Scroll to:

FOURTH INDUSTRIAL REVOLUTION: HOW THE INTERNET OF THINGS INFLUENCESON INDUSTRIAL BUSINESS RELATIONSHIPS?

https://doi.org/10.17747/2078-8886-2018-3-16-29

Abstract

Empirical research is devoted to influence of quality and value of relationship of partners on acceptance of the Internet-of-Things (IoT) technologies. Research is based on carrying out interview in selection of 51 companies (157 respondents).Transformation of relationship of the industrial companies in the B2B markets as a result of introduction of technology of the Internet of things is shown. It is shown that the IoT technologies influence transformation of norms of relationship among which a key role play: information exchange, technical feasibility, flexibility, openness, technological acceptance, trust, lack of opportunism, monitoring of behavior of partners. IntroductionofIoTaddsonemorekeyinterrelationhavingnatureofblastingtechnology – information. Further it will demand “information as service” model development.

Key characteristics of quality, and also function of value of the relationship, influencing acceptance by the companies of the IoT technologies are allocated. Рractical recommendations about application of the received results of research are presented.

Keywords

For citations:

Trachuk A.V., Linder N.V. FOURTH INDUSTRIAL REVOLUTION: HOW THE INTERNET OF THINGS INFLUENCESON INDUSTRIAL BUSINESS RELATIONSHIPS? Strategic decisions and risk management. 2018;(3):16-29. https://doi.org/10.17747/2078-8886-2018-3-16-29

INTRODUCTION

At present, new digital technologies are actively introduced in industry. However, digital optimization of the current business may not be enough to remain competitive. In the long run, those actors will occupy leading positions on the market who will be able to make more drastic changes - create ecosystems of partner services and enter adjacent markets. The important components of a long-term strategy will be: improving mechanisms of organizing partnerships, accumulating expertise in related sectors, introducing application programming interfaces (API) to create digital ecosystems around the main business, as well as the readiness of business owners and investors to higher competition and other aspects related to profitability of the invested capital, low free cash flow at the entry to adjacent digital markets. In order to obtain resources and develop competences needed to transform traditional companies into highly technological, the actors in the sector should already now lay the foundations for building partner services ecosystems. The key technology that helps create such partnership networks is the Internet of Things, the IoT. In the survey published by PwC, the IoT is the first ‘among the eight emerging technologies that can change business models of companies and whole industries’ [A Decade of Digital. Keeping pace with transformation, https://www.pwc.ru/ru/publications/global-digital-iq-survey-rus.pdf 2017], and in this rating it is ahead of the artificial intelligence, augmented reality, drone technology, blockchain and others. The IoT is also first in the rating that assesses the level of investment in various emerging technologies.

The term Internet of Things was first introduced by K. Ashton [Ashton K., 2009], who suggested adding radio-frequency identification (RFID) tags to objects of everyday use.

The concept of IoT is based on the principle of computer-to- computer communication without man’s participation, which makes it possible to build networks of enterprises transforming business models and expanding marketing opportunities [Miorandi D., Sicari S., De Pellegrini F. et al., 2012]. To achieve common goals, companies need to interact in real time via standard communication protocols, which can be ensured only with the introduction of IoT [Atzori L., Iera A., Morabito G., 2010; Atzori L., Iera A., Morabito G. Et al., 2012]. It enables them to conduct experiments and model industrial designs in real time without participation of manufacturer’s representatives [Civerchia F., Bocchino S., Salvadori C. et al., 2017]. The clients can analyze the prototype, identify whether it corresponds to key expectations and control the achievement of the desired result [Marquier J., Lee N.-C., Jeon Y.- G. et al., 2016].

The use of IoT technology enables businesses to increase operational efficiency and cut costs [Atzori L., Iera A., Morabito G., 2010; Da Xu L., He W., Li S., 2014], expand the interaction between sellers and buyers. The key value for clients within this cooperation is the service’s reliability and quality achieved with the help of technologies used [KannanR, Hongshuang A. L., 2016].

At present, businesses do not relate the introduction of IoT with gaining competitive advantages including the possibility to create a value together with the consumer.

Transfer of data to the manufacturer presents a problem to the consumer, primarily connected with trust, even if the partnership is a long-standing and stable one. The introduction of IoT causes a disruption, a break, largely pertaining to the partners’ trust, their interaction norms, technical adaptation of seller/buyer’s devices [Stankovic J. A., 2014].

The study aims to analyze how the relationship models are transformed and to empirically identify the key factors that impact the acceptance of IoT technology when forming the partnership. The answer to this question will enable the companies to improve the ways of forming long-term partnerships.

Table 1

Norms of relationships with partners [Medlin C. J., 2004]

|

Norm |

Description |

|---|---|

|

Norms that form value |

|

|

Long-term orientation Infonnation sharing Flexibility Fulfilhnent of mutual obligations Plaiming relations Solidarity |

Intention and willingness to long-tenn cooperation Reciprocal provision of information needed by partners Intention and willingness to adapt existing objectives, strategies and business processes to changing external conditions Accurate fulfillment of the agreements reached (including verbal ones) Definmg objectives and tasks for future cooperation Supporting partners, including providing assistance in difficult economic conditions |

|

Norms aimed at sharing of jointly created value |

|

|

Reciprocity Monitormg partner’s behavior Conflict resolution Restricting the use of force |

Perceivmg success as a result of joint actions Controllmg how the partner fulfills the agreements reached within the partnership Hie sides’ abilities to reach agreement, including with the help of informal relations and flexible interpersonal tools Restricting the use of pressure and market power of one of the sides for the sake of better conditions for one side exclusively |

LITERATURE REVIEW

Business interaction models at B2B markets

Over the last few decades, business relations at B2B markets have been undergoing substantial changes. Since 1980-s, there has been a clear trend to form long-term relationships and build supplier-customer partnerships as well as strategic alliances and inter-company networks. Norms are the tools used to manage relations within these partnerships [Medlin C. J., 2004], and they can be conditionally divided into those forming the value of relationship (trust, mutual fulfillment of obligations, etc.) and those supporting the mutual benefits of relationship and sharing of the jointly created value (Table 1).

Strategic alliances began to emerge vigorously in the late 1980-s, and presently they are a widespread form of partnership. The definition used most often is this one: ‘Alliance is an association of companies oriented at achieving a common strategic goal while maintaining strategic autonomies’ [Garrette B., Dussauge P., 2002]. A strategic alliance is legally established relations regardless of the form of companies’ association. Participants create the alliance in order to increase competitiveness of each of them. As the partners maintain their independence, the alliance has several management centers [Garrette B., Dussauge P, 2002].

A term ‘inter-firm network’ is used in academic research alongside with the term ‘ strategic alliance’. They are often used as synonyms due to similarity of their major characteristics.

