Scroll to:

OPPORTUNITIES FOR IMPROVING THE COMPETITIVENESS OF RAIL FREIGHT TRANSPORTATION ALONG THE TRANSPORT CORRIDORS OF THE RUSSIAN FEDERATION

https://doi.org/10.17747/2618-947X-2020-2-160-171

Abstract

The greatest prospects associated with transnational rail freight are determined by the use of containers. In Russian publications, the development of containerized cargo transportation is mainly considered by analyzing the general laws of functioning of international transport corridors. At the same time, aspects affecting infrastructure diagnostics and analysis of the throughput capacity of sections of the railway network are not considered.

The purpose of the study was to identify the characteristics of freight flows in the direction of the EU—EAEU—PRC, to identify infrastructure barriers that slow down the acceleration and increase in the volume of container railway freight transportation, as well as to develop a set of measures aimed at improving the competitiveness of container railway freight transportation along the transport corridors of the Russian Federation.

In the course of the study, infrastructural diagnostics was carried out, which revealed a number of barriers that did not allow realizing the growth potential of transit container cargo transportation.

To remove infrastructure barriers, it is necessary to implement a number of measures, the key of which are measures to increase the capacity of infrastructure at border crossings, increase the speed of trains along the railway networks of JSCo RZD, develop terminal and logistics centers that provide a wide range of services for consignors and consignees.

The development of container rail freight is a strategically important area for the Russian Federation. The well-coordinated work of Russian Railways with private investors and the state in the framework of expanding and modernizing the terminal infrastructure, as well as increasing intermodal interactions, is able to overcome the existing infrastructure barriers and ensure the growth of container transit in the required volumes.

For citations:

Kuzmin P.S. OPPORTUNITIES FOR IMPROVING THE COMPETITIVENESS OF RAIL FREIGHT TRANSPORTATION ALONG THE TRANSPORT CORRIDORS OF THE RUSSIAN FEDERATION. Strategic decisions and risk management. 2020;11(2):160-171. https://doi.org/10.17747/2618-947X-2020-2-160-171

1. INTRODUCTION

The development of container cargo transportation is a strategically important drive for the Russian Federation. A comprehensive plan for expanding and modernizing the railway infrastructure was approved by the President of the Russian Federation V. V. Putin in the framework of decrees signed on May 7, 2018. According to them, by 2024 it is necessary to significantly expand the ”West-East” and ”North-South” transport corridors for cargo transportation. Development is expected both through the construction of node multi-modal terminal and logistics centers (TLC), and by accelerating and increasing the volume of transit container rail cargo transportation from the Far East to the Western border of Russia.

The purpose of the study was to identify the features of cross-border cargo corridors, identify infrastructure barriers that prevent the acceleration and increase in the volume of container rail cargo transportation, and develop a set of measures aimed at improving the competitiveness of container rail cargo transportation along the transport corridors of the Russian Federation.

The focus of Russian researchers is mainly on aspects of the development of container cargo transportation within the framework of relationships related to the functioning of transport corridors as the main wire routes of world trade. At the same time, the analysis of barriers, including infrastructure barriers, and the capacity of individual elements of the Russian Railways (AO RZhD) railway network routes is not sufficiently covered in national studies.

The paper [Vardomsky, Turaeva, 2018] notes a wide range of positive effects from the development of container rail cargo transportation, namely, diversification of goods for export, modernization of the national transport system, growth of non-resource and non-energy exports along Trans-Eurasian transport corridors, and increased efficiency of foreign trade. The development of container cargo transportation should be comprehensive.

In foreign literature, the basis for making strategic decisions is the cost of transportation and infrastructure diagnostics. Foreign researchers [Schott, Cimino, 2013] also emphasize the need for an integrated approach to the study of the development of container rail cargo transportation. It is necessary to study the general patterns of development of transport corridors and practical aspects of container transportation development.

This research is aimed at identifying barriers that hinder the development of transnational container cargo transportation, systematizing the leading Russian and foreign approaches to overcoming them and developing recommendations aimed at increasing the competitiveness of container rail cargo transportation along the transport corridors of the Russian Federation.

In order to develop measures that increase the volume of cargo transported by containers of railway trains, it is necessary to answer a number of questions.

- What features characterize the formation of cargo flows through transnational cargo corridors?

- Which of the infrastructure barriers that slow down the development of container rail cargo transportation are the most significant?

- What solutions can increase the competitiveness of container rail transport through Russia's transport corridors?

2. FEATURES OF THE CARGO FLOWS FORMATION THROUGH TRANSNATIONAL TRANSPORT CORRIDORS

One of the key advantages of continental cooperation in Eurasia is the possibility of developing transport and logistics infrastructure. The effects of such work can be expressed in an increase in the volume of trade, the development

of industry located along transport routes, as well as the strengthening of relationships between countries [Fowkes et аl., 1991; Maier, Bergman, 2001]. China, the countries of the European Union and the Eurasian Economic Union are key participants in this interaction. The EAEU transport systems form highly efficient and high-speed routes between Europe and Asia, which, in turn, contributes to the increase in passenger and cargo traffic and the development of the participating countries. Prospects of the partnership of the EU and China with the EAEU, expressed in the form of joint creation of transnational cargo corridors will largely determine the pace of development of railway and logistic infrastructure, and elimination of diverse barriers (e.g. infrastructure limitations, procedures at border crossings, etc.), complicating the freight trains crossing national borders and slowing their movement within States [Libman, 2016; Toops, 2016].

