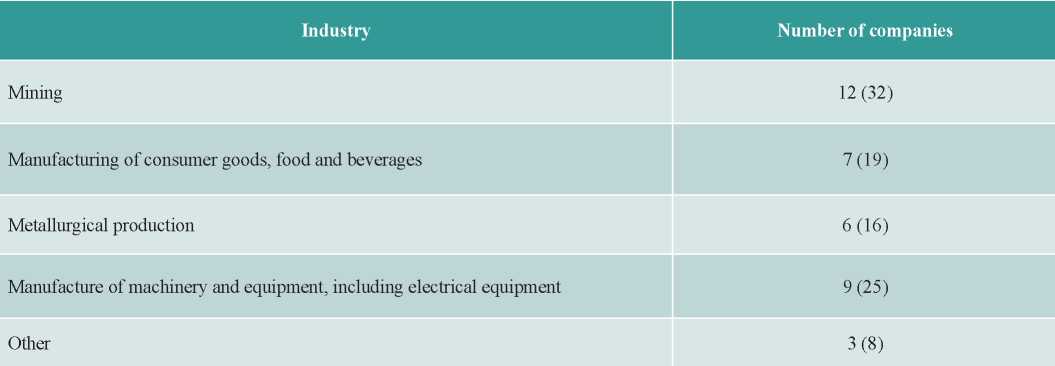

The subsequent assessment of the risks affecting the effectiveness of the implementation of corporate innovations was carried out on the basis of a survey of experts. Questionnaires were sent to 120 industrial companies in various industries, the response to the questionnaires was 31% (37 companies), which is a good result. The presented sample of companies is sufficient for conducting regression analysis and building a regression model. A description of the sample of industrial companies is presented in table. 2.

Table 2

Description of the sample of companies that participated in the survey

Source: compiled by the author.

At the quantitative stage of the study, a correlation and regression analysis was carried out, which made it possible to identify the most significant risks affecting the effectiveness of the implementation of corporate innovations, and also built a regression model designed to predict the impact of risks on the effectiveness of the implementation of corporate innovations in industrial companies.

