Scroll to:

Current issues of company evaluation under fintech

https://doi.org/10.17747/2078-8886-2018-1-102-1

Abstract

The purpose of the current study was to form theoretical issues and practical recommendations on development of methodology evaluation for companies implementing modern financial technologies. The research was conducted based on methodology of systematic research, synthesis, abstract logic and scientific forecast, statistical methods and factor analysis methods, expert evaluation, real option method, explored fuzzy logic. Research resulted in discovery of such companies’ features that implement modern financial technology as evaluation objects, as well as exogenous and endogenous factors that impact the evaluation of the researched companies, and these factors’ classification offered; there were methodological recommendations developed on qualitative and quantitative ranking of specific indeterminacy; there were adaptations performed to discounted cash flows, real options, and ratio methods. The methodology developed was approbated based on domestic and foreign companies that provide consulting and evaluations services. As a result of its usage, a more precise evaluation was provided for the companies implementing modern financial technologies. A separate practical usage regarded the adopted method of discounting rate calculation based on the correction for specific fintech implementation risks and the developed mechanism of real options usage for additional company’s value that allows receiving a more accurate evaluation numbers. The classification manual of specific risks developed by the author is used by evaluation practitioners. The scientific issues and practical recommendations on improvement of the companies’ evaluation that were developed within the study are being used for teaching of “Evaluation and business value management” course in Financial University.

For citations:

Demyanova E.A. Current issues of company evaluation under fintech. Strategic decisions and risk management. 2018;(1):102-117. https://doi.org/10.17747/2078-8886-2018-1-102-1

INTRODUCTION

At the present stage of development the fourth industrial revolution is gaining momentum as innovations are being introduced more actively than before in all sectors of the economy. After the global crisis of 2008-2009 a new form of interaction in the financial markets began to form. Technological innovations fundamentally change the formation and functioning of the world financial system with the priority being the development of intellectual activity. Commercialization and the transfer of innovations create colossal opportunities for the state, the economy as a whole as well as for businesses.

The Government of the Russian Federation prioritizes the strategy of an innovative breakthrough. One of the priorities of the state policy for the coming years is the national technology initiative: "On the basis of long-term forecasting it is necessary to understand what challenges Russia will face in 10-15 years, which advanced solutions will be required in order to ensure national security, the quality of people's lives, the development of branches of a new technological order " [V. Putin, 2014]. In July 2017 the Government of the Russian Federation approved the program "The Digital Economy of the Russian Federation" [Decree, 2017], in the framework of which various program documents, development concepts, "road maps" dealing with the issues of informing the society taking into account economic security are issued quite quickly [Basic directions, 2018]. The achievements of the Russian science in creating an innovative economy are coming to the forefront, which makes relevant the study of the issues of financial technologies.

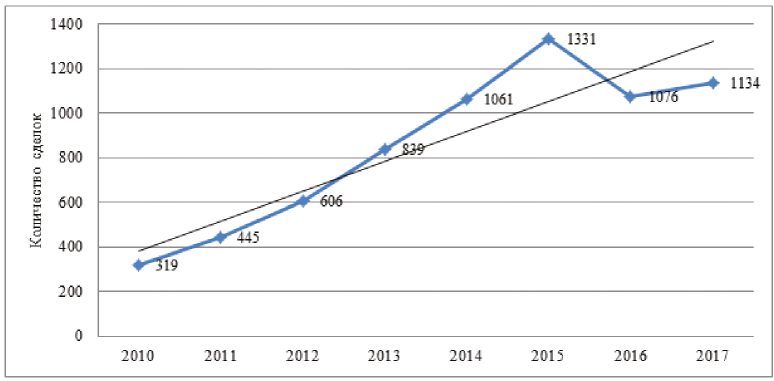

In the scientific literature the concept of "Fintech" can be defined as "a complex system that unites sectors of new technologies and financial services, start-ups and the corresponding infrastructure" [Maslenikov V.V., Fedotova M.A., Sorokin A.N., 2017]. The domestic segment of financial technologies is just emerging, but its potential is considered the third in the world [Nabiullina E.S., 2017]. According to the forecasts of Russian experts, by 2020 the e-commerce market, which uses new financial and technological applications, will amount to 2200 billion rubles. [Eskindarov M.A., Maslennikov V.V., Abramova M.A., et al, 2017]. Financial technologies can also be described as "digital innovative solutions in the sphere of financial services offered by companies using a new technology platform, which compete or cooperate with financial institutions" [Demyanova E.A., 2017]. In total, by 2018, more than 5,000 transactions with financial technology companies have been conducted in the world with the number of such transactions increasing over the years (Figure 1).

Fig. 1. Thenumberofmarkettransactionswithallcompanies of the financial technology sector by years with a trend line around the world, according to [German Fintech landscape, 2016; The pulse, 2017]

The Bank of Russia published an analysis of the state and the main directions of development of the emerging industry of financial technologies for 2018-2020 with the use of data from surveys of the leading international consulting companies Ernst & Young, Pwc, KPMG [Main Directions, 2018].

The interviewed experts identify the main factors contributing to the development of the financial technology industry in Russia It is expected that by 2020 82 per cent of financial organizations will enter into partnerships with financial and technology companies, and up to 50% of bank customers will be the users of a mobile bank. According to the report of the consulting company Ernst & Young [Fintech adoption index 2017, 2017], today the number of active users of financial technologies is steadily growing. In 2017 innovative technologies are used by one out of three active users of innovative solutions, whereas in 2105 it was one out of seven. "... the growing penetration of the Internet defining the range of potential users of financial services, the technical progress and the changing consumer preferences that stimulate technological transformation of financial products". [The focus on Fintech, 2018].

One distinguishes three groups of financial and technological companies:

- private companies, the value of which does not exceed 1 billion dollars;

- private companies, the value of which is estimated at more than $ I billion and the number of which is not high - only 25 companies in the world at the end of 2016, their total estimated value was $ 150 billion (the volume of investments into them did not exceed $ 16,9 billion, ) [Life. Sereda, 2016];

- public corporations, of which there were 47 as of February 2018 [Bloomberg Professional, [s.a.]].

The Russian market is in the initial stage of its development. According to the data of September 2017, there are about 250 companies in the financial technology sector with a volume of investments of 12,6 billion rubles.

