Scroll to:

INNOVATION INFLUENCE ON EXPORT ACTIVITIES: ЕMPIRICAL ANALYSIS OF RUSSIAN COMPANIES

https://doi.org/10.17747/2618-947X-2020-1-56-69

Abstract

The article gives an overview on existing the incentives and barriers of innovation activity that the company forces with when it enters foreign markets. The main incentives are: communication with suppliers, foreign partners, and customers; economies of scale; financing; the nature of the demand and the external economic conditions. Barriers are: competition; risks and costs associated with entering foreign markets; lack of financing and information, qualified personnel, government support; long payback period; technological lag and instability of the economic environment. Сountry analysis showed that the government is more profitable when it develops its own innovations rather than imports them. In countries with developed innovative strategy (Great Britain, Germany, USA, France, Japan, and Republic of Korea), the share of innovative industries in gross output and in export volume is significantly higher than in countries with a development model. These countries have created an innovative culture in which all participants interact in the process of increasing the country's competitive advantage.

According to an econometric analysis conducted in the study, it was concluded that the Russian export indicator depends on the internal scientific developments, the costs for implementing high-tech innovations and the number of registered patents, and in 2020 these indicators will develop with the same trend.Keywords

For citations:

Faiazova S.I. INNOVATION INFLUENCE ON EXPORT ACTIVITIES: ЕMPIRICAL ANALYSIS OF RUSSIAN COMPANIES. Strategic decisions and risk management. 2020;11(1):56-69. https://doi.org/10.17747/2618-947X-2020-1-56-69

1. INTRODUCTION

Today, in the context of globalization and accelerated technological progress, developing countries are beginning to catch up with developed economies and create difficult competitive conditions for them.

Recently, we are able to see that the share of developing countries in global export is increasing faster than the share of developed countries. Moreover, developing countries are being highly ranked in the Global Innovation Index (Global Innovation Index, GII).

Innovation has become one of the key export factors. At the same time, technological innovations play an important role [Trachuk, 2013]. The current development of world trade and the international economy is closely related to the development of new production technologies, the creation of new products and the production of new types of products. These trends in the activities of a modern firm can be combined under one common name – innovations. There are two key factors that affect economic growth: the accumulation of capital that will allow to increase production and human resources in the future, and the development of technologies that will help to improve the productivity and efficiency of the company. In essence, the constant development of technologies implies the constant introduction of innovations.

The purpose of this research is to study the impact of innovation on export performance. Therefore, it is important to trace the relationship between the level of innovation and export indicators in terms of factors identified and presented in the literature, and new factors that may have a significant impact on the innovation and economic development of the country.

2. THEORETICAL OVERVIEW

The first researchers who began to associate export activity with the productivity and innovation of the enterprise were American scientists Andrew Bernard and Bradford Jensen [Bernard, Jensen, 2004 (1987-1992)]. They affirmed that the export boom that occurred in the United States at the end of the twentieth century was due to the depreciation of the dollar and the increased productivity and capability of American industry as a whole.

Figure 1 shows the relationship between export volumes and gross expenditure for research and development for the countries leading the global innovation index in their geographical region and in the Russian Federation. Surely, it is impossible to talk about the direct impact of investment in research and development on foreign trade, but there is a certain correlation between the indicators. This confirms the correctness of the arguments that innovative development is important not only for individual enterprises and industries, but also for the national and global economy as a whole.

Source: compiled by the author based on data of https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS and https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm.

In the literature on this subject, there are two fundamental hypotheses that explain the interconnection among the concepts of innovation, export, and productivity.

According to the self-selection hypothesis, firms with a high propensity for innovation are more productive and have well-organized production processes and management systems, and higher incomes, can afford the financial costs associated with entering foreign markets, such as licenses and permits for sales, market research, training and marketing. In this case, innovation is one of the factors that increases the overall productivity of the firm, reduces costs in the production of higher-quality products, which more likely allows it to enter foreign markets.

According to the learning-by-exporting hypothesis, firms in the process of exporting products to foreign markets acquire new experience from their foreign partners in conducting business, distributing and promoting products, and actively introduce technological innovations to maintain their market share and expand the area of influence. After entering foreign markets, companies have more incentives and opportunities to implement innovations, in particular organizational ones, which contribute to the positive effect of learning from international interactions. We can also say that exports and innovations are competitive investment projects, so companies that are already present in foreign markets do not have to invest in the development of innovations.

Despite the fact that the export learning effect hypothesis has less empirical support than the self-selection hypothesis, there are studies showing that these two hypotheses do not exclude each other's effects and are complementary [Trachuk, Linder, 2018]. In other words, more competitive firms enter international markets as a result of innovation, where they become more productive due to the export effect.

In this regard, we can conclude that export activity leads to an increase in productivity, even taking into account the selfselection effect.

