Scroll to:

IMPORT SUBSTITUTION IN THE POWER ENGINEERING INDUSTRY

https://doi.org/10.17747/2618-947X-2020-2-182-195

Abstract

This article discusses the issues of dependence of power engineering in the Russian Federation on imported equipment in general and in the field of gas turbine technologies. The paper describes the features of foreign-made equipment that is operated at the power facilities of the Russian Federation, identifies the countries that produce the installed foreign equipment in the power industry. Possible economic consequences for the energy-intensive industry from the implementation of the program for the modernization of generating equipment within the framework of the import substitution program are estimated. The forecast scenario of the impact of the coronavirus pandemic on power consumption in the UNEG and the program for the modernization of generating equipment is also presented.

Keywords

For citations:

Balashov M.M. IMPORT SUBSTITUTION IN THE POWER ENGINEERING INDUSTRY. Strategic decisions and risk management. 2020;11(2):182-195. https://doi.org/10.17747/2618-947X-2020-2-182-195

1. INTRODUCTION

In the Russian fuel and energy complex due to the current geopolitical and economic situation, the topic of import substitution plays an extremely important role. Following the imposition of sanctions by the United States and European Union countries, reducing the purchasing power of the population and stopping the supply of high-tech equipment, badly needed for stable the functioning of key areas of public life, it has become apparent that that it is necessary to abandon the use of imported equipment and technology. The only expedient solution to prevent the shortage of equipment that ensures the functioning of all public services was accelerated development of domestic productions. Most industries required improvements in manufacturing and technology, while electric power required the development of a number of technologies almost from scratch. Thus, one of the key directions in energy industry starting in spring of 2014 was the development of domestic power engineering.

According to the Doctrine of Energy Security, internal threats to energy security of economic character are low innovation activity in energy engineering, which can lead to a lag in the development of important modern technologies, and the high level of dependence on the import of equipment of production enterprises of the fuel and energy complex.

Clearly, a reliable independent energy system that is consistent with sustainable development is a key component in determining the welfare and quality of life of consumers operating within the energy system [Ouedraogo, 2013; Energy poverty handbook, 2016; Holland et al., 2016]. These threats pose a serious risk of disrupting the stability of the country's power system, and their possible consequences affect all areas of public life and can directly affect safety and defense capacity of the country. Therefore, the process of import substitution in key directions is especially closely monitored by the President and the Government of the Russian Federation.

2. THEORY AND PROBLEMS OF IMPLEMENTATION OF IMPORT SUBSTITUTION PROGRAM

According to the Energy Strategy approved by the Decree of the Government of the Russian Federation dated 13.11.2009 No. 1715-r adopted for the period up to 2030, the solution of the problem of import substitution is one of the important tasks our country1. In this regard, at the state level there is support for the production development of domestic equipment.

To date, the Ministry of Industry and Trade of the Russian Federation has approved more than 20 production plans defining a set of measures to stimulate enterprises, including 2,200 technological directions of development of Russian industry, including energy [Vatolkina, 2015]. The opinions of Russian companies, development institutions and federal executive bodies, as well as the Russian Academy of Sciences, were taken into account in their drafting. Tools used to improve the implementation of sectoral plans and to coordinate all stakeholders include development institutes programs, expert councils, inter - agency, as well as working groups.

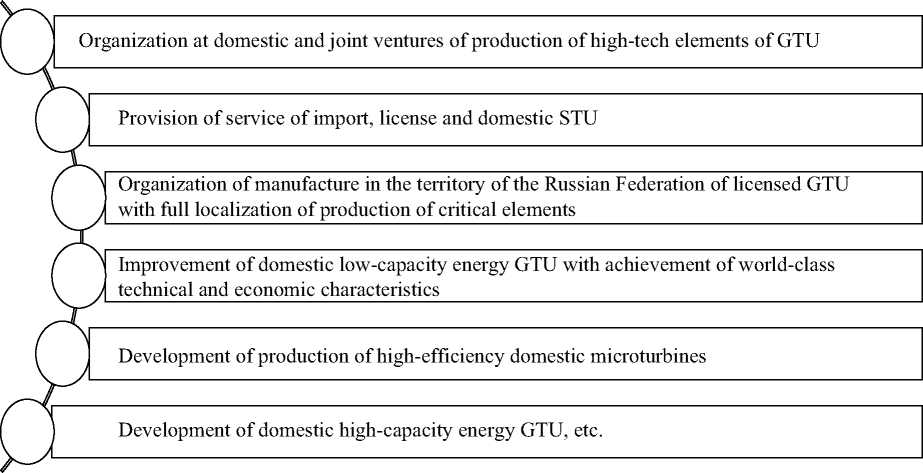

In 2016, an interdepartmental working group approved a program in the field of gas turbine technologies concerning import substitution of power engineering equipment2 [Kozinchenko, 2015], the tasks of which are presented in Figure 1.

The program provides a set of measures aimed at the development of domestic gas turbine as the most promising and environmentally neutral technology taking into account consumption forecasts energy for the period up to 2025.

