Scroll to:

OPTIMIZATION OF INVESTMENTS IN CORPORATE RISK MANAGEMENT

https://doi.org/10.17747/2618-947X-2019-3-220-227

Abstract

In tIn this article, the problem of optimizing investments in risk management is considered through the theory of the firm and the problems arising from this theory (the problem of the «principal-agent», the theory of contracts).

The purpose of this study is the theoretical and empirical evidence of the optimal investment model proposed by the author for corporate risk management. The object of the research is the companies of the metal and mining industry of the Russian Federation. The subject of research are the financial performance and the amount of management expenses of companies.

The theoretical significance of the study is in the ability of indirect evaluating investments in corporate risk management based on the company's financial statements. Practical significance is the ability to use the results obtained in the real conditions of corporate governance of the company. The practical significance of the study is the ability to determine the appropriate amount of investment in risk management.

For citations:

Makarova V.A. OPTIMIZATION OF INVESTMENTS IN CORPORATE RISK MANAGEMENT. Strategic decisions and risk management. 2019;10(3):220-227. https://doi.org/10.17747/2618-947X-2019-3-220-227

1. THEORETICAL MODEL OF EVALUATION OF INVESTMENTS IN CORPORATE RISK MANAGEMENT

Risk management falls out of the obligatory requirements to the disclosure of information. Companies do not provide reports on events conducted in the field of risk management, incurred losses and profit gained specifically from these events. Valuation of investments in risk management is not a simple task. Investment outlays on risk management include not only salaries for risk managers and payments for training, but also expenses on the risk management preventive measures in every possible risk situation, as well as the factual loss upon a realized risk. Moreover, if the system of risk management is deeply integrated into the corporate management, it is difficult to trace it at all levels of the company’s activity. All basic costs for risk management are usually shown in the “administrative costs” line of a balance sheet; exactly by it the volume of investments in corporate risk management will be estimated. Administrative expenses include costs for administration, additional expenses for maintenance of the management staff, depreciation of managing and general business expenses, leasing of premises, expenses for information, audit and consultation services and others. According to the managerial theory of profit maximization the effect from increasing expenses for management staff is equivalent to bonuses, gained by them from the profit maximization, however managers prefer to maximize the administrative expenses. In this relation we can consider that administrative expenses directly reflect the managers’ efforts.

C. Chen and his coauthors considered the interdependence between the agency costs and amount of administrative expenses [Chen, Lu, Sougiannis, 2012]. The authors suggest that corporate management will decrease the risk of the “principal - agent” problem. The study revealed the significant interconnection between the amount of administrative expenses, motivation of managers and the reward system. Positive connection between these factors is better seen when corporate management is loose. Thus, H. Leland considers the interconnection between the capital structure and the investment risk through the example of hedging (Leland, 1998). The inverse dependence between hedging effectiveness and administrative expenses was revealed, if no heavy expenses are expected from realization of hedging. M.K. Berkowitz found that there is a negative relation between administrative expenses and effectiveness for those managers, who are not enough motivated (Berkowitz, Kotowitz, 2002). Salaries to managers were considered in the context of alteration of the amount of administrative expenses. The problem of negative selection adversely affects the quality of risk management, and additional administrative expenses can improve the situation only in case, if a manager has motivation to work or is initially an effective worker. This way, administrative expenses may be used as an indicator of contributions in risk management, however, workers’ motivation and the information inequality between superior management and risk managers should be taken into account.

According to the theory of the firm, when employing an agent for implementation of specific tasks, it is necessary to define optimal costs, but in meanwhile to create motivation for high quality of work made by employer in order to avoid situations connected with moral risk.

