Scroll to:

THE IMPACT OF DOWNSIZING ON THE BANKRUPTCY OF RUSSIAN COMPANIES

https://doi.org/10.17747/2618-947X-2019-2-134-143

Abstract

Links between staff reductions and the company’s bankruptcyare identified. The empirical base of research included 650 companies (150 bankrupts) in the manufacturing industry and 1,500 companies (410 bankrupts) in the construction industry. The logit model was implemented in the center of a research methodology. According to the research it was revealed that the reduction of staff by 3%, 5%, 7% and 10% leads to the company’s bankruptcy. Moreover, the meaningful factor of bankruptcy is the change in financial, physical and intangible resources used by company to reverse negative consequences of the stuff reduction.

For citations:

Fedorova E.A., Strelkov V.S. THE IMPACT OF DOWNSIZING ON THE BANKRUPTCY OF RUSSIAN COMPANIES. Strategic decisions and risk management. 2019;10(2):134-143. https://doi.org/10.17747/2618-947X-2019-2-134-143

1. INTRODUCTION

The Russian market is constantly moving under the influence of both external and internal factors. Companies operating in the market are required to comply with the rules and conditions of this market. In a rapidly developing information economy, the company needs to constantly develop in order to keep up with their competitors in the industry, as the models of financial insolvency forecasting are of interest to both internal and external users of the company. Accordingly, the prerequisites for bankruptcy, creation and optimization of forecasting models attract the attention of the scientific community. Basically, the works on this subject consider financial indicators, the change of which predicts the bankruptcy of companies. We look at the problem from the other side, adding to the analysis the nonfinancial indicators related to the size of the company.

Companies are made up of people working in them. Regardless of the industry and its own financial condition and legal form, the organization carries out staff restructuring. It is not necessarily related to financial problems, the reason may be the optimization of activities or the introduction of new information technologies. A number of questions arises: how does the number of employees and its change affect the work of the company? Are reductions an integral factor to be taken into account when designing insolvency forecasting models?

To emphasize the relevance of the research topic, we consider specific practical examples:

- in June 2017 G. Gref talked about plans for the Bank's staff: "33 thousand accountants worked in Sberbank, today we have 1.5 thousand of them, and only 500 people will work further". Six months later, the topic remained relevant: "If we look into our future, we now have 330,000 employees, but in 2025, I think we will have half of them." In this case, we see a certain strategy of work with personnel, which is clearly aimed at reducing its number.

- the representative of the Ulianovsk automobile plant announced plans for personnel as follows: "The functions of the office and maintenance of the main production for all enterprises of the site will be optimized by an average of 7%, or 611 people." This was followed by the explanation that the reductions were associated with plans to ensure the salaries growth for technical staff. Reduction of such number of employees can lead to an increase in the burden on the remaining ones, performance impairment and, accordingly, can negatively affect the quality of products, sales and operational cash flow.

The issue of staff reduction is relevant not only in terms of strategy, but also to reduce the possible risks for the company. In Russian practice, the staff is reduced in order to reduce costs to overcome financial problems. In reality, reductions do not always deliver a positive result (Fisher, White, 2000). On the contrary, there are additional risks of declining profitability as well as falling productivity (Niehoff, Moorman, Blakely et al., 2001).

In domestic and foreign science and practice, the question remains whether the reduction of personnel leads to the bankruptcy of the company. Supporters of the reduction believe that it has a positive impact on the position of the company in the market, helps the organization to increase productivity, reduce costs. For example, the positive aspects of companies' actions on reduction are considered (DeMeuse, Dai, 2013). Other studies, on the contrary, reflect negative trends after staff reduction: performance impairment, fall of customer satisfaction. The study (Goesaert, Heinz, Vanormelingen, 2015) revealed that the situation is not limited to the dismissal of some employees: the remaining ones may experience decadent moods, decreased confidence in work, creativity, which leads to a performance impairment in terms of one employee.

2. HYPOTHESES OF THE STUDY

To substantiate the boundaries of the use of the phrase "reduction of the number" we refer to the domestic legal framework. There are two possible scenarios for dissolution of the employment: on the initiative of the employee or the employer. Regarding the reduction, the law distinguishes two more concepts:

- reduction in the number of staff units, the dismissal includes some employees who occupy a certain position in the company;

- reduction of staff of the organization: all employees holding similar positions in the company fall under dismissal (Labor code, 2001, article 81).

Of course, there is a special difference in the qualitative assessment of the reductions, but for us it is important the fact of mass reductions, which will vary in percentage terms of the total number of employees in the company, namely 3, 5, 7 and 10%.

We understand the reduction as a decrease in the number of personnel in order to normalize and optimize the financial condition of the company. Further, we consider several hypotheses.

Hypothesis 1. Companies that have made stuff reduction are more likely to declare bankruptcy than companies that have not made reductions.