4. RESULTS OF THE STUDY

4.1. QUALITATIVE STAGE OF RESEARCH

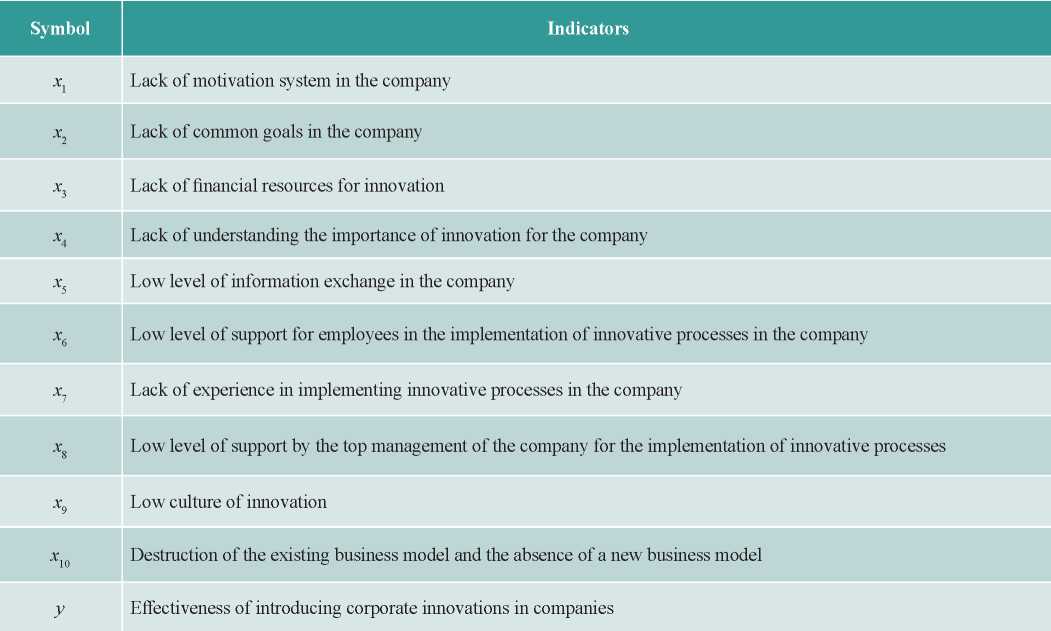

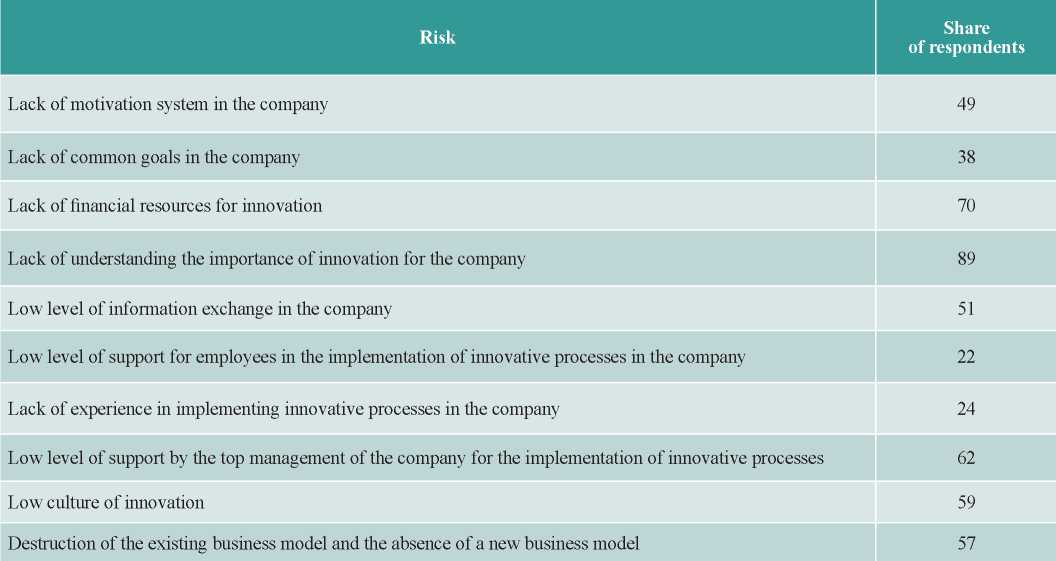

The report of the consulting company KPMG indicates the main risks and barriers that have a significant impact on the implementation of corporate innovation in domestic companies [Corporate Innovation, 2017]. The list of these risks is presented in table. 3.

Table 3

Risks affecting the implementation of corporate innovation in companies

Source: compiled by the author based on [Corporate Innovation, 2017].

Table 4

The most significant risks affecting the effectiveness of the implementation of corporate innovations (results of a survey of experts)

Source: compiled by the author.

Next, a survey of managers was conducted of industrial companies responsible for the implementation of innovations to identify the most significant risks that influence the effectiveness of the implementation of corporate innovations. The results of the survey are presented in table. 4.

Thus, the most significant risks in the opinion of the respondents were:

- lack of understanding of the importance of innovation for the company;

- lack of financial resources for the implementation of innovations;

- low level of support by the top management of the company for the implementation of innovative processes;

- low level of innovation culture;

- destruction of the existing business model and the absence of a new business model.