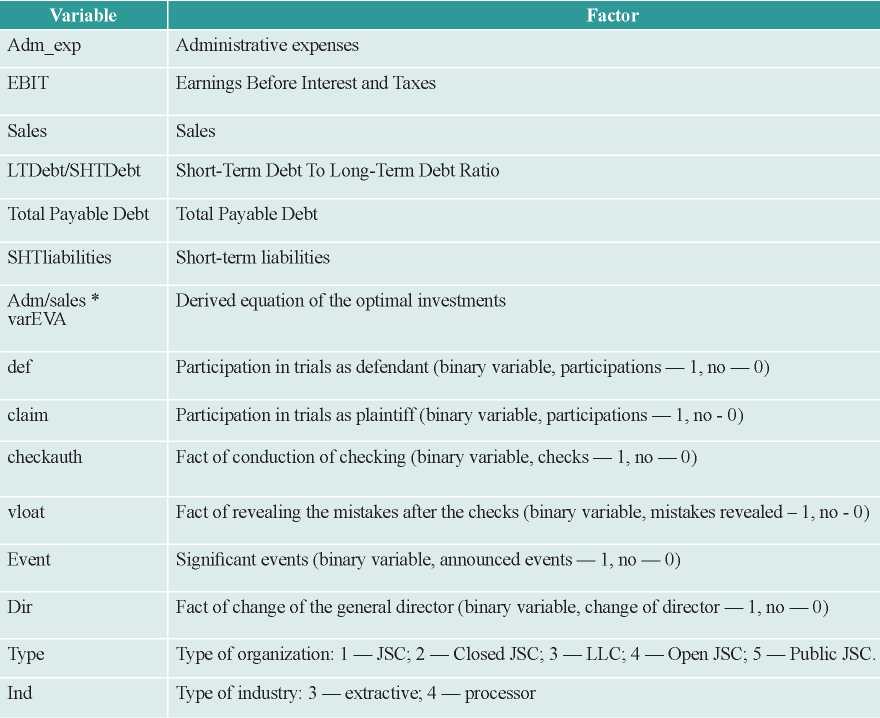

There are articles and studies presented below in the table, which served as basis for the formation of an empirical model described below.

2. FORMULATION OF AN OPTIMIZATION EQUATION

In the context of this research the optimal investments in risk management may be estimated by the following formula:

CE = A - CL,

where SGA - administrative expenses; S - sales; CE - capital employed; EVA - economic value added; A - total amount of assets; CL - short-term liabilities.

Capital employed is the cost of all assets employed in business; it is calculated by adding fixed assets to the working capital or by subtracting current liabilities from the total amount of assets (Mazur, Shapiro, Korotkov et al., 2005).

Economic value added is used to evaluate a company’s value for owners, demonstrates the real capability of an enterprise to make profit on basis of available capital. This indicator shows the excess of profitability over the weighted average capital cost; the higher its value, the more effectively the capital is used. With the aid of economic value added it is possible to estimate the investment attractiveness of an enterprise, its competitiveness, financial viability, and solvency.

EVA = NOPAT – WACC * IC,

where NOPAT - net operating profit after tax and before interest payments on credit; WACC - weight average cost of capital, profit margin; IC - invested capital, represents the sum lines “Capital and reserves” and “Long-term liabilities” of a balance sheet.

WACC and IC together show the cost of capital. Depending on the data, the indicator can be calculated as follows:

EVA = (EBIT – T) – WACC * IC = (ROIC – WACC) * IC

Table 1

Explanatory variables for empirical investigation

Variance (dispersion) of EVA allows estimating its volatility from the mean value, which is the risk measure. Since the high value of EVA is more attractive, its variance should be small. In practice a lot of investors are not risk-prone, therefore in conditions, when investors determine the company’s development strategy by themselves, the task of risk management is to decrease volatility and consequently to decrease the EVA. Эdispersion. It justifies the use of EVA dispersion as a multiplier. The variance is calculated according to the following formula:

where varEVA – dispersion EVA, EVAi – individual value.

3. TEST OF HYPOTHESES AND EMPIRICAL INVESTIGATION

Data of almost 300 companies in metallurgy industry of Russian Federation were used to build empirical models. The companies with incomplete or inaccessible data were excluded from sample in course of the research. Data were taken from financial statements published by companies in 2013-2017 years.