2.1. CARGO TRAFFIC BETWEEN THE EURASIAN ECONOMIC UNION AND THE PEOPLE'S REPUBLIC OF CHINA

By 2018, the mutual trade turnover between the EAEU countries and the People's Republic of China reached $ 126.3 billion, the highest level in the previous ten years. The growth of exports from the Eurasian Economic Union to China led to an increase in trade almost completely. The key drivers of growth were:

- export of mineral products (growth by 59.7% – $ 45.7 billion in 2018);

- exports of food products and agricultural raw materials (growth by 43.9% – $ 2.8 billion in 2018);

- exports of steel products (growth by 22.6% – $ 3.7 billion in 2018);

- exports of wood and pulp, and paper products (growth by 15.8% – $ 4.8 billion in 2018).

Russia, as the largest economy of the EAEU, occupies a leading position in the structure of foreign trade cargo flows of the EAEU.

Land cargo transportation between the EAEU and the People's Republic of China is primarily conducted by rail. Wood is accounted for by half of rail freight traffic from Russia. Railways are also used to transport significant volumes of the following goods to the People's Republic of China: mineral and chemical raw materials, mineral fertilizers, fuel (mainly coal), and pulp and paper products.

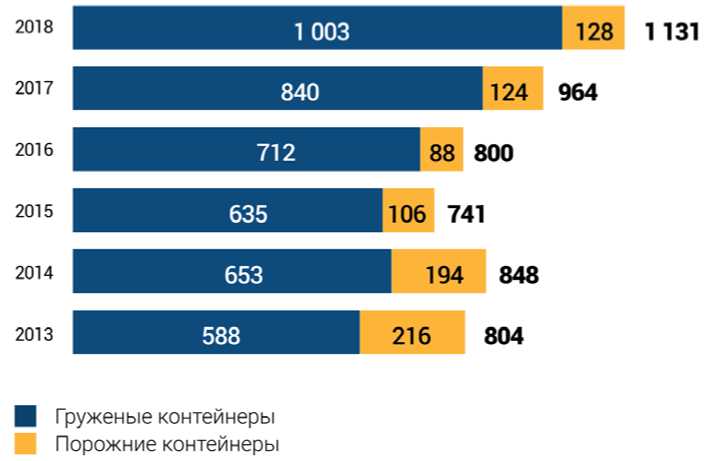

The volume of railway container traffic in export traffic increased by 17.3% in 2018 and amounted to 1,131 thousand twenty-foot equivalent units (TEU) (Fig. 1). The share of loaded container traffic in export traffic increased to 88.7% (from 87.1% a year earlier) due to faster growth of loaded container traffic (+19.4%) compared to empty container traffic (+3.2%). At the same time, only 10–20% of containers actually cross the border with China, which means that the main part of railway container traffic to China is carried out through sea ports (multimodal transport).

Source: Annual Report of PJSC TransContainer for 2018. URL: https://ar2018.trcont.com/ru/30/20/10/.

According to Russian foreign trade statistics, the volume of Russian railway imports from China reaches about 2 million tons per year. Machine-building products account for about a quarter of rail cargo traffic from China to Russia, while metal products and finished construction materials account for 15–20% each, and finished chemical products, fuel, mineral and chemical raw materials account for about 10% each. The statistical indicators of Russian Railways for imported rail cargo transport from China to Russia are approximately twice higher since they cover multimodal transport related to rail transport and tare weight.

The main part of railway container traffic coming from China is carried out through sea ports. Only about 1 / 4 of the total volume of imported container traffic passes through checkpoints on the border with China. Almost all imported railway container traffic from China crosses the land border in Zabaikalsk and Dostyk. Cargo traffic through other border crossings is currently minimal.

The growing share of containerized cargo in the structure of railway imports from China to Russia may increase even more, especially in relation to ”other cargo”, almost all of which can be containerized. Relatively small imported rail container traffic from China may show multiple mediumterm growth.

The volume of Kazakhstan's railway exports to China, according to JSC ”KTZ – Cargo Transportation”, continues to grow as the capacity of the Kazakh-Chinese border checkpoints (Dostyk – Alashankou and Altynkol – Khorgos) increases. The commodity composition of export cargo transportation mainly consists of mineral raw materials, metal products, fuel and agricultural raw materials. The share of containerized cargo, consisting mainly of ferrous alloys and non-ferrous metals, in Kazakhstan's railway cargo transportation to China is about 15%. Due to the favorable geographical position of Kazakhstan compared to competing countries, as well as the growing transport capabilities of the railway, we can expect further growth in these cargo shipments and an increase in the share of container cargo in Kazakhstan's railway exports to China.

Analysis of foreign trade and transport statistics shows that almost 100% of Belarusian exports to China are carried out by multimodal (rail /sea) transport through the Baltic States and Baltic sea ports. The main export items are mineral fertilizers and roundwood. The share of container cargo is 1–2%, they are mainly represented by finished chemical products and engineering products. According to Russian Railways, the volume of Belarusian transit export cargo transported to China by Russian and Kazakh railways is still quite low key (about 5000–8000 tons per year).

Belarusian imports from China are also carried out by multimodal transport via the Baltic States and Baltic sea ports. According to statistics from Russian Railways, Belarusian imports of rail cargo from China in 2018 increased significantly and exceeded 65,000 tons, while the share of container cargo in it was about 85%.

The volume of Kyrgyzstan's railway exports to China is currently insignificant and restrains the implementation of the project to create a direct railway connection between the two countries.

According to Russian Railways statistics, railway transport is not currently used to support export or import traffic between China and Armenia.

