Scroll to:

SEARCHING FOR BUSINESS MODEL BY EDTECH STARTUPS IN ADULT EDUCATION SEGMENT ON THE RUSSIAN MARKET

https://doi.org/10.17747/2618-947X-2020-1-70-97

Abstract

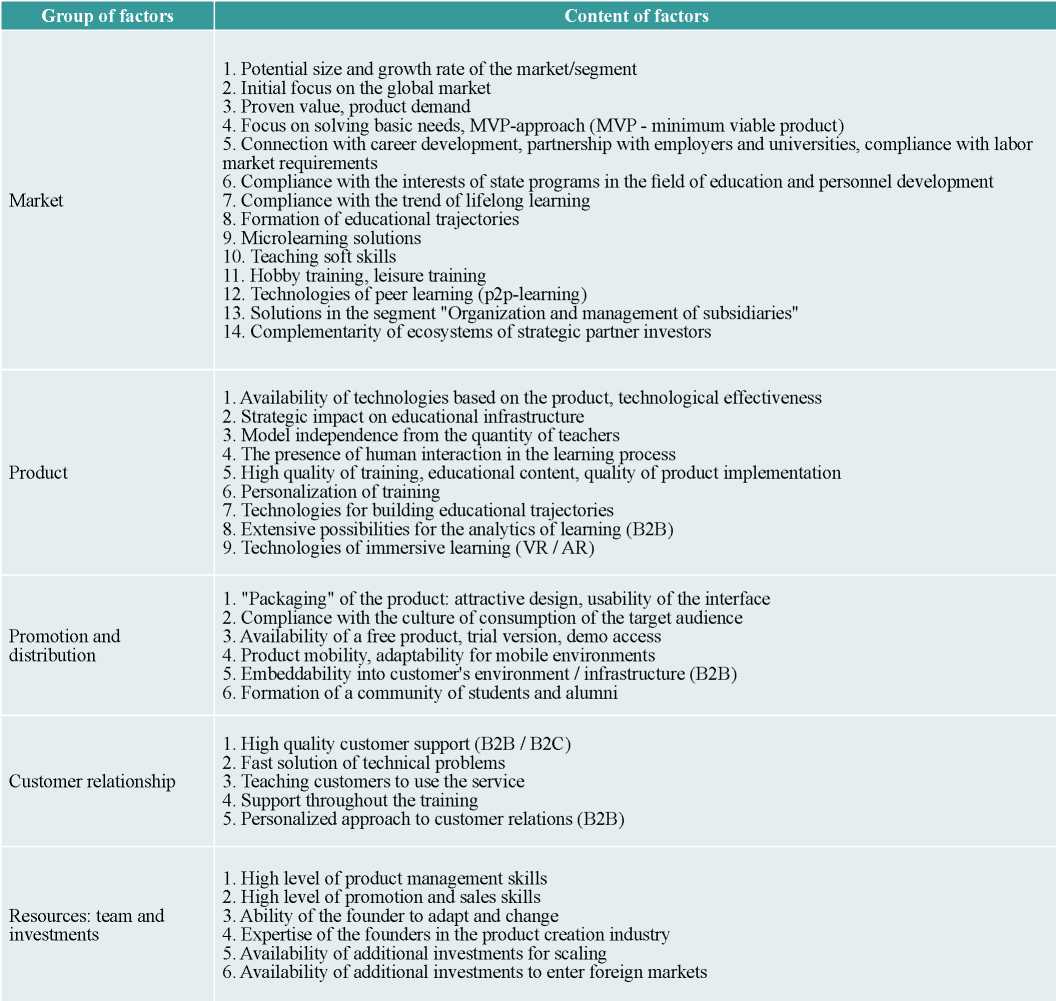

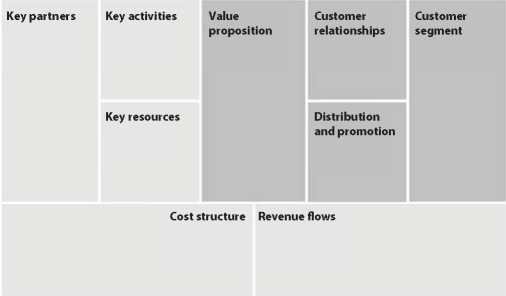

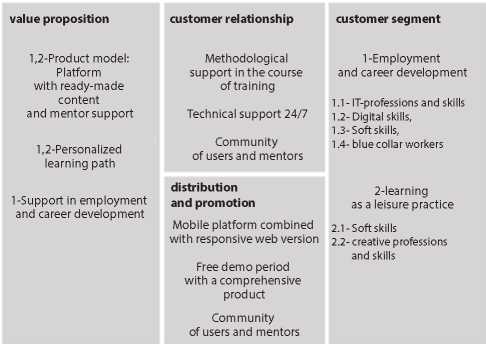

In the article, the author attempts to identify the scalability factors of Russian EdTech startups, as well as offer recommendations for building a scalable business model. As a result, the author identified five groups of factors affecting the business model scalability and, somewhat, the success of an EdTech startup. It is especially important that this groups of factors correspond to the most important business model elements of an early-stage startup: the market (or “Customer segments”), the product (or “Value Proposition”), customer relations, distribution, as well as resources regarding the team and investments. Such a complex set of factors interconnected with the main elements of the business model can become a tool for making more effective management decisions, reducing entrepreneurial risks, and increasing the success possibility of an educational project. It was also discovered that copying the leader’s business model is not a relevant strategy for an educational startup and the subscription model does not affect success. On the contrary, the orientation to the global market, the key market trends exploitation, and high-quality distribution and promotion affect scalability and success.

Keywords

For citations:

Chavkin Z.V. SEARCHING FOR BUSINESS MODEL BY EDTECH STARTUPS IN ADULT EDUCATION SEGMENT ON THE RUSSIAN MARKET. Strategic decisions and risk management. 2020;11(1):70-97. https://doi.org/10.17747/2618-947X-2020-1-70-97

-

INTRODUCTION

Over the past few years, and especially in the current year 2020, the educational system, both the global and the Russian, has been undergoing large-scale transformations. In the current emergency situation the educational system, not excluding the segments of additional professional education (APE), has been forced to rapidly master various educational technologies and to transfer training to a distance format, which leads to an increase in demand for technological educational solutions. An urgent transition to the use of the Internet in education will most likely lead to a large-scale assimilation of online education technologies in all segments, increase its penetration and loyalty of the mass audience, including educational staff, to online education, which will accelerate the growth of the market, investments and the quantity of players. The issue of choosing a successful business model in the conditions of growing competition, the expansion of leading global startups, accelerating technological development and changing habits of users will become even more relevant.

All over the world the field of education is considered by investors to be one of the most attractive and promising for business. Compared to other areas of the IT industry, the market of online education is at an early stage of its development and it still occupies less than 4% of the total educational market, which, together with the identified factors, can serve as a basis for predicting a relatively rapid growth in the medium and long term.

The existing methods of finding a scalable business model, developed by such authors as Steve Blank [Blank, Dorf, 2019], Eric Ries [Rees, 2018], Ash Maurya [Maurya, 2012] and others, are universal for almost all industries and geographic markets, including the Russian education market. The theories of lean startup and customer development, as well as universal methods of HADI cycles (hypothesis- action-data-insight cycle), iterative testing of hypotheses and the concept of “product-market fit”, minimum viable product, value hypothesis and value proposition constitute a sufficient theoretical and methodological basis used by startups around the world in the early stages of their development.

At the same time, even with such a methodological base at their disposal, the overwhelming majority of startups “cease to exist” without a scalable business model1. An educational startup lacks an understanding of which business models, value propositions and monetization models need to be chosen and which customer segments should be targeted in the first place in order to increase their chances of finding a scalable business model. In this case, it is necessary to take into account the specifics of the Russian educational and venture capital markets, forecasts for the development of trends and drivers that form the market conditions in which a startup exists.

The question that the author wishes to answer in this article is the following: what factors related to the business model lead to the success of educational startups on the Russian market? All other things being equal, the author considers the finding of a scalable business model and scaling itself to be the success of an educational startup. The author's goal is to form a set of recommendations for finding a scalable business model for a Russian educational startup.

It should be noted that on the Russian educational market each of its segments, from preschool education to the teaching of foreign languages, has its own specific features in terms of business models and conditions for the development of startups. The segment of additional professional education is distinguished by a high penetration of the online component and a high share of private business. In addition, this segment, along with the segment of school education, is the one, which attracts the majority of investments. Therefore, the search for an answer to the above question will be carried out specifically for additional professional education. Due to inaccuracies in the classification, this segment, in addition to direct vocational education, often includes the training that is not related to profession and substantive work, - the so-called leisure training. Therefore, within the framework of this work, the segment of additional vocational education will be called the segment of adult education, or adult education.

To answer this question and achieve the article’s goal, it is necessary, firstly, to determine the characteristics of the online education market, its drivers and trends. Secondly, it is necessary to highlight the features of the segment of adult education, as well as the features of business models of educational startups. Thirdly, to identify the success factors of educational startups based on the experience of investors and the startups themselves, as well as the opinions of customers of educational solutions. And finally, it is necessary to aggregate the data obtained in the previous steps in order to develop a set of recommendations for the key elements of the business model.

-

DRIVERS AND TRENDS INFLUENCING THE SEARCH FOR A BUSINESS MODEL BY AN EDUCATIONAL START-UP

In 2020 a joint study of the online training market “Netology”, Talent Tech and EdMarket estimates the compound annual growth rate of the global online education market at 7-10%, while it accounts for only 4% of the global education market at 6,5 trillion dollars. [Market research.., 2020]. The online education market is still significantly smaller than other IT markets and is relatively young. That is why the low base effect is likely to provide a stable growth in the medium term. Indeed, the largest EdTech companies cost about 3-6 billion dollars, while, for example, Airbnb - 31 billion, Alibaba - 30 billion.