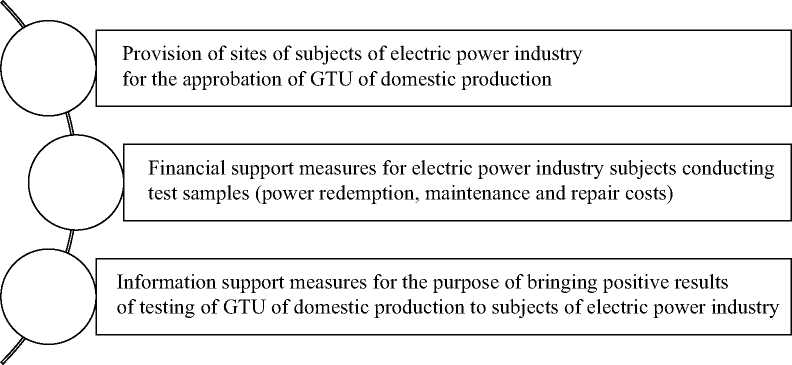

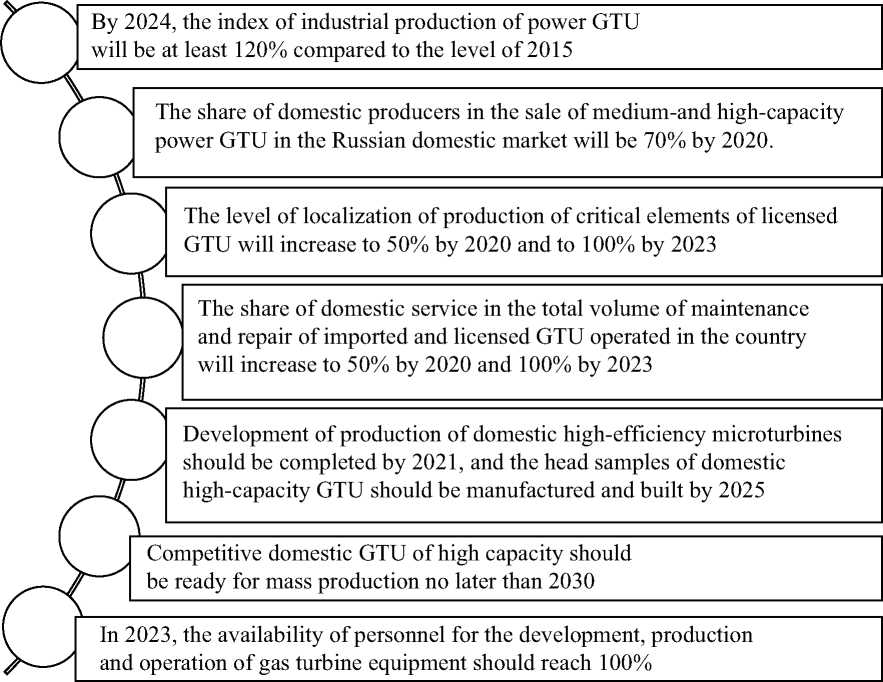

Measures to support domestic producers of gas-turbine units (GTU) within the framework of the implementation of this import substitution program are presented in Figure 2. Project targets are presented in Figure 3 The key participant in the process of import substitution and development of domestic industry is the industrial development Fund. According to the Government of the Russian Federation, during 2019, 74 projects worth 24.6 billion rubles were approved by the industrial development Fund, and in the period from 2014 to 2016, the volume of financing of the industrial development Fund reached 136.5 billion rubles.

According to the reporting data on the main performance indicators of the Ministry of industry and trade for 2018, the market volume:

- cable production – 236.3 billion rubles.,

- electrical production – 137 billion rubles.,

- power engineering industry – 117.2 billion rubles.

By the end of 2019, 374.4 billion rubles were spent on the implementation of import substitution projects in general, while the share of expenditures from the Federal budget reached 71.4 billion rubles3.

As part of the preparation and development of the import substitution program, special emphasis was placed on the fact that the domestic economy is characterized by a significant geographical concentration, high energy intensity, relatively low cost of carbon fuel and low cost of electric energy. Given that Russia has the most energy-intensive economy, the total share of electricity in GDP is at an average level. The ratio of thermal power plants to other types of generating equipment is one of the highest in the world and is about 68%. At the same time, the average wear rate of the main generating equipment is the highest in the world. At the same time, it should be noted that the problem of obsolescence of the main generating equipment arose more than ten years before the introduction of economic sanctions. Initially, according to the results of examinations, the maximum operating time of equipment was extended depending on the General condition of the equipment [Yershov, 2011], in some cases twice. However, it is clear that such measures do not lead to increased efficiency in the fuel and energy sector and are only a temporary measure. At the same time, the accident rate of electric power production increases and accidents with equipment failure become more frequent. At the beginning of 2015, the issues of modernizing the equipment of thermal power plants were more acute than ever. This leads to the conclusion that the consequences of the sanctions imposed against Russia can cause significant damage to the country's economy due to the inability to purchase foreign power equipment for the construction or modernization and reequipment of rapidly aging power plants.

3. IMPORT SUBSTITUTION OF TURBINE EQUIPMENT

In November 2017, the Minister of energy of the Russian Federation Alexander Novak made a report on the results of the first program of power supply agreements at a meeting on the development of the electric power industry. The report focused on the problem of widespread aging of generating and auxiliary equipment. According to the report, the average age of all operating generating equipment exceeds 34 years. A more detailed analysis showed that just over 30% of all generating equipment is over 45 years old, and twothirds of all generating equipment has fully developed the standard Park resource. Under the first capacity agreement program (DPM-1), more than 21 GW of new capacity was put into operation from 2008 to 2017, and another 7 GW of capacity was extensively upgraded. Thus, about 15% of the total installed capacity of the power system was updated. At the end of the DPM-1 program, it became possible to free up about 180 billion rubles a year. According to the Ministry of energy of the Russian Federation, these funds should be spent on deep modernization of outdated generating equipment that has developed a standard Park resource, based on import substitution programs and the development of domestic power engineering. According to the report of the Russian Ministry of energy, at the beginning of 2020, the share of thermal power plants in the structure of installed capacity of power plants in the unified energy system of Russia is 66.82%4. The cost of wholesale gas prices is regulated by the Federal Antimonopoly service and is about 5,000 rubles per 1,000 cubic meters, which is one of the lowest rates in the world.

However, it should be noted that a significant proportion of thermal generation in the Russian Federation are coal power plants, a priori, has a significantly lower performance compared to gas power plants. Moreover, for most coal-fired

power plants have the following characteristics: useful life not less than half of main equipment is more than 45 years; steam parameters are at the level of standard solutions 1950- ies; about a third of the equipment (boilers and turbines) has a very low settings; low heat recovery boilers and flue gas seal gas paths, reducing the economic efficiency of their exploitation; insufficient level of equipment of boiler plants by means of flue gas and excess as a result of emissions of harmful substances [Budilov et al., 2006]. The conversion of coal-fired power plants to the steam-gas cycle as part of the modernization program can significantly improve the safety and economic efficiency of power plants and the energy system as a whole.

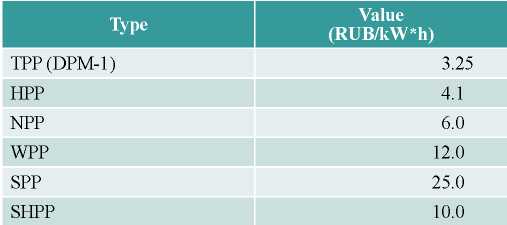

At the same time, the average estimated cost of electricity production over the entire life cycle of a thermal power plant (LCOE TPP) is the lowest among any other types of generating equipment (table 1).

Table 1

Average estimated cost of electricity generation over the entire life cycle of a thermal power plant (LCOE TPP)

Thus, the Russian electric power industry is largely dependent on modern thermal power plants and their reliability. The need to ensure a continuous process of development and increase the efficiency of the use of hydrocarbon resources is due to ensuring the reliability of the power system, but at the same time it is not possible without the use of modern technologies implemented on the territory of the Russian Federation [Grabchak, 2016].