2.2. CARGO TRAFFIC BETWEEN THE EUROPEAN UNION AND THE PEOPLE'S REPUBLIC OF CHINA

In 2019, China was the third largest export partner of goods from the EU (9% of total exports from the EU) and the largest importer of goods to the EU (19% of total imports to the EU). In monetary terms, EU exports to China in 2019 amounted to 198 billion euros, and imports from China – 362 billion euros. The share of cars and vehicles in total EU exports in 2019 reached 55%. Chemical products accounted for approximately 14% of European exports to China. Among EU member states, the Netherlands was the largest importer of goods (88 billion euros) from China, and Germany was the largest exporter of goods (96 billion euros) to China in 2019.

When analyzing the statistical data of Russian Railways, it was revealed that almost all railway cargo transported from the EU to China is containerized. The current high rate of containerization of mutual trade and cargo transport between the EU and China is primarily due to maritime trade.

Russian Railways' statistics on transit and reverse rail container traffic between the EU and China also shows explosive growth, from 1,300 TEU in 2010 to more than 370,000 TEU in 2018. If until 2014 almost all transit rail container traffic from the EU to China was carried out through Zabaikalsk, in 2016 the share of this checkpoint decreased to 22%, with 2 / 3 of containers transported through Dostyk and another 10% – through Naushki.

A notable development in 2019 was the improvement in the balance of trains running between Europe and Asia, as much more freight was sent in the eastbound direction compared to previous years. This was partly due to the increased efforts of many stakeholders and the recognition by European countries of the ability to transport goods quickly, compared to sea transport. At the same time, westbound train traffic has become more controlled in order to prevent empty trains from moving from China to Europe. At the end of 2018, Chinese Railways limited the number of empty containers to no more than 10% in each block train. According to Chinese Railways, in 2019, in Chongqing, Chengdu, Zhengzhou, Wuhan, Suzhou, Yiwu and Xi'an, the share of loaded containers on westbound trains exceeded 90%.

The multimodal connection is also worth mentioning. Kaliningrad is becoming increasingly important not only as a railway, but also as a maritime hub. For example, in November 2018, Joint stock company ”United Transport and Logistics Company – Eurasian Rail Alliance” (JSC UTLC ERA) established a multimodal connection between the Chinese city of Chengdu and the port of Rotterdam. Containers are delivered to Kaliningrad by rail, where they are loaded onto a ship for delivery to Rotterdam by sea. At the same time, Gdansk joined the New Silk Road. In November, 2019, the Polish port opened its first container railway link to China, which provides a faster connection than sea shipping between China's Xi'an and the Polish seaport: the train runs for only twelve days.

The greatest potential associated with cargo transportation in the direction of the PRC – EAEU – EU can be implemented with the help of container rail transport. Container cargo transportation remains almost the only way to ensure Eurasian transit. The use of containers guarantees greater cargo safety, reduced packaging costs, increased speed of cargo handling, and easier expediting.

As a result, it is important to consider the potential and opportunities for the development of Trans-Eurasian transport corridors and related terminal and logistics infrastructure.

3. GROWTH POTENTIAL OF CONTAINER CARGO TRANSPORTATION

According to the annual reports of Russian Railways, between 2015 and 2018, container rail transport was actively developing. The average annual growth rate of cargo transportation in containers excluding empty containers was 16%, or 1075 thousand TEU (2998 thousand TEU at the end of 2018). The main drivers of growth were:

- growth in domestic transport, including switching volumes carried by tanks to tank containers (for example, the ”Chemicals and soda” category provided more than 60% of the total increase);

- export: forest products, chemical products, metalware and ferrous metal products for account of a number of major shippers;

- import: recovery growth of the 2013–2014 crisis in general for all categories of goods;

- transit: mainly between China and Europe (Dostyk – Brest) due to the development of Western China and a small switch from sea to rail transport.

In 2018, about 1 million TEU were transported by road, the main volume was accounted for by import-export to and from ports.

However, the share of goods suitable for transportation in containers and transported in containers does not exceed 22%, which means that there is a great potential for growth in container cargo transportation.

Experts estimate a potential growth in the volume of container cargo transportation to 10.6–13.8 million TEU by 2030, which is 2.8–3.7 times higher than in 2017, respectively. This growth can be achieved by the following factors:

- economic growth (with the same transportation structure by mode of transport);

- switching traffic volume from covered wagons and other rolling stock to containers;

- transit growth of railway container traffic on the territory of the Russian Federation;

- switching the volume of export and import to and from ports from autotent to containers;

- switching the volume of exports and imports across the Russian border from autotent to containers;

- switching the volume of long-and medium-distance domestic transport from autotent to containers.

Russian Railways is implementing a number of measures that, according to forecasts, will increase the volume of transit container cargo transportation by four times, as well as reduce the time of train movement from the Far East to the Western border of Russia to seven days.

However, today there is a number of barriers, including those caused by the current infrastructure of Russian Railways and the infrastructure of the EU, EAEU and China [Tsvetkov et al., 2014; 2015a; 2015b]. The suboptimal location and low efficiency of container terminals, outdated loading and unloading infrastructure for shippers and consignees (focused on a covered wagon), insufficient processing capacity of border checkpoints, differences in train lengths and speeds in different countries, as well as differences in the electrification of railway networks significantly slow down the growth rate of container railway cargo transportation [Vinokurov et al., 2018a; 2018b].

4. EXISTING INFRASTRUCTURE BARRIERS

Согласно отчету [Винокуров и др., 2018а], несмотря на According to the report [Vinokurov et al., 2018a], despite a significant increase in container cargo transportation by rail, the scale of container traffic between China and the European Union countries as a whole is still not significant. Coal, building materials, iron ores, metals, and passenger transportation form a large part of the railway infrastructure load.

