Scroll to:

EXPLORING INNOVATION MODES OF RUSSIAN INDUSTRIAL COMPANIES

https://doi.org/10.17747/2618-947X-2020-3-272-285

Abstract

In paper the empirical assessment of formation of innovative modes is presented to the industries. Relevance of research is caused by need of development of new tools of the analysis and stimulation of innovative development as industrial companies and national economy as a whole.

Research objective – an assessment of the factors influencing innovative behavior of the company and allocation of innovative modes in the industry. Authors for the analysis of factors have used a method of the regression analysis of 627 Russian industrial companies given questioning, for allocation of innovative modes the clustering method is used with the help to – averages. In research factors are analysed: investments of the companies in researches and development, orientation to grocery and technological innovations, orientation to marketing innovations and creation of value, orientation to organizational and administrative innovations. Results of research show that in the Russian industrial sector it is possible to allocate innovative modes: “simulators”, “founders of valuable innovations”, “effective producers”, “technological innovators”, “radical innovators”. The “maturity levels” are developed for the allocated innovative modes depending on characteristics: opportunities the company independently to develop new products (services); improvement existing products, managements of researches and development, including coordination with external developers in network projects, strategic alliances, digital innovative platforms; generation and identification of new ideas; implementation of selection of ideas on the basis of the principles of compliance of strategy and their further development; identifications of new enterprise opportunities (studying of changes of environment and branch market, assessment of influence and identification of threats); providing a susceptibility to new technologies, a transfer of technologies; ensuring rationalization of system of production and management and commercial processes; improvement of operating technological processes; commercial use of objects of intellectual property. It is shown that the companies of higher level of an innovative mode make a bigger contribution to gross domestic product, create more workplaces and provide higher level of a salary, therefore development of the mechanism of stimulation of transition of the companies to more advanced level of an innovative mode is necessary.

Keywords

For citations:

Linder N.V. EXPLORING INNOVATION MODES OF RUSSIAN INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2020;11(3):272-285. https://doi.org/10.17747/2618-947X-2020-3-272-285

1. INTRODUCTION

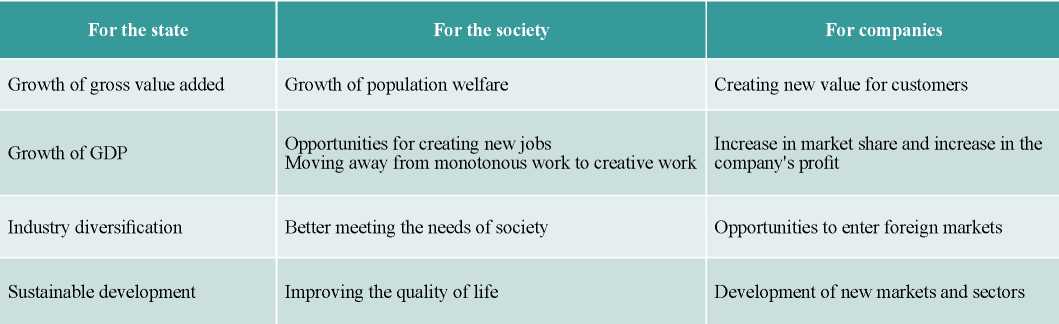

Russia has set an ambitious goal of GDP growth through innovation, as other sources are already exhausted or do not have sufficient potential.1 Innovation is a key factor in the competitiveness of both individual companies and the national economy as a whole. Components of the effects of innovation development are presented in Table 1.

Table 1

Effects of innovations implementation

Source: compiled by the author.

Total factor productivity2, which reflects the impact of innovations on the economy, can range from 3.9 to 5.7 percentage points, provided that innovation activity is stimulated in the Russian economy, and primarily in industrial production [Trachuk, 2013].

At the same time, the program for stimulating innovation activity in economic sectors cannot be formed based only on the indicators of the share of new products in the total output, the number of registered patents, published articles and references to them, sinceThe first factor - companies' investment in research and development - reflects the company's ability to independently generate and select new ideas, develop innovations without outsourcing.