Reduction can lead to both positive and negative changes in the company. There are opinions that the reduction does not affect the probability of bankruptcy:

- optimization of the number of personnel is aimed at increasing efficiency by reallocating available resources to achieve the goals (Glazova, 2016);

- the reduction leads to positive changes in the company caused by the optimization of the number of personnel, reduction of daily expenses of the company (Arshad, 2016).

Most authors tend to believe that the corporate restructurings leads to irreversible changes that increase the probability of bankruptcy. As a result of planned changes in the number of

personnel, the company's productivity does not increase, and sometimes decreases (Matsaev, 2015). The rest of the staff is losing confidence in the management, valuable staff involved in the production is leaving, that leads to financial losses that are impossible to calculate (Bezrukova, Borisov, Shanin, 2012). Firms that reduce staff, hoping to improve their efficiency, are struggling with negative consequences (Goesaert, Heinz, Vanormelingen, 2015). They, in turn, can lead to the insolvency of the firm.

Summing up the interim result, we can say that the reduction is a large-scale change that can lead to the bankruptcy of the company.

To substantiate our hypothesis, in addition to a literature review, we present aspects that are affected by staff reduction.

Psychological aspect. The reduction increases the burden on the remaining staff, causing stress and possible loss of confidence in management (Yu, Park, 2006). The remaining staff in conditions of constant pressure and increased attention of management to the activities of employees has the decreasing interest in the effective activities of the company, which can lead to a drop in the productivity of the entire company.

Social capital of the company. "Social capital, which is the relationships and connections between employees that improve the quality of their interaction, as well as resources that facilitate access to a variety of sources of information, provides an effective process of mutual transformation of human and intellectual capital" (Kharin, 2017). It is a competitive advantage in the market, high social capital is necessary for building daily activities within the company. With the reduction, the links are being broken, mutual understanding between groups within the organization is lost, the time of transmission and acquisition of knowledge increases, which in turn leads to an increase in the production cycle. The production cycle includes time and affects the timing of achieving the goals set by the organization.

Hypothesis 2. The company neutralizes the negative consequences of staff reduction by changing the available financial, physical and immaterial resources.

The reduction of employees can lead to destabilization of the financial condition of the company. The company is trying to smooth out the negative consequences of the decline in financial stability at the expense of available resources. Such resources are divided into 3 main types: immaterial, financial, and physical resources (Zorn, 2017). In our work we will consider separately the impact of the reduction of each type of resource on the probability of bankruptcy, as well as the specific impact of certain types of resources on various industries.

Hypothesis 2.1. Reduction of immaterial resources increases the probability of bankruptcy.

In modern Russian practice, immaterial assets are treated as certain assets of the organization that meet the requirements specified in the legislation, the main of which is the ability to bring economic benefits in the course of core business (Order 2007). Like any other assets, they should bring economic benefits through their use in production, either by themselves or by their influence. Surely, immaterial assets cannot be quickly converted into cash, but at the same time they are not less valuable to the organization. Immaterial assets include: the developed software, inventions, subtleties of process engineering, business reputation. They are important competitive advantages of the company, they are difficult to quantify and reflect in the financial statements of the company. Some firms do not formally have such assets, but they have "brand strength", reputation can also be attributed to immaterial assets, but it is also not always reflected in the balance sheet.

The main feature of immaterial assets is their flexibility. After the reduction of immaterial assets can serve as a means to overcome the crisis, the reputable brands in the market will be able to more easily establish partnerships, get additional funding (Norman, Butler, Ranft, 2013). Therefore, their reduction can lead to changes in the financial condition of the company, the increase in the probability of bankruptcy: firms can sell their patents, their own inventions to get money to solve faced issues. At the same time, they are deprived of competitive advantages in the market, which, in turn, leads to a deterioration of the company's position in the market, and therefore even greater financial difficulties and an increase in the probability of bankruptcy.

Hypothesis 2.2. Reduction of financial resources increases the probability of bankruptcy.

As early as the first foreign works on the creation of predictive models used the financial indicators. (Altman, 1968; Taffler, Tisshaw, 1977, Springate, 1978). The works of E.A. Fedorova (2016) and L. Chiaramonte, B. Casu (2017) describe the high predictive accuracy of determining bankruptcies based on financial indicators: liquidity ratios, coverage and autonomy ratios, these indicators reflect the main aspects of the company's life, namely solvency and financial efficiency. If these financial indicators deteriorate, it is an indicator of possible difficulties, such as inability to pay off the debts, which affects the position of the company in the market.

Hypothesis 2.3. Reduction of physical resources increases the probability of bankruptcy.

Physical resources - buildings, machines, production lines, which are directly used in the production process. The organization may lease its property and sell it (Eisenhardt, Martin, 2000). All these actions are reflected in the statements, so when the company sells part of its assets, you can judge the deteriorating financial condition of the company, as the companies sell liquid specific equipment to get more money to cover, for example, their debts. This is what leads to a stop or deterioration of products and an increase in production time. Therefore, the reduction of physical resources directly affects the company's activities.

