Scroll to:

INTERNATIONAL MARKET EXPANSION

https://doi.org/10.17747/2078-8886-2018-4-20-35

Abstract

In article various theoretical aspects of an exit of the companies on the foreign markets are considered. Influence of globalization on productivity of the companies is considered, ways and factors of a choice of strategy of an exit to the world market are analysed. The behavioural and cultural aspects influencing strategy of an exit to the world market are analysed. The analysis of strategy of the companies which have entered the foreign markets, is carried out taking into account the previous researches in this area.

The following conclusions became result of research: 1) globalization positively influences the companies as the market increases, however the small companies and the companies in emerging markets lose in competitive fight; 2) the companies with considerable experience are inclined to choose strategy of opening of own enterprise while the organizations without similar experience prefer export or joint venture in the host country territory; 3) the strategy choice with a bigger involvement of resources is directly proportional to knowledge of culture of the country to which there is a company. At entry into the market with other culture smooth adaptation is necessary for successful realization of strategy. At last, people are inclined to make behavioural mistakes, and knowledge of them and continuous control will help to achieve successful results; 4) for an exit and successful work in the foreign markets of the company important not only to possess competences, but also to be able to protect them and to keep in time; 5) on the market with high political and investment risks, and also adverse economic conditions of the company are inclined to choose strategy with the minimum investment of money (franchizes, licensing).

Keywords

For citations:

Volodin Yu.V., Podkovyrov P.A. INTERNATIONAL MARKET EXPANSION. Strategic decisions and risk management. 2018;(4):20-35. https://doi.org/10.17747/2078-8886-2018-4-20-35

INTRODUCTION

In accordance with microeconomic theory, the main goal of the company is to maximize profits, which is achieved by its growth and development. This goal can be achieved in different ways. One of the possible ways is a company's entry onto the international level. The making of this decision is influenced by two groups of factors. Firstly, these are push factors, which are caused by the lack of opportunities in the companies’ development on the local market due to the existing restrictions. Secondly, these are pull factors caused by the better conditions for the development of business abroad [Trachuk, 2014a],

Each firm and market is specific. Therefore, this article will study the experience of different companies entering foreign markets, which will be adapted and applied to Russian and German companies.

The main objective of this paper is to study the strategies for companies to enter foreign markets and identify their subsequent use by German and Russian companies.

In carrying out this research we did not find a single study that focused specifically on Russian and German companies and on their strategies for entering foreign markets, which is why we consider this topic relevant. For the analysis the “case study” method was used (from the English “case study” - analysis of the situation). The main reason for choosing this method was the lack of public data necessary for quantitative analysis and the lack of the necessary resources to collect representative data.

The article has the following structure. In the first part the theoretical aspects of the companies’ entering foreign markets are considered along with the study of the impact of globalization, the analysis of methods and results of previous studies in the area of companies’ entry to international markets.

The second part describes the methodology of this study. Further, the analysis of the specifics of the Russian and German markets was carried out together with the comparison of strategies of German and Russian companies for entering international markets based on the previous research.

In conclusion the proposals for further research were reviewed and the results summarized.

THEORETICAL REVIEW

The impact ofglobalization on the performance of companies

Speaking of entering the international markets one cannot but mention globalization. A massive trade liberalization and financial integration, as well as technological progress, have made the term “globalization” one of the most popular in the 21st century. As a rule, this concept is understood as the process by which the perception of social reality is interpreted as a single whole [Robertson R, 1992]. Globalization also refers to the development of closer economic and political ties between countries1. Globalization is not a new phenomenon, but this process has accelerated significantly in the recent centuries. It is important to consider the impact of globalization on the activities of companies, because it is inextricably linked with the companies’ entering the international market.

De and Pal (2011) define the concept of “globalization” as the process of opening up the economy to the outside world, which promotes trade, reduces various barriers to an increased mobility of goods, production factors and labor. This is a process of integration of economies through economic, social and political processes [De U. K., Pal M., 2011 ].

The developed and developing countries have different consequences of globalization. For example, the Russian Federation is classified by the World Bank as a developing country with a high level of income, while Germany belongs to the developed countries with high income. At the same time, the World Bank’s methodology is based only on gross national income, which can be debatable, but given that other economic and social indicators, such as the quality of life, life expectancy and mortality among children, are closely correlated with GNI, which makes GNI acceptable and easy for the ranking of countries2.

In particular, on should consider the impact of globalization on the performance of companies. Karadagli (2012) examines the financial performance of companies in seven developing countries (Brazil, China, India, Indonesia, Mexico, Russia and Turkey) using the data for the period 1998-2009. The results of the study indicate that the overall level of globalization significantly improves financial performance. In addition, the political dimension of globalization is the most significant. The research method is based on the building of regression where the stock market index is used as an indicator characterizing the results of the company’s performance, as well as globalization data obtained from the KOF index developed by Dreher (2006). A regression model with random effects demonstrates that the effect of globalization has a positive impact on the company’s performance with the level of significance of I %. Apolitical and social globalization is a significant parameter of the model with a positive beta coefficient and significance levels of 5 % and I %, respectively [Karadagli E. C, 2012].

Similar results were obtained by Akinola (2012), who investigated the impact of globalization on the performance of banks in Nigeria. The results showed a significant and positive effect of globalization; in particular, high profitability was obtained by covering most of the market both on the local and foreign markets [Akinola G. O., 2012]. On the other hand, Kaplinsky (2004) notes that globalization forms the global market for companies, which increases competition and kills companies on emerging markets, as they lag far behind the equivalent companies on more developed markets [Kaplinsky R., 2004].

Another study by Acheampong et al. (2000) focuses on how increasing globalization affects the equation of profits among global firms in the tobacco and beverage industry, as well as food and consumer goods (here, the equation refers to the microeconomic hypothesis which states: with increasing competition profits decrease and reach zero with perfect competition.) In the survey results it was noted that in the tobacco and beverage industry there was no significant correction in profits, while in the sector of food and consumer goods there was a different equation of profits depending on the country. Moreover, the authors noted that the smaller the firm, the greater the risk of not making a profit in the process of globalization [Acheampong Y. J. et al., 2004].

Peltonen (2008) studied the impact of import penetration on the performance of companies in 15 manufacturing sectors in 10 developed eurozone countries from 1955 to 2004. As a result of the study it was noted that import competition in general had a negative effect on the profitability of companies in the euro area in the manufacturing sector, especially for imports from Russia and China [Peltonen T.A. et al., 2008]. On the other hand, Georgiou (2011) analyzed the impact of imports on company profitability (ROE) from 1999-2009 using the generalized least squares method and confirmed the positive impact of globalization on the profitability of companies in Europe, particularly in Germany [Georgiou M.N., 2009].

The results of previous studies make it obvious that not only globalization, but also other factors affect the performance of companies on foreign markets. And this, in turn, reinforces the importance of focusing the attention of managers on the strategies for entering foreign markets. Moreover, as noted by De Pal (2011), such country-specific characteristics as production capacity and quality are important [De U.K., Pal M., 2011]. Summary findings are presented in Table I.

Table 1. A summary of the impact of globalization

Author | The main conclusion of the study |

|---|---|

Karadagli (2012) | The level of globalization has a positive impact on the financial indicators of developing countries. The most significant indicator affecting companies is the level of political globalization. |

Akinola (2012) | Globalization has a significant and positive impact on the Nigerian banking market. This impact arises from covering most of the market. |

Kaplinsky (2004) | Globalization causes increased competition, which kills companies on the emerging markets, as they lag far behind the equivalent companies on more developed markets. |

Acheampong and others (2000) | In the tobacco and beverage industry there is no significant correction in profits with an increase in globalization, and in the production of food and consumer goods there is a significant reduction in profits. |

Peltonen (2008) | An increased import competition in 10 eurozone countries has a negative impact in the manufacturing sector |

Georgiou (2011) | Obtained opposite results studying all European countries |

Source: Compiled by the authors

The peculiarities of entry into international markets by individual companies

Any company that thinks of entering a foreign market should resolve the following questions: I) which foreign market should be chosen? 2) When to enter the market? 3) What is the way to enter the foreign market? [Hill C., 2008].