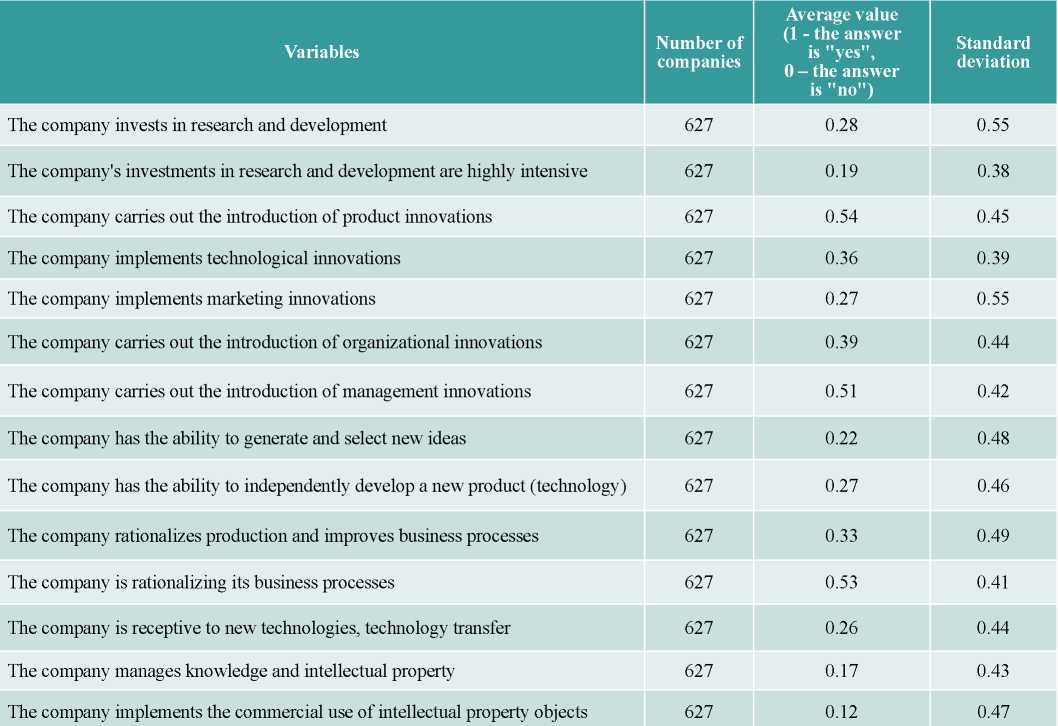

Table 2

Descriptive statistics of study variables

Source: author's calculations.

The second factor - the focus on product and technological innovation - indicates the implementation of an innovation strategy aimed at developing and introducing new products to the market or improving existing products in order to

maintain or expand market share. Companies also improve their technologies and business processes in order to reduce costs while maintaining or improving the quality of the product.

The third factor - marketing innovation and creating value for consumers - signals the implementation of an innovative strategy aimed at expanding markets by meeting the needs of consumers as best as possible and thereby expanding market share.

Table 3

Analysis of the factors for the selection of innovative modes

Source: author's calculations.

The fourth factor - organizational and managerial changes - reflects the implementation of an innovative strategy aimed at changing the organizational structure and introducing new management methods.

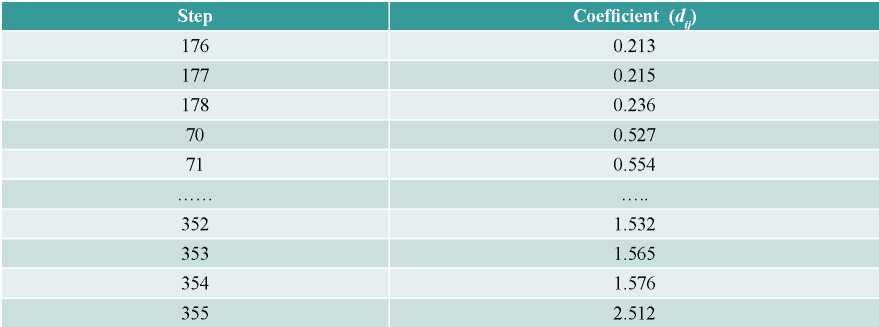

To determine the distance between arbitrary pairs of clusters, we use the maximum local distance method. The number of clusters in this case will be equal to the difference between the total number of objects and the sequence number of the step that has the maximum distance. The calculation results are presented in Table 4 (627 companies, 625 steps).

Table 4

The results of calculating the Hamming distances

Based on the calculations performed, we can see two jumps in the dynamics of changes in the threshold for splitting clusters at steps 178 and 353 (highlighted in bold), which indicates the possibility of splitting the existing population into two clusters.

We also used the k-average method to divide companies into groups within the selected clusters. The method is based on minimizing the total square deviation of cluster points from the centers of these clusters:

where k is the number of clusters; s is the resulting clusters; μi– is the centers of mass of the vectors, where i is the number of steps, varying from 1 to k.

