Scroll to:

BRINGING INNOVATION PRODUCTS ONTO EXTERNAL MARKET: AN EMPIRICAL ANALYSIS OF MEDICAL DEVICES INDUSTRY

https://doi.org/10.17747/2078-8886-2018-3-80-87

Abstract

The article is aimed at defining effective methods to manage promotion of high-tech products onto foreign markets, on basis of medical equipment market research. Key trends for development of medical equipment market in foreign countries are defined, which are consolidation of small laboratories and scientific centers in net associations, and offering personified products and diagnostic systems for individual usage. Features of algorithm of entering foreign markets are presented. In context of recommendations for bringing innovation high-tech products onto external markets, it is necessary to hold preliminary monitoring of local and foreign analogues on target market, to offer complex decisions, to organize conjoint enterprises for products promotion, and to form public-private partnership in long-term perspective.

For citations:

Sayapina K.V. BRINGING INNOVATION PRODUCTS ONTO EXTERNAL MARKET: AN EMPIRICAL ANALYSIS OF MEDICAL DEVICES INDUSTRY. Strategic decisions and risk management. 2018;(3):80-87. https://doi.org/10.17747/2078-8886-2018-3-80-87

INTRODUCTION

In the global perspective, the key feature of the output of an innovative product to the external markets is the fundamental changes in the existing markets, a deep transformation, or the creation of new market niches [Flauser J., Tellis G.J., GriffinA., 2006]. The development of new innovative products using high technologies and innovations allows small businesses to compete with large companies both in sales and in financial performance [ SharmaaA., IyeraR., EvanschitzkyaFl., 2008]. Thuswise, the industry of medical devices and equipment is considered to be high-tech and innovative, because it apples advanced technologies, it has high costs for research and development in the field of medical equipment [Mohr J., Sengupta S., SlateraS., 2010]. New high-tech innovative products, many of which have no analogues in the market, are being developed to solve urgent problems in the field of healthcare. Among the latest achievements is the endoscopic medical information system, endoscopic modelling for reparative surgery, equipment for emergency treatment of newborns.

More than 60% of all high-tech innovative products reach only the commercialization [Cooper R. G., Edgett S. E., 2010], the other 40% did not reach the level of effective sales [Allen K. R., 2003]. The unsuccessful launch of an innovative product to external markets is substantiated by environmental factors [Flauser J., Tellis G. J., Griffin A., 2006], the problems of staff initiative and ineffective implementation of the planned strategies in the large companies [ SharmaaA., IyeraR., EvanschitzkyaFl., 2008]. According to the survey conducted in the foreign companies specializing in the launch of an innovative product to foreign markets, 55% of respondents believe that the main problem area is the incorrect strategy of promotion and marketing, 16% refer to the low level of product quality, 10% — to the high costs, which requires the development of a new product, 6% — to the problems in the production process, 13% - other reasons [Allen K. R., 2003].

The article analyzes how it is possible to effectively launch the high-tech innovative products to foreign markets, on the example of the medical equipment market.

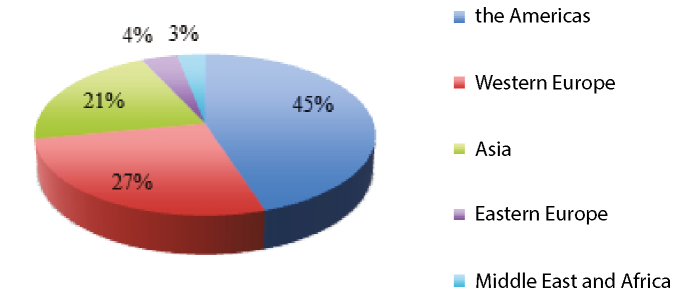

Fig. 1. Medicaldevicesglobal market in 2016 [2016 Top Markets Report, 2016, [s.a.]]