The share of the Russian market in the total volume of the online education market is no more than 1 %, according to the research conducted by “Interfax-Academy” (hereinafter “Interfax”) [Research of digital.., 2020], and the Moscow Innovation Agency (hereinafter the Innovation Agency) [EdTech.., 2019]. At the same time, due to the low base the growth rates of the Russian market are higher than the world average - 20-25%. Similar data is provided by the study carried out by “Netology”: according to its data, in 2019 the Russian B2C market of online education reached 38,5 billion rubles with an average annual growth rate of 20%, which is 10-13 percentage points higher than the global growth rate. By the end of 2023 the capacity of the Russian market is predicted to be over 60 billion Rublesw per year at an average annual growth rate of 12-15% [Market Research.., 2020].

According to the study conducted by the Innovation Agency, the largest domestic players provide "products and services for learning" - ready-made educational programs and courses, half of which are aimed at schoolchildren. The share of management solutions (mainly the B2B market) in Russia is two times smaller than in the world, and there are no companies that develop financial services for EdTech, for example, services for obtaining loans for education purposes. A relatively new area on the Russian market is products and services for the creation / development of educational products (2 % in Moscow and 7 % in the world). The HolonIQ analytical agency in its study "Education in 2030" analyzed more than five thousand publications and identified four main drivers of changes in the educational system: globalization, population growth, changing requirements for workers' skills, improving technologies [Education in 2030, 2018]. It is obvious that the educational market is influenced by many more factors: from the level of disposable income of the population to the degree of technology development and the scale of globalization. Within the framework of this study we will limit ourselves to the following list (primarily for the Russian market):

- changes on the labor market;

- demand drivers;

- investor preferences (which, in fact, is a derivative driver, since preferences are formed on the basis of market conditions and global changes).

Changes on the labor market, among other things, are manifested in the emergence of the new demanded professions2 and the disappearance of those that are easy to automate. As a result, comprehensive atlases of new professions3 appear. The Innovation Agency singles out changes on the labor market among the main drivers of development.

The disappearance of old and the emergence of new professions, along with the automation of production, creates a demand for mastering new professions or individual skills from scratch often using microformats that make it possible to get knowledge quickly and without "unnecessary" information. The growing popularity of microformats can also be explained by changes in the culture of consumption and generational change in the structure of the workforce: generation Z, which will soon become the main component of the able-bodied and solvent population, is characterized by clip thinking and the habit of mobile consumption4.

At the same time, there is a growing proportion of the population over 65 whose skills become obsolete even before retirement, which necessitates the development of educational products taking into account the needs and specifics of the perception of material by this population group.

Changes on the labor market lead to the transition from formalized professions to sets of competencies, requirements of interdisciplinarity of specialists. The demand for flexible skills and digital competencies is also increasing as a group of competencies that can hardly be automated.

The drivers of demand primarily include an increase in the penetration of online education and the requirements for the quality of an educational product. According to Interfax, despite the high level of Internet penetration in Russia, there is a lagging behind developed countries in its use for educational purposes. At the same time, the main barriers to the massive penetration of online learning, according to students, are "the habit of getting education in the full-time form" (42% of the surveyed students) and "low level of confidence in online learning" (40 %). The reasons for the rejection of online education among the adult population also include the “lack of time”, “lack of motivation and external demands” [Digital research.., 2020]. Yevgeniy Lebedev, Marketing Director of the project “Yandex. Workshop”, notes that the Russian audience has increased demands to product quality and reduced loyalty to primitive training formats (webinars, linear online courses) and information business5. This is also facilitated by the rapid growth in the number of online schools and online courses offering a primitive format of webinars or video recordings without additional educational services.

“If this is a long-term vocational training, then consumers expect assistance with employment; if it is an inexpensive course, then they expect relevant professional knowledge, not outdated videos. We see that on the US market these requirements have already been formed, there are special training aggregators and requirements at the legislative level. We will have to cover this path in three or five years”, - says Yevgeny Lebedev.

Due to the lack of confidence in the quality of online education, free products, demo versions and trial periods have become a popular and effective promotion tool (according to one of the founders of City Business School, Yulia Budishevskaya). Alexander Turilin (co-founder of SkillFactory) claims that free products brought his startup 15% of its revenues in 2019. Skillbox, Talentsy, Netology, Skyeng and others also use a free product to promote their basic proposals.

The third group of drivers includes changes in investment activities on the education market. The Agency for Innovations in its study notes the growing volume of investments in educational projects on the global market - a sevenfold increase in five years (up to 16 billion dollars in 2018). The period 2016-2018 accounted for 62 % of all global investments in EdTech in twenty years. At the same time, in 2018 the volume of investments in EdTech in Moscow amounted to about 1 % of the global one.

From the point of view of product models, the most attractive for investors, according to the Agency for Innovation, are projects from the “educational” segment - startups that provide ready-made educational programs and courses. An increase in investments in 2018 was mainly due to investments in projects in this segment. The second most attractive segment is the testing knowledge and competencies - such solutions can be used to bridge the gap between an educational institution and employers. Finally, an interest in the learning of foreign languages continues to grow (especially in the Asian region). Also, according to the forecasts of the Innovation Agency, in the next five years the market for EdTech solutions with the use of virtual and augmented reality technologies will grow most dynamically: the volume of investments by 2025 will grow sevenfold, to 12,6 billion dollars [EdTech.., 2019].

As for educational areas, according to the Innovation Agency, attractive for investors are training programs related to the category of hobbies: the average annual growth rate of investments in 2015-2018 was 252%. The example of Bluprint, which offers online courses on needlework and other applied skills from world experts with more than 150 million users from 35 countries is typical. International market players assume that training in these “soft niches” takes root as a leisure practice and takes away market share from other entertainments. On the Russian market the GetCourse project is the leader among the “soft niches”.

Regarding customer segments, adult education and school education are the leaders in terms of funding. According to HolonIQ, among the fourteen largest deals on the U.S. educational market in 2019, eight were in startups offering products to employers or employees. These deals included four mega-rounds exceeding 100 million dollars per deal, and all of them were associated with the segment of additional professional training and offered training for specialists and development services. These included Andela, BetterUp, Coursera, and Guild Education. “The lines between higher education and the workforce are blurring,” said Jason Horn, the managing director of GSV Advisors. Guild Education offers government-approved educational programs from top universities to major US employers. Coursera has also begun to tailor its tertiary education programs to business needs taking into consideration specific skills of employees.

In their research analysts from TalentTech, Netology and EdMarket highlight one of the important criteria for the attractiveness of startups for investors: "Most often investors invest in companies focused on international expansion." The study also notes that “the Russian market is also witnessing a rapid growth of projects that offer soft skills training in the areas of hobbies and personal development” [Market research.., 2020].

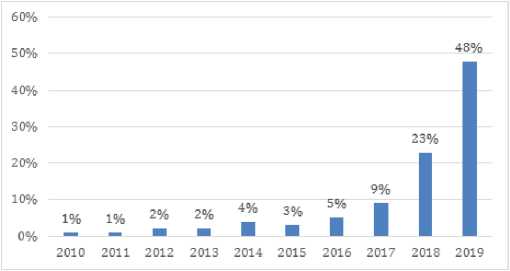

In the period from 2017 to 2019 analysts from Netology recorded 45 venture capital deals for investments in educational startups. According to the study, only six companies - Netology, Maximum Education, Skyeng, Wikium, MEL Science, ProctorEdu - received repeated investments. At the same time, the size of investments has continued to grow since 2016, although in 2020 the trend may change due to the recession (Fig. 1).

Note. Data in 2017 is presented for August-December, in 2019 - for January-August.

Source: [Market research.., 2020].

Over the past few years several significant transactions have been made on the Russian market, including:

- Severgroup bought a 40% stake in Netology-Group, 2017;

- Baring Vostok invested about 15 million dollars into Styeng online English school, 2018;

- ru Group bought 11,7% of Algorithmika, 2018;

- Skolkovo Digital Fund and other investors invested 390 million rubles into Maximum Education online platform, 2019;

- ru bought 60,3% of Skillbox educational platform, 2019.

Each of these funded startups - to a lesser extent Skyeng and Maximum Education - create digital skills products, and three out of five projects are related to the adult learning segment. As Andrey Mityukov, managing partner of the Talent Tech IT holding, notes: “Digital skills are no longer the domain of IT employees and become a “new English”, that is, the kind of skills without which it is difficult to have a successful career in the company”. He also notes that "35-50% of Russians, choosing additional professional training, study to acquire digital professions: they are trained to become programmers, Internet marketers, web designers, etc." [Market research.., 2020]. The same study revealed that investors prefer projects in the segment of additional school education and adult education, which is similar to the situation on the global market.

Education market trends can be broadly divided into behavioral and technological. The first and one of the most important behavioral trends is an increase in the penetration of online education along with an increase in the loyalty of the mass audience to it. Until now, one of the main arguments against online education has been its low quality, incomparable with classical education. The events that took place in the spring of 2020 provoked an accelerated the transition of educational systems in developed and developing countries to the online learning space, which in itself greatly increased the degree of penetration of online education. Equally important, along with this, dramatic changes can occur in the perception of online education and awareness of its benefits. A possible consequence of this, at the moment when the economy begins to recover and increase growth rates, may be a multiple expansion of the addressable market along with the emergence of new niches for educational startups.

In addition to the growing penetration of online education and increasing loyalty to EdTech technologies, other trends stand out, especially those ones which are characteristic of the Russian market. Firstly, more and more startups are beginning to expand into the global market: the Algorithmic programming school for children (more than 18 countries), the Uchi.ru platform (Brazil, India, Canada, the USA, China, etc.), the English school language Puzzle English (Spanish and French speaking markets), Study Free platform (developing markets in Asia, Africa, Latin America). In 2020, the school for teaching IT professions "Yandex. Practicum" enters the American market, the SkyEng English language school enters the Spanish market.

