Scroll to:

Win vs. Profit maximization: optimal strategy for managing organizational performance of russian football clubs

https://doi.org/10.17747/2078-8886-2018-2-86-91

Abstract

The cause-effect relationships between performance dimensions were assessed using a multivariate linear regression. The author analyzes the strategic behavior of Russian football clubs using the profit/win maximization classification. The causality tests allowed the author to form a conceptual model of the main performance dimensions of professional football clubs in Russia. The results help better understand the managerial pitfalls in Russian club football. The article contributes to the literature on organizational performance of professional football clubs by focusing on the Russian context, which has not been done previously. The findings of the paper confront the managerial fallacies of Russian club football and broaden the understanding of club football management practices in general.

Keywords

For citations:

Osokin N.A. Win vs. Profit maximization: optimal strategy for managing organizational performance of russian football clubs. Strategic decisions and risk management. 2018;(2):86-91. https://doi.org/10.17747/2078-8886-2018-2-86-91

INTRODUCTION

Professional football is growing vigorously, and the results achieved so far indicate establishment of a multibillion industry. The items of income continue to grow: TV rights, commercial rights and proceeds on game days. The increase in the clubs’ wealth is uneven: rich clubs get richer, while the less successful are not only far from catching up with them, but also lag behind in terms of economic growth rate. The leading European leagues (England, Spain, Germany, Italy and France) are developing the economic attractiveness of the national football tournaments. The majority of underdog football clubs are based in Eastern Europe. Besides the objective reasons (macroeconomic uncertainty, which entails the risk of high volatility of national currencies (most deals in professional football are made in dollars, Euro, British pounds or Swiss francs), as well as socialist past where sport was considered as something widely accessible), there are also serious organizational flaws that hinder the commercial development of local markets. The majority of clubs is still affiliated with state authorities or companies and depends on a sole source of funding [N.A. Osokin, 2017]. Such clubs are using an outdated operating model and ignoring their key performance indicators.

The purpose of the article is to show the causal relationship between various efficiency and performance indicators of football clubs. The empirical analysis is based on the data on Russian football.

LITERATURE REVIEW

Efficiency midperfonnance of football clubs

Academic literature provides few descriptions of what the organizational objectives of professional football clubs are. The universal approach to define the clubs’ key performance indicators is not appropriate since the efficiency and performance of any organization depend on its environment, stakeholders’ actions, strategic position etc. [Leach S., Szymanski S., 2015]. The major research problem of sports management is the dichotomy of efficiency in terms of balance between sports achievements and financial results [Chadwick S., 2009]. A similar approach can be seen in the majority of academic works that attempted to assess the efficiency and performance of professional football clubs. A review of research papers in this area is available here: [TerrienM., ScellesN., Morrow S. et al., 2017].

The issue of organizational efficiency and performance of sports organizations was the topic of many studies (for more details see: [O'Boyle I., Hassan D., 2014]). Flowever, only a small portion of academic publications has been devoted to the assessment of efficiency of professional football clubs. It has been suggested to consider four groups of indicators: sports results, media, fans and stakeholders [Andrikopoulos A., Kaimenakis N., 2009], and use sports, financial and social indicators to assess organizational efficiency of football clubs [Dima T., Otoiu A, 2015]. A system of assessing the activity of professional football clubs presented by the authors as comprehensive has also been put forward [Plumley D., Wilson R., Ramchandani G., 2017]. Essentially, all the indicators mentioned were either sports or financial ones.

There are also academic papers where the object of study was the causal relationship between the three components of the activity of French clubs: sports results, business and finances. The clubs’ business activity is defined as the ability of clubs to generate earnings, whereas financial activity - as the ability to achieve the necessary profitability, liquidity and financial autonomy etc. [Galariotis E., Germain C., Zopounidis C., 2017]. A statistically relevant positive relationship between business activity and sport results has been identified. The clubs are inclined to spend their earnings to improve their competitiveness in terms of sports. The clubs’ financial state did not appear to be connected with their business activity or sports performance in any way. A detailed review of literature on the efficiency and performance of football clubs is available in the paper [N.A. Osokin, 2017].