Hypothesis 3. The impact of a reduction in a certain type of resource on the probability of a company's bankruptcy depends on its industry.

The accuracy and applicability of the models depends on the industry, for each industry the model needs to be adjusted (Ilysheva N. N., Kim N. V, 2007). It is impossible to create a model that would be common for any company. Each industry is looking for its resources related to the overcoming the crisis, as for financial resources, the models with their use are different for each industry (Sayari, Mugan, 2017). From here we conclude that the impact of certain types of resources will depend on the industry.

3. МЕТОДОЛОГИЯ ИССЛЕДОВАНИЯ

To evaluate the data and to analyze the hypothesis, we took a binary choice model, which is often used to assess the probability of insolvency of companies both in the classical works of R. Taffler and G. Springate, and in modern studies (Tian, Yu, Guo, 2015; Fedorova, Dovzhenko, Fedorov, 2016). We applied a model where the dependent variable can take only two values, in our case - 1 and 0:

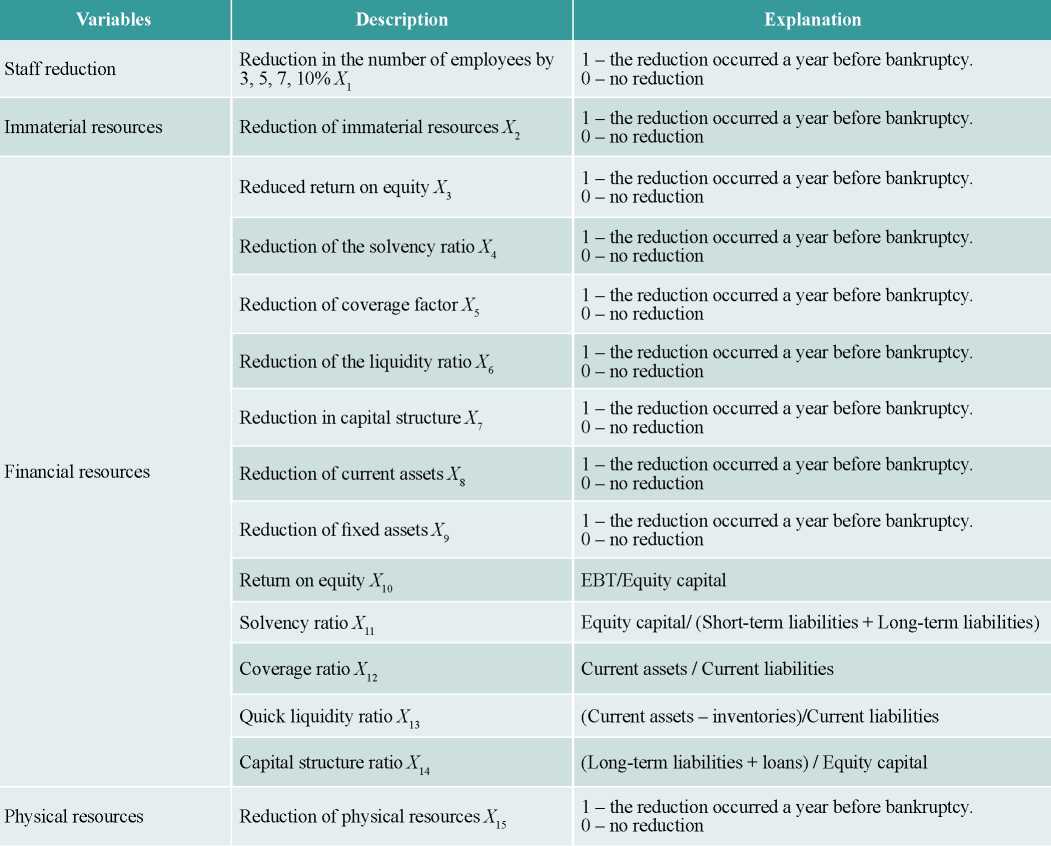

where а0 - constant; аi - coefficients before the corresponding parameters; Xi - staff reduction; Х2 - reduction of immaterial resources; X3-14 - reduction of financial resources (see table. 1); X15 - reduction of physical resources. If Y=0, the enterprise is healthy, if Y=1, the enterprise is bankrupt.

Tabulation 1

Description of variables used in the model

4. DATA ANALYSIS

To test our hypotheses, we collected two different samples. The first sample consisted of 650 companies in the manufacturing industry, including 150 bankrupts, the second — 1500 companies in the construction sector, with 410 bankrupts. The data was collected using the RUSLANA database. For bankrupt companies we collected data for 2 years, i.e. for our model we calculated all the indicators for the year before bankruptcy.

Firms were selected only by the number of staff (at least 200 people). We identified the reduction with the dismissal of more than 3, 5, 7, 10% of the staff, the minimum threshold for 3% was chosen based on the study (Zorn, Norman, Butler et al., 2017).