There is a large layer of economic literature that covers the problem of interaction between exports and innovations both at the macro level and from the point of view of an individual firm (see, for example, [Trachuk, Linder, 2017a]).

Continuing to develop the study of the effect of the export boom in the United States, Bernard and Jensen, together with Jonathan Eaton and Samuel Courton [Bernard et al., 2003], hypothesized that factories are most likely to export due to their technological efficiency and, as a result, are more productive due to export activities. Based on the analysis of statistics of industrial American firms at the macro and micro levels, scientists have built a model showing the relationship between technological efficiency and exports, but large assumptions were made in the model due to the heterogeneity of plants (in size and scope of activity).

The next significant stage in the evolution of scientific views on the subject is a number of scientific works by American economist Professor of Harvard University Marc J. Melitz. In the works "International Trade and Heterogenic Firms" [Melitz, 2005] and "Heterogenic Firms and Trade" [Melitz et al., 2012], he introduces a new concept – heterogeneity of firms, which explains their diversity in size, industry, and market segment. Based on the existing models of technology development, firm behavior, and economic characteristics, Melitz developed several new models that explain the impact of innovation on exports, depending on the size and characteristics of the firm's operation. The scientist concluded that oftentimes firms that generate the most profit can "push" less productive ones out of the market, and for the first time noted the possibility of a direct impact of innovation on the company's financial results.

One of the most cited authors of publications on this topic is the German scientist Joakim Wagner. In his research “Exports and productivity: A survey of the evidence from firm level data” [Wagner, 2005], he introduces the concept of technological productivity for the first time in terms of issue under consideration. Wagner brings forward the idea of technological choice and asserts that productivity growth in a country is not only a result of pushing inefficient firms out of markets, but also because trade liberalization promotes the use of more advanced technologies and increases the return on R&D costs. The success of innovation, technological efficiency and export activity of the firm, according to the author, also depends on its size and features of work. After conducting 45 microeconomic studies with data from 33 countries for the period from 1995 to 2004, Wagner concluded that the development of innovation and productivity of the firm itself pushes it to enter foreign markets, while export activities do not encourage the company to develop.

In their research, German scientists Stefan Lachenmaier and Ludger Wößmann [Lachenmaier, Wößmann] analyzed the product life cycle in the framework of international trade models based on statistical data from German manufacturers and proved that innovation is the driving force in industrialized countries. At the same time, the effect of heterogeneity decreased in the country by 17% compared to previous studies.

In 2007, Melitz made a new assumption in his new scientific work [Melitz, Costantini, 2007]. Assuming that the main struggle between more and less productive companies occurs within the industry, he proved, based on the behavior of companies in different types of economies, that there are indeed many significant barriers to entering a new market, if it is already anchored by innovatively active companies that generate large profits.

For the first time, American economists Richard Harris and John Moffard focused on R&D in their work [Harris, Moffat, 2011]. They assumed that the relationship between expenditures for R&D and innovation has a certain impact on a firm's export activity, depending on the industry. The hypothesis was empirically supported. The authors note that state support for exporters should take into account industry characteristics in order to enable firms engaged in innovative activities to develop.

In 2012, when the Russian Federation joined the WTO, the issues of competitiveness of domestic firms became extremely acute. They also did not bypass the scientific community. Fredrik Wilhelmson and Konstantin Kozlov in their study [Wilhelmsson, Kozlov 2007] based on the census of Russian manufacturing firms in the period from 1996 to 2000, prove that exporters are more productive than nonexporters. Moreover, more productive exporters engaged in innovative activities choose the export market themselves.

Maria Gorbunova and Tatyana Morozova in their research [Gorbunova, Morozova, 2012] affirm that the problem of competitiveness of Russian enterprises and their products has recently become sharply aggravated due to increasing pressure from foreign manufacturers on the domestic market of the Russian Federation. As a solution to the existing problem, they suggest the introduction of institutional mechanisms for coordinating activities, protecting interests, putting forward legislative initiatives, solving specific problems and overcoming barriers that arise when small innovatively active enterprises enter foreign markets.

Alexey Eroshkin and Dmitry Plisetsky in their work [Eroshkin, Plisetsky, 2012] note that the volume of innovation financing has a significant impact on the country's competitiveness in the world economy: the more states spend on research and development, the stronger their competitive position in the world. Based on the developed in Russia and abroad scientific approaches to assess the impact of innovations on the structure and dynamics of growth of the national economy, the authors made the following conclusions: large-scale investments in innovations and their active introduction to economic practice set a new quality of national economies growth, which is based on broad intellectualization of production, continuous improvement of management processes, as well as a rapid increase in human capital investment, the value of which is immeasurably increasing in modern conditions.