Using this method, we get five clusters, so we divide the companies first into two, and then into five clusters. In this case, clusters 1, 2 form cluster I, and clusters 3-5 form cluster II (Fig. 1).

It should be noted that when dividing into clusters I and II, the division was based on the factor of companies' investment in research and development, the presence of which allows companies to independently generate new knowledge and develop new products and technologies. At the same time, clusters I and II do not represent any models of innovative behavior, do not have common components and combine different models of innovative behavior. The main difference between these clusters is that companies have the ability to independently generate knowledge, while cluster I unites companies that independently conduct research and development and in most cases are engaged in product and technological innovations, while cluster II includes companies that do not independently develop new products and do not generate new knowledge. This division is due to the focus on the possibility of introducing radical innovations and the transition to a higher level of the innovation regime [Trachuk, Linder, 2017].

The division of companies into five clusters is determined by the general characteristics of the innovation process and the innovation strategy of the company. Each of the selected clusters has a set of typical characteristics.

Cluster 1 - technological innovators. The companies included in this cluster implement an innovative strategy aimed at creating and developing new products through the integration of technologies with partners in the value chain. The largest share in the structure of innovation activity costs is research and development costs (from 3 to 10% of gross revenue). The products of such companies have a relatively short life cycle - from 2 to 8 years.

Among the tools for implementing such innovative strategies are the development and professional training of employees, patenting inventions, ensuring the protection of intellectual property, and creating partnerships aimed at accessing global sources of new knowledge and technologies.

This innovative mode is most often found among companies in the following industries: equipment manufacturing, metallurgical production, production of building materials, mechanical engineering.

Cluster - radical innovators. Companies included in this cluster create new products based on the commercialization of basic scientific research. The largest share in the structure of spending on innovation activities is occupied by research and development costs (as a rule, from 10 to 35% of gross revenue).

Since the innovation process in such companies involves conducting fundamental and applied scientific research, it has a relatively long period – from 7 to 20 years. As a rule, companies in this cluster have an extensive network of partnerships in the implementation of innovative projects, and the corporate innovation system is built using open innovation tools. The success of such innovative strategies depends, among other things, on the implementation of the state policy in the field of innovation: tax incentives, the development of innovation infrastructure, the possibility of commercialization of innovations and the creation of demand for innovations. In addition, important success factors are the work of such companies in international markets, the availability of qualified employees in innovation, and the protection of intellectual property.

This mode is most widely used in pharmaceuticals, chemical and metallurgical production.

Cluster 3 - efficient producers. Companies included in this cluster are aimed at improving operational activities and, accordingly, introducing process and technological innovations. The cost of innovation activities mainly consists of investments in new technologies, equipment, and infrastructure improvements. Costs of organizational and marketing innovations are negligible.

Innovative behavior of such companies is characterized by an emphasis on the creation and development of new products that reduce the cost of production, administrative and commercial costs. When implementing an innovative strategy, companies in this cluster form a network of partnerships that optimize logistics costs and promote the most effective interaction with suppliers, customers and end users.

This innovative mode is most widely used in the textile industry, metallurgy, woodworking, and the production of machinery and equipment.

Cluster 4 - creators of value innovations. Cluster companies implement a strategy aimed at creating the highest value for customers and optimizing the ways of its delivery, while ensuring the offer of new products, services and the formation of alternative business models. The goal of companies that adhere to this type of innovative behavior is to get to know their customers in order to increase the consumer value of products, reduce the operating costs of consumers, and find new markets.

The innovation cycle of companies in this mode is relatively short, the features of building a corporate innovation system are determined by the presence of undeveloped markets and niches, unsatisfied consumer requests.

The structure of the costs of innovation activity is dominated by the costs of marketing innovations (about 3-7% of gross revenue).

The success of this strategy lies in a deeper knowledge of the market and consumers, as well as opportunities to enter new consumer markets, diversification, and the potential to quickly scale up innovation and refine products after they are put on the market. The presence of domestic demand for innovations and measures to support entrepreneurship also have a positive impact on the performance of these companies.

This innovative mode is more common in the food, textile and clothing industries.

Cluster 5 - simulators. Companies that are part of this cluster do not independently create or distribute new knowledge and products on the market. The basis of this strategy is borrowing. At the same time, there are three types of borrowing: copying products as a whole; copying individual technical parameters, design and brand elements; borrowing innovative solutions (technologies, patents, knowledge, business processes, management principles and business models); creative imitation, when the company makes changes to the original innovation or finds a new application, as a result of which it creates a new product, process, technology.