We would like to note the difficulties that have arisen in the calculation of some indicators. In the work (Zorn, Norman, Butler et al., 2017) immaterial resources were calculated as

R = (V + X + Kр) С,

where R - immaterial resources; V - capitalisation; X - total debt; Kp - cost of preferred stocks settlement; C - balance sheet assets.

At the first stage, we collected an array of companies whose shares are traded on the stock exchange. Since there were very few bankrupts and the model was incorrect, we abandoned the specified condition and estimated immaterial assets on the balance sheet line (1110).

We also used the formula used in the evaluation of physical means (Adler, Capkun, Weiss, 2013).

R = N/A, (3)

where R - physical assets; N - fixed assets value; and; А - assets.

5. RESEARCH RESULTS AND DISCUSSION

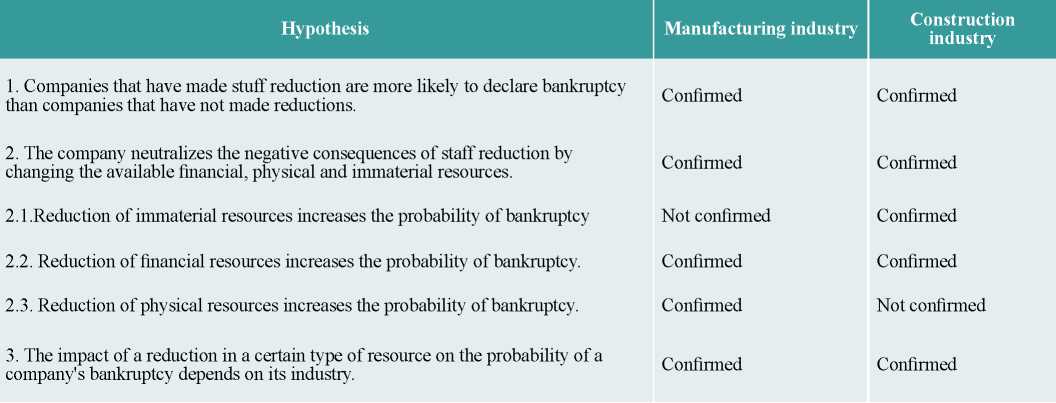

Tabulation 2

Research results for the manufacturing industry with staff reductions of 3, 5, 7 and 10%

* Significance level 10%, 0,05 < p < 0,10.

** Significance level 5%, 0,01 < p < 0,05.

*** Significance level 1%, 0 < p < 0,01.

Based on the data obtained, we can predict the bankruptcy of the company according to the formula:

Y = -1,1 + 1,07X1 + 0,37X3 + 0,75X4 - 0,0496X9 - 0,19X12 + 0,22X13 - 0,001X14 - 0,0015X15 , Y > 0, company is a bankrupt.