Hein Roelfsema and Yu Zhang in their research [Roelfsema, Zhang, 2018] assert that a company will be more effective if it is engaged in export and innovation activity at the same time than if it is doing one thing, even well. Based on an empirical analysis of 13,874 Chinese firms, it was concluded that the use of export training effects in emerging markets allows them to be innovators in the domestic market, in addition, being more competitive by selling cheaper analogues of foreign products.

An important justification for the interdependence between innovation and export in the IT industry was made by Russian researcher Elena Bozheva [Bozheva, 2018]. Based on the analysis of the IT companies activities, it was proved that new IT exporters do not have a visible connection between the introduction of new products and technologies and the start of exports. The expansion and direction of exports have a significant impact on the innovative activity of organizations, while innovations do not always push the heads of IT companies to initiate export activities.

An empirical analysis of export and import indicators was made in [Adodina, 2013]. The study analyzes the hypothesis of Russia's insignificant share in the world market of innovative goods and services and the possibility of mathematical derivation of this hypothesis. The author has proved that with the indicators of innovations export and import, it is possible to track trends in Russia's trade turnover at the global innovation market, which means that it is possible to identify negative trends in this area in time and take measures to prevent or minimize them.

Thus, we can conclude that the main theoretical model applied in analyzing the learning effects of exports is the trade model of heterogeneous fi rms of Melitz and Bernard [Bernard et al., 1999; Melitz, 2003], which predicts that if more productive firms generate higher profi ts, they are able to bear the costs of entering foreign markets, resulting in a redistribution of the market in favor of more productive exporters, and all this leads to an overall increase in productivity.

In theoretical works, the complementarity of exports and innovations is justified, when one investment decision (export) becomes a condition for another investment decision (innovation), and vice versa. Complementarity is achieved mainly due to the fact that both exports and innovations serve as a potential way to obtain new knowledge, as well as due to the possible relationship between product and process innovations: often the company's decision to launch a new product on the market precedes the decision to start exporting, while subsequent export revenues allow the company to start more expensive process technological innovations and as a result — to increase productivity [Linder, Arsenova, 2016].

As a result of the complementarity of exports and innovations, the following hierarchy of firms is being formed: firms that simultaneously participate in exports and innovations are the most effective, followed by only innovators and only exporters, and on last place are firms that do not participate in either activity [Liu, Buck, 2007].

3. METHODOLOGY FOR ANALYZING THE MOST SIGNIFICANT FACTORS OF INNOVATION ACTIVITY AFFECTING THE EXPORT OF RUSSIAN COMPANIES

Regression models are the best tool for analyzing, evaluating, and predicting economic growth, including identifying key factors that directly affect economic growth. Regression analysis is a method of modeling measured data and investigating their properties. The source data consists of a combination of values of the dependent variable and independent (explanatory) variables. The model parameters are configured so that the model best approximates the data.

The approximation quality criterion is usually the standard error of the model. It is assumed that the dependent variable is the sum of the values of a certain model and a random value. Regression analysis is used for forecasting, analyzing time series, testing hypotheses, and identifying hidden relationships in data.

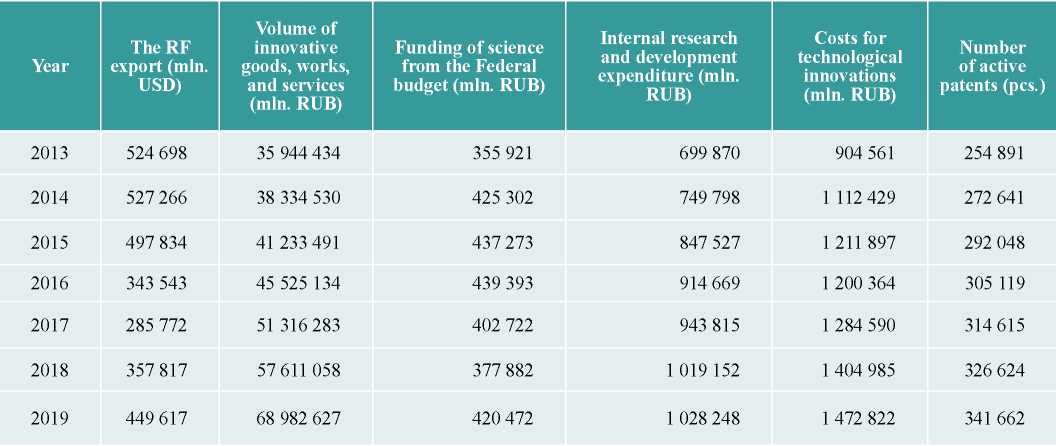

For analysis, the export indicator and indicators of innovation activity of the Russian Federation in the period from 2013 to 2019 were taken from the Rosstat website, and the export indicator was designated as an endogenous variable (table 1). In this study, a multi-factor regression model is constructed with fi ve predictors, each of which is an indicator of innovation activity of Russian enterprises: the volume of innovative goods, works, and services, science funding from the Federal budget, internal research and development costs, technological innovation costs, and the number of active patents. Through the analysis, it will be revealed which factors have a signifi cant impact on the resulting indicator, and a forecast for this indicator will be made.