Which foreign market to choose?

First of all, it is necessary to consider the macroeconomic situation. Further, the attractiveness of a country as a market for international business depends on the ratio of advantages of this market and potential costs, as well as on the level of risks associated with the implementation of the project. One should also pay attention to the following factors: the size of the market, the purchasing power of the country's population and potential future growth [Collis D. J., 2003]. Another equally important factor is the value that international business can bring. It depends on the sustainability of the product on the market and its sustainable competitive advantage.

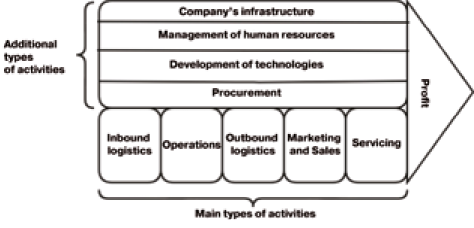

The term "competitive advantage" was introduced by Michael Porter in 1985. In accordance with his approach, a competitive advantage stems from the company's ability to create value for the buyer, which will exceed the cost of the product’s creation. The company's activities are divided into the main and auxiliary (Fig. I) [Porter M.E. et al., 1985].

Fig. 1. Porter's model

Source: Porter М. (1985)

Nevertheless, the competitive advantage alone is not enough for the company's long-term market leadership [Trachuk, Linder, 2014]. Barney (1991) developed a VRIO-approach that defines a set of required characteristics that can create a sustainable competitive advantage. In accordance with this approach, the company's resources should have value, rarity, inability to imitate and indispensability. The value of such resources lies in the fact that their combination makes it possible to neutralize potential threats from competitors and, on the other hand, to use the emerging opportunities [Barney J., 1991]. Such properties are necessary for the sustainable development of companies on the international market. The lack of a complete list of product characteristics can be dangerous for the company's existence, since it does not guarantee a stable future.

For example, the advantage of the company DJI, which produces drones, over its competitors is achieved by providing more valuable products while remaining a relatively cheap product compared to competitors [Popper B., 2015]. Innovative technologies allow the company to operate as efficiently as it does. They have a rarity and indispensability. Firstly, the competitors need much more time to develop a similar product. Secondly, innovations are protected by patents, and in case of unfair competition, the judiciary will prevent illegal actions [Tilley A., 2016]. Considering the fact that DJI adds new characteristics in each subsequent model and leads the market, the innovative technology is difficult to replace with something at the moment [Shao H., 2016]. Now the competitors on the international market do not have an opportunity to imitate such technology, although in the future another approach may be invented that satisfies the same needs of buyers. In general, it can be said that at the moment innovative technologies are a sustainable competitive advantage. The possession of this property allowed DJI to conquer the global market and to remain the leader in its niche. For the subsequent development of strategies for entering foreign markets Russian and German companies should take into account this case of the DJI company.

When to enter the market?

The next step is the selection of the most optimal time to enter a foreign market. An early penetration is characterized by the fact that the company appears to be the first on the new market. A late penetration is characterized by the fact that at the moment when the company is going to expand into a new foreign market this market has already been formed and there are competitors on it. The pioneer company can get a very promising opportunity of an access to the most profitable channels in order to sell its product in a given country. In the theory of strategic management this is called diffusion (a process in which information about the product spreads through channels in the society that have four key aspects: innovation, communication channels, time, and social system) [Rogers E.M., 2002].

Being a pioneer, a company entering the international market and can receive the advantages mentioned by Lieberman and Montgomer (1998): significant market share, brand value, product differentiation [Lieberman M. B., Montgomery D..B., 1998]. On the other hand, Geroski and Markides (2005) dispute the pioneering strategy's rationality, since innovators face great market uncertainties and may go bankrupt if the dominant model of the product has not yet been created [Markides C., Geroski P., 2005]. Moreover, on rapidly developing markets it is difficult for pioneers to retain leadership for a long time [Johnson G., 2016]. Finally, a Chinese proverb says: “Be the second to exit, be the first to enter” [Tarasov, 2017].

Which way to choose

In addition to the timing of the market penetration another task is to determine how to penetrate foreign markets. There are the following main types of market entry: export, joint venture, franchising, takeovers.

Joint venture. The choice of the expansion method depends directly on the specifics of the market and the specific company. For example, at the end of the twentieth century General Motors, during a slump in sales, entered the Chinese market by creating a joint venture in China - Shanghai Automotive Industry Corp (SAIC). The results of this decision were impressive: the company sold about 900000 cars in 2007 on the Chinese market. How- ever, the choice of such form of cooperation was determined by the legislative regulation of that time [Hill C., 2008].

The advantage of joint venture is the obtaining of knowledge, business conditions and culture in the host country. It should be noted that the Western and Oriental leadership styles are radically different [Weldon E., Chow M., 2005]. Such differences can lead to serious conflicts within organization. Moreover, the payment for the acquired knowledge will be the lack of full control over the subsidiary. In the end, this leads to a struggle for power. Quinn and Lindblom were among the first to mention the use of power and political methods by managers in literature [Ahlstrand B., Lampel J., Mintzberg Tl., 2001]. In this situation it would be difficult for managers to make the right decision. Flowever, Mitchell, Agle, Wood, (1997) and Freeman (2010) proposed an approach that solves this problem [Mitchell R.K., Agle B.R., Wood D. J., 1997; Freeman R.E., 2010]. The manager should evaluate the influence of stakeholders by analyzing three components: legality, urgency and power. This approach makes it possible to divide stakeholders into the following groups according to their importance: having low significance (hidden), having medium importance (waiting) and having high importance, whose interests should be considered first of all [Trachuk, Linder, 2016 a].

Export. Many companies begin to expand into foreign markets as exporters and only after that turn to other types of internationalization, which allows them to strengthen the already achieved positions [Trachuk, 2017]. The advantages of exporting are the absence of significant costs associated with setting up production in a foreign market, as well as the fact that the exporting company can gain an advantage by saving on production volumes. On the other hand, such approach causes additional transaction costs associated with logistics, especially when it comes to bulky goods. In addition, import duties can make exports inexpedient from an economic point of view. Moreover, there is a possibility that in the future the state will increase import taxes, which will have a negative effect: this could further aggravate the situation if the company invested in the expansion of production. The next problem may arise during cooperation with a local organization that is responsible for sales and marketing: the counterparty may not perform its functions as well as the manufacturing company, which leads to a loss of profits [Hill C., 2008].

Franchising. Franchising can be a form of international business development, in which the franchisee has the right to use the brand, and also receives strict instructions on how to conduct business. The franchisor usually helps the business of its counterparty and in return receives royalties. McDonalds is a good example of a company that has developed through the use of franchise strategies [Dunning J.H., McQueen M., 1981]. The parent company controls how the franchisee works, the quality of products, the methods of cooking, conducts management trainings and financial counselling [Serwer A.E., 1994].

The main advantage of opening a franchise on a foreign market is the absence of many costs and risks, which makes it possible to quickly create a presence on the global market at relatively low costs, as McDonald’s has demonstrated.

The drawback of franchise is the difficulty to control quality - for example, visitors to the Four Seasons Hotel expect the same quality of services regardless of where they are. If the quality of the hotel abroad does not meet the standards, the establishment’s reputation will decrease, which will lead to the decline in sales. Moreover, the distance and the number of franchises complicate the control. The solution to this problem may be the opening of a subsidiary in each country with special control functions [Hill C., 2008].

Takeover. The takeover is a transaction, the purpose of which is to establish control over another organization carried out by acquiring an authorized capital [Virobian, 2017]. International takeovers account for about 60% of all takeovers. Takeovers are popular because they give companies a quick and established access to the market. Nevertheless, this type of transaction is extremely expensive, since companies are often bought at a price higher than their market price.

