Scroll to:

Developing a new product development & launch process. Case: pharmaceutical market

https://doi.org/10.17747/2078-8886-2018-2-50-61

Abstract

Projects on development and a conclusion of new products to the market remain one of the most demanded in practice of the modern companies. In case of their successful realization the companies manage to increase significantly a market share, to attract new consumers, to raise level of the innovative activity, and also to improve financial performance. At the same time a fact of common knowledge is the high share of unsuccessful projects in the field of a conclusion of new products to the market, especially it is characteristic for pharmaceutical branch. Therefore, the purpose of this article is identification of the main channels of obtaining information by the consumer about innovative products, and; definition of the factors having impact on consumers at a choice of new products in the pharmaceutical market.

As a result of research it is revealed that two components belong to factors of success of an innovative product: technical, defining high usefulness of an innovative product, and marketing, considering criteria of a choice of goods of consumers. In work it is shown that the majority of consumers as B2B, and B2C of segments during making decision on purchase rely on such source of information as the Internet. Thus, effective communication with potential consumers on the Internet will be one of major factors of success of start of a new product. Following the results of the conducted research it was defined that the main factors allocating an innovative pharmaceutical product are completeness of information on it, and also high level of client support. In this connection, for satisfaction of requirements, it is offered to start a hotel independent platform of support of start of an innovative product which will include: full information on properties of a product; all necessary technical documentation, and also the section devoted to support of potential clients.

Practical realization of results of the conducted research is shown on the example of development of strategy of advance innovative BIOCAD company products.

Keywords

For citations:

Savin D.N. Developing a new product development & launch process. Case: pharmaceutical market. Strategic decisions and risk management. 2018;(2):50-61. https://doi.org/10.17747/2078-8886-2018-2-50-61

INTRODUCTION

For the companies' success in the market, careful planning and a good strategy for developing and bringing new products to the market are particularly important. A large number of new products is a mandatory condition to retain leadership positions in the conditions of strong competition. However, most of these products do not provide competitive advantages, and the cost of their development is costing companies too much [Cooper R. G., 2009]. Indirect confirmation of the practical importance of projects on launching new products in the market is the fact that there are many studies where the authors show that company's position in the market, its financial stability and innovative performance depend on successful implementation of projects on launching new products to market [Tra- chuk A. V, Lmder N. V, 2016a; 2017a], However, the development and launch of new products to the market are accompanied by high risks and require large investments [Edgett S., Cooper R., 2008].

Many domestic and foreign experts consider the promotion of any product as a set of some functions, and not as a complex process. For instance, to launch new products to the market successfully, it is necessary to build relationships with clients, relationships with stakeholders [Alexa S. V., Volodin Yu. V., 2017], constantly review the business models and form the organization's capacity to adaptation of their competence to changing environmental conditions [Trachuk A. V., Linder N. V., Ubeyko N. V., 2017], the role of open innovations and networks is shown [Kuriatnikov A. B, Linder N. V., 2015; Trachuk A. V., Linder N. V., 2016b], The launch of new products to the market is one of the stages of the innovation process [Trachuk A., Tarasov I., 2015; Arsenova E. V., Nikolaeva T. Yu., 2018].

In foreign studies, models for the phased development and implementation of new products in order to minimize the risks of bringing new products to the market and reduce costs, are presented [Cooper R. G., Edgett S. J., 2012].

Today, there are no studies on the successful implementation of projects on launching new products to the Russian pharmaceutical market. Promotion of the innovative product of the pharmaceutical industry requires a completely new approach and the entire promotion policy. In this article, an attempt is made to identify key features of the development and implementation of strategies for bringing new products to the market by Russian companies in the pharmaceutical industry. In this article, an attempt is made to identify key features of the development and implementation of strategies for bringing new products to the market by Russian companies in the pharmaceutical industry. For their successful promotion, a study was conducted to determine the parameters of innovative products in the pharmaceutical industry, which are the most significant for consumers.

MODERN APPROACHES TO BRINGING NEW PRODUCTS TO THE MARKET

There is a significant number of publications devoted to the strategy of bringing new products to the market and their commercialization [Krishnan V., Ulrich К. T., 2001; Bhattacharya S., Kavadias S. 2007; Chao R. O., Kavadias S., 2006; Trachuk A. V., Kornilov G.V., 2013; Trachuk, Linder, 2017c; Trachuk A., Linder N., 2017], the following questions remain open:

- How to increase the probability of successful launch of a new product in various industries, including in the pharmaceutical industry?

- How can the existing product development and the process of launching new products be changed and adopted in innovation-oriented companies, including pharmaceutical companies?

Among the most effective tools for promoting new products, researchers identify the following:

- involving consumers in the process of new products development [Linder N.V., Dmitrieva A.I., 2016; Arsenova E. V., Sokolova T. Yu., 2017];

- use of e-business tools [Trachuk A. V, Linder N. V., 2016a; Trachuk A. V., Linder N. V., Antonov D.A., 2014];

- personalized communication [Arsenova E.V., Pankova O.N., 2017];

- Improvement of marketing mix tools [Akrani G., 2010], including pricing strategy [van Vliet V., 2013].

In order to be successful and attract consumer's attention, a new product must meet consumer's preferences and have the manufacturer's claimed properties. Price, quality, functions and brand of the product are also important. Therefore, before bringing new products to the consumer, it is important to conduct market and consumers' research. The important stages of launch of new product have been determined: product development, internal testing, external testing, choice of the target market and consumer, timing of the launch of a new product to the market, bringing of the product to the market [Gluck, 2012].