Tabulation 1

Statistical data characterizing the modeled entity

Source: URL: https://www.gks.ru/folder/14477

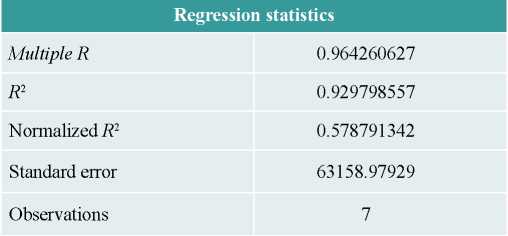

After analyzing the regression statistics of this sample, we note that the coefficient of determination is 0.9298 (table 2), which allows us to draw the first conclusions about the high adequacy of the model and the significant influence of exogenous factors on the resulting variable.

Tabulation 2

Output of regression analysis results

Source: compiled by the author based on table 1.

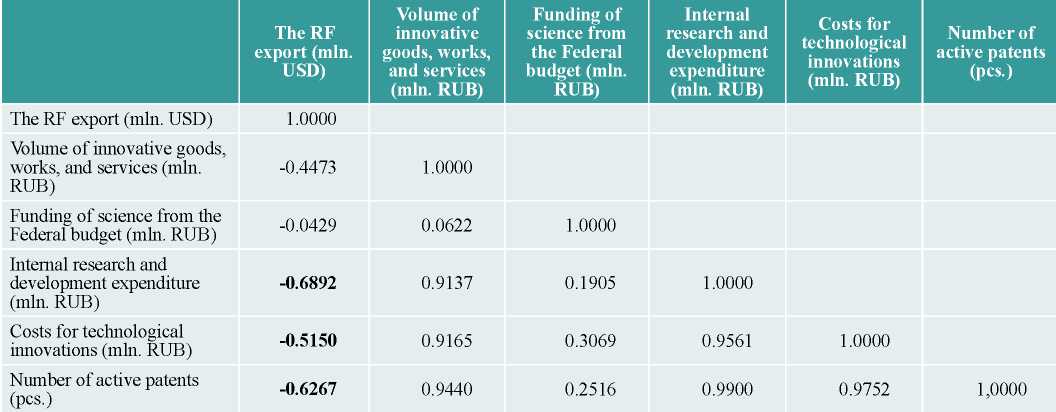

Let's construct a matrix of pair correlation coefficients (table 3). The criterion for inferring high multicollinearity among exogenous variables is the >0.5 correlation coefficient for them. For inclusion into the regression model, we will select among the multicollinear factors those that have a greater influence on the resulting variable, i.e. those whose correlation coefficient with the indicator of Russian exports is larger. Thus, as a result of visual analysis, it is advisable to include three factors in the regression model: internal costs for research and development, costs for technological innovations, and the number of active patents.

Tabulation 3

Matrix of pair correlation coefficients

Note. Factors whose correlation coeffi cient with the Russian export index is greater than 0.5 are shown in bold.

Source: compiled by the author based on table 1.