LITERATURE REVIEW AND STATEMENT OF HYPOTHESES FORTHE RESEARCH

In the economic sphere changes turn out to be fundamental, passing quickly and affecting the methods of valuation of domestic and foreign companies. The risks of applying financial technologies in the form of applications, for example, the risks of payments through cyberspace, the risks of distributed registry technologies, the Internet of things, artificial intelligence, robotization, volatility of digital currencies, etc. have not yet been considered by analysts and appraisers. Insufficiently studied are the issues of the specifics of companies implementing modem financial technologies, their impact on valuation and classification of new, not previously covered, risks. Therefore, it is necessary to develop new approaches to determining the level of uncertainty and measuring it in assessing the value of companies in order to identify risks and opportunities.

Due to its novelty, the topic has been partially covered in scientific publications about the development of financial technologies [Abramova M.A., Goncharenko L. I., Dubova S. Y. et al., 2017; Abramova M.A., Dubova S.E., Zvonova E.A. et al., 2017; Lavrushin O.I., 2017; Lukasevich I.Y., Lvova N.A., 2017; Rubtsov B.B., Annenskaya N.E., 2017; Rudakova O.S., 2017; Ruchkina G.F., 2017; Ledkov A.A., Sidorenko E. L., 2017], the development of electronic business and payment technologies in Russia [Trachuk A. V., Golembiovsky D. Y., 2012; Trachuk A.V., Linder N.V., Antonov D.A., 2014; Dostov V.L., Shust P.M., Ryabkova E.S., 2016; Dostov V. L., Shust PM, 2017; Dostov V. L., Shust P.M., Kozyreva A.D., 2017; Trachuk A. V., Lmder N. V., 2017; Trachuk A. V., Lmer N. V., Ubeiko N. V., 2017]. It is necessary to adapt the classical methods of evaluation to modem phenomena. We need to develop progressive assessment methods that will allow us to take into account both risk factors and potential opportunities under the conditions of uncertain business environment. During their creation we consider it expedient to take into account not only the valuation methods adopted in domestic and foreign practice [Stewart G. B., 1999; Ivashkovskaya I.V., 2004; Copeland T., 2005; Busov V.I., 2007; Hitchner J., 2008; Gryaznova A.G., Fedotova M.A., 2009; Kozyr Y. V., 2009; Loseva O.V., 2011; Bakulina A.A., 2015; Eskindarov M.A., Fedotova M.A., 2016; Tazikhina T.V., Sycheva E.A., 2017], but also the opinions of world economists and practitioners who tend to use the method of real options more widely [Black F., Scholes M., 1973; Cox J., Ross S., Rubinstein M., 1979; Trigeorgis L., 1993; Luehrman T., 1998; Knight F., 2003; Brayley R., Myers S., 2009; Gusev A.A., 2009; Trifonov Y.V., Koshelev E.'V.,"Kuptsov A.'V., 2012; DamodaranA., 2017].

The comparative analysis of models of the real options method showed that in practice it is preferable to use the binomial model of Cox-Ross-Rubinshtein instead of the model of Black- Scholes due to the following factors:

- the Black-Scholes model requires the calculation of the root-mean-square deviation, which is possible only with the accumulation of statistical data, which are usually absent because of the novelty of the problematics of financial technologies as a phenomenon in general;

- in the Black-Scholes model real options are subject to execution "on the date"; their execution, even ahead of schedule, should be flexible, which is impossible in the context of financial technologies. The Russian model of the method of real options created by the Russian scientists Y. V. Trifonov, E. V. Koshelev and A. V. Kuptsov for the Russian innovation market and based on the Cox-Ross- Rubinstein binomial model proved to be the most adequate for financial and technological companies.

In recent years we have seen the appearance of works on the topics related to innovative development [Trachuk A. V., Linder N. V., 2017], which are also taken into account in this study. The methods of fuzzy sets [ZadehL.A., 1965; Nedosekin A.O., 2003] and qualitative-comparative analysis [Ragin C., 1987; Zott C., Amit R., 2007] under certain conditions make it possible to build a multifactor model of analysis, they can also be useful in the works devoted to financial technologies.

Owners or investors increasingly face the questions of valuation of companies in the conditions of a rapidly changing external environment. Today, companies use modem financial technologies to attract customers or to avoid a crisis situation. Therefore, the application of financial technologies was the answer to the changed economic environment.

THE GOAL AND OBJECTIVES OF THE STUDY

The goal of this study is to formulate theoretical propositions, methodological and practical recommendations on how to develop methods of valuation of companies implementing modem financial technologies. To achieve this goal it was necessary to:

- identify the peculiar features of companies implementing financial technologies that affect the valuation of business;

- identify the specific factors that form the value of such companies;

- classify opportunities and specific risks;

- systematize the international and Russian experience of evaluating companies implementing financial technologies;

- identify the best methods for valuing companies in the digital environment;

- develop methodological tools by adapting the classical valuation methods and the real options method to the specifics of such companies and to test it in practice.

The study of valuation methods was based on the methodology of system research, synthesis, abstract-logical and scientific forecasting, the use of methods of statistical and factor analysis, expert assessments, the method of real options and the method of fuzzy sets.

The informational and empirical basis of the work includes monographs, works of economic scientists, scientific publications, articles, reports and reviews of the leading consulting companies on the issues of financial technologies, valuation and risk assessment in relation to the financial sector of the economy, regulatory documents of international organizations and the Russian Federation, statistical data of the Bloomberg information system [Bloomberg, [sa]] on 47 public financial and technological companies, 1423 companies of the financial sector, various forecasts and evaluation reports of experts, materials of the Russian- and English-language media.

THE ORETICAL NOVELTY OF RESEARCH

The majority of companies that implement financial technologies are startups that offer some high-tech, very user- friendly applications. Almost all of them (98,8%) are private enterprises that are not obliged to publish reports, which virtually eliminates the comparability of such business with competitors and makes it difficult to analyze their activities.

The second characteristic feature of companies implementing financial technologies in general is the mode of implementation, which also determines the amount of added value. Depending on the phase of the life cycle and specialization, companies prefer to develop their own applications based on financial technologies, to enter into partnerships to develop a product in the field of financial technologies or to cooperate with financial and technological start-ups as developers. A comparative analysis of these three main ways of introducing new financial technologies was presented in detail in the author's previous work [Demyanova E.A., 2017a], We should note that in the future this will determine the choice of the method of valuation.