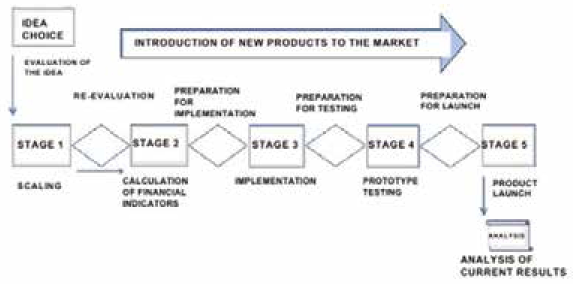

Fig. 1. The "Stage Gate" model [Cooper R., 2001, p. 130]

Fig. 2. Media sources that are used to bring a new product to the market [Adams D., 2012]

The structure of the process of developing and launching a new product to the market is described by the model" Stage Gate" [Cooper R. G., 2001] (Fig. I). After each stage there is a gate, a sort of checkpoint. In fact, these are the criteria that determine whether or not to continue working on launching this product. The model is used by many international companies in order to increase the chances of success when launching new products.

In addition to the studies mentioned, a number of works mention the importance of researching sources that consumers prefer to obtain information about the product [Adams D., 2012].

Before starting to develop and launch a new product to the market, which traditional media is preferred by the target audience of customers (Fig. 2) [Gray C., 2012]. With the use of these media, the company can invest in the promotion of new products to the market more effectively [Gray C., 2012].

Literature review allows us to make the following hypotheses about the nature of the tools for bringing new products to the market that pharmaceutical companies can use:

- selection of information sources, taking into account the greatest demand for the Internet;

- providing consumers with complete information about the properties of the new product by means of personalized communication with them.

FACTORS OF CONSUMER'S CHOICE OFAN INNOVATIVE PRODUCT

The object of the research is strategic aspects of development and launch of new products, the subject is the peculiarities of consumers' perception of new products, the main source for obtaining information by consumers.

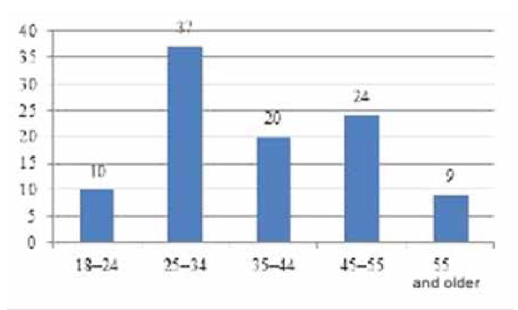

The sample was 220 people: 121 men (55%) and 99 women (45%), average age: 25-35 years old. People aged 25-34 (37%) prevailed, while there were slightly fewer people of age 45-55 years old (24%) (Figure 3).

Рис. 3. Возрастные группы, %

The tasks were to identify:

- the main source for a consumer for obtaining information about innovative products, especially those that enjoy the consumer's confidence;

- factors that influence consumers when selecting new products in the pharmaceutical market;

- barriers to bringing new products to the pharmaceutical market.

Stages of research

Stage 1. The survey method is a questionnaire using a spontaneous sample and the snowball method. Participants of the research were asked: by what sources they receive basic information about innovative products, which sources they trust?

Stage 2. The analysis of factors of successful promotion of innovative products of the pharmaceutical industry was carried out.

Stage 3. In order to investigate the influence of the factor of consumer choice on the promotion of the innovative product, in-depth interviews were conducted with managers of pharmaceutical companies and customers in order to identify the key parameters of innovative pharmaceutical products. Questioning of BIOCAD's customers was also held in order to rank these parameters according to the degree importance for the consumer.

Stage 4. The analysis of barriers to the distribution of innovative products on the pharmaceutical market has been carried out.

