Scroll to:

RETURN ON INVESTMENT MECHANISMS OF THE INCINERATORS DEVELOPMENT BY SELLING ELECTRICITY AND POWER

https://doi.org/10.17747/2618-947X-2020-1-28-47

Abstract

The article analyzes the current state and world experience of the waste management sphere, identifies the reasons for incinerators development, identifies and classifies the main mechanisms for returning investments in their construction. The necessity of building incineration plants in Russia is demonstrated.

Has been given a critical analysis of the plan of new waste incineration plants development in Russia. Has been made an inference about their environmental safety and the possibility of equating this type of generation theoretically and legislatively.to renewable.

A qualitative and quantitative analysis of the planned method of return on investment was carried out. It was established that the use of power supply agreements as a mechanism for the return on investment is impractical. Rational methods of return on investment were identified: the mechanism of free bilateral agreements, inclusion in the structure of regime facilities and combining the selling of electricity in the balancing market and the day-ahead market with the selling of utilization services. The combination method turned out to be optimal, recommendations for its usage are given.

Thus, the article developed recommendations on the usage of mechanisms for the return on investment in the incinerators development in Russia by selling electricity and power.

For citations:

Melnikova E.A. RETURN ON INVESTMENT MECHANISMS OF THE INCINERATORS DEVELOPMENT BY SELLING ELECTRICITY AND POWER. Strategic decisions and risk management. 2020;11(1):28-47. https://doi.org/10.17747/2618-947X-2020-1-28-47

1. INTRODUCTION

Increase of the well-being of society and development of technology are inextricably linked with increase of amount of waste, which is becoming an increasing problem year after year. Initially, waste was disposed of in landfills, but the existing areas began to be insufficient over time.

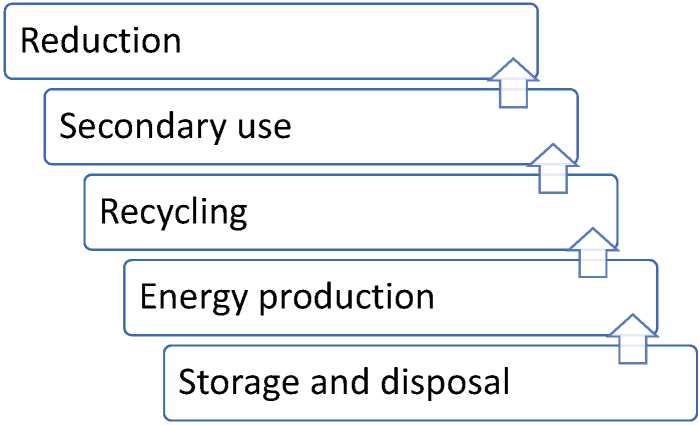

The issue of overloading landfills and their negative impact on the ecosystem, air purity and human health has been facing the world community for several decades. In 2016, 2017 million tons of waste were generated in the world annually; according to World Bank forecasts, this figure will increase to 2,586 million tons per year by 2030, and to 3401 million tons per year by 2050. In response to this growing problem, the European Environment Agency has developed a hierarchy of waste management practices in the 2012 Basel Waste Treatment Convention (Figure 1).

Storage and disposal of waste in landfills is considered the least efficient and acceptable. First, landfills pollute the environment: regular replenishment leads to compaction of waste, oxygen ceases to flow to lower layers of landfills, which leads to chemical reactions that emit highly toxic gases. Secondly, landfills occupy large areas that states can use more efficiently – the average landfill occupies about 100 hectares, but it is dangerous to build housing and recreational areas in place of former landfills. At the moment, according to World Bank statistics, 70% of newly generated waste is buried at landfills.

Production of electricity and heat by waste incineration ranks second in the hierarchy of waste management methods. In European countries, this method is extremely common, since incineration is the most effective way to dispose of large amount of waste and allows to solve the problem of overloading landfills quickly.

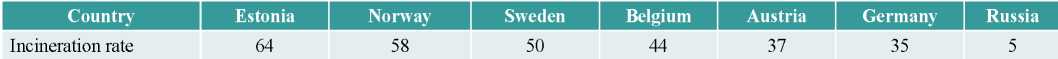

For year 2017, the leader among European countries in terms of the share of waste incineration was Estonia (64% of newly generated waste), followed by Norway (58%) and Sweden (50%), the smallest share of waste is incinerated in Russia (5%) (Table 1). It should be noted that electricity generated by waste incineration in the countries of the European Region is equated to energy obtained using renewable sources. At the moment, according to statistics from the World Bank,in Europe, 19% of newly generated waste is averagely incinerated for energy.

Table 1

Share of waste incineration in total disposal in European countries, 2017 (%)

Source: compiled by the author based on [Mochalova et al., 2017].

The third and fourth steps in the hierarchy are recycling and reuse of waste. This division is very arbitrary, since some types of waste can fall into both categories of treatment, for example, glass containers are reused, and cullet is recycled. At the moment, such types of waste as metals, household appliances, paper and cardboard products, glass, plastic bottles and products of special markings, a number of chemical waste, textiles, batteries, etc. are recycled and reused; however, today construction waste, food waste, medical and biological waste, as well as most of the packaging, etc. cannot be recycled due to lack of technology, which makes it difficult for a full-fledged transition of society to higher levels. Today, only 11% of newly generated waste is recycled and reused.

The top in the hierarchy is reduction in the number of generated costs. This method includes the concept of conscious consumption and Zero waste: no overconsumption, less shopping for excess food, reuse of all items and materials and decrease in use of disposable packaging.

The 2012 Basel Convention identifies waste reduction as a priority in tackling excess waste issue. However, it is not enough just to reduce the amount of newly generated waste; it is necessary to dispose of the already accumulated amount by means of recycling and incineration. For several decades, many countries have been solving this problem with the help of waste incineration plants (hereinafter referred to as Incinerators), construction of which requires large capital investments. Therefore, identification of mechanisms for return of investments for their construction is an extremely urgent task.

The purpose of this article is to study the use of mechanisms for return on investment for construction of incinerators in Russia through sale of electricity and capacity. The article analyzes the current state of the waste management sector in Russia and the world experience in construction of incinerators, identifies and classifies mechanisms for return on investment in construction, examines existing projects for construction of incinerators in the Russian Federation. Further, critical analysis of the planned method of return on investment for construction of new plants is carried out. The identified electric power mechanisms for return of investments in construction of new waste incineration plants in Russia are considered, recommendations for their use are developed.

Also methods of return on investment are structured and systematized in the article, and benchmarking of waste management technologies is carried out between countries.

2. WASTE HANDLING IN RUSSIA AND THE WORLD

2.1. WASTE IN RUSSIA

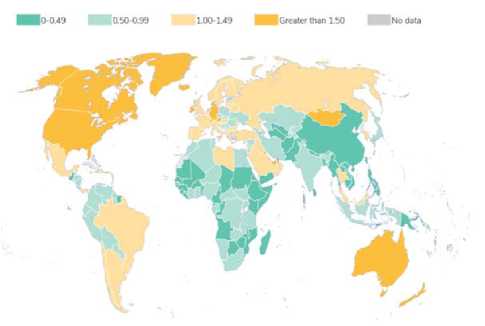

According to the World Bank, today Russia belongs to the block of countries with a high level of production of municipal solid waste (MSW) – from 1 to 1.5 kg of waste per capita per day1(Fig. 2).

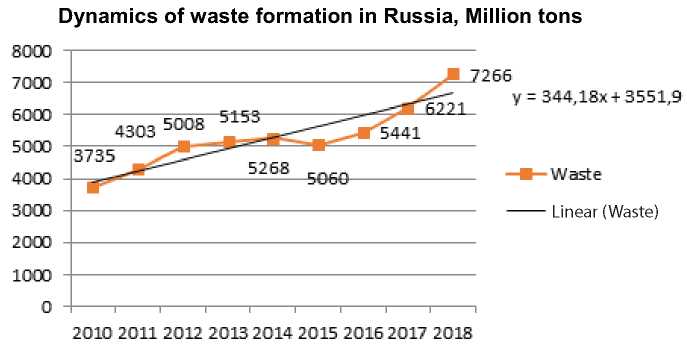

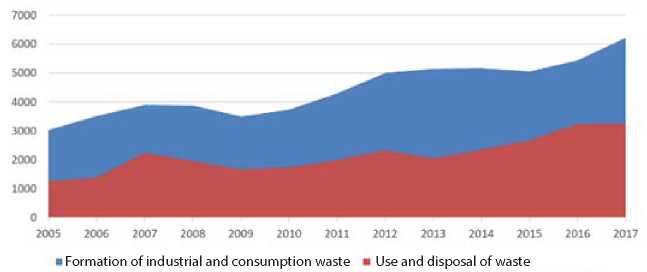

According to the report "On the State and Protection of the Environment of the Russian Federation in 2018”2, 7,266 million tons of waste were generated in the Russian Federation, which is 1,045 million tons more than in 2017 (Fig. 3). From year 2010 to 2018, the amount of generated waste increased by 3531 million tons, which is about 95%. It is worth noting that there has been a dramatic increase in annual generation of waste in the past three years. Accordingto estimates of the Ministry of Natural Resources and Environment of the Russian Federation, the increase rate of waste generation will continue in 2019-2024, which will adversely affect the state of the environment and the level of public health in the country.