China's railway infrastructure is developing at a pace sufficient to serve the potential flow of containers in the direction of China – EAEU – EU. In Russia, railways are fully electrified and double-track in the main East-West direction. Russian Railways carries out comprehensive reconstruction and modernization of the busiest areas in Zabaikalsk: Zabaikalsk – Borzya and Borzya – Olovyannaya. Kazakhstan is developing railway networks to provide the necessary capacity reserves for international transit destinations. In the medium term, a significant limitation in the growth of container cargo transportation is observed in the EU countries due to relatively low carrying and transportation capacities.

Barriers related to the processing capacity of railway facilities at international checkpoints

The transit volume passing through international checkpoints remained relatively low until 2017. The total number of container trains for 2016 was 1,702 units – 1,130 and 572 from China to the EU and in the opposite direction, respectively. At the same time, the average number of trains crossing the border of Russia and China, Mongolia and Kazakhstan, as well as the Belarusian-Polish border per day was less than five. By the end of 2017, the number of trains crossing the borders of the EAEU in the East and in the West increased to ten per day, and their total number increased to 3700:2400 in the direction from China, 1300 – to China [CRCT, 2018].

The Zabaikalsk-Manchuria border crossing point is crossed by no more than two container trains per day, while the daily capacity is about ten. According to the reports of PJSC TransContainer, the Zabaikalsk-Manchuria checkpoint has the potential to increase the processing capacity for handling container transit traffic by almost ten times (up to 470,000 TEU per year), an increase of five times can be implemented in the short term1.

However, the most significant restriction on the growth of potential transit cargo traffic is due to insufficient processing capacity of the checkpoint on the BelarusianPolish border. Brest – Malaszewicze border crossing point turned out to be the busiest one2. Already in 2017, instead of the planned fourteen trains per day, the Polish side handled only nine or ten, provided that, based on the current state of locomotives, wagons and track infrastructure, we could not expect a significant increase in container traffic in the nearest future. Trains coming from China stand idle on the Belarusian-Polish border for up to five or six days3. Despite Poland implemented a number of projects aimed at developing the railway infrastructure and removing restrictions, experts expect the retention of difficulties of transit trains passage during the modernization period4 [Lewandowski, 2016]. It should be noted that such demurrage undermines the competitiveness of the route relative to shipping by sea [Janic, 2008].

Barriers caused by the differentiated length of trains

The length of the train is determined by a wide range of technical and technological aspects of the railway infrastructure and is formed by the railway operator of each country independently.

Depending on the length of the created train, the loading of fitting platforms by containers is determined. A common practice for the China – EAEU – EU transport corridor is the most common 40-foot fitting platforms with two 20-foot or one 40-foot container. The use of 60- and 80-foot platforms on the areas from Brest to Malaszewicze is still limited.

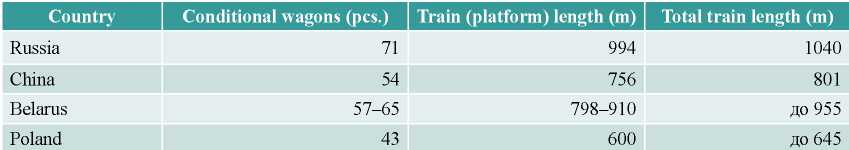

Typical lengths of trains, without taking into account trains formed by empty cars, for different countries are shown in table 1 (based on the length of a conventional wagon – 14 m, to estimate the total length of the train, the length of the locomotive of 33–35 m is added, as well as the tolerance of 10 m for the train spacing).

Tabulation 1

Average length of a non-road train, depending on the country

Source: [Vinokurov et al., 2018а; 2018b].

Based on this, at the Brest – Małaszewicze border crossing, a train with a length of 57 conventional wagons will form a train with a length of 43 wagons, and 14 wagons will wait for the formation of the next train, which also negatively affects the speed of cargo traffic in the direction of the EU.

Barriers due to the differentiated width of the railway track

In the countries of the former USSR, as well as in Mongolia, the railway track width is 1520 mm, in Finland - 1524 mm. Thus, when rolling stock passes through the borders of these countries, there is no need to reload containers. In addition, the permissible overall dimensions of wagons, braking devices, coupling devices of wagons, etc. are similar [Goreltsev, Polyakova, 2015].

In Western Europe, there are three options for the width of the railway track. The most commonly used width is 1435 mm, in Portugal and Spain - 1668 mm, in Ireland - 1600 mm. In PRC, as in the countries of Central and Western Europe, the width of the railway track is 1435 mm.

The difference in the width of the railway track at the borders of the former USSR, PRC and Western Europe makes it necessary to reload containers or replace carts at border crossings.

As a result, cargo owners' transportation costs increase, as well as cargo delivery time increases, which also negatively affects the competitiveness of railway cargo transportation in comparison with sea transport [Vinokurov et al., 2018a; 2018b].

Thus, there are four main ways to overcome this barrier:

1) direct reloading of containers from one rolling stock to another rolling stock of the required railway gauge;

2) use of carts with sliding wheel pairs to switch to a different standard of track;

3) switching to a new track by replacing the cart;

4) extension of the European standard railway track in the Eastern direction and to the West, or, conversely, laying the standard gauge line of the former USSR countries to Western Europe and China.

The transition from the 1435 mm rail gauge to the 1520 mm one and back is associated with the need to carry out a number of documentary procedures, which also negatively affects the time of cargo transportation.

Barriers due to different electrification

Another factor that slows down cargo traffic is the difference in railway electrification systems. Now in Russia, it is decided to develop a 25 kV AC system, as this system is more economically competitive than DC systems. At the same time, in Poland, where trains run from East to West, as well as in the Czech Republic and Slovakia, an electrification system built on a 3 kV DC has become widespread.

