Scroll to:

STIMULATING INNOVATION IN DISTRIBUTED ENERGY

https://doi.org/10.17747/2078-8886-2018-3-54-59

Abstract

The development of distributed energy can significantly improve the efficiency of the electric power industry by using new technologies. Existing mechanisms are associated with the threats of losing existing competencies in the production of domestic equipment for distributed energy and the risks of creating the market only for foreign producers. The article contains analysis of incentive measures for distributed energy, in particular, objects based on renewable energy sources, and contains identified problems and suggested ways to solve them.

Keywords

For citations:

Popadyuk T.G., Kupreev D.A. STIMULATING INNOVATION IN DISTRIBUTED ENERGY. Strategic decisions and risk management. 2018;(3):54-59. https://doi.org/10.17747/2078-8886-2018-3-54-59

INTRODUCTION

Thermal and electrical energy occupies a significant proportion in the finished product value; respectively, the desire to reduce the cost of produced and consumed energy encourages active engagement in the implementation of various innovations. Innovative development of power industry is one of the main priorities in the state policy of the developed countries.

This segment of power industry has existed since the early 20th century, when domestic energy was formed at large. In future, the choice was made in favor of large power plants, whose technical and economic characteristics were superior to the objects of low-power generation, and the electricity transmission systems appeared. The distributed energy objects actually existed only in the inaccessible places, where attaching of consumers to the centralized electrical networks was economically inexpedient. Energy sources for the distributed energy objects may be natural gas, coal, municipal solid waste, renewable energy sources (the sun, water, wind, etc.).

Distributed energy assumes that small up to 25 Mw power plants of consumers are included into the unified energy system or operate autonomously. Abroad other power limits are practiced ranging from I Mw in Italy to 100 Mw in Slovakia and Hungary [Bayod Rtijula A. A, 2005; Trachuk A.V., Lmder N.V., 2018]. To date, distributed energy is demanded in many areas: in the remote territory, housing and communal services, mobile consumers, as well as in the industries requiring special characteristics of the used energy, etc. Distributed energy includes the following technologies:

- gas piston and diesel plants;

- gas-turbine and steam-gas plants;

- plants of direct combustion and gasification of coal and solid waste;

- solar batteries;

- wind turbines;

- water turbines of small power;

- thermal pumps;

- energy storage technologies;

- intelligent network technologies ;

- other (the use of atomic energy, fuel cells on natural and producer gas and etc.) [Nalbandyan G.G., Zholnerchik S.S., 2018].

According to various estimates, in Russia the distributed energy share is about 5-7% [Hannes B., Abbott M., 2013; Distributed energy, 2015; Khovalova T.V., 2017]. The lack of fixed definitions and classifications results in the lack of statistical service of this kind of objects.

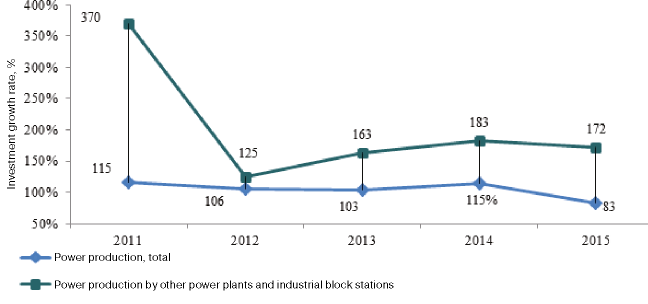

Fig. 1. Dynamics of investments into fixed capital by the types of activity [Federal agency, [б.г.]]

Nevertheless, the segment itself is growing, evidenced by the increased investment in the fixed capital of the facilities of the industrial block stations of consumers (fig. I), and at that more than the electric power industry as a whole.

According to General Electric company forecasts the worldwide introduction of new capacities by 42% will be provided by distributed energy to 2022 (fig. 2).