Secondly, the number of new online schools based on platforms and accelerators such as GetCourse or Accel continues to grow. The threshold for entering the market has decreased, but at the same time, the transition from micro- to-medium and large business has become more difficult compared to 2016-2017, when the first big players were appearing and growing.

Thirdly, the ecosystem-forming companies of the Runet perceive online education as one of the most important areas of development. In the fall of 2019 Yandex announced its intention to invest 5 billion rubles in EdTech projects (both its own and third-party ones) in the next three years6. At the beginning of 2019 Mail.ru Group became a co-owner of Skillbox service and during that year brought its share in the business to a controlling one - in addition to the control over GeekBrains obtained in 2016. In early 2018 Sberbank introduced “School 21”, which offers free IT development training. MTS created MTS Startup Hub and Smart University, Yandex launched such projects as “Yandex. Workshop”, “Yandex. Education” and an educational initiative7, and MegaFon - “MegaFon. Education".

It is important to note that the strategy of intra-corporate startups will differ from the strategy of single startups, including the aspects related to marketing budgets. “In the next year (2020) superbrands will take the maximum amount of traffic, since they do not have a task to show profits, their task is to show growth, respectively, they can focus on development and expansion, which is something smaller players cannot afford”, says Yulia Budishevskaya, co-founder of City Business School8. The imbalance in the size of marketing budgets will be characteristic not only for the current year - this is one of the main differences in principle. The competition of budgets leads to an increase in the cost of promotion and shifts the focus towards the formation of communities, rather than individual products. Already in 2019 the practice of price wars was widespread on the market along with an active game with discounts (they can go up to 70%).

Finally, the share of hobby education on the online educational market is growing rapidly - from 19% at the beginning of 2018 to 27% in its IV quarter. Popular areas include business competencies, finance, painting, applied design and decor skills, and motivational courses.

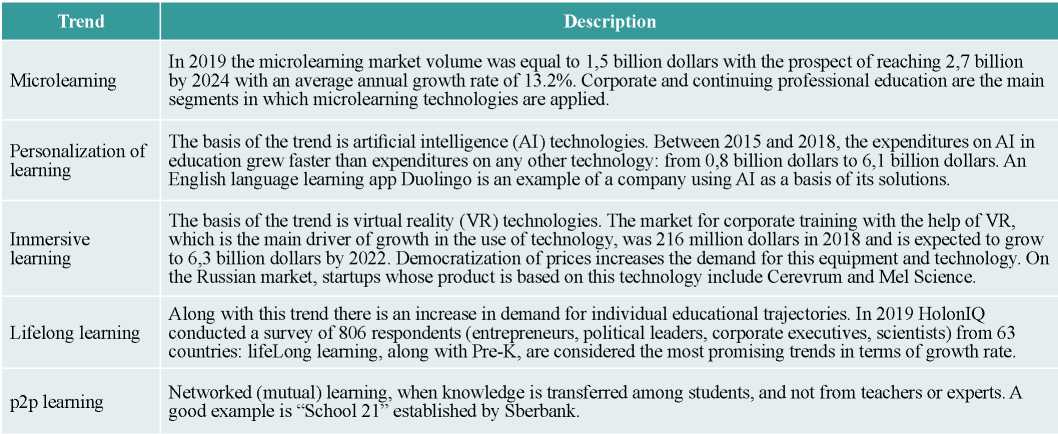

In addition to the economic trends discussed above, technological trends stand out on the global educational market (Table 1). According to experts from the leading countries of the world, the future of education lies in network (mutual) learning with a strong component of personification based on big data reducing the role of traditional institutions [Market Research.., 2020].

Table 1

Technological trends of the education market

Source: compiled by the author

-

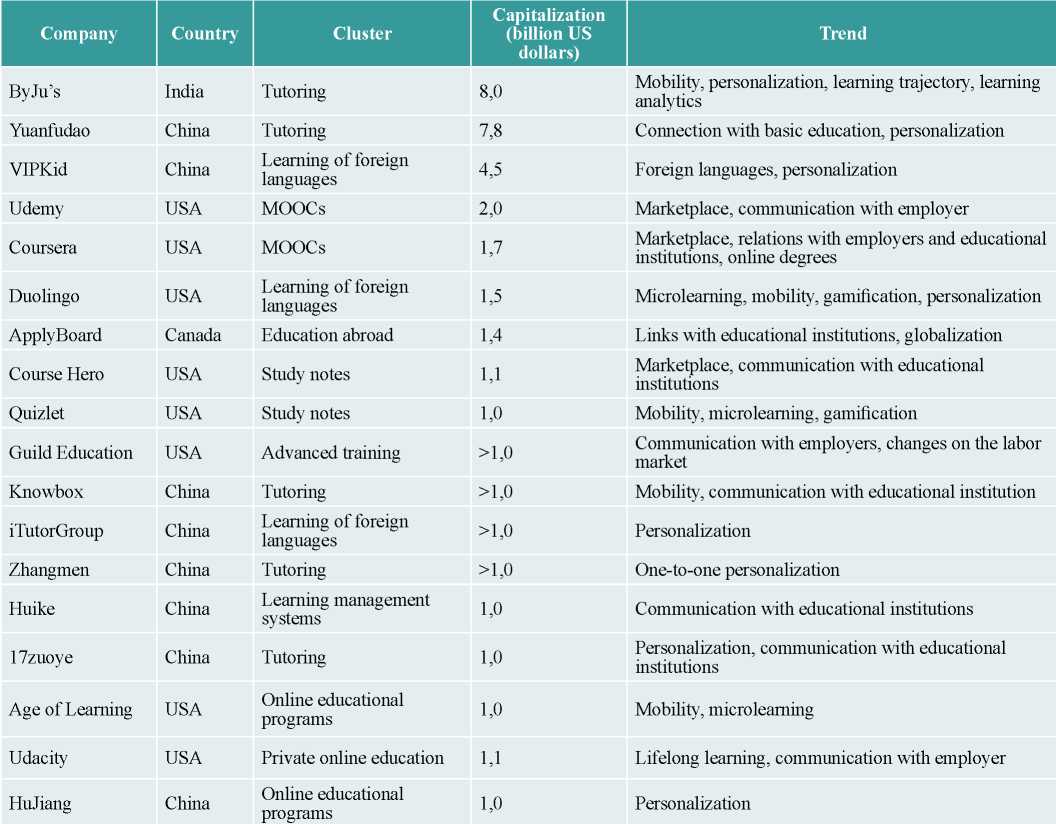

EDUCATIONAL STARTUPS IN THE WORLD AND RUSSIA

According to the analytical agency HolonIQ, at the beginning of 2020 there were fourteen EdTech startups operating on the global market with a capitalization of more than 1 billion dollars - they are usually called unicorns (Table 2). China is the leader according to the number of unicorns - eight startups (57%), five unicorns are in the United States, and one in India. There are no unicorns in other countries, which confirms the leading positions of the markets of China and the United States. American startups such as Duolingo, Coursera and Udacity operate on the global market, unlike most Chinese ones, which are focused on local or regional markets. The first startup to join the unicorn club was the American Course Hero formed in 2006.

Table 2

Educational unicorn startups, January 2020

Source: compiled by the author based on data Global EdTech Unicorns. 13.03.2020. URL: https://www.holoniq.com/edtech-unicorns/

HolonIQ owns the most detailed classification of the global educational market, consisting of ten product niches and fifty-five clusters [2020 Global Learning.., 2020]. Unicorns are represented in only nine clusters:

- Tutoring, learning support niche - five companies, all Chinese;

- study of foreign languages, international education niche - three companies;

- educational online curriculum, knowledge & content niche - two companies;

- MOOC, new delivery models niche - two companies;

- study notes, training support niche - two companies;

- UpSkilling, Skills&Jobs niche (one company),

- private online education (proprietary online), niche "new models of delivery of educational content" - one company,

- learning management systems (online program managers), niche "New models of educational content delivery" (one company).

- international study, "international education" niche - one company.

According to Interfax [Research of digital.., 2020], the leaders of the global EdTech market are represented by three product area groups:

- tools for creating educational content;

- services, platforms for organizing, analyzing and administering the learning process - learning management system;

- platforms for the distribution of educational content and involvement in the learning process.

In the fourth quarter of 2019, RBK group analyzed the biggest EdTech companies on the Russian market and made a rating based on the “Revenue size”9 criterion. The rating resulted in a list of the most successful Russian educational startups, which can be considered as an informational basis for identifying the general criteria of success. Table 3 provides a brief overview of some elements of the business models of startups from the rating (top 10 companies).

Table 3

The rating of Russian educational startups according to revenues in 2018

Source: compiled by the author

Almost half of the companies from the top 35 list and 40 % from the top 10 list create an offer on the market of additional professional education. On the one hand, this fact makes the segment of adult education relatively more competitive, and on the other, one of the most promising, especially given the interest of investors. The most popular monetization model is the classic fixed fee for product units (course, lesson), which is modified by installments and a free trial period. The subscription model remains the mainstream for B2B projects and is extremely rare in B2C, in contrast to American startups.