Source: built by the author based on the data of Rosstat. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/environment/#.

If we consider the amount of waste that is used and neutralized after production, it can be seen that their absolute value grows with time along with the amount of waste production, but at the same time the share of used and neutralized waste among all waste is gradually increasing, which indicates a transition to a more efficient waste disposal policy perspective (Figure 4). Nevertheless, the rate of increase of this share is not high; therefore, it is necessary to change the waste disposal system in order to stop accumulation of long-term negative effects of MSW existing in the environment.

Source: built by the author based on the data of Rosstat. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/environment/#.

Waste is divided into five classes according to the degree of hazard:

- Class I – extremely hazardous waste that causes irreversible changes in the ecosystem and the environment. Such wastes include polonium, mercury, plutonium, synthetic oils, etc.; waste of this class is disposed of by burial in special landfills or cementing.

- II – highly hazardous waste that causes changes in the ecosystem, recovery after elimination of the source takes at least thirty years. This class of waste includes galvanic cells, lead, accumulators, batteries, etc.; such waste is first chemically treated and then buried or recycled.

- III – moderately hazardous waste that has adverse effects on the ecosystem, the recovery period after elimination of the source is at least ten years. Waste of the third hazard class includes fuel, acetone-containing solvents, waste from the petrochemical industry, biological waste from animal husbandry, etc.; the main method of disposal of this class of waste is incineration; processing and disposal at special landfills in sealed containers is also used.

- IV – low-hazard waste with a weak negative impact on the environment, the ecosystem restoration period is three years. Waste of the fourth class includes construction waste, car tires, glass, biological waste from animal husbandry, wood products, etc.; the main method of disposal of this type of waste is burial, incineration and recycling are also used.

- V – practically non-hazardous waste that does not pose a threat to the ecosystem. This includes paper, sawdust, food waste, packaging, rubber products, etc. The main methods of disposal of this waste are recycling and burial, less often incineration. It is also worth noting that the disposal of waste paper, glass and cullet, scrap metal and plastic products is prohibited in Russia; this waste must be recycled.

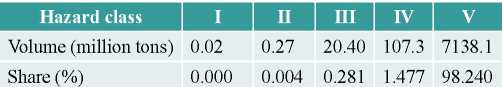

In 2018, waste of III-V hazard classes accounted for 99.9% of all waste generated on the territory of the state in the Russian Federation (Table 2). Thus, 99.9% of all generated waste can be recycled and incinerated.

Table 2

Share of different types of waste, 2018

Source: built by the author based on the data of Rosstat. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/environment/#.

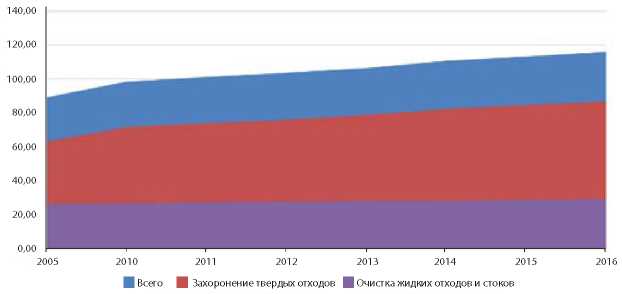

If we look at the dynamics of the value of greenhouse gas emissions associated with disposal of municipal solid waste as shown in Fig. 5, it can be seen that there was an increase in the total amount of greenhouse gases emitted into the atmosphere due to waste from 2005 to 2016, with most part of it from their disposal, and this share only grows over time. Thus, negative external effects for the atmosphere from the current production and waste disposal method are large and only increase, which indicates the need to change the existing MSW disposal system.

Source: built by the author based on the data of Rosstat. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/environment/#

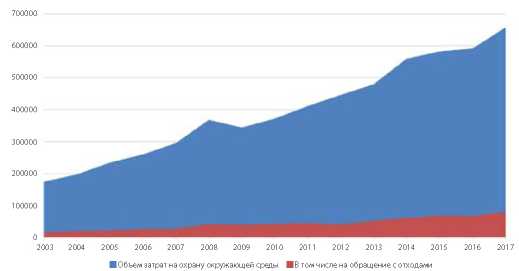

The amount of government spending on environmental protection increased significantly from 2003 to 2017 from RUB 180,000 million. up to RUB 650,000 million. (Fig. 6). There has also been an increase in waste management costs, although their share in total environmental expenditures declines over time. This indicates that this direction was not a priority and the development of technologies related to waste disposal was slow.

Source: built by the author based on the data of Rosstat. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/environment/#.

As noted in [Shyngarkina, 2015], about 3.5 billion tons of waste are accumulated in Russia annually, of which only a quarter is recycled. Most of waste is sent to landfill. The use of the landfill system is due to historical tradition of the USSR and underdevelopment of the waste processing sector, which requires large investments and structural changes in the economy and law. At the moment, the economic and legal systems in Russia are designed in such a way that more environmentally efficient waste processing methods are less beneficial for the population than inefficient ones, such as landfill disposal.

2.2. LITERATURE OVERVIEW

This subsection will consider domestic and foreign scientific literature on the current situation in the branch of waste disposal in Russia and a description of effectiveness of various waste disposal methods.

L. A. Mochalova and her co-authors in [Mochalova et al., 2017] describe indirect external effects of municipal solid waste: physical, chemical and biological pollution of the environment, the increase of infectious diseases. In addition, authors describe foreign experience in the field of waste disposal and argue that the most effective waste disposal technology in the world at the moment is a combination of various methods: sorting and recycling of waste by aerobic and anaerobic means, incineration and burial.

In the article by V.S. Shingarkina [Shingarkina, 2015] discusses the need to create a special industry for disposal of MSW, due to the annual increase in the amount of produced waste, as well as increase in territories used as landfills around settlements. While most of the waste is sent to landfills in Russia, in other countries of the world only those that cannot be recycled end up in landfills; thus, the level of environmental pollution by waste in Russia is higher than in other countries. In addition, before the reform in the field of solid municipal waste disposal, all stages of waste disposal: collection, transportation, sorting, processing or disposal – were carried out by different enterprises, which increased the risk of problems at each of them and made it difficult to centrally manage the process. In addition, tariffs for waste treatment were by an order higher than the cost of disposal, which predetermined the way of their disposal.

VK. Viscusi et al. [Viscusi et al., 2011] discuss which methods of influencing public consciousness in the field of environmental protection are more effective, and they cite two possible channels of non-material influence: social norms, that is, social norms of permissible behavior in the area under consideration, and "warm glow" – the individual intangible usefulness of participating in environmental protection. The introduction of more stringent environmental laws leads to the fact that more people begin to comply with them, social expectations of what behavior is normal change, and as a result, social norms and the amount of individual usefulness from following these norms change.

According to G. Sigman and S. Stafford [Sigman, Stafford, 2011], the effectiveness of cleaning up a contaminated area should be assessed in terms of balance of benefits and costs of such cleaning, and among benefits should be considered such effects of reducing pollution as reducing the number of congenital diseases in newborns and the number of oncological diseases, which in turn leads to an increase in the life expectancy of the population.

Thus, from the review of the literature it can be concluded that the current state of the environment associated with its pollution with MSW requires a reduction in waste production and changes in methods of their disposal. They embrace:

- impact on public consciousness by changing social norms and individual usefulness of citizens from participation in environmental protection programs;

- sorting, processing of waste and their recycling;

- incineration of waste to generate electricity;

- disposal of waste at landfills.

At current moment, as already noted, the predominant method of waste disposal in Russia is disposal at landfills, which causes serious long-term environmental pollution, deterioration of health and decrease in the life expectancy of the population, as well as social discontent of citizens living in settlements near landfills. According to the Ministry of Natural Resources of Russia for 20183, about 70 million tons of solid municipal waste is generated in Russia every year, and existing landfills will last no more than 6 years, and in some territories their capabilities have already been exhausted, therefore, a new sector of the economy needs to be created, and involvement of people in separate accumulation of waste as well. Thus, it is required to change the structure of waste disposal in the Russian Federation, as well as to take measures to reduce the amount of waste at existing landfills, which can be solved by building waste incineration plants.