The world experience shows that the development of power systems based on distributed energy not only solves the trivial tasks of remote energy consumers, but also is one of the most relevant innovative directions. Through the use of new technologies, it can significantly improve the performance of the electric power complex [see, e.g.: Trachuk A.V., Linder N.V., Zubakm V.A. et al.,2017].

Abroad, distributed energy represents predominantly objects based on renewable energy sources (RES). According to Bloomberg New Energy Finance, by 2040 72% of investments in the new generation will account for the facility that uses sun and wind energy. Stimulating the development of RES technologies has led to the fact that by the cost of electricity such generation objects came up with traditional energy sources, in some circumstances, it became even less. In general, reducing the cost of electricity production on solar panels from 2009 to 2017 decreased by 67%, and on wind turbines — by 86% [Lazard’s levelized cost, 2017]. Perhaps by 2050 the world's energy system will 100% consist of renewable energy sources and at that the cost of the produced electricity will be cheaper than it is today [Energy watch group, 2017].

Such achievements in the field of RES were made possible thanks to the fact that many countries have policies that includes subsidies to the large-scale use of technologies through the establishment of special tariffs, tax credits and other mechanisms. The basic idea is to use the effects of training and investment in training, as well as reducing the cost of equipment and increasing the output volumes [Rubin E.S., 2015]. It also assumes the subsidization of expanded innovations until they become fully competitive in comparison with the traditional technologies.

Fig. 2. Forecasts of the distributed generation introduction in the world [Owens B., 2014]

ANALYSIS OF INCENTIVE MEASURES FOR INNOVATION DEVELOPMENT OF DISTRIBUTED ENERGY IN RUSSIA

Support for RES development in Russia began only in recent years. It was set the target volume of production and consumption of electric power with the use of renewable energy sources (excluding hydroelectric power stations with the installed power exceeding 25 Mw) — 4,5% [Regulations, 2009].

Development of distributed energy in Russia is assigned in the regulations [Energy strategy, 2009; Draft of energy strategy, 2017]. It is defined the state support for the introduction of power generating facilities on the basis of RES [Regulations 2013; Regulations 2015; Plan 2017]. Adetailed analysis of these regulations has been held in a number of works [New scheme, 2013; Zhykharev A., 2017; Zubakm V. A., Kovshov N.M., 2015]. The subject of their research was the shortcomings of the practical embedding of implementation mechanisms for RES that remains outside the scope of this work.

Incentive mechanism of power production was embedded on the wholesale market of electric energy and power via power provision contracts (PPC) by the qualified generating objects, operating on the basis of the use of renewable energy sources [Regulations, 2013]. PPC are made to ensure the increased cost for electrical power for RES objects that allows achieving the payback of investment. The PPC mechanism fully operates on the wholesale market.

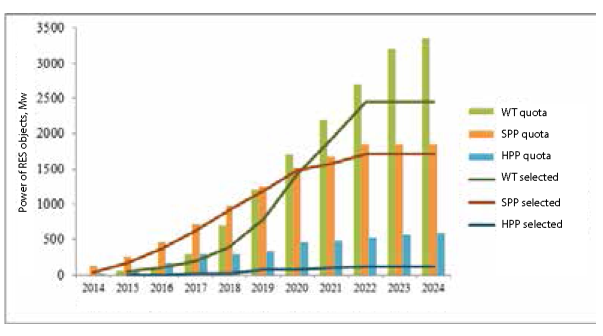

The main criteria in selecting projects are capital costs, load factor, which limiting value is established by the regulatory framework, the level of localization of the used equipment. Targets of RES object localization degree are presented in table I. As of November 2017 2452.06 Mw was selected from wind turbines (WT), 1704.2 MW from solar power plant (SPP), 120.2 Mw from small hydro power plants (HPP). The actual selection of projects RES and SPS almost completely covers the allocated quotas (by 91 and 97% respectively), while ElPP lag far behind: the proportion of the selected projects is 34%. In Fig I. information is provided for RES objects scheduled for commissioning and actually selected as of 2017.