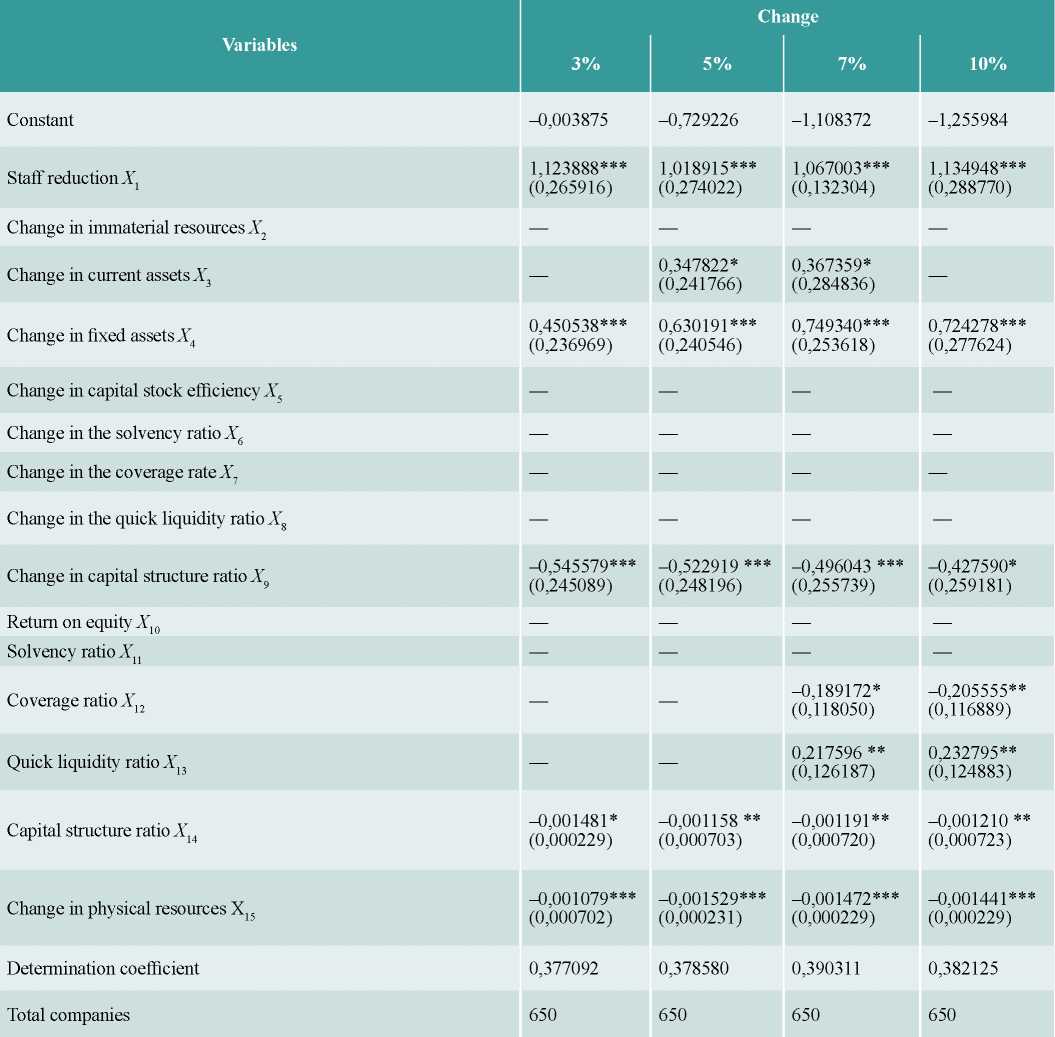

Tabulation 3

Research results for the construction industry with staff reductions of 3, 5, 7 and 10%

*Significance level 10%, 0,05 < p < 0,10.

** Significance level 5%, 0,01 < p < 0,05.

*** Significance level 1%, 0 < p < 0,01.

Here is an example for a 5% reduction:

Y = -0,73 + 0,493Х1 - 0,68Х2 - 0,624Х3 + 0,178Х5 - 0,352Х6 - 0,362Х9 - 0,0018Х10 - 0,005Х11 + 0,113Х13 - 0,003Х14, Y > 0, enterprise is a bankrupt.

To analyze the dependence, we used logistic regression, the results are presented in table. 2.

The reduction of personnel significantly affects the probability of bankruptcy of the company at the 1 % level of significance. This trend can be seen with any reduction in staff: at 3, 5, 7, 10%. Thus, for Russian companies, the reduction of personnel clearly leads to potential bankruptcy due to the reduction of significant personnel. The higher the percentage of staff reduction, the more it affects the probability of bankruptcy (coefficient a1 increases).

Immaterial assets appeared to be insignificant for the manufacturing industry compared to other types of resources, as companies do not have patents and other possible similar assets that they could sell and release some of the money.

It can also be assumed that the aggregate amount of immaterial assets is small relatively to the total amount of assets compared to other resources.

The change in physical resources, on the contrary, is significant at the 1 % significance level which can be explained by the industry specifics, the production requires machines and production lines. The activities of companies that have lost even a part of liquid equipment can lead to a fall in production and further to the bankruptcy of the company, which will inevitably lead to a laying-off of production, and it can grow into bankruptcy.

The results obtained for financial resources prove numerous studies on their significance for insolvency forecasting (James, 2016). Even minimal changes in financial ratios have negative consequences. At the level of 1%, the change in the capital structure coefficient was significant, and the capital structure coefficient itself, the solvency coefficient was also significant at the level of 1 %. Financial resources and their changes affect the probability of bankruptcy.

In table. 3 the results for the construction industry are presented.

As for the manufacturing industry, the reduction of personnel in the construction industry leads to an increase in the probability of bankruptcy of the company, the significance of this ratio remains at 1 % for each percentage level (3, 5, 7, 10% of staff reduction. A feature of this industry is the importance of the impact of material assets on the probability of bankruptcy. The loss of even 3 % of immaterial resources is as significant as a similar reduction in staff.

The change in physical resources turned out to be insignificant, it is impossible to say about the probability of bankruptcy on this indicator, because it does not have a significant impact on this process.

If we consider financial resources, it is worth highlighting the importance of changes in fixed assets at a level of resource reduction of more than 7%. The solvency coefficient is also significant even with minimal changes, this is due to the financial model of the construction business, it is conducted on borrowed capital, violation of the capital structure definitely leads to the announcement of the company bankrupt.

(Federal law 2004). For the construction industry, as well as for the production, the fact of the influence of financial indicators on the probability of bankruptcy was confirmed, which also confirmed the conclusions of the work (Fedorova, Fedorov, Khrustova, 2016) for the construction industry. The only difference is in the choice of certain financial ratios as indicators of bankruptcy.