Table 2

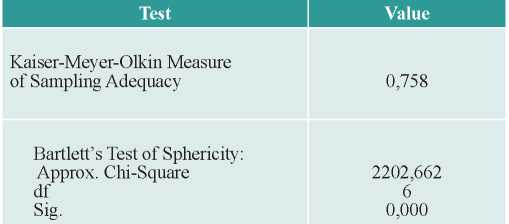

Barletta Test

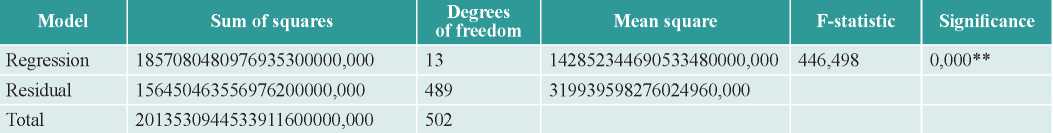

Table 3

Totality

Table 4

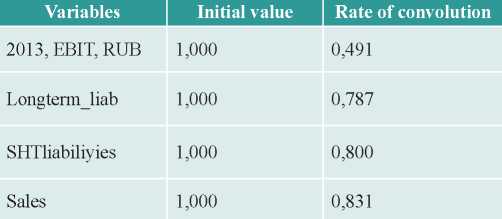

Анализ дисперсии

Table 5

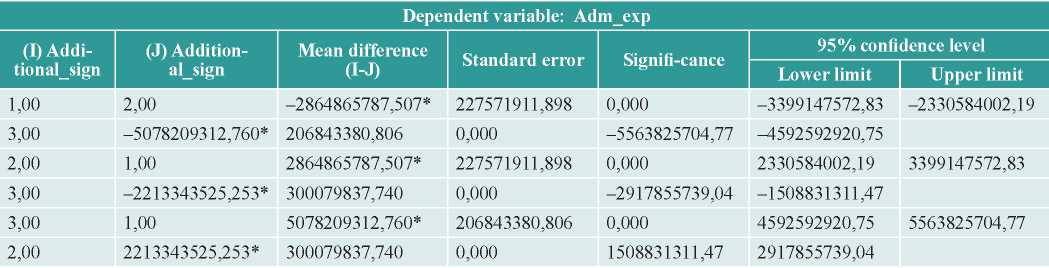

Check of the groups’ difference significance on basis on Tukey’s criterion

Table 6

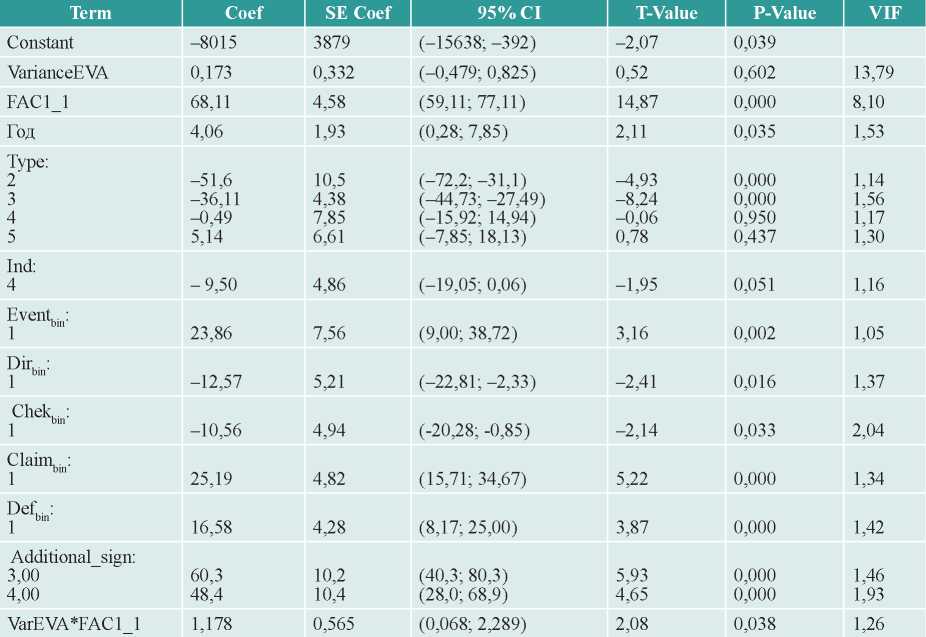

Regression coefficients

Table 7

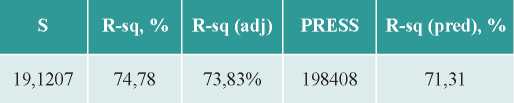

Explanatory power of the model

In this work the significant events, which are subject to disclosure, act as indicators of investments in corporate risk management. The most significant events are deemed those ones, which may show the effectiveness of risk management:

- a report on adopting a decision about decrease of the authorized capital;

- a report on adopting a decision about reorganization;

- adoption of a decision about reorganization or liquidation of the organization supervised by issuer, which is essential for the later;

- a report of a debtor or creditor about his intention to go to court;

- change of the general director;

- detection of mistakes in financial statements published earlier;

- participation in arbitration cases as defendant and plaintiff.