Table 1

The level of production equipment localization

|

Source for electric generation of a generating object |

Year of commissioning |

Target of localization degree, % |

|---|---|---|

|

Wind energy |

2015-2016 |

25 |

|

2017 |

40 |

|

|

|

|

|

|

2018 |

55 |

|

|

2019-2024 |

65 |

|

|

Photoelectric transformation of solar energy |

2014-2015 |

50 |

|

|

|

|

|

2016-2024 |

70 |

|

|

Energy of waters *

|

2014-2015 |

20 |

|

2016-2017 |

45 |

|

|

|

65 |

|

|

* Power of object less than 25 Mw. |

||

It is expected that the deficit of commissioning of RES objects will be compensated through the implementation of two other incentive measures.

It is planned to install special higher tariffs for RES-based energy producers on the retail market to ensure the recoupment of projects over 15 years [Regulations, 2015].

To get these tariffs, the producer must meet the following conditions:

- electricity production should be on qualified generative object;

- the amount of electric energy production by qualified RES objects should not exceed 5% of the forecast losses of territorial network organizations on the territory of a subject;

- the project implementation should lead to minimizing the increase of prices (tariffs) for electric energy (power) to the ultimate consumers of the electric energy (power) retail market;

- the proj ect implementation should contribute to minimizing the environmental damage;

- the proj ect implementation should contribute to the solution of social problems on the territory of the investment project implementation.

To date, within the framework of this mechanism no project was implemented.

An action plan for promoting the development of power generating facilities on the basis of renewable energy sources with the installed capacity of up to 15 kW implies the compulsory purchase of electricity from private microgeneration owners on the basis of RES by the ensuring suppliers and network companies. Individuals carrying out such operations shall be exempt from tax liabilities.

In Russia there are no domestic commercially successful technologies of production of million- kilowatt class wind-generator plants [Regulations, 2015]. Implementation of localization requirements for the used foreign equipment demanded the establishment of new industries. It is planned to build joint productions to manufacture the equipment for wind power plants. The founders will be:

- JSC "VetroOGK" (a subsidiary of JSC "ОТЕК" (Division of SC “Rosatom” on non-nuclear assets management) and Lagerway (Netherlands);

- LLC “Fortum Energy” (a j oint fund Fortum and “Rosnano”) and Vestas (Denmark).

- PJSC «Enel Russia» and Siemens Gamesa (Germany, Spain).

Solar energy equipment needs to implement the scheduled ccommissioning for more than 80% are covered by the domestic company "Heveb (joint venture SC “Renova” and OJSC “Rosnano”). The only foreign player, who took part in the competition for the selection of RES projects, was LLC “Solar Systems” (the founder is the Chinese company Amur Sirius).

With regard to the equipment production for small hydropower industry, the small capacity hydraulic turbines are produced by JSC «MIES», JSC «Nord Gicko ", PJSC Silovye mashrny, OJSC "TMZ", JSC "Tyazhmash", JSC "Inset". The more surprising is the low level of investor interest in the construction of power plants. The scheduled commissioning of RES objects look quite realistic in view of the fact that there are domestic producers of the appropriate equipment and it is planned to open the new ones.

However the chosen way of promoting RES implementation can lead to a number of negative consequences from the point of view of innovative development of domestic technology for the following reasons:

- The market volume of RES objects in Russia, taking into account the learning models, which assume the cost saving of equipment production, is inadequate for the competitiveness of the Russian power equipment manufacturers. Thus, one of the basic principles of the development of RES technologies is broken, which leads to the ultimate reduction in the cost of electricity generation at such sites. As a result, the implementation of RES projects is likely to ensure that the costs of more expensive electricity production, compared to the conventional sources, will be passed on to the customers [Ratner S. V., KlochkovV.V, 2015].