It should also be noted that the gas turbines of large capacity are an integral and inalienable part of the Russian energy system. Steam conversion at combined cycle power plants together with gas turbine units has become mainstream in Russia. Over the past fifteen years, combined-cycle gas turbines have been the most promising technology in thermal power generation. In addition to combined generation, gas turbines in power plants are widely used for cogeneration and to cover the peaks of consumption in the power system [Klimenko et al., 2017].

In this case, the key problem is that currently in the electric power industry at generation facilities there is a high share of imports on the following equipment:

- gas turbines;

- hydraulic turbines;

- transformers (autotransformers);

- switches [Zernova, 2016].

Combined-cycle gas plants (CCGTs) of domestic production, produced on the basis of high - power gas turbines with popular characteristics, are a key factor that will ensure the functioning of the energy system and, as a result, the development of the Russian economy. It is also worth noting the practical significance of gas turbine installations: highly maneuverable gas turbine installations are indispensable for effectively covering the schedule of electrical loads (intraday fluctuations in the consumption schedule). However, within the framework of the development of domestic power engineering, it should be noted that there is some "open-loop" in the cycle of innovative development of the industry. The process of development of turbine engineering involves development work, development of a scientific direction, preparation of capacities for mass production, preliminary pilot operation and sale of manufactured products at power plant sites, as well as service support for product operation.

The current legislation provides for a number of measures that guarantee a refund of funds spent on the production and installation of GTU. In accordance with the instructions of the Government of the Russian Federation in the process of

preparing the legislative base for the project of attracting investment in the modernization of thermal generation with the use of localized energy power equipment the Ministry of energy has established a base level rate of return on invested capital of 14%, as well as the inadmissibility of exceeding the level of inflation in connection with the implementation of mechanisms for attracting investments in the projects on modernization of heat generating facilities in conjunction with other solutions to be adopted in the electricity sector for the whole period of validity of this mechanism.

The government of the Russian Federation has approved measures to set these parameters in contracts that will be concluded based on the results of competitive procedures for the modernization of thermal power plants with the start of power supply in 2022-2024, but the necessary regulatory framework is constantly being refined and updated, based on the opinions of key participants in the process.

Thus, the law provides for a refund of funds spent on the purchase and installation of power equipment, but the procedure for developing the corresponding equipment, as well as financing developments, occurs only if there is a need for equipment. It is noted that a significant lag in the level of development of domestic power equipment from foreign analogues was the result of long-term underfunding of design institutes, as well as the availability of ready-made offers with commercially more favorable conditions. As a result, it is impossible to provide funding for the initial stages of the innovation cycle, primarily scientific developments that determine the scientific and technological level of products in the future. At the time of the introduction of sanctions, the Russian power engineering industry was functioning without sufficient state support, and the interaction of power engineering enterprises with power generating companies was also sharply reduced. As a result, design institutes underestimated the targets for the development of the industry or abandoned the planned ones, in particular, the creation of new equipment for the energy sector and its serial replication.

Thanks to the experience gained, it became clear that it is necessary to provide financial and regulatory support not only to manufacturers and owners of power equipment, but also to specialists responsible for developing promising technologies in the power engineering industry.

Experts also note that state participation in managing innovation processes, providing favorable conditions for firms to design and develop new equipment, co-financing priority projects, operating pilot plants, exporting domestic equipment and encouraging its acquisition in the domestic market has not yet reached the required level.

However, in accordance with the instructions of the Government of the Russian Federation the Ministry of energy is considering possible options for the implementation of pilot projects using experimental designs gas turbines, Russian production capacity of 65 MW and above with the use of power of new generating facilities on the sites of existing power plants. In accordance with the decision of the Deputy Chairman of Russian Government D. N. Kozak, the Ministry of industry and trade in conjunction with potential manufacturers of domestic high-power gas turbines requested to develop a list of specific projects that can be implemented with the use of power of new generating facilities.

Based on the results of the study of possible options for the implementation of pilot projects using experimental samples of Russian-made gas turbines, the Ministry of industry and trade of Russia proposes to consider the construction of a thermal power plant with an installed capacity of up to 1.4 GW near SDPP of Novocherkassy, blocks 1-4 of which have the status of forced generation and are expected to be decommissioned in the medium term until 2024. It was also noted that additional analysis of the demand for electric energy in the republics of Tatarstan, Bashkiria and Crimea is advisable. In order to study in detail the placement site(s), the composition of turbine generators, as well as to clarify the forecast balance situation in the United energy system (UES) of the South, the Federal Executive authorities continue to assess the possibilities of installing innovative and experimental gas turbines.

As part of the study of possible ways to implement domestic gas turbines, the lack of confidence of their manufacturers in the possibility of selling products was repeatedly noted, which significantly affects their desire to develop large and medium-capacity of GTU. The main part of the problem when creating GTU of their own design is solved by manufacturers of power power equipment themselves, which is one of the features of Russian gas turbine construction. At the same time, as already noted, R&D is financed by orders of generating companies only in the event of demand.

In addition, manufacturers of main and auxiliary generating equipment have a lack of working capital (available), so it becomes impossible to Finance promising technologies based on subsequent demand.

The process of import substitution, in addition to creating a regulatory framework, also required significant changes in the energy engineering industry. Research and design institutes had to urgently develop the experimental design base, as well as work out options for upgrading outdated power equipment, in particular the necessary and scarce medium – and high - power turbines, since historically, in the USSR, and later in Russia, only low-power GTU production was established-up to 25 MW. All this time, the demand for high - capacity turbines - from 65 MW or more-was imported from abroad. Low-power turbines were designed mainly based on aircraft engines, which also negatively affected the experience of building large turbines.

At the time of the economic sanctions and to this day, high-power turbines are produced by a limited number of companies around the world, in particular Siemens, General Electric and the Japanese company Mitsubishi Heavy Industries. At domestic power plants, it is the turbines produced by Siemens and General Electric that are most widely used.