MAIN RESULTS OF THE STUDY

Infonnation sources

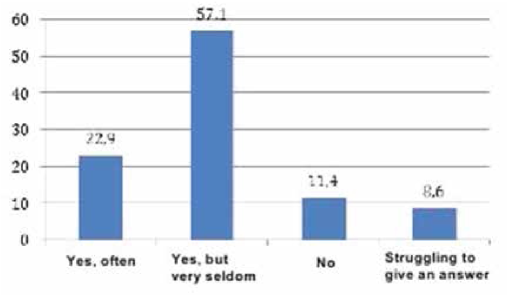

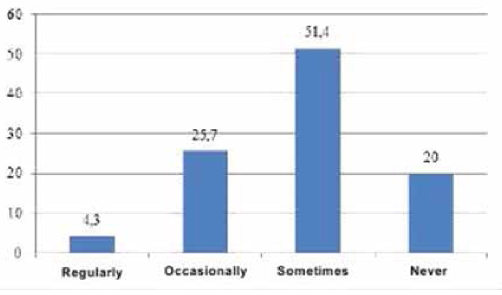

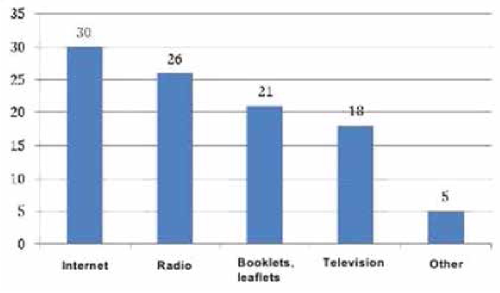

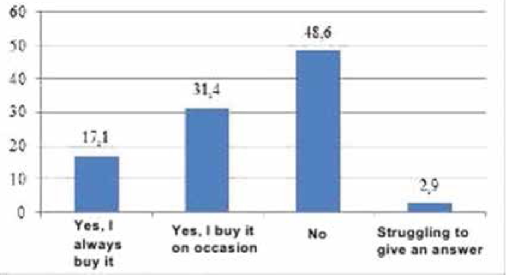

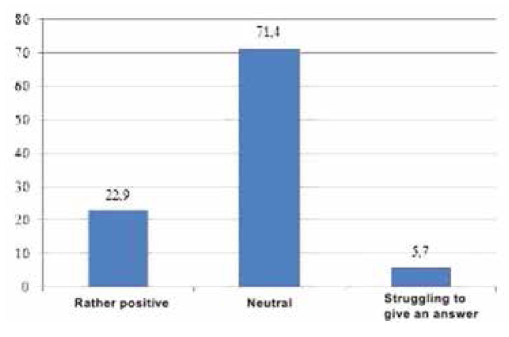

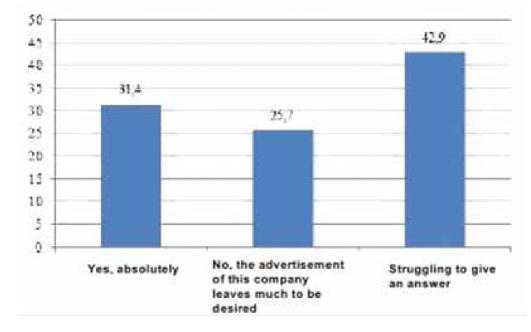

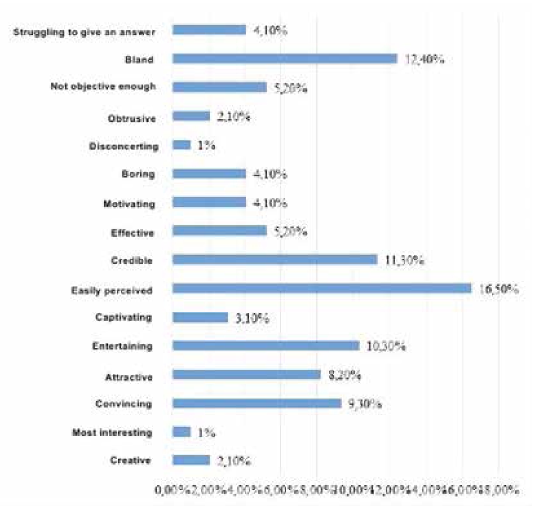

To obtain the data, qualitative and quantitative research methods were used with an unbelievable sample: the snowball method, spontaneous sampling. Respondents often refer to reviews of relatives, reviews on social networks, blogs and forums. Most of all they trust their relatives. Reviews on the forums are trusted less, they are perceived only as an information source. Respondents carefully study information and feedback on medical services before using them. Only 5% of respondents leave feedback on the Internet by themselves, both grateful and negative. The majority of respondents preferred the Internet (60 people, 30%), a little less - radio (50 people, 25%). Leaflets (40 people, 20%), television (30 people, 15%) and other sources (10 people, 5%) were noted less frequently (Figure 4). According to the respondents, advertisement does not influence the acquisition of pharmaceutical products (48.6%). 63 people (31.4%) buy advertised pharmaceutical products, 34 people (17.0%) try to buy them (Figure 5). The majority of respondents saw the advertisement of innovative pharmaceutical products extremely rarely (115 people, 57.1%), comparatively less than those who saw it often (45 people, 22.9%), did not see it at all (23 people, 11.4%) (Figure 6). The prevailing are those who refer to advertising neutrally (144 people, 71.4%), significantly less than those who rated the attitude as "more positive" (45 people, 22.9%), the rest haven’t decided on the answer (11 people, 5.7%) (Figure I). It is possible that respondents saw advertisements about pharmaceutical products rarely enough and did not remember them. The majority (86 people, 42.9%) found it difficult to assess those who are satisfied with completeness, somewhat more (63 people, 31.4%) than dissatisfied (51 people, 25.7%) (Figure 8). When answering the question about the qualities of advertising innovative pharmaceutical products, opinions were divided. According to the majority, advertising is easily perceived (33 people, 16.5%), but many do not remembered it (25 people, 12.4%) (Figure 9). It is likely that advertising materials do not convey to the consumer what is needed, as a result of which advertising does not produce the desired effect. Advertising of pharmaceutical products in Insta- gram causes a neutral attitude in almost half (96 people, 48.6%), a relatively smaller proportion is of those who like it to some extent (46 people, 22.9%) (23 people, 11, 4 %). Only 5 respondents (2.5%) like advertisement of this enterprise and 11 (5.7%) do not like it, the rest remained neutral (144 people, 71.4%). The majority purchase pharmaceutical goods sometimes (103 people, 51.4%), followed by those who do it periodically (51 people, 25.7%). Almost as many do not get anything at all (40 people, 20%). The smallest is the number of respondents who buy pharmaceutical products regularly (5 people, 2.9%) (Figure 9).

Promotion of innovative pharmaceutical products was mainly rated as insufficient (69 people, 34.3%) and extremely inadequate (46 people, 22.9%), comparatively fewer respondents rated it as sufficient (57 people, 28.6%) or found it difficult to answer (29 people, 14.3%).

So, the most popular information sources is the Internet. When looking for a pharmaceutical product, every third person turns to the Internet. A significant number of consumers remain unsatisfied with the quality of innovative pharmaceutical products. Respondents are neutral about advertising of pharmaceutical products, probably because it is not interesting and creative enough. Advertisements do not contain all the information you need. As a result, respondents noted that advertising leaves much to be desired. Therefore, it is necessary to make significant changes in advertising messages and to achieve correspondence of messages to customers' requests. Thus, the first hypothesis of this study about dissatisfaction with the quality of information about innovative products by consumers and on the Internet as the main information sources on innovative products in the pharmaceutical industry can be considered as confirmed.

Fig. 4. Information sources on innovative pharmaceutical products: distribution of consumers,%

Fig. 5. Influence of advertising on acquisition, %

Fig. 6. Answers to the question "Have you ever seen advertisement of innovative pharmaceutical products?", %

Fig. 7. The attitude of respondents to advertising of pharmaceutical products,%

Fig. 8. Completeness of information in advertisements of pharmaceutical products, %

Fig. 9. Features of advertising for pharmaceutical products

Fig. 10. Frequencyofpurchasesofpharmaceuticalproducts

Table 1

Assessment of environmental factors

|

Factor |

Weight, % |

Direction of influence |

Total |

|---|---|---|---|

|

Growth of the phannaceutical market and the increase in the share of Russian companies |