Aplethora of definitions of a ‘network’ is offered:

- ‘combination of interacting companies conjoining their resources for joint activity to render goods or services to a certain segment of market’ [HakanssonH., SnehotaI., 1995];

- combination of companies united by formal and informal relations, having common expertise and technologies, joint access to resources and management [Brass D. J., Galaskiewicz J., Greve H. R. et al., 2004].

When making the decision to choose a product, consumers are inclined to rely on objective criteria and rational strategies. Hence, at B2B markets companies are also free to choose partners, and they interact on a mutually beneficial basis aiming to form stable competitive advantages [Brown B. P., Zabla A. R., Bellenger D. N. et al., 2011]. The development of such partnerships led to transformation of sectoral markets, where inter-firm networks started to compete and the markets globalized. This transformation was called ‘network economy’ or ‘network society’ [Achrol R. S., Kotler P., 1999].

Formation and development of inter-firm networks was the response to the evolving external conditions and the need to compete amidst globalization. Mainly, they are built for development of high-tech products and new technologies, risk-hedging, etc. The sources of competitive advantage of inter-firm networks are cutting the costs for development and market launch of new products, joint investment in research and development, etc.

If earlier alliances and inter-firm networks formed randomly, now partnerships are the tools to intentionally coordinate the activity of participants and gain key competitive advantages. Therefore, it is essential to understand how company-to- company relations are changing in the conditions of the new industrial revolution. This issue is as much important for Russian companies, who face competition with inter-firm networks at both internal and external markets.

IoT and interaction models of businesses: disruptive transfonnation

The existing studies of key technologies of Industry 4.0, including the IoT, do not provide comprehensive understanding of the transformation of companies’ interaction models at industrial markets. With regards to companies’ interaction models, IoT is a disruptive innovation at an early stage of implementation. The ‘disruption’ lies in the new ways of data transfer and interaction that excludes participation of companies’ officials [Ng I. C., Wakenshaw S. Y., 2017].

The classical interaction model presents a combination of ties that include:

- economic (special terms of delivery, discounts, etc.);

- social (personal contacts, disposition, trust);

- legal (long-term contracts, interdependence relations);

- technical (agreement of technical standards, adaptation of products and business processes).

The interaction using IoT requires transfer of data, which can subsequently be available to others; hence, there is a chance of an unauthorized access to the customer’s data [Ng I. C., Wakenshaw S. Y., 2017]. Companies have not only direct, but also indirect relations, between organizations not connected directly, but interacting through a third company, with which they have a stable relationship. The network has no boundaries and evolves due to these indirect links. Moreover, a business can participate in several networks simultaneously. AU this leads to increased risks when company’s information is transferred and possibility to obtain data of companies that are indirectly connected.

The key element of relations within the IoT projects is data. The implementation of IoT requires the development of an ‘information as a service’ model, which is the basic aspect in the ‘customer-manufacturer’ relationship. To represent inter-firm relations with the adopted IoT technology, we have included the key component - the information sharing - in the ARA model (suggested by IMP Consulting, A - actors, R - resources, A - activities) (Figure I).

It is likely that introduction of the IoT will require a change in norms that define relations between partners. The key transformation of inter-firm relationships will Iie in the addition of informational ties between partners, which will acquire the key role, and the disruptive transformation of relationship norms: trust between partners, openness, absence of opportunism, technical adaptation (Table 2). With the introduction of the IoT, common features of relations in an inter-firm network will be readiness to technical adaptation, information sharing, openness, trust, engagement of sides. The given characteristics of relationship are assessed by their quality and value.

INTER-FIRM RELATIONSHIP QUALITY AND ACCEPTANCE OF IOT ВУ BUSINESSES

Relationship quality is a composite characteristic of partnership networks at B2B markets and it is quite well described in literature [Jiang Z., Shiu E., Henneberg S. et al., 2016]. Description of relationship quality helps to analyze the effectiveness of inter-organizational networks that are being created and reduce negative outcomes of partners’ interaction [GriffithD. A., Harvey M. G., 2001].

Рис. 1. Модель ARA в контексте межфирменной сети с внедрением технологий ИВ [Hcikansson H., 1982]

Table 2

Transformation of relationship between companies

|

Parameter |

Relationship within social interaction (without IoT) |

Adaptive activities |

Relationship with the introduction of IoT |

|---|---|---|---|

|

Relationship level |

Single transactions, recurring transactions, long-term relations |

‘ Supplier-customer’ partnership, strategic alliances, network organization |

Network organization built with the help of IoT technology |

|

Goal of relationship |

Exchange of goods and services with the aim of gaining mutual benefit |

Fonning partnerships, alliances and inter-firm networks to gain competitive advantage |

Exchange of goods, services and information in order to receive mutual benefit and better understand clients |

|

Time frame |

Up to the end of 1980-s |

Since 1990-s, presently and in the future |

Future |

|

Ties between participants |

Economic ties |

Economic, social, legal, technical |

Economic, legal, technical, informational |

|

Coordination mechanism |

Market |

Relationship related |

Computer-to-computer |

|

Basis of relationship |

Economic exchange |

Economic and social exchange |

Economic, social technological and informational exchange |

|

Relationship nonns |

Nonns established by business practice and regulating bodies, cultural and social norms |

Long-term orientation, information sharing, flexibility, fulfillment of mutual obligations, planning, monitoring partners’ behavior, conflict settlement, restricting the use of force |

Infonnation sharing, technical feasibility, flexibility, openness, technological acceptance, trust, absence of opportunism, monitoring partners’ behavior |

The relationship quality management is usually identified as a combination of people, technologies and processes for better understanding and satisfaction of customers [Chen I. J., Popovich K., 2003]. The following are used for their assessment:

- mutual trust and commitment to relationship [Cannon J., Perrault W. J., 1999; Cho J., 2006; Doney P., Cannon J., 1997; Lang B., Colgate M., 2003; Rebyazina V.A., Smimova M.M., 2011],

- effectiveness of communication between partners [Ganesan S., 1994; Huang Y., Wilkmson I. F., 2013; Trachuk A.V., Linder N.V., 2016 a];

- proper fulfillment of mutual obligations [Cater T., Cater B., 2010; Morgan R. M., Hunt S. D., 1994; Krotov K.V., Kushch S.R, Smimova М. , 2008];

- regular information sharing and joint decision making [Jiang Z., ShiuE., Henneberg S. et al., 2016; Trachuk A.V., Lmder N.V., 2016 b],

The relationship quality is determined by the following factors:

- mutual openness and willingness to continue interaction,

- level of coherence of partners’ processes, goals and values,

- quantity of contacts and communication intensity,

- level of customer satisfaction, tmst to supplier and willingness to continue interaction,

- justice in interaction as a key factor for forming and developing a strong relationship [Crosby L. A., Evans K. Rj, 1990].