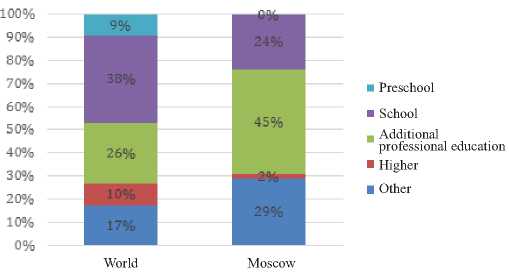

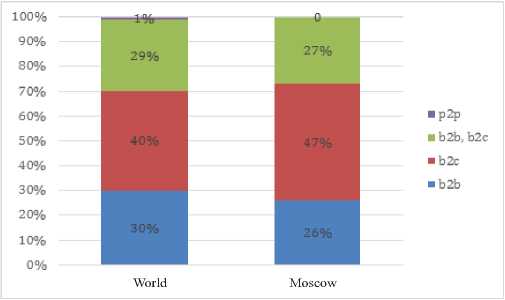

According to the study conducted by the Agency for Innovation, in Moscow 45 % of projects create solutions in the segment of additional professional education and 24 % in the segment of school education, including additional education (Fig. 2). If we consider that some projects from the category "Other", including language training and universal projects for several client segments, partially offer solutions for the additional professional education and adult education segment, then the share of additional professional education in Figure 3 may grow to 55-60%. In the world, the situation between school and additional vocational education is more balanced. In Moscow B2B companies are more focused on corporate clients than educational organizations. The P2P model (mutual education) is practically not represented in Moscow and Russia (Fig. 3).

Source: [EdTech.., 2019].

Source: [EdTech.., 2019].

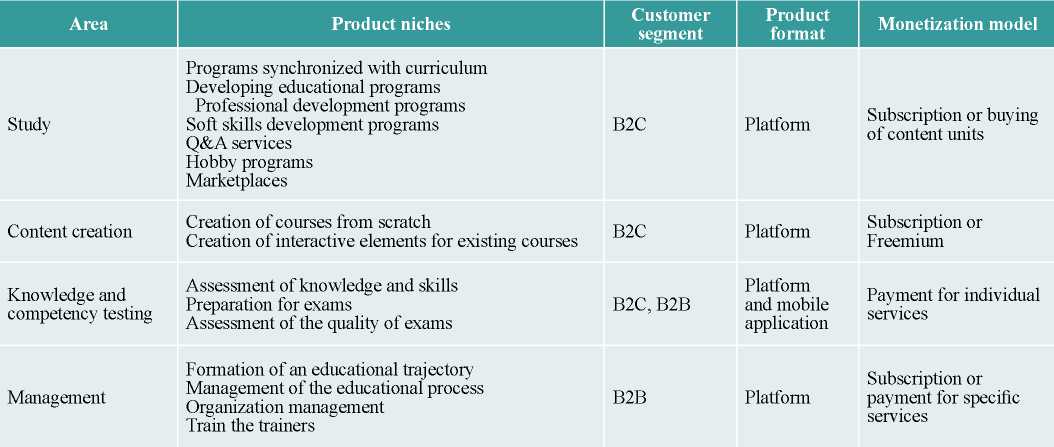

The Innovation Agency segments the EdTech market into four areas - research, content creation, knowledge and competence testing, and management (Table 4).

Table 4

Dominant elements of business models depending on the specialization of the EdTech market

Source: [EdTech.., 2019].

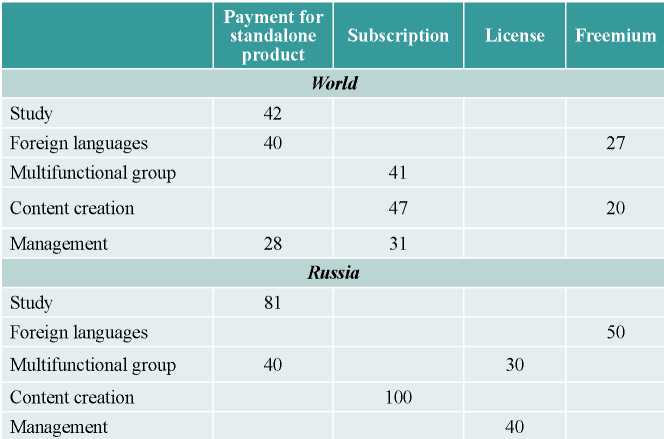

According to the Innovation Agency, subscription is the dominant monetization model on the EdTech global market. Moscow projects prefer one-time payments for units of consumed content/service. The purchasing of a license, which is widespread on the Russian market for certain product groups, is considered an outdated model and is practically not used in the world. Compared to the global market, the monetization models of Moscow startups are less diverse and more concentrated for each product group (Table 5).

Table 5

Prevailing monetization models by functional areas (% of the total number of startups in this group)

Source: [EdTech.., 2019].

According to the research results of the Agency for Innovations, one can distinguish the following areas of the EdTech market, which are poorly represented among Moscow (and Russian) startups and, at the same time, are characterized by an investment growth of more than 100 % in 2015-2018:

- solutions for managing an organization or educational process with the possibility to create an individual educational trajectory and automated selection of relevant training programs, including products to help school graduates in choosing an educational institution and a career path;

- solutions for the preparation and training of teachers taking into account the changing approaches to the educational process;

- solutions related to the preparation for exams in addition to Unified National Examinations and Basic State Examination;

- solutions for teaching creative skills (drawing, creative industry, piano playing) and programs synchronized with the curriculum.

According to Interfax, the estimated capacity of EdTech within the framework of additional professional education and distance learning (DL) is 45 billion rubles and 55 billion rubles in 2019 and 2020, respectively. The volume of the total market for additional professional and additional education is 310 and 315 billion rubles in 2019 and 2020, respectively, the penetration of the online component into the segment is 14,5 and 17,5%, respectively. In a study carried out by Netology, which covered only the B2C segment, the penetration in 2019 was estimated at 13,5%, while the coverage of the market of additional professional education by online education is at 7,5%, reaching 24% in such niches as digital -skills.

At the same time, in Russia the share of the population that participates in programs of additional professional education is significantly lower than in developed countries: 15 % versus 40 % [Market Research.., 2020]. In addition, the bulk of adult audience is enrolled in programs of additional professional education and continuing education financed from other sources (government, employers) - household funds are spent much less frequently.

The studies of Interfax-Academy and Netology probably for the first time presented a detailed structure of the segment of additional professional education and distance learning in Russia (the segment of adult education). Based on the areas of study, seven segments are distinguished:

- language training;

- digital professions;

- applied professions;

- development of methods and teaching aids;

- corporate training (corporate universities);

- development of flexible skills (soft-skills);

- business education (MBA and other forms).

There are three leaders in the segment of digital professions - these are the previously mentioned Skillbox, Netology-group and Geekbrains. In 2019 these projects accounted for about 17 % of the digital professions segment - 6,5, 5,3 and 5,3 %, respectively. The rest of the players have less than 1 % each.

According to Interfax, in the segment of applied professions the situation is even less “monopolized”. The absolute leader - GetCourse last year occupied about 3,5 % in the segment, closely followed by - Infourok and Sikorsky Academy - 2,7 and 1 %, respectively.

The language learning segment can be called the most concentrated. The leader of the segment and the leader of the Russian EdTech as a whole - SkyEng - occupied about 20 % of language training in 2019, and according to Interfax forecasts, in 2020 its share may grow to 30 %. The three companies following the leader - LinguaLeo, Puzzle English and Easy Ten - took 4.5, 3 and 2.3 % of the segment in 2019, respectively.

The segment of language learning is the most concentrated. The leader of this segment and the leader of the Russian EdTech as a whole - SkyEng - occupied about 20% of language training in 2019, and according to Interfax forecasts, in 2020 its share may grow to 30%. Three other companies following the leader - LinguaLeo, Puzzle English and Easy Ten - took 4,5, 3 and 2,3 % of the segment in 2019, respectively.

Finally, the segment for developing methods and means of corporate training is characterized by a large number of players and relatively low shares of each of them. The leaders here are Mirapolis (7,3%), eQueo (5,3%), iSpring (5,3 %), Netrika (4 %), SkillCup (2,6 %), Teachbase (1,2%), Eduson (<1 %).

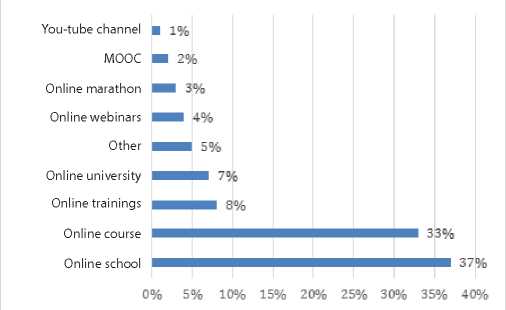

The survey of “Online Education Barometer” conducted in the fall of 2019 [Russian Market Survey.., 2019] confirms the growing popularity of educational business and the existing imbalance in prevailing business models. Therefore, most of the objects of research position themselves as online schools or online courses (Fig. 4. Most of these projects appeared in the last year and create solutions in the segment of additional professional education (Fig. 5).

Source: [Research of the Russian market .., 2019].

Source: [Research of the Russian market .., 2019].

Fig. 5. Distribution of answers to the question: "Year of creation of your online school?"

Based on the research data, it is possible to describe the most common profile of educational organization in the segment of additional professional education. This is an online school about one to two years old offering short online training programs up to 3 months (73 % of organizations) and costing up to 50 000 rubles. (88 % of organizations).

In spite of the long list of online schools and online courses, most revenues in the segment of additional professional education are generated by several of the major players mentioned above. This indicates, firstly, the high attractiveness of the segment of additional professional education for entrepreneurs; secondly, the primitiveness of the online school model, which does not require big investments to start a project; thirdly, the high competition and market imbalance in terms of the concentration of revenues in the hands of a small number of players; and, fourthly, the small variety of business models and the primitiveness of the proposed educational solutions.

The studies highlight the main problems of the market of additional professional education, the lack of a systemic connection between the educational programs of additional professional education and the demands of the labor market [Digital Research.., 2020]. One of the reasons for this is the absence of a single platform for communication and interaction between training platforms and employers.