- The reviewed incentive measures in wind power industry will be implemented mainly by foreign technology. There are adopted requirements for the production localization, but the question remains whether there will be the transfer of technology, critical for domestic power engineering. Foreign experience also shows that the deployment policy stimulates innovation activity of basically foreign manufacturers [DechezlepretreA,, MartinR., Bassi S,2016; Fluenteler J.; 2012]. In Russia the investment promotion mechanisms in RES suggest only the measurements to establish the market, the research and development stages are ignored.

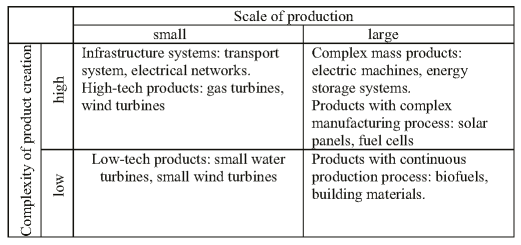

- Modem research shows that different technologies require different support measures [Fluenteler J., 2016; Trachuk A.V., 2011]. Products of mass production require a large market, ideally coordinated at the international level, to achieve the necessary economy at the expense of a scale and learning in the production process. For larger and complex equipment (wind turbines, geothermal systems, nuclear power plants and tidal energy systems) the deployment policy should go beyond a mere subsidization of the scale of production. The large-scale financing of R&D is needed. The policy should aim at reducing the technological uncertainty of innovative products. In Fig 4. the classification of technologies depending on the complexity of their creation and the scale of production is presented.

- Innovative development of RES technologies is precluded by the rigid attachment of one kind of the applied technologies within the framework of realization of investment projects. Development of distributed energy technologies, including those based on the renewable energy sources, is directly related to the problems of electric power transporting and maintenance of energy system sustainability. Because of functioning peculiarities of RES objects (for example, varying duty) it is expedient to apply a set of different technologies within a single project, including those on the basis of traditional energy sources [Trachuk A.V., 2010].

Fig. 3

Power of RES objects scheduled for commissioning and actually selected as of 2017, cumulative, Mw

Fig. 4. Energytechnologies depending on the scale of production and complexity of creation

Domestic technologies of distributed generation based on natural resources are quite competitive as compared with foreign counterparts. But in this segment import prevails, in various directions it reaches 80% [Regulations, 2015], which also makes up the urgent task to stimulate domestic producers.

For the development of distributed energy and power industry as a whole, it will be important to create intelligent networks (smart - grid). Their technologies allow to combine various technologies of energy generation and accumulation, provide the increased reliability and security of energy supply, provide for consumers — owners of their own means of generating and accumulation — opportunities to implement the surplus power produced by own sources of generation, to manage the demand for electricity and, as a consequence, they optimize the electrical loads and can reduce the need for new facilities that is absent so far.

Forecast of electric power industry development up to 2040 suggests that the main trend in the global power industry will be the aggregate of the following technological breakthroughs:

- The substantial cost reduction and performance improvement of technology of renewable energy and cogeneration of low power;

- the radical cheapening and mass distribution of stationary and mobile power storage technologies based on storage batteries;

- the transition to new principles of control of power supply systems and organization of market operations on the basis of new information technologies [Forecast, 2016].

Thus, the promotion of integrated projects, involving the combination of different RES technologies and traditional generation objects, connected by intellectual networks, will not only improve the efficiency of power grids, but also provide the development of domestic equipment manufacturers for various segments of distributed energy.

CONCLUSIONS

Analysis of stimulating of enhanced embedding of RES obj ects in Russia showed that there are a number of challenges and barriers to the innovative development of domestic technologies of distributed energy. In our opinion, to overcome this the existing mechanisms should be supplemented by the following measures:

- to provide funding for research on the creation of technologically complex products (wind turbines, gas turbines, smart grid), encourage the establishment of testing laboratories and certification centers, where the cooperation of manufacturers and research institutions, control and testing of developments with the minimal bureaucratic barriers will be provided;

- to encourage the domestic equipment (solar power plants) export for the mass market by providing the export subsidies, concessional export credits and support at the international certification stages;

- to pursue the balanced development of all innovative directions in this segment (RES, traditional technologies of distributed generation, intelligent networks) through the implementation of projects with the ability to use the aggregate of various technologies.