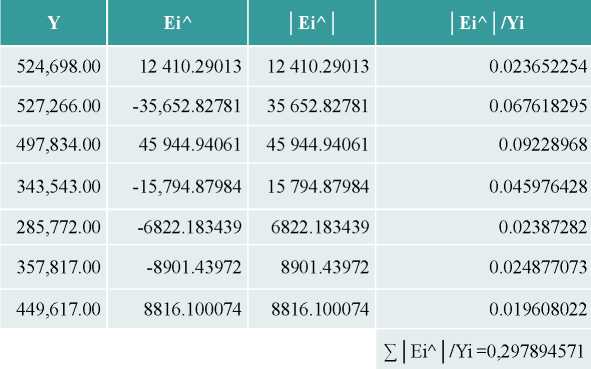

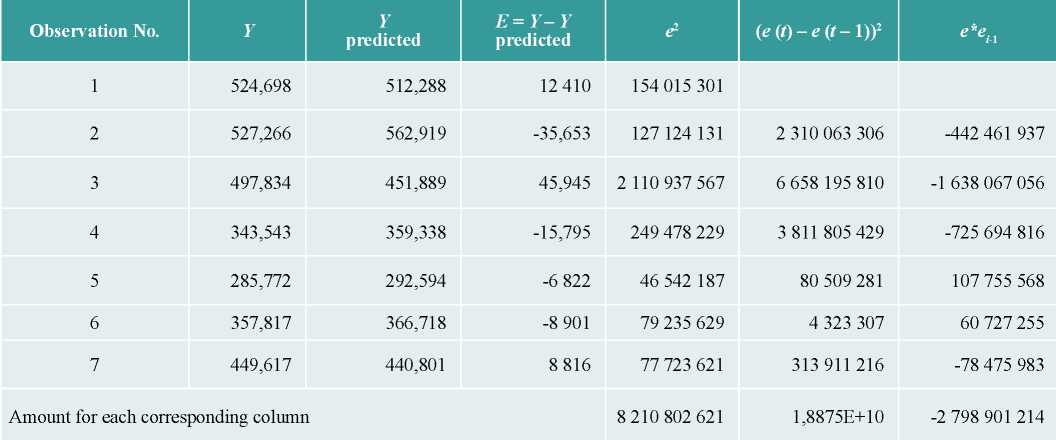

We estimate the accuracy of the model parameters using an approximation error for the appropriateness of conducting subsequent analysis.

Calculate the approximation error using the formula:

Erel = = 5,412977.

Thus, the accuracy of the model is good, since the Еrel. is < 7%.

To make an accurate forecast, it's required to test the data for the presence or absence of autocorrelation. Autocorrelation of the random component violates the third prerequisite of normal linear regression, which assumes that there is no systematic relationship between the values of the random component in any two observations. Autocorrelation of deviations is most often observed when the econometric model is based on time series. If there is a correlation between successive values of some independent variable, then there will also be a correlation between successive values of the residuals. Autocorrelation can also be a consequence of an erroneous specifi cation of the econometric model. In addition, the presence of residual autocorrelation may mean that it's needed to put a new independent variable into the model. The presence (absence) of autocorrelation in deviations is checked using the Durbin-Watson model. The numerical value of the coefficient is equal to

(1)

(1)

where

The statistics dw value is close to the value 2 (1 – r (1)), where r (1) is a selective autocorrelation function of first-order residuals. Thus, the value of the Durbin–Watson statistics is distributed in the range from 0 to 4. Accordingly, the ideal statistical value is 2 (there is no autocorrelation). Smaller values of the criterion correspond to positive autocorrelation of the residual, while larger values correspond to negative autocorrelation. Statistics takes into account only first-order autocorrelation. The upper (dl) and lower (du) кcritical values for accepting or rejecting the autocorrelation hypothesis depend on the number of levels of the dynamic series and the number of independent variables in the model. The values of these boundaries for the α = 0,05 significance level are given in the Appendix.

When comparing the calculated statistics dw value for formula (1) with the table one, the following situations may occur: dl < dw < 2 – a number of residuals is not correlated; dw < du – residuals contain autocorrelation; du < dw < dl an uncertainty area ratio when there is no reason to accept or reject the hypothesis of the autocorrelation existence. If the dw exceeds 2, this indicates a negative correlation. Before comparison with table values, dw criterion should be converted using the formula dw´= 4 – dw.

We calculate the Durbin–Watson criterion for our sample, taking into account all observations.

Thus, dw = 3,3037. Borders according to the Appendix: Dl=0,467 Du = 1,896 for n = 7 и k = 2. Since the value falls in the range from (4 – Du) to (4 – Dl), the Durbin– Watson test cannot give a definite answer about the presence

or absence of autocorrelation. To make a decision about the presence or absence of autocorrelation in the studied series, the actual value of the autocorrelation coefficient r (1) с) is comparable to the table (critical) value for the 5% significance level (the probability of making an error when accepting the null hypothesis about the independence of the series levels):

The autocorrelation table value is 3.3037. Since the actual value of the autocorrelation coefficient is less than the table value, the hypothesis on autocorrelation absence in the series can be accepted.

After making sure that the systematic relationship between the indicators exists from year to year and the specification of the econometric model is not erroneous, it's possible to make a forecast for this model and identify trends in the dynamics of Russian exports in 2018, depending on the factors considered.

Tabulation 4

Calculating model parameters using an approximation error

Source: compiled by the author based on table 1.

Tabulation 5

Calculation of formula parameters for deriving the statistics dw coefficient

Source: compiled by the author based on table 1.