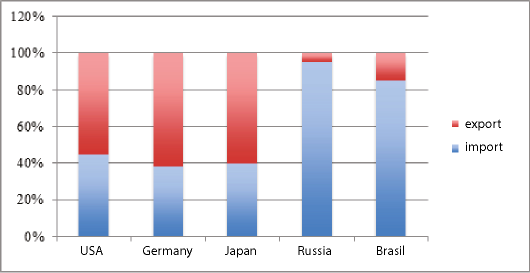

Fig. 2. Structure of export and import of medical equipment and products [2016 TopMarketsReport, 2016]

RESEARCH METHODOLOGY

In order to identify the features of innovative product d launching (medical devices and equipment), mainly are used:

- the study of the main demand trends in the market of medical equipment, the most successful examples of launching the innovative products of foreign and Russian manufacturers operating in other industries (US market development by leading Japanese automobile corporations; entering foreign markets of Siemens, JSC "Rostselmash", LLC " Microbor”);

- analysis of the most successful practices of leading foreign and Russian companies specializing in the production of high-tech medical equipment (GE Healthcare, Philips Healthcare, Draegor Medical GmbH, Smiths Medical, Medtronic, "Shvabe" JSC);

- determination of factors contributing to the success of core business when they enter foreign markets (particularly the markets of Asia) [ZhuryloaV., IazvinkaaN., 2007];

- development of an algorithm for bringing an innovative product to foreign markets and offering recommendations.

WORLD MARKET OF MEDICAL DEVICES: TRENDS

The world market of medical equipment and devices shows high growth rates. The main consumers of medical equipment and devices in 2016 were the USA and EU countries (Fig. I). The largest are the sectors of ophthalmic equipment, medical equipment for laboratory diagnostics, orthopedic and cardiovascular surgery devices.

In 2016, the highest demand was for high-tech innovative medical equipment (for electronic diagnostics-12%, orthopedics-8%, x — ray studies — 4%, respiratory therapy — 3.5%, neonatal intensive care-1.5%) [2016 TopMarketsReport, 2016]. In general, the global turnover of medical equipment and devices amounted to more than $ 130 billion. (Fig. 2). A significant market share belongs to American producers (more than 40%).

In general, the medical equipment and devices market growth is more than 6% per year. A significant market share is occupied by manufacturers of Germany, China, Japan, Italy and the United States, but in recent years Greece (15%), Macedonia (12.5%), Kazakhstan (12%) and Bolivia (11%) increased their share [2016 TopMarketsReport, 2016]. Table I shows the trends in the development of medical equipment and devices in the global perspective, that have an impact on the effectiveness of the company's entry into foreign markets.

In Eastern Europe, the Russian market of medical equipment is the most significant. In 2016, more than 80% of the market is occupied by foreign manufacturers of medical equipment and devices. The index of production of medical devices in Russia amounted to 107.2% (compared to 2015). In total, in 2016, medical devices were made for the amount of 52.8 billion rubles. [Pharmaceutical and medical industry, 2017]. In 2018-2019, the global market is expected tp grow by 5-6% and the Russian market of medical devices - by 8-10%.

In the domestic market of medical devices, the sales leaders focused on such areas as laboratory diagnostics (in vitro), minimally invasive surgery, diagnostic imaging, medical devices for resuscitation, general surgery, rehabilitation, etc. Further active growth in the segment of laboratory diagnostics and medical devices for resuscitation is predicted.

Tabulation 1

Global trends in the development of medical equipment and devices industry [Localproduction, 2012]

|

Trend |

Developed countries (USA, Western Europe) |

Developing countries (the BRIC countries and the Asian region) |

Growth opportunity |

|---|---|---|---|

|

The laboratories' expenditures for equipment |

Eligh staff turnover among management decision-makers. Ήιε tendency towards consolidation of smaller laboratories into the large networks |

Lack of basic equipment accumulates the demand |

Modernization of major Public Healtlicare Centres in Brazil and China. Development of rural medicine |

|

Impact of automation |

Medimn and long-term impact due to the prevalence of high technologies |

High impact for large medical facilities. Access to high-quality medical care is difficult for many categories of patients |

Decentralization and development of local laboratories in developed countries. Reduction in the cost of healthcare through the introduction of new methods of treatment. |

|

Market conditions |

Uiere is an "aging" of the market, growth of the competition among a limited number of players |

Protectionist policies on the local producers |

China provides foreign investment and imports with access to the public health facilities sector. There is a high potential for imports to Indonesia and Eastern Europe. |

|

End customer (patient) access to diagnostic systems |

Increasing the number of visits, personalized approach to each patient |

Due to the complex socio-economic situation, a narrow range of services is available |