The strategy of creative imitation characterizes the ability of companies to self-study, accumulate knowledge and competencies that allow them to critically rethink existing business practices, quickly and effectively respond to changes in the external environment.

This strategy allows companies that do not have the resources for their own research and development to develop and participate in the competition. Companies start with imitation to learn from innovators and market leaders, and over time develop their own innovative technologies and products. Under certain conditions, simulation strategies can also help create a sustainable competitive advantage and improve business performance.

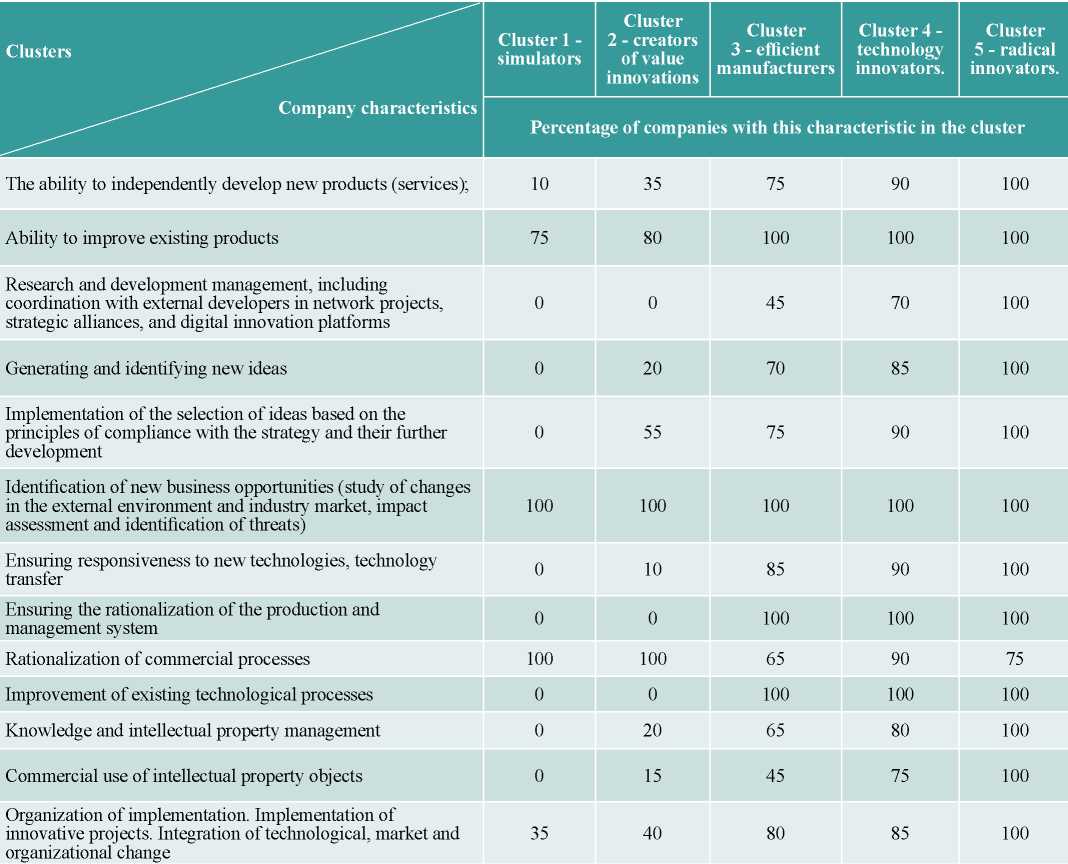

The characteristics of the selected innovative modes in industry are presented in Table 5.

Table 5

Characteristics of innovative modes in industry

Source: compiled by the author.