It should be noted that, until recently, in the undeveloped part of the world companies did not have an opportunity to carry out such transactions due to the lack of necessary resources. When deciding on the takeover strategy for an international company one should take into account the legislative regulation of the company being taken over - for example, China has restrictions on foreign ownership of local companies, and in the US only Americans are allowed to own television channels. Similarly, foreigners can not own a share of more than 25% of the shares of US airlines. The takeover is a good strategy when it is possible to obtain volume savings (for example, in wireless telecommunications). Nevertheless, this is a very risky strategy for entering the international market, since according to the statistics; about 40-60% of takeovers cannot increase their market value by the amount of invested funds. Similar studies have been conducted by KPMG and McKenzie, who also claim that approximately 70% of cases of takeovers do not generate the expected results [Christoffer- son S. A., McNishR. S., Sias D.L., 2004]. Despite this, managers are attracted by takeovers because they receive both tangible and intangible assets, a customer base, streamlined logistics, a brand, which may be difficult to build independently due to cultural differences between countries.

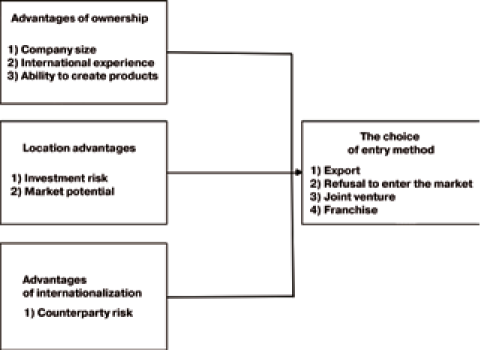

As mentioned earlier, those firms, which are interested in foreign markets, are required to decide on a way to enter a foreign market. The factors determining a particular method can be divided into three categories: advantages of owning a company, advantages of a company's location and internalization of advantages (counterparty risks) (Fig. 2) [Dunning J. H., 1991].

If a company has a significant ability to create products, then in choosing a joint venture strategy it may face a possible loss of long-term profits, because a foreign partner may decide to separate and use a unique production technology after studying this technology. Also, according to this model, the size of the firm is positively correlated with its propensity to enter foreign markets. The bigger the company, the more likely it is to enter a foreign market. In addition, large companies tend to create their own venture, rather than a joint venture - in order to protect their developments and prevent the loss of their competitive advantages [Trachuk, 2014 b; Doz Y. L., 1987]. Firms without any previous experience in international operations tend to face big problems, and therefore, the forms of entry without significant investments are more attractive for them [Terpstra V., Yu С. M., 1988].

Fig. 2. The Dunning model

Source: DunningJ., 1991.

Considering the advantages of location, those firms interested in serving foreign markets, assess them in terms of market potential and investment risks. The latter reflects the uncertainty in the host country about the duration of the current situation, political conditions and government regulation [Root F. R., 1994].

The advantages of internalization (counterparty risk) are the third aspect, which requires the attention of the manager. At the stage of entering the international market a company may face the problem of inefficiency in doing business, limited rationality of employees of the partner company - such problems can make contracting ineffective. Under these conditions, the exporting activities and the creation of an enterprise on the international market will give a greater control over the situation. Moreover, over the past decades, psychologists and economists have noted the ambiguity of rational behavior of people; studies indicate the lack of self-control, the use of heuristics, which leads to systematically incorrect decisions and inconsistency of behavior [Thaler R. H., Sunstein C.R., 2003].

It can be noted that globalization has a significant impact on the activities of organizations on the international market. However, depending on the prevailing conditions the impact of globalization can be different. This makes it obvious that not only globalization, but also other factors influence the performance of companies on foreign markets (table 2). Moreover, the strategies of entering the international market should differ depending on the resources and abilities of companies, and finally, due to the specificity of companies they should be considered separately [Trachuk, 2014 b].

The studies of the companies ’ entry into foreign markets

Isobe, Makino and Montgomery (2000) conducted a study, the purpose of which was to determine whether pioneers and technological leaders have excellent results in the developing economic regions. The authors used the data of Japanese companies, which entered the Chinese market in the form of joint ventures. Initially, the data were collected by using a survey method. Then a generalized least squares method was applied. An early entry into the market (“pioneer”) and investment of significant resources had a statistically significant positive impact on the company's financial performance. Moreover, the study showed that the availability of advanced infrastructure is not a decisive factor for a foreign company in an emerging market to promote its products. On the contrary, the results of the analysis suggest the opposite. One possible explanation for this is that when the infrastructure has already been formed, it is too late for a pioneer company to enter the market [Isobe T., Makino S., Montgomery D.B.,2000],

With a quarter of the world's population and one of the fastest growing economies over the past two decades, China has attracted many family-owned firms that have tried to expand their businesses [Hsiao F.S.T., Hsiao M.C.W., 2004]. A study of companies' entry into emerging markets was conducted by Deng, Huan, Carraher and Duan (2009). They explored the entry of Taiwanese companies into the Chinese market. Their work focused on the expansion of family-owned businesses. The study of small companies is complicated by the fact that information about them is usually non-public. To collect data the authors used surveys, which were sent out to CEOs of Taiwanese family-owned firms with offices in China, as well as a modeling with structural equations for the factors affecting foreign direct investments and companies’ results. The obtained results confirm the theory about a resource-oriented approach — that firms with special abilities are motivated to enter new markets and achieve better results [Deng F.J. et al., 2009; Sayapina, 2018].

Table 2. Factorsforchoosing a strategy of entry to the international market

Question | Answer | |

|---|---|---|

Wliich foreign market to choose? | The market in which the company will have a sustainable competitive advantage. The company’s resources should have value, rarity, indispensability and not be easily imitated. | |

Wlien to enter the market? | A pioneer company can get profitable sales channels, a significant market share and high brand value. Innovators can also face high uncertainty due to the absence of a dominant model on the market. On emerging markets it is difficult for pioneers to hold the leading positions. | |

| Joint venture | Makes it possible to gain experience from a partner. Does not allow obtaining full control. |

Wliich | Export | No significant costs when entering foreign markets. Exports can be inexpedient with high duties. |

way to choose? | Franchising | The lack of significant costs. The complexity of quality control of products. |

| Takeover | Quick and established access to the market. However, about 70% of takeovers do not generate the expected results. |

Source: Compiled by the authors

Agarwal Sridhar Ramaswami (1992) explores companies on the American market of equipment leasing and their entry into the international market. The data was collected through interviews. The sample contained 97 observations with data analysis performed by means of multiple logistic regression. The main results include a stronger tendency of big firms to enter foreign markets compared with small firms. In addition, big companies tend to create not joint ventures, but their own enterprises in host countries [Trachuk, A., Linder, N., 2018]. Moreover, companies choose to invest in markets with great potential. Finally, firms try to avoid markets with high investment risks, choosing to export to these markets. These results are consistent with the theory suggested earlier [Agarwal S., Ramaswami S.N., 1992].

Chen and Demou (2005) also investigated the entry of hotels to foreign markets. Flighly controlled entry methods were preferred in low-risk countries. The results also show that the level of economic development and the choice of entry methods with high control have a positive relationship. In addition, the significance of the brand in low-risk countries is not statistically significant [Chen J.J., Dimou I., 2005]. These results are comparable with Agarwal Sridhar Ramaswami (1992).

Finally, Zahra, Ireland and Flitt (2000) explore strategies for venture firms to enter the international market. Today there is a tendency for venture firms to enter international markets in the early stages of life cycle. The classic explanation for this phenomenon is technological knowledge and special skills [Zahra S. A., Ireland R D., Hitt M. A., 2000].

A similar study of the choice of strategy for entering international markets is the work of Erramilli Rao (1990) and Bozhe- va E.O. (2018), which focuses on service companies. The main questions posed in the article are the following: how do service firms enter foreign markets? how their behavior depends on their types and market conditions on the market of services?