It is anticipated that administrative expenses are susceptible to the specified signals. The rest of events, such as reports on the net assets cost, reports on the shareholders’ meeting, disclosure of the affiliates list in the Internet, report on results of the obligatory audit, etc., were not included in the investigation, because they were of large-scale nature and occurred to be not significantly important.

The following regression model was built to check the hypotheses in this article:

y = const +β1 * EBIT + β2 * VarEVA +β3 * control variables + ε

Administrative expenses serve as a dependent variable. The factors, shown in the table 1, act as the main explanatory variables.

All variables were checked on subject of the distribution normality. Homogeneous significant factors (EBIT, longterm loans, short-term liabilities, sales) demonstrated high multicollinearity and were convoluted in the single variable (A-R factor score 1 for analysis 1). The convolution percent is estimated with the aid of the Barletta Test, convolution percent equals to 73% (table 2, 3).

Variable Adm/sales * varEVA is used only on the phase of checking the variable on subject of the distribution normality, the variable is not taken into account in the very model. The main means for assessing the consistency of the formula is the variable varEVA, 3the significance of which will be tested. In the empirical investigation the hypothesis was offered that the variable varEVA significantly influences the amount of administrative expenses.

4. MAIN RESULTS OF EMPIRICAL INVESTIGATION

A prior assessment of the model on significance with the aid of variance analysis showed the significance of the model (table 4).

Analysis of the model’s partial-outs showed that the sample possesses additional stable features, which can’t be described by chosen dependent variables. Partial-outs are in clear correlation with the legal form of business organization, which points out again the “principal-agent” problem. In order not to lose individual features, an additional variable (additional sign) was created, which accepts values between 1 and 3. The variable accepts the value “1” as basic. Partial- outs are shown as values “2” and “3” depending on size. Division in groups is significant in the limits of statistical significance (table 5).

The following equation became the final result of regression analysis:

The main features of explanatory variables in equation are presented in Table 6.

Explanatory power of model is high. It may be deemed as suitable for forecasting due to similarity of R-sq, R-sq(adj) and R-sq(pred) values (table 7).

5. ANALYSIS OF THE RESULTS OBTAINED

Multicollinearity of variables for convolution can be explained by the direct relationship between the gained profit and the volume of investments in operational activities. However, the agency theory makes adjustments in the distribution proportion of these sources of investment. According to it, the existence of long-term debts disciplines the firm’s managers against taking unnecessary risks, while companies with the low quality risk management are financially limited and seek to attract short-term loans. At the same time, agents can be motivated equally by both growing profits and growing administrative expenses. The choice of an indicator for optimization depends on the practice in organization. Thus, variable obtained as a result of the convolution demonstrates the management efforts in managing financial constraints.

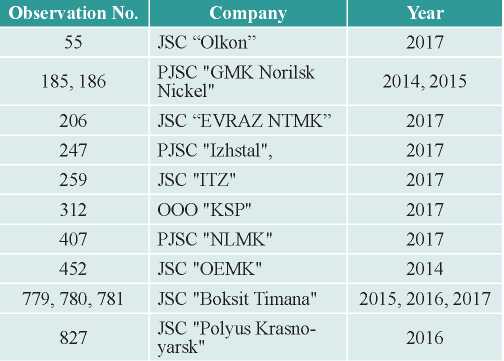

Table 8

Companies with uncharacteristic growth of administrative expenses

Resulting regression with interdependencies included has shown that the cross-effect of the EVA variance and financial indicators is statistically significant in relation to administrative expenses. At this stage, hypothesis is confirmed that indicator of the EVA variance is theoretically and statistically significant while calculating optimal investments in risk management. Overall, the optimal amount of costs associated with risk management is 17.8%.

6. ANALYSIS OF TOTAL STANDARDIZED REGRESSION PARTIAL-OUTS

In process of the regression analysis, two partial-out groups were formed: abnormal leaps of explanatory variables and abnormal behavior of the dependent variable. A list of companies with uncharacteristic behavior of the dependent variable is presented in Table 8. They found an abnormal growth spurt of administrative expenses in the specified years. We searched for the causes of such anomalies on the Internet.