Financial transparency

Since 2009, the Union of European Football Associations (UEFA) has required that all clubs participating in the European competitions comply with Financial Fair Play Regulations (FFP). The requirement was introduced to encourage clubs to use sustainable business models, develop sources of earnings and ensure strict control over spending. In this case, the basic criteria is self-sustain- ability. The clubs’ variance between relevant earnings and expenditures should not exceed 5 mln Euro over three years. The clubs may allow losses up to 30 mln Euro on the condition that their shareholders are willing to make a dedicated investment up to 25 mln Euro.

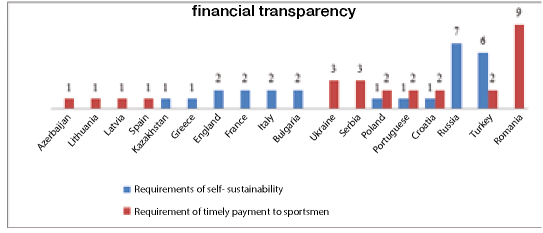

Figure 1. Number of disciplinary sanctions for violating

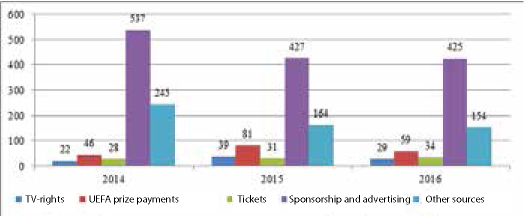

Figure. 2. Earnings of the RPLcIubs (2014-2016), mln Euro

Practical implementation of financial transparency has been extensively discussed in literature; however, the conclusions drawn are far from being unambiguous. E. Frank points out that FFP increases the competition between clubs since the relatively rich clubs have less opportunities to use soft budget constraints [Franck E., 2014]. It is impossible to endlessly increase the expenditure budget at the expense of direct shareholders’ investments. Therefore, the increasingly important role of management is pointed out: if a club with mid-level wealth is well managed, it has a chance to outplay a weakly managed big club at least for a short period of time.

The requirement of self-sustainability forces clubs to cut the players’ wage fund and continue to receive earnings on the same level as before [Peeters T., Szymanski S., 2014]. Financial transparency is primarily helping the big clubs to dominate the market, rather than constraining them. After its implementation, it is hardly likely that big clubs will see the emergence of their new rivals supported by influential investors. These conclusions have been made on the level of both national and international competitions.

Italian football clubs are still depending on the proceeds from selling players’ contracts. Despite the implementation of financial transparency, the majority of teams were not able to properly develop key earnings sources. It is noted that a possible explanation for this may be the lack of a national system to assess the clubs’ activity designed to improve their financial health [Nicoliello M., Zampatti D., 2016].

REVIEW OF RUSSIAN CLUB FOOTBALL DEVELOPMENT

Over the last few years, Russian football clubs have been consistently successful

in international competitions. Flowever, the picture is not so optimistic in terms of complying with financial transparency. By 2016, Russian clubs had been subject to disciplinary sanctions of the UEFA club financial control body on seven occasions due to violations of self-sustainability requirement (Figure I). Clubs from Russia broke the FFP rules more frequently than other European clubs. In 2015, FC Dynamo Moscow concluded a sponsorship agreement with its majority shareholder, the VTB Bank (public joint-stock company), which entailed a ban from participating in the Europa Feague. Within the FFP financial transparency recommendations, any agreements concluded with shareholders or their affiliated structures that help accumulate relevant income are subject to a fair reevaluation. Correction of the value of the sponsorship agreement led the club to indicate a 302 mln Euro loss over three reporting periods. Thus, self-sus- tainability requirement was ten times exceeded.

Over the last three years, the clubs of the Russian Premier Feague (RPF) have not demonstrated a significant rate of earnings growth1. From 2014 to 2016, the total revenue of national clubs decreased by 100 mln Euro. This was, in part, due to the national currency depreciation and economic recession. No management decisions were made to resist such trends or minimize them.