Service companies were divided into two groups. The first included those ones where the production of services and their consumption are almost impossible to divide (“Soft service”: car rentals, restaurants, medical services). The second group included companies with services where production and consumption can be divided (“Hard service”: consulting services, software, design development). This classification has two important conclusions. In the first group companies cannot export their services, because exports imply a separation of the production of goods or services from their consumption, and companies that produce “soft services” have to rely on such methods as licensing, franchises or joint ventures and their subsidiaries abroad. On the other hand, the second group of companies can often resort to exporting their services.

Another feature of the services market is the fact that a large number of firms enter foreign markets in order to provide services to foreign branches of their customers on the domestic market [Terpstra V., Yu C.M., 1988]. For example, many US advertising companies and banks have opened their branches abroad following their customers to foreign markets. This phenomenon of following customers is not characteristic of the manufacturing sector, but is specific and unique to service companies. Another type of market entry is a search for new markets. This type of entry into the overseas markets is characterized by companies providing services that serve foreign customers.

A sample of 638 decisions to enter foreign markets was collected by conducting surveys. Based on this survey, firms were divided into those that follow their customers and seek new markets, as well as into “Hard-service” and “Soft-service”. Further, all decisions on the method of entering foreign markets were rated from I to 9, where 9 is the largest number of involved resources (opening a subsidiary) and I — the entry to foreign markets by using franchises. The Wilcoxon test was applied to test the difference in involved resources among the companies, which follow their customers and companies, which seek new markets. As the results showed, among the first ones the level of resource involvement was significantly higher. In addition, the values between “hard service” and “soft service” companies are statistically significant. However, for the countries with similar markets the difference between the preferred ways to enter foreign markets was not significant.

The main aspects of the research are shown in table 3.

Table 3. Results of the previous studies of companies entering foreign markets

Author | The main conclusions |

|---|---|

Isobe, Makino and Montgomery (2000) | The Japanese companies that were the first to enter the Chinese market as joint ventures received significantly liigher profits than companies, which refrained from choosing this strategy. |

Deng, Huan, Carralier and Duan (2009) | The firms with special abilities are motivated to enter new markets and achieve better results. |

Agarwal Sridhar Ramaswami (1992) | Companies choose to invest in markets with great potential and avoid markets with high investment risks, preferring to use an export strategy for them. |

Chen и Demou (2005) | The level of the country’s economic development and the choice of strategy with greater involvement of resources have a positive relationship. |

Zahra, Ireland и Hitt (2000) | Because of their abilities technology companies prefer to enter foreign markets at an early stage of development. |

Erramilli Rao (1990) | Companies, which enter foreign markets, choose the strategies of greater involvement of resources, while companies seeking new markets prefer to refrain from significant investments. |

Source: Compiled by the authors

RESEARCH METHODOLOGY

This research was carried out in accordance with the philosophy of positivism, which states that the surrounding reality can be studied through empirical research [Saunders M.N. K., 2011].

There are two main methods of research: deductive and inductive. The first one assumes that the hypothesis is based on the existing theory. An analysis of data is carried out, which confirms or refutes the hypothesis. On the contrary, the inductive approach begins with a study of the data, which is followed by the formulation of theory [Minocha S., 2005]. Due to the fact that there is no single theory regarding the entry to foreign markets and because of the lack of sufficient data, none of these methods was selected. Moreover, for the same reason no quantitative method of analysis was chosen. Most often, specific numerical data about the strategy for entering foreign markets are not even published by public companies. This is confirmed by the analysis of previous studies, in which surveys were conducted to collect data [Isobe T., Makino S., Montgomery D. B., 2000; Deng F. J. et al., 2009; Agarwal S., Ramaswami S.N., 1992; Erramilli, Μ. K., Rao C.P., 1990]. In addition, despite the fact that financial institutions often guarantee data accuracy, this is not always the case: some inaccuracies may occur [Saunders M.N. K., 2011]. Companies tend to resort to fraud in the process of reporting, which makes their analysis inadequate [Bhasin M.L., 2015]. Therefore, in this work the qualitative analysis was applied. Typically, this method involves the use of surveys or interviews to obtain information. The problem of a survey is the fact that not all respondents respond and often do not fully respond - for example, in the study of Erramilli Rao (1990) only 3 3 % responded [Erramilli Μ. K., Rao C.R, 1990]. Moreover, the formulation of questions can influence the obtained answers, and the correct preparation of surveys requires the involvement of a specialist in this field [Gilovich T., Griffin D., Kahneman D., 2002; H. Schu- man, Presser S., 1996]. The answers can be inaccurate, and the company’s representatives may tend to exaggerate to improve its reputation.

Finally, in sampling a quantitative and qualitative analysis randomization of selected companies is required. Otherwise, the results will be subject to systematic selection error [Fleck- man J. J. 1977]. Due to the lack of the required resources in order to perform such task it was decided to use the “case study” method.

As a rule, a “case study” refers to qualitative methods of analysis and can be considered the most appropriate and holistic method, when in-depth research is required. As a rule, this method is applied in social sciences, sociology, management and law [Yin R.K., 2011]. One of the reasons why “case study” is gaining popularity is the limitation of quantitative methods in the process of in-depth analysis of social and behavioral issues. By means of the case study method it is possible to study the problem more thoroughly than guided by statistical results and to analyze the situation from the point of view of decision makers [Tellis W.M., 1997].

As a rule, within the framework of the “case study” one investigates issues in a specific context, in which a small sample of observations is made and in which a contextual analysis of the limited number of events and their interrelationships is applied.

Unlike quantitative analysis, which examines relationships at the macro level, case studies are more focused on the micro level based on the frequency of occurrences of events [Zainal Z., 2007].

In the process of making a study one can select a single case or more depending on the question posed. The choice of a single case is made when there is only one phenomenon of an event (for example, an analysis of the tsunami effect in Indonesia in 2004). However, the drawback of this approach is its inability to produce a generalized conclusion. One of the ways to overcome this problem is to use other approaches to confirm the reality of the phenomenon; moreover, the use of several cases can increase the reliability of results.

There are several types of case studies. Yin (1994) identified three categories: scientific, practical (descriptive) and training [Yin R. K., 1994]. The first type of case study is associated with the study of any phenomenon, which is of interest to the researcher. For example, within this type one can ask the following question: does the firm use any strategies when entering the international market? Is there such a phenomenon in practice? This question makes it possible to make advances in the study of any problem and is applied at the initial stage of the study.

The purpose of the second type of "case study" is to describe a phenomenon. For example: which strategies for entering international markets are used and how. Often such “case studies” are presented in descriptive form [McDonough J., McDonough S., 1997]. Apeculiar feature of this approach is also the fact that its application requires a theory regarding this problem, on which the analysis will be based. The third “case study” approach examines the problem more deeply. For example, a manager may be asked a question: why was a particular strategy applied in the process of entering the international market? It should be noted that there are other classifications of “case study” (in more detail - Stake (1995)) [Stake R.E., 1995].

The advantages of “case study” include the fact that in the process of researching the strategies for entering foreign markets by using this method one can observe a company in its environment - for example, among external and internal factors, while in an experimental study the phenomenon and associated factors are usually divided with the focus on the limited number of variables [Zainal Z., 2003]. Moreover, in the framework of “case study” both quantitative and qualitative methods can be applied. Finally, a detailed qualitative study conducted in the framework of the “case study” not only makes it possible to investigate and describe the data in real conditions, but also to explain the complexity of the problem, which is ignored by experimental methods. This is achieved by using both digital information in choosing a particular strategy and the reasons for choosing a strategy, as well as why some were preferable to others [Zainal Z., 2007]. Moreover, the cause-and-effect relationship is difficult to determine by the method of regression - the results of a false correlation are often published in studies.