Development of diagnostic systems for individual use |

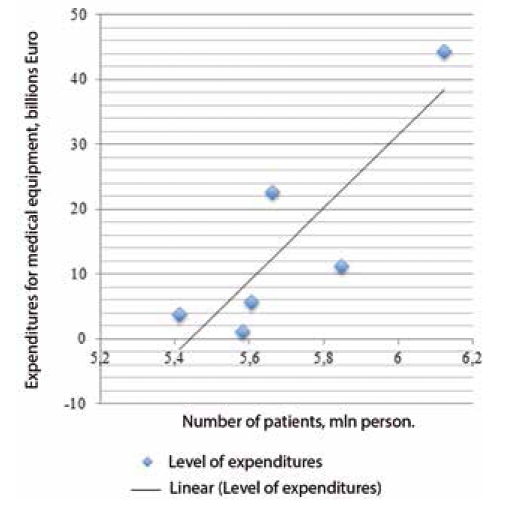

A linear regression is proposed based on the existing statistical data on the number of registered patients in a certain Department of medical institutions in the country, taking into account the purchased key equipment for their treatment:

y = kx + b,

where x-the total number of patients using the services of a particular Department of medical institutions in the country; v - the total number of units of basic medical equipment that is necessary for the treatment of patients of the Department for the year. Let us consider a linear regression model for patients with cardiovascular diseases in medical institutions of the European Union. From 1990 to 2015, in the European Union the number of registered patients with cardiovascular diseases increased. Table 2 shows the actual expenditures for medical equipment and treatment. The correlation between the number of patients and the expenditures for medical equipment is shown in Fig. 3. Based on the trend line, the following linear regression equation was derived:

y = 56,609 x + 3 x 1O0,8. If in the future the number of patients increases by one, the average value of the level of expenditures for medical equipment v will increase by 18.93 thousand euros.

Tabulation 2

Dynamics of the number of patients and expenditures for the cardiovascular diseases treatment in 1990-2015 [European CardiovascuIarDisease Statistics, 2017. EuropeanHeartNetwork, 2017]

|

Year |

Number of patients |

Expenditures, thousand euros |

|

|---|---|---|---|

|

for medical equipment |

for hospital treatment |

||

|

1990 |

5413 203 |

3 791 193 |

9 477 982 |

|

1995 |

5604 813 |

5 693 978 |

14 234 946 |

|

2000 |

5582 202 |

985 580 |

2 464 625 |

|

2005 |

5662 247 |

22 640 292 |

56 600 730 |

|

2010 |

5848 180 |

11 212 473 |

28 031 183 |

|

2015 |

6124 468 |

44 323 786 |

110 809 465 |

FEATURES OF LAUNCHING THE INNOVATIVE PRODUCT TO EXTERNAL MARKETS

Currently, the launch of medical equipment to the new market requires quite large financial resources, decisionmaking at many levels in the manufacturing company, including taking into account external opportunities.

The main areas of expenditures of the manufacturer include the protection of intellectual property rights, licensing and certification of equipment [Local production, 2017]. The consumer has to pay the manufacturer for the training of employees how to operate the new equipment. They will study the technological features of the equipment, the rules of safe operation, learn how to use various options of the equipment, training must be carried out on an ongoing basis. Only then can the new equipment be put into operation.

In order a manufacturer of high-tech medical equipment to successfully enter external markets, it is necessary to conduct a long and laborious assessment analysis, involving marketing, production, quality specialists, lawyers, financial managers; the period of such assessment can reach five years, taking into account the scale of the project. It is also necessary to work out the issue of localization of production (advantageous location in relation to the resources, including in the territory of special economic zones, where there are benefits for residents), the sales market, optimization of logistics), to take into account the peculiarities of state, legal and regulatory framework in the field of production and sale of medical equipment. [Tretyakova A. M., 2013]. In recent years, the developed countries have adopted stricter requirements for the quality of medical equipment than before.