When switching from gauges that are electrified using a direct current system to gauges that use alternating current, it is necessary to replace the electric locomotive, inspect the rolling stock, etc., which leads to higher costs and longer delivery time.

Barriers caused by different speeds of cargo trains

It is considered that the key advantage of container cargo transportation in the direction of China – EAEU – EU is their speed. At the same time, indicators are provided that demonstrate the high speed and efficiency of container trains, but leave without proper consideration issues about speeds on specific areas of the route, as well as the time spent on final operations [Review of the cargo transportation industry.., 2018].

Today in Russia, most of the traffic (more than 80% of cargo turnover) is concentrated on 1/5 of the railway network. This is the Eastern polygon, accesses to the ports of the North-Western and Azov-Black sea directions. At these directions, the set speed is not uniform throughout the entire train tracks. In most cases, the speed limit for cargo trains is set at 80 km/h. At the same time, the speed limit is set at 90 km/h for only 6% of the length of railway lines, 70 km/h for 4000 km of line, and 60 km/h for 5700 km [Bureika et al., 2016]. There are restrictions on the speed of passing empty wagons on a significant length of railway tracks. The need to slow down before an area with a lower set speed and accelerate the train after it leads to the fact that on a significant part of the railway lines it is not possible to implement the maximum allowed speed – it takes time to brake and accelerate the train. Thus, an interesting situation is being formed: the average weighted speed by the length of the route sections is more than 70 km/h, while the average area speed is 40.9 km/h5. Acceleration and deceleration also negatively affect fuel consumption, which subsequently affects the cost of cargo transportation6.

An analysis of the restrictions impact carried out by Russian experts revealed more than 3,200 barrier sites, which were 22,800 km long and which limit both the achievement of the set speed and its increase on the main railway routes7. Within the framework of the "Transsib in 7 days" project, implemented by Russian Railways since 2019, it is planned to modernize the infrastructure in order to remove restrictions on reaching the set speed by container trains and abolish speed limits on the necks and main stations lines below 80 km/h8.

In addition to internal speed restrictions, there is a significant slowdown in the movement of container trains after passing through border crossings on the BelarusianPolish border. The average local speed in the EU is 18.2 km/h, which is significantly lower than the average local speed in Russia and China.

Barriers on the part of the terminals infrastructure

A number of such barriers are caused by the fact that existing terminals have low load due to the suboptimal network structure. The suboptimality of the terminal structure is due to the excessive number of small terminals that duplicate the functions of large ones.

In addition, the inefficient configuration of the terminals themselves leads to long processing of container trains: the size limit of the accepted train does not allow most freight yards and medium-sized terminal and logistics centers to accept more than 26 conventional wagons at a time. As a result, it is necessary to divide the train into parts for handling. Separation of the train significantly slows down handling: long waiting periods for shunting operations when dividing a long train is up to 2.5 hours for each part of the train.

Russia lags significantly behind China and the EU countries in terms of warehouse availability. In particular, in the most developed market in terms of warehouse infrastructure – in Moscow – the availability of storage facilities, as well as warehouse functionality, is several times lower than in the capital of any Western country. In the regions of Russia, these problems are even more acute.

A significant constraint is the lack of terminals multimodality. Most sites have no warehouse infrastructure or it's insufficiently developed . The "first and last mile" services at the TLCs are implemented not enough effectively, and the transshipment of containers to motor transport is associated with significant inconveniences.

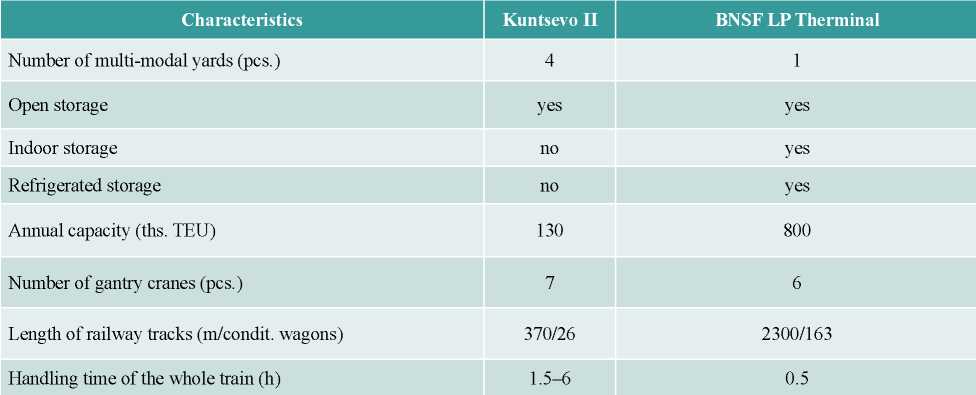

Comparative analysis has shown that even large Russian TLCs are significantly inferior in characteristics to their foreign counterparts. Table 2 presents a comparison of the key characteristics of the Moscow's Kuntsevo II terminal and Chicago's BNSF LP Therminal.

Tabulation 2

Key characteristics of terminals

Despite a large number of multimodal platforms at the Moscow TLC, the Chicago one implements a significantly larger annual cargo handling capacity. The reason for this is a number of factors.

Unlike BNSF LP Therminal, which implements a through route of the train when overloading, "Kuntsevo II" provides entry and exit from one direction. The dead end of the multi-modal route significantly slows down the maneuvering of the train.

Also, the multimodal yard of the Chicago TLC is 6.2 times longer than its Moscow counterpart. This solution allows entering the whole trains, which significantly saves time on maneuvering. The combination of these factors, as well as long customs control and document processing procedures in Russia, leads to the fact that the handling time of a full train in Moscow exceeds the Chicago indicators by 3-12 times.