In addition, in order to improve energy security, the Government of the Russian Federation adopted Resolution No. 719 of 17.07.2015 "On confirming the production of industrial products on the territory of the Russian Federation", which established a number of criteria and restrictions that determine the degree of localization of power equipment. Given that foreign technologies in the energy sector are prohibited from being transferred to companies that are subject to sanctions, which also applies to the supply of spare parts and service, this measure, in the opinion of the government, is reasonable and appropriate. At the same time, these restrictions have greatly affected the availability of power equipment, as well as significantly reduced the speed of development and development of new promising technologies in turbine construction. The main difficulty encountered when creating a new turbine is the creation of the most labor-intensive, high tech and scienceintensive parts, namely the combustion chamber, as well as the working and nozzle blades of the turbine. Simple copying of other people's technologies and design features of components is obviously doomed to failure, and therefore a number of reengineering measures are needed [Filatov et al., 2016]. Currently, existing developments are being investigated for potential improvements, and attempts are being made to exchange experience with industry leaders [Coatings for high temperature.., 1996].

Currently, there are several companies on the territory of the Russian Federation that have successfully adopted and applied foreign experience in turbine construction, applying for the implementation of developed highcapacity gas turbines as part of the selection of projects for the modernization of generating facilities of thermal power plants using innovative gas turbines in the amount of up to 2000 MW. These are the partnership of Gazprom energoholding LLC with Siemens Gas Turbine Technologies LLC, a subsidiary of Siemens, and Power machines PJSC; the consortium of the United engine Corporation (UEC) Rostekh with Inter RAO holding and ROSNANO JSC; and Inter RAO with the well-known General Electric Corporation (GE) in the energy industry. Also worth noting are the offers for the supply of turbines from Russian Gas Turbines LLC and REP holding JSC. Even now, before summing up the results of the selection of projects for the modernization of generating facilities of thermal power plants, scheduled until September 1, 2020, we can talk about significant interest on the part of manufacturers of power equipment in the development, production and sale of their products.

In Russia, over the past 10-15 years, steam-gas and gasturbine installations of medium and large capacity have become widely used. This applies both to new thermal power plants that have already been built during this time, and to upgraded ones that run on natural gas.

At the same time, it should be noted that the share of equipment supplied by foreign companies for already operating CCGT and GTU in their total capacity is more than 70%, and their projected share in the planned commissioning exceeds 80%.

In Russia, most gas turbines are manufactured by the world's leading manufacturers. Among them are such companies as Siemens, General Electric, Alstom, Ansaldo, as well as Mitsubishi, Kawasaki, Solar and a number of others. If we take their total number, they have already delivered more than hundreds of GTU units, and in most cases these installations belong to previous generations. On all delivered GTU their service and repair work is performed exclusively by specialists of foreign companies, whose services are extremely expensive. Such a high dependence on imported energy equipment supplies to the country threatens the scientific and technological sovereignty of the energy industry. However, we should also note the positive trends in the localization of GTU production on the basis of joint ventures in the country and the opening of subsidiaries by foreign manufacturers.

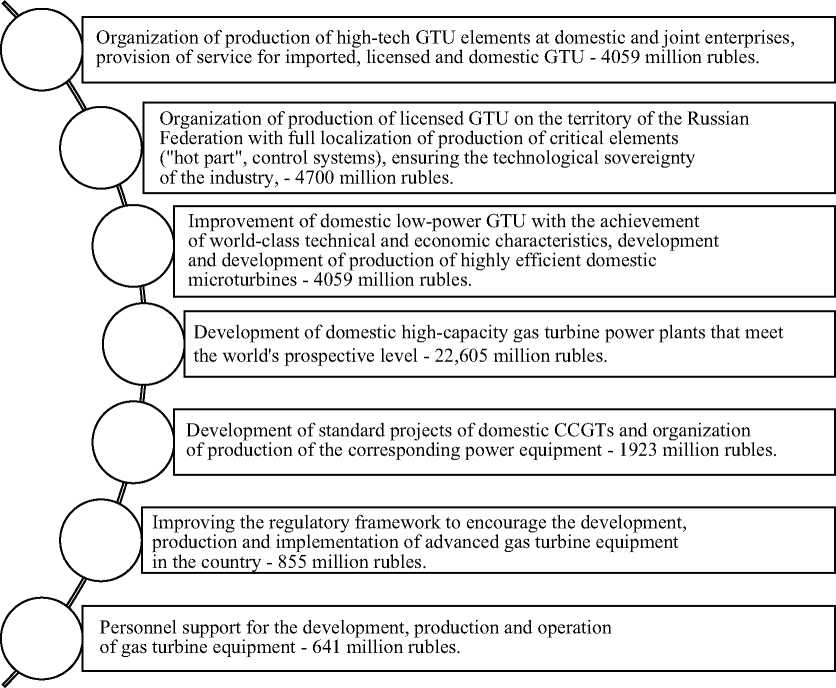

To solve the problem of high dependence of domestic power equipment on foreign materials, components and specialists, special emphasis was placed on the preparation of the necessary resource base, consisting of the tasks presented in figure 4.

The total amount of funding for the program's activities from the Federal budget is estimated at 38.84 billion rubles, including the first stage-at 21.36 billion rubles, the second stage-at 17.48 billion rubles. The total amount of necessary financial resources for the implementation of the program is estimated at 117.7 billion rubles. Thus, the share of Federal budget funds in total expenditures is about 33%. The remaining 67% of the amount of funding is extra – budgetary and attracted funds.

According to a representative of the Siemens Corporation, the localization level of the SGT5-2000E gas turbine at the Siemens Gas Turbine Technologies plant reaches 60%. At the same time, the localization level can be quickly increased to 90% or higher if a special investment contract (SPIC) is signed. The deadline for reaching this level is 2023.

According to the SPIC data, the volume of investments will be about 1.3 billion rubles. The purpose of these investments is to localize and continue the development of production. As representatives of the company explained, the development of the ecosystem has already begun. It concerns Russian suppliers of those components that are most important. For example, these are elements of the hot path of a turbine.

According to the company's representatives, a number of potential partners have already received technical documents. However, investments are also expected from the Russian side. So, PJSC "Power machines" is the development of two types of gas turbines. These are standard sizes GTE-65, GTE-170. At the same time, according to the TGE-65 model, the technical part of the documents is fully ready. However, work is still being done on the combustion chamber. Regarding the GTE-170, the documentation readiness is about 80%. Moreover, the test model of the equipment has already started working. Back in 2012, the GTE-65 model was tested. At the moment, this equipment is undergoing revision measures at the manufacturer's production.

The presented turbines are produced exclusively by Russian companies. Equipment deliveries will begin in 2023. At the same time, PJSC "Power machines" specialists continue to work on improving the quality of both turbines to increase their capacity and technical and economic parameters.

Currently, the GTD-110M project is the only one that is 100% implemented in Russia. The upgrade of this equipment is carried out by several companies. The consortium includes Inter RAO, ROSNANO, and Rostekh.