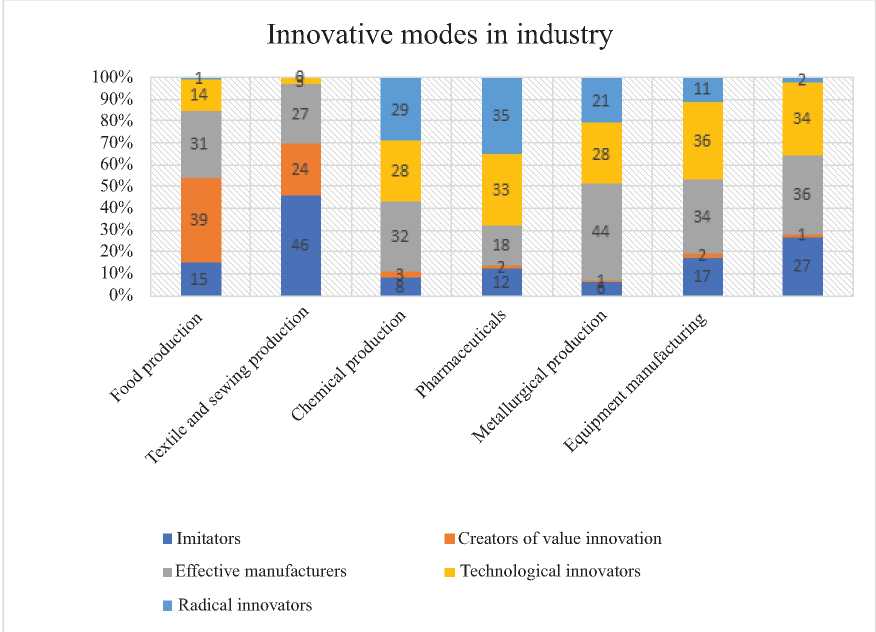

Figure 2 shows the distribution of the selected innovative modes among Russian industries.

Источник: составлено автором.