In addition, BNSF LP Therminal provides more extensive warehouse storage services: in addition to open storage, indoor and refrigerated storage is provided. Creating additional value for customers and partners of BNSF LP Therminal is carried out through the organization of "first and last mile" services, parking of towing trucks and auto platforms, as well as maintenance and repair of vehicles.

Thus, the modern TLC is a key hub in the railway corridor, which should be able to handle container trains without dividing them into parts, carry out loading and unloading, including the necessary procedures at the customs, sanitary and veterinary control posts located in the terminal.

To eliminate infrastructure barriers to container transport development, it is necessary to implement a set of measures, of which the key ones are:

- development of the target TLC network and the necessary infrastructure (for example, transportation to TLC), including through the creation of mechanisms to encourage non-state investment;

- development of border crossings infrastructure development projects with railway companies of partner countries.

Modern TLCs should be configured in such a way as to provide users with maximum convenience, speed, and efficiency.

The key elements should be the large hub TLCs that underpin the network for all types of transport. Maintenance of large cities and enterprises should fall on small auxiliary TLCs.

According to experts, the effective radius of the TLC service is about 700 km. Delivery and distribution of goods to and from the hub TLC is carried out within a radius of 500-700 km, including using multimodality. The presence of an airport nearby will be an advantage.

As noted above, the key characteristic of an effective TLC is the ability to accept a full-length container train without breaking the train into parts, reducing the time spent on maneuvering.

Additional value for consumers will be in providing comprehensive services for shippers and consignees, such as:

- warehouse services, including storage of goods that require special storage conditions;

- organization of "first and last mile" events, including door-to-door delivery;

- customs clearance.

According to experts, at the initial stage, 13-16 nodal TLCs are needed with a total investment of up to 300 billion rubles, and private capital in the amount of 195-230 billion rubles will need to be attracted.

The key to successful implementation of infrastructure projects for the construction of TLC is seen in the creation of a public-private partnership, in which JSC "Russian Railways" plays the role of the "architect" of the system and co-investor. Its competencies include: development of the TLCs network architecture, development of TLC projects (in the absence of competencies for a private player), co-investment (in individual TLCs), as well as providing access to current transport and logistics assets and railway tracks.

Private players and institutional investors play the role of co-investors and operators when investing in TLC. If they have the competencies, they can implement the design and construction of a TLC in accordance with the developed concept.

The state is a grant and facilitator for the implementation of TLC projects. Its activities include: providing access to land and infrastructure on favorable terms, providing preferential tax regimes for investors and operators, and, if necessary, providing bank guarantees.

Russian Railways, together with private and public investors, is implementing a major project to expand and modernize the terminal infrastructure – creating a network of terminal and logistics centers in Russia. The developing network of terminal and logistics centers, connected by regular movement of container trains, will allow Russian Railways to increase the volume of container cargo transportation along the EU – EAEU – China corridor, which is one of the tasks being implemented within the framework of the Federal Project ”Transport and Logistics Centers”.

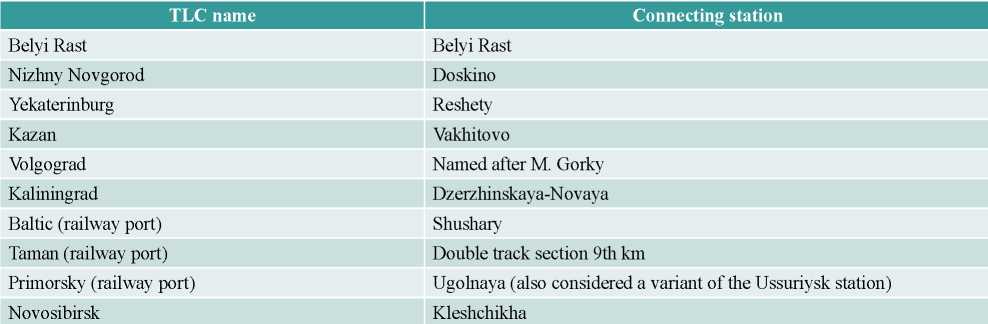

In 2012, the Concept of creating terminal and logistics centers on the territory of the Russian Federation was approved, which provided for the gradual creation of TLCs network. At the initial stage, a backbone of TLCs should be created, which will encourage potential investors to participate in further modernization and expansion of the terminal infrastructure.

Information on priority objects of the TLCs backbone is presented in table 3.

Tabulation 3

Priority objects for creating backbone of TLCs of JSC "Russian Railways"

Source: [Concept of creation.., 2012].

Thus, the creation of a backbone of intermodal TLCs in different regions of the Russian Federation will form the basis for further development of high-speed container cargo transportation.

5. RECOMMENDATIONS FOR REMOVING INFRASTRUCTURE BARRIERS OF RUSSIAN RAILWAYS

Barriers related to low crossing capacity on the Belarusian-Polish border The movement of container trains is significantly slowing down in the EU countries, on the BelarusianPolish border in particular. Low crossing and carrying capacity is due to shorter container trains formed in Poland, compared to trains arriving from Belarus. The need to switch from a 1520 mm wide railway gauge to a 1435 mm gauge also significantly slows down the passage of the border crossing. Thus, the low capacity of the border crossing at the Belarusian-Polish border is a significant infrastructure constraint for the growth of transit container cargo transportation.

Due to the fact that the EAEU countries are not able to influence the speed of modernization of the Polish railway infrastructure, the development of alternative routes for container trains in the direction from East to West may be a solution:

1) more intensive use of the Saint Petersburg transport hub;

2) redirecting part of cargo flows to checkpoints in the Kaliningrad region.