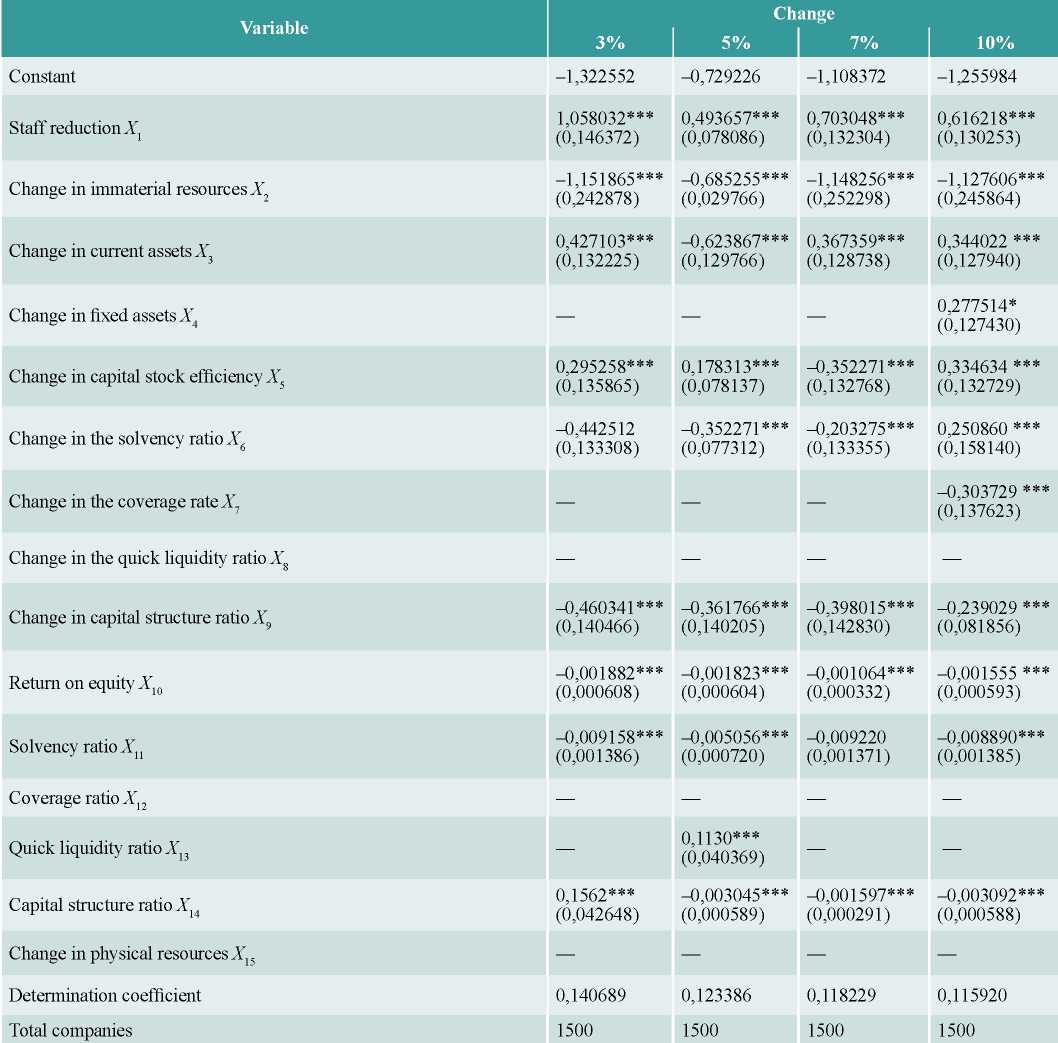

Summing up, having analyzed all the above data, we generalized the hypothesis testing (table. 4).

Our hypothesis No. 1 was confirmed for both industries, we confirmed the importance of the impact of staff reductions for values of 3, 5, 7, 10% (for comparison: in the work (Zorn, Norman, Butler et al., 2017) a similar conclusion is made for 3%). The change in the company's resources serves as an important indicator of the trend towards bankruptcy (this confirmed hypothesis 2). The analyzed changes in the three types of assets did not give a homogeneous result, only a decrease in financial resources for any industry can be considered significant in identifying bankruptcy (hypothesis 2.2 is confirmed). In respect of immaterial resources, the hypothesis was confirmed only for the construction industry, in respect of physical resources - for the manufacturing industry: Not all companies have a large amount of physical resources on the balance sheet, and therefore the significance of their changes to the activity is minimal (hypothesises 2.1 and 2.3 are applicable for certain industries and not for any company), that's why these hypotheses were not confirmed. We can say that in the preparation of forecasting models and the choice of resources for observation, it is necessary to take into account the belonging of the company to a certain industry, there are no universal models for any industry. According to the significance, the individual types of resources prevail over others, based on the area in which the company operates (hypothesis 3 is confirmed).

Tabulation 4

The results of testing hypotheses

We assessed the impact of immaterial, financial and physical resources in only two sectors. The main attention is paid to the reductions, their impact on the activities of companies, as well as their importance in identifying trends to bankruptcy. For example, the deterioration of the financial condition could lead to a reduction of the staff, but the primary was just the changes in financial indicators. Therefore, it is impossible to consider the reduction as an accurate indicator in identifying the probability of bankruptcy, but there are cases when layoffs were a factor that led to the destabilization of the company.