25 |

+ 1 |

+25 |

|

A large number of imported goods on the Russian market |

20 |

-1 |

-20 |

|

Dependence on foreign suppliers |

20 |

-1 |

-20 |

|

Dependence on the exchange rate |

15 |

-1 |

-15 |

|

Governmental support |

10 |

+ 1 |

+ 10 |

|

The trend of low-quality food consumption |

5 |

0 |

0 |

|

Fertility growth |

5 |

+ 1 |

+5 |

|

Total |

100 |

|

-15 |

Table 2

Assessment of factors of the internal environment of the company "Pharm standard"

|

Factor |

Weight, % |

Direction of influence |

Total |

|---|---|---|---|

|

Size of the company |

30 |

+ 1 |

+30 |

|

Dependence on state regulation |

10 |

-1 |

-10 |

|

Dependence on sales figures |

10 |

-1 |

-10 |

|

Low industry consolidation |

20 |

+1 |

+20 |

|

GMP standard |

5 |

0 |

0 |

|

Strong production base |

20 |

+ 1 |

+20 |

|

Center of Scientific Research and Development |

5 |

-I |

-5 |

|

Total |

100 |

|

45 |

Analysis offactors for successful promotion

The pharmaceutical industry remains one of the most profitable industries, with a sales profitability of 17%. Developed countries that have a powerful pharmaceutical industry do not directly support the industry, but actively stimulate the development of new areas of research: biotechnology, genetic engineering, etc.

When analyzing the external and internal environment of the pharmaceutical companies, each factor was given a importance rate and an estimate (Tables 1,2). AU factors of external and internal environment are grouped in Tab. 3 and 4.

BIOCAD is constantly working on expanding research and development. Thus, the company's development strategy can be defined as the development of the market and activation of R & D to launch innovations.

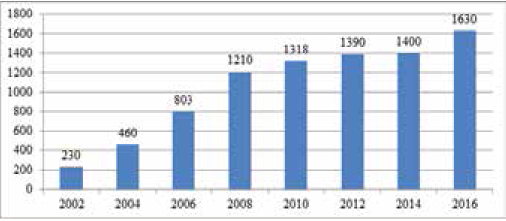

WrIthin thirteen years, the total costs of the bringing of new BIOCAD medicines to the pharmaceutical market have increased almost times 10 (Fig. 11). This is due to a high risk of failure, the costs for longer clinical trials and the growing costs for obtaining permission from government authorities.

Many promising substances are often brought to the advanced stage of clinical trials, and then get rejected. Very few substations (according to different estimates, 1-2%) reach the market stage are received. To finance such research and development, considerable financial resources are needed, which the pharmaceutical company has only if it releases new medicines at once to several national markets as soon as possible. Only transnational companies can afford this.

Table 3

SWOT-analysis of the state of pharmaceutical companies

|

Strong sides |

Weak sides |

||

|---|---|---|---|

|

Factor |

Total |

Factor |

Total |

|

Size of the company |

+30 |

Dependence on sales figures |

-10 |

|

Growtli of the phannaceutical market and the increase of share of Russian companies in it. |

+25 |

Dependence on the exchange rate |

15 |

|

Govenmiental support |

+10 |

Dependence on state regulation |

-10 |

|

GMP standard |

0 |

Center for Scientific Research and Development |

-5 |

|

|

|

The trend of low- quality food consumption |

0 |

Table 4

Opportunities and Risks of Pharmaceutical Companies

|

Opportunities |

Risk |

||

|---|---|---|---|

|

Factor |

Total |

Factor |

Total |

|

Strong production base |

+20 |

A large number of imported goods on the Russian market |

-20 |

|

Low industry consolidation |

+20 |

Dependence on foreign suppliers |

-20 |

Fig. 11. Value of launching new medicines in the market, bill. doll. [The Pharmaceutical Industry, 2016]

The success factors of the innovative product include the high utility of the innovative product and the criteria for selecting the goods by the consumer. To achieve success, it is necessary to look at the innovative product from consumer' point of view, to present his expectations regarding this product. It is necessary to take into account the peculiarities of the market (B2B or B2C). A corporate (professional) customer is much better informed than an individual consumer, since there are several specialists in a particular area in the preparation and decision making center.

The influence of consumer choice on the promotion of innovative products

When studying the influence of the consumer choice factor on promotion of the innovative product by the author, we conducted in-depth interviews with the managers of pharmaceutical companies and clients in order to identify the key parameters of pharmaceutical innovative products. BIOCAD customers were asked to fill out questionnaires in order to rank these parameters in terms of importance for the consumer.

Step I. A depth interview was conducted with 5 employees of BIOCAD's central office and 12 regional consumers of innovative pharmaceutical products, their opinions and recommendations are taken into account in this study. AU of them were asked the main question:

"What parameters of the quality of innovative pharmaceutical products, in your opinion, are important for the consumer?" It was proposed to determine five important parameters. Conversations were conducted in person, by phone and by e-mail. As a result, a list was compiled.

Quality parameters of innovative pharmaceutical products

- Compliance with pharmaceutical products standards;

- product availability;

- delivery of the product on time;

- availability of additional options / applications to the service;

- possibility of express delivery of the product;

- informing and supporting partners;

- reservation of goods;

- delivery time in case of delivery delay;

- response time to a delivery failure;

- qualification of the company's employees;

- availability of the company's outlets;

- quality management system (ISO 9001: 2000);

- provision of a contract work plan;

- agreement with the client on the execution of contracts;

- flexible discounts system;

- individual approach to the client;

- the time the company responds to customer requests;

- company's employees’ friendly communication manner;

- providing additional information materials;

- possibility of resolving issues through the representation of the company in the region;

- timely invoicing;

- availability of license

Stage 2. In order to assess the parameters of the innovative product in terms of its attractiveness and consumer's need, a questionnaire was compiled. The questionnaires were sent by e-mail to representatives of 20 regional companies, specialists in the field of advancement had two questions.

- If this parameter is present in the product, how do you feel about it?

- If this parameter is not in the product, how do you feel about it?

The following answers were proposed:

- "It suits me completely" - 2 points;

- "It is necessary" - I point;

- "Does not matter" - 0 points;

- "Not exactly what I need, but I take it easy" - I point;

- "I do not like it" - 2 points.

The results were sorted by the CANO method (Table 5). The frequency of assigning parameters to categories by the CANO method (Table 6) is calculated by the formula:

Frequency of assignment = (Number of references to the category /Number of respondents) * 100%.