Fig. 3. Correlation of the number of patients with cardiovascular diseases and the level of medical equipment costs in the EU from 1990 to 2015

In the process of bringing an innovative product to foreign markets, it is also necessary to analyze potential risks and develop measures to prevent them. As shown by the analysis of the activities of Russian and foreign producers of medical equipment, the most common are the risks listed in the table 3. There are also proposed measures that can minimize them.

Due to the significant scientific potential and high production technologies, the United States, Japan, the European Union traditionally occupy a significant share in the production and consumption of innovative high-tech medical equipment. Nevertheless, over the past decade, the production of medical equipment is improving in the BRICS and Asian countries, which were previously only consumers in this market.

State support is necessary for the optimal promotion of high-tech medical equipment. Thus, in the European Union, the European Commission is actively implementing a program to support manufacturers of medical equipment and devices, initiated in 2009 [Medical Devices, [s.a.]], in the United States, comprehensive support is provided by the Department of Eiealthcare and Social Services [Recent Final, 2018], in the Russian Federation the Federal Target-Oriented Program "The Development of Pharmaceutical and Medical Industry" was adopted [Government Decree, 2011].

ALGORITHM OF LAUNCHING THE INNOVATIVE MEDICAL EQUIPMENT TO EXTERNAL MARKETS

To implement successful development, market players need not only to expand the product portfolio, but also to use a set of strategies that are diversified depending on specific goals and market conditions. The key factors of success of medical manufacturing companies in foreign markets are:

- the creation of centers of competence and scientific and technological design centers, the formation of expert commissions for innovative development;

- the expansion and strengthening of the range for the specific cases of consumption (the formation of customized offers along with large-scale diversification of production);

- establishment of partnerships with high-tech companies in local markets, the possibility of establishing joint ventures with them;

- launch of funds developed and patented by major research institutes (under license agreements) to the markets

The overall improvement in the standard of living, the need to maintain and improve health, the development of the healthcare system in Asian countries, as well as the state of their markets, provide great opportunities for the development of both the national medical device industry, which is most flexible in responding to the needs of the current moment, and for the introduction and adaptation of the most effective and safe medical technologies available in international markets.

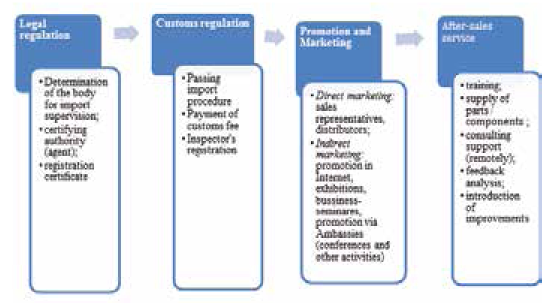

The algorithm of medical equipment launch consists of four main stages: legal regulation, foreign economic activity and customs regulation, promotion and marketing, after-sales service (Fig. 4).

Legal regulation. It is necessary to find out which authority is responsible for the legal regulation of the import of medical equipment in the target country (for example, in the India it's a Central Drugs Standard Control Organization (CDSCO)). In many countries, the import of medical equipment and devices requires the involvement of special organizations authorized by the national regulatory authority. Authorized organizations registered on behalf of the manufacturer and acting by proxy, carry out the necessary trade operations.

Customs regulation. The procedure for importing medical equipment includes providing a proforma invoice and placing an order for products by the purchasing organization in the target country. Customs clearance is carried out after payment of customs duty, assessment of the correctness of classification of medical equipment, as well as the presentation of the "certificate of origin" of medical equipment (documentary evidence of the proper quality of devices and their compliance with the requirements of existing legal documents) [Registration and certification of medical equipment, 2018].

Promotion and marketing. Direct marketing tools are based on direct personal communication with a representative of the organization acting as an intermediary or a potential buyer. Sales representatives and distributors promote the company's products, referring to public hospitals, hospitals, medical centers, private medical institutions, insurance companies, professional associations (for example, associations of neonatologists, resuscitators, anesthesiologists, pediatricians.