In the fall, the updated turbine worked 3,000 hours for testing purposes. At the same time, the tests were divided into two stages – bench and industrial operation. It is planned that the specified size of the turbine will continue to work at the Ivanovo CCGT.

The developers had to overcome the damage and problems of the installation - after all, such a complex energy technology requires systematic monitoring and improvements.

Energy companies and machine builders are also discussing another way - the transfer of foreign turbobuilding technologies to Russia. But there are serious difficulties here, as there are strict requirements of the Ministry of industry and trade for localization – its level should not be lower than 90%. All critical components are taken into account: the combustion chambers, the hot path, the quality of cast billets, control systems, and packages.

4. CONSEQUENCES OF IMPOSED SANCTIONS AND UNDERSTANDING OF THE CRITICALITY OF THE SITUATION IN THE FIELD OF DOMESTIC ENERGY ENGINEERING

In 2017, there was a scandal caused by dependence on imports: at that time, two power plants were being built in the Crimea, which needed gas installations of significant capacity. Siemens turbines were purchased on the secondary market, then updated at Russian factories. But European manufacturers still expressed dissatisfaction, limiting the supply of high-tech equipment to the country. In order to minimize sanctions risks in the basic industry, the Ministry of industry and trade and the Ministry of energy decided to seriously engage in import substitution.

At the beginning of 2019, the government adopted a program for the modernization of DPM-2 thermal power plants, but it did not allow the use of gas turbines for setting up steam power plants or implementing projects for the installation of CCGT. This was due to the fact that projects have a set maximum total capital investment (CAPEX), which is 33 thousand rubles per installed kW for the most common capacity range. Projects with gas turbines for this indicator are at the level of 55-60 thousand rubles per installed kW (new construction) and 36-40 thousand rubles per installed kW (existing stations).

The CEO of Infoline Analytics explains that combinedcycle gas projects are cut off under CAPEX, while LCOE - a one-step tariff that shows the costs of the entire life cycle - is not even considered. The main interest of Russian gas turbine manufacturers is to increase the CAPEX limit in the PDM-2, guarantee the preservation of localization requirements, according to decree No. 719 of the Government of the Russian Federation, prohibit individual solutions after the conclusion of non-standard investment contracts, and provide innovative Russian developments with benefits for penalties in case of accidents or violations of the commissioning deadlines.

In the future, it is possible to increase the presence of Russian manufacturers in the gas turbine industry by activating the production potential of the country's power engineering enterprises and using the aircraft engine building capacities to produce small and medium-sized gas turbines. For example, JSC Ural turbine plant, if the business is interested and there is sufficient state support, has the potential to introduce the production of equipment of this class.

Recently, the growth rate of demand for gas turbine power plants, including the use of other power equipment, has significantly decreased. The reason for this was the fact that there was an excess of such generating capacity in the country.

This was due to the fact that in the last decade, as a result of their intensive commissioning, there was a significant decline in the growth rate of electricity consumption. And according to forecasts, this trend is likely to continue in the medium-to-short term. The grounds for making a decision on the need for large-scale modernization of thermal power plants in the UES of Russia are formulated in the General layout of objects until 2035, approved by Order of the Government of the Russian Federation No. 1209-R of 09.06.2017. According to the specified program document, investment decisions should be made in relation to 53 GW of generating capacity in terms of dismantling, including replacement; in relation to 76 GW of generating capacity in terms of modernization with the extension of the Park resource, increasing the technical and economic performance of equipment with a specific capital expenditure of no more than 40% of new construction.

When working out mechanisms for attracting investment in modernization, we took into account, in particular, restrictions on financing remote electric power facilities, the development of the country's electric grid complex, financing the modernization of nuclear energy, and the development of renewable energy sources.

To assess the maximum amount of money that can be allocated to Finance projects in the electric power industry, several scenario conditions were considered in the framework of existing decisions taken by the Government of the Russian Federation earlier, which differ in the rate of change in electricity consumption and the projected growth rate of the consumer price index.

In the conservative scenario the growth of energy consumption defined at the level of 0.5%, the rate of inflation reduced from 4% in 2018 2% in 2027 and thereafter; optimistic scenario predicted on the basis of 1% of electricity consumption growth and lower inflation from 4 to 3.2% in 2020 and stabilize inflation expectations at 3% in 2021.

The maximum amount of money that can be used to Finance projects in the electric power industry, defined as the excess of prices based on inflationary expectations over the projected price based on decisions already made, in 2021 prices and given scenarios is from 3486 billion rubles. (conservative) up to 4355 billion rubles (optimistic) on the horizon until 2035. The government of the Russian Federation considers it appropriate to work out mechanisms for attracting investment in the industry based on a conservative development scenario, given that the dynamics of electricity consumption in the last few years is characterized by volatility with a slight increase of about 1%.

Thus, the conservative scenario for the development of energy in the country until 2035 assumes the total commissioning of CCGT of about 40-50 units with a unit capacity of up to 500 MW, as well as such units with a capacity of 800-1000 MW. This will require the supply of 110 to 120 gas turbines with a capacity of about 300 MW or more.

Such needs in GTU can be almost completely covered by the existing products of domestic manufacturers and at the expense of joint productions. Additional demand for such equipment is possible only in the conditions of economic recovery and higher rates of its development due to the intensification of renewal of such power generating capacities.

The level of development of the power engineering industry in different countries can be estimated by the installed capacity of all operating turbines in the world. Thus, the undisputed leader in the production of high-power turbines is General Electric, whose turbines account for 27% of the installed capacity of thermal power in the world, followed by Siemens AG, whose turbines cover 7% of the total capacity of thermal power plants. At the same time, the domestic company PJSC "Power machines" covers 4% of the global capacity, without having high-power units [Lozenko, Boldyrev, 2019].

However, the problem of the lack of domestic mediumand high-power turbines was solved thanks to the start of work of Siemens Gas Turbine Technologies LLC. It is a joint venture of Siemens with 65% of the shares and PJSC Power machines with 35% of the shares. The company can produce modern gas turbines developed by Siemens with a unit capacity of 60 to 80 MW, 172 MW and also from 190 to 200 and 304 MW.

But the license agreement does not yet provide for the level of localization of production on a sufficient scale, and this is despite the fact that intensive localization of production will require high-tech elements of flow parts of turbomachines. There is also a need for combustion chambers, automation systems, and a number of other hightech components. All this is necessary to reduce the cost of maintenance and repair, including solving problems of technological safety.