Further, the world experience in waste management and construction of incineration plants will be considered and mechanisms for return on investment in their construction will be identified.

2.3. WORLD EXPERIENCE IN CONSTRUCTION OF INCINERATION PLANTS

China

The sharp rise in China's socio-economic development since the 1970s and population growth have led to a dramatic increase in consumer demand and, as a result, in the amount of waste [Landsberger, 2019]. The country's authorities began to actively address the problem of overfl owing landfi lls for waste disposal in the early 1980s. Prior to that, waste was taken to landfills on outskirts of cities and was not disposed of in any way; this led to pollution of soil and air, which contributed to an increase in incidence of diseases in megacities. The environmental policy of the early 1980s was based on the principle of "pollution is eliminated by the culprit"; specialized scientifi c research centers on environmental issues, in particular on waste disposal, were created.

Measures taken in the 1980s were not effective enough to significantly improve the environmental situation in China. Therefore, a new law on environmental protection was issued in the country at the end of 1995, which contained 364 environmental standards, in particular, a decision was made to build incinerators in 640 cities of the country. Incinerators have been recognized by Chinese scientists as a greener alternative to thermal power plants that use peat, coal and wood as fuel, and have the advantage of being able to recycle large amounts of waste. Thus, two environmental problems were solved at once with the help of construction of incinerators.

Financing construction of incineration plants in China is stimulated by the government through tax cuts and the interest rate on loans from the National Bank for investment companies [Bondes, 2019]. The composition of investing companies is formed as a result of organizing a competitive selection. According to investment projects, return on investment in construction of incineration plants is 8-12 years, the time for making a profit is 18-22 years, and the service life is 30 years.

In 2018, 40% of newly formed waste was incinerated in China, 30.1 GW of electricity was generated, which amounted to 1.58% of the total generation [Bondes, 2019]. By 2025, it is planned to incinerate 50% of newly generated waste. In 2015, 244 incinerators were operating in the country, 121 incinerators were under construction, 133 projects were at the stage of construction tenders. In case of technological connection to grids for the purpose of selling electricity, priority is given to waste incineration plants.

In China, electricity generated by waste incineration is equated to renewable energy and therefore has a green tariff. When using it, the owner of the generator sells the surplus electricity left after his own use to the state (in China – the United Grid Company) at a special increased tariff, since the cost of renewable energy is higher than the traditional one.

Thus, the main burden on return on investment in construction of incineration plants in China lies directly and indirectly with the state [Bondes, 2019]: in 2018, the cost of 1 kWh at the incineration plant was $ 0.1, in which state subsidies (“green” tariff) for 1 kWh were $ 0.04, or 40%; taking into account the indirect investment burden – tax and credit benefits to investing companies – the state's investment burden was about 70%.

Estonia

The first waste incineration power generating unit in Estonia was built in 2013 at the Iru TPP with an installed capacity of 17 MW, or 6% of Estonia's installed capacity4. In addition to electricity, this unit also generates heat (60 MW), fully meeting needs of cities of Maardu and Paide, as well as 20% of needs of Tallinn.

The power unit was built by the Estonian holding Eesti Energia at a cost of 10.9 million Euros, of which 3 million Euros came from government subsidies for joint production. According to experts, the cost of 1 kWh of energy generated at the new unit is 20% lower than at a gas turbine TPP, and amounts to 0.08 euros. This difference is due to high cost of fossil fuels for electricity generation, since Estonia is an importer of fuel and does not produce its own. Therefore, construction of expensive waste incineration units is more profitable when analyzing the total cost of ownership due to low cost of the fuel used.

According to calculations of development department of the Iru TPP, the introduction of waste incineration unit saves residents of Tallinn, Paide and Maardu 3.5 million Euros in electricity bills annually. The structure of the Estonian electricity and capacity market allows participants in the wholesale electricity market to choose a generator independently and conclude an agreement with it for supply of electricity at unregulated tariffs, then an agreement for transmission of electricity is concluded with a single electricity grid company with a regulated tariff depending on the transmission distance. Thus, multi-apartment associations and manufacturing enterprises located in the vicinity of the Iru TPP prefer to buy electricity generated by waste incineration, as it is the cheapest. With an increase in the distance of electricity transmission, consumers switch to energy consumption of gas turbine TPPs.

According to a study [Krivulkin, 2017], 64% of newly generated annual waste in Estonia is burned to generate electricity in 2017, which loads the waste incineration unit by 72%; the rest of the waste is recycled. In order to fully load the power unit, 10 thousand tons of waste is annually imported from Finland to generate electricity, since the country does not have its own capacity for waste processing. Further, Finland buys out the electricity produced at the Iru TPP through the Nord Pool5 electricity exchange at dayahead tariffs.

Thus, the main burden for return on investment in construction of a waste incineration power unit in Estonia lies with electricity consumers through trading in the national wholesale and retail electricity and capacity markets. No surcharges, price subsidies or green tariffs apply, and return on investment is made by selling large amounts of energy at low cost. Also, the return on investment is carried out through export of electricity to Finland through the Nord Pool at tariffs for the day ahead, energy is not equated to renewable energy. According to preliminary estimates, a full return on investment in construction of this power unit will come in 2024.

Finland

In Finland, 58% of newly generated waste was incinerated for the purpose of generating electricity and heat in 2018, the share of waste energy in the country's total electricity generation in 2018 was 2.3%6. Finland currently has nine incineration plants, eight of which are owned by Fortum company; the ninth, most powerful one, was built by the Vantaan Energia Company in 2014. This plant is located in suburbs of Helsinki and provides electricity for 20% of the capital's needs, and also serves the central heating system for 45%. According to experts' calculations, the payback period for waste incineration plants in Finland is 12 years.

According to research [Alexander, 2016], the main goal of construction of incinerators in Finland is to reduce consumption of coal for electricity production, since the Ministry of Agriculture and Environmental Protection considers decarbonization as one of the main directions of environmental development. According to experts' calculations, after launch of the Vantaan plant, coal consumption in the country has decreased by 34%.

It should be noted that incinerators do not buy waste in Finland: housing and industrial enterprises pay for waste disposal services for both incinerating plants and recycling plants. Part of waste is exported to Estonia and Sweden for further purchase of electricity.

Unlike Estonian incinerators, Finland's incinerators trade energy directly on the Nord Pool exchange on the intraday market without selling it on the domestic market. However, incinerators in Finland sell heat to the state for the district heating system.

Thus, return on investment in construction of incineration plants is carried out through provision of waste disposal services, sale of electricity and capacity through the Nord Pool exchange on the intraday market, and sale of heat to the central heating system. Government subsidies are not used, as well as "green" tariffs, energy is not equated with RES. Finland plans to build five more plants.

Sweden

As of 2018, there were 34 waste incinerators in Sweden, producing 3,4%7 of the country's total electricity consumption and 20% of heat. 50% of the newly generated waste was incinerated, the rest was recycled8. Production of electricity by burning waste is very economically beneficial for the state: On one hand, it is an inexpensive way of waste disposal, on the other hand, waste is the most affordable fuel for production of heat and electricity at TPPs. It should be noted that the share of TPPs in electricity production in Sweden is only 9%, their main purpose is to produce heat for the central heating system. The backbone of the Swedish electricity system is hydro and nuclear power plants, which produce 82% of the country's total electricity.

A distinctive feature of Sweden is export of waste disposal services at waste incinerators. Sweden annually imports about 1.5 million tons of waste from the UK, Ireland, Norway, France, the Netherlands and Russia, which is 45% of the country's waste incineration. The cost of disposal of 1 ton of waste for importing countries is about 70 Euros; thus, Sweden not only reloads excess capacity of incineration plants, but also receives additional income.

According to [Dzebo, 2017], all Swedish incinerators were built by two companies without external investment and government subsidies – Fortum and Borlange Energy. The largest incinerator in Sweden is the Hogdalenverket

plant built in 1970 and refurbished in the early 1990s. Located in a dormitory area of Stockholm, Hogdalenverket covers 60% of capital's needs for thermal energy and 20% for electricity, utilizing 95% of the newly generated waste in Stockholm and its suburbs. Despite the overcapacity of existing incinerators, Borlange Energy plans to build a new plant with an installed capacity of 30 GW by 2025, which will handle waste imported from Norway and Finland.

The return on investment in waste incineration plants in Sweden comes from three sources, the main one being the export of waste management services. Electricity produced at the incineration plant is traded on the Nord Pool exchange within the free-flow zones where the generator is located; electricity is traded on the day-ahead market and on the intraday market, government subsidies and “green” tariffs are absent. Also, the return on investment is carried out through sale of heat energy to the state to provide central heating supply to cities.