Tabulation 3

Risks and measures to reduce the probability of occurrence and to mitigate the risks impact of JSC "Shvabe" [GE Healthcare, 2016; Development Strategy, 2017;Annual Report, 2017]

|

Risk description |

Implications |

Measure |

|---|---|---|

|

Long terms of development and approval of requirements documents regulating the activities of project managers of companies and organizations in the structure of the manufacturing company |

Uncertainty in decisionmaking, failure to meet deadlines, reduction of profits |

• Attracting of qualified personnel; • control over the development and approval of documents; • control over the coordination and performance of work in accordance with the approved documents |

|

The growth of prices for products manufactured by large enterprises within the framework of the production program of the industry development |

Growth of production primecosts |

• Attraction of the reliable suppliers of materials, equipment and technologies; • balanced supply planning of all resources on the basis of a single planning system; • real-time monitoring of work implementation |

|

Decrease of debtors' solvency |

Occurrence of cash deficiency, growth of accounts receivable, untimely settlements with suppliers and contractors |

• Interaction with reliable customers on an ongoing basis; • selection of optimal forms of payment schemes and financial instruments; • optimal pricing policy; • maintaining liquidity at a sufficient level; • maintaining a certain level of accounts payable to suppliers and contractors; • development of measures to reduce costs and generate additional income. |

|

Reduction of budget financing of individual projects in certain industry areas |

Obtaining funds for the implementation of programs of technical reequipment production and research and development conducted in a smaller volume |

• Duration of works optimization; • search and attraction of other sources of financing, including own funds |

|

Destabilization of the financial market |

Increase in the cost of loans and credit lines services |

• Appeal to reliable banks that can provide loans at optimal cost (in case of emergency); • analysis of competitors in setting prices for finished products |

|

Failure to perform work due to insufficient qualification and number of staff |

Falling profits, lack of funds to finance current activities |

• Staff training and development; • recruitment of qualified staff; • the transfer of certain manufacturing operations to outsourcing |

Indirect marketing tools are effective in the long term for further expansion and gaining market share. These include the system of contextual advertising, promotion through social networks, advertising in the media and the Internet, as well as participation in industry exhibitions and seminars. A big role for medical equipment manufacturers is to participate in local tenders, to be present at highly specialized portals and forums for medical staff, in online catalogues of medical equipment. Thus, participating in industrial thematic exhibitions, manufacturers can attract new customers, and monitor key competitors. At the exhibition you can learn about their technological innovations, ergonomic advantages and guarantees of equipment operation. At business seminars and symposia, you can get acquainted with the heads of medical organizations responsible for making decisions about the purchase of equipment. The tools of indirect marketing include the cooperation with the embassies on the territory of the Russian Federation (participation in the activities of the embassies, raising awareness of participants of the Embassy activities about the brand and products, acquaintanceship and cooperation with potential clients, public relations (PR) events).

After-sales service. The company provides training for employees of the client company, how to operate the equipment (brochures, detailed operating instructions in English and the national language of the client), organization of delivery of the necessary components at the request of the client, and consulting support (at the beginning of cooperation — on a remote basis, in the future, a personal meeting of representatives of the manufacturer and medical institution).

Fig. 4: The algorithm of medical equipment launch to foreign markets

In the process of using the products, it is necessary to periodically analyze the feedback data in order to further improve the operation of the products, take into account the individual needs and wishes of the customer organizations.

CONCLUSIONS

Based on the analysis of the experience of leading global and Russian manufacturers of medical equipment for the development of foreign markets, we can give some practical recommendations on how to bring high-tech innovative products of the company to external markets.

- Control over the price — quality ratio on the basis of monitoring of local and foreign analogues of products and analysis of competitors' offers in order to ensure the competitiveness of their products in price and quality. This situation is very relevant in the markets of developing countries.

- Offering the integrated solutions in the international market:

- consulting services in the context of acquisition and use of the company's products;

- comprehensive, universal solutions for mobile healthcare;

- full after-sales service and on-site and remote support;

- application of digital technologies within the most convenient and effective use of the company's products;

- training of the staff of medical institutions — customers in the framework of maintenance service(trainings, masterclasses on site and remotely);

- training of heads of departments of medical institutions (mainly in the framework of remote consulting);

- Formation of joint ventures with foreign medical institutions for the implementation of medium - and long-term projects in the target foreign marketfprimarily in the field of research and development), taking into account the individual needs of the audience in this market.

- Creation of public-private associations for the implementation of projects in the field of healthcare, including through participation in the state targeted programs to support healthcare in the country.