Table 5 CAHO table

|

Quality parameter is present |

Quality parameter is missing |

||||

|---|---|---|---|---|---|

|

2 |

1 |

0 |

-1 |

-2 |

|

|

2 |

Error |

Attractive |

Attractive |

Attractive |

Linear |

|

I |

Inverse dependence |

Indifferent |

Indifferent |

Indifferent |

Necessary |

|

0 |

Inverse dependence |

Indifferent |

Indifferent |

Indifferent |

Necessary |

|

- 1 |

Inverse dependence |

Indifferent |

Indifferent |

Indifferent |

Necessary |

|

- 2 |

Inverse dependence |

Inverse dependence |

Inverse dependence |

Inverse dependence |

Error |

Table 6

Evaluation of the importance of the quality parameters of innovative pharmaceutical products

|

Parameter |

Importance |

|||

|---|---|---|---|---|

|

Necessary |

Linear |

Attractive |

Indifferent |

|

|

Compliance with Phannaceutical Product Standards |

7.7 |

76.9 |

0 |

15.4 |

|

Product availability |

38.5 |

53.8 |

0 |

7.7 |

|

Delivery of the product on time |

15.4 |

30.8 |

15.4 |

38.5 |

|

Availability of additional options / applications to the service |

0 |

0 |

15.4 |

84.6 |

|

Possibility of express delivery of the product |

0 |

23.1 |

30.8 |

46.2 |

|

Partners informing and support |

23.1 |

46.2 |

7.7 |

23.1 |

|

Reservation of goods |

7.7 |

23.1 |

15.4 |

53.8 |

|

Delivery time in case of delivery delay |

7.7 |

46.2 |

23.1 |

23.1 |

|

Response time to a delivery failure |

23.1 |

15.4 |

15.4 |

46.2 |

|

Qualification of the company's employees |

15.3 |

38.5 |

23.1 |

15.4 |

|

Availability of the company's outlets |

7.7 |

46.2 |

23.1 |

23.1 |

|

Quality management system (ISO 9001: 2000) |

0 |

7.7 |

7.7 |

84.6 |

|

Provision of a contract work plan |

23.1 |

0 |

15.4 |

61.5 |

|

Agreement on the execution of contracts with the client |

30.8 |

38.5 |

15.4 |

15.4 |

|

Flexible discounts system |

0 |

53.8 |

30.8 |

15.4 |

|

Individual approach to the client |

15.4 |

15.4 |

38.5 |

30.8 |

|

The time the company responds to customer requests |

15.4 |

23.0 |

38.5 |

23.1 |

|

Company's employees’ friendly communication manner |

30.8 |

53.8 |

0 |

15.4 |

|

Providing additional information materials |

30.8 |

15.4 |

38.5 |

15.4 |

|

Possibility of resolving issues through representation of the company in the region |

15.4 |

30.8 |

0 |

53.8 |

|

Timely invoicing |

15.4 |

23.1 |

7.7 |

53.8 |

|

Availability of license |

30.8 |

23.1 |

7.7 |

38.5 |

|

Note. The highest value of the parameter is selected. |

|

|

|

|

Table 7

Evaluation of the quality level of innovative pharmaceutical products of pharmaceutical companies in new cities (11 regions)

|

Quality parameter |

Average |

|---|---|

|

Compliance with Phannaceutical Product Standards |

7.73 |

|

Availability of the service |

7.27 |

|

Infonning and supporting partners |

6.18 |

|

Delivery time in case of a delivery failure |

5.64 |

|

Qualification of the company's employees |

7.18 |

|

Access to the company's outlets |

6.73 |

|

Agreement with the client on the execution of contracts |

6.82 |

|

Flexible discount system |

4.64 |

|

Individual approach to the client |

5.91 |

|

The time the company responds to customer requests |

4.82 |

|

Friendly maimer of communication of the staff |

8.91 |

|

Provision of additional information materials |

5.93 |

Table 8

Evaluation of the quality level of innovative pharmaceutical products of BIOCAD (11 regions) and other companies

|

Parameter |

Assessment |

Competitiveness of BIocaD |

|

|---|---|---|---|

|

BIOCAD (medium) |

Other pharmaceutical companies |

||

|

Compliance with Phannaceutical Product Standards |

8.75 |

7.73 |

Middle |

|

Service availability |

8.50 |

7.27 |

Middle |

|

Partners’ informing and support |

9.33 |

6.18 |

High |

|

Delivery time in case of a delay of delivery |

8.58 |

5.64 |

High |

|

Qualification of the company's employees |

8.25 |

7.18 |

High |

|

Access to the company's outlets |

6.50 |

6.73 |

Middle |

|

Agreement with the client on the execution of contracts |

8.33 |

6.82 |

High |

|

Flexible discounts system |

7.17 |

4.64 |

High |

|

Individual approach to the client |

7.75 |

5.91 |

High |

|

The time the company responds to customer’s requests |

7.67 |

4.82 |

High |

|

Company's employees' friendly communication manner |

9.33 |

8.91 |

High |

|

Providing additional information materials |

6.94 |

5.93 |

High |

So, in the proposed list of qualities of innovative pharmaceutical products, the representatives of the firms did not find any that would seem necessary to them. 13 parameters were indifferent (52%), 9 parameters were linear parameters (36%). Individual approach to the client and the time the company responded to customer requests is attractive to representatives of companiesro

Stage 3. The quality parameters of innovative products are chosen by their attractiveness and consumers' need:

- meeting the standards of pharmaceutical products;

- service availability;

- partners’ informing and support;

- delivery time in case of delay in delivery;

- qualification of the company's employees;

- availability to the company's outlets;

- agreement with the client on the execution of contracts;

- flexible discount system;

- individual approach to the client;

- time of the company respond to customer requests;

- friendly communication manner of staff;

- providing additional information materials.