These factors are divided into three major groups:

- characteristics of quality assessing the seller’s contribution in relationship building;

- characteristics of quality assessing the customer’s contribution in relationship;

- and characteristics of bilateral relations [Palmatier R. W., Dant R. R, Grewal D. et al., 2006; Holmlund M., 2008].

In our study, we will be testing bilateral relations factors. In our view, these are cmcial for building partnerships with the use of the IoT (Table 3).

Most often scholars refer to tmst as the major driving force of partner relationship [Medlin C. J., 2004; Morgan R. M., Hunt S. D., 1994], the significance of tmst is even greater in Internet transactions, which is related to sharing information with the partner [Watson G. F., IV,

Beck J. Т., Henderson С. M. et al., 2015]. Trust develops with recurring transactions and evolving relationship, i.e. with commitment to interaction [Dwyer F. R., SchurrR H., Oh S., 1987; Palmatier R. W., Houston M. B., Dant R. P. et al., 2013; Bensaou M., Anderson E. 2004]. With trust and openness in a relationship, interdependence is viewed as a positive factor [Johnsen R. E., Lacoste S., 2016]. Other important features of relationship are the ability to act in agreement and communicate efficiently as well as to resolve conflicts [Watson G. F., IV, Beck J. T., Henderson C. M. et al., 2015; MorganR. M., Hunt S. D., 1994; Palmatier R. W., Houston M. B., Dant R. P et al., 2013; Kushch S.P, 2006].

Referring to the above stated, we formulate the following hypothesis.

Hypothesis 1. The quality of relationship with partners influences the acceptance of the IoT technology by companies to build relationship network: (a) trust; (b) commitment; (c) ability to resolve conflicts; (d) communication effectiveness; (e) continuous information sharing; (f) joint problem solving, (g) interdependence; (h) coordination of activities; (i) relationship profitability.

RELATIONSHIP VALUE

Relationship value is understood as creation of a competitive advantage through partner relationship. The value makes it possible to analyze not only qualitative the outcomes of relations, but also quantitative (profit, costs per individual consumer, etc.). The scholars are focused on determining the balance between costs and benefits of building a partnership, which is the basis of relationship value [Wilkinson I., Young L., 2002].

In case of building long-term customer relations at B2B markets, the understanding of value becomes more profound and includes relationship safety, trust, intention to continue relations. At B2B markets, creating relationship value is a key factor for longterm success [Moorman C., Zaltman G., Deshpande R., 1992].

Table 3

Main characteristics of quality of bilateral relations

|

Characteristic |

Literature |

|---|---|

|

Trust |

Wang C. L., 2007; Brown B. P., Zabla A. R., Bellenger D. N. et al., 2011; Morgan R. M., Hunt S. D., 1994 |

|

Satisfaction |

Wang C. L., SiuN. Y., Bames B. R., 2008 |

|

Conmiitment to interaction |

Wang C. L., 2007; Griffitli D. A., Harvey M. G., 2001; Morgan R. M., Himt S. D., 1994 |

|

Product quality |

BrownB. P.,ZablaA. R., BellengerD. N. etal.,2011 |

|

Ability to resolve conflicts |

BergerR., Zviling M., 2013; Griffitli D. A., Harvey M. G., 2001 |

|

Social and structural ties |

BergerR., Zviling M., 2013; Kim J.-B., Choi C., MilarC. et al., 2006 |

|

Justice |

Buslmian R., Poiotroski J., SmitliA., 2004 |

|

Absence of opportunism |

Buslmian R., Poiotroski J., SmitliA., 2004 |

|

Willingness to invest |

BergerR., HersteinR., Silbiger A. etal.,2015 |

|

Expectations related to further relations |

BergerR., Zviling M., 2013 |

|

Profit |

Wang C. L., SiuN. Y., Bames B. R., 2008; BergerR., HersteinR., Silbiger A. et al., 2015 |

|

Conmiunication |

Brownetal., 2011; Kim J.-B., Choi C., Milar C. et al., 2006; Berger R., Zviling M., 2013; Ganesan S., 1994; Huang Y., Wilkinson I. F., 2013 |

|

Coordination |

Brownetal., 2011; Kim J.-B., Choi C., Milar C. et al., 2006 |

|

Joint problem solving |

Buslmian R., Poiotroski J., SmitliA., 2004; Kim J.-B., Choi C., Milar C. et al., 2006; Jiang Z., Shiu E., Heimeberg S. et al., 2016] |

|

Agreement of goals |

BergerR., HersteinR., Silbiger A. etal.,2015; JiangZ., ShiuE., Heimeberg S. etal.,2016 |

Almost all contemporary studies of relationship value feature two key components of value: economic (monetary) and noneconomic (non-monetary). The economic component has direct impact on company’s performance (reducing costs, cross-selling, additional sales, additional profit, etc.). Non-monetary component of relationship value is strategic and social benefits resulting from forming a unique, hard-to-copy competitive advantage gained by building partnerships. These both components are a characteristic of success and mutual benefit of a partner relationship. Table 4 describes the sources of creating relationship value.

The scholars who have studied this issue are offering many models describing the components and sources of relationship value (see for example [Wilson D., Jantrania S., 1994]). The model most often referred to is the model of functions of relationship suggested by Walter, Ritter and Gemunden [Walter A., Ritter T., Gemunden H. G., 2001]. The authors define the relationship value as a set of direct and indirect functions. The direct include profit, volume and safeguard functions. The indirect - innovation, market, scout and access functions (Table 5). This division is based on function’s ability to influence the outcomes of partners’ activity: direct functions influence outcomes directly and indirect impact the development of partnership network on the whole.

Consequently, we formulate the second hypotheses of our study.

Hypothesis 2. The higher the relationship value, the more likely companies will accept IoT to build relationship network for the reason that only with high relationship value partners are oriented at maximum mutual adaptation to achieve common goals.

DESCRIPTION OF THE STUDY

The objective of the study is to determine the relationship quality and value that influence the success of IoT acceptance by companies, compare the understanding of relationship value in IoT projects for Russian and foreign companies.

Sampling

The empirical data were collected from May to August 2018. Stratified sample was used for the study selected on the basis of criteria: average annual earnings, property form, form of inter-firm relations. The sample included 51 large companies with more than 500 employees. The businesses represent the following sectors:

- food production-21.6%;

- chemical production-17.8%;

- mineral extraction-13.7%;

- light industry - 12.5%;

- building materials production -8.9 %;

- manufacture of machinery and equipment - 7.8%;

- steel industry - 5.5%;

- electrical equipment manufacture - 8.9%,

- others-3.9%.