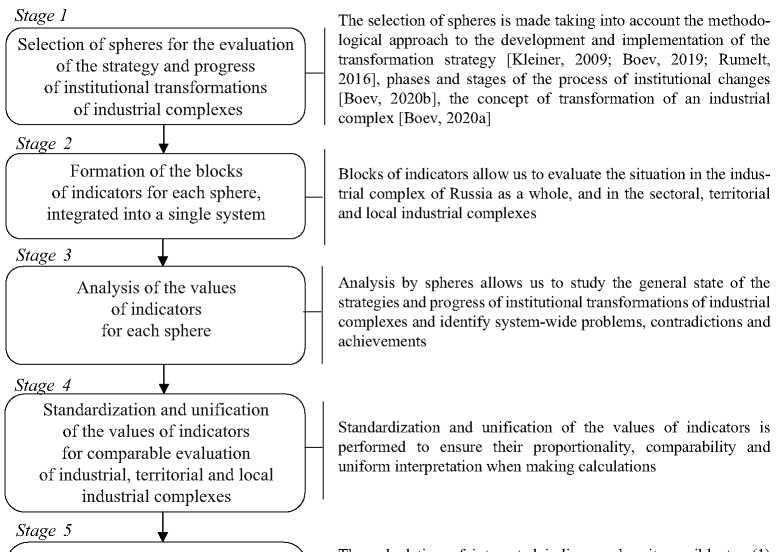

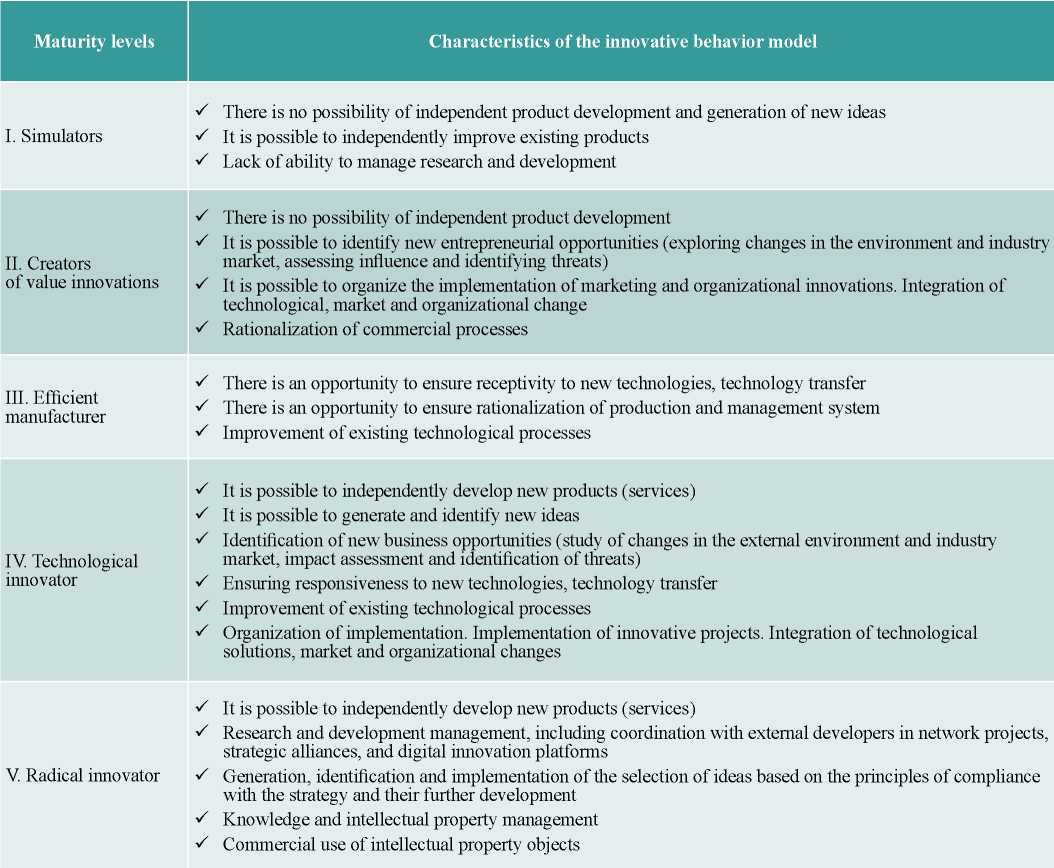

5. LEVELS OF MATURITY OF INNOVATION MODES

Model of innovative behavior and corresponding corporate innovation system ensure the implementation of the company's strategy. At the same time, in order to develop an innovative development strategy, it is necessary to analyze the possibilities of companies' transition to a higher level of the innovation regime. Proposed analysis of the maturity level of the innovative behavior model can be a tool for such an assessment. Fifteen key dimensions are identified, each of which is analyzed through the prism of five levels of maturity, which are characterized by certain characteristics. The first level means that the model measurement is at the initial stage of development, and the fifth level indicates high progress in this measurement (Table 6).

Table 6

Characteristics of the maturity levels of the corporate innovation system and the model of innovative behavior of industrial enterprises

Source: compiled by the author.

In accordance with these maturity levels, the identified models of innovative behavior of industrial enterprises are ranked (Table 7).

Table 7

Maturity levels of models of innovative behavior of industrial enterprises

Source: compiled by the author.

Based on the analysis of data from 627 industrial enterprises, the level of maturity of their innovative behavior model is analyzed and the innovative regimes of Russian industrial sectors are analyzed (Table 8).

Table 8

Characteristics of the maturity level of industrial companies participating in the study

Source: compiled by the author.

Next, we calculate the contribution of each innovation regime to the development of industry and the country's economy as a whole. Results of calculations showed that enterprises that implement more advanced models of innovative behavior have higher revenue and profit from sales, as well as a higher level of labor productivity (Table 9).

Table 9

Assessment of contribution of innovation regimes to the development of industry and the Russian economy

аCalculated on the basis of the form of Rosstat 5-z "Information on the costs of production and difference between output and material costs" .

Source: compiled by the author.

Thus, companies of a higher level of innovation regime contribute more to GDP, create more jobs and provide a higher level of wages, therefore, it is necessary to develop a mechanism to stimulate the transition of companies to a higher level of innovation regime. However, the development of such a mechanism should be accompanied by an analysis of the barriers to the transition of companies to it.

6. BARRIERS TO COMPANIES' TRANSITION TO A HIGHER LEVEL OF INNOVATION REGIME

To identify the barriers, a survey was conducted with representatives of the management of Russian industrial enterprises responsible for innovation activities. The questionnaire questions were formulated as follows: "How much do you agree with the statements below?", a 7-point Likert scale was used for the answers (1 – "completely disagree", 4 – "I do not know whether I agree or disagree", 7 – "completely agree"), the most significant barriers were measured at two levels: the level of innovation creation and the level of innovation commercialization.

Next, an index was calculated for the main barriers to innovation activity of companies by summing up the mentions of individual items from the questionnaire.

Table 10 shows the rating of factors that hinder innovation activity for enterprises of different innovation regimes at two levels: the level of innovation creation and the level of innovation commercialization.

Table 10

Rating of factors that hinder the effectiveness of innovation activities for enterprises of various innovation regimes

Results of analysis show that the barriers to innovation activity differ significantly not only from the level of innovation process: the creation or commercialization of innovations, but also from the type of innovation regime.

Thus, at the level of innovation creation, the most significant barriers for enterprises are the lack of their own sources of financing, limited access to financial capital, and the high cost of research and development.

The second most important factor for effective manufacturers and radical innovators was the lack of qualified personnel capable of generating new ideas.

Another significant factor for imitators, creators of value innovations and effective manufacturers was the lack of their own R&D departments, for technological innovators - the lack of opportunities to cooperate with the most attractive partners, and for radical innovators - the lack of intellectual property protection.