Despite the mentioned advantages, the “case study” method has several drawbacks. Firstly, many “case studies” are not accurate due to ambiguous data and often contain systematic errors of opinion on the part of researchers, which leads to incorrect results and conclusions. Secondly, the “case study” method lacks a base for scientific generalization because of the small sample [ Wmston T., 1997].

Based on the previous research and theories put forward in the work it can be concluded that firms use strategies to enter foreign markets; moreover, given the goals and objectives, the most appropriate type of “case study” is the second type - practical (descriptive).

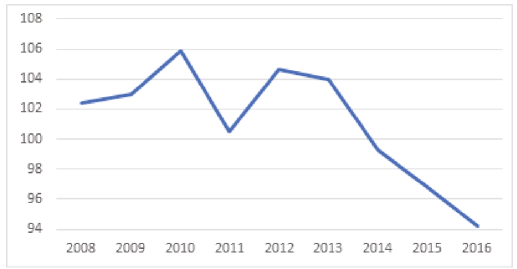

Fig. 3. The real disposable income in the Russian Federation in percentage to the previous year

Source: Rosstat

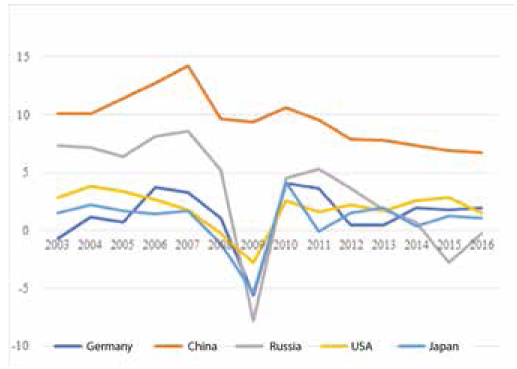

Fig. 4. The dynamics of real GDP across countries in percentage to the previous year

Source: World Bankdatabase

RESEARCH RESULTS

The aspects of expansion of Russian companies

For Russian companies the option of developing business on the international scale can be attractive due to the unfavorable economic situation on the local market (in this example it is a “push factor”). For example, Fig. 3 shows the real disposable incomes in the Russian Federation as a percentage of the previous year; since 2012 one can observe a downward trend, which indicates a decline in the purchasing power of the population leading to the possible decline in demand for the company's products. Giffen products may be an exception (Fig. 3).

Fig. 4 shows the dynamics of the real GDP across countries. The positive dynamics of GDP encourage companies to invest in the development of new products and production capacities. This statement was empirically proven by Chen and Demou (2005) [Chen J. J., Dimou I., 2005]. Moreover, GDP growth increases tax revenues used for large infrastructure projects, which ultimately contributes to the long-term growth. Therefore, for Russian companies, markets with growing GDP will be potentially attractive, because they will have an effective demand.

Other indicators of managers' orientation include the leading economic indicators (business activity index, consumer confidence index, etc.).

Flowever, according to Karadagli (2012), the political aspect is the most important in deciding whether companies enter foreign markets [Karadagli E. C., 2012]. Thus, in April 2018, after the announcement about the next batch of sanctions, the Russian market in one trading session lost about 10%5. Also, the realities of the Russian market are consistent with Kaplinsky (2004), who noted that globalization can interfere with the activities of companies on emerging markets, since they significantly lag behind their equivalent companies on more developed markets [Kap- linsky R., 2004]. It is also worth noting the importance of the results obtained by De and Pal (2011): considering the environment of the Russian market, the strategy of entry to international markets should take into account the quality of goods as in the case of DJI.

Finally, due to the historical situation, the peculiarity of Russian companies is the fact that they are mainly focused on the production and servicing of the domestic market [Sychev Yu. K., Trifonov PV, 2017]. And although over the past 25 years a complete isolation from the outside world has disappeared, the consciousness of entrepreneurs is not yet focused on the world market. Export duties and certification problems (especially electronic products) also complicate the access to foreign markets.

A. A. Kizim and S. S. Fokin (2008) noted the following difficulties that companies face when entering international markets (Table 4).

It should be noted that macroeconomic indicators characterize the overall situation in the region.

To make a decision on entering foreign markets it is necessary to take into account the specific features of companies.

Moving from macro indicators to the specific features of a company we will consider an IT company of Russian origin, which has recently entered the international market. This is ICL Services - a Kazan company specializing in IT business solutions, which works with big customers from 26 countries of the world. The company's solutions make it possible to increase the efficiency of management of business processes of client companies as a whole and to obtain the economic effect of reducing the time it takes to develop new business activities (network infrastructure, software development, etc.). Initially, the company entered the international market selling its products directly abroad. In 2016 the company opened an office in Serbia7. The competitive advantage of this company is in possessing the skills to create products that optimize business processes. It is these skills that add value to the product, which allows the company to develop in foreign markets - in 2015 its revenues amounted to almost 800 billion rubles. Joseph Schumpeter was one of the first economists who noted the importance of innovation in the theory of development [Trott P., 2008]. In its work ICL Services abides by this principle. Another advantage of this company is an easy scalability of business, because it does not require a significant increase in production capacities when expanding its activities: there are no costs for building factories unlike in the car industry, for example. When exporting its products to a foreign market ICL Services had an opportunity to test them without facing serious costs - such approach was proposed by Terpstra and Yu (1988) [Terpstra V., Yu C.M., 1988]. Acompetitive advantage, as in the case of DJI mentioned above, also enabled the company to get established internationally. This company can hardly be called a pioneer on this market, because similar products had been presented on the IT services market. This provided the company with information about the demand for the product on the international market [Markides C., Geroski P., 2005].

Table 6. The problems of Russian companies entering foreign markets

External problems | Internal problems |

|---|---|

High level of competition on international markets. Customs barriers. Cultural differences Lack of confidence in Russian enterprises | Stmctural problems Imperfect legislation. Non- compliance with international standards Lack of competent marketing strategy |

Source: Kizim, Fokin (2008)

For close monitoring of the situation on the foreign market and after receiving the initial experience in accordance with the Dunning model (1988) the company opened an office closer to its sales points, which gives additional value to the Porter’s model by simplifying communication between customers. In addition, the entry of this company is consistent with the findings of Deng Huan Carraher Duan (2009), who argue that companies with competitive advantages tend to enter the international market. Finally, as asserted by Zahra, Ireland, and Hitt (2000), at a relatively early stage of its life cycle ICL Services entered foreign markets due to technological skills and knowledge [Zahra S.A., Ireland R.D. D., Hitt M.A., 2000]. The same results were obtained in the work of [A. Trachuk and N. Linder, 2018 b].

The results of Erramilli and Rao (1990) can also be applied. In accordance with them, ICL Service company belongs to Hard service company, since the consumption of products can be separated from their production (table 7) [Erramilli Μ. K., Rao C.P, 1990]. The activity of ICL Service is consistent with the observations of the authors: the organization under review first looked for new customers without investing a significant amount of resources to enter the international market, and then, having customers, invested heavily in business development by opening a branch office. Finally, according to Davidson (1982), the company, having no initial experience, did not open its own office abroad, but limited its activities to exporting its services due to the lack of the necessary experience and knowledge of the international market [Davidson W. H., 1982].

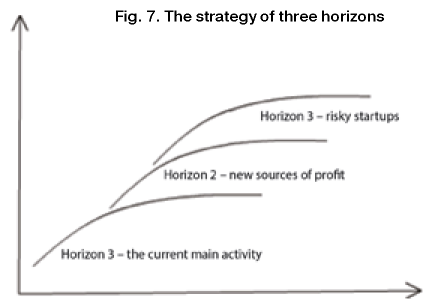

It is advisable to build the company’s future strategy on the international market based on three horizons (Fig. 5) [Baghai M., Coley S., White D., 2000]. On the first horizon a further improvement of the company's product should be carried out in order to maintain its market share and stable growth to ensure the loyalty of customers. In addition, it is recommended to take into account the cultural specifics of other countries [Deresky H., 2017].