Using published materials and other external sources, the author estimated the level of quality of innovative pharmaceutical pharmaceuticals on a scale from 0 to 10 in 11 regions: the Urals, the Far East, the Sakhalin Oblast, the Trans-Baikal Territory, the North, Siberia, Caucasus, the Center, the Irkutsk region, the Volga region, the Samara region. Estimates by region were averaged (Table 7).

Stage 4. Via e-mail, a survey of 30 BIOCAD clients was carried out in the regions where the selected cities are located. The questionnaire contained a list of service quality parameters for representatives of the retail network, the respondent was to evaluate the specified parameters of BIOCAD services. "

Conditions for rating:

the minimum value is 0 points;

the maximum value is 10 points.

We calculated the average value of each parameter of innovative pharmaceutical products of BIOCAD, and then compared them with other pharmaceutical companies (Table 8).

Stage 5. Via e-mail, we sent another questionnaire to 52 regional consumers of innovative pharmaceutical products. The questionnaire contained a list of quality parameters of the service of representatives of the retail network, the respondent had to answer the question:

"If BIOCAD has the opportunity to provide services of representatives of the retail network in your city, and the quality of services for you may change, are you ready to conclude an agreement with the company of this company?" Variants of answer: "I choose BIOCAD" "I remain with the former representative of retail trade", "I find it difficult to answer". After receiving the questionnaires, we calculated the percentage of potential consumers ready to become BIOCAD clients (Table 9).

Table 9

Willingness to conclude an agreement with BIOCAD

|

Reply |

Number of clients |

|

|---|---|---|

|

absolute, persons |

Relative, % |

|

|

Choosing blocAD |

32 |

61.5 |

|

I remain with the former representative of retail trade |

11 |

21.1 |

|

Struggling to give an answer |

9 |

17.4 |

Absence of "necessary" parameters in the category "Necessary", a large number of "the indifferent" and the final sample of services characteristics can indicate a lack of experience of consumers, inadequate quantity of services and lack of the necessary level of service from retail representatives.

Analysis of published materials and other sources showed that 11 pharmaceutical companies provide services with a quality above the average (estimated from 5 to 8 points). Suppliers of innovative pharmaceutical products carefully monitor compliance with technical requirements to the service, pay attention to the level of staff qualifications.

30 BIOCAD partners in the regions rated the quality of goods and services of the company higher than those of other market players. Comparative characteristics of the quality of innovative pharmaceutical products of BIOCAD and other pharmaceutical companies have shown BIOCAD's competitive advantage over future competitors in the event of release to a new market and launching an innovative product.

This confirms the second hypothesis of the study about the importance of personalized communication with potential consumers of innovative products in order to convey complete information about the properties of the product.

Barriers to the bringing new phannaceutical products in the market

The main problem of the pharmaceutical industry remains the lack of a mechanism and system for supporting start-ups, a deficit of venture funds. In the next five years, dynamics of the Russian market will be determined by economic factors (economic recovery and growth in household incomes), demographic trends (aging of the population, morbidity growth) and state support for domestic enterprises. The process of research and development in the pharmaceutical industry consists of several stages. The total cost of BIOCAD for R & D is 18-20% of revenue, the distribution of this amount is shown in Table. 10.

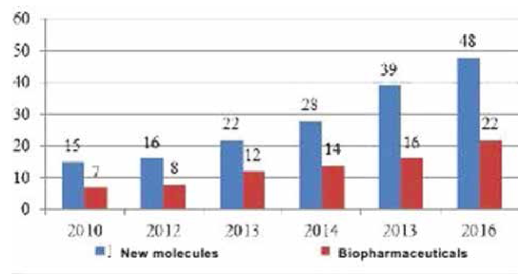

With the complication of technologies for the development of new drugs, the volume of innovations is decreasing, while the level of regulation on pharmaceutical markets, the requirements for drugs, and testing are growing. Even today there is a shortage of innovative funds that could be brought to market; there is a low productivity of R & D. Over the past 10 years, the annual volume of BIOCAD medicines at the development and research stage has actually declined (Eigure 12).

Fig. 12. Numberof registered BIOCAD products [EFPIA2016]

Table 10

Structure of BIOCAD investments in R&D at different stages of the pharmaceutical process,% [Intellectual Property, 2015]

|

Stages |

Number of patients |

Duration, year |

Contents |

Shaiv of total investments in R&D, % |

|---|---|---|---|---|

|

Preclinical trials |

— |

4 |

Synthesis of new substances, biological screening, phannacological testing |

28 |

|

Clinical trials: |

— |

7 |

— |

67 |

|

Stage I |

20-100 healthy volunteers |

Up to 1 |

Testing for toxicity, safety, optimal dose selection |

8 |

|

Stage 2 |

Several hundred patients |

1-2 |

Evaluation of efficacy and identification of side effects |

13 |

|

Stage 3 |

Several hundred to several thousand of patients |

2-4 |

Confirmation of efficacy and side effects with prolonged use |

33 |

|

Stage 4 (additional trials) |

Usually several thousand patients |

1-5 |

Identification of new consumers, comparison with other medicine, determination of the clinical effect and long-term drug safety on a wide sample of patients and compliance with the terms of the permits |

13 |

|

Approval and Pennissions |

— |

2-3 |

|

5 |

The development of new medicines and their promotion to the market costs more and more. From 2005 to 2015, R & D expenditures increased from 15% to 17.1% of total costs, sales and general management expenses from 28.7% to 33.1%. The largest share of costs falls on marketing in the pharmaceutical market. The increase in marketing costs can be considered as one of the reasons for the shortage of innovative medicines, while it is believed that drugs that are really in demand do not require promotion in the market. Limited resources and high competition force companies to focus on several areas, reduce the product portfolio and, accordingly, to strengthen cooperation with the best specialists in selected areas.

Industry entry barriers are a combination of economic, technological, institutional conditions and parameters that, on the one hand, allow existing firms to set prices above the minimum average costs of production and bring their product to the consumer without stimulating potential competitors to entry to the market, and, on the other hand, prevent new companies from earning a profit in the same amount as received by those who have entrenched in the market.