At the second stage of innovation process – the commercialization of innovations - the barrier of difficulty in attracting financing for the introduction of innovative products, on the contrary, does not play a decisive role. In the first place there are factors of low demand from consumers for innovative products (for radical innovators), the problems of commercialization (transition from technology to product) for technological innovators, the lack of managerial personnel capable of implementing innovative projects for effective manufacturers and imitators, the lack of information about sales markets for the creators of value innovations.

The results obtained indicate the need to use different tools to stimulate innovation and neutralize the identified barriers for companies of different innovation regimes in the industry.

7. CONCLUSIONS AND DIRECTIONS FOR FURTHER RESEARCH

Industrial companies, depending on the industry, the ability to independently conduct research and development, the specifics of the innovation process and the construction of corporate innovation systems, implement a particular competitive and innovative strategy. Objectives of the innovation strategy of sustainable growth of the company's business by improving product competitiveness, increase profitability, improve product quality, maintaining and increasing market share, improving the structure of consumers.

Depending on the type of innovation and competitive strategy being implemented, the type of innovation being implemented, and the characteristics of the corporate innovation system, five types of innovation modes in industry are identified: imitators, creators of value innovations, effective manufacturers, technological innovators, and radical innovators.

In order to stimulate the innovation activity of industrial companies and their transition to a more advanced level of the innovation regime, a scale for assessing the potential of the innovation system was developed and the maturity levels of the selected innovation regimes were determined.

The analysis showed that companies of a higher level of innovation regime contribute more to GDP, create more jobs and provide a higher level of wages, therefore, it is necessary to develop a mechanism to encourage companies to move to a higher level of innovation regime.

In addition, we have analyzed the barriers to the transition of companies to a higher level of innovation regimes. The results of the analysis show that the barriers to innovation activity differ significantly not only from the level of the innovation process: the creation or commercialization of innovations, but also from the type of innovation regime.

Thus, at the level of innovation creation, the most significant barriers for enterprises are the lack of their own sources of financing, limited access to financial capital, and the high cost of research and development. At the level of commercialization of innovations, the barrier of difficulty in attracting financing for the introduction of innovative products, on the contrary, does not play a decisive role. In the first place there are factors of low demand from consumers for innovative products (for radical innovators), the problems of commercialization (transition from technology to product) for technological innovators, the lack of managerial personnel capable of implementing innovative projects for effective manufacturers and imitators, the lack of information about sales markets for the creators of value innovations.

The obtained results will allow managers of the companies in more detail to develop a strategy of innovation based on the analysis of such corporate innovation system, as the development of new products (services); the improvement of existing products (services); the management of research and development, including coordination with external developers in network projects, as well as in strategic alliances, identify new business opportunities (the study of changes in the external environment and industry market, impact evaluation and detection of threats); the generation and detection of new ideas; the possibility of selecting ideas based on the principles of compliance strategies and their further development; ensuring receptivity to new technologies, transfer of technologies; organization of the implementation of technologies, innovative projects, integrating technological, market and organizational change, improving existing technological processes; ensuring policy of streamlining production and management; opportunities to streamline business processes; knowledge management and intellectual property commercial exploitation of intellectual property.

1. Innovation in Russia is an inexhaustible source of growth. McKinsey Innovation Practice Center for Innovation. 2018. July. URL: https://www.mckinsey.com/~/media/McKinsey/Locations/Europe%20and%20Middle%20East/Russia/Our%20Insights/Innovations%20in%20Russia/Innovations-in-Russia_web_lq-1.ashx

2. Total factor productivity is calculated as the difference between total GDP growth and factors of production (capital and labor gains).

References

1. Gokhberg L.M., Kuznetsova T.E., Rud V.A. (2010). Analiz innovatsionnykh rezhimov v rossiyskoy ekonomike: metodologicheskie podkhody i pervye rezul’taty [The analysis of innovative modes in the Russian economy: Methodological Approaches and First Results]. Forsayt [Foresight and STI Governance], 4(3), 18-30.

2. Miles I. (2020). Budushchee skvoz’ prizmu podryvnykh innovatsiy [A Disrupted future?]. Forsayt [Foresight and STI Governance], 14(1), 6-27. DOI: 10.17323/2500-2597.2020.1.6.27.

3. Trachuk A.V. (2013). Formirovanie innovatsionnoy strategii kompanii [Formation of innovative strategy of the company]. Upravlencheskie nauki [Administrative Sciences], 3, 16-25.