The process of introduction of financial and technological developments is associated with characteristic risks, including in relation to assets and liabilities of the balance sheet, which affects the evaluated property. This issue was also analyzed in detail and illustrated. During the study the following risks were analyzed: the risk of cyber security, the risk of using the technologies of the Internet of things, the risk of financial losses (insolvency), the risk of neo-banking, the risk of shortage of specialists with the required qualifications, the risk of damage to reputation, the risk of lack of demand for the product on the part of end-users, the risk of legal regulations [Demyanova E.A., 2017b],

The creation of the value of companies in the emerging market of the financial technology industry is largely due to the recognition of the knowledge and skills of key employees as an asset similar to the process of capitalization of expenditures on R & D of innovative companies. This phenomenon is described in detail by A. Damodaran, a recognized expert on the valuation of assets [Damodaran A., 2017], detailing the stages in the formation of the value of intellectual capital.

The surveyed companies are characterized by high profitability and high risks of losses, including bankruptcy. The profitability of start-ups equals 676%, 80% of start-ups are unprofitable, 30% are fraudsters, 60% are closed due to the lack of professional management [Shabarshin A.A., Fomin F.V., 2017].

The methodology for identifying internal and external factors affecting the value of companies introducing financial technologies, the grouping of factors as opportunities and risks were discussed in detail in the author's early publications [Demyanova E.A., 2017b, c] (Table 1).

The study of theoretical aspects of the problem of valuation under the conditions of introduction of financial technologies revealed three points of novelty in the theory:

- specific features of such companies as valuation objects;

- external and internal factors affecting the value of the surveyed companies were identified;

- classification of specific risk factors affecting the value of financial and technological companies was proposed.

Table 1

Specific external and internal factors affecting the value of companies

|

External factors |

Internal factors |

|---|---|

|

Eligh risks associated with the activities of national regulators |

Risk of shortage of specialists with the necessary competences |

|

Tlrreats to cybersecurity |

Insufficient amount of capital |

|

Increase in the number of competitors and increasing competition |

The risk of the technology of the Internet of tilings |

|

Reduction in competitiveness of the existing business model |

The risk of financial losses due to unavailability of liquid assets for customers at the required time in the required amount |

|

Lack of demand from potential consumers |

The company's image in the Internet and fast interaction on a peer-to-peer level with all counterparties |

|

The number of peer-to-peer transactions |

The number of active accounts of the financial and technological application |

The obtained results served as a basis for methodological and practical components of the improved evaluation methodology developed during the study.

In order to conduct a comparative analysis of the existing evaluation experience, the data of the Western and Russian studies in the field of the current valuation practice of companies implementing financial technologies were analyzed and systematized. It should be noted that scientists and practitioners have not yet come to a consensus regarding the best method of assessment, which once again confirms the relevance of our research. The results of the comparative analysis are presented in Table. 2.

Contemporary authors [Berkus D., 2009; Barrington G., 2011; Payne B., 2011; DamodaranA., 2017] do not propose an integrated approach that takes into account risks and opportunities of financial technologies.

Acomparative analysis of foreign and domestic experience in valuation activities showed:

- the cost approach is not applicable for evaluation;

- the comparative approach is limited due to the small number of public companies; suitable multipliers are Price/Book Value, the price of one share/eamings per share (Price/Earnings), Enterprise Value/Earnings Before Interest, Taxes, Depreciation and Amortization;

- with the income approach we apply the discounted cash flow method and the real options method.

It should be noted that the choice of valuation methods is caused by the stage of the company's life cycle. For companies at the project stage the venture capital method is applicable, and for mature companies and those who develop financial technologies on their own - the methods of a profit approach should be applied.

Sometimes only expert data are available and there are no classification reference books on financial and technological factors affecting the value of companies in the context of introduction of financial technologies. In this study, efforts are focused on the development of alternative adjustments that take into account the identified specific risks and potential opportunities for implementing financial technologies.

Table 2

The results of comparative analysis of the methods of valuation of financial and technological companies

|

Method |

Basis of method |

Drawbacks |

|---|---|---|

|

Liquidation value method |

Liquidation value of tangible assets |

Takes into account only tangible assets, but there can be very few of them in the case of financial-technological companies; it does not take into account risks and potential changes in the situation |

|

The method of book value |

The value of tangible assets |

Linancial and technological companies may have a small share of tangible assets in contrast to intangible assets; it does not take into account risks and potential changes in the situation |

|

Discounted cash flow method (DCL) |

Bringing the value of the estimated future cash flows to a certain discount rate |

Problems with choosing the correct rate, which would take into account risks and opportunities; it is not always possible to correctly predict future cash flows |

|

Payne scoring method |

Weighted average value in comparison with the value of an analogue company |

It is not always possible to select an analogue company |

|

The method of comparable operations |

Key indicators adjusted for an analogue company |

It is not always possible to select an analogue company |

|

Die first Chicago method |

Weighted average comparison of three scenarios estimated according to the discounted cash flow method or the multiplier method |

Does not take into account risks and potential changes in the situation; it applies only to companies that already generate revenues |

|

Venture capital method |

Estimation of profits expected by investors |

The method is applicable for companies at the startup stage, but at other stages it is not enough to calculate only the return on investments |

|

The method of using the models of added economic profits |

The measuring of excess profits generated by investments, incl. portfolio investments |

The cost depends on expectations; one does not distinguish negative and positive factors affecting profits |

|

Otlier methods using equity and market value added |

The market value of shares less book value of equity capital |

The method is not applicable to private companies |

|

The Berkus method |

Live factors of success (idea, technology, employees, market entry, start of sales) |

The method does not take into account potential opportunities; the result depends heavily on expert opinion |

|

The method of summation of risk factors based on the expansion of the Berkus method |

Estimation of the base cost adjusted for 12 risk factors (technological, legislative, production risks, risks of attracting capital, international risks, reputational risks, risk of inefficient management, etc.) |

The method does not take into account potential possibilities; the result depends heavily on expert opinion |

|

Comparative valuation by multipliers |

Indicators of balance sheet, financial income |

Balance sheet multipliers do not take into account human capital, risks and projected values |

|

Real options valuation method |

Consideration of opportunities as carrying some added value |

It is difficult to estimate the probability in the used models of this method |

FORMATION OF SAMPLE AND THE RESULTS OF COMPARATIVE ANALYSIS

With the help of IAS Bloomberg we carried out the analysis of companies with a mono-software application and companies implementing financial technologies, i.e. companies that do not have such application, in three areas:

- comparison with control groups of normal companies, which do not actively use financial technologies;

- comparison with traditional financial institutions;

- comparison with other companies that have a monoprogram product.