According to Interfax, the system of lifelong learning (LLL) is still not built, and the LLL phenomenon itself exists in the form of a slogan, without really manifesting itself in the intended quality [Research of digital.., 2020]. Universities, which in the ideal model should be the foundation and the starting point for building an ecosystem of research and technological development, have not yet built systems for accompanying students throughout life. Nevertheless, the focus on the implementation of the principle of lifelong learning is one of the main theses of national programs for the development of education in the Russian Federation.

Today, a model of helping graduates with employment or even guaranteed employment has become widespread. As Dmitry Voloshin, founder of Otus, noted, “there is an overabundance of newcomers on the market. The main question is how to prepare people for business tasks, while minimizing the employer's costs for the adaptation of employees".

In the study of Netology and TalentTech one of the growth points is the blue-collar customer segment - educational solutions for workers, engineers, doctors and others. Their prospects are justified, among other things, by the weak penetration of online education into this client segment, while at the end of 2019 in the Russian Federation “there are about 30 million skilled workers, and only a small part of them are covered by modern educational solutions” [Market Research.., 2020].

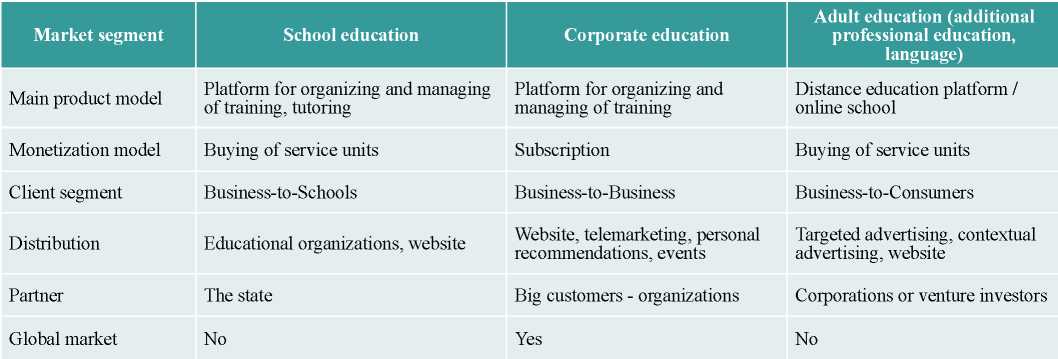

Table 6 describes business models of the three segments, which represent the majority of successful startups on the Russian market.

Тable 6

Prevailing business models of Russian educational startups

Source: compiled by the author.

-

ANALYSIS OF INTERVIEW RESULTS AND CONTENT ANALYSIS OF STARTUP REPRESENTATIVES, INVESTORS AND CLIENTS

The sample of startups included representatives of nine projects, four of which are among the thirty biggest educational projects on the Russian market (Table 7). The sampling criteria were: variety of product models, variety of scale, presence of projects with B2B and B2C client models in the sample. Six out of nine objects were studied by the interview method, the other three - by the content analysis method.

Table 7

Sample of representatives of educational startups

The sample of customers included representatives of five companies, two of which are branches of international companies (Table 8). The sample was formed from Russian and international companies of various sizes and different branches: a state company, an international bank, an FMCG sector company, a telecommunications company, and a game developer. All five objects were studied using the semistructured interview method.

Table 8

Sample of B2B customer representatives

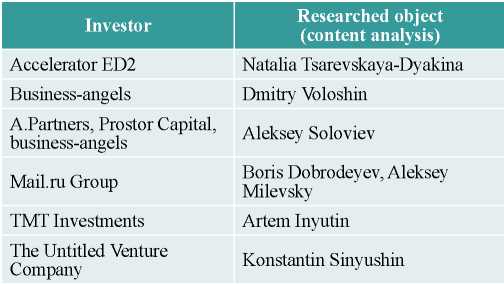

The sample of investors included representatives of venture and corporate funds and business-angels investing or planning to invest in educational startups (Table 9). The sample was formed from different types of investors; all objects were studied by the method of content analysis.

Table 9

A sample of investors in educational startups

Source: compiled by the author

Questions and topics can be considered identical within each group of the studied objects. Therefore, the research results are grouped similarly into three classes of objects and represent theses that, firstly, form a general pattern of behavior of objects in a separate group, secondly, they provide data for testing the hypotheses formulated earlier and, thirdly, highlight other important pattern for the purpose of the research.

The first thing that the studied startups have in common is an understanding of the importance of the size of the market in which a project operates, which determines its potential for scaling. On the one hand, the absence of this factor quickly makes a startup reach a certain “ceiling” in terms of both the audience size and turnover and, on the other hand, it significantly reduces its attractiveness in the eyes of investors. In the case of the Full House project, the absence of this factor, that is, “focusing on a very narrow target audience,” according to the founder, Natalia Landau, is the main reason for the failure. On the contrary, for Skyeng English language school, the presence of a big market with a high growth rate has become one of the main reasons for obtaining investments and the joining of a strong partner in the person of Alexander Laryanovsky.

Representatives of two projects from the RBK rating - Georgy Soloviev, co-founder of Skyeng, and Vladimir Shcherbakov, founder of Teachbase - confirm another statement of the Lean Startup philosophy. In one of his interviews Shcherbakov expresses the opinion that a startup should not offer a comprehensive solution to cover all the needs of the target audience: "The main thing is to devote oneself to solving the main problem".10 Georgy Soloviev confirms this opinion admitting that an attempt to enter the market with a big product immediately was one of the biggest mistakes of the project: "You should not do this until you have thoroughly studied the market and customers, otherwise you can lose everything".11 When discussing business models representatives of the studied startups focused on three components: technological effectiveness of the product, the importance of promotion and relations with the target audience. In addition, Alexander Laryanovsky argues that “there is no repetition of successful business models”12؛ Therefore, each new startup case can hardly be called a confirmed business model.

Kristina Gevorkyan, head of methodology at the international startup Lectera13 as well as the author of one of the biggest Russian blogs on the topic of online education, identified the main drawback of business models of Russian educational startups noting that they are “tied to human resources (teachers, curators)” and “initially they are not intended for scaling". The growth of such projects is inevitably accompanied by the need to expand the staff and the number of processes for the production of educational content, which leads to a constant increase in costs and can reduce the margins of the product.

Skyeng executives, whose product is based on the live interaction of a teacher and a student (user) making their business model dependent on the growth of the teaching staff, consider the presence of human interaction necessary in an educational product, since the teacher's motivational function is very important. However, this did not prevent them from scaling and becoming a market leader, which is probably due to the technological effectiveness of the product. “We immediately started implementing technological, analytical tools”14, says Laryanovsky, probably referring to the Vimbox platform, which the project launched after two years of its existence. The platform uses the analysis of user data to offer personalized content and to help teachers personalize their approach to teaching. Anton Yeremin, Manager of the product Practicum by Yandex, also spoke about the importance of a technological solution in terms of scaling. He believes that "the online lecture model around which most of the products on the market are built, is difficult to scale, measure and maintain, since it is not possible to control the outcome and quality at the time of conducting lessons". In the segment of platforms for organizing and managing distance learning, which include iSpring, GetCourse, Teachbase and others, the importance of this factor is only increasing. “You need to understand that it is impossible to enter the LMS market without a technological solution, selling in this segment is not enough now, we need functionality,” says Vladimir Shcherbakov, founder of Teachbase.

Shcherbakov also spoke about the importance of promotion for scaling the educational business: "The content of the course is certainly important, but without competent marketing and packaging of the product for the external market it will be difficult to make money on it". A similar position is maintained by Gabriel Levy, founder of Dnevnik. ru: "EdTech is not a business about technology or content, it is a business about promotion"15.

Finally, the representatives of the studied projects named the quality of relations with clients as an important factor for the success of the educational business. This factor can become a competitive advantage for a startup, because "big companies are gradually losing the quality of services"16. Shcherbakov also notes that the quality of technical support is the main reason why Teachbase is chosen among other similar solutions. Georgy Soloviev, saying that Skyeng has reached a certain “market ceiling”, sees a solution is developing relations with customers: “In order to grow and increase revenues, we need to provide even better services every day”17.

After direct elements of the business model the second cited factor influencing the success of an educational startup is the team’s professionalism. According to the respondents, forming a strong team at the start of the project is one of the most difficult tasks; in addition, the low level of specialists and entrepreneurs is generally considered by some players to be a feature of the Russian market.

Dmitry Krutov, founder and executive director of the Skillbox University of Digital Professions, is confident that "the difficulty of startups is in not understanding why they are doing business"18. Krutov considers the level of entrepreneurs in the country to be low. Natalia Landau expresses a similar opinion that the “startup culture is very poorly developed in Russia” and sees this as one of the reasons why projects aimed at the global market do not appear. Kristina Gevorkyan, citing her experience in several educational projects as an example, argues that very little attention is paid to the economic modeling of a startup, “no one considers” unit economics, as a result of which the project team finds problems with the business model too late.

In addition, Gevorkyan believes that there are not enough good specialists in the promotion and marketing of educational business. “Finally, the problem of frequent educational players is their attachment to the founder”, concludes Gevorkian confirming the experience of the Full House school, which will be discussed below. Yeremin confirms what has been said calling a strong team with strong product management skills one of the main reasons for the success of "Yandex. Practicum".

From the point of view of demand, the main and, probably, stable trend for all the studied startups is the relationship between the demand for training with career development and work itself. Laryanovsky says that the strongest motivation for studying at Skyeng is training for work. Shcherbakov believes that training at the workplace will remain relevant for a long time. According to Yeremin, on the US market for "Yandex. Practicum" the employment of graduates is a point of growth and a way to create stable demand.

The need to take into account the requests of employers when creating educational products is determined, according to Laryanovsky, by the fact that employers’ dictate has developed on the labor market. The crisis occurring in 2020 and job cuts will only strengthen this position and “soon employers will again be saying: “We want these employees and more with such skills!"19.