Germany

According to [Sigman, 2011], the active construction of waste incineration plants in Germany in the early 1980s was due to the country's environmental policy aimed at decarbonization, in particular, reduction in use of coal for generation of electricity and heat, since incineration of waste produces carbon dioxide four times lower than when burning coal, and the energy intensity corresponds to the energy intensity of brown coal. A new wave of plant construction began in 2015 after adoption of the Paris Agreement as a part of the UN Framework Convention on Climate Change, which regulates measures to reduce carbon dioxide in the atmosphere and calls for limiting the use of natural resources as fuel9.

At the end of 2018, there were 68 incinerators in Germany and 30 power plants connected to them10. A distinctive feature of Germany in production of electricity from waste fuel is separation of the direct incineration of waste and its conversion into electricity, that is, the incineration plant sells the steam generated from utilization to the nearby power plant.

The second distinctive feature is use of the dry residue of wastewater from wastewater treatment plants as fuel for electricity generation: today more than 60% of residues is thermally affected.

90 % of hazardous biological waste, including medical waste, is also heat treated to generate electricity; a plant for their incineration was built in every state of Germany. These plants use the layer combustion method – hot air flow is supplied to the layer of waste loaded onto the grate at a temperature of 1000°C, which ensures the safety of disposal.

In 2018, incineration utilized 35% of newly generated waste with an annual electricity generation of 6,000 GWh, the rest of waste was recycled11. As noted, medical waste, residual waste that cannot be recycled due to its condition, recyclable waste, such as dirty plastic or oiled cardboard, is sent to incineration plants in Germany. A separate category includes wastes, the processing of which is possible, but its energy intensity is extremely high; such waste is more efficiently burned for the purpose of generating electricity. Iron and non-ferrous metals are extracted from the ash and slags remaining after incineration of waste, they are further processed for recycling; other incineration residues are used in production of road building materials.

The cost of building one incinerator in Germany is 243 million Euros12, about 70% of which goes to construction and installation of furnaces and systems for cleaning emissions from production. The return on investment in construction of waste incineration plant complexes with adjacent power plants occurs by accounting for depreciation in the electricity tariff for industrial and domestic consumers and fees for waste disposal services. Thus, consumers bear the double burden of investing in construction of an incineration plant: payment for consumed electricity and payment for waste disposal services.

Austria

A distinctive feature of Austria in the experience of using incinerators is their integration into the urban environment. A prime example is the Spittelau incinerator, located in the center of Vienna and being one of ten main attractions of the capital. The plant is equipped with advanced Japanese technologies for cleaning emissions, therefore it is safe for the city's ecosystem and does not cause protests and complaints from local residents.

According to the description [Silvestri, 2015], initially the plant was built in 1972 for the purpose of waste disposal, and the generated electricity was only supposed to ensure its operation, however, during the planned modernization, the installed capacity of the plant was increased by 40%, which made it possible to produce heat for needs of the police headquarters, the central hospital, city lighting and the central district of Vienna. Today the plant's installed capacity is 460 MW. In 2015, an electric car charging station fully supported by the plant was opened on the territory of Spittelau. Investments in modernization of the incineration plant are carried out through sale of electricity directly to city authorities under contracts – analogs of free bilateral contracts (FBC) at fixed rates determined for the year, sale of services for charging electric vehicles and conducting excursions.

At the end of 2020, it is planned to launch another waste incineration plant in Vienna with an installed capacity of 100 MW13. This plant will provide services for disposal of not only municipal solid waste, but also waste water treatment facilities. The treated water will return to the Danube via turbines, creating additional power generation capacity. The new plant will provide electricity to the city's infrastructure, in particular lighting, traffic lights and charging stations for electric vehicles. The cost of its construction was 250 million Euros, the planned payback period is 12 years. The mechanism for return on investment for construction is the sale of electricity to Vienna authorities at fixed annual tariffs (similar to the FBC) and provision of services for charging electric vehicles.

For 2018, the share of electricity generated by incinerators in Austria was 2.6%, government's plans are to increase the share to 5% by 2030 as a part of the decarbonisation program14.

Main mechanisms for return on investment in construction of incineration plants in Austria are: sale of electricity at fixed rates to city authorities, provision of waste disposal services, charging electric vehicles, entertainment services (observation decks, excursions and catering points).

Japan

For 2018, Japan was one of the world leaders in generation of electricity by waste incineration, the share of incinerators was 5.4% of the country's total electricity generation. In 2018, there were 358 incinerators in Japan generating electricity with a total installed capacity of 1.77 GW15. The popularity of this type of generation is determined not only by the need to dispose of large volumes of waste, which is a consequence of growth of the state's technological development and, accordingly, increase of consumption, but also by the high cost of fossil fuels that the country imports. Also, changes in the country's energy balance were caused by the abandonment of nuclear generation after the accident at the Fukushima-1 nuclear power plant in 2011.

Japan's electricity reform plan includes further restructuring of generation. By 2025, it is planned to recommission all nuclear power units and a further gradual phase-out of generating electricity from fossil fuel in favor of biofuel, waste energy and renewable energy sources, the share of which in the country's energy balance should exceed 20% in 2030.

This result is due not only to man-made and economic reasons, but also to social characteristics of Japan. Separate waste collection has been introduced in the country since the early 1960s16. Unlike European countries where waste is sorted according to its origin or material of manufacture, in Japan waste is divided into incinerated, non-combustible, recyclable and bulky. The priority method of waste disposal is incineration, which, for example, undergoes 37% of recycled paper, which is prohibited by law in other countries. In total, about 70% of newly generated waste goes to incineration plants.

The first incinerator in Japan was built in 1924 and covers an area of 18 thousand square meters; the plant utilizes both household and hazardous waste, and medical waste as well. Disposal safety is ensured by plasma gasification at temperatures above 1200°C, emissions are neutralized and purified by special high-tech filters17. The plant generates electricity to meet its own needs, the surplus is sold to power supply companies in the market for the day ahead. In total, 21 incinerators operated on the territory of Tokyo City in 2018, the energy of their waste provided 20% of the city's needs, including urban infrastructure.

As in Austria, Japanese incinerator plants are actively integrating into the urban environment. For example, the incineration plant on the island of Mishima was renovated into a cartoon castle during modernization, a garden was planted around and an amusement park is located. In Tokyo City, guided tours are organized at incinerator plants, and inside plants there are catering points and lecture rooms overlooking the recycling process. In a number of Japanese cities, factories have set up rehabilitation centers for disabled people and nursing homes, for example, in Takahama and at the Shinkogozak plant.

By 2025, Japan plans to build and modernize 55 incinerators. The reason for this active development was liberalization of the country's electricity market, which, according to experts, will significantly reduce the payback period for construction and modernization of power facilities.

In Japan, reforms similar to Russian reforms of the 2000s have already been carried out to separate vertically integrated energy companies by type of activity, and a free choice of electricity suppliers for high-voltage electricity consumers with a peak power of over 50 kW was opened [Mochalova et al., 2017]. In 2010, an exchange was created in the country that trades on the day-ahead market and trades for conclusion of long-term bilateral contracts for supply of electricity at fixed rates. In 2016, the retail electricity market was liberalized, allowing residential and small commercial consumers to choose their electricity suppliers. Until 2020, consumers in the retail market paid for electricity at tariffs offered by independent market participants, but not exceeding the top set by the state. At the end of 2020, it is planned to complete the final stage of liberalization, including separation of energy sales and power grid companies, separation of energy sales companies and generation, in order to increase competitiveness of the industry as a whole, which will allow the transition from regulated tariffs for transmission, distribution and electricity to competitive trade in services and electricity on retail and wholesale markets.

Completion of liberalization will make it possible to fully use such mechanisms for return of investments in construction of electric power facilities as sale of electricity on the balancing market and sale of electricity on the day-ahead market, will make it possible to move away from the system of "green" tariffs, which is an indirect type of subsidization, which will complement the existing mechanisms return on investment: provision of waste management services and provision of social and recreational services.

USA

At the end of 2017, there were 71 incinerators in the United States, of which 17 were located in Florida. The total installed capacity of all plants was 2.3 GW, which is only 1.2% of the installed capacity of the country's power system.18

According to [Muller, 2017], low prevalence of this type of generation and disposal is due to high cost of waste incineration, which is 1.5 times higher than the tariff for waste disposal at landfills. Main methods of waste disposal in the USA are composting and burial, which is the reason for increase in holding capacity of landfills. Another reason for low spread of the technology is the high share of combined cycle gas turbines (CCGT) in the country's energy balance. The share of electricity generation by burning natural gas in 2018 in the United States was 45%; by 2025, it is planned to increase this index to 65% thanks to construction and modernization of existing CCGT units in order to abandon coal generation.