Thus, the models of bankruptcy forecasting should take into account the indicators of staff reduction and changes in physical assets and immaterial resources.

6. CONCLUSION

The issue on the fact, that the reduction is an important indicator in identifying trends to financial difficulties is important for making further decisions in the anti-crisis management of the company. We have demonstrated the impact of staff reduction on the company's bankruptcy. We also presented facts that show the specifics of the choice of resources of a certain type to prevent insolvency related to the industry specifics of the company.

In our study, the key results were the following:

- the impact of any reduction (by 3, 5, 7 and 10%) on the probability of bankruptcy of the company, which was proved by the example of two industries.

- the reduction of physical, financial and immaterial resources has an impact on the probability of bankruptcy. The resources available to the company are used to overcome the crisis.

- The choice of resources is related to the industry affiliation of the company. The importance of resources of a certain type depends on the industry, for the construction industry, immaterial resources are important, and for the manufectoring - physical.

The resulting coefficients can be used to create models for selected areas, taking into account staff reductions as a new indicator for crisis management and strategic decision-making in the company.

References

1. Bezrukova T. L., Borisov A. N., SHanin I. I. (2012). Sovershenstvovanie upravleniya effektivnym razvitiem ekonomicheskoj deyatel'nosti predpriyatij // Obshhestvo: politika, ekonomika, pravo. № 3. S. 45–52. [Bezrukova, T. L., Borisov, A. N., Shanin, I. I. (2012). Improving the management of the effective development of the economic activity of enterprises. Society: politics, economics, law. 3:45–52. (In Russ.)].

2. Glazova M. V. (2016). Analiz potenciala razvitiya i otnosheniya k predprinimatel'stvu v nacional'nykh ekonomik // Teoriya i praktika. № 9. S. 129–137. [Glazov, M. V. (2016). Analysis of the potential for development and attitudes towards entrepreneurship in national economies. Theory and Practice. 9:129–137. (In Russ.)].

3. Ilysheva N. N., Kim N. V. (2007) Matematicheskaya model' opredeleniya normativov finansovykh pokazatelej // Finansy i kredit. N 31 (271). S. 80–87. [Ilysheva, N. N., Kim, N. V. (2007). Mathematical Model for Determining the Ratios of Financial Indicators. Finance and Credit. 31(271):80–87. (In Russ.)].

4. Macaev E.V. (2015). Razrabotka metoda prinyatiya upravlencheskogo resheniya na baze zaprogrammirovannykh upravlencheskikh reshenij (na primere upravleniya MSP) // Ekonomika i predprinimatel'stvo. № 4-1. S. 950–953. [Matsaev, E. V. (2015). Development of a management decision-making method based on programmed management decisions (on the example of SME management). Economics and Entrepreneurship. 4-1:950–953. (In Russ.)].

5. Fedorova Е. A., Fedorov F., KHrustova L. Е. (2016). Prognozirovanie bankrotstva predpriyatij na primere otraslej stroitel'stva, promyshlennosti, transporta, sel'skogo khozyajstva i torgovli // Finansy i kredit. № 43 (715). S. 14–27. [Fedorova E. A., Fedorov F., Khrustova L. E. (2016). Prediction of bankruptcy of enterprises on the example of the construction, industry, transport, agriculture and trade sectors. Finance and credit. 43(715):14–27. (In Russ.)].

6. Nalogovyj kodeks Rossijskoj Federacii (chast' pervaya) ot 31.07.1998 N 146-FZ (red. ot 27.12.2018) // KonsultantPlyus. [The tax code of the Russian Federation (part one) of 07/31/1998 N 146-FZ (as amended on 12/27/2018). ConsultantPlus. (In Russ.)]. http://www.consultant.ru/document/cons_doc_LAW_19671/.

7. Prikaz Minfina RF ot 27.12.2007 N 153n «Ob utverzhdenii Polozheniya po bukhgalterskomu uchetu “Uchet nematerial'nykh aktivov” (PBU 14/2007)» (s izmeneniyami i dopolneniyami) // KonsultantPlyus. [Order of the Ministry of Finance of the Russian Federation of 27.12.2007 N 153n “On approval of the Accounting Regulations “Accounting for intangible assets” (PBU 14/2007)" (with amendments and additions). ConsultantPlus. (In Russ.)]. http://www.consultant.ru/document/cons_doc_LAW_63465/.

8. Trudovoj kodeks Rossijskoj Federacii ot 30.12.2001 N 197-FZ (red. ot 27.12.2018) // KonsultantPlyus. [Labor Code of the Russian Federation of December 30, 2001 No. 197-FZ (as amended on December 27, 2018). ConsultantPlus. (In Russ.)]. http://www.consultant.ru/document/cons_doc_LAW_34683/.