However, it should be noted that the modernization program that meets the demand for domestic high-capacity turbines is financed from extra-budgetary funds, namely through special non-market surcharges or contracts for the provision of capacity. Thus, the demand for turbines is mainly provided by the demand for electric power, which is paid for as a separate product by consumers of the wholesale electricity and power market.

The specific capital costs for installing domestic turbines are quite high, largely due to the requirements for the degree of localization of generating equipment, as well as due to the lack of sufficient experience in optimizing the production of components for turbines. Therefore, consumers of electric energy and power have to pay an increased cost compared to ready-made Western models.

A striking example of the dependence of energy security and, ultimately, the economy on domestic power engineering is the example of the construction of the Udarnaya TPP in Taman. The power plant was planned to be built in 2015. 500 MW TPP was considered a necessary element for the stable operation of the energy bridge to Crimea. At that time, Technopromeksport https://news.myseldon.com/away?to=http%253a%252f%252finfoline.spb.ru%252fshop%252fspravka-okompanii%252fpage.php%253fID%253d35245 stated that it had already purchased German Siemens turbines for the construction of the station,which eventually ended up in Crimea in 2017.

After the imposition of sanctions by the U.S. Ministry of Finance on the Russian Federation, the project became unfeasible due to the extension of sanctions on manufacturers of foreign power equipment supplying their products to the territory of the Crimean peninsula. The supply of Siemens turbines caused an international scandal, and the EU and the US imposed new sanctions on participants in the supply of turbines.

After the scandal of 2017 with the re-delivery of German Siemens turbines to the Crimea, the government decided to create domestic samples of high-power gas turbines in Russia. Historically, the USSR and Russia made GTU with a capacity of up to 25 MW based on aircraft engines, but large machines were not produced independently. Now in the country they are collected only in cooperation with the American GE and German Siemens. However, the level of localization is quite low. Both concerns are thinking about deepening localization, while Alexey Mordashov's Power machines and the consortium of the United engine Corporation (UEC) Rostec with inter RAO and RUSNANO promise to make a fully Russian turbine.

This situation clearly demonstrates that the threat of power outages on the Crimean Peninsula could have been avoided if domestic contractors had domestic high-capacity turbines at their disposal.

5. IMPACT OF THE CORONAVIRUS PANDEMIC ON THE ENERGY SECTOR AND THE POWER GENERATION MODERNIZATION PROGRAM

The coronavirus pandemic has significantly affected the Russian economy. The current economic crisis will obviously affect the long-term development plans of the UNEC. The main indicator of the state of the dynamics of the power system development is the growth rate of electricity consumption. The growth of electricity consumption requires the rapid development of energy infrastructure, and Vice versa, the reduction of electricity consumption indicates the need to reduce investment activity in the energy infrastructure.

According to the "System operator", in may 2020, electricity consumption in Russia as a whole fell by 5.3% compared to the same indicator last year, to 77.6 billion kWh, and in the Unified energy system (UES) of Russia, the indicator decreased by 5.5%, to 76.2 billion kWh. Over the same period, electricity production in Russia as a whole decreased by 6.3%, to 78.3 billion kWh, and in the UES of Russia-by 6.4%, to 77 billion kWh.

Consumption declined in six of the seven United energy systems (UES):

- the deepest reduction was recorded in the Ural UES – system-by 10.4% year – on-year;

- in the middle Volga UES – by 9.8%;

- in the UES of Siberia – by 5.2%;

- in the UES of the South – by 3.5%.

- Growth was shown only by the UES of the East, where consumption increased by 1.6%.

According to forecasts of the Ministry of energy of Russia, electricity consumption for 2020 may decrease by 2.4%, and according to analysts, the decline may be up to 6%. According to the estimates of the NP "Community of energy consumers", the drop in the industrial sector may amount to 7-10%.

The current situation with a decrease in electricity consumption negatively affects long-term plans and investments in generating capacities of the UES of Russia, which primarily provide for an increase in demand for electricity in the long term.

In the electricity sector the projected growth of electricity consumption determined by the General scheme of development of electric power industry till 2035, approved by RF Government Decree from 09.06.2017 No. 1209-R. According to the minimum scenario of the long-Term forecast of electricity demand and capacity of the General scheme for the Unified electric power system of Russia, from 2020 to 2025, the maximum increase in power consumption from 152 to 163 GW will be 7.23%, and the increase in electricity consumption from 1018 to 1192 billion kWh will be 17%. It is under this forecast that the program of modernization of thermal generation in 40 GW was adopted.

In further implementing the modernization program, the government of the Russian Federation needs to rely on forecasts of economic recovery after the end of the pandemic. According to the first Deputy Chairman of the Bank of Russia Ksenia Yudaeva, the Russian economy will be able to recover to the level of 2019 only in the first quarter of 2022 and reach the growth trend, probably by the end of 2022.

At the same time, the government is making efforts to ensure that economic growth is restored as soon as possible. So, the Ministry of economic development has submitted to the government of the Russian Federation National economic recovery plan, which is a continuation of a package of anti-crisis measures aimed at supporting employment and incomes, as well as the recovery of economic activity in General.

The national plan, according to its developers, should restart the investment cycle and ensure the growth of investment activity in the private and public sectors of the economy, ensure the restoration and development of individual, small and medium-sized businesses, accelerate the technological development of the economy and increase labor productivity, including through digitalization.

As a result, the Agency expects faster growth in the ITindustry, an increase in the number of small and mediumsized high-tech companies, as well as an increase in nonresource exports. It is obvious that the approaches laid down in the National plan and its activities do not stimulate the electric-intensive industry and will not lead to an increase in electricity consumption. The export-oriented power-intensive industry has always been the driver of growth in electricity consumption. However, there is little hope for the export of raw materials and oil and gas exports, including due to the continuing economic sanctions of the United States and the European Union.

In the oil and gas sector, the current situation is constrained by the OPEC + deal, which provides for a reduction in hydrocarbon production. Given that the oil production and transportation sector accounts for about 11% of electricity consumption in the energy system, the overall decline in Russia from the OPEC + deal in 2020 may be up to 1% (about 5 billion kWh).

According to the forecast of socio-economic development of the Russian Federation until 2036, the global GDP growth rate is projected to decrease to 3.2% by 2024, excluding the economic slowdown as a result of the coronavirus pandemic. In the future, the global economy will continue to grow at a rate of just under 3%, which is below the long-term average (3.6% over the past 30 years). Slowing global growth in the medium and long term will constrain demand for commodities. In particular, the slowdown in the Chinese economy will negatively affect the situation in the base metals and coal markets, where China is the largest consumer.