Companies’ average earnings is 950 million RUR, age of the interviewed companies varies from 2 to 199 years old, average being 54 years. 96.0% of companies have supplier-customer relationships, 17.6% are participants of strategic alliances and 52.5% are part of inter-firm networks.

International companies make up 27.4% of the sample, foreign companies operating on Russian market - 35.3%, Russian companies operating on foreign markets - 23.5%, Russian companies operating only on internal market - 13.7% (Table 6).

The first stage of the study included semi-structured interviews with company officials heading research and development, marketing and strategic planning units or company’s top management. Respondents were selected based on their awareness of company’s relations with partners. A total of 157 employees were interviewed. Duration of interviews was from 30 minutes to I hour.

Table 4

Sources of creating relationship value [Kushch S.P., Smirnova M.M., 2010]

|

Component |

Sources of creating value |

|---|---|

|

Monetary component |

|

|

Economic |

Reducing the costs of interaction Market potential of relationship |

|

Non-monetary component |

|

|

Strategic |

Fonning and improving new competences on the basis of interaction Joint development of innovations Resource potential (availability of partner’s resources, technology transfer, possibility of complementary use of resources) Increasing interaction security and stability Receiving additional information within the interaction New opportunities related to joint development |

|

Social |

Tmst and commitment Creating unique relationship norms Creating unique organizational culture |

Measurement and variables

The study was conducted to compare relative significance of characteristics of relationship quality of foreign companies operating on Russian market, Russian companies operating on foreign markets, Russian companies operating only on internal market. To measure relationship quality, the variables were used as follows: trust, commitment, coordination of actions, ability to resolve conflicts, interdependence, effectiveness of communication, information sharing, joint problem solving and profit. Readiness to introduce IoT technology was chosen as the resulting indicator.

We used functions of relationship model by Walter, Ritter and Gemunden as the basis for the analysis of relationship value with the introduction of IoT. Direct functions were used as analysis variables: profit, volume, quality, safeguard, innovation functions as well as the indirect ones: support, scout and market functions.

Using the methodology [Smirnova M., Kushch S., 2008], we formed 4 clusters of companies according to the level of relationship value:

- companies with low value;

- companies with balanced value;

- companies with high value;

- companies with basic value.

To understand which value functions are the most important for the businesses to be ready to introduce IoT into their relations, we identified which of the clusters is the most prepared to adopt IoT.

Table 5

Functions of relationship in the Walter, Ritterand Gemunden model [Walter A., RitterT., Gemunden H.G., 2001]

|

Function |

Description |

|---|---|

|

Directfunctions |

|

|

Profit function |

Successful relationship should bring profit to partners. |

|

Volume function |

In supplier-customer partnership, suppliers wish to increase volume of sales and therefore are willing to make discounts, special conditions etc. |

|

Quality function |

Product quality is a key driver of a long-term relationship. Qualitative goods/services create higher relationship value. |

|

Safeguard function |

Safe relationship is a guarantee that the company will survive in uncertain environment, when demand is low, etc. |

|

Indirect functions |

|

|

Market function |

Creating a value jointly with the customer gives a chance for suppliers to better understand the customer’s needs, more easily enter a new market and operate there. |

|

Scout function |

To be successful on the market, supplier needs to receive information from customers. Customers-partners will be valuable sources of information about the market. |

|

Iimovation function |

Rie suppliers are more willing to develop relationship with customers that are liiglily qualified technological leaders on the market. Suggestions how to improve products or process innovations received from such customers provide an opportunity to increase value for all customers on the market. |

|

Access function |

Qualification and leading position of partners on the market help get easier access to key market players, credits, permits, licenses, etc. |

FINDINGS OF THE STUDY

Relation between relationship quality mid readiness to accept IoT

All characteristics of relationship quality can be divided in two groups: material, which include profit, and non-material, which include trust, commitment, coordination, ability to resolve conflicts, interdependence, effectiveness of communication, etc. When determining the relationship quality, the key role belongs to profit. The profile of Russian companies operating on foreign markets is comparable to the one of foreign companies: the most significant were trust, commitment, effectiveness of communication among non-material relationship quality features, the least significant - interdependence and coordination of actions. The profile of Russian businesses operating on Russian market differs: factors of profit and trust are the most significant, whereas others have roughly equal significance.

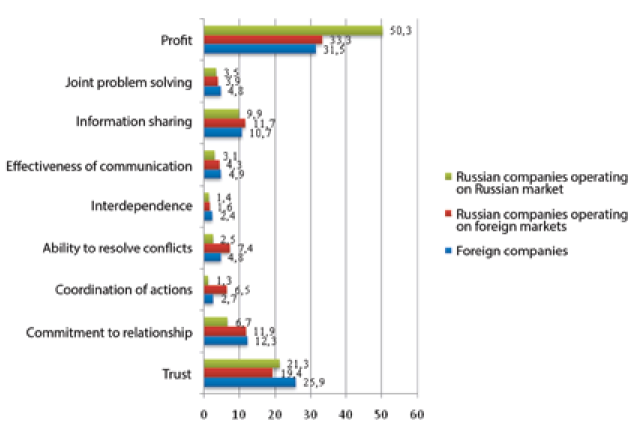

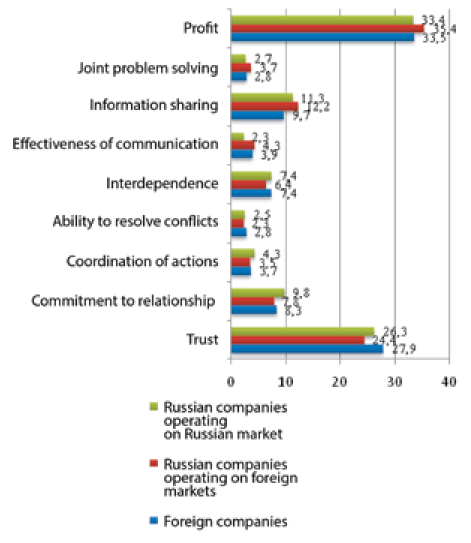

The Table 7 and Figures 2 and 3 illustrate the results of assessing relative significance of relationship quality characteristics with the introduction of IoT and without it.

At the same time, company officials point out that the significance of relationship quality characteristics will change with the introduction of IoT technology (Figure 3).The respondents defined trust as the most important of non-material factors, and the significance of this characteristic increased with the introduction of IoT. In general, such findings confirm the results of the study [Falkenreck C., Wagner R., 2014; Morgan R. M., Flunt S. D., 1994] that also concluded that trust is a crucial factor in the process of building a relationship.