At the moment, in most states, MSW energy is equated to RES, which is why the main mechanism for return on investment in construction of incinerators is the mechanism of power supply contracts (PSC), in which consumers undertake to buy power from the generator directly at a set price.

In Nevada, main mechanisms for return on investment are investment tax credits and property tax cuts for power generators. The effectiveness of using this mechanism has not yet been determined.

In Minnesota, according to [Gomberg, 2015], the Xcel Energy Company is the leader in renewable energy in the United States, the share of which in the state reached 35% in 2016. The company invests in projects for construction of incineration plants; in 2015, their share in the state's energy balance was 5%. The main mechanism for return on investment for construction of incinerators in the state is sale of electricity in the retail electricity market.

In the United States, each state has different mechanisms for return on investment: power supply contracts, "green" tariff, tax incentives for investments and fixed assets and sale of electricity on the day-ahead market.

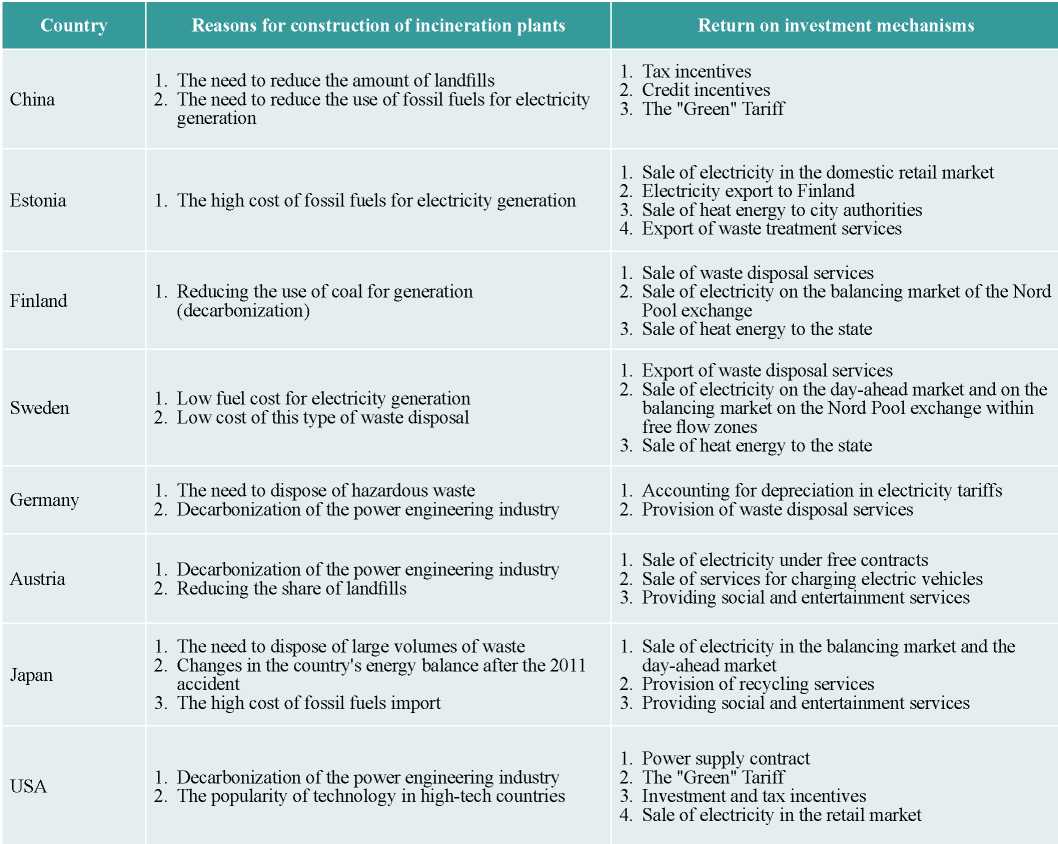

Thus, the main reasons for construction of waste incineration plants in the world are the efficiency in waste disposal and relatively inexpensive cost of this method, decarbonization of the electric power industry, cheapness of waste use in relation to fossil fuels, as well as equating this technology with RES (Table 3).

Table 3

Reasons and mechanisms of return on investment for construction of incinerators in the world

Source: compiled by the author.

The identified mechanisms of return on investment can be grouped into three groups: government subsidies, sale of electricity in competitive markets and other mechanisms.

Government subsidies include: “Green” tariff, power supply agreement, investment, tax and credit benefits, sale of heat energy to the state. These mechanisms are used in countries where the market for electricity and capacity is not fully competitive, and in countries where there is no developed system of utilization and recycling and where landfill waste disposal prevails.

Competitive mechanisms for return on investment include: sale of electricity in retail markets, stock exchanges, day-ahead market, balancing market, selection of the composition of the included generating equipment (SCIGE), inclusion of depreciation in electricity tariffs, as well as sale of services for charging electric vehicles and export of electricity. These mechanisms are used in countries with a highly competitive electricity industry and a developed waste management system.

Other mechanisms include provision and export of waste management services, social and recreational services. These mechanisms are unique to different countries and are combined with competitive mechanisms.

Next, we will consider how this technology is applied in Russia and identify mechanisms for return on investment in construction of waste incineration plants.

3. PROJECTS FOR CONSTRUCTION OF NEW WASTE INCINERATION PLANTS IN RUSSIA

At the moment, seven waste incineration plants are in the process of design and construction in Russia within the framework of the state Clean Country Project: four ones in the Moscow region with an installed capacity of 70 MW each, one each in Kazan City, Sochi City and Krasnodar City with an installed capacity of 55 MW each19.

3.1. PROJECTS FOR CONSTRUCTION OF NEW INCINERATORS IN RUSSIA

The passport of the Clean Country Project20 was prepared on the basis of the minutes of meeting of the Presidium of the Council under the President of the Russian Federation for Strategic Development and Priority Projects No. 3 dated August 31, 2016 and the Order of the Ministry of Natural Resources of Russia dated September 15, 2016 No. 22-r "On formation of the Working Group on preparation of priority projects passports". The project is aimed at solving problems identified in the document "Fundamentals of State Policy in the Field of Environmental Development of the Russian Federation for the Period up to 2030" (approved by the President of the Russian Federation on April 30, 2012). The objectives are aimed at preventing and reducing the current negative impact on the environment, ensuring environmentally safe waste management and restoring distorted natural ecological systems.

The main criterion for selecting a company that will build four waste incineration plants in the Moscow region and one in Kazan City was the maximum cost of 1 kW of installed capacity, which was RUR 380 thousand. The selection winner was the RT-Invest Company, whose proposed costs per 1 kW of capacity amounted to RUR 378,700.

The company was established by the state corporation Rostec and Tsaritsyn Capital LLC (ownership of the company is 25.01 and 74.99%, respectively) for construction and management of waste disposal facilities. In 2013, the RTInvest acquired a waste management operator in Kazan City, in 2014 it signed a contract with the Moscow Mayor's Office for removal of waste from the North-Western Administrative District for 15 years, and it became an operator for waste management in Moscow region in 2018. At the moment, the company is developing projects for installation of automatic waste collection and recycling machines in the Republic of Tatarstan. Thus, the RT-Invest will be able to fully ensure waste management according to the “zero waste” model, as well as increase the energy sustainability of Moscow, the Moscow region and the Republic of Tatarstan.

In the Moscow region, plants will be located in Bogorodsk, Voskresensk, Naro-Fominsk and Solnechnogorsk, their total installed capacity will be 280 MW, which will provide electricity for about 1.2 million people, the amount of waste processing will be 2.8 million tons per year. In 2018, Moscow and the Moscow Region generated 12 million tons of waste per year, thus, waste incineration plants under construction will be able to utilize 23.3% of newly generated waste. The start-up of plants near Moscow is planned for the end of 2022.

Construction of five incineration plants of the first stage is estimated for RUR127 billion, where 20% of financing will be own funds of the RT-Invest, 80% – a syndicated loan from Vnesheconombank and Gazprombank. An incineration plant with an installed capacity of 55 MW and a waste processing volume of 550 thousand tons per year will be built in the Republic of Tatarstan by 2022.

Construction of the plant will make it possible to achieve a “zero disposal” model in Kazan City and will provide electricity to 35% of the city. With successful transition to this model, it can be extended to other cities of the country with a population of more than 500,000 people.

Under the Clean Country Program, in the second stage of construction, two waste incineration plants, 55 MW each, will be built – one in the suburbs of Sochi City, the second one – at a complex for sorting solid waste in Krasnodar City.

The competition for construction of incineration plants in Krasnodar and Sochi is still underway, but at the moment only the RT-Invest Company21, which is building five plants of the first stage, has submitted an application.