9. Federal'nyj zakon ot 30.12.2004 N 214-FZ (red. ot 25.12.2018) «Ob uchastii v dolevom stroitel'stve mnogokvartirnykh domov i inykh ob"ektov nedvizhimosti i o vnesenii izmenenij v nekotorye zakonodatel'nye akty Rossijskoj Federacii» // Konsul'tantPlyus. [Federal Law of 30.12.2004 N 214-ФЗ (as amended on 12.25.2018) “On participation in the shared construction of apartment buildings and other real estate objects and on introducing amendments to certain legislative acts of the Russian Federation”. ConsultantPlus. (In Russ.)]. http://www.consultant.ru/document/cons_doc_LAW_51038.

10. Kharin, A. G. (2017). Social capital of an organization: the concept and methods of evaluation. Economic Analysis: Theory and Practice. 16(4):711–725.

11. Adler, B. E., Capkun V., Weiss, L. A. (2013). Value destruction in the new era of Chapter 11. Journal of Law, Economics, and Organization. 29(2):461–483.

12. Altman, E. I. Financial Ratios (1968). Discriminant Analysis and the Prediction of Corporate Bankruptcy. Journal of Finance. 589–609. DOI: https://doi.org/10.1111/j.1540-6261.1968.tb00843.x.

13. Arshad, R. (2016). Psychological contract violation and turnover intention: Do cultural values matter. Journal of Managerial Psychology. 31(1):251–264. DOI: 10.1108/JMP-10-2013-0337.

14. Chiaramonte, L., Casu, B. (2017). Capital and liquidity ratios and financial distress. Evidence from the European banking industry. The British Accounting Review. 49(2):138–161. DOI: 10.1016/j.bar.2016.04.001.

15. De Meuse, K. P., Dai, G. (2013). Organizational downsizing: Its effect on financial performance. Journal of Managerial Issues. 25(4):324–344.

16. Eisenhardt, K. M., Martin, J. A. (2000). Dynamic capabilities: What are they? // Strategic Management Journal. 21(10/11):1105–1121. DOI: https://doi.org/10.1002/1097-0266(200010/11)21:10/11<1105::AID-SMJ133>3.0.CO;2-E.

17. Fisher, S. R., White, M. A. (2000). Downsizing in a learning organization: Are there hidden costs? Academy of Management Review. 25(1):244–251.

18. Goesaert T., Heinz, M., Vanormelingen, S. (2015). Downsizing and firm performance: Evidence from German firm data. Industrial and Corporate Change. 24(6):1443–1472.

19. James S. D. (2016). Strategic bankruptcy: A stakeholder management perspective. Journal of Business Research. 69(2): 492–499. DOI: 10.1016/j.jbusres.2015.05.006.

20. Norman, P. M., Butler, F. C., Ranft, A. L. (2013). Resources matter: Examining the effects of resources on the state of firms following downsizing. Journal of Management. 39(7):2009–2038.

21. Sayari, N., Mugan, C. S. (2017). Industry specific financial distress modeling. BRQ. Business Research Quarterly. 20(1):45–62. DOI: https://doi.org/10.1016/j.brq.2016.03.003.

22. Springate, G. L. V. (1978). Predicting the Possibility of Failure in a Canadian Firm: Unpublished M.B.A. Research Project / Simon Fraser University.

23. Taffler, R. J. Tisshaw, H. J. (1977). Going, Going, Gone, Four Factors Which Predict. Accountancy. 88:50–54.

24. Tian, S., Yu, Y., Guo, H. (2015). Variable selection and corporate bankruptcy forecasts. Journal of Banking & Finance. 52:89–100. DOI; http://dx.doi.org/10.1016/j.jbankfin.2014.12.003.

25. Yu, G. C., Park, J. S. (2006). The effect of downsizing on the financial performance and employee productivity of Korean firms. International Journal of Manpower. 27(3):230–250. DOI: https://doi.org/10.1108/01437720610672158.

26. Zorn, M. L., Norman, P. M., Butler, F. C. et al. (2017). Cure or curse: Does downsizing increase the likelihood of bankruptcy? Journal of Business Research. P. 24–33. DOI: https://doi.org/10.1016/j.jbusres.2017.03.006.

About the Authors

E. A. FedorovaRussian Federation

Doctor of Economics, Professor of the Department of Corporate Finance and Corporate Governance of the Financial University under the Government of the Russian Federation, Professor, School of Finance, National Research University Higher School of Economics. Research Interests: economic and mathematical methods and models, finance, behavioral finance.

V. S. Strelkov

Russian Federation

Student, Faculty of Management, Financial University under the Government of the Russian Federation. Research interests: the formation of management decisions, crisis management, industry characteristics of companies

Review

For citations:

Fedorova E.A., Strelkov V.S. THE IMPACT OF DOWNSIZING ON THE BANKRUPTCY OF RUSSIAN COMPANIES. Strategic decisions and risk management. 2019;10(2):134-143. https://doi.org/10.17747/2618-947X-2019-2-134-143