The second most important aspect of relationship for companies not using the IoT is commitment to relationship. Respondents described it as confidence that the partner has sufficient expertise, competence and experience to work professionally. The second most important aspect for companies that have introduced IoT is information sharing. The interviewees understand it as confidence that the partner will not take advantage of information received from the customer (customer’s vulnerability).

Accordingly, the main relationship quality characteristics with the IoT is trust and the likelihood that the partners will not take advantage of the data received using IoT. It is likely that these aspects will be crucial factors when companies adopt IoT technologies.

Moreover, an important factor for the readiness to adopt IoT is the expectation of relationship profitability.

The respondents noted that when trust in personal interaction is increasing, they have ‘a feeling of moral obligation to people who trust them’. The respondents also think that transactions with the use of IoT are potentially more dangerous since there is no chance of human interaction and control of transaction (no feeling of moral obligation), as well as there is no experience related to ensuring informational security of such transactions.

For more profound analysis of interviewees’ responses and validity of our conclusions, we conducted significance testing taking into account the small size of sample [Flair J. F., Flult G. M., Ringle C. M. et al., 2017] and using the structural equation modeling method, which includes multiple indicators for every variable (factors) and paths that represent connections between latent variables. The SPSS software was used for the analysis. Table 8 represents the results of testing the hypotheses regarding the impact of relationship quality factors on acceptance of IoT by a company.

Table 6

Profile of industrial companies in the sample

|

Description |

Guantity |

|

|---|---|---|

|

absolute, units |

ratio, % |

|

|

Field of activity |

||

|

Food production |

11 |

21,6 |

|

Chemical production |

9 |

17,6 |

|

Mineral extraction |

7 |

13,7 |

|

Light industry |

6 |

11,7 |

|

Building materials production |

5 |

9,8 |

|

Manufactme of machinery and equipment |

4 |

7,8 |

|

Electrical equipment manufacture |

4 |

7,8 |

|

Steel industry |

3 |

5,5 |

|

Otliers |

2 |

3,9 |

|

Age, years |

||

|

Younger than 3 years old |

4 |

7,8 |

|

From 3 to 5 years |

2 |

3,9 |

|

5-10 |

11 |

21,6 |

|

10-20 |

13 |

25,4 |

|

Over 20 |

21 |

41,2 |

|

Average annual earnings, mln RUR |

||

|

Up to 50 |

6 |

11,7 |

|

50-150 |

11 |

21,6 |

|

150-500 |

16 |

31,4 |

|

500-1000 |

6 |

11,7 |

|

Over 1000 |

12 |

23,5 |

|

Number of personnel, employees |

||

|

500-1000 |

12 |

23,5 |

|

1000-5000 |

17 |

33,3 |

|

5000-10000 |

13 |

25,4 |

|

Over 10000 |

9 |

17,6 |

|

Inter-firm relationship format |

||

|

Supplier-customer relationship |

49 |

96 |

|

Strategic alliances |

9 |

17,6 |

|

Inter-firm network |

27 |

52,5 |

|

Property form |

||

|

Foreign company operating on the Russian market |

21 |

41,2 |

|

Russian company operating on foreign markets |

18 |

36,3 |

|

Russian company operating on internal market |

12 |

23,5 |

Table 7

Relative significance of relationship quality characteristics, %

| Characteristic |

Иностранные компании |

Российские компании | ||||

|---|---|---|---|---|---|---|

|

Зарубежный рынок |

Российский рынок |

|||||

|

Без IoT |

С внедрением |

Без IoT |

С внедрением |

Без IoT |

С внедрением |

|

| Trust |

25,9 |

27,9 |

19,4 |

24,4 |

21,3 |

26,3 |

| Commitment to relationship |

12,3 |

8,3 |

11,9 |

7,8 |

6,7 |

9,8 |

| Coordination of actions |

2,7 |

3,7 |

6,5 |

3,5 |

1,3 |

4,3 |

|

Ability to resolve conflicts |

4,8 |

2,8 |

7,4 |

2,3 |

2,5 |

2,5 |

| Interdependence |

2,4 |

7,4 |

1,6 |

6,4 |

3,1 |

7,4 |

|

Effectiveness of communication |

4,9 |

3,9 |

4,3 |

4,3 |

1,4 |

2,3 |

| Infonnation sharing |

10,7 |

9,7 |

11,7 |

12,2 |

9,9 |

11,3 |

| Joint problem solving |

4,8 |

2,8 |

3,9 |

3,7 |

3,5 |

2,7 |

| Profit |

31,5 |

33,5 |

33,3 |

35,4 |

50,3 |

33,4 |

| Readiness to introduce IoT technology into the relationship (share of companies with affinnative response), % |

16,9 |

14,2 |

9,7 |

|||

Trust has a positive impact on the readiness of businesses to adopt IoT technology (β = 0.326; p < 0.01), the same can be said about commitment to relationship (β = 0.215; p < 0.01 ), information sharing (β = 0.246; p <0.01) , interdependence (β = 0.293; p < 0.01) and profit (β = 0.371; p < 0.01). Neither ability to resolve conflicts, nor joint problem solving, nor effectiveness of communication had significant impact on acceptance of IoT. Therefore, our first hypothesis is confirmed partially, for such aspects as: (a) trust; (b) commitment to relationship; (e) continuous information sharing; (g) interdependence; (i) relationship profitability.

Fonning relationship value mid acceptance of IoT

Table 9 illustrates the analysis of relationship functions on a Likert scale from one to seven and the division of companies into four clusters. Additionally, we measured the readiness of companies to adopt IoT (Table 10).

Figure 2. Comparing the significance of relationship characteristics in companies that did not introduce IoT

Cluster I is made up of five Russian companies (10% of the total number, one company operating on foreign markets, one - on internal market), which gave a low rating to the value of relationship with partners due to both direct and indirect functions. However, they rated direct functions higher than the indirect ones. The key value of relationship is the product/ service quality (5.4 on Likert scale), which enables companies to maintain long-term relationships. The level of their readiness to adopt IoT for relationship building is 12.6%.

Cluster 2 is comprised of 23 companies (47%, 12 foreign companies, 8 Russian operating on foreign markets, 3 - on internal market), which rated highly the contribution of both direct and indirect relationship functions in creating value.

The level of their readiness to adopt IoT for relationship building is 16.3%.

Cluster 3 is represented by 16 companies (31%, 6 foreign companies, 7 Russian companies operating on foreign markets, 3 - operating on internal market). They gave the highest rating to the contribution of both direct and indirect relationship functions. The level of readiness to adopt IoT for relationship building is indeed high -21.4 %, which confirms our hypothesis regarding the influence of relationship value on the businesses’ readiness to adopt IoT.