4.2. QUANTITATIVE STAGE OF THE RESEARCH

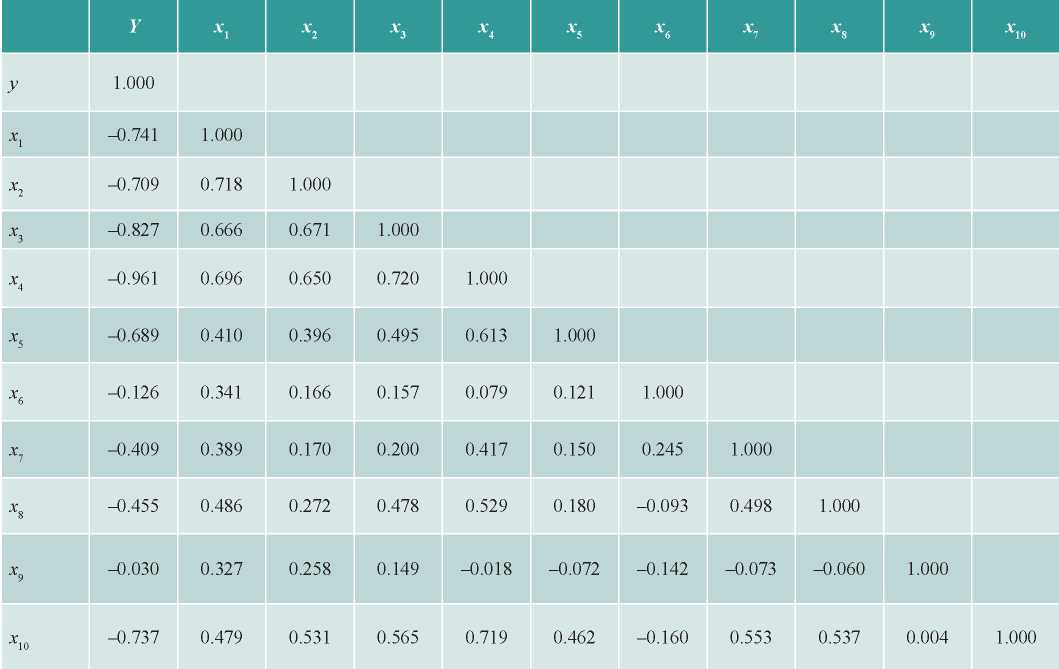

Correlation analysis of risks affecting the efficiency of corporate innovation implementation was carried out using the STATISTICA software package. Its results are presented in table. 5.

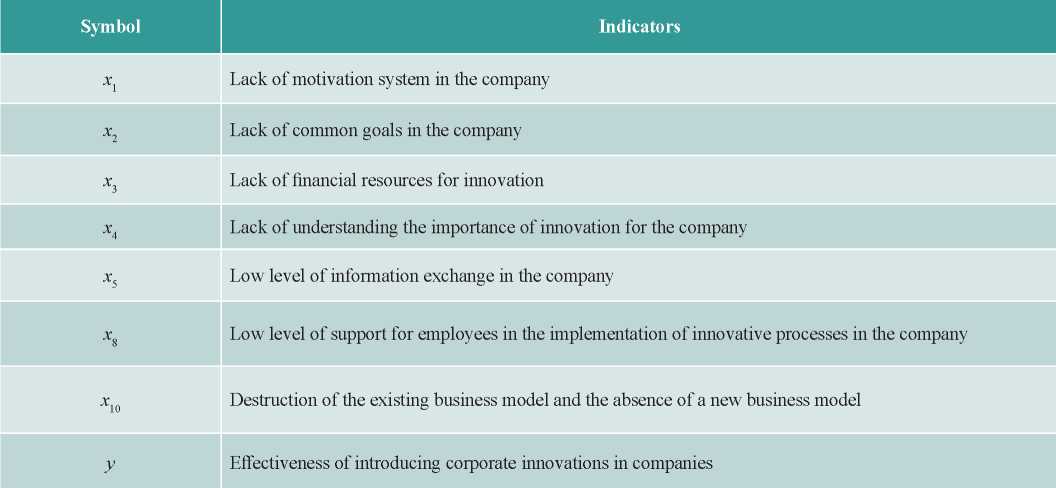

Correlation analysis made it possible to select the most significant risks (Table 6) that affect the effectiveness of the implementation of corporate innovations. Based on the analysis results, those risks were selected for which there is a high relationship with the dependent variable, as well as risks with a low level of multicollinearity (<0.8).

Table 5

Correlation analysis of risks

Source: compiled by the author.