According to the updated forecast of Russia's socioeconomic development for 2020 and 2021-2023, exports from the Russian Federation will decrease by 36.04% in 2020, although a gradual recovery of indicators is predicted in the next three years.

The world Bank has estimated a 5.2% drop in global GDP in 2020. If the situation develops according to a pessimistic scenario, the global economy can expect a fall of 8%, and then, in 2021, a sluggish recovery growth of a little more than 1%.

In the current economic uncertainty, there are almost no long-term forecasts for the recovery of demand for Russian exports, which could provide an increase in electricity consumption.

Given the expected timing of economic recovery, as well as the structural measures of the government of the Russian Federation, it is not expected to increase the growth of electricity consumption to the level provided for in the General development scheme in the foreseeable future.

In this situation, the first to react to the situation in the largest electricity consumers, United in NP "Partnership of electricity consumers" (members of the Association are 33 companies, the total volume of electricity consumption - more than half of the total industrial electricity consumption in the Russian Federation), who appealed to the Russian Government with a request to assess the dynamics of growth of cost of electricity in relation to the future investment costs associated with the modernization of thermal generation. According to the authors, price forecasts, prepared in 2018 ahead of the start of the program of modernization of thermal power plants has lost its relevance, "because it contains obsolete parameters (dynamics of electricity consumption, inflation) does not take into account a new payments, which appeared as part of the final price of electricity."5. In addition, consumers noted a drop in energy consumption against the background of coronavirus, the economic downturn and the OPEC + deal, which the Agency's forecast also does not take into account.

According to the authors of the letter, the forecast lacks the necessary adjustments in the following areas: the extension of subsidies for far Eastern tariffs until 2028, a new pilot selection using a domestic gas turbine, an increase in the quota of the government Commission for selecting modernization projects in 2019, an increase in the surcharge for generating the Kaliningrad region, the development of the Eastern polygon of Railways, an increase in network payments, and a number of other factors.

In addition to updating the forecast, consumers were asked to submit proposals that would help limit the growth rate of electricity prices, such as"proposals for revising the parameters of the TPP modernization program".

As a result of working out all the economic factors, the government should be presented with proposals from Federal Executive authorities for further implementation of the heat generation modernization program. Thus, a balanced decision will be made to ensure the most efficient development of the electric power system.

6. CONCLUSIONS AND FURTHER RESEARCH

The modernization program is necessary for the development of domestic power engineering and the reliability of the power system, but its significant cost, distributed to consumers of electric energy and power, entails serious threats to industrial consumers of electric energy and power.

Significant investments in energy infrastructure in recent years, as well as capacity price surcharges (inter-territorial cross-subsidies), which currently account for almost 70% of the price per capacity, have led to an increase in the cost of electricity that is significantly faster than inflation. So, in 2019, the price for industrial consumers increased by 7.2%, which is almost twice as high as inflation.

The decision of the Government of the Russian Federation (Decree of the RF Government dated 29.06.2020 № 948 "On amendments to certain acts of the Government of the Russian Federation on issues of improving the mechanism

of attracting investments in the modernization of generating units of thermal power plants and the additional selection of projects of modernization of generating units of thermal power plants with the use of innovative energy equipment») for inclusion in the program of modernization of thermal power generation heavy duty gas turbines increases as the cost of the program and the forecast final cost for consumers, which carries risks of failure in the instructions of the President of the Russian Federation on the non-exceedance of the rising cost of electricity above inflation, which was the basis of the price calculation load of the entire modernization program.

This Decree of the Government of the Russian Federation defines the following features of the selection of projects for the construction of experimental GTU.

1. Volumes:

- for 2026 – up to 560 MW in the first price zone, up to 140 MW in the second price zone;

- for 2027 – up to 560 MW in the first price zone, up to 140 MW in the second price zone;

- for 2028 – up to 470 MW in the first price zone, up to 130 MW in the second price zone.

2. Gas turbines with an installed capacity in the following ranges: 65-80 MW MW 100-130, 150-190 MW.

3. There are no restrictions on the implementation of the project on the demand for equipment (historical data on equipment availability).

4. Providing an opportunity to postpone the commissioning of the facility when indexing the value of capital expenditures in the first 36 months relative to the planned date of commissioning.

5. Preferential conditions for the procedure for calculating fines for equipment unavailability to generate electricity.

The main condition for participation in the selection is the compliance of projects with the decree Of the Government of the Russian Federation dated 17.07.2015 No. 719 "On confirmation of production of industrial products on the territory of the Russian Federation", which established that gas turbines with a capacity from 35 MW to 499 MW from January 1, 2022 must have no more than 10% of the cost of foreign goods used in production.x-apple-data-detectors://10

The increase in the cost of the modernization program and additional expenses of consumers of OREM for the construction of new GTU will amount to 145.8 billion rubles. At the same time, the second price zone will account for a quarter, that is, 36.45 billion rubles for the period of delivery under the DPM. Given that gasification in Siberia is limited and local, it is most likely that the construction of new GTU will unfold in the first price zone, and, accordingly, the burden will fall on consumers in the Central and European parts of the Russian Federation.

In Russia, electricity prices for industrial consumers are already higher than in foreign countries (Canada, the USA, Mexico, the Netherlands, Finland, Poland, and South Korea). The main reason for this, as indicated above, is the almost two-fold advance in electricity prices for the threeshift industry over the CPI from 2013 to 2019, with this trend expected to continue in 2020-2021.

Given the high share of electric-intensive products in the structure of Russian exports, the price of electricity is one of the most important factors of competitiveness. Thus, the energy intensity of Russian GDP is 46% higher than the world level, and 17% higher than that of Canada (in us dollars in 2010 prices at purchasing power parity).

In the national project "International cooperation and export", the President of the Russian Federation set a goal to increase the volume of exports of competitive industrial products from $ 136 billion in 2019 to $ 205 billion by 2024, of which more than half of the increase should be provided by the chemical, metallurgical and machine-building sectors.

Further unjustified increase in the price of electricity will lead to the loss of domestic companies ' current positions in foreign markets, reduce the return on investment projects in the industrial sector, which will cost the country up to 2.5% of industrial growth and up to 0.5% of GDP growth.

Given the current situation with the uncertainty of recovery economic growth, as well as the existing surplus of generating capacity, Federal regulators will need to further analyze the impact of new domestic gas turbines on the final cost burden on consumers, which may well lead to postponing the construction and commissioning of such generating facilities.