According to [Popov, 2016], when solving the optimization problem for choosing the direction of development of the regional energy system, construction of an incineration plant with an installed capacity of 55 MW is the priority for energy balance of the Krasnodar Territory.

All seven incinerator plants will be built using technology and equipment from the Swiss-Japanese Hitachi Zosen INOVA company. Incinerators of Germany, Sweden, China, Japan and France have been built using this technology. It should be noted that not only foreign technologies will be used in construction of factories. The state-owned Rosatom company is taking part in construction, by its order the ZiO-Podolsk company will produce fourteen boilers forincineration of waste with a maximum temperature of 1260°C, which will make it possible to dispose of biological and medical waste safely. Turbines for thermal processing of waste will be manufactured at the Ural Turbine Works under its own patent. These turbines will generate 690 kW of electricity per ton of waste. These developments can also be used at conventional power facilities. Thus, the share of Russian equipment at new plants will make 60%.

In total, it is planned to build thirty waste incineration plants according to the Clean Country project by 2030; construction is planned in cities with a population of more than 500,000 people in order to provide cities with additional electric power capacity and reduce the amount of waste buried at landfills within the framework of the concept of “zero waste ". The total planned installed capacity of plants will be 1.8 GW, the planned waste processing capacity will be 18 million tons per year, which will be 20% of total amount of newly generated waste, another 40% of waste will be recycled. Thus, the share of waste disposed of at landfills will decrease from 97 to 40%, what is the target of the program.

3.2. RUSSIAN PRACTICE OF EQUATING WASTE INCINERATION PLANTS TO RENEWABLE ENERGY SOURCES

Waste incineration plants built under the Clean Country program will be equated to green energy facilities in Russia and to renewable energy sources.

According to research by Greenpeace Russia, construction of five new incinerator plants will reduce the amount of harmful emissions into the atmosphere compared to emissions from fires occurring at landfills by 8000 times. Studies with similar conclusions were carried out by British scientists: the activity of incineration plants does not contribute to an increase in concentration of heavy metals in the atmosphere. Waste storage and burial at landfills also pollute the surrounding land and groundwater with toxic substances, and rotting waste causes air intoxication, which negatively affects the epidemiological situation in nearby settlements

In December 2019, the State Duma adopted a law equating waste incineration in the third reading, in which waste is used as a renewable energy source, to recycling, therefore, electricity generation by waste incineration can be equated to renewable energy sources not only technologically, but also in law.

Thus, incinerators can be equated to distributed generation, which means that they can take part in the mechanism for managing the demand for electricity.

3.3. SOCIAL CONTRADICTIONS IN CONSTRUCTION OF INCINERATION PLANTS IN RUSSIA

One of the most serious difficulties in implementation of the project for construction of seven new incineration plants in Russia is lack of awareness of the public about safety and environmental friendliness of technologies used. Scientists of the Russian Academy of Sciences fear that disposal of waste at incineration plants by incineration on a grate without preliminary sorting followed by purification of emissions may lead to an increase in the amount of hazardous emissions. However, on December 27, 2019, amendments were adopted to the Federal Law "On Environmental Protection”22 prohibiting incineration of waste that has not passed the processing procedure, including sorting. This law introduces a mandatory environmental impact assessment of incineration facilities. These measures will help to minimize the environmental impact of incineration plants and reduce the amount of discussion about waste disposal by incineration.

It is worth noting here that the RT-Invest not only constructs waste incineration plants, but also organizes events for separate collection of waste, is engaged in construction and operation of special complexes for sorting and recycling waste.

In the territories of the RT-Invest presence: in Moscow and Moscow Region, the Republic of Tatarstan and the Krasnodar Territory – from January 1, 2020, a mandatory separate waste collection has been introduced; thus, in regions where the incineration plant is being built, priority will be given to primary waste processing, then incineration of waste that is not suitable for processing, and only then – disposal at landfills.

Waste incinerator plants producing electricity and heat will only recycle waste that cannot be recycled (about 50% of total amount), which will ensure safety of emissions into the atmosphere and the efficient use of resources. This approach closes the waste cycle according to the Zero waste model23. In this regard, social dissatisfaction with construction of incineration plants is insufficiently substantiated and cannot influence the decision on construction.

Thus, according to the Clean Country project, it is planned to build thirty waste incineration plants in cities with a population of more than 500,000 by 2030 in order to provide cities with additional electricity capacity and reduce waste within the framework of the Zero Waste concept. Incinerator plants can be equated with distributed generation, which means that they can take part in the mechanism for managing the demand for electricity. Social dissatisfaction with construction of incinerators is not sufficiently substantiated and cannot influence the decision on construction. When implementing the program of the Clean Country project, the entire identified need of the Russian Federation for construction and modernization of waste incineration plants can be covered by 2030.

4. METHODOLOGY FOR ANALYSIS OF MECHANISMS OF RETURN OF INVESTMENT

4.1. POWER SUPPLY CONTRACTS

According to the Clean Country project, as well as the updated legislation of the Russian Federation, waste incineration plants will be equated to renewable energy sources. This means that the main mechanism for return on investment for construction of seven new incinerator plants will be the CDA. It is a capacity payment mechanism created to attract investments in the power industry for construction of new generation facilities; capacity under this agreement is paid at a specially established increased tariff, commonly known as the “green” tariff, or payments under CDA.

Seven new incinerator plants are expected to be built within the framework of the CDA-2 project, contracts will be concluded for sixteen years, fifteen of which companies will sell capacity with a guaranteed rate of return, which is currently 12% and is tied to the yield of federal loan bonds (FLB) at 7.5%. The CDA payment is recalculated annually. Thus, with an increase in the yield of 10-year FLBs, CDA tariffs will be revised upward and vice versa, which will smooth out economic risks for both investors and buyers of capacity24. The payment under the CDA will be divided into equal parts between buyers of the first price zone and the region of construction of the generating facility.

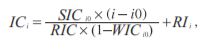

Capacity price under CDA consists of:

- возврата на инвестиционный капитал

(1)

(1)

where SIC – is the size of the invested capital in the long term; i – year of price calculation; RIC – the term for the return of the invested capital (15 years for the CDA-2); WIC – physical wear and tear of the invested capital; RI – return on investment accumulated since the beginning of the long-term period;

- доходности на инвестиционный капитал

(2)

(2)

where the base rate of return is 12%; LTGB – rate on long-term government bonds, base LTGB = 7,5%;

- operating costs (RUR150 per ton of solid waste);

- Income Taxes.

According to calculations, the price of capacity for each of the plants under the CDA will be 5.6 million rubles. per 1 MW per month, which is three times higher than the cost of 1 MW of capacities passing through a competitive selection of capacity (CCC), which will lead to an increase in cost of electricity for consumers on the wholesale electricity market. In Moscow and the Moscow Region, the increase for commercial consumers will be 5%, in the Republic of Tatarstan – 3%, in other regions of the first price zone the increase will be less than 1%.

It should be noted that a distinctive feature of a CDA is the priority25 in the wholesale market and the obligation to conclude for all buyers of the wholesale market, that is, the capacity traded under the CDA is redeemed in the first place, only then the capacity within the CCA is presented. This feature allows CDA facilities to return capital expenditures on time.

According to the Market Council analysis26, the use of CDA as a mechanism for return on investment in construction of incinerator plants in the Moscow region will lead to an increase in the cost of a metro ticket by RUB 1.02 (the Moscow metro is one of the biggest consumers in Moscow City, this imposes a considerable load on household consumers).

When using the CDA mechanism, wholesale market participants pay directly pay the increased cost of capacity, then increasing its cost for power supply companies. However, due to the cross-subsidization mechanism – a preferential electricity tariff for residential consumers – the increased cost of capacity will not directly affect residential consumers, but the increase in electricity costs for commercial consumers will be indirectly transmitted through sale of goods and services to the population. Thus, the burden of introducing a “green” tariff will fall entirely on residential consumers.

The return on investment through CDA is criticized by A. Shokhin, President of the Russian Union of Industrialists and Entrepreneurs (RUIE): in his opinion, there may be an additional financial burden on industrial enterprises due to “subsidizing waste disposal”. However, Shokhin does not consider the possibility of combining such mechanisms of return on investment as the sale of electricity within the framework of the SCIGE and sale of waste disposal services. At the same time, today industrial enterprises independently carry out waste disposal, costs of which are much higher than the possible tariffs for waste disposal at waste incineration plants due to lack of returns from scale.

Thus, it can be concluded that it is inexpedient to use capacity supply contracts as the only mechanism for return on investment in construction of incineration plants due to large final burden on household consumers and the complete subsidization of the waste disposal market through the wholesale power and capacity market. Next, we will consider alternative mechanisms for return on investment in construction of incineration plants.