On the Russian market, startups, especially those working with corporate customers and the government, focus on the difficulties associated with formal processes: “The tender culture is a barrier to market development and interaction between startups and the system,” - Krutov notes.

Shcherbakov highlights the excessive safety requirements of some companies, which can be attributed to the same group of barriers.

With regard to overseas markets and the expansion of startups to the global level, all projects associate this strategy with significant difficulties. Of those projects whose representatives' opinions were studied only "Ya. Practicum" is trying to enter foreign markets. Yeremin notes that this process is associated with high costs and, moreover, is especially difficult for companies that have achieved success on the Russian market: "The fact that your product works in Russia is a minus". Those startups that did not start this process early and have achieved some success on the Russian market, in order to enter the markets of other countries, it will be necessary to rebuild many business processes and carry out large-scale localization of their products. Teachbase plans to find a partner for the expansion process. Skyeng made several attempts to enter foreign markets, but they were unsuccessful. Gevorkyan, defending an alternative position to Yeremin, believes that “it seems to our domestic players that the volume of our small market is sufficient for now”. At the same time, the Full House marketing director believes that new educational projects can survive and remain competitive if they initially focus on the global market.

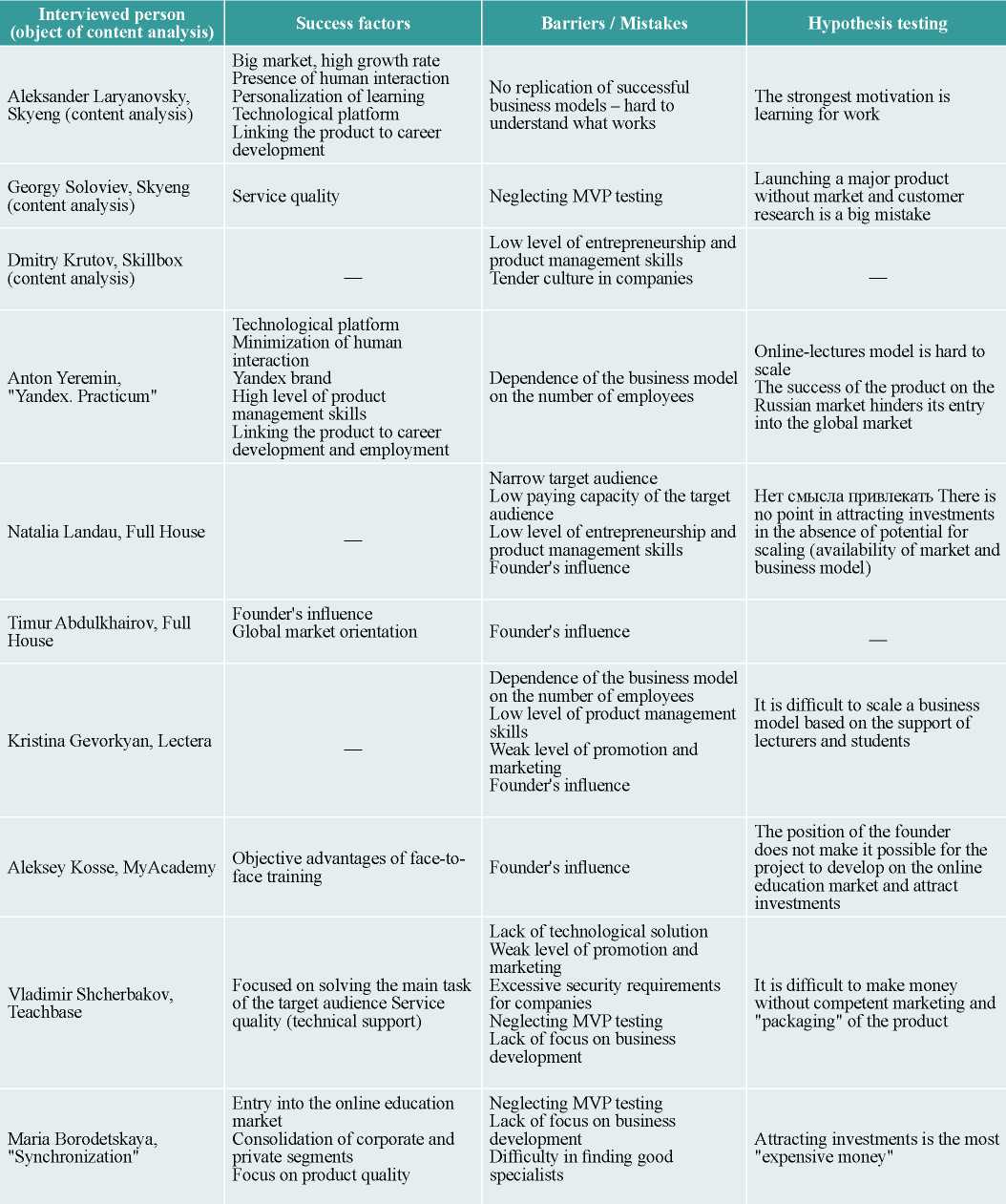

Table 10 shows the main success factors and barriers that were identified as a result of interviews or content analysis of interviews with representatives of startups, including the opinions of those representatives who were not mentioned in the main text of this section. The table also shows the intermediate results of testing of the previously formulated hypotheses.

Table 10

The results of interviews and content analysis of startup representatives

Source: compiled by the author.

The study considered the companies that are active clients of educational startups and are qualitatively different from each other in a number of parameters: a representative of a highly regulated industry - “Rosatom” corporation and “Rostelecom” with state connections, companies that are branches of international companies - L'Oreal, Raiffeisen, PWC, a Russian technology company developing 101XP games.

The information received from customer companies shows: the specifics of selection of educational solutions, internal barriers of working with startups, problems related to startups. All customer representatives refer to the recommendations of the internal peer community in the selection process. The bigger the company, the more often it pays attention to the status and size of the provider of educational solutions. Raiffeisen and Rosatom actively use a selection through “piloting” solutions - either in a separate subdivision or within a department dealing with personnel development and training.

Almost all interviewed persons noted the presence of internal barriers to the implementation of educational solutions. “The fear of business, HR-departments and conservatism in making educational decisions are the barriers that are difficult to work with”, - noted one of the interviewees. In general, a resistance to changes and a lack of demand for training are cited as problems by most customer representatives. For Rosatom the main barriers are information security requirements. For example, a corporation cannot use the solutions of companies whose servers are located outside of Russia.

The most common drawback of educational projects is bad "packaging", which means several elements: from inappropriate product design to inability of an educational project to present itself and its solution. “A good design strongly influences the decision-making process,” said Mariya Mamatova, director of training and personnel development at L'Oreal. In addition, representatives of L'Oreal and Rosatom noted that educational solutions often lack opportunities for analytics. Firstly, without analytics “it’s impossible to rely on anything to launch mixed programs”, and secondly, “if there was an obvious result (the startup could show how the metrics changed after training), it would be easier to sell (that is, to convince individuals decision makers of the value of the educational product)”.

Yevgeniy Salyukov, head of the personnel training and development department of Rosatom, also said that there is no platform that would be integrated with the personnel system and HR functions. Karina Akopyan from Raiffeisen's talent development department noted that it was a disadvantage that “after training it is not always obvious to employees how they can apply knowledge in practice”.

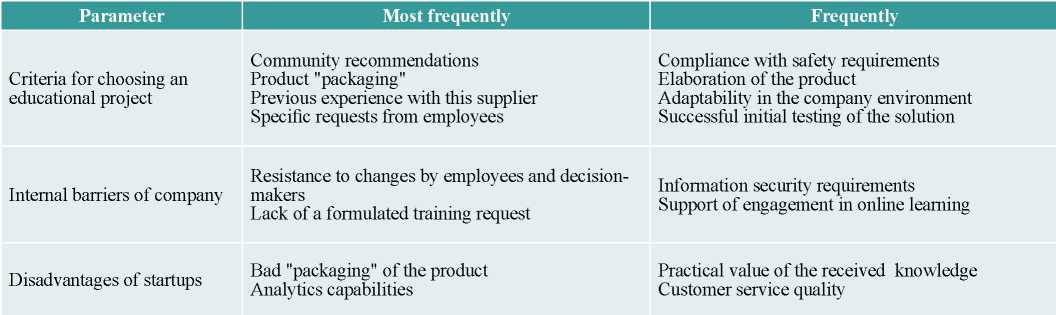

The results of interviews with client companies are presented in Table 11. It shows the most common criteria for choosing educational solutions, internal barriers to working with external projects, deficiencies of startups themselves, as well as preliminary results of hypothesis testing.

Table 11

Results of interviews with representatives of B2B clients

Источник: составлено автором.

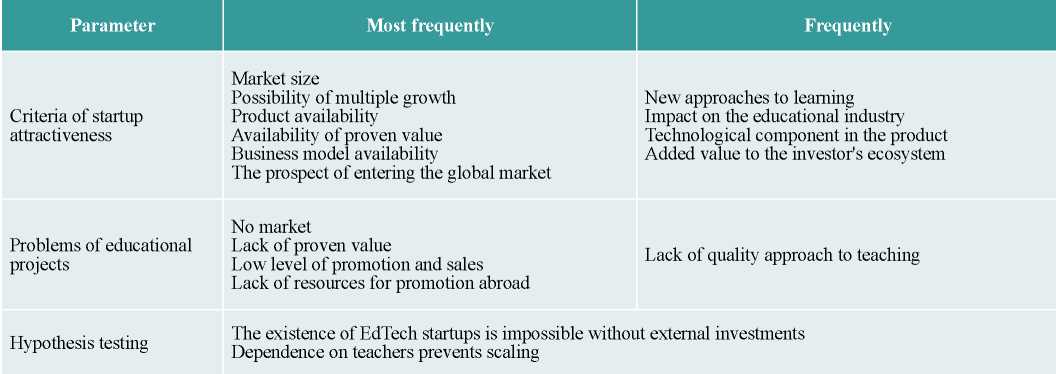

Investors' opinions were studied mainly by the method of content analysis. The obtained data can be divided into the following groups: the specifics of the educational industry through the eyes of an investor, the priorities of investors when choosing educational projects and the problems of Russian startups.