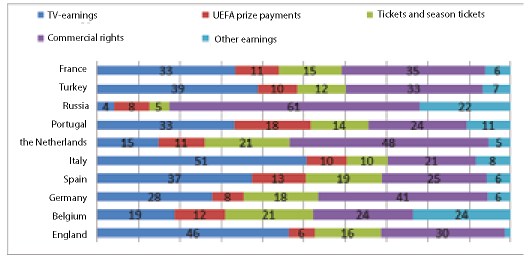

The composition of national clubs’ revenue is not balanced, especially in comparison with the earnings of European clubs. As a rule, most proceeds are received from the broadcasting rights, commercial rights and sales of tickets and season tickets; the share of every earnings’ source does not exceed 50% in the overall revenue structure. Russian clubs mostly live off the commercial rights sales (61% of earnings), the bulk of which is the sponsorship agreements. Proceeds from selling broadcasting rights, tickets and season tickets provides less than 10 % of total revenue.

Figure 3. Revenue structure of European football clubs (UEFA, 2018)

Chart 1

Attendance of RPL matches (2012-2017)

|

Indicator |

2012/13 |

2013/14 |

2014/15 |

2015/16 |

2016/17 |

|---|---|---|---|---|---|

|

Minimum value |

7032 |

5487 |

3173 |

5377 |

4492 |

|

Maximum value |

20934 |

18952 |

25001 |

25179 |

32760 |

|

Average value |

13179.88 |

11620 |

10305.88 |

11085.13 |

11333.25 |

|

Standard deviation |

3694.75 |

2763.625 |

3622.359 |

3513.781 |

5027.594 |

|

Coefficient of variation |

0.28 |

0.234 |

0.35 |

0.32 |

0.44 |

One of the key problems for national club football is the attendance. The average attendance of RPL matches (Chart 1) has not increased over the five seasons; coefficient of variation went up from 0.28 to 0.44. Consequently, the gap between clubs in terms of match attendance is widening. Matches of big clubs are continuously attended by increasing number of fans, whereas medium and little clubs are losing their audience. This trend is particularly worrying. If the level of interest in football matches remains the same, most stadiums risk of becoming ‘white elephants’ [Aim J., Solberg H.A., Storm R. K. et al., 2016], thus overburdening the budget of Russian clubs even more [ Solntsev I., Osokin N., 2018].

Many clubs experience problems with attracting fans because of poor understanding of what attendance depends on. With due regard for the literature surveyed and the review of the state of Russian club football, we put forward three research questions:

- What is the strategic behavior of national clubs?

- How much does the clubs’ sports performance depend on financial resources?

- How much does the sports performance impact the match attendance?

Chart 2

Football clubs' strategies [Terrien M., Scelles N., MorrowS. etal., 2017]

|

Strategy |

Constraints |

Operating profitability, % |

|---|---|---|

|

Profit-maximizing |

Sports performance |

Over 5 |

|

Utility (win) maximizing |

Hard budget constraints |

From -5 to 5 |

|

Utility (win) maximizing |

Soft budget constraints |

Under -5 |

RESEARCH METHODOLOGY

Strategic behavior

The classification of football clubs’ strategic behavior [Terrien M., Seelies N., Morrow S. et al., 2017] enables us to identify whether Russian clubs are inclined to maximization of wins or profits (Chart 2). The data on clubs’ financial and economic activity were drawn from the SPARK information and analysis database. The sample included 15 clubs participating in the RPL from 2010 to 2016; 63 accounting statements on their activity were available. Data on other clubs were unavailable.

Relationship between efficiency and performance indicators

The causal relationship between indicators of football clubs’ efficiency is assessed using multiple linear regression method. The first model will evaluate how various factors affect the teams’ sports performance. The number of points the clubs scored in SPORT season is used as a dependent variable. The second model is evaluating the determinants of the clubs’ season attendance. The average clubs’ season attendance is the dependent variable (LAN) (Chart 3).

The research sample includes four competition seasons from 2012 to 2016. Dummy variables were created to take into account the impact of every season, 2015/16 season is used as a starting point. Variables were calculated to indicate club’s participation

Chart 3

Independent variables of regression analysis

|

Description |

Code |

Model |

Purpose |

|---|---|---|---|

|

Season 2014/15 |

S2015 |

Both |

Control |

|

Season 2013/14 |

S2014 |

Both |

Control |

|

Season 2012/13 |

S2013 |

Both |

Control |

|

Participating in the LIEFA Champion's League in this season |

CL |

Both |

Control |

|

Participating in the UEFA Europa League in this season |

EL |

Both |

Control |

|

Game on a newly opened stadium |

New Stadium |

FAN |

Control |

|

Reconstruction of the club's home stadium in this season |

Closed Stadium |

FAN |

Control |

|

Number of points the club scored this season |

Points |

FAN |

Studying the second research question |

|

Annual expenditure, mln USD |

Budget |

SPORT |

Studying the third research question |

in international tournaments (CL and EL) and extraordinary circumstances, e.g. the state of the home stadium (New_Stadium and Closed_Stadium). The number of points the teams scored in the RPL season (Points) was used to study the second research question. The third research question was analyzed using the variable reflecting the clubs’ annual operating expenditures (Budget).