4.2 FREE BILATERAL AGREEMENT

This mechanism is used to return investments in already built waste incineration plants in Russia. An analogue of free bilateral contracts is used in Finland and Estonia for sale of heat generated by waste incineration plants, in Sweden a similar mechanism is used for sale of waste electricity to city distribution companies.

Free bilateral electricity purchase and sale agreement is an agreement in which the supplier undertakes to provide the buyer with electrical energy, and the buyer undertakes to pay and accept power under terms of the agreement UBA is concluded for a specified period. The agreement contains a number of mandatory parameters:

- total scope of delivery, MW*h;

- electricity price, RUB/MW*h;

- start and end dates of the contract period;

- the number and duration of time intervals within the validity period;

- minimum and maximum amount of electricity for a time interval.

Within the framework of the wholesale electricity market, this agreement is intended to provide stability and long-term guarantees in obtaining certain volumes of electricity at established tariffs. For a generator, this tool allows you to ensure and plan loading of power generating equipment.

To determine optimal parameters of the agreement, it is necessary to carry out calculations on the principle of zero profit, depending on the value of the agreement on the amount (P(V)), namely: the price of a free contract should be such that the sale of energy on the day-ahead market and resale of power to end-users bring zero profit to both parties to the agreement.

In the case of concluding free contracts for supply of electricity from an incineration plant, the buyer determines the amount of electricity purchased due to low competitiveness of this type of generation (due to high cost of electricity generation due to high capital construction costs). Thus, parameters for concluding the agreement are found by solving the problem of maximizing the expected profit of the counterparty:

(3)

(3)

where pst – is the price of electricity on the day-ahead market (DAM), a random variable, RUR/MW*h;

хst – the amount of electricity purchased on the DAM in the t interval and sold to end users, MW*h;

хtss – the amount of energy purchased under a free contract and sold on DAM, MW*h;

xdt – volume of electricity consumption by end consumers, MW*h;

pdt – the cost of selling electricity to end consumers, RUB/MW*h;

xkt – the amount of electricity purchased by UBA and sold to end consumers, MW*h.

Let us denote constraints for maximization function:

- the total volume of the agreement will be:

(4)

(4)

- total sales amount: xdt = xkt + хst ; (5)

- non-negativity of variables and market restrictions for the day ahead.

When solving this optimization problem, the maximum cost of the contract is determined, at which the company is at the break-even point, and remaining parameters of the agreement are determined from this value.

Such a mechanism for return on investment is already functioning for currently operating waste incineration plants in Russia, rates range from RUR0.6 to RUR2/kW*h.

Provided that incinerator plants operate continuously with an installed capacity utilization rate of 85%, the cost of 1 kW/h will be RUR 3.44, and 1 MW of energy per month - RUR 2.48 million, which is almost two times lower than its cost according to CDA. Provided that the share of generation in the final tariff for consumers is 51%, on average and other things being equal, assuming a payback period of 15 years, a one-rate tariff for Moscow City household consumers using waste energy would be RUR6.73/kW*h, which is 20% higher than the current tariff. With an increase in the payback period, the cost for 1 kW*h may decrease.

Thus, it can be concluded that the use of free bilateral contracts as a mechanism for return on investment in construction of incinerators is more effective and less expensive than the CDA mechanism, but the UBA mechanism is difficult to consider as an independent instrument; in addition, this mechanism in the case of WIP is monopsony, which contradicts the goal of popularizing this type of generation.

4.3. GOVERNMENT SUBSIDIES

Provision of government subsidies for construction of new generation facilities, in particular for construction of incinerator plants, is used in countries such as the United States and China. The main instruments of state subsidies for electric power industry are: income tax incentives for companies investing in the industry, preferential terms for obtaining loans from a national bank, investment incentives and exemption from property taxes.

Direct subsidies for construction of power generation facilities are common in countries with low competition in power markets. Direct subsidies were used in Japan before liberalization of power industry; at the moment, the country has switched to other mechanisms for return of investments in construction of generation facilities, namely, to trade in electricity on the wholesale market.

Use of government subsidies as a mechanism for return on investment for construction of seven new incinerator plants in Russia cannot be applied for two reasons.

- An incineration plant is primarily a generator of electricity, that is, product of the plant is a competitive commodity traded on the market, therefore, only mechanisms of power and capacity markets that exclude subsidies, are applicable.

- Subsidizing power generation facilities that also provide waste disposal services launches a mechanism for cross-subsidizing the waste management sector at the expense of the country's power industry. Such a measure causes a slowdown in the growth and development of both industries, and this contradicts the Clean Country Program, the initiative of which was construction of waste incinerator plants.

Thus, it can be concluded that the instrument of state subsidies is inapplicable in order to ensure return on investment in construction of incineration plants.

5. RESEARCH RESULTS

5.1. WHOLESALE ELECTRICITY MARKET

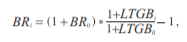

According to the analysis, the sale of electricity on the wholesale market is the main mechanism for return on investment in construction of incinerators in countries with a competitive electricity market, such as Germany, Austria, Estonia and Japan.

Today, Russia has a two-level electricity and capacity market - wholesale and retail one. The composition of participants and the infrastructure of the wholesale electricity and capacity market can be seen in Fig. 7.

The wholesale market operates separately in price zones that consist of combined regions. The first price zone includes the Central, South, North-West, Volga, North Caucasus and Ural Federal Districts, the second price zone – the Siberian Federal District. The rest of regions, for technological reasons, are in non-price zones.

The products of the wholesale electricity and capacity market are electricity and capacity. Power is a special product that gives the buyer the right to require the seller to ensure that the generating equipment is ready to generate electricity. The principles of functioning of the wholesale market are determined by the Rules of the Wholesale Electricity and Capacity Market, approved by the Decree of the Government of the Russian Federation dated December 27, 2010 No. 1172.

Electricity in the wholesale electricity market can be traded under regulated contracts and at unregulated prices. The mechanism for return on investment through conclusion of regulated contracts was discussed in the section "Free bilateral contract". Electricity that does not fall within the scope of sales under regulated contracts is traded at unregulated prices in the day-ahead and the balancing markets. To be able to sell electricity within the day-ahead market and the balancing market, you need to meet the selection criteria for the wholesale electricity market, as well as go through the procedure for selecting the composition of the generating equipment included.

5.2. SELECTION OF THE COMPOSITION OF THE GENERATING EQUIPMENT INCLUDED

The calculation of SCIGE is carried out daily by the system operator of the power system for three days, the calculation is carried out two days before the start. The generator can be included into the operating generating equipment on own initiative within its own forced mode for technological or economic reasons, or as an unoptimized unit of power generating equipment. Also, the generator can be turned on for external reasons independent thereof, namely, being a mode generator (for example, a nuclear power plant) or being turned on for optimization, that is, it can be selected based on a set of price and technological characteristics.

Since incinerators are equated to renewable energy sources, they can be included in the included generating equipment on own initiative, if they meet selection criteria for the wholesale electricity market.

Waste incineration plants to be built under the Clean Country project meet requirements, that is, they will legally own generating equipment, the installed capacity of which in each group of supply points exceeds 5 MW, the installed capacity of plants will be 70 MW and 55 MW, as well, necessary technical measures will be taken.

Due to the specificity of technical characteristics of incineration plants for continuity of the production cycle, this type of generation can be included as a regime facility for generating electricity along with nuclear power plants and hydroelectric power plants. The cost of 1 MW per month for this generator will be RUR 2.48 million with a payback period of fifteen years, which is 30% lower than the cost of 1 MW of new facilities at nuclear power plants. Thus, inclusion of waste incineration plants in the structure of regime power generation facilities can serve as a mechanism for return of investments in their construction in absence of an increase in their payback period. It should be noted that, depending on the final tariff, the investment return period may be reduced.

5.3. DAY-AHEAD MARKET

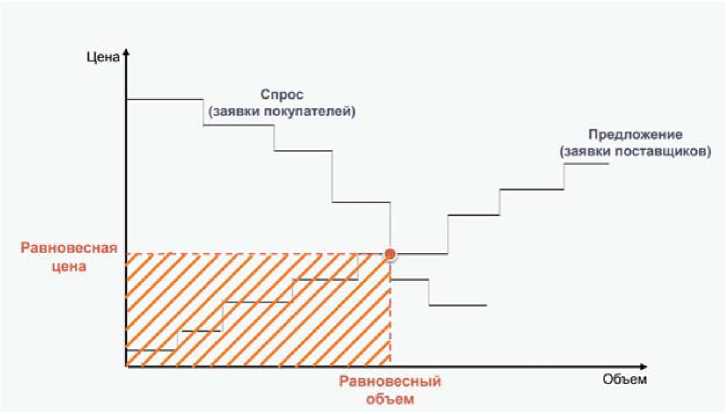

Within the day-ahead market, the trading system administrator conducts a competitive selection of price bids among the included generating equipment and buyers one day before the start of supplies.