Natalia Tsarevskaya-Dyakina, head of the EdTech accelerator ED2, in one of her interviews highlights two promising technologies in educational solutions: virtual reality (VR) and mobile-first solutions (for example, mobile LMS)20. According to Tsarevskaya-Dyakina, educational products with virtual reality are already used globally and are worth paying attention to. As an example she cites a domestic startup Cerevrum21, which in 2019 received 3 million US dollars in investments and entered the US market.

“The choice of a startup is based on the same criteria as for other industries”, - notes Tsarevskaya-Dyakina mentioning as criteria a big growing market, confirmed demand for a product and the possibility of multiple growth22. She said that as an individual investor she is considering new approaches to learning. Describing the approach of the ED2 accelerator in an interview with the Rambler portal, Tsarevskaya- Dyakina said that it does not work with projects at the stage of idea-generation: firstly, a startup must have a product; secondly, "there must be sales, at least some, albeit random, but confirmed by the accounting department"23; and, thirdly, there must be a business model.

ED2 accelerator does not consider startups with online school model as candidates for acceleration or investment. Tsarevskaya-Dyakina argues for this position saying that "an online school is the digitization of content and uploading it to the Internet," and accelerator "is engaged in projects that develop the industry"24. In addition to the above-mentioned factors that affect the attractiveness of a startup for an investor or accelerator, interviews with various investors often point to the potential of a startup on the global market. Konstantin Sinyushin, Managing Partner of The Untitled Venture Company, claims that it is almost impossible to attract investments on the stages following the seed rounds, "if they (startups - author) do not plan to enter the world market"25.

Artem Inyutin, co-founder and investment director of TMT Investments, at the panel discussion on investments in EdTech at the Open Innovations forum, also noted that in addition to scalable technology, startups are attracted by “the opportunity to enter the international market”26. Dmitry Voloshin, the founder of the Otus.ru startup and business angel, adheres to the same position. In April 2020, he posted on his blog the news that he was looking for two EdTech or HRTech projects for investments with the note “I give preference to projects with the prospect to expand abroad”27.

Speaking about the specifics of the educational market and educational startups, investors note a number of problems. Aleksey Soloviev, investor and partner of the Prostor Capital fund, believes that "the biggest mistake of Edtech startups is that they don't want to sell". In addition, the study "Startup Barometer", one of the initiators of which is Soloviev, indicates three main reasons why startups fail to enter the global market (according to startups themselves):

- there are no resources for promotion abroad (money, connections, understanding of the specifics);

- desire to test the product on the Russian market;

- believe that the product is not yet ready for this.

Tsarevskaya-Dyakina believes that startups have enough technologies, but "there is no quality approach to teaching". At the same time, she confirms that “a good tutor is a weakly scalable story with a complex economy”28. Nevertheless, “education must be accompanied,” says Tsarevskaya- Dyakina. Perhaps, such contradiction also confirms the justification of the position of Solovyov, who believes that "the existence of EdTech startups is impossible without external investment"29.

The results of the study of investors' opinions are presented in Table 12. The most common positions on the attractiveness and problems of educational projects are highlighted, and the intermediate stages of hypothesis testing are described.

Тable 12

Survey results of investor opinion

Source: compiled by the author

-

RESULTS OF RESEARCH CASE ANALYSIS

As part of this study, four startups were examined, each of which is qualitatively different from the others:

- unsuccessful B2C startup that has ceased its activities - the Full House school;

- successful B2C startup that entered the US market in the first year of its existence, but at the same time it is a corporate startup - "Ya. Practicum";

- startup leader whose product is aimed primarily at the B2C market - Skyeng;

- successful B2B startup - Teachbase.

Each of the cases was studied by using three methods: content analysis (video interviews, text interviews, blog posts), product study through information on websites and in social networks, interviews with startup representatives. The latter were also included in the general sample of interviews with representatives of startups.

Full House30 is a startup founded in 2018 around one product - the online course "Educational Project Manager". Its founder - Natalia Landau, former head of B2B programs and Business Development at Netologia, head of full-time education programs at Digital October. Market segment - additional professional education. Product model - online school. Client model - B2C, B2B. Monetization model - the purchasing of a service unit. Full House did not receive funding from industrial investors, did not undergo acceleration, and is not a participant in grant programs.

During 2018-2019 the product line for the B2C segment was supplemented with three other online courses. In 2019 the startup also tested new training formats - online courses based on the mechanics of user interaction with a chat bot in the Telegram messenger. During 2019 Full House has been actively developing its B2B areas, offering turnkey educational programs for company employees. Nevertheless, for the entire reviewed period the online course "Head of educational projects" continued to bring the bulk of the startup's revenues. At the beginning of 2020, after two years of existence, Full House suspended its activities.

As part of the study, interviews were conducted with the founder, Natalia Landau, as well as with the marketing director, Timur Abdulkhairov. The purpose of the interview was to identify the factors that prevented the business model from scaling and continuing to work.

Both interviewed persons named the main reason for their failure - focusing on a narrow target audience. Indeed, the main audience of the startup included heads of training and HR departments of big and medium-sized companies, management and staff of educational institutions and, to a lesser extent, consultants, business coaches and tutors. According to Landau, "we have exhausted this audience in two years". In addition, she noted that a significant part of the target audience was characterized by low payment capacity. Therefore, the startup initially built a business model in a segment that did not have the potential for scaling.

Landau and Abdulkhairov noted the personal interests of the founder as the main reason why the startup did not go into other niches and used a more aggressive promotion strategy. “Most likely, it was necessary to initiate an “open a school in three days” and to add an information business component, but I did not want that, and for the same reason we did not expand the project to other segments - this was not part of my range of interests” - said Landau. The head of marketing noted that at first the founder's personal brand helped to get the first customers, and later it became a barrier to scaling and testing new monetization and promotion models.

The experience of the Full House startup confirms, firstly, that the initial choice of a narrow segment deprives the business model of the potential for scaling, and the low solvency of the target audience only enhances the negative impact of this factor. Secondly, the use of the founder's personal brand in the same narrow segment as the main competitive advantage with the growth and development of the project becomes a barrier, including for the purposes of scaling.

“Yandex. Practicum''31(hereinafter "Ya. Practicum") is an internal project of Yandex, which can be considered as an internal corporate startup, and in the situation of entering the US market, which is not covered by the power of Yandex brand, "Ya. Practicum" can be compared to any other startup that is expanding into the Western market.

"Ya. Practicum" works on the platform model for distance learning, offering long (4-10 months) courses for mastering professions and skills in the segment of "digital additional professional training". The monetization model is the purchasing of service units. The main specialization of the startup is professions related to programming and data analysis. The cost of training varies from 45000 to 95000 rubles. In the fall of 2019 the startup began the process of entering the US market under the brand “Practicum by Yandex”32. In the spring of 2020 "Ya. Practicum" launched an English course "Flow" and announced an imminent appearance of courses in the specialties "Internet marketer" and "interface designer".

The startup was launched in early 2019, and according to the results of the same year, its revenue amounted to about 100 million rubles, which made "Ya. Practicum" the leader among educational startups in terms of revenue growth. As part of the study an interview was conducted with Anton Yeremin, the chief product manager in the American version of Practicum by Yandex and the product manager at "Ya.Workshop", as well as a conducted content analysis of the interview with Mikhail Yanovich, head of the "Ya. Practicum" project.

The goal of the interview was to identify the factors that helped the project to scale on the Russian market and the specifics of scaling on the American market.

According to the head of the "Ya. Practicum" Mikhail Yanovich, the launch of the project in the USA was based on the existence of similar problems with education on the American and Russian markets. “During interviews applicants are asked to design a web page for the test, but they cannot do that”, says Yanovich. "The US needs a million new developers a year, and this demand is not satisfied by local education"33. Yanovich explains the emergence of the major Russian project "Ya. Practicum" by three reasons. Firstly, the educational market has become big and attractive enough (probably for the Yandex brand). Secondly, Yandex itself has accumulated enough expertise in teaching IT specialties. Finally, the company has sufficient technologies and skills to create a quality educational product.

According to Yeremin, the Yandex brand made a small impact on the US market, although it aroused some confidence among the audience. Entering the foreign market was accompanied by product localization, translation into English and adaptation to the specifics of the foreign labor market. However, unlike other projects that have to transform a product to the consumption profile of an American customer, "Ya. Practicum" practically did not change anything when moving to the US market, according to Yeremin. Professions related to Data Science and programming are international.

Most often they are tied to the English language and foreign tools. At the same time, Yeremin noted that "Russian startups do not enter the United States, because it is very expensive, just as expensive as entering the Chinese market". According to him, both markets are more developed than the Russian one, and they set high standards of quality with big and strong players.

Therefore, Russian projects, which have achieved success in Russia, have to simultaneously spend resources on localization in a new linguistic and cultural context and think over a new competitive strategy. Yeremin considers successful work on the Russian market a disadvantage for companies entering the global market, "because business processes and the team are already attuned to the consumption style of the Russian audience". That is, the success on the Russian market, in his opinion, is not an obvious advantage when expanding to other markets, since positive experiences cannot be repeated with the same success in qualitatively different conditions.

Speaking about the rapid scaling of "Ya. Practicum", Yeremin noted that there were no special scaling strategies: "We adopted clear, proven teaching mechanics (simulators, mentor support, trial period, platform), combined them and made a good product". Other important factors of success, in his opinion, were a team with strong product management skills (apparently referring to design skills, prototype testing, unit economics modeling, user research, etc.), as well as brand credibility of "Yandex".