1. Decree of the Government of the Russian Federation dated 13.11.2009 No. 1715-r “On the Energy Strategy of Russia for the Period Until 2030”. URL: http://www.consultant.ru/document/cons_doc_LAW_94054/f50e5f99cb9b0fedce1e1e3378abc0dcba942948/.

2. Resolution of the Government of the Russian Federation No. 1135 of 20.09.2017 “On criteria for attribution of industrial products to industrial products that have no analogues produced in the Russian Federation”. URL: http://www.consultant.ru/document/cons_doc_LAW_278519/.

3. Order of the Government of the Russian Federation dated 03.07.2014 No. 1217-r "On approval of the action plan ("road map") "Introduction of innovative technologies and modern materials in the fuel and energy sector”.

4. Main characteristics of the Russian electric power industry. URL: https://minenergo.gov.ru/node/532.

5. Association (non-profi t partnership) "Community of energy consumers". The government of the Russian Federation has instructed agencies to update the forecast of electricity price dynamics. URL: https://www.np-ace.ru/news/power_industry/1519/.

References

1. Budilov O.I., Budilov D.O., Zavorin A.S. (2006). Mekhanizmy Kiotskogo protokola dlya modernizatsii teploenergetiki [Mechanisms of the Kyoto Protocol for the modernization of heat and power engineering]. Izvestiya TPU [Bulletin of the Tomsk Polytechnic University], 309(4), 129-133.

2. Vatolkina N.S. (2015). Importozameshchenie: zarubezhnyy opyt, instrumenty i effekty [Import substitution: Foreign experience, tools and effects]. Nauchno-tekhnicheskie vedomosti SPbPU. Ekonomicheskie nauki [Scientific and Technical Statements of SPbPU. Economic Sciences], 6, 29-39.

3. Grabchak E.P., Medvedeva E.A., Golovanov K.P. (2016). Importozameshchenie – drayver razvitiya ili vynuzhdennaya mera [Import substitution as a driver of development or a forced measure]. Energeticheskaya politika [Energy Policy], 3, 74-85.

4. Ershov A.N. (2011). Rol’ modernizatsii v ustoychivom razvitii TEK [The role of modernization in the sustainable development of the fuel and energy complex]. Vestnik Tambovskogo universiteta. Seriya: Gumanitarnye nauki [Bulletin of the Tambov University. Series “Humanities”], 104(12).

5. Zernova L.E., Mohsen F. (2016). Analiz opyta importozameshcheniya v Irane [Analysis of the experience of import substitution in Iran]. Innovatsionnaya nauka [Innovative Science], 3-1, 105-108.

6. Kozinchenko E., Ramos A., Mordovenko D. (2015). Importozameshchenie. Opyt Brazilii [Import substitution. Brazil experience]. Gazprom, 3, 32-36.

7. Kushnarev N. (2016). Regiony i obshchiy rynok EAES: proizvodstvennye tsepochki [Regions and the common market of the EAEU: production chains]. Eurasian Economic Commission. URL: http://www.eurasiancommission.org/ru/nae/news/Pages/30-09- 2016-2.aspx.

8. Lozenko V.K., Boldyrev K.V. (2019). Mesto rossiyskikh energomashinostroitel’nykh kompaniy na mirovom rynke energeticheskogo oborudovaniya [The share of Russian energy machine building companies in the structure of global installed capacity]. Mezhdunarodnaya torgovlya i torgovaya politika [International Trade and Trade Policy]. DOI: http:/ /dx.doi.org/10.21686/2410-7395-2019-2-63-71.

9. Tcherezov A.V. (ed.) (2017). Osnovnye rezul’taty funktsionirovaniya ob’’ektov elektroenergetiki v 2016 g. Itogi prokhozhdeniya OZP 2016-2017 gg. Zadachi na srednesrochnuyu perspektivu [The main results of the functioning of electric power facilities in 2016. The results of the completion of the AWP 2016-2017. Tasks for the medium term]. Moscow.

10. Problemy importozameshcheniya v otraslyakh TEK i smezhnykh sferakh: Rezul’taty oprosa [Problems of import substitution in the fuel and energy complex and related areas: Survey results] (2016). Analiticheskiy tsentr pri Pravitel’stve Rossiyskoy Federatsii [Analytical Center for the Government of the Russian Federation]. September.

11. Filatov A.A., Nasteka V.V., Krioni N.K., Smyslov A.M. (2016). Kontseptsiya reinzhiniringa detaley GTU v usloviyakh importozameshcheniya [The concept of reengineering parts of gas turbines in terms of import]. Vestnik Ufimskogo gosudarstvennogo aviatsionnogo tekhnicheskogo universiteta [Bulletin of the Ufa State Aviation Technical University], 20(2), 50-54.

12. Filippov S.P., Polishchuk V.L. (2016). Programma importozameshcheniya oborudovaniya energeticheskogo mashinostroeniya v oblasti gazoturbinnykh tekhnologiy [Import substitution program for power engineering equipment in the field of gas turbine technologies]. Moscow, ERI RAS. https://www.eriras.ru/files/programma_po_gtu_inei_ran.pdf.

13. Coatings for high-temperature structural materials. Trends and opportunities (1996). Committee of Coatings for High-Temperature Structural Materials. Commission on Engineering and Technical Systems. Washington, DC, National Research Council, National Academy Press.

14. Csiba K. (ed.). Energy poverty handbook (2016). Brussels: The Greens, European Free Alliance in the European Parliament.

15. Holland R.A., Scott K., Hinton E.D., Austen M.C., Barrett J., Beaumont N. (2016). Bridging the gap between energy and the environment. Energy Policy, 92, 181-189.

16. Klimenko V., Fedotova E.V., Tereshin A.G. (2018). Vulnerability of the Russian power industry to the climate change. Energy, 142, 1010-1022. URL: https://doi.org/10.1016/j.energy.2017.10.069.

17. Ouedraogo N.S. (2013). Energy consumption and human development: Evidence from a panel cointegration and error correction model. Energy, 63, 28-41.

About the Author

M. M. BalashovРоссия

The chief specialist – the expert, Ministry of Energy of the Russian Federation. Research interests: renewable power, energy efficiency, power industry development in the conditions of the fourth industrial revolution.

Review

For citations:

Balashov M.M. IMPORT SUBSTITUTION IN THE POWER ENGINEERING INDUSTRY. Strategic decisions and risk management. 2020;11(2):182-195. https://doi.org/10.17747/2618-947X-2020-2-182-195

JATS XML