On the second horizon the company should think about new sources of profits. In accordance with the approach proposed by the founder of Acer - Stan Shih in 1992, patents and technologies, as well as the company's brand, bring the greatest additional value to technological companies. Given the specifics of ICL Service, the company should try to develop new areas - for example, security, monitoring, and video surveillance software, which could become the potential areas of activity on the international market (Fig. 6) [Shih S., 92].

Given the large amount of resources on the third horizon one can try to enter the international market with a product developed on the basis of blockchain. For example, it may be smart-contracts. The established brand and reputation of the company will help promote the product on the international market making it successful.

Another example of a Russian company that entered the overseas market was Antraks, which began its existence in 1989 and was formed through the merger of two scientific institutes. At the moment the main activity of the company is the development and production of intelligent systems for energy. These systems are designed for control and automation. The company operates on the principle of a full cycle - from development to installation of electrical equipment and its maintenance.

The main products are: devices for control and measurement of power supply networks, a complex for the monitoring of power lines with indicators for icing, damage and short circuit. The customers on the Russian market are: Lukoil, Tatneft, Rosseti, Tagras Holding and others.

The company entered the foreign market in 2014. As pointed out by its director, Audrey Kucheryavenkov, the main reason for this was the rise of dollar, which made the company's products more competitive on the international market, as well as the interest of potential partners abroad. This company was from Switzerland. The first thing that Antraks encountered was distrust on the part of its European partners and an external problem was the lack of confidence in the quality of the produced products as was indicated by A. A. Kizim and S. S. Fokin (2008). This was confirmed by the visit of Swiss specialists to Russia - in order to see for themselves how the production was organized. The next problem, according to the classification of Kizim and Fokin (2008), was incompatibility with international standards [Kizim A.A., Fokin S. S., 2008]. Partners were not particularly interested in the previous customer reviews or the volumes of the sold products. Flaving undergone expensive certification, the company managed to conclude contracts with suppliers from other countries, since the Swiss certification is accepted worldwide. Currently, the company is working with customers from 28 countries, most of which are far abroad countries.

Table 7. Examples of market entry for two types of firms

Reasons for market entry | Types of firms | |

|---|---|---|

Soft service | Hard service | |

Followmg the customers Search of new markets | An advertising agency opens a branch to serve a domestic customer, who has an office abroad A fast food company opens a network of franchises in a foreign market to serve local customers. | A software manufacturing company provides technical support to a domestic customer, who has an office abroad. An architectural finn sells its services to foreign customers |

Source: Erramilli, Rao (1990)

Source: Baghai, Coley, White, 2000.

Fig. 6. Additional cost of technological companies

Source: compiled by the author based on Shih 1992

Initially, a partnership with the Swiss company was concluded on the basis of a dealer agreement, in which the Swiss company acted as an exclusive distributor. This decision was dictated by the lack of experience in concluding such transactions. In fact, Antraks renounced its right to sell its own products abroad, which naturally led to a shortfall in profits. Subsequently, the framework of the contract was revised. Cooperating with Swiss companies, Antraks acquired important skills in the creation of technical documentation, as well as an experience in international business.

Considering the company's mistakes in concluding contracts for the supply of products to a foreign market the following recommendations will be helpful. Firstly, the subject matter of the contract must be stated clearly and unequivocally so that the volume of the exported goods, their prices and terms of delivery (Incoterms) are spelled unequivocally. No less important components are the payments of goods, the responsibility of the parties and the terms of dispute resolution. These aspects are common in contracts focused on foreign trade. If the exporting company did not pay attention to these aspects, it mighty face losses.

Another peculiarity was the company’s name - "Antraks", which means stone. Flowever, Antraks stands for anthrax in Lat- in - hence, this name caused problems in deliveries to international markets, because customs officers had often to figure out what was in the boxes with “anthrax” written on them. Subsequently, the export-oriented brand of the company was changed. This aspect emphasizes the importance of understanding the aspects of culture in general and language in particular when conducting international business, the examples of which were given in the second chapter.

Anderson and Coughlan (1987) studied the problem of a manufacturer’s entry to a foreign market in terms of whether it is worth entering the market on one’s own or through an intermediary, which was done by Antraks [Anderson E., Coughlan A. T., 1987]. The issue of vertical integration was studied in the US market, and, as the results of the study showed, integration is chosen by companies producing the most technically complex products, like Antraks. The same results were obtained by Filien (1979) [LihenG.L., 1979].

For similar companies with fewer resources or when entering a market with political or investment risks it is advisable, according to Agarwal, Sridhar and Ramaswami (1992) to choose the ways of entering the market with a small amount of funds, for example, through licensing or exporting [Agarwal S., Ramaswami SN, 1992]. The advantage of choosing a foreign counterparty will be the absence of significant costs for opening a branch, as well as the absence of bureaucratic difficulties [Williamson O. E., 1979].

The aspects of expansion of German companies

Considering the German market it should be noted that Germany is part of the European Economic Area, according to the rules of which the participating countries have the freedom of movement of capital, goods and people. Thus, a business operating within the European Union and the European Economic Area has the right to freely import and export goods and services. Moreover, if the product was imported into the EU, then it can also freely move on its territory11. Such regulation is one of the reasons why Germany is the third largest exporter in the world with a positive foreign trade balance12. Industry is one of the leading branches in Germany. The largest automobile concerns include Volkswagen, BMW, Daimler; in the electrical industry - Siemens, Bosch and others. Many head offices are located in Germany, since the the location of production is influenced by the availability of laborresources of different skill levels and the proximity of research centers in Germany.

On the other hand, as noted by Peltonen (2008), Acheam- pong et al. (2000), there is high competition on the European Union market, and in order to survive, a high labor productivity is applied on the market, which is achieved through mechanization and the use of modem technologies [Peltonen TA et al., 2008; Acheampong Y. J. et al., 2004].

An important aspect in the expansion process is the ability to conduct business in accordance with the laws and customs of a country [Barkema Tl.G., Vermeulen F.]. Elowever, during the existence of the European Union cultures and institutions of the joining countries merged. Therefore, the entry of German companies into the markets of Switzerland and China will be completely different: here one of the key aspects of competitive advantages is cultural differences.

The most successful companies entering the German market will be the companies offering an innovative product combined with high quality and excellent design. The Germans are very responsive to innovative products such as computers, software, automatic technologies and medicine. In many cases the determining factor for potential customers is not the price, but quality.

The German business is decentilized and diverse, with different interests depending on federal lands. A successful marketing strategy should take into account regional peculiarities. For investors the German high taxes and complicated legislation can create some difficulties, but an effective system of tax deductions will reduce taxes to the world average. Another difficulty is a minimum statutory capital to open a limited liability company. At the moment it amounts to 25000 euros, while in Russia it is 10000 rubles. Moreover, there is a trend among the companies operating in Germany to be registered abroad, for example, in the UK, in order to avoid the bureaucratic and formal requirements of supervisory authorities.

In December 2017 the EU and Japan concluded a free trade agreement, which enters into force in 2019. Germany and Japan are attractive markets for each other. Japan currently ranks second after China in terms of trade with the EU in Asia. For German companies, which are medium in size and engaged in the production of 3D printers, the following way to enter the Japanese market can be offered. On the first phase (1—2 years) it is advisable for the company to collaborate with a leading research institute such as the Tokyo Institute of Technology. At the same time it is necessary to search for a suitable business partner. Due to legal restrictions it is necessary to create a joint venture with a Japanese company or to take over an existing one; it should be noted that it is impossible to have a 100% ownership of the company. The next stage will be the location of production in Japan, which will lead to the consumption and production in one country reducing costs. Such recommendations were obtained for a specific German high-tech company wishing to enter the Japanese market. It should also be borne in mind that when changing any pre-market conditions such as changing technologies, economic or political situation, the strategy should be revised.

If the German market is saturated it is expedient for other German companies to enter foreign markets in order to increase sales. These can be the markets of the USA, China, Japan, the EU, where there is a positive dynamics in GDR Moreover, it is quite easy for German companies to export to Europe, since there are no import duties and low transport costs due to the developed infrastructure.