In general, in order to achieve success in the development of foreign markets, the manufacturer of medical equipment should be guided by the principle of continuity of innovative processes and developments to ensure continuous improvement of ergonomics, reliability and functionality of products.

References

1. Miklashova E. V. (2015) Comparative analysis of the state and development of markets for medical equipment in Russia and abroad // Modern scientific research and innovations. URL: http://web.snauka.ru/issues/2015/07/56036.

2. Resolution of the Government of the Russian Federation No. 91 "On the Federal Target-Oriented Program "The Development of Pharmaceutical and Medical Industry of the Russian Federation for the Period up to 2020 and Beyond" as of 17.02.2011. URL: http://incip.ru/wp-content/uploads/2014/03/FCP_pharmaceutical_and_medicine_industry.pdf.

3. Registration and certification of medical equipment for import and export, 2018, official website of Scientific-Research Engineering Center "PromEk". URL: http://www.medical-promek.com/ru/regMed_Ind.php.

4. Development strategy 2020 (2015) // "Shvabe" JSC. URL: http://shvabe.com/upload/iblock/7b5/7b56703c52e034dbfcbcc0f0d149bc09.pdf.

5. Tretyakova M. (2013) Localization of medical devices: international experience and key success factors // Roszdravnadzor Vestnik No. 1. P. 25-33.

6. Pharmaceutical and medical industry: some important results and indicators of 2016 (2017) / / The Government of the Russian Federation. URL: http://government.ru/info/27213/.

7. Allen K. R. (2003) Bringing New Technology to Market. Upper Saddle River, NJ.

8. Annual Report (2017) .// Draeger. URL: https://static.draeger.com/cc/finanzberichte/2018/gb-2017/annual-report-2017-wmet6azyn.pdf.

9. Cooper R. G., Edgett S. E. (2010) Developing a product innovation and technology strategy for your business // Research Technology Management. 53(3). P. 33–40.

10. GE Healthcare, Investor Update (2016) // GE. URL: https://www.ge.com/sites/default/files/ge_webcast_presentation_03112016_0.pdf.

11. HauserJ., TellisG.J., GriffinA.(2006) Research on Innovation: A Review and Agenda for Marketing Science // Marketing Science. Vol. 25, N 6. P. 687–717.

12. Local production and technology transfer to increase access to medical devices. Addressing the barriers and challenges in low- and middle-income countries (2012) //WHO. URL: http://www.who.int/medical_devices/1240EHT_final.pdf.

13. Medical Devices ([s.a.]) // European Commission. URL: https://ec.europa.eu/growth/sectors/medical-devices_en.

14. MohrJ.,SenguptaS., SlaterãS.(2010) Marketing of High-Technology Products and Innovations. Upper Saddle River, NJ.

15. Recent Final Medical Device Guidance Documents ([s.a.]) // U.S. Department of Health and Human Services. URL: https://www.fda.gov/MedicalDevices/DeviceRegulationandGuidance/GuidanceDocuments/ucm418448.htm.

16. SharmaãA., IyerãR., EvanschitzkyãH.(2008) Personal Selling of High-Technology Products: The Solution-Selling Imperative // Journal of Relationship Marketing. Vol. 7, N 3. P. 287–308.

17. 2016 Top Markets Report Medical Devices (2016) // International Trade Administration, U.S. Department of Commerce. URL: http://www.trade.gov/topmarkets/pdf/Medical_Devices_Executive_Summary.pdf.

18. ZhuryloãV.,IazvinkaãN.(2007) Marketing strategies for technology innovation products // Economics and Management. Vol. 16, N 1. P. 32–39.

19.

About the Author

K. V. SayapinaRussian Federation

PhD in Economics, Associate Professor, Department of Management, Financial University under the Government of the Russian Federation. Research interests: innovation management, strategic management in high-tech industries.

Review

For citations:

Sayapina K.V. BRINGING INNOVATION PRODUCTS ONTO EXTERNAL MARKET: AN EMPIRICAL ANALYSIS OF MEDICAL DEVICES INDUSTRY. Strategic decisions and risk management. 2018;(3):80-87. https://doi.org/10.17747/2078-8886-2018-3-80-87