However, even in this case, investments in the development of border infrastructure on the part of Poland are necessary.

Removal of speed restrictions for container trains on the territory of Russia

It is necessary to cancel speed limits of 80 km/h on the necks and main tracks of stations and that the route speed of freight trains is increased. The route speed of a freight train takes into account traffic on stages, stops at intermediate stations, and time spent on technical operations, including inspection of rolling stock and changing locomotives.

As measures for improving the route speeds may be represented:

1) increasing the efficiency of locomotive depots to reduce the standing time of container trains;

2) optimization of the traffic schedule to reduce the standing time of container trains due to the passage of passenger trains;

3) establishing priority commercial and technical inspections for container trains at service stations and locomotive change stations.

Development of terminal and logistics centers To increase cargo flows and form sufficient capacity reserves for future growth, it is necessary to develop the network infrastructure.

The most important direction of investment at present is the creation of terminal and logistics centers in Russia. The lack of backing-up TLCs throughout the country leads to increase of transport run life and as a consequence to higher costs to shippers, increase in the time of accumulation and distribution of goods. The main guidelines for creating terminal and logistics centers in Russia should be:

1) modernization of container terminals and construction of new terminal and logistics centers capable of receiving full-fledged container trains and providing fast and efficient train handling, including receiving and loading, delivery of goods in containers, and reloading containers from one train to another;

2) accumulation of container cargo on the territory of TLCs and satellites with subsequent export by rail or road to China and Western Europe (short-run transport);

3) connection of the TLC reference network with regular movement of container trains for accumulation of cargo transported by containers, for further completion of transit container trains moving along the China – EAEU – EU route;

4) improvement of warehouse infrastructure both due to the growth of warehouse premises and by improving the quality of warehouse functionality. It is necessary to ensure the construction of covered warehouses, the development of refrigerated storage, storage of special containers. The use of special containers, as well as refrigerated containers in international container cargo transportation is a promising direction with a high development potential;

5) development of comprehensive services for shippers and consignees. Organization of ”first and last mile” events, including door-to-door delivery, customs clearance support. Development of external and internal highways, including parking for cars and trucks;

6) development of administrative and economic infrastructure, areas of repair and maintenance of motor transport, as well as business infrastructure.

The analysis showed that there is a significant potential for growth in transit container cargo transportation. The growth of cargo flows can be provided by the strengthening of EU trade with China due to the flow of cargo from motor transport to railway container trains, as well as due to the containerization of previously non-containerized cargo.

6. CONCLUSION

The article discusses the features of the formation of cargo flows at transnational cargo corridors. The countries participating in trade and economic relations that lie along the China - EEU-EU route, the commodity composition of railway cargo transportation, as well as the main directions of containerization of cargo transportation are determined.

A number of infrastructure barriers were identified that significantly slow down the growth rate of container rail cargo transportation, both on the part of JSC "Russian Railways", and on the part of the EU, EAEU and China. These barriers are underpinned by the lack of handling capacity of railway facilities at international checkpoints, the differentiated length of railway trains and the width of the railway track in different countries, the different electrification of railway networks on different sections of the route, the uneven speed of freight trains, as well as the imperfection of the terminal and logistics infrastructure.

To break infrastructure barriers, it is necessary to implement a number of measures, the key of which are to increase the capacity of infrastructure at border crossings, increase the speed of trains on the railway networks of JSC "Russian Railways", and develop terminal and logistics centers that provide a wide range of services for shippers and consignees.

The well-coordinated work of Russian Railways with private investors and the state in expanding and modernizing the terminal infrastructure, as well as increasing intermodal interactions, can overcome the existing infrastructure barriers and ensure the growth of container transit in the required volumes.

1. Burdukovskykh M. (2014). From China to Europe in 13 days // SCBIST. August 13. URL: http://scbist.com/novosti-na-seti-dorog/36448-iz-kitaya-v-evropu-za-13-sutok.html.

2. The Belarusian railway develops the infrastructure of cargo terminals located on the Belarusian-Polish border (2017) // BZHD. November 3. URL: http://www.rw.by/corporate/press_center/corporate_news/2017/11/belorusskaja_zheleznaja_dor889/.

3. Tonin I. (2017). BZHD: Poland restrains container fl ows // Russian Railways-Partner. September 20. URL: http://www.rzd-partner.ru/zhd-transport/news/bzhd-polsha-sderzhivaetkonteynernye-potoki-/.

4. Pletnev S. (2017). Poland is closed for repairs // Gudok. No. 150(26289). August 30. URL: http://www.gudok.ru/newspaper/?ID=1384830&archive=2017.08.30.

5. Russian Railways Annual report 2018. URL: https://ar2018.rzd.ru/ru.

6. Tsypleva N. (2017). Speed in priority // Gudok. No. 155 (26294). September 6. URL: http://www.gudok.ru/newspaper/?ID=1385773&archive=2017.09.06.

7. Ibid

8. Eastern polygon -Transsib and BAM (2020) // RZD.ru. URL: https://cargo.rzd.ru/ru/9787/page/103290?id=11150#main-header.

References

1. Vardomsky L.B., Turaeva M.O. (2018). Razvitie transportnykh koridorov postsovetskogo prostranstva v usloviyakh sovremennykh geopoliticheskikh i ekonomicheskikh vyzovov (nauch. doklad) [Development of the post-soviet transport corridors in terms of contemporary geopolitical and economic challenges. Scient. report]. Moscow, Institute of Economics of the Russian Academy of Sciences.