Elutzschenreuter and Voll (2008) study the entry of German multi-national companies to foreign markets. They found the confirmation that it is necessary to gradually enter markets with a different culture. If the cultural difference is too big, in a short period of time it leads to the fact that employees do not have enough time to adapt to new conditions, and, as a result, the company's performance falls [Elutzschenreuter T., Voll J. C., 2008]. The higher the rate of expansion to a foreign market with a different culture, the greater the likelihood of a drop in company’s profits.

Another example of entry to the international market is the German company Allianz, which was founded in 1890 in Berlin. After that it opened its branches in the European countries such as France and the United Kingdom. Before World War I about 20% of the profits were generated on foreign markets. After the war the company was forced to abandon its international activities under the Versailles Treaty. In the interwar period Allianz achieved the presence on the European market becoming the largest insurance company in Germany. Elowever, during World War II all international ties were lost.

In the early 1970s Allianz entered a period of active internalization. In 1970 the income from foreign activities was only 3%, while in 199148% of the income was received in foreign markets, most of which were in Europe. In 1992 Allianz entered the top five largest insurance companies in the world [Eloschka Т. C., 1993]. Initially, the company's activities abroad were conducted as a form of following customers; the entry to foreign markets in order to provide services to foreign branches of its customers on the domestic market, the expansion was carried out by opening branches of the company; the choice of this approach is consistent with the results of Erramilli Rao (1990) [Erramilli Μ. K., Rao C.P., 1990]. This decision is consistent with the behavioral aspects, since the company already had experience on the international market, which reduced the uncertainty regarding the services market and, as a result, led to more significant involvement of resources [Cavusgil S. T., 1982].

Later the company resorted to diversification of its business. As it was formulated in the strategic plan of Allianz, it is too dangerous to depend only on one market. The adherence to this approach served as the foundation for creating a competitive advantage over those companies that operated only on one market.

Allianz also resorted to takeovers on the Italian market buying a 51,5 % stake in RAS, which was also an international insurance company and operated in Italy, Spain and Austria. After the takeover Allianz sent only two of its employees to RAS adhering to the strategy of non-interference in usual activities. What could be the reason for the success of this takeover, because in the Chrysler’s takeover by Daimler it was the imposition of new orders that led to the leaving of many top managers. The expediency of gradual integration was also shown in the work of Hutzschenreuter and Voll (2008). On the other hand, the success of the takeover was probably due to the similarity of cultures in the two countries.

As already mentioned, there is strong evidence that the nature of international expansion has an impact on a firm’s performance. Companies must learn to manage foreign operations and adapt to the business environment in order to realize the potential of entry to world markets. Vermuelen and Barkema (2002) found a confirmation that companies with a balance of speed, size and orderliness of expansion received much more profit from entering the foreign market [Vermeulen F., Barke- maH.,2002].

Summarizing, we can say that the general approach of Allianz based on offering high-quality, rather than low-cost, services of product innovation and a high level of service standards were the key areas for gaining competitive advantages.

CONCLUSIONS AND FURTHER RESEARCH AREAS

The purpose of this work was to study the strategies of companies’ entry into foreign markets and identifying their subsequent use by German and Russian companies.

The issue of choosing a strategy in entering the international market is one of the most significant decisions made in international management, since this determines its further development.

We have shown the influence of globalization on the company's performance, considered the factors influencing the choice of a strategy for the entry to the international market, including behavioral aspects, cultural aspects, competitive advantages and macroeconomic characteristics of countries.

It should be noted that most of the decisions to enter a foreign market were similar to predictions built on the basis of econometric models. This allows us to conclude that it is not necessary to have detailed information about each company in order to formulate a single solution. Of course, this statement cannot be absolutely true, since a limited number of cases were considered and this conclusion can be a mere coincidence.

Despite this, the important results of this study of the criteria for choosing a strategy on a foreign market are:

- The impact of globalization. Globalization has a positive influence on companies as the market grows. However, small companies and companies on emerging markets lose the competition.

- The experience in conducting foreign economic activity. Companies with significant experience tend to choose their own strategy of setting up an enterprise, while organizations without such experience prefer to export or a joint venture in the host country.

- Cross-cultural knowledge. The choice of a strategy with greater involvement of resources is directly proportional to the knowledge about the country’s culture, the market of which is entered by the company. In entering a market with a different culture a smooth adaptation is necessary for successful implementation of the strategy. Finally, people tend to make behavioral errors, and the knowledge about them and their constant monitoring will help achieve successful results.

- Possessing a competitive advantage. This aspect is fundamental for the implementation of profitable activities in the framework of free competition. It is important for companies not only to have competencies, but also to be able to protect and preserve them over time.

- Macroeconomic indicators. On markets with high political and investment risks, as well as unfavorable economic conditions companies tend to choose strategies with a minimum investment of money (franchises, licensing).

Recommendations for further research

As part of the further research into the choice of strategies for entering international markets the third type of the “case-case” method can be applied, namely, addressing companies and finding out the specific reasons for adhering to one or another strategy for entering international markets. Further, the obtained data can be converted into numerical indicators to be used for econometric model explaining the reasons for choosing a particular strategy. It should be noted that within the framework of data collection it is necessary to conduct a survey not only of companies that entered foreign markets, as it was done in previous studies, but also of companies that did not enter foreign markets. Depending on the tasks and the collected data, a censored regression or a truncated regression can be applied [Tobin J., 1958; Fleckman J. J. 1976]. The estimates obtained by this method will reflect the situation much more accurately than the values obtained by the least squares method.

On the other hand, in order not to complicate calculations by selecting the correct specification of econometric model and getting rid of the limitations of the model, after collecting the data one can use the machine learning method to determine the relationship between the dependent variable (the choice of a specific strategy for entering foreign markets) and independent variables (external and internal factors of organizations). Based on the literature explanatory variables can include the experience on foreign markets, similarity of cultures, availability of financial resources, macroeconomic indicators, etc. Moreover, the lasso-regression can be used to determine significant variables.

References

1. Acheampong Y.J. et al. Profitability adjustment patterns in international food and consumer products industries // Agribusiness. — 2004. — Vol. 20. — N 1. — Pp. 31–43.

2. Agarwal S., Ramaswami S.N. Choice of foreign market entry mode: Impact of ownership, location and internalization factors // Journal of International business studies. — 1992. — Vol. 23. — N 1. — Рр. 1–27.

3. Ahlstrand B., Lampel J., Mintzberg H. Strategy Safari: A Guided Tour Through The Wilds of Strategic Mangament. — Simon and Schuster, 2001.

4. Akinola G.O. Effect of globalization on performance in the Nigerian Banking Industry //International Journal of Management and Marketing Research. — 2012. — Vol. 5. — N. 1. — Р. 79.

5. Anderson E., Coughlan A.T. International market entry and expansion via independent or integrated channels of distribution // The Journal of Marketing. — 1987. — Pp. 71–82.

6. Baghai M., Coley S., White D. The alchemy of growth: Practical insights for building the enduring enterprise. — Da Capo Press, 2000

7. Barkema H.G., Vermeulen F. International expansion through start-up or acquisition: A learning perspective // Academy of Management journal. — 1998. — Vol. 41. — N 1. — Pp. 7–26.

8. Barney J. Firm resources and sustained competitive advantage //Journal of management. — 1991. — Vol. 17. — N 1. — Pp. 99–120.

9. Bhasin M.L. Corporate accounting fraud: A case study of Satyam Computers Limited. — 2015.

10. Cavusgil S.T. Some observations on the relevance of critical variables for internationalization stages // Export management: An international context. — 1982. — Рр. 276–285.

11. Chen J.J., Dimou I. Expansion strategy of international hotel firms // Journal of Business Research. — 2005. — Vol. 58. — N 12. — Рр. 1730–1740.