Table 6

Risks affecting the implementation of corporate innovation in companies

Source: compiled by the author.

Further, a regression analysis was carried out based on a multiple regression model using the formula:

y = β0 + β1 x1 + β2 x2 + β3 x3 + β4 x4 + β5 x5 + β8 x8 + β10 x10, (1)

where y is the dependent variable (efficiency of corporate innovation), βI is the non-standardized coefficient.

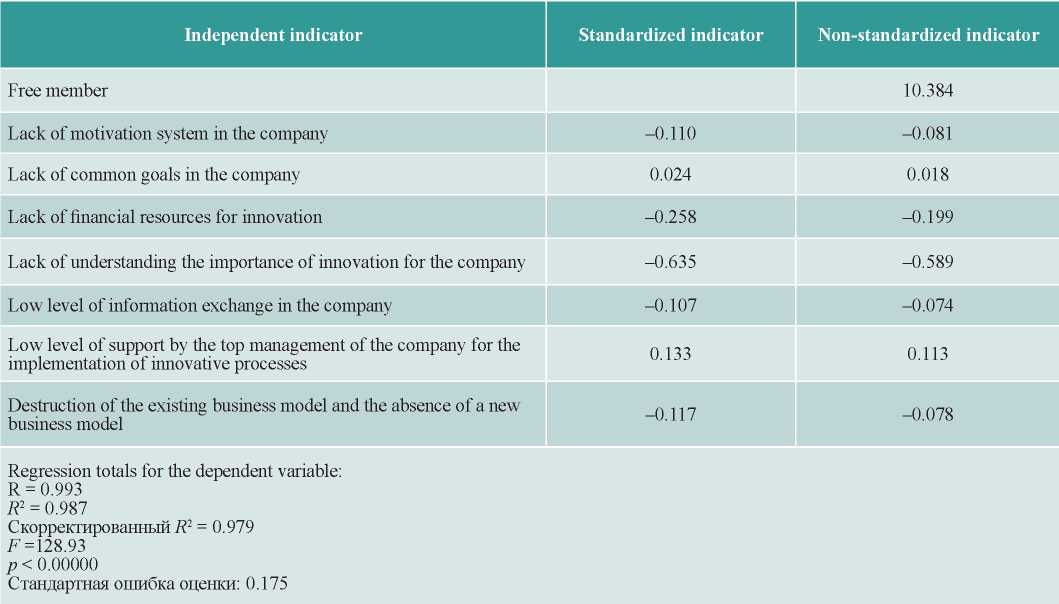

The results of the regression analysis are presented in table. 7.

Table 7

Impact of risks on the implementation of corporate innovations by companies

Source: compiled by the author.

The resulting regression equation is statistically significant, since the coefficient of determination R2= 0.987 is close to 1. This indicates the high quality of the resulting model. The significance level of the model is p < 0.05, which also demonstrates the high quality of the resulting model for predicting the impact of risks on the effectiveness of the implementation of corporate innovations. It should be noted that the most significant risks influencing the effectiveness of the implementation of corporate innovations are the lack of understanding of innovations importance for the company (β = –0.635), the lack of financial resources for the implementation of innovations (β = –0.258), the low level of support from the top management of the company for the implementation innovation processes (β = 0.133).

Thus, the regression model of the impact of risks on the efficiency of introducing corporate innovations has the following form:

y = 10,384 – 0,081 x1+ 0,018 x2 – 0,199x3 – 0,589 x4 – 0,074 x5 + 0,113 x8 – 0,078 x10 . (2)

The resulting regression model makes it possible to predict the impact of risks on the effectiveness of the implementation of corporate innovations. In the author's opinion, in order to manage risks affecting the efficiency of introducing corporate innovations, it is necessary to build risk management systems in industrial companies that correspond to their levels of innovative development.

The consulting company KPMG distinguishes three levels of innovative development of companies [Corporate Innovation, 2017].

1. Companies with a stable business. These companies operate within the framework of standard market methods, in general, they are not ready to spend their resources on any significant changes, they do not have valid corporate innovation tools.