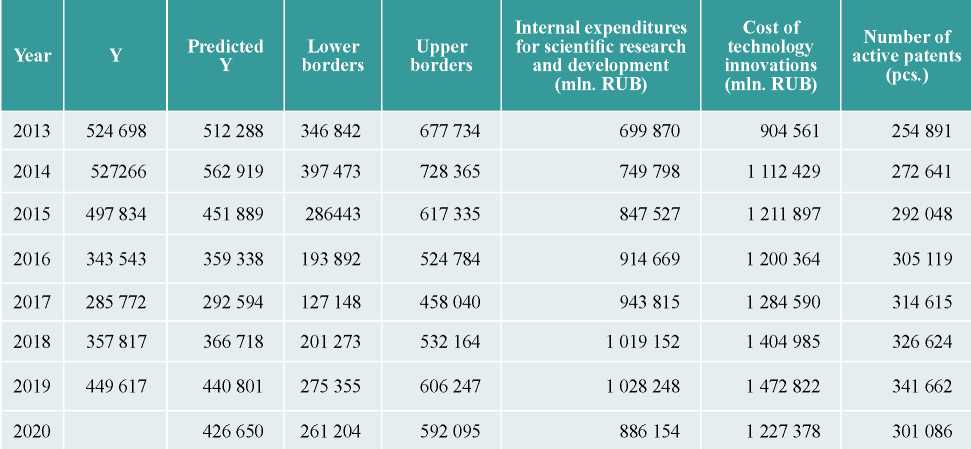

Tabulation 6

Calculation of confidence intervals

Source: compiled by the author based on table 1.

Tabulation 7

Innovation success factors depending on the industry archetype

Source: compiled by the author based on table 2

4. RESEARCH RESULTS

We can predict the average value of the Y indicator (exports of the Russian Federation) at the significance level α = 0,1, if the forecast value of factor Хj is the average value of all the values of factor Хj for the period under review.

Calculate confidence intervals using the formula

Let's present the actual Y, data, simulation results, predictive valuation, and confidence interval boundaries on the graph. The indicator of the Russian Federation in 2020 with a probability of 90% will be located within the upper and lower borders.

Thus, it can be concluded that the Russian export index depends quite strongly on the internal development of scientific developments, the level of expenditures for implementing high-tech innovations, and the number of registered patents. In connection with the economic sanctions imposed on the Russian Federation, since 2015, there has been a decrease in the total volume of financial indicators under consideration. The forecast also shows that by 2020, the volume of exports will continue to decline, together with exogenous innovative factors affecting it. In this regard, it is necessary to pay due attention to the considered indicators of innovation activity as the most significant both from the state and from business in order to improve the efficiency of innovation and export activities at the country level.

The analysis shows that the key success factor is the development of innovations independently by the organization. Domestic high-tech products are represented on foreign markets, and the export indicators of the Russian Federation depend on them.

We would also like to note that Russia has been in the top twenty of leaders in the global ranking of countries on indicators of innovative activity only on the indicator of the intensity of expenditure on technological innovations (i.e.

their share in the total volume of shipped products), while by the share of expenditures on research and development in the total volume of expenditures on technological innovation of organizations of industrial production (23,6%) Russia occupies 22nd place at the ordered series of countries. The Russian Federation occupies approximately the same position in terms of the share of innovative goods, works, and services in total sales (28th place compared to the EU countries1). These figures once again confirm the adequacy of the analysis and the need to reorient domestic innovation policy towards those factors that have a greater resulting impact on productivity and export indices.

5. FACTORS INFLUENCING THE PROMOTION OF INNOVATIVE ACTIVITY OF COMPANIES

Innovation activity is a multifaceted concept that includes many components that directly form it. The already mentioned global innovation index includes more than twenty different indicators, which are divided into groups of incoming and outgoing factors. The prerequisites for success on a particular indicator in each country are individual and obviously depend on the specific economic situation, historical facts and its capabilities. This means that there is no universal rule for the success of innovation and the output of its results to foreign markets. For each economic entity, it is necessary to build an individual development strategy.

In this context, it is important to identify the factors that stimulate and constrain innovative activity of enterprises in the Russian Federation.

A review of the literature allows for the conclusion that competition and demand are the main factors driving innovation in Russian manufacturers [Gonchar et al., 2012; Cassimana et al., 2010]. While the limiting factors are the instability of the external environment and the lack of qualifi ed personnel [Trachuk, Linder, 2017b; Leonidas, 1995].

According to some researchers, the degree of criticality of innovation success factors for the development of a particular industry is determined by the archetype of innovation [Gorodnichenko et al., 2010]. However, in [Sandua, Ciocanel, 2014] work, all industries can be divided into four main archetypes according to the dominant source of innovation: scientific, engineering, consumer, or efficiency archetype. The industries of the same archetype share a common specificity, namely, the importance of infrastructure factors or the same level of investment in R&D, which in turn allows us to identify patterns of innovation emergence and development. Such an integrated approach makes it possible to develop effective recommendations for specific industries, since the features of innovative development, characteristic for one archetype, may be secondary to another.

By modeling the archetypes of industries, it's possible to take into account the particular nature of specific sectors of the economy and then use them to build a strategy for innovative development both at the level of the organization and at the level of the state.