RESULTS

Win-maximizing vs. profit-maximizing

National clubs’ organizational and financial discipline is not sufficient since the majority of them are using the win-maximi- zation strategy with soft budget restrictions. Clubs are ensuring their business continuity only through direct investments of their founders [Andreff W., 2015]. Only in 3 out of 63 cases, national clubs did use the win-maximizing strategy with hard budget constraints (Chart 4).

Chart 4

Strategic priorities of Russian football clubs (2010-2016) (according to [Terrien M., Seelies N., MorrowS. etal., 2017; SPARK [database])

|

Club |

Profit- maximizing |

Win-maximizing |

Total |

|

|---|---|---|---|---|

|

Hard constrains |

Soft constraints |

|||

|

CSKA Moscow |

0 |

0 |

7 |

7 |

|

Rostov |

0 |

0 |

7 |

7 |

|

Zenit |

1 |

1 |

5 |

7 |

|

Krasnodar |

0 |

0 |

2 |

2 |

|

Spartak |

0 |

1 |

6 |

7 |

|

Ural |

2 |

1 |

0 |

3 |

|

Krylia Sovetov |

0 |

0 |

5 |

5 |

|

Ufa |

2 |

0 |

0 |

2 |

|

Anzhi |

1 |

0 |

5 |

6 |

|

Kuban |

0 |

0 |

5 |

5 |

|

Dynamo |

0 |

0 |

4 |

4 |

|

Torpedo |

0 |

0 |

1 |

1 |

|

Arsenal |

0 |

0 |

1 |

1 |

|

Tom |

1 |

0 |

2 |

3 |

|

Lokomotiv |

3 |

0 |

0 |

3 |

|

Total |

10 |

3 |

50 |

63 |

The win-maximizing strategy in the conditions of soft budget constraints can be viewed as one of the key reasons for experiencing difficulties, even if clubs comply with financial transparency requirements. Clubs are not motivated to develop their own sources of earnings because they rely heavily on the founders’ financial resources. In the current conditions such approach can be identified as an unsustainable business model [Sass M., 2016]. The answer to the first question is explicit: the majority of national clubs are win-maximizers.

Sports performance

The results of regression analysis of the SPORT model (Chart 5) indicate that the operating budget and participation in the UEFA Champions League have a positive impact on the clubs’ sports performance. For instance, after a team scores 32 points in a season (the constant), each next point is equivalent to approximately 10 mln USD in the club’s budget. Elowever, this model describes only 50.9% of the dependent variable. The clubs’ sports performance is almost by a half influenced by other indicators.

Chart 5

Results of regression analysis of the SPORT model

|

Variable |

Beta |

Significance |

|---|---|---|

|

Константа |

32 957*** |

0.000 |

|

S2015 |

-1.377 |

0.683 |

|

S2014 |

-4.065 |

0.245 |

|

S2013 |

-2.999 |

0.385 |

|

CL |

11.731** |

0.013 |

|

EL |

4.385 |

0.148 |

|

Budget |

0.106*** |

0.000 |

|

Coefficient of detennination |

0.556 |

|

|

Corrected coefficient of detennination |

0.509 |

|

|

Durbin Watson statistic |

1.498 |

|

|

Number of observations |

64 |

|

|

*** p < 0.01; ** p< 0.05; * p < 0.1. |

||

Match attendance

The results of the FAN model regression analysis are presented in Chart 6. Stadium variables and sports performance demonstrated a statistically significant influence on the attendance of the RPL clubs’ home matches. Every point scored by the team in the season helped to attract further 140 spectators to home games. The positive impact of sports performance on the fans’ interest in games has been confirmed, though this result has to be interpreted with caution. Every team is playing 30 games within the RPL; the maximum number of points cannot exceed 90. According to the model, national clubs can attract additional 12600 spectators to home matches in the best case. The capacity of the most stadiums built for 2018 FIFA World Cup is 35 000 and more, and solely sports performance will not suffice to effectively use these arenas.