2. Vinokurov E. Yu., Lobyrev V.G., Tikhomirov A.A., Tsukarev T.V. (2018). Transportnye koridory Shelkovogo puti: potentsial rosta gruzopotokov cherez EAES. Doklad no. 49 [Silk road transport corridors: Assessment of trans-EAEU freight traffic growth potential. Report 49]. St. Petersburg, Eurasian Development Bank, Centre for Integration Studies. URL: https://eabr.org / analytics / integration-research / cii-reports / transportnye-koridory-shelkovogo-putipotentsial-rosta-gruzopotokov-cherez-eaes / .

3. Vinokurov E.Yu., Lobyrev V.G., Tikhomirov A.A., Tsukarev T.V. (2018). Transportnye koridory Shelkovogo puti: analiz bar’erov i rekomendatsii po napravleniyu investitsiy. Doklad no. 50 [Belt and road transport corridors: Barriers and investments. Report 50]. St. Petersburg, Eurasian Development Bank, Centre for Integration Studies. URL: https://eabr.org / upload / iblock / 304 / EDB-Centre_2018_Report-50_Transport-Corridors_Barriers-and-Investments_RUS.pdf.

4. Goreltsev S., Polyakova M. (2015). Perspektivy razvitiya terminal’no-logisticheskoy infrastruktury na ”prostranstve 1520” [Development prospects terminal and logistics infrastructure in the ”1520”]. Moscow, Institute of Transport Economics and Development. URL: http://iert.com.ru / images / Gorelcev.pdf.

5. Kontseptsiya sozdaniya terminal’no-logisticheskikh tsentrov na territorii Rossiyskoy Federatsii [The concept of terminal and logistics centres on the territory of the Russian Federation] (2012). URL: https://cargo.rzd.ru / api / media / resources / c / 5 / 121 / 74208? action=download.

6. Obzor otrasli gruzoperevozok v Rossii [Overview of the Russian freight industry] (2018). EY. URL: https://assets.ey.com / content / dam / ey-sites / ey-com / ru_ru / topics / automotive-and-transportation / ey-overview-of-the-cargo-industry-in-russia.pdf.

7. Tsvetkov V.A., Zoidov K.Kh., Medkov A.A. (2014). Formirovanie evolyutsionnoy modeli transportno-tranzitnoy sistemy Rossii v usloviyakh integratsii i globalizatsii [Formation of evolutionary model of transport and tranzit system of Russia in the conditions of integration and globalization]. Moscow, Market Economy Institute of the Russian Academy of Sciences, SPb., Nestor-Istoriya.

8. Tsvetkov V.A., Zoidov K.Kh., Medkov A.A., Ionicheva V.N. (2015). Institucional’no-organizatsionnye osobennosti transgranichnykh perevozok gruzov v usloviyakh integratsii na postsovetskom ekonomicheskom prostranstve. Ch. I [Institutional and organizational features of the cross-border freight traffic in the conditions of integration among former Soviet States. Part I]. Ekonomika regiona [Economy of Region], 3, 188‑204.

9. Tsvetkov V.A., Zoidov K.Kh., Medkov A.A., Ionicheva V.N. (2015). Institucional’no-organizatsionnye osobennosti transgranichnykh perevozok gruzov v usloviyakh integratsii na postsovetskom ekonomicheskom prostranstve. Ch. II [Institutional and organizational features of the cross-border freight traffic in the conditions of integration among former Soviet States. Part II]. Ekonomika regiona [Economy of Region], 4, 249‑259.

10. Bureika G., Boile M., Pyrgidis C., Kortsari I., Ivanova N., Titova T., Tsykhmistro S. (2016). Consolidation of technical, safety and human resources in Eurasian railway transport corridors. Vilnius, VGTU Press Technika.

11. CRCT (2018). CEIBS column operations over the years (2011-2017). URL: http://www.crct.com / index.php?m=content&c=index&a=lists&catid=22.

12. Fowkes A.S., Nash C.A., Tweddle G. (1991). Investigating the market for inter-modal freight technologies. Transportation Research, A 25A-4, 161‑172.

13. Janic M. (2008). An assessment of the performance of the European long intermodal freight trains (LIFTs). Transportation Research, Part A, 42, 1326‑1339.

14. Lewandowski K. (2016). Long freight trains in Poland, What is the problem of its usage? Prace Naukowe Politechniki Warszawskiej, 111, 357‑369. URL: https://www.researchgate.net / publication / 309486866.

15. Libman A. (2016). Linking the Silk road economic belt and the Eurasian Economic Union: Mission impossible? Caucasus International, 1(6), 41‑53.

16. Maier G., Bergman E.M. (2001). Stated preferences for transport among industrial cluster firms. Transport Planning, Logistics and Spatial Mismatch: European Research in Regional Science, 11, 41‑61.

17. Schott J., Cimino C. (2013). Crafting a transatlantic trade and investment partner-ship: What can be done. Peterson Institute for International Economics. March. URL: http://www.iie.com / publications / pb / pb13–8.pdf.

18. Toops S. (2016) Reflections on China’s belt and road initiative. Area Development and Policy, 3(1), October 6, 352‑360.

About the Author

P. S. KuzminRussian Federation

Specialist of the Department of economic planning and contract relations, CJSC “Sintez Grupp”. Research interests: strategy and management of company development, formation of a company development strategy.

Review

For citations:

Kuzmin P.S. OPPORTUNITIES FOR IMPROVING THE COMPETITIVENESS OF RAIL FREIGHT TRANSPORTATION ALONG THE TRANSPORT CORRIDORS OF THE RUSSIAN FEDERATION. Strategic decisions and risk management. 2020;11(2):160-171. https://doi.org/10.17747/2618-947X-2020-2-160-171