Each of the archetypes needs its own approach from the state and private business. In this context, success factors can be divided into two groups: those that determine the supply of innovation and those that are related to the demand for innovation. The first group includes the availability of competencies and financing technologies, as well as infrastructure and development culture. Factors of the second group include both internal demand from the company (for example, as a result of increased competition in the industry), and external demand from the state or end consumers. Large sales markets and large-scale investments are often necessary conditions for implementing innovations. The relevant large-scale industries (for example, metallurgy, energy, and oil and gas) can become centers of national innovation and leaders in breakthrough innovation. However, increasing the frequency and speed of new technologies, services and products requires a fundamental change in their operation and a fundamentally different amount of resources for innovative development.

In relatively small industries, Russian companies have the opportunity to create and distribute innovative solutions in certain promising niches. In some industries, such as pharmaceuticals and engineering, the size of the national market is not sufficient to provide meaningful leadership in innovation throughout the value chain. Despite this, there are areas in every industry where Russian companies have all opportunities to earn revenue from the implementation of their innovative solutions and accumulated competencies, thus forming a platform for future development.

When selecting areas for innovative development, Russia should first improve its competence in those sectors that already have strong competitive advantages, as well as focus on the development of certain promising areas where there is a strong human potential for industrial development and a high demand for innovation from the state. These industries include, for example, medicine and petrochemicals.

This approach is consistent with the long-term development forecast of the Russian Federation prepared by the Ministry of Economic Development, according to which the country can claim leading positions in the production of aerospace technologies, composite materials, nanotechnology, hydrogen and nuclear energy, in the development of biomedical technologies for the protection and life support of people and animals, in certain areas of environmental management and protection, as well as in a number of other areas.

The degree to which innovation success factors are critical to the development of an industry is determined by the innovation archetype. And each of the archetypes needs a separate approach from the state and private business.

6. CONCLUSIONS AND FURTHER RESEARCH

The problems of the infl uence of enterprise innovative activity and its productivity on business growth and its access to international level are being considered by scientists for quite a long time since the export boom in the United States in the late twentieth century. Many empirical studies have shown a positive relationship between innovation and exports. According to the two main hypotheses considered in the literature on this issue: the hypothesis of self-selection and the hypothesis of the exports learning effect, it is possible to assert the complementarity of innovations and exports, namely, the possibility of their mutual influence on each other.

There are many incentives for innovation and barriers to entering foreign markets. The main incentives include interaction with contractors, foreign partners, suppliers and customers; economies of scale; additional financing; the nature of demand and the state of the external environment. Barriers are competition; risks and costs associated with entering foreign markets; lack of funding, information of qualified personnel, support from the state; long payback period; technological backwardness and instability of the external environment.

According to the conducted econometric analysis, it was concluded that the export indicator of the Russian Federation is quite strongly dependent on the internal development of scientifi c research, the level of costs for implementing high-tech innovations and the number of registered patents, and in 2020 these indicators will maintain the same dynamics of development. It should be noted that proper development of the approach to organizing the innovation process at the macro and micro levels can open up new opportunities for domestic producers, which will eventually make national exports competitive. In turn, a developed domestic market implies full-fledged business conditions for a firm of any size, which is important for the successful implementation of the country's export potential. The issue of the innovations impact on the company's activities and on its access to foreign markets can be disclosed in the future even more fully, taking into account the changing economic situation.

1. URL: http://ec.europa.eu/eurostat/data/database; URL: https://www.gks.ru/folder/14477.

References

1. Adodina A.O. (2013). Eksport i import innovatsiy v ekonomike Rossii [Export and import of innovations in the Russian economy]. Vestnik Voronezhskogo gosudarstvennogo universiteta. Seriya: Ekonomika i upravlenie [Bulletin of the Voronezh State University. Section: Economics and Management], 2, 26-31.

2. Bogeva E.O. (2018). Obuchayushchie effekty eksporta v rossiyskoy softvernoy industrii [Educational effects of export in the Russian software industry]. Strategicheskie resheniya i risk-menedzhment [Strategic Decisions and Risk Management], 2, 38-49.

3. Gonchar K.R., Golikov V.V., Kuznetsov B.V. (2012). Vliyanie eksportnoy deyatel’nosti na tekhnologicheskie i upravlencheskie innovatsii rossiyskikh firm [The impact of export activities on technological and managerial innovations of Russian firms]. Rossiyskiy zhurnal menedzhmenta [Russian Journal of Management], 10(1), 3-28.

4. Gorbunova M.L., Morozova T.S. (2012). Bar’ery pri vykhode innovatsionno aktivnykh predpriyatiy na vneshnie rynki [Barriers to entry of innovative enterprises into external markets]. Vestnik Nizhegorodskogo universiteta im. N.I. Lobachevskogo [Bulletin of the Nizhny Novgorod Lobachevsky University], 2(2), 47-51.