Cluster 4 is made up of 7 companies (14%, 3 foreign companies, 2 Russian companies operating on foreign markets, 2 - on internal market), which gave the highest rating to the contribution of relationship functions, though considered indirect functions less important. The level of readiness to adopt IoT for relationship building is the highest - 27.9 %.

Thereby, our second hypothesis is confirmed partially. Indeed, the higher the relationship value, the more ready businesses are to adopt IoT. As the sample used for the study was small, we can make a cautious conclusion that value achieved through direct functions is more important to companies than the value created by indirect functions.

Figure 3. Comparing the significance of relationship characteristics in companies that introduced IoT

CONCLUSIONS AND PRACTICAL APPLICATION OF RESULTS OFTHESTUDY

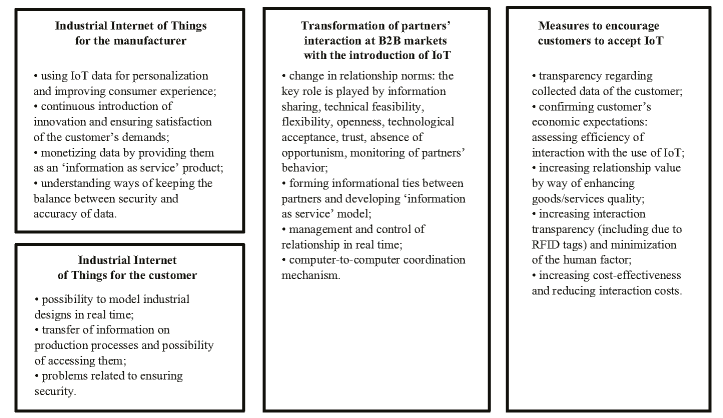

The majority of company directors expect from the adoption of IoT an increase in profitability and a reduction of interaction costs. The second most important expectation was improving customer service quality due to better understanding of needs and increased sales revenue. The third expectation was a reduction of risks related to human factor of relationship.

Mutual trust, readiness to cooperate and commitment to relationship are important for the introduction of IoT technology. Regression analysis showed that the interdependence factor (β = 0,293) has considerable influence on acceptance of IoT. We can say with high level of probability that IoT will be primarily introduced in the relationship of businesses connected by ownership relations (e.g. holdings or group of companies belonging to one owner) and will further become more widespread. Positive experience of relationships with the help of IoT inside one group of companies may become an example to encourage external partners to build relations with IoT. Moreover, such experience can help reduce risks related to data transfer.

Table 8

Acceptance of IoT technology: impact of relationship quality variables

|

Independent variable |

Hypothesis |

Coefficient Non-standardized I Standardized |

|

|---|---|---|---|

|

Constant |

— |

0,553 (0,178) |

— |

|

Trust |

Hypotliesis I (a) |

0,314*** (0,094) |

0,326*** |

|

Commitment to relationship |

Hypothesis I (в) |

0,212*** (0,080) |

0,215*** |

|

Coordination of actions |

Hypothesis l(i) |

0,087*** (0,053) |

0,091*** |

|

Ability to resolve conflicts |

Hypothesis 1(c) |

0,063** (0,044) |

0,061** |

|

Interdependence |

Hypothesis 1(h) |

0,247* * * (0,103) |

0,293*** |

|

Effectiveness of communication |

Hypothesis 1(d) |

0,129*** (0,073) |

0,137*** |

|

Infonnation sharing |

Hypothesis 1(f) |

0,217*** (0,149) |

0,246*** |

|

Joint problem solving |

Hypothesis 1(g) |

0,108** (0,094) |

0,119** |

|

Proht |

Hypotliesis I (к) |

0,367*** (0,198) |

0,371*** |

|

Readiness to adopt IoT into the |

|

0,009 |

0,106 |

|

relationship |

|

(0,006) |

|

|

Corrected R2 |

— |

0,275 |

— |

|

Number of observations |

— |

157 |

— |

|

* — coefficient significance p < 0.10; ** — coefficient significance p < 0.05; *** — coefficient significance p < 0.01. Standard enors are given in the brackets. |

|||

Table 9

Comparing clusters on the basis of relationship functions and assessment of readiness to adopt IoT

|

Functions |

Cluster I (low value) |

Cluster 2 (balanced value) |

Cluster 3 (high value) |

Cluster 4 (basic value) |

|---|---|---|---|---|

|

Direct functions |

||||

|

Profit function |

5,2 |

5,9 |

6,3 |

6,5 |

|

Volume function |

5,1 |

6,1 |

6,5 |

6,7 |

|

Quality function |

5,4 |

5,9 |

6,2 |

6,8 |

|

Safeguard function |

4,4 |

5,7

|

6,1 |

6,4 |

| Indirectfunctions | ||||

|

Iimovation function |

2,3 |

4,7 |

5,4 |

2,7 |

|

Market function |

2,8 |

3,8 |

4,4 |

L7 |

|

Scout function |

2,9 |

4,3 |

5,1 |

2,1 |

|

Access function |

2,4 |

3,6 |

4,9 |

1,9 |

In general, we were able to confirm the first hypothesis for such aspects as: (a) trust; (b) commitment to relationship; (e) continuous information sharing; (g) interdependence; (i) relationship profitability. We also confirmed the relation between relationship quality and the possibility to accept IoT.

The suggested model explains only 50% of factors that influence the businesses’ readiness to adopt IoT. Other factors are relationship value functions. Our hypothesis regarding relation between high value and IoT acceptance was partially confirmed as well. Indeed, the higher the relationship value, the more ready companies are to adopt IoT. However, in terms of IoT acceptance the value achieved through direct functions is more important than the value achieved through the indirect ones. It is likely that the companies expect that the acceptance of this technology will lead to a reduction of costs and increase of profitability (profit function), enhancing marketing capability (volume function) and a reduction of risks (safeguard function). Therefore, the key expectations of company directors from IoT acceptance are related specifically to direct relationship value functions.

At present, the majority of companies are not ready to adopt IoT, which is related to complications of mutual adaptation of business processes, regulations, document flow and approaches to information obtaining and processing, forming single standards as well as difficulty to integrate IoT into the existing IT- environment. AU these factors are not connected with relationship quality or value and pertain to factors of emerging technologies acceptance [Trachuk A., LinderN., 2017].

Figure 4 illustrates the main outcomes of the study and the measures to encourage customers to accept IoT technology.

Figure 4. Transformation of inter-firm relations with the introduction of IoT

Within the supplier-customer relationship, suppliers are gaining key advantages from the IoT acceptance: they can maintain close relationship with customers, better understand their needs, promptly change and improve goods and services in accordance with the changing clients’ preferences. The supplier should remove vulnerabilities related to possible leak of customer data and find balance between risks and opportunities.