- The implementation of the identified measures will allow adopting the integrated policy for innovation development of distributed power industry, taking into account the interests of domestic equipment manufacturers.

References

1. Zhykharev А. (2017) Support of RES on retail markets: signal to action// VygonConsulting. URL: https://vygon.consulting/upload/iblock/411/vygon_consulting_res_retail.pdf.

2. Zubakin V.A., Kovshov N.M. (2015). Volatility analysis models and methods of RES manufacture, taking into account cyclicity and stochasticity // Effective crisis management. № 4. p.p. 86–98.

3. Nalbandyan G.G., Zholnerchik S.S (2018). Key factors in the effective use of distributed generation technologies in the industry // Strategic decision making and risk management. № 1. p.p. 80–87.

4. New renewable energy support scheme on the basis of power fees: analysis of regulations № 449 (2013) // The International Finance Corporation URL: https://www.ifc.org/wps/wcm/connect/0a3d858040c76575ad72bd5d948a4a50/Energy+Support+Scheme_Rus.pdf?MOD=AJPERES.

5. An action plan for promoting the development of power generating facilities on the basis of renewable energy sources with an installed power of up to 15 kW (2017) // http://static.government.ru/media/files/D7T1wAHJ0E8vEWst5MYzr5DOnhHFA3To.pdf.

6. Resolution of the Government of the Russian Federation of 23.01.2015 N 47 “On amendments to certain acts of the Government of the Russian Federation for the promotion of renewable energy sources in the electricity retail markets” // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_174584/.

7. Resolution of the Government of the Russian Federation of 28.05.2013 N 449 (ed. of 28.02.2017) “On the mechanism for encouraging the use of renewable energy sources on the wholesale market of electric energy and power” // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_146916/.

8. The order of the Trade and Industry Ministry of Russia of 31.03.2015 N 653 (ed. of 30.11.2016) "On approval of the action plan for import replacement in power engineering, cable and electrical industries of the Russian Federation"./ ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_224909/.

9. Forecast of energy development in the world and Russia (2016) / Ed. by А. А. Makarov, L.M.Grigoriev, Т. А. Mitrova; ERI RAS – AC at RF government. М., 200 p.

10. The project of energy strategy of the Russian Federation for the period up to 2035 (2017)// Ministry of Energy of the Russian Federation. URL: https://minenergo.gov.ru/node/1920.

11. Decree of Russian Federation Government of 08.01.2009 N 1-р (ed. of 15.05.2018) «About the main directions of the state policy in the sphere of energy efficiency increase of power industry through the use of renewable energy sources for the period up to 2024» // ConsultantPlus. URL: http://www.consultant.ru/document/cons_doc_LAW_83805/.

12. Distributed energy of RF and the market of power plants. The results of 2014. Trends of 2015. Forecast up to 2017. Extended version (2015) // INFOLine.URL: http://infoline.spb.ru/shop/issledovaniya-rynkov/page.php?ID=97202&sphrase_id=123951.

13. Ratnet S.V., Klochkov V.V. (2015) Efficiency analysis of localization of equipment production for "green" energy in Russia // Financial Analytics: problems and solutions. № 38. p.p. 2–14.

14. Trachuk A.V., Linder N.V. (2018) Distributed generation technologies: empirical assessment of application factors // Strategic decision making and risk management. № 1. p.p. 32–49.

15. Trachuk A.V. (2010). The risks of concentration increase in the electricity market / Energy market. № 3. p.p. 28–32.

16. Trachuk A.V. (2011) Development of power industry regulatory mechanisms in the context of its reformation // Economy and management. № 2 (64). p.p. 60–63.