2. Mature companies. These companies have the tools to work with innovation, they are ready to innovate, and they have elements of an innovation culture.

3. Companies are leaders in innovative development. These companies have a full arsenal of tools for working in the innovation market: a high level of innovation culture, the necessary infrastructure for innovation, corporate funds, their own programs for acceleration and integration of startups.

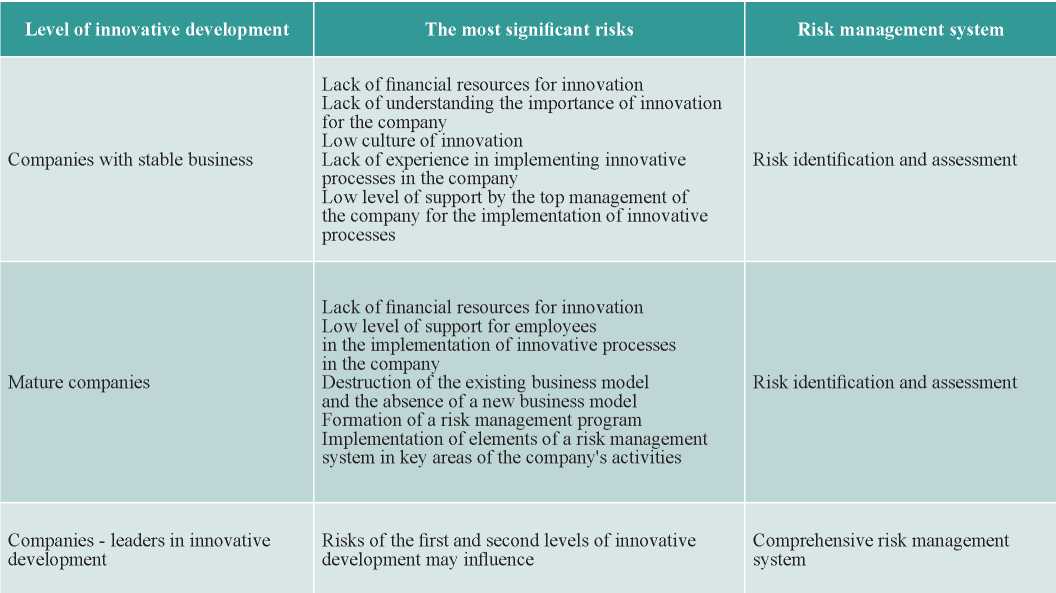

Table 8, the author proposes risk management systems for introducing corporate innovations in accordance with their levels of innovative development, which will improve the efficiency of introducing corporate innovations in industrial companies and ensure a high level of competitiveness in them..

Table 8

Risk management systems for the implementation of corporate innovations of industrial companies by levels of innovative development

Sources: compiled by the author based on [Boosting resilience .., 2014;

Corporate innovation, 2017; Sakai, 2018; Sharpe, 2018; Bilcan et al., 2019].

Thus, the proposed risk management systems will allow building risk management processes in companies in accordance with the level of their innovative development, which is an important condition for ensuring the competitiveness of industrial companies and their transition to a higher level of innovative development.

5. SUMMARY AND CONCLUSION

The article presents the results of a qualitative and quantitative assessment of risks influencing the effectiveness of the implementation of corporate innovations in industrial companies.

Correlation-regression analysis revealed the most significant risks influencing the efficiency of corporate innovation implementation in industrial companies. These include a lack of understanding of the importance of innovation for the company, a lack of financial resources for the implementation of innovations, a low level of support by the top management of the company for the implementation of innovation processes.

A regression model was also presented, which allows to predict the impact of risks on the efficiency of introducing corporate innovations of industrial companies.

In order to ensure the competitiveness of industrial companies and their innovative development, risk management systems are proposed for different levels of innovative development of industrial companies, taking into account their capabilities to carry out risk management processes for introducing corporate innovations.