In 2016 JSC “OLKON” the General Director was replaced. In 2017, the company reached a record quality level of iron ore concentrate: iron content in products of the company equaled to 67% in average. Improvement of the products quality compared to previous years may be the result of increased administrative expenses (JSC “Olkon”, [bg.]).

In 2015, the shares of PJSC “GMK Norilsk Nickel” fell by more than 15% in 10 days. The fall in market value is one of the results of ineffective management, including risk management. The response to the fall in market value could be abnormal growth of administrative expenses (Nornickel, [bg.]).

In 2017, JSC “EVRAZ NTMK” reduced emissions into the atmosphere. The increase in administrative expenses could be a response to state sanctions related to environmental safety (Evraz, [s.a.]).

In the same year, PJSC “Izhstal” increased production volumes by 14% compared to 2016. Perhaps this has led to the increase of administrative expenses [Mechel, [bg.]).

PJSC “NLMK” achieved a 55% net profit growth in 2017. The incentive for such profit growth could be the growth of administrative expenses (Finanz, [s.a.]).

From 2015 to 2017 JSC “Boksit Timana” achieved a stable growth in bauxite ore production by 11.5%. Most likely, this is ensured by increasing administrative expenses (BNK News Agency, [bg.]).

In 2017, JSC “Polyus Krasnoyarsk” increased the production of precious metal by 12% compared to 2016. Revenue from sales grew by 14%. This development could have been stimulated by the increase of administrative expenses a year earlier (Newslab, [bg.]).

7. CONCLUSION

Problem of optimization of investments in corporate risk management can be solved by application of the proposed equation. It shows the structure of a company’s financial indicators, describing the return of the capital employed taking into account the value of economic value added (EVA). The proposed model of optimal investments is theoretically and statistically confirmed. The value of the EVA dispersion is connected with the main indicators of financial activity and significantly influences the amount of company’s administrative costs with the interdependence of the indicator and main indicators of financial activity included.

The administrative expenses to economic value added ratio is frequently enough used to assess the indirect commercial effectiveness of IT projects (Strassmann, 1996; Pisello, Strassmann, 2003), for which, as well as for the risk management introduction projects, no direct evidence of effectiveness was found (Makarova, 2015). In the context of this study the time-line analysis (inclusion of lags in regressions) and trend analysis can serve as additional criteria for assessing the response of administrative expenses to the risk factors, however such analysis is impossible to conduct within the period of 5 years, therefore it was not done. In future, the empirical model may be checked on longer period of time, what would allow to check the data for existence of a trend and to correct the empirical model. Extension of the observation time will also allow better tracing the dynamics of the administrative expenses response to negative events.

References

1. AO «Olkon» ( [b.g.]). [JSC “Olkon” ( [s.a.]). (In Russ.)]. http://olcon.ru.

2.

3. Evraz ( [b.g.]). [Evraz ( [s.a.]). (In Russ.)]. http://rus.evraz.com.

4.

5. Internet-gazeta Newslab ( [b.g.]) [Internet newspaper Newslab ( [s.a.]). (In Russ.)]. http://newslab.ru.

6.

7. Informatsionnoye agentstvo BNK ( [b.g.]). [News agency BNK ( [s.a.]). (In Russ.)]. https://www.bnkomi.ru.

8.

9. Mazur, I. I., Shapiro, V. D., Korotkov, E. M. i dr. (2005). Korporativnyj menedzhment. M.: Omega-L. [Mazur, I. I., Shapiro, V. D., Korotkov, E. M. et al. (2005). Corporate Management. Moscow: Omega-L. (In Russ.)].

10.

11. Makarova, V. A. (2015) Analiz i otsenka ekonomicheskoj effektivnosti risk-menedzhmenta // Effektivnoye antikrizisnoye upravleniye. №3. S. 72–83. [Makarova, V. A. (2015). Analysis and assessment of the economic efficiency of risk management. Effective crisis management. 3:72–83. (In Russ.)].

12.

13. Mechel ( [b.g.]). [Mechel ( [s.a.]). (In Russ.)]. http://www.mechel.ru.

14.

15. Nornickel ( [b.g.]). [Nornickel ( [s.a.]). (In Russ.)]. https://www.nornickel.ru.

16.

17. Spark – proverka kontragenta ( [b.g.]). [Spark – counterparty verification ( [s.a.]). (In Russ.)]. http://www.spark-interfax.ru.