Strategic barriers arise due to the conscious activity of the firms acting in the market, their strategic behavior. Non-strategic barriers are created by fundamental conditions of the industry, factors of an objective nature and, for the most part, independent from the companies activities or weakly susceptible to their influence. Since strategic barriers are difficult to track due to the unpredictability of firms' behavior in the market, let's consider non-strategic barriers:

- Market capacity (restraint of demand). Among the companies represented in the research, there are negligible few Russian enterprises (I out of 20 - this is "Pharmstandard"). Of course, there are other companies in the market, but they are unlikely to enter the top 20. Meanwhile, the pharmaceutical market in Russia is considered to be growing rapidly.

- Material infrastructure base. Due to the geographic features of Russia, the costs of logistics play a large role in the efficiency of any enterprise.

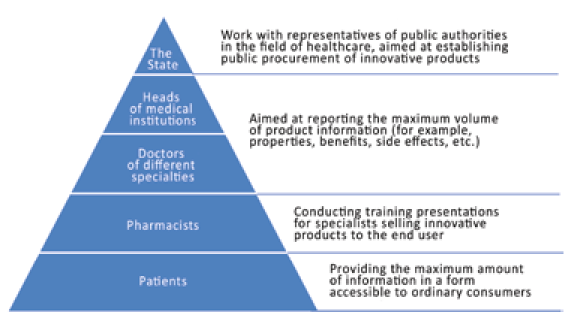

Fig. 13. Communication pyramid

However, the state takes measures to support enterprises of the industry as strategically important and shaping the country's economic security. The federal target program "Development of the pharmaceutical and medical industry of the Russian Federation for the period until 2020 and further prospects" presupposes measures to support the pharmaceutical domestic business. In addition, a number of other programs that indirectly affect this industry are being carried out, with a stake on innovative developments in the field of medicines. The trend leads to an increase in prices for imported medicines and medical equipment, and their accessibility for consumers, especially for socially unprotected categories of citizens of the Russian Federation, decreases. The technological level of the production capacity of domestic enterprises in the pharmaceutical and medical industry does not meet modem production standards. There is a shortage of highly qualified personnel capable of performing the necessary work. The program "Development of new educational programs and educational modules for specialized higher and secondary special educational institutions" is called upon to overcome their deficit. Financing and selection of companies and medicines are very selective and, possibly, even subjective, there are no proper measures for tax incentives, the state control is rather weak. Nevertheless, there are no effective organizational mechanisms for introducing the results of research and development works into the industrial production of innovative pharmaceutical and medical products, the results either remain unclaimed or go abroad, from where they "return" as finished products.

CONCLUSIONS AND PRACTICAL APPLICATION OFTHE RESULTS

In the buying decision-making process, most B2B and B2C customers rely on the Internet. Thus, effective communication with potential consumers on the Internet will be one of the main factors for the success of launching a new product.

Among other proposals in the market, an innovative pharmaceutical product can be allocated mainly due to the completeness of information about it, customer support at a high level. To meet the needs and support the product, it is proposed to launch a separate independent platform where full information about product properties, all necessary technical documentation, a section on customer support will be presented. To promote this platform, it is suggested to use methods of Internet promotion, develop relations with medical professionals.

AU methods of promotion on the Internet can be globally divided into SEO methods (Search Engine Optimization) and SMM methods (Social Media Marketing). SMM promotion methods are not applicable in the case of a prescription medicine. The SEO methods are divided into internal and external. Internal SEO-methods are aimed at optimizing the Internet platform (site) in order to increase its relevance for consumers and promotion on the list of issuance by search engines. To successfully advance with the help of SEO-methods, the platform should have the following qualities:

- optimized semantic core, eliminating inefficient queries;

- optimized information materials: shorten the length of headlines, increase the uniqueness of texts by editing them, add visual materials;

- optimal speed of the site load: compression of the code and removal of elements from JavaScript and CSS code that block the display of pages, setting the correct image format and compressing them to reduce the volume;

- optimal response time of the server by the absence of errors in HTML and CSS-code, absence of "broken" links with the help of the service, no shortcomings in navigation of the promoted site.

The external search site optimization (contextual advertising) is aimed directly at potential site visitors:

- attraction of targeted traffic from sites related to the BIOCAD website;

- ensuring awareness of the potential target audience about pharmaceutical innovative products of BIOCAD.

Within the framework of promotion in the target audience, work with clients is conducted: studying their desires and needs and forming a positive image. First of all, they determine the target audience, develop individual proposals for it, including presentation materials for diverse communication with the consumer.

To systemize the communication strategy with professionals and consumers of the medical industry, the communication pyramid is used, which displays the hierarchy of interaction with different levels of specialists and consumers (Figure 13).

The scope of communications with medical representatives includes:

- The State. On its behalf, the Ministry of Health and state in stitutions responsible for purchasing pharmaceutical products enter into interaction with the pharmaceutical industry. Communication is extremely important at this level, as public procurement in the field of innovative products make up the bulk of sales, especially at the first stages of the life cycle of the innovative product.

- Heads of medical institutions and doctors of different specialties. At this level, a decision is made to prescribe a specific drug to the patient. It is very important that specialists of this level have full information about the product, understand why this product differs from the main competitors and the closest analogues.

- Specialists responsible for the direct sale of the product also need to understand the innovative product so that they can give advice to customers at the point of sale.

- End-consumers of the innovative product are the key link in the matter of innovations diffusion. Consumers need to be able to get all the information they need. This can be achieved through an individual approach to each consumer and client, using the technological capabilities of Internet platforms.

The proposed measures are universal for pharmaceutical companies and can be used by them in practical activities.

References

1. Алекса С. В., Володин Ю. В. (2017) Подходы к формированию методологии оценки эффективности разработки и внедрения мобильных приложений // Стратегии бизнеса. № 4 (36). С. 15–22.

2. Арсенова Е. В., Николаева Т. Ю. (2018). Внедрение системы бережливого производства в процессы создания и разработки новых продуктов: пример компании «Нестле-Россия» // Стратегические решения и риск-менеджмент. № 1. С. 118–132.