4. Trachuk A.V., Linder N.V. (2015). Transformatsiya biznes-modeley elektronnogo biznesa v usloviyakh nestabil'noy vneshney sredy [Transformation of business models of electronic business in conditions of unstable external environment]. Effektivnoe antikrizisnoe upravlenie [Strategic Decisions and Risk Management], 2, 58-71. URL: https://doi.org/10.17747/2078-8886-2015-2-58-71.

5. Trachuk A.V., Linder N.V. (2017). Innovatsii i proizvoditel’nost’: empiricheskoe issledovanie faktorov, prepyatstvuyushchikh rostu metodom prodol’nogo analiza [Innovations and productivity: Empirical research of the factors interfering growth by a method of the longitudinal analysis]. Upravlencheskie nauki [Administrative Sciences], 7(3), 43-59.

6. Desyllas P., Miozzo M., Lee H.F., Miles I. (2018). Capturing value from innovation in knowledge- intensive business service firms: The role of competitive strategy. British Journal of Management, 29, 769-795.

7. Dosi G. (1982). Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Research Рolicy, 11, 147-162.

8. Dosi G. (1988). Sources, procedures, and microeconomic effects of innovation. Journal of Economic Literature, 26, 1120-1171.

9. Evangelista R. (2000). Sectoral patterns of technological change in services. Economics of Innovation and New Technology, 9(3), 183-222.

10. Faria L., Andersen M.M. (2017). Sectoral dynamics and technological convergence: An evolutionary analysis of eco-innovation in the automotive sector. Industry and Innovation, 24(8), 837-857. URL: https://doi.org/10.1080/13662716.2017.1319801.

11. Hatzichronoglou T. (1997) Revision of the high-technology sector and product classification. OECD Science, Technology and Industry Working Papers, 1997/2. doi:https://dx.doi.org/10.1787/134337307632.

12. Janger J., Schubert T., Andries P., Rammer C., Hoskens M. (2017). The EU 2020 innovation indicator: A step forward in measuring innovation outputs and outcomes? Research Policy, 46(1), 30-42.

13. Malerba F., Nelson R., Orsenigo L., Winter S. (2016). Innovation and industrial evolution. In: Innovation and the evolution of industries: History-friendly models. Cambridge, MA, Cambridge University Press. doi:10.1017/CBO9781107280120.004.

14. Malerba F., Orsenigo L. (1993). Technological regimes and firm behavior. Industrial and Сorporate Сhange, 2, 45-71.

15. Miles I., Belousova V., Chichkanov N. (2017). Innovation configurations in knowledge-intensive business services. Foresight and STI Governance, 11(3), 94-102. DOI: 10.17323/2500-2597.2017.3.94.102

16. Nelson R.R., Winter S.G. (1982). An evolutionary theory of economic change. Cambridge, MА, London, Harvard University Press.

17. Pavitt K. (1984). Sectoral patterns of technical change: Towards a taxonomy and a theory. Research Policy, 13, 343-373.

18. Pyka A., Nelson R. (2018). Schumpeterian competition and industrial dynamics. In: Modern evolutionary economics: An overview. Cambridge, МА, Cambridge University Press. doi:10.1017/9781108661928.004.

19. Rodriguez M., Camacho J.A. (2010). Are knowledge-intensive business services so “hard” innovators? Some insights using Spanish microdata. Journal of Innovation Economics & Management, 1(5), 41-65.

20. Van den Bergh J. (2018). Technological evolution. In: Human evolution beyond biology and culture: Evolutionary social, environmental and policy sciences. Cambridge, MA, Cambridge University Press. doi:10.1017/9781108564922.011.

21. Winter S. (1984). Schumpeterian competition in alternative technological regimes. Journal of Economic Behavior & Organization, 5(3-4), 287-320.

About the Author

N. V. LinderRussian Federation

Candidate of economic sciences, professor, head of Department of management and innovations, deputy dean of faculty “Higher school of management” of the Financial University under the Government of the Russian Federation. Research interests: strategy and development management companies, formation of development strategy of industrial companies in the context of the fourth industrial revolution, innovation transformation of business models, dynamics and development of e-business development strategies of companies in the energy sector in the fourth industrial revolution, exit strategies of Russian companies on international markets.

Review

For citations:

Linder N.V. EXPLORING INNOVATION MODES OF RUSSIAN INDUSTRIAL COMPANIES. Strategic decisions and risk management. 2020;11(3):272-285. https://doi.org/10.17747/2618-947X-2020-3-272-285