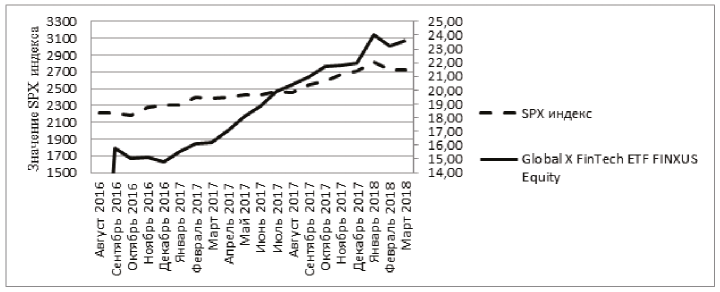

In all three areas we discovered a clear growth in the market value of companies, which base their activities on financial technologies in comparison with companies that do not use them.

As an illustration of the first area we present a comparative analysis of the GlobalXFinTechETF fund consisting of 31 public companies in the field of financial technologies and stock index S & P 500 for 2016-2018 (figure 2). In the second area we conducted a comparative analysis of a number of indicators for the valuation of 1423 companies in the financial services industry around the world compared with 1468 financial institutions, incl. in the context of regions. The calculations are based on the data from open sources, in particular, from the IAS Bloomberg and the site of A. Damodaran [Damodaran online, [s.a.]]. They relate to the sectors of financial services (with the exception of the insurance sector), information services, online trading. The last sector is made up of open companies, including those that have implemented modem financial technologies, but do not necessarily position themselves as finance and technology companies. During the research we selected and analyzed those indicators that were suitable for the evaluation of companies implementing solutions based on financial technologies (Table 2).

Fig. 2. The comparative analysis of the indicators of 2016-2018 of the Ieadingfinancial and technological fund Global X Fin Tech ETF and the index S & P 500 by using IAS Bloomberg

As a result, it was discovered that in the group of companies implementing financial technologies:

- the beta coefficient is twice as high as in the control group, which can be explained by a higher risk load;

- on average, the cost of raising capital is almost 2.5 times higher than in the control group;

- the multipliers that characterize the projected growth and return on invested capital in the surveyed companies are sometimes five times higher than in the control group, which can be explained by a higher risk of investment.

For the third area the dynamics of valuation of 47 world companies was analyzed (a fragment of the analysis is given in Table 3).

The obtained result illustrates a positive influence of the introduction of a general process of transition to financial and technological development on the value of a group of companies in dynamics, which allows to identify potentially underestimated companies (for example, Intuit Inc., Fidelity National Info Serv, Fiserv Inc). The comparison of the indicators of 2018- 2019 allows us to make a forecast about the growth of income in general for the sample and for the newly launched company Square it promises super-profits.

INSTRUMENTS OF ASSESSING COMPANIES’VALUE

Identification of risks and real options is the first and one of the key steps in the valuation of business. To identify sources of uncertainty, we chose

the method of brainstorming and modified it for a deeper understanding of the processes of implementation of modem financial technologies. In the process of brainstorming one has to look at Descartes square and ask the questions written there - this activates the process of brainstorming (Table 4).

Table 4

The scheme of expert analysis on Descartessquare [Demyanova E.A., 2017a]

|

Wliat will happen if the company takes this risk? Wliat will not happen if the company takes this risk? |

Wliat happens if the company does not take it? Wliat will not happen if it does not take it? |

The developed algorithm for identifying risks and real options contains a number of actions:

- to collect information on the purpose and scope of evaluation;

- to determine at what stage the evaluation is carried out (before/ after the introduction of financial technologies);

- to select an expert group working with the functional directions of the company;

- to identify the causes and sources of risks and opportunities, depending on where they originated, at what level, how the modem financial technologies were implemented;

- to conduct a preliminary analysis on Descartes square;

- to compile questionnaires and by means of the brainstorming method to select risks and real options for each level and in each area.

Table 3

Key indicators of valuation of financial services companies around the world as of January 5, 2018

|

region |

Number of companies |

Beta coefficient |

Discount rate, % |

Price of share/book value |

Price per share / earnings per share |

|---|---|---|---|---|---|

|

Globally |

|||||

|

Banks |

1468 |

0,62-1,00 |

4,68-4,78 |

1,08-1,12 |

22,25-29,82 |

|

companies |

1423 |

0,82-1,32 |

4,02-9,65 |

1,46-7,84 |

56,01-125,13 |

|

USA |

|||||

|

Banks |

623 |

0,50-0,64 |

3,87-4,14 |

1,24-1,50 |

17,09-33,24 |

|

companies |

386 |

0,61-1,18 |

2,99-7,86 |

2,20-9,37 |

41,45-73,27 |

|

Western Europe |

|||||

|

Banks |

196 |

0,70-1,60 |

3,94-4,92 |

0,69-0,87 |

11,01-21,01 |

|

companies |

210 |

0,94-1,63 |

4,00-11,01 |

0,77-6,37 |

31,64-81,34 |

|

Developing countries |

|||||

|

Banks |

539 |

0,82-0,85 |

5,02-5,68 |

0,99-1,14 |

23,01-43,67 |

|

companies |

628 |

0,86-1,58 |

6,21-12,76 |

2,15—4,39 |

50,49-97,52 |

Table 4

Dynamics of key indicators of valuation of the first five public companies in the sphere of financial technologies according to "market capitalization" as of February 21, 2018

|

Name |

Market capitalization, mln. dollars |

Value of company, mln. dollars |

Price per share/eamings per share |

Company value / Profit before taxes, interest payments, all depreciation charges |

Price of share/book value |

|

|---|---|---|---|---|---|---|

|

2018 |

2019 Forecast |

|||||

|

Paypal Eloldings Inc |

92,48 |

87,79 |

33,80 |

27,83 |

22,73 |

5,78 |

|

Intuit Inc |

44,37 |

44,47 |

32,53 |

28,14 |

21,32 |

36,89 |

|

Fidelity National Info Serv |

32,49 |

40,70 |

18,77 |

16,82 |

15,55 |

3,00 |

|

Fiserv Inc |

29,53 |

34,11 |

22,86 |

20,10 |

17,46 |

10,81 |

|

WirecardAG |

15,19 |

14,25 |

46,32 |

35,32 |

26,90 |

7,98 |

A successive implementation of the steps makes it possible to identify the volume of previously not covered risks and possibilities for implementing financial technologies.