One of the important factors that contributes to scaling is associated with product models - for “Ya. Praktikum” it is a platform in which the simulator mechanics, educational content and support from mentors and curators are prevalent. Yeremin contrasted the platform's scalability potential with a more common product model used by most online schools: “The model of online lectures (video or webinar - the author), around which most products on the market are built, is difficult to scale, measure and maintain, because it is impossible to control the results and quality at the time of the lesson... We, in turn, can quickly make improvements to the product by editing the platform and content on a daily basis”, - concluded Yeremin.

One of the strong advantages of Y.Praktikum is the support of mentors and supervisors. This element is operational, and, according to Yremin, it is necessary to attract mentors. The project team adheres to the following strategy: students who undergo training, after one or two years, will grow to a level where they can become mentors themselves. We can say that Y. Praktikum forms a community that constantly grows and supports product processes strengthening the startup’s brand.

“Ya. Praktikum” uses a promotion tool, which was already mentioned at the beginning of the article: the user has an opportunity to study for the first twenty hours for free. This is practically the first case of using such big part of the product for free, which makes Ya.Praktikum different from its competitors. On the one hand, such an opportunity makes it possible to reduce distrust of the product and form a desire to study further, on the other, according to Y.Praktikum Marketing Director Yevgeny Lebedev, “this is a kind of filter that weeds out people with insufficient motivation to study”34.

The peculiar feature of Y.Praktikum, mentioned by Lebedev, is that “90% of our students, upon admission, say that they want to get a new profession”. For both projects, the Russian and the American, employment assistance is one of the main competitive advantages. For Ya. Praktikum, it is complemented by the fact that Yandex itself is the biggest employer of IT specialists. Lebedev asserts: "We did not reinvent the wheel in the matter of presenting information, but we screwed the necessary elements into those parts of the course where they are most needed". It is a quick-learning simulator, great hands-on exercises and mentors, which "instill behavioral algorithms that should help students get a job and survive in the first three months"35.

Probably, another significant advantage of Y.Praktikum is that the project has combined the strengths of competitors' projects in one product. Aleksey Polekhin, head of Netology's programming department, notes in this regard: “Netology has a career development center, we offer employment opportunities for graduates, Code Academy also offers training simulators, and GeekBrains works in conjunction with Mail.ru Group”36... But Yandex. Praktikum” for the first time combined all three components - a scalable simulator model, a focus on the employment of graduates and a strong Yandex brand - in one product.

The experience of “Yandex. Praktikum” proves that in order to increase the chances of scaling, an educational startup must initially enter a big market or wait for this market to grow rapidly. In addition, an obvious factor in the success of the startup's business model is the choice of a product model that is minimally tied to operational processes - in this case, it is a platform with simulator mechanics without online classes in the format of webinars or pre-recorded video lectures. Another factor of success, especially characteristic of the segment of additional professional training, in the case of Ya. Practicum, is its orientation towards the employment of graduates.

It is impossible not to mention three more factors that certainly affect the success of the project. Firstly, it is a positioning based on deep research of users and insights, a promotion strategy. Secondly, the importance of a strong team with the skills to manage educational and IT products. Thirdly, it is Yandex brand recognition and loyalty to it.

Finally, the experience of “Yandex. Practicum” emphasizes the importance of building communities as a tool for promoting and ensuring product processes of an educational project and confirms that entering the US market is an expensive process, especially for projects whose product is tied to the culture of consumption of the Russian audience or the specifics of the educational system. An equally important conclusion about the entering of foreign markets is that there are segments and user scenarios that do not differ significantly for the Russian and, for example, the American markets, which can provide an easier expansion process.

Skyeng is the third project in the case study. Skyeng Online School of English is the biggest educational startup on the Russian market, as well as the biggest English language school in Europe. According to the RBK rating, Skyeng's revenue is 1,1 billion rubles and exceeds the revenues of the next company "Netology Group" by 41%, while "Netology Group" represents two big projects: the online university "Netology" (segment of additional professional education) and online school "Foxford" (segment of school education). Skyeng has maintained a threefold growth for several years. This case was researched with the use of content analysis (interview with the founder Georgy Solovyov and partner Alexander Laryanovsky), insider information, as well as the study of the product through the analysis of its website and social networks.

Skyeng has been on the market since 2012 and until 2019 operated in the language training segment, starting with teaching an adult audience and then adding corporate clients and a children's audience. In the past two years, the product line has been expanded with the Skyes school platform (target audiences: teachers, parents, students), a full- featured children's line Stysmart with courses in English, mathematics and IT skills, competitions for schoolchildren and a Youtube channel.

At the time of the project’s creation the Skyeng product consisted of tutoring using the Skype program. However, already in 2014, the first version of its own platform for virtual classes Vimbox was launched. The founders of the project, Georgy Solovyov, Khariton Matveyev, Denis Smetnev, Andrey Yaunzem, had a goal to create a "box" solution, standardize training and put it on the conveyor using technologies and data37. In 2014, Alexander Laryanovsty, former director of international development at Yandex, joined the project and invested about 300000 US dollars in the company or 9,5 million rubles.

“One of the first decisions was the understanding that we needed a lot of small educational quick decisions, because the result in the horizon of five years does not work”, - Laryanovsky notes38. With the advent of the Vimbox platform, the team began implementing technological and methodological solutions to optimize operations and accelerate scaling. During the introductory lesson, the level of English, temperament and group of interests are determined for each user, which makes it possible to provide a personalized product, which increases the metrics of involvement and satisfaction ensuring the organic growth of the service.

As the co-founder of Skyeng, Georgy Soloviev, noted in an interview with Inc.: “At the beginning, we attracted a lot of clients by advertising. Now most of the students come through the referral program"39.

Despite the fact that the presence of personal contact with the teacher (tutor model) is the very operational component of the business model that complicates its scaling, this did not prevent Skyeng from finding a product/market fit and scale it. In addition, the main startup product still includes classes with a "live" teacher.

Laryanovsky highlights the advantage of this approach, enhanced by data-driven personalization: “When an app is waiting for you for a lesson and when a teacher is waiting for you, there is a big difference; when a teacher who remembers your cat's birthday is waiting for you for a lesson, you cannot miss it". Skyeng strives to combine the benefits of technology and personal interaction in education. "The motivational function of a teacher is very important", - Laryanovsky notes, "but the computer turns on at the stage of memorizing your mistakes and vocabulary". As a result, the emotional component that forms the attachment to the product remains dependent on the human factor, and technology enhances the personalization of learning, improving the user experience and facilitating the teacher's work.

Despite the fact that Skyeng's product is not directly related to employment and career, the main user scenario and the strongest motivation, according to Laryanovsky, is learning English for work.

Skyeng is trying to expand into the global market. In 2017, the project entered the US and Latin American markets40, but they stopped developing this area. Over the years, the project was launched in Turkey, Greece and China. But, as Forbes reports with reference to a company spokesman, these attempts have not been successful41. In 2020, Skyeng announced its entry into the Spanish market, according to Forbes. Speaking about the entry of Russian startups into the global market as part of the panel discussion at the Open Innovations 2019 forum, Laryanovsky notes the objective difficulties associated with understanding the cultural aspect and the need to adapt the product, and “it is easier to enter the global market when there is no market of one’s own, like in Israel"42.

Speaking about the mistakes made in the development of Skyeng, Solovyev highlighted the first and the most important one: “We spent a lot of time and almost all our resources to make and launch a large aircraft carrier at once, an ideal product”43. In his opinion, one should not do this without a clear understanding of the market and customers, otherwise it is easy to lose everything.

One of the factors that determined the success and leadership of Skyeng was its early entry into a big market (the size of the language training segment on a global scale in 2016 was estimated at 60 billion dollars, according to the "Research of the Russian Market of Online Education and Educational Technologies" with reference to the data of Ambient Insight data) with low concentration and fast growth rates (in 2016, Technavio estimated market growth in 2017-2021 at 23%).

At the same time, Skyeng grew faster than the market -by three to four times annually. The second factor is that Skyeng's experience here, as well as in the situation with the market size, is confirmed by the case of “Yandex. Practicum" -the initial focus on platform solutions using automation and data analysis, which provides personalization of the educational product.

In addition, Skyeng managed to combine the platform with the classic teaching method - one-on-one teacher- student interaction. This interaction, enhanced by the analysis of user data, helps to maintain motivation and create a positive learning experience, which leads to organic product growth. Despite the need to constantly increase its staff (in 2019, about 6000 teachers worked at Styeng44), the startup managed to scale - perhaps one of the decisive factors here was the timely and efficiently used investments.

Despite its leadership on the Russian market, Skyeng's attempts to scale the business model to other countries and regions have so far been unsuccessful. This confirms the statement of Anton Yeremin from “Yandex. Practicum” that success on the Russian market can hinder expansion into the global market.

Teachbase45 is a platform for organizing distance learning for employees, which also makes it possible to create online courses and to test knowledge. The project was founded in 2013, and in 2017 it was accelerated by the Internet Initiatives Development Fund. In 2019 it was ranked 28th in the rating of the biggest educational startups, according to RBK, with revenues of about 100 million rubles. Teachbase creates solutions in the segment of corporate training and additional professional education. Its product model is a platform for organizing and managing distance learning. As part of the case study, a content analysis and an interview with the founder of the project Vladimir Shcherbakov were conducted.

According to Shcherbakov, the main client segment of the startup are medium and large corporate customers, their share is about 80 % of all project clients. These include Ozon, IJA (International Jewelry Academy), Invitro, Siberian Health, Styeng, Gazprom Neft and others46. Shcherbakov says that the main product of Teachbase is a platform for automating education in educational centers and companies. 80% of the revenues is generated by the subscription model, the remaining 20% is generated mainly through the sale of white label solutions - a platform customized to the needs of customers and used by them under their own brands.