The introduction of IoT opens up new capabilities for customers: remote prototyping and modeling industrial designs, ordering goods and services in real time as well as monitoring order performance. Alongside with that, adoption of IoT presents a potential danger for customers, which lies in information transfer and possible leaks.

For companies-customers to adopt IoT, suppliers should take steps to increase trust between partners and reduce risks, for example, by introducing a risk management system at all levels, not making it a separate function, increasing relationship quality and value.

LIMITATIONS OF THE STUDY AND FURTHER RESEARCH

The limitations of this study are related to the sample size due to the constraints connected with data collection and emphasis on studying the companies that are carrying out a vigorous digital transformation of current activity and business processes. In the future, a study can be conducted using a wider sample.

Furthermore, the acceptance of IoT is influenced not only by the factors of relationship quality and perceived value, but also by the technology acceptance factors (Davis’s model [Davis F.D., 1989]). Therefore, they should be included in the analysis in further studies to cover all the aspects affecting the IoT acceptance.

Table 10

Profile of clusters of companies

|

Indicator |

Cluster I (low value) |

Cluster 2 (balanced value) |

Cluster 3 (high value) |

Cluster 4 (basic value) |

|---|---|---|---|---|

|

Readiness to adopt IoT, % |

12,6 |

16,3 |

21,4 |

27,9 |

|

Number of companies in a cluster |

5 |

23 |

16 |

7 |

|

Cluster composition: Foreign companies Russian companies operating: on foreign markets on Russian market |

I 4 |

12 8 3 |

6 7 3 |

3 2 2 |

References

1. Bensaou M., Anderson E. (2004) Supplier-customer relationship on industrial markets: when will customers invest in idiosyncratic assets? // Russian Journal of Management. Vol. 2, No 2. P. 111-152.

2. Garrette B., Dussauge P. (2002) Strategic alliances: Infra-M. 402 p.

3. Krotov K.V., Kushch S.P., Smirnova M.M. (2008). Marketing approach to relationship management in supply chain: results of studying Russian companies // Russian Journal of Management. Vol. 6, No 2. P. 3-26.

4. Kushch S.P. (2006) Marketing of relationships on industrial markets. Saint-Petersburg University Publishing House; Higher School of Management. 342 p.

5. Kushch S.P., Smirnova M.M. (2010). Marketing on B2B markets: relationship related approach: tutorial. Higher School of Management, 2010. 272 p.

6. Rebyazina V.A., Smirnova M.M. (2011). Interaction with partners as a factor of innovation development on the example of Russian industrial companies // Innovations. Vol. 7 (153). P. 48-57.

7. Trachuk A.V., Linder N.V. (2016 a) Interaction with stakeholders as a factor of achieving company’s strategic goals: empirical study on the example of the Goznak Federal State Unitary Enterprise // Management and Business Administration. No 1. P. 109-123.

8. Trachuk A.V., Linder N.V. (2016 b) Managing stakeholders for achieving sustainable development: case of the Goznak company // Management Sciences in the Modern World. Vol. 2. No 2. P. 455-469.

9. A Decade of Digital. Keeping pace with transformation. // PwC. URL: https://www.pwc.ru/ru/publications/global-digital-iq-survey-rus.pdf.

10. Achrol R. S., Kotler P. (1999) Marketing in the Network Economy // Journal of Marketing. Vol. 63. Special Issue. P. 146–163.

11. Ashton K. (2009) That “internet of things” thing // RFID Journal. Vol. 22, N 7. Vol. 97–114.

12. Atzori L., Iera A., Morabito G. (2010). The internet of things: A survey. Computer Networks. Vol. 54, N 15. P. 2787–2805.

13. Atzori L., Iera A., Morabito G. et al. (2012). The Social Internet of Things (SIoT)- When social networks meet the Internet of Things: Concept, architecture, and network characterization // Computer Networks. Vol. 56, N 16. P. 3594–3608.

14. Berger R., Zviling M. (2013). The relationship between stakeholder marketing and reciprocity in Eastern Europe // International Journal of Management, Knowledge and Learning. Vol. 2, N 2. P. 149–164.

15. Berger R., Herstein R., Silbiger A. et al. (2015). Can guanxi be created in Sino-Western relationships? An assessment of Western firms trading with China using the GRX scale // Industrial Marketing Management. Vol. 47. P. 166–174.

16. Brass D. J., Galaskiewicz J., Greve H. R. et al. (2004). Taking stock of networks and organizations: A multilevel perspective // Academy of Management Journal. Vol. 47, N 6. P. 795–817.

17. Brown B. P., Zabla A. R., Bellenger D. N. et al. (2011). When do B2B brands influence the decision making of organizational buyers? An examination of the relationship between purchase risk and brand sensitivity // International Journal of Research in Marketing. Vol. 28. P. 194–204.

18. Bushman R., Poiotroski J., Smith A. (2004) What determines corporate transparency? // Journal of Accounting Research. Vol. 42, N 2. P. 207–252.

19. Cannon J., Perrault W. J. (1999) Buyer-seller relationships in business markets // Journal of Marketing Research. Vol. 36. P. 439–460.

20. Cater T., Cater B. (2010) Product and relationship quality influence on customer commitment and loyalty in B2B manufacturing relationships // Industrial Marketing Management. Vol. 39. P. 1321–1333.

21. Chen I. J., Popovich K. (2003) Understanding customer relationship management (CRM) // Business Process Management Journal. Vol. 9, N 5. P. 672–688.

22. Cho J. (2006) The mechanism of trust and distrust formation and their relational outcomes // Journal of Retailing. Vol. 82. P. 25–35.

23. Civerchia F., Bocchino S., Salvadori C. et al. (2017) Industrial Internet of Things monitoring solution for advanced predictive maintenance applications // Journal of Industrial Information Integration. Vol. 7. P. 4–12.

24. Crosby L. A., Evans K. R., Cowles D. (1990). Relationship quality in service selling: An interpersonal influence perspective // Journal of Marketing. Vol.54, N 7. P. 68–81.

25. Da Xu L., He W., Li S. (2014). Internet of things in industries: A survey // IEEE Transactions on Industrial Informatics. Vol. 10, N 4. P. 2233–2243.

26. Davis F. D. (1989) Perceived usefulness, perceived ease of use and user acceptance of information technology // MIS Quarterly. Vol. 13, N 3. P. 319–340.

27. Doney P., Cannon J. (1997) An examination of the nature of trust in buyer-seller relationships // Journal of Marketing. Vol. 61, N 2. P. 35–51.

28. Dwyer F. R., Schurr P. H., Oh S. (1987) Developing buyer-seller relationships // Journal of Marketing. Vol. 51. P. 11–27.