References

1. Aktual’nye voprosy risk-menedzhmenta [Current Risk Management Issues] (2018). PWC. URL: https://www.pwc.ru/ru/riskassurance/assets/risk-management-and-compliance/e-ver-spravochnik-risk-man-july-18.pdf.

2. Berch K. (2015). Risk-appetit: ne otkusyvayte bol’she, chem mozhete proglotit’ [Risk appetite: don’t bite off more than you can swallow]. Korporativnyy menedhzment [Corporate management]. URL: https://www.cfin.ru/finanalysis/risk/Risk_Appetite.shtml.

3. Korporativnye innovatsii [Corporate Innovation] (2017). KPMG. URL: https://assets.kpmg/content/dam/kpmg/ru/pdf/2017/11/ru-ru-corporate-innovations.pdf.

4. Linder N.V., Kuznetsova M.O. (2020). Klyuchevye riski, svyazannye s tranzitnymi konteynernymi zheleznodorozhnymi gruzoperevozkami [Key risks associated with transit container rail freight]. Risk: resursy, informaciya, snabzhenie, konkurenciya [Risk: Resources, Information, Supply, Competition], 4, 12-19.

5. Bansal P., DesJardine M.R. (2014). Business sustainability: It is about time. SAGE Journals. URL: https://journals.sagepub.com/doi/full/10.1177/1476127013520265.

6. Bilcan F.R., Ghibanu I.A., Bratu I.I., Bilcan G.A. (2019). Risk and uncertainty in information society. Academic Journal of Economic Studies, “Dimitrie Cantemir” Christian University of Bucharest, 5(4), 126-131.

7. Bonciani D., Ricci M. (2020). The global effects of global risk and uncertainty. Bank of England Working Papers 863.

8. Boosting resilience through innovative risk governance (2014). OECD Publishing. URL: http://dx.doi.org/10.1787/9789264209114-en.

9. Drăghici D.M. (2017). The complexity of risk and uncertainty assessment. Studies in Business and Economics, Lucian Blaga University of Sibiu, 12(3), 43-49.

10. European risk manager report (2018). FERMA. URL: https://www.ferma.eu/2018-european-risk-manager-report.

11. Gollier С. (ed.) (2018). The economics of risk and uncertainty. Edward Elgar Publishing, no. 17427.

12. Purpura P.P. (2007). Resilience, risk management, business continuity, and emergency management. Reliability Engineering & System Safety, 355-392. https://doi.org/10.1016/j.ress.2006.11.002.

13. Sakai Y. (2018) On the economics of risk and uncertainty: A historical perspective. CRR Discussion Paper Series A: General 28, Shiga University, Faculty of Economics, Center for Risk Research.

14. Salci S., Jenkins G.P. (2016). Incorporating risk and uncertainty in cost-benefit analysis. Development Discussion Papers 2016-09, JDI Executive Programs.

15. Santos M.J., Ferreira P., Araújo M. (2016). A methodology to incorporate risk and uncertainty in electricity power planning». Energy, 115(P2), 1400-1411.

16. Sharpe K. (2018). On risk and uncertainty, and objective versus subjective probability. The Economic Record, The Economic Society of Australia, 94(S1), 49-72.

17. Tărăbîc А.А. (2018). Defining the concept of risk applied in entrepreneurship. Conceptual delimitation risk - entrepreneurial uncertainty. Ovidius University Annals, Economic Sciences Series, 0(2), 542-545.

18. Terzic I., Milojevic M. (2016.) Risk model backtesting. Ekonomika (Nis, Serbia), 62(1).

About the Author

M. O. KuznetsovaRussian Federation

Senior lecturer, department of management and innovation, faculty “Higher school of management”, Financial University under the Government of the Russian Federation. Research interests: strategic sustainability, risk management, strategic management.

Review

For citations:

Kuznetsova M.O. INDUSTRY CORPORATE INNOVATION RISKS: ЕMPIRICAL RESEARCH RESULTS. Strategic decisions and risk management. 2021;12(1):82-91. https://doi.org/10.17747/2618-947X-2021-1-82-91