5. Eroshkin A.M., Plisetskiy D.E. (2012). Rol’ innovatsiy v stimulirovanii rosta i povyshenii konkurentosposobnosti national’nykh ekonomik [The role of innovations in growth stimulation and increasing the competitiveness of national economies]. Ekonomicheskiy analiz: teoriya i praktika [Economic Analysis: Theory and Practice], 27, 20-30.

6. Linder N.V., Arsenova E.V. (2016). Instrumenty stimulirovaniya innovatsionnoy aktivnosti kholdingov v promyshlennosti [Instruments to stimulate the innovation activity of holdings in industry]. Nauchnye trudy Vol’nogo ekonomicheskogo obshchestva Rossii [Scientific Works of the Free Economic Society of Russia], 198(2), 266-274.

7. Trachuk A.V. (2013). Formirovanie innovatsionnoy strategii kompanii [Innovation strategy creation of the company]. Upravlencheskie nauki [Management Sciences], 3, 16-25.

8. Trachuk A.V., Linder N.V. (2017a). Innovatsii i proizvoditel’nost’ rossiyskikh promyshlennykh kompaniy [Innovations and productivity of Russian industrial companies]. Innovatsii [Innovations], 4(222), 53-65.

9. Trachuk A.V., Linder N.V. (2017b). Innovatsii i proizvoditel’nost’: empiricheskoe issledovanie faktorov, prepyatstvuyushchikh rostu metodom prodol’nogo analiza [Innovation and productivity: an empirical study of factors that impede growth by the method of longitudinal analysis]. Upravlencheskie nauki [Management Sciences], 3, 43-58.

10. Bernard B.A., Jensen J.B. (2004). Entry, expansion, and intensity in the us export boom, 1987-1992. Review of International Economics, 12(4), 62-75.

11. Bernard B.A., Jensen J.B., Eaton J., Kortum S. (2003). Plants and productivity in international trade. American Economic Review, 93(4), 1268-1290.

12. Cassimana В., Golovko Е., Martínez-Ros Е. (2010). Innovation, exports and productivity. International Journal of Industrial Organization, 28(4), July, 372-376.

13. Gorodnichenko Yu., Svejnar J., Terrell K. (2010). Globalization and innovation in emerging markets. American Economic Journal: Macroeconomics, 2(2), 194-226.

14. Harris R., Moffat J. (2011). R&D, Innovation and Exporting. SERC Discussion Paper 73.

15. Lachenmaier S., Wößmann L. (2006). Does innovation cause exports? Evidence from exogenous innovation impulses and obstacles using German micro data. Oxford Economic Papers, 58(2), 317-350.

16. Leonidas C.L. (1995). Export barriers: Non-exporters’ perceptions. International Marketing Review, 12(1), 4-25.

17. Liu X., Buck T. (2007). Innovation performance and channels for international technology spill overs: Evidence from Chinese high-tech industries. Research Policy, 36(3), April, 355-366.

18. Melitz M.J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica, 71(6), 1695-1725.

19. Melitz M.J. (2005). International trade and heterogeneous firms. New Palgrave Dictionary of Economics.

20. Melitz M., Costantini J. (2007). The dynamics of firm-level adjustment to trade liberalization. In: Helpman E., Marin D.,

21. Verdier Т. (eds.). The organization of firms in a global economy. Cambridge, Harvard University Press.

22. Melitz M.J., Redding S.J. (2012). Heterogeneous firms and trade. NBER Working Paper No. w18652.

23. Roelfsema H., Zhang Y. (2018). Internationalization and innovation in emerging markets. Foresight and STI Governance, 12(3), 34-42.

24. Sandua S., Ciocanel B. (2014). Impact of R&D and innovation on high-tech export. Procedia Economics and Finance, 15, 80-90.

25. Trachuk A., Linder N. (2018). Learning-by-exporting effects on innovative performance: Empiric study results. Knowledge Management Research & Practice, 16(2), 220-234.

26. Wagner J. (2005). Exports and productivity: А survey of the evidence from firm level data. Universität Lüneburg, Institut für Volkswirtschaftslehre. Working Paper Series in Economics no. 4.

27. Wilhelmsson F., Kozlov K. (2007). Exports and productivity of Russian firms: in search of causality. Economic Change, 40, 361-385.

About the Author

S. I. FaiazovaRussian Federation

Master student in South Champagne Business School (France), Intern at Transdev the mobility company (France).

Research interests: interdependence of export and innovations, strategies for Russian companies to enter international markets, international trade, financial instruments to support export activities, business models based on innovations.

Review

For citations:

Faiazova S.I. INNOVATION INFLUENCE ON EXPORT ACTIVITIES: ЕMPIRICAL ANALYSIS OF RUSSIAN COMPANIES. Strategic decisions and risk management. 2020;11(1):56-69. https://doi.org/10.17747/2618-947X-2020-1-56-69