18.

19. Federal'naya sluzhba gosudarstvennoj statistiki ( [b.g.]). [Federal State Statistics Service ( [s.a.]). (In Russ.)]. http://www.gks.ru.

20.

21. Berkowitz, M. K., Kotowitz, Y. (2002). Managerial quality and the structure of management expenses in the US mutual fund industry. International Review of Economics & Finance. 11 (3): 315–330. DOI: https://doi.org/10.1016/S1059–0560 (02) 00099–0.

22.

23. Chen, C. X., Lu, H., Sougiannis, T. (2012). The agency problem, corporate governance, and the asymmetrical behavior of selling, general, and administrative costs. Contemporary Accounting Research. 29 (1):252–282. DOI: 10.1111/j.1911–3846.2011.01094.x.

24.

25. Coase, R. (1937). The Nature of the Firm. Economica. 4 (16):386–405.

26.

27. COSO ERM–Integrated Framework ( [s.a.]). http://www.coso.org.

28.

29. Demsetz, H. (1995). The economics of the firm: Seven critical commentaries. Cambridge. Cambridge University Press. 192 p.

30.

31. FERMA Risk Management Standard ( [s.a.]). http://www.ferma.eu.

32.

33. Finanz ( [s.a.]). https://www.finanz.ru.

34.

35. Grinstein, Y. (2006). The disciplinary role of debt and equity contracts: Theory and tests. Journal of Financial Intermediation. 15:419–443. DOI: doi:10.1016/j.jfi.2006.02.001.

36.

37. ISO 31000 – Risk Management ( [s.a.]). http://www.iso.org.

38.

39. Jensen, C. M. (1976). Theory of the Firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics. 3 (4):305–360.

40.

41. Leland, H. E. (1998). Agency costs, risk management, and capital structure // The Journal of Finance. 53 (4):1213–1243. DOI: https://doi.org/10.1111/0022–1082.00051.

42.

43. Merna, T., Al-Thani, F. F. (2011). Corporate risk management. West Sussex: John Wiley & Sons. 440 p.

44.

45. OCEG Red Book 2.1 ( [s.a.]). URL: http://www.oceg.org.

46.

47. Pisello, T., Strassmann, P. (2003). IT Value Chain Management – Maximizing the ROI from IT Investments. New Canaan, Connecticut: Information Economics Press.

48.

49. Prokop, J. (2010). Contemporary economic theories of the firm. Warsaw: Warsaw school of economics. 2010. 61 p.

50.

51. SOLVENCY II ( [s.a.]). URL: http://www.eur-lex.europa.eu.

52.

53. Strassmann, P. (1997). The Squandered Computer: Estimating the Business Alignment of Information Technology. New Canaan, Connecticut: The Information Economics Press. 402 p.

54.

55. Stulz, R. M. (1996). Rethinking risk management. Journal of applied corporate finance. 9 (3):8–25. DOI: https://doi.org/10.1111/j.1745–6622.1996.tb00295.x.

56.

57. Sung, J. (2005). Optimal contracts under adverse selection and moral hazard: a continuous-time approach. The Review of Financial Studies. 18 (3):1021–1073. DOI: 10.2139/ssrn.274543.

58.

59. Wagner, C., Mylovanov, T., Troger, T. (2015). Informed-principal problem with moral hazard, risk neutrality, and no limited liability. Journal of Economic Theory. 159:280–289. DOI: 10.1016/j.jet.2015.05.004.

60.

61. Williamson, O. (2002). The Theory of the Firm as Governance Structure: From Choice to Contract. Journal of Economic Perspectives. 16 (3):171–195. DOI: 10.1257/089533002760278776.

62.

63. Williamson, O. E. (1970). Corporate control and business behavior. Prentice Hall. 196 p.

64.

65. Yazdipour, R. (2011). Advances in Entrepreneurial Finance. New York: Springer Science + Business Media, LLC. 254 p.

About the Author

V. A. MakarovaRussian Federation

PhD in Economics, Associate Professor of department of finance, National Research University Higher School of Economics.

Review

For citations:

Makarova V.A. OPTIMIZATION OF INVESTMENTS IN CORPORATE RISK MANAGEMENT. Strategic decisions and risk management. 2019;10(3):220-227. https://doi.org/10.17747/2618-947X-2019-3-220-227