12. Christofferson S.A., McNish R.S., Sias D.L. Where mergers go wrong // McKinsey Quarterly. — 2004. — N 2. — Pp. 92–99.

13. Collis D.J. A resource‐based analysis of global competition: the case of the bearings industry //Strategic management journal. — 1991. — Vol. 12. — N S1. — Рр. 49–68.

14. Davidson W.H. Global strategic management. — John Wiley & Sons Incorporated, 1982.

15. De U.K., Pal M. Dimensions of globalization and their effects on economic growth and Human Development Index. — 2011.

16. Deng F.J. et al. International expansion of family firms: An integrative framework using Taiwanese manufacturers //Academy of Entrepreneurship Journal. — 2009. — Vol. 15. — No 1/2. — P. 25.

17. Deresky H. International management: Managing across borders and cultures. — Pearson Education India, 2017.

18. Doz Y.L. Technology partnerships between larger and smaller firms: Some critical issues // International Studies of Management & Organization. — 1987. — Vol. 17. — N 4. — Pp. 31–57.

19. Dreher A. Does globalization affect growth? Evidence from a new index of globalization // Applied economics. — 2006. — Vol. 38. — N. 10. — Рр. 1091–1110.

20. Dunning J.H. The eclectic paradigm of international production: a personal perspective // The nature of the transnational firm. — 1991. — Рр. 117–136.

21. Erramilli M.K., Rao C.P. Choice of foreign market entry modes by service firms: role of market knowledge //MIR: Management International Review. — 1990. — Pp. 135–150.

22. Freeman R.E. Strategic management: A stakeholder approach. — Cambridge university press, 2010.

23. Gilovich T., Griffin D., Kahneman D. (ed.). Heuristics and biases: The psychology of intuitive judgment. — Cambridge university press, 2002.

24. Heckman J.J. Sample selection bias as a specification error (with an application to the estimation of labor supply functions). — 1977.

25. Heckman J.J. The common structure of statistical models of truncation, sample selection and limited dependent variables and a simple estimator for such models //Annals of Economic and Social Measurement, Vol. 5. — N 4. — NBER, 1976. — Рр. 475–492.

26. Hill C. International business: Competing in the global market place //Strategic Direction. — 2008. — Vol. 24. — N 9.

27. Hoschka T.C. Cross-border entry in European retail financial services: determinants, regulation and the impact on competition. — Springer, 1993.

28. Hsiao F.S.T., Hsiao M.C.W. The chaotic attractor of foreign direct investment—Why China?: A panel data analysis // Journal of Asian Economics. — 2004. — Vol. 15. — N 4. — Pp. 641–670.

29. Hutzschenreuter T., Voll J.C. Performance effects of “added cultural distance” in the path of international expansion: The case of German multinational enterprises //Journal of International Business Studies. — 2008. — Vol. 39. — N 1. — Рр. 53–70.

30. Isobe T., Makino S., Montgomery D.B. Resource commitment, entry timing, and market performance of foreign direct investments in emerging economies: The case of Japanese international joint ventures in China // Academy of management journal. — 2000. — Vol. 43. — N 3. — Pp. 468–484.

31. Johnson G. Exploring strategy: text and cases. — Pearson Education, 2016.

32. Kaplinsky R. How does it all add up? Caught between a rock and a hard place //Paper submitted for the Globalization, Employment, and Economic Development Workshop, Sloan Workshop Series in Industry Studies. Rockport, Massachusetts, June. — 2004. — Рр. 14–16.

33. Karadagli E.C. The effects of globalization on firm performance in emerging markets: Evidence from emerging-7 countries // Asian Economic and Financial Review. — 2012. — Vol. 2. — N 7. — Р. 858.

34. Leung K. et al. Culture and international business: Recent advances and their implications for future research //Journal of international business studies. — 2005. — Vol. 36. — N 4. — Рр. 357–378.

35. Lieberman M.B., Montgomery D.B. First-mover (dis) advantages: Retrospective and link with the resource-based view //Strategic management journal. — 1998. — Рр. 1111–1125.

36. Lilien G.L. Exceptional Paper—ADVISOR 2: Modeling the Marketing Mix Decision for Industrial Products // Management Science. — 1979. — Vol. 25. — N 2. — Pp. 191–204.

37. Markides C., Geroski P. Fast second. — Audio-Tech Business Book Summaries, Incorporated, 2005.

38. McDonough J., McDonough S. Research Methods for English Language. — 1997.

39. Minocha S. Dissertation preparation and research methods. — 2005.

40. Mitchell R.K., Agle B.R., Wood D.J. Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts // Academy of management review. — 1997. — Vol. 22. — N 4. — Рр. 853–886.

41. Peltonen T.A. et al. Imports and profitability in the euro area manufacturing sector: the role of emerging market economies. — 2008.Georgiou M.N. Globalization and Roe: A Panel Data Empirical Analysis for Europe (1999–2009). — 2011.De U.K., Pal M. Dimensions of globalization and their effects on economic growth and Human Development Index. — 2011.

42. Popper B. (2015). DJI is about to become the first billion-dollar consumer drone company. The Verge. http://www.theverge.com/2015/3/12/8196413/dji-drone-funding-billion-dollar-sales

43. Porter M.E. et al. How information gives you competitive advantage. — 1985.

44. Robertson R. Globalization: Social theory and global culture. — Sage, 1992. — Vol. 16.

45. Rogers E.M. Diffusion of preventive innovations // Addictive behaviors. — 2002. — Vol. 27. — N 6. — Рр. 989–993.

46. Root F.R. Entry strategies for international markets. — Lexington, MA : Lexington books, 1994. — Pp. 22–44.

47. Saunders M.N.K. Research methods for business students, 5/e. — Pearson Education India, 2011.

48. Schuman H., Presser S. Questions and answers in attitude surveys: Experiments on question form, wording, and context. — Sage, 1996.

49. Serwer A.E. McDonald’s conquers the world // Fortune. — 1994. — Vol. 130. — N 8. — Pp. 103–107.

50. Shao H. (2016) Drone Overlord Frank Wang. Forbes.com.

51. Shih S. Empowering technology — making your life easier // Acer’s Report, Acer’s, New Taipei. — 1992.

52. Stake R.E. The art of case study research. — Sage, 1995.

53. Taleb N.N. The black swan: The impact of the highly improbable. — Random house, 2007. — Vol. 2.

54. Tellis W.M. Application of a case study methodology // The qualitative report. — 1997. — Vol. 3. — N 3. — Pp. 1–19.

55. Terpstra V., Yu C.M. Determinants of foreign investment of US advertising agencies // Journal of International business studies. — 1988. — Vol. 19. — N 1. — Pp. 33–46.

56. Thaler R.H., Sunstein C.R. Libertarian paternalism // American economic review. — 2003. — Vol. 93. — N 2. — Pp. 175–179.

57. Tilley A. (2016) The Drone Patent Wars Begin: DJI Files Lawsuit Against Yuneec. Forbes.com. http://www.forbes.com/sites/aarontilley/2016/04/01/the-drone-patent-wars-begin-dji-files-lawsuit-against-yuneec/#3e2fe34158c0

58. Tobin J. Estimation of relationships for limited dependent variables // Econometrica: journal of the Econometric Society. — 1958. — Рр. 24–36.

59. Trachuk, A., Linder, N. (2018 а) 'Learning-by-exporting effects on innovative performance: empiric study results' // Knowledge Management Research & Practice. – 2018.

60. A. Trachuk and N. Linder (2018 б). Innovation and Performance: An Empirical Study of Russian Industrial Companies // International Journal of Innovation and Technology Management Vol. 15, No. 3 2018

61. Trott P. Innovation management and new product development. — Pearson education, 2008.

62. Vermeulen F., Barkema H. Pace, rhythm, and scope: Process dependence in building a profitable multinational corporation // Strategic Management Journal. — 2002. — Vol. 23. — N 7. — Pp. 637–653.