Based on results of the auction, the following is being determined:

- planned hourly consumption;

- scheduled hourly production;

- equilibrium prices for electricity.

The Figure 8 shows the day-ahead pricing in the market. The price for all generators will be set at the equilibrium level; those who offered higher prices will not be included in the wholesale market for the next day. One of main risks of the day-ahead market is accidental emergence of monopolies and monopsony within certain regions.

Source: compiled by the Author.

Due to capital capacity of construction of new incinerators and availability of less expensive generation within the first price zone, participation of the incineration plant in the tender for bids is impractical. Thus, it can be concluded that the day ahead market instrument is inapplicable as a mechanism for return of investment in construction of waste incineration plants.

5.4. BALANCING MARKET

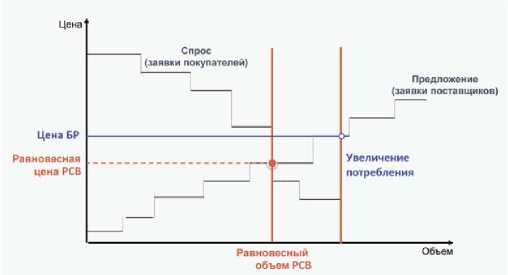

Another mechanism for return on investment in construction of new generators of electricity in countries with a competitive electricity market is participation ofa new generator in the balancing, or intra day, electricity market (Fig. 9).

Источник: составлено автором.

The balancing market in Russia is a market for deviations arising from actual production and consumption of electricity from the day-ahead market. The system operator competitively selects applications three hours in advance in real time. Pricing is based on losses and system constraints.

The price on the balancing market is determined depending on the required amount of additional purchase, is set at a new equilibrium value and changes every hour depending on declared deviation from the market for the day-ahead and on composition of the equipment operating for a given hour.

The purchase price of electricity in the balancing market may increase relative to the day-ahead market price, but the cost of generating electricity in incinerator plants, with a payback period of fifteen years, is quite high to obtain transactions in the balancing market on an ongoing basis. Thus, participation of electricity generation by WIPs in the balancing electricity market cannot be an independent mechanism for return on investment in construction.

5.5. PROVISION OF SERVICES FOR CHARGING ELECTRIC VEHICLES

Another mechanism for return on investment in construction of incinerator plants is sale of services for charging electric vehicles (this mechanism is used in countries such as Austria and Japan).

It is not possible to apply this mechanism in relation to incineration plants that will be built in the Moscow Region, the Republic of Tatarstan and the Krasnodar Territory not only due to weak development of electric transport in Russia, but also due to location of these plants, namely, far from settlements and large cities. Therefore, it is not possible to apply a ROI mechanism for construction of seven incinerator plants by selling electric vehicle charging services.

5.6. PAYMENT FOR DISPOSAL SERVICES

Since January 1, 2019, according to Federal Law No. 89, waste removal and disposal have been equated to public utilities, tariffs have been set for waste management both for the population and for legal entities; the tariff is calculated based on the area of premises and is being indexed in January and July.

The amount of the tariff depends on various factors: population density, area of the region, presence and size of landfills, waste processing and incineration plants. Waste management operators have been identified in each region. Today, the cost of waste management services in Moscow City is RUR5.23 per square meter of area.

Further, the mechanism of producer responsibility was changed, which implies inclusion of cost of waste management services into the environmental fee. In December 2019, the State Duma adopted a law equating incineration with recycling in the third reading, therefore, fees for operation of incinerators will be taken into account in tariffs for removal and disposal of waste. This will reduce electricity industry cross-subsidization of waste management while reducing the direct burden on residential consumers by transferring facility costs into environmental charges for industrial enterprises.

Provision of waste management services is one of main mechanisms for return on investment in construction of incinerators in Germany, Austria, Sweden, Japan and Estonia.

These countries use a combination of tariff setting for waste disposal and electricity sales in the local wholesale market.

5.7. RECOMMENDATIONS

Combining tariffs for waste disposal with sale of electricity on the wholesale market can be used in Russia to return investment in construction of seven new incinerator plants. During management of solid waste and inclusion of cost of these services in environmental tax for industrial enterprises, the price of electricity generation at the incineration plant may be reduced due to division of the investment burden between goods and services of related industries. The tariff for waste disposal will take into account costs of building and maintaining filters and costs of installing and maintaining boilers, calculation of cost of electricity will include depreciation and maintenance of turbines. Under reduction in this price, incinerators will become more competitive generation facilities and will be able to become full-fledged participants in the day-ahead market and in the balancing market.

6. CONCLUSIONS AND FURTHER RESEARCH

In this article, the current method of return on investment in construction of new incineration plants in Russia was considered, its main disadvantages were analyzed. Alternative mechanisms of return on investments were identified, which are used in the world practice of construction of incinerator plants and are used by existing plants in the Russian Federation.

The effectiveness of use of the mechanism of free bilateral contracts and the mechanism for including waste incineration plants in the regime facilities of the wholesale electricity and capacity market, was calculated.

A qualitative analysis was carried out of the possibility of using government subsidy mechanisms, participation in the balancing market and the day-ahead market, as well as sale of services for charging electric vehicles and combination of provision of services for disposal and sale of electricity.

Based on the analysis, most effective mechanisms were:

- mechanism of free bilateral agreements;

- mechanism of inclusion of the electricity and capacity market into regime facilities;

- Combining sale of recycling services with participation in the day-ahead market and the balancing electricity market.

In the course of analyzing advantages and disadvantages of effective mechanisms for return on investment in construction of waste incineration plants, the priority was chosen for the mechanism of combining the sale of utilization services and sale of electricity in the balancing market and the day-ahead market. Main advantages of this mechanism are reduction of the investment burden of household consumers and absence of cross-subsidization of waste management industry by the electric power industry.

1. URL: http://datatopics.worldbank.org/what-a-waste/

4. State portal of Estonia. URL: https://www.eesti.ee/ru/.

5. URL: https://www.nordpoolgroup.com/

6. Finland statistics. URL: https://www.stat.fi/.

7. EES EAEC. World energy statistics. URL: http://www.eeseaec.org/energetika-stran-mira/.

8. Official site of Sweden (in Russian). URL: https://ru.sweden.se/.

9. European Commission. Research results. URL: https://cordis.europa.eu/.

10. German Federal Ministry for the Environment. URL: https://www.bmu.de/.

11. Federal Environment Agency of Germany. URL: https://www.umweltbundesamt.de/.

12. Ibidem.

13. International portal for electricity generation statistics. URL: https://www.iea.org/.

14. Ibidem.

15. Ibidem.

16. Gordenker A. Japan’s incompatible power grids//Japan Times. 2011. July 19. Р. 9.

17. Ibidem.

18. World Bank. URL: https://www.worldbank.org/.

19. Information about competitive selection for construction of an incineration plant. URL: http://www.atsenergo.ru/tbo/otborinfo.

20. Passport of the Clean Country Project. 2016. URL: http://static.government.ru/media/files/B3JtWzMSWVAHKTd6plVchwnOLWEYmF9f.pdf.

21. URL: http://rt-invest.com/.

22. Federal Law of 10.012002 No. 7-FZ "On Environmental Protection" (as amended and supplemented). URL: http://www.consultant.ru/document/cons_doc_LAW_34823/

23. "Waste to energy"//Energy from waste. URL: https://w2e.ru/process/.

24. System operator. URL: https://so-ups.ru/

25. Resolution of the Government of the Russian Federation of December 27, 2010 N 1172 (revised on May 13, 2020). URL: http://www.consultant.ru/document/cons_doc_LAW_112537//

26. This refers to the SE Market Council association. URL: https://www.np-sr.ru/ru.

References

1. Agapova K. (2013). Sertifikatsiya zdaniy po standartam LEED i BREEAM v Rossii [Certification of buildings according to LEED and BREEAM standards in Russia]. Zdaniya vysokikh tekhnologiy [High-Tech Buildings]. URL: http://zvt.abok.ru / articles / 79.

2. Vladimirov Y. (2017). Perspektivy energeticheskogo ispol’zovaniya tverdykh kommunal’nykh otkhodov v krupnykh gorodakh [Prospects for the energy use of municipal solid waste in large cities]. Vestnik Kazanskogo gosudarstvennogo energeticheskogo universiteta [Bulletin of Kazan State Energy University], 4(36).