As a result, we can get a list of 7-10 key risks and real options, then identify the most significant of them.

In the scientific writings of domestic authors they emphasize the sufficiency of applying the method of species analysis and the consequences of refusals (Failure Mode and Effects Analysis, FMEA) to rank the level of uncertainty in terms of selecting the most significant risk events at all stages of the life cycle of technological developments to analyze the risks of potential inconsistencies.

In the West this method has been successfully used for more than half a century to assess the level of risks in the military, aviation, nuclear, automotive and other areas.

The work systematizes the main features of applicability of the FMEA method. It is proved that when ranking the level of uncertainty of implementation of modem financial technologies the following conditions are fulfilled:

- risks and opportunities for implementing financial and technological applications are assessed in the context of limited information and are one of the types of innovative technological risks;

- it is convenient to comprehensively evaluate the maximum number of significant risk events related to the projects of implementation of modem financial technologies;

- not all risk events are carefully evaluated, but only the most significant ones;

- the results of the ranking are input data for further quantitative evaluation of the risk event.

Methodical recommendations for the scoring of the level of specific uncertainty are proposed. It is shown that the method of FMEA risk assessment in its original form is not applicable for these purposes, since it includes an overly aggregated estimate of the "value" parameter without taking into account specific factors.

It is proposed to improve this method of preliminary assessment and the ranking of risky implementation of financial technologies, for which three new parameters with the corresponding specific weight were introduced: the area of occurrence of uncertainty, the level of occurrence of uncertainty, the way of introduction of financial technologies.

The developed algorithm for ranking specific uncertainties in the introduction of financial technologies allows:

- to determine input data for each identified uncertainty;

- to select the objects of analysis (assets, liabilities, processes), which are influenced by potential risks/opportunities

- to determine the sequence of analysis;

- to establish the boundaries of values for the level of risk priorities;

- to calculate the indicators of the priority rank of risks taking into account the modified parameters;

- to rank risk events by using a modified FMEA methodology;

- to use the obtained results of ranking of specific risks to adjust the discount rate by the amount of specific risks of financial technologies in assessing businesses using the method of discounted cash flows within the income approach.

Within the comparative approach we analyzed the existing multipliers of business valuation, identified those that are suitable for the evaluation of companies implementing modem financial technologies: the price of one share/book value, the price of one share / earnings per share, the value of the company / profit before taxes, interest, all depreciation costs. It is proposed to use additional industry multipliers: company value/number of active clients and company value/number of transactions. To further quantify the level of risks and opportunities it is difficult to use the Russian model of the real options, because it uses only one parameter - inflation. This is not enough for a correct assessment of companies in the conditions of implementation of modem financial technologies.

We propose to adapt this model for valuation of financial and technological companies adjusting three parameters in the following way:

- the rate of the largest forecast inflation should be replaced by the rate of the biggest value of the forecast growth in the risk factor for the period, expressed in percentages;

- the rate of the least predicted inflation should be replaced by the rate of the least value of the forecast growth of risk factor for the period, expressed in percent;

- the rate of inflation, forecast, stipulated by the contract, is to be replaced by the expected growth rate of the risk factor for the period, expressed in percentage.

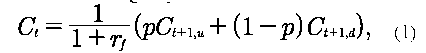

Then the additional value of companies under the conditions of implementation of modem financial technologies can be assessed in the following way:

where Ct — the price of a real option after the expiration of period /, (time), in monetary terms; rf — risk-free factor for the period t, %; p - pseudo-probability determined by the relation p = (rf - rd)/(ru - rd); ru bet the greatest volume of the projected growth of the risk factor over period t, %; rd - rate of least magnitude of the projected growth in risk factor over time t, %; Cu - the price of real option in the case of the greatest growth (up - up) risk factor, in terms of money; Cd - the price of real option in the case of the lowest (down - down) of manifestation of risk factors in monetary terms [Trifonov, Yu., Koshelev E. V., Kuptsov A.V., 2012].

The limitations of the original binomial model result in the limitation of the proposed model - the analysis of real options of risk factors for which growth is projected. Elowever, this is not a problem, since in practice one usually tries to determine and quantify real options precisely for the projected increasing risks of implementation of financial technologies.

The cost of a real option is the payment for taking a certain risk during the implementation of new financial technologies.

Ultimately, the determined value of the risk factor affects the final net present value of the risky project:

where V-the cost of risk in monetary terms; NPVro, NPVf- the cost of the net present value of the project of implementation of new financial technologies with and without consideration of risks, in monetary terms (RO - real option).

The company's value is defined as a sum of the value discovered by the discounted cash flow method without taking into account the cost of real options and the cost of the real option for this company. Therefore, for the valuation of domestic companies that do not publish financial statements the method of real options is applied as a set of actions:

- to choose a real option from the previously identified ones, to determine input data for the calculation;

- to assess the value of business without taking real options into account;

- to build a binomial tree and determine the value of risk in monetary terms;

- to calculate the value of business taking into account the real options;

- to draw conclusions from the obtained quantitative assessment.

BUSINESS CASE: APPROBATION OF METHODOLOGICAL RECOMMENDATIONS IN WORK MODE

The size of this article does not allow us to give a complete step-by-step approbation of the proposed methodology; therefore, we will present a fragment of its application for the valuation of a specific company implementing financial technologies. As an object of analysis we chose a real company - a customer of Eagle Rock Resources Group Ltd, for which we carried out evaluation. Maintaining confidentiality, we designated the company as FC "Fintech", the indicators of the used reporting are multiplied by an by an arbitrary coefficient, which does not distort our conclusions.