Chart 6

Results of the FAN model regression analysis

|

Variable |

Beta |

Significance |

|---|---|---|

|

Константа |

4981.459*** |

0.005 |

|

S2015 |

-1129.947 |

0.350 |

|

S2014 |

281.115 |

0.815 |

|

S2013 |

2902.429** |

0.020 |

|

CL |

669.194 |

0.685 |

|

EL |

-398.258 |

0.711 |

|

New Stadium |

11581.987** |

0.000 |

|

Closed stadium |

-3002.582* |

0.069 |

|

Points |

140.138*** |

0.001 |

|

Coefficient of detennination |

0.542 |

|

|

Conected coefficient of detennination |

475 |

|

|

Durbin Watson statistic |

1.928 |

|

|

Number of observations |

64 |

|

|

*** p < 0.01; ** p < 0.05; * p < 0.1. |

||

DISCUSSION AND APPLIED IMPORTANCE

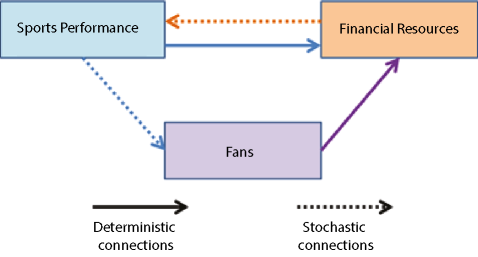

The results of the regression analysis conducted confirm the existence of internal relations between various indicators of efficiency and performance of Russian football clubs. If funds are available, clubs can increase sports competitiveness; high sports performance attracts fans to home matches. These relations are of stochastic nature.

There are deterministic connections between clubs' indicators of efficiency and performance: higher sports performance leads to higher earnings as teams receive prize money of national and international competitions. Through attracting higher number of fans to stadiums, clubs increase earnings on game days. An outline of our model is represented at Figure 4.

Figure 4. Conceptual framework of football clubs’ efficiency and performance indicators’ influence on each other

It is advisable for the clubs to use the win-maximizing strategy with hard budget constraints. Win-maximizing with soft budget constraints caused difficulties for national clubs with regards to observing financial transparency. In such cases, teams lose access to UEFA prize funds that are dozens of times higher than RPL participation awards. In this way, deterministic connection between sports performance and financial resources is eliminated. Besides, not adhering to financial transparency rules can influence the shareholders/founders’ moods.

Clubs are not able to demonstrate high sports results all the time. Uncertainty is one of distinctive features of sports management. Therefore, difficulty of predicting sports results can lead to distortion of planned economic benefits. The majority of national teams use the win-maximization strategy with soft budget constraints, and this means that the risk of relying on the founders’ targeted investments has to be taken into account. If the founders lose interest in the club’s activity or experience financial difficulties, the club will have to face serious economic hardship.

The story of the Anzhi Club (Makhachkala) is a telling example. The Russian businessman Suleyman Kerimov bought the club in 2011 and spent a considerable amount of funds to buy famous players. Anzhi FC managed to sign contracts with the well-known sportsmen Samuel Eto’o and Willian as well as the manager Guus Fhddink Only over two seasons, the club’s expenditure budget grew from 50 to 180 mln USD. The club’s sport performance improved dramatically. The team even managed to participate in the UEFA Europa League, where they reached play-offs. Flowever, in 2013 a criminal case was launched against Suleyman Kerimov, and this resulted in financial and reputation losses. Consequently, Kerimov was not able to secure the club’s funding on the same level. Key players were sold, which negatively affected the team’s competitiveness; the club was relegated from the Russian Premier League due to sports performance [Anisimov V., 2017].

The win-maximization strategy in the conditions of soft budget constraints does not correspond to the present trends in professional football and contradicts the UEFA-promoted model how to organize a football club’s activity. The lack of adapted regulatory requirements based on financial transparency rules is one of the reasons for poor organizational and financial discipline of the most national clubs.

CONCLUSIONS

The conceptual model put forward in this article can become a basis to form a system for assessment of professional football clubs in Russia. The model can be acceptable for adaptation taking into account the balanced scorecard methodology [Kaplan R. S., Norton D. P., 1992]. For further research, it would be useful to compare the efficiency and performance indicators studied here with the four perspectives of the balanced scorecard.