29. Falkenreck C., Wagner R. (2014). How long does it take a brand loyalty program to become effective — if ever? Empirical research results from Australia and Spain // Proceedings of the IMP Asia conference. Bali: IMP Group. P. 742–749.

30. Ganesan S. (1994). Determinants of long-term orientation in buyer-seller relationships // Journal of Marketing. Vol. 58, N 2. P 1–18.

31. Griffith D. A., Harvey M. G. (2001) Executive insights: An intercultural communication model for use in global interorganizational networks // Journal of International Marketing. Vol. 9, N 3. P. 87–103.

32. Hair J. F., Hult G. M., Ringle C. M. et al. (2017) A primer on partial least squares structural equation modeling (PLS-SEM). Thousand Oaks: Sage Publications Ltd.

33. Håkansson H., Snehota I. (1995) Developing relationships in business networks. London: Routledge. 460 p.

34. Holmlund M. (2008) A definition, model, and empirical analysis of business-to-business relationship quality // International Journal of Service Industry Management. Vol. 19, N 1. P. 32–62.

35. Huang Y., Wilkinson I. F. (2013) The dynamics and evolution of trust in business relationships // Industrial Marketing Management. Vol. 42. P. 455–465.

36. Håkansson H. (1982) International marketing and purchasing of industrial goods: An interaction approach. Chichester: John Wiley.

37. Jiang Z., Shiu E., Henneberg S.et al. (2016). Relationship quality in Business to Business relationships — Reviewing the current literatures and proposing a new measurement model // Psychology and Marketing. Vol. 33, N 4. P. 297–313.

38. Johnsen R. E., Lacoste S. (2016) An exploration of the ‘dark side’ associations of conflict, power and dependence in customer–supplier relationships. Industrial Marketing Management. Vol. 1. P. 76–95.

39. Kannan P., Hongshuang A. L. (2016) Digital marketing: A framework, review and research agenda // International Journal of Research in Marketing. Vol. 39, N 8. P. 48–54.

40. Kim J.-B., Choi C., Milar C. et al. (2006) Global sourcing partnerships and emerging MNC markets: A conceptual framework // International Journal of Services, Technology and Management. Vol. 7, N 5–6. P. 463–474.

41. Lang B., Colgate M. (2003). Relationship quality, on-line banking and the information technology gap // Journal of Banking Marketing. Vol. 21, N 1. P. 29–37.

42. Marquier J., Lee N.-C., Jeon Y.-G. et al. (2016) The Internet of Things — Seizing the benefits and addressing the challenges. 2016 ministerial meeting on the digital economy. OECD digital economy papers. N 252. Paris: OECD Publishing. P. 1–57.

43. Medlin C. J. (2004) Interaction in business relationships: A time perspective // Industrial Marketing Management. Vol. 33. P. 185–193.

44. Miorandi D., Sicari S., De Pellegrini F. et al. (2012) Internet of things: Vision, applications and research challenges // Ad Hoc Networks. Vol. 10. P. 1497–1516.

45. Moorman C., Zaltman G., Deshpande R. (1992) Relationships between providers and users of market research: The dynamics of trust // Journal of Marketing Research. Vol. 29, N 3. P. 314–328.

46. Morgan R. M., Hunt S. D. (1994) The commit. Vol. 34, N 1. P. 3–21.

47. Palmatier R. W., Dant R. P., Grewal D.et al. (2006) Factors influencing the effectiveness of relationship marketing: A meta-analysis // Journal of Marketing. Vol. 70, N 10. P. 136–153.

48. Palmatier R. W., Houston M. B., Dant R. P. et al. (2013) Relationship velocity: Towards a theory of relationship dynamics // Journal of Marketing. Vol. 77, N 1. P. 13–30.

49. Smirnova M., Kouchtch S. (2008) Key Supplier Relationships Value Creation Profiles (Empirical Evidence from Russian Markets) // Proceeding of 37th EMAC Conference, May, 2008 / Brighton University. Brighton. P. 352–359.

50. Stankovic J. A. (2014) Research directions for the Internet of Things // IEEE Internet of Things Journal. Vol. 1, N 1. P. 3–9.

51. Trachuk A., Linder N. (2017) The adoption of mobile payment services by consumers: an empirical analysis results // Business and Economic Horizons. Vol.. 13. N 3. P. 383–408.

52. Walter A., Ritter T., Gemunden H. G. (2001) Value Creationin Buyer-Seller Relations //Industrial Marketing Management. Vol. 30, N 4. P. 365–377.

53. Wang C. L. (2007) Guanxi vs. relationship marketing: Exploring underlying differences. Industrial Marketing Management. Vol. 36. P. 81–86.

54. Wang C. L., Siu N. Y., Barnes B. R. (2008). The significance of trust and renqing in the long-term orientation of Chinese business-to-business relationships // Industrial Marketing Management. Vol. 37, N 7. P.819–824.

55. Watson G. F., IV, Beck J. T., Henderson C. M. et al. (2015) Building, measuring, and profiting from customer loyalty // Journal of the Academy of Marketing Science. Vol. 43. P. 790–825.

56. Wilkinson I., Young L. (2002) On cooperating firms, relations and networks // Journal of Business Research. Vol. 55. P. 123–132.

57. Wilson D., Jantrania S. (1994) Understanding the Value of a Relationship //Asia-Australia Marketing Journal. Vol. 2, N 1. P. 55–66.

58.

About the Authors

A. V. TrachukRussian Federation

Doctor of Economics, Professor, Head of the Management Department, Research Supervisor of the Faculty of Management at the FGOBU VO “Financial University under the Government of the Russian Federation”, General Director of JSC “Goznak”. Research interests: strategy and management of company development, innovations, entrepreneurship and modern business models in the financial and real sectors of economy, dynamics and development of e-business, operational experience and prospects for the development of natural monopolies.

N. V. Linder

Russian Federation

Ph.D. in Economics, Professor, First Deputy Head of the Management Department at the FGOBU VO “Financial University under the Government of the Russian Federation”. Research interests: strategy and management of company development, formation of a strategy for the development of industrial companies under the conditions of the fourth industrial revolution, innovation and transformation of business models, dynamics and development of e-business, strategies for developing energy companies under the conditions of the fourth industrial revolution, strategies for Russian companies to enter international markets.

Review

For citations:

Trachuk A.V., Linder N.V. FOURTH INDUSTRIAL REVOLUTION: HOW THE INTERNET OF THINGS INFLUENCESON INDUSTRIAL BUSINESS RELATIONSHIPS? Strategic decisions and risk management. 2018;(3):16-29. https://doi.org/10.17747/2078-8886-2018-3-16-29