Step 1. Problem statement

FC "Fintech" develops a new integrated mobile application for neo-banking in order for physical persons to be able to trade with shares by using the Internet of things (IoT) technology and the use of mobile phones. Perhaps, such an application will generate big profits, but this is not obvious. One of the essential components of the system can be developed independently, but on the market there is a company (start-up), which develops or intends to develop a financial and technological product, it has an almost ready application, but it needs to be modified to fit the needs of FC "Fintech".

The company's management is not completely sure if there will be a demand for the product and a full-scale modification of the development will be successful, but after creating the beta version of the application and conducting additional research it will be possible to establish if a successful implementation of this new financial technology is possible on the required scale. Non-participation in the project is not considered; in this case the competitiveness of the company will be lost. The management of FC "Fintech" has a choice: to invest in the development of the existing application or not. Startup owners will have to decide whether to finance further expensive development on their own or to invite investors represented by FC “Fintech”, who is willing to finance an additional study to create a full-scale beta version of the new banking product with the possibility of buying preferential rights. Obviously, in this case, both FC Fintech and the start-up find themselves in the situation of uncertainty. If the beta version and the conducted studies of the banking application are successful, then the price of rights to this object will instantly increase. If FC “Fintech” agrees to finance an additional study, its own position may deteriorate. If the startup conducts this research at its own expense, and the beta version does not find commercial application, it will simply lose its investments. If we consider the choice of both sides as a real option "an opportunity to acquire rights without obligations", then in the event of a negative research result the startup does not lose anything, FC "Fintech" investing in the project obtains the right to choose (as soon as the outcome of the beta-version development is clear): to acquire exclusive rights to a complex banking application or to give up such deal. The right to acquire exclusive rights for the implementation of new financial technologies was fixed in advance at a certain price, and the startup insists that the price should be indicated in a digital currency traded on the stock exchange (in bitcoins, BTc), believing in its stable growth at a level of 30%. The management of FC "Fintech" is skeptical about the forecasts of bitcoin growth and believes that strong fluctuations are possible - from 5 to 50%.

FC “Fintech” invited an appraiser and asked him to assess the value of the company in monetary terms taking into account risks if a contract is concluded to carry out additional research for the complex development of this banking application, and to submit a quarterly assessment of the risks of changes related to the high volatility of bitcoin.

The analysis and valuation are carried out according to the above-mentioned stages as of January I, 2016 for the contract ending on December 31, 2017.

Step 2. Identification of risk events

Step. 2.1. Identificarion of previously not covered risks with respect to assets and liabilities of the company

Step 2.1.1. Collection of infonnation about, the goals mid scope of evaluation

In this study, only previously not covered risks are considered. Accordingly, the described scope of assessment and practical measures address only the risks specific to the implementation of financial technologies.

Step 2.1.2. Selection of mi expert group for the company's functional areas

To carry out a risk analysis for this project of implementation the professional knowledge of economic appraiser is not enough, because it is necessary to get an opinion on a number of technical issues. Therefore, a team of experts is formed:

- the head of the working group (the appraiser himself);

- a specialist in software development from the Department of Information Technologies of FC "Fintech";

- a specialist from the company’s marketing department (from those employees who promote such new financial technologies and have the experience of working with e-banking applications);

- a specialist from the department of quality control and risk management;

- a representative of the startup, from whom it is planned to buy the developed product for its further modification.

Step 2.1.3. The search of causes mid sources of risks

We have identified certain problems that can arise at the macro- and microlevel connected with the way of implementation of new financial technologies (Table 5). The way of implementation is interaction with the startup.

Table 5

Expected areas of risk occurrence

|

Risk areas |

Level of occurence |

|---|---|

|

An application at the junction of mobile banking and online platforms for transactions |

Macro |

|

High volatility of bitcoin rate |

Macro |

|

The risk of using the technology of the Internet of things (IoT) |

Micro, macro |

|

The risk of cybersecurity as a threat to stability (possible attacks) |

Micro, macro |

Step 2.1.4. Detennination of the time horizon of evaluation The project is evaluated taking into account the duration (two years), the quantitative assessment of the leading risk, which is carried out on a quarterly basis.

Step 2.1.5. Preparation of questionnaires and selection of a methodfor identifying risks or their combinations

Through the method of brainstorming the expert group identifies risks (Table 6). As a result of discussion it was determined to consider the risk of cybersecurity only at the macro level, and the risk of using the technologies of the Internet of things, on the contrary, only at the microlevel. It was also decided to additionally include the risk of shortage of specialists with the necessary competencies.

Step 2.2. Preliminaiy risk analysis with Descartes square

At the next stage the group of experts analyzed all the identified risks with Descartes square (Table I). As a result, the list of risks was expanded: the risk of damage to reputation as a result of implementation of cyber-risks and the risk of loss of client data as a result of defects in the technology of the Internet of things were also added.

Step 3. The ranking of uncertainty of risk events

Step 3.1. Qualitative assessment of the identified risks and their ranking according to FMEA

Step 3.1.1. Detennination of input, data for each identified risk

The expert group collected the data and documents, which served as a basis for risk assessment (Table 8). For example, the risk of inconsistencies in various technologies, the risks of loss of reputation, etc. The data and supporting documents were collected for each risk.

Step 3.1.2. The choice of the objects of analysis (assets/ liabilities and processes), which are affected by potential risks

According to the requirements of the FMEA model, in choosing the technological processes to be assessed for the present risks we chose those ones in which:

- there are more than half of new operations: there are no such banking applications on the market yet, therefore, the application is 75% new;

- the implementation process affects the security of the system;

- new tools are used, in this case - the technology of the Internet of things;

- the procedures for customer support in the future are changing: support procedures should be reviewed in connection with the use of the new technology of the Internet of things and for reasons of cybersecurity.

The company’s assets and liabilities were also analyzed, which are influenced by the identified risks (Table 9).

Step 3.1.3. Setting the limits for the ranking of risk priorities

The limits of RPR values are set during the repeated analysis of the same risks based on expert estimates or accumulated statistical data on deviations. Since in this case there were no statistical data on the onset of risks, at the initial analysis the limits were not set.

Step 3.1.4. Calculation of RPR indicators taking into account, the improved parameters

The project was assigned parameter A2 - implementation by cooperating with the startup. The parameter is important if it is necessary to carry out a comparative evaluation of two or more projects for the introduction of financial technologies. In the considered practical example this parameter is irrelevant. RPR indicators are calculated taking into account the proposed modifications of the FMEAmodel (Table 10). One can also enter information on the causes of risks for their subsequent analysis and elimination.