References

1. Анисимов В. (2017) Чем был «Анжи» задержанного Керимова? Вспоминаем историю одного шумного проекта // Советский спорт. URL: https://www.sovsport.ru / football / articles / 1012579‑chem-byl-anzhi-zaderzhannogo-kerimova-ljubov-k-futbolu-ili-politicheskij-proekt.

2. Осокин Н. А. (2017) Детерминанты организационной эффективности и результативности футбольных клубов //Эффективное Антикризисное Управление. №. 3 (102). С. 98–109.

3. СПАРК ( [б.г.]). URL: http://www.spark-interfax.ru.

4. Alm J., Solberg H. A., Storm R. K. et al. (2016) Hosting major sports events: the challenge of taming white elephants // Leisure Studies. Vol. 35, № 5. P. 564–582.

5. Andreff W. (2015) Governance of Professional Team Sports Clubs: Agency Problems and Soft Budget Constraints // Disequilibrium Sports Economics. London: Elgar. P. 175–228.

6. Andrikopoulos A., Kaimenakis N. (2009) Introducing FOrNeX: A composite index for the intangible resources of the football club // International Journal of Sport Management and Marketing. Vol. 5, № 3. P. 251–266.

7. Chadwick S. (2009). From outside lane to inside track: sport management research in the twenty-first century // Management Decision. Vol. 47, № 1. P. 191–203.

8. Dima T., Otoiu A. (2015) A Composite Index To Assess The Top European Football Clubs in 2014 // RevistaEconomică. Vol. 67, № 2. P. 68–85.

9. Franck E. Financial Fair Play in European Club Football: What Is It All About? // International Journal of Sport Finance. 2014. Vol. 9, № 3. P. 193–218.

10. Galariotis E., Germain C., Zopounidis C. (2017) A combined methodology for the concurrent evaluation of the business, financial and sports performance of football clubs: the case of France // Annals of Operations Research. P. 1–24.

11. Kaplan R. S., Norton D. P. (1992) The Balanced Scorecard-Measures that Drive Performance // Harvard Business Review. Vol. 70, № 1. P. 71–79.

12. Leach S., Szymanski S. (2015) Making money out of football //Scottish Journal of Political Economy. Vol. 62, № 1. P. 25–50.

13. Nicoliello M., Zampatti D. (2016) Football clubs’ profitability after the Financial Fair Play regulation: evidence from Italy // Sport, Business and Management. Vol. 6, № 4. P. 460–475.

14. O'Boyle I., Hassan D. (2014) Performance management and measurement in national-level non-profit sport organisations // European Sport Management Quarterly. Vol. 14, № 3. P. 299–314.

15. Peeters T., Szymanski S. (2014) Financial fair play in European football // Economic Policy. Vol. 29, № 78. P. 343–390.

16. Plumley D., Wilson R., Ramchandani G. (2017) Towards a model for measuring holistic performance of professional Football clubs // Soccer & Society. Vol. 18, № 1. P. 16–29.

17. Richard P. J., Devinney T. M., Yip G. S. et al. (2009) Measuring organizational performance: Towards methodological best practice // Journal of management. Vol. 35, № 3. P. 718–804.

18. Sass M. (2016) Glory hunters, sugar daddies, and long-term competitive balance under UEFA Financial Fair Play // Journal of Sports Economics. Vol. 17, № 2. P. 148–158.

19. Solntsev I., Osokin N. (2018) Designing a performance measurement framework for regional networks of national sports organizations: evidence from Russian football //Managing Sport and Leisure. P. 1–21.

20. Terrien M., Scelles N., Morrow S. et al. (2017). The win / profit maximization debate: strategic adaptation as the answer? // Sport, Business and Management. Vol. 7, № 2. P. 121–140.

About the Author

N. A. OsokinRussian Federation

Research specialist, Center of Strategic Sport Research, Plekhanov Russian University of Economics. Sports economics, sports management, performance management.

Review

For citations:

Osokin N.A. Win vs. Profit maximization: optimal strategy for managing organizational performance of russian football clubs. Strategic decisions and risk management. 2018;(2):86-91. https://doi.org/10.17747/2078-8886-2018-2-86-91