17. Trachuk A.V., Linder N.V., Zubakin V.A.et al. (2017) Cross-subsidization in the electric power industry: problems and solutions.. St.Petersburg: Real economy. 121 p. URL: https://elibrary. ru/item.asp?id=29835475.

18. Federal agency of state statistics ([б.г.]). URL: www.gks.ru.

19. Khovalova T.V. (2017) Modelling of effectiveness of transition to proper generation // Effective crisis management. № 3 (102). p.p. 44–57.

20. Energy strategy of Russia for the period up to 2030 (2009) // Ministry of Energy of the Russian Federation. URL: https://minenergo.gov.ru/node/1026/.

21. Dechezleprêtre A., Martin R., Bassi S. (2016) Climate change policy, innovation and growth // The Grantham Research Institute on Climate Change and the Environment, Global Green Growth Institute. URL: http://www.lse.ac.uk/GranthamInstitute/wp-content/uploads/2016/01/Dechezlepretre-et-al-policy-brief-Jan-2016.pdf.

22. Hannes B., Abbott M. (2013) Distributed energy: Disrupting the utility business model // Bain & Company. URL: http://www.bain.com/Images/BAIN_BRIEF_Distributed_energy_Disrupting_the_utility_business_model.pdf

23. Hossain M. S., Madlool N. A., Rahim N. A. et al. (2016) Role of smart grid in renewable energy: An overview // Renewable and Sustainable Energy Reviews. Vol. 60. P. 1168–1184

24. Huenteler J. (2012) Japan’s post-Fukushima challenge – implications from the German experience on renewable energy policy // Energy Policy. № 45. P. 6–11.

25. Huenteler J., Schmidt T. S., Ossenbrink J. et al. (2016) Technology life-cycles in the energy sector — Technological characteristics and the role of deployment for innovation // Technological Forecasting & Social Change. Vol. 104. P. 102–121.

26. Bayod Rújula A.A., Mur Amada J., Bernal-Agustín J.L. et al. (2005) Definitions for Distributed Generation: a revision. // RE&PQJ. Vol. 1, N 3. P. 341.

27. Lazard’s levelized cost of energy analysis – version 11.0 (2017) // Lazard URL:https://www.lazard.com/media/450337/lazard-levelized-cost-of-energy-version-110.pdf.

28. New Energy Outlook 2017 // Bloomberg New Energy Finance. URL: https://www.res4med.org/wp-content/uploads/2017/06/BNEF_NEO2017_ExecutiveSummary.pdf.

29. Owens B. (2014) The rise of distributed power // General Electric Company. URL: https://www.ge.com/sites/default/files/2014%2002%20Rise%20of%20Distributed%20Power.pdf.

30. Ram М., Bogdanov D., Aghahosseini A. et al. (2017) Global Energy System based on 100% Renewable Energy — Power Sector // Lappeenranta University of Technology and Energy Watch Group. URL: http://energywatchgroup.org/wp-content/uploads/2017/11/Full-Study-100-Renewable-Energy-Worldwide-Power-Sector.pdf.

31. Rubin E.S. (2015) A review of learning rates for electricity supply technologies // Energy Policy. Vol. 86. P. 198–218.

32.

About the Authors

T. G. PopadyukRussian Federation

Doctor of Economics, Professor, Department of Management, Finance University under the Government of the Russian Federation. Research interests: innovations, distributed energy, renewable energy sources.

D. A. Kupreev

Russian Federation

Economist, “TRAIDING HOUSE “AGROTORG”, LLC. Research interests: innovations, distributed energy, renewable energy sources.

Review

For citations:

Popadyuk T.G., Kupreev D.A. STIMULATING INNOVATION IN DISTRIBUTED ENERGY. Strategic decisions and risk management. 2018;(3):54-59. https://doi.org/10.17747/2078-8886-2018-3-54-59