It is proposed to determine RPR by the formula: RPR = SxQxD, where S- is the level of significance defined as S=

∑m= K tnm x Ti ,

where K tnm - attribute of risk classification, t - risk type; n - subrisk; m - risk level; 1 - high; 2 - average; 3 - low; T 1, 2 - the level of risk occurrence (T1 - macrolevel; T2 - microlevel); O - frequency of occurence; D - level of detection.

Table 6 Identified risks

|

Risk area |

risk |

Level of occurence |

|---|---|---|

|

An application at the junction of mobile banking and online platforms for transactions |

The risks of inconsistencies in different technologies, the risks of insufficient scalability of the existing application |

Macrolevel |

|

High volatility of bitcoin rate |

In case of the rapid growth in the rate of bitcoin there is a risk unnecessary expenses for FC "Fintech" as an investor into the project of modification of the banking application |

Macrolevel |

|

The risk of using the technology of the Internet of things |

Insufficient availability of the application from the point of view of the Internet of things, the need in additional capital investments |

Microlevel |

|

The risk of cybersecurity as a threat to stability (possible attacks) |

The risks of disruption in the safe operation of applications resulting in lost data and customer money |

Macrolevel |

|

The risk of shortage of specialists with the necessary skills |

The risk of leaving of the main ideologist and developer of the application in connection with potential purchase by FC "Fintech" |

Microlevel |

Strep 3.1.5. Rmiking of risk events by using the modified FMEA methodology

Based on the values (Table 9) a conclusion was made about the priority of the identified risks in implementing new financial technologies:

- risk of volatility of bitcoin;

- risk of cybersecurity;

- risk of using the technology of the Internet of things.

Table 7

The preliminary analysis of risks identified with Descartes Square

|

risk |

If the company takes this risk... |

If the company does not take this risk |

||

|---|---|---|---|---|

|

What happens? |

What does not happen? |

What happens? |

What does not happen? |

|

|

The risks of inconsistencies in different technologies, the risks of insufficient scalability of the existing application |

Measures are necessary to neutralize this risk; it may be necessary to attract investments for further development |

FC “Fintech” will not be able to maintain a competitive position on the market if this risk event occurs |

FC “Fintech” cannot get rid of this risk without abandoning the project as a whole |

There will be no delay in implementation |

|

The risk of unnecessary costs for FC "Fintech" as an investor in the project of improvement of the banking application if bitcoin will grow rapidly |

It may be necessary to attract additional investments, since the developer insists on a fixed price in a digital currency |

FC “Fintech” will not be able to maintain a competitive position on the market if this risk event occurs |

FC “Fintech” cannot get rid of this risk without abandoning the project as a whole |

There will be no additional outflow of funds |

|

Insufficient readiness of the application from the point of view of the Internet of things, the need in additional capital for development |

It may be necessary to attract additional investments for development if the marketing department confirms the demand for the technology of the Internet of things for this application; it is possible to carry out the development in stages if there are not enough investments |

FC “Fintech” will not enter the market with a new application, which is a year ahead of competitive offers. |

One will have to enter the market with partial solution, gradually updating the implementation of the Internet of things as a separate project. |

There will be no delay in implementation |

|

The risks of disruption in the safe operation of applications resulting in lost data and customer money |

The measures of reliable modem proactive protection are necessary |

FC “Fintech” will not be able to maintain a competitive position on the market if this risk event occurs |

FC “Fintech” cannot get rid of this risk without abandoning the project as a whole |

There will be no loss of company image and, consequently, loss of customers |

|

The risk of leaving of the main ideologist and developer of the application in connection with potential purchase by FC "Fintech" |

The costs to attract a specialist, whose services are expensive, are possible |

FC “Fintech” will not be able to finish the project on time without replacing a specialist |

One will have to delay the market entry |

There will be no delay in implementation |

Step 4. Quantitative assessment of significant risks by the method of real options

Step 4.1. Selection of the studied risk from the previously identified qualitatively assessed specific risks; deterrmnarion of input data for calculation

A significant risk level for this case is macrolevel risk - the exchange rate of bitcoin to the dollar. We analyzed bitcoin’s volatility for all years of its existence before the signing of the contract. The rates of the annual growth of the rate for 2008- 2015 were calculated, the rate of growth of the exchange rate was analyzed:

T общ= 1004/770 x 100% - 100% = 30%.

The forecasts of market experts regarding further changes in bitcoin’s rate were taken into account. Input data for the calculation are summarized in Table 11.

Table 11

Input data for calculations with the method of real options

|

Parameter |

Indicator |

|---|---|

|

Annual growth rate of bitcoin, %: maximum |

50 |

|

minimum |

5 |

|

projected |

30 |

|

Market price*, bitcoin |

500 |

|

Strike price*, bitcoin |

500 |

|

Total period of the agreement, year |

2 |

|

The number of evaluation periods (quarter) |

8 |

|

* At the date of execution |

|

Table 8

The collected data and documents for evaluation of specific risks

|

risk |

Data and documents |

|---|---|

|

The risks of inconsistencies in different technologies, the risks of insufficient scalability of the existing application |

Technical documents of the new banking application, test protocols, security certificates |

|

The risk of unnecessary costs for FC "Fintech" as an investor in the project of improvement of the banking application if bitcoin will grow rapidly |

The statistics of fluctuations of bitcoin rate over the past years, the analysis of trends for the next two years |

|

Insufficient readiness of the application from the point of view of the Internet of things, the need in additional capital for development |

The analysis of factors influencing the development of elements in the Internet of things, test protocols, security certificates |

|

The risks of disruption in the safe operation of applications |

The existing protocols of the company’s security |

|

The risk of loss of the company’s reputation |

The analysis of statistics, mainly the foreign one, to estimate the frequency of occurrence of this risk |

|

The risk of losing money or data of customers |

The analysis of statistics, mainly the foreign one, to estimate the frequency of occurrence of this risk |

|

The risk of leaving of the main ideologist and developer of the application in connection with potential purchase by FC "Fintech" |

The analysis of the labor market of specialists with similar qualifications |

By analogy with financial options for investors this will be a call option with the possibility of early execution of the contract. The cost of a real option is the cost of conducting an additional study of the complex banking application. The startup neutralizes its risk by selling options that can be converted into contracts at a fixed price, when the scalability and relevance of this mobile application will be determined.