3. Арсенова Е. В., Панкова О. Н. (2017). Инструменты коммерциализации инноваций: эмпирическое исследование рынка FMCG // Эффективное Антикризисное Управление. № 6. C. 42–51.

4. Арсенова Е. В., Соколова Т. Ю. (2017). Создание ценности совместно с потребителем: результаты эмпирической проверки на рынке В2В // Эффективное Антикризисное Управление. № 3. С.68–78.

5. Курятников А. Б., Линдер Н. В. (2015) Использование парадигмы «открытых инноваций» при построении корпоративных инновационных систем холдинга: эмпирическое исследование // Стратегии бизнеса. № 7 (14). С. 44–51.

6. Линдер Н. В., Дмитриева А. И. (2016) Роли профессиональных потребителей в совместном создании ценности // Управленческие науки в современном мире: В 2 т. СПб.: Реальная экономика. Т.2, ч. 2. С. 475–486.

7. Трачук А. В. (2013). Формирование инновационной стратегии компании // Управленческие науки. № 3. С. 16–25.

8. Трачук А. В. (2012). Инновации как условие долгосрочной устойчивости российской промышленности // Эффективное Антикризисное Управление. № 6 (75). С. 66–71.

9. Трачук А. В., Корнилов Г. В. (2013). Динамика процессов внедрения инноваций в области производства банкнот // Деньги и кредит. № 9. С. 3–9.

10. Трачук А. В., Линдер Н. В. (2016а) Адаптация российских фирм к изменениям внешней среды: роль инструментов электронного бизнеса // Управленческие науки. № 1. С. 61–73.

11. Трачук А. В., Линдер Н. В. (2016в) Взаимодействие со стейкхолдерами как фактор достижения стратегических целей компании: эмпирическое исследование на примере ФГУП «Гознак» // Менеджмент и бизнес-администрирование. № 1. С. 109–123.

12. Трачук А. В., Линдер Н. В. (2016б) Методика многофакторной оценки инновационной активности холдингов в промышленности // Научные труды Вольного экономического общества России. Т. 198. С. 298–308.

13. Трачук А. В., Линдер Н. В. (2017а). Инновации и производительность российских промышленных компаний // Инновации. № 4 (222). С. 53–65.

14. Трачук А. В., Линдер Н. В. (2017б) Инновации и производительность: эмпирическое исследование факторов, препятствующих росту методом продольного анализа // Управленческие науки. Т.7. № 3. С. 43–58.

15. Трачук А. В., Линдер Н. В. (2017 в). Распространение инструментов электронного бизнеса в России: результаты эмпирического исследования // Российский журнал менеджмента. Т. 15, № 1. С. 27–50.

16. Трачук А. В., Линдер Н. В., Антонов Д. А. (2014) Влияние информационно-коммуникационных технологий на бизнес-модели современных компаний // Эффективное Антикризисное Управление. № 5. С. 60–69.

17. Трачук А. В., Линдер Н. В., Убейко Н. В. (2017). Формирование динамических бизнес-моделей компаниями электронной коммерции // Управленец. № 4 (68). С. 61–74.

18. Трачук А., Тарасов И. (2015). Исследование эффективности инновационной деятельности организаций на основе процессного подхода // Проблемы теории и практики управления. № 9. С. 52–61.

19. Adams D. (2012) B2B Launch: Advanced Industrial Marketing // AIM Insitute. URL: https://launchstar.theaiminstitute.com / wp-content / themes / aim-ls / assets / 12‑New-Rules-of-B2B-Product-Launch.pdf

20. Akrani G. (2010) Marketing Mix and 4P’s of Marketing // Kalyan city live. URL: http://kalyan- city.blogspot.com / 2010 / 05 / marketing-marketing-mix-4‑ps-of.html.

21. Chao R. O., Kavadias S. (2006) A Theoretical Framework for Managing the NPD Portfolio: When and How to Use the Strategic Buckets // Management Science. Vol. 54, № 5. P. 907–921.

22. Cooper R. (2009) How Companies are reinventing their idea-to-launch methodologies // Research technology management. Vol. 52, № 2. P. 47–57.

23. Cooper R. G., Edgett S. J. (2012) Best Practices in the Idea-to-Launch Process and Its Governance // Research-Technology Management. Vol. 55, № 2. P. 43–54.

24. Cooper R. G. (2001) Wining at new products. Cambridge МА: Persus Publishing.

25. Edgett S., Cooper R. (2008). Ideationfor Product Innovation: What are the best methods? // PDMA Visions Magazine. March. P. 12–17.

26. Gray C. (2012) Integrated Marketing Communication for a Product Launch Smallbusiness // Chron. URL: http://smallbusiness.chron.com / integrated-marketing- communication-product-launch-21782.html.

27. Krishnan V., Ulrich K. T. (2001) Product Development Decisions: A ReviewoftheLiterature // Management Science. Vol. 47, № 1. P. 1–21.

28. The Pharmaceutical Industry in Figures (2016) // EFPIA URL: https://www.efpia.eu / media / 25055 / the-pharmaceutical-industry-in-figures-june-2016.pdf.

29. Intellectual Property and Pharmaceutical (2016) // EFPIA. URL: https://www.efpia.eu / about-medicines / development-of-medicines / intellectual-property / .

30. Trachuk A., Linder N. (2017) The adoption of mobile payment services by consumers: an empirical analysis results // Business and Economic Horizons. Vol. 13, № 3. P. 383–408.

31. van Vliet V. (2013) Service Marketing Mix (7P’s) // Toolshero. URL: http://www.toolshero.com / marketing / service-marketing-mix-7ps.

About the Author

D. N. SavinRussian Federation

Innovation manager of OOO “Bacardi Rus” (Limited Liability Company). Area of expertise: innovation management and business enterprise

Review

For citations:

Savin D.N. Developing a new product development & launch process. Case: pharmaceutical market. Strategic decisions and risk management. 2018;(2):50-61. https://doi.org/10.17747/2078-8886-2018-2-50-61

JATS XML