Table 9

Assets and liabilities affected by the identified risks

|

risk |

Assets and liabilities |

|---|---|

|

The risks of inconsistencies in different technologies, the risks of insufficient scalability of the existing application |

Software products; company’s monetary resources - investments are required for the completion and coordination of applications |

|

The risk of unnecessary costs for FC "Fintech" as an investor in the project of improvement of the banking application if bitcoin will grow rapidly |

Company’s monetary resources |

|

Insufficient readiness of the application from the point of view of the Internet of things, the need in additional capital for development |

Company’s monetary resources; personal data of clients; channels of communication between the device and the cloud storage |

|

The risks of disruption in the safe operation of applications |

Software products, company’s monetary resources; as a result, there is an obligation to compensate customers' losses at the expense of FC “Fintech” to preserve the image and loyalty of customers |

|

The risk of loss of the company’s reputation |

Damage to reputation |

|

The risk of losing money or customer data |

Company’s monetary resources |

|

The risk of leaving of the main ideologist and developer of the application in connection with potential purchase by FC "Fintech" |

Company's monetary resources - payment for attracting a new specialist and for his adaptation; the risk of disruptions in the timing of the market launch of the application |

For “FC "Fintech"” as an investor it is an investment tool that can be profitable to use or resell.

Let us check whether the conditions for applying the real option method (binomial model) in the particular case are fulfilled. The management of FC "Fintech" has the opportunity and the intention to make managerial decisions on the progress of the project. This is evidenced by the request for a quarterly risk assessment. The project is closely monitored with adjustments made according to the project’s progress. The outcome of implementation depends, among other things, on the management decisions regarding the use of the provided options.

The management asks to evaluate the number of possible options intending to act according to the results of evaluation.

There is a high level of uncertainty, volatility, that is, of risks. During the qualitative assessment and the ranking of risks a high volatility of the bitcoin rate was determined. The net present value of the project, not including risks, calculated by using the discounted cash flow method, is negative or slightly above zero.

Step 4.2. Calculation of the traditional net present value (NPV) of the project without risks

The market price under contract on the date of its conclusion is 500 bitcoins; the same is true for the price of execution of the contract on the date of conclusion. Consequently:

NPVf = 500-500 = 0.

Table 10

The results of calculation of RPR indicators taking into account the modified parameters

|

risk |

Assets and liabilities affected |

Level of occurence Ti |

Attribute of classification Kt,n,m |

Significance level S |

Frequency of occurence O |

Level of detection D |

RPR |

|---|---|---|---|---|---|---|---|

|

Risks of technology,scalability |

Software products; company’s monetary resources |

T1 |

К 4.1.3, |

6 |

3 |

2 |

36 |

|

Risk of volatility of bitcoin |

Monetary resources |

T1 |

К 3.1.1, |

2 |

10 |

10 |

200 |

|

Risk of the Internet of things |

Monetary resources |

T2 |

К 2.2.2, |

10 |

4 |

1 |

40 |

|

Risk of cybersecurity: • Risk of reputation loss; • risk of loss of money/ customer data |

Software products; monetary obligations to customers |

T1 |

К 1.4.3, |

5 |

7 |

4 |

140 |

|

Risk of loss of key personnel |

Monetary resource; personnel |

T2 |

К 5.1.2, |

10 |

2 |

1 |

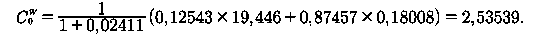

20 |

Step 4.3. Building a binomial tree and determining the value of the risk in monetary terms

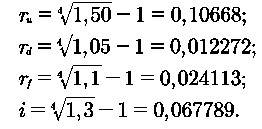

Based on the input data we determine quarterly rates for further calculations. As a risk-free rate of return we take the rate of refinancing on the date of the contract’s conclusion, in this case - 10% on the date of the contract’s conclusion.

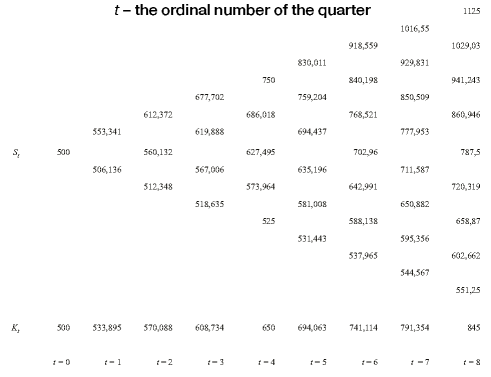

On the basis of the obtained data we build a binomial tree (Figure 4), which shows how the market price of the option contract K13varies for each of the eight quarters and how the strike price of the option changes according to the predicted growth rate of bitcoin 7.

The price of the "working" option is calculated with the formula of the classical binomial model for C1 The calculation is made from right to left, in the direction from the last quarter to the contract’s starting date. Therefore, the price of the option on the date of the contract’s conclusion is the last calculated number The results are shown in Fig. 5.

The procedure for calculating the price of "working" and "burned" (those that do not work anymore) options in each period is given below. As we have established, for an investor this will be a call option, which means that in the last quarter (t = 8) the option price is calculated:

C8 = maxS8 - K8,0) = max( 1125-845,0) = 280 bitcoins.

where C8 - option’s price in the eighth quarter; Sg - market price of option contract in the eighth quarter; Kg - price of option execution in the eighth quarter. Similarly, we obtain the values of the whole column in the period /=8. The negative values are not fixed, in such cases zero is selected.

To calculate the following periods it is necessary to calculate pseudo-probability valuesp and (I -p)\

p = (0,02411-0,01227)/(0,10668-0,01227) =0,12543;

1-p = 0,87457

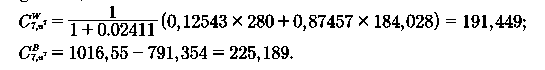

Using the data in Fig. 4, 5, by the first formula we calculate the greatest growth in the seventh quarter. In the situation of the greatest, seven-fold increase in the bitcoin rate:

The "burned" option is chosen as the largest of the two, because under the terms of the contract there is always the possibility of an early execution of the option. Accordingly, 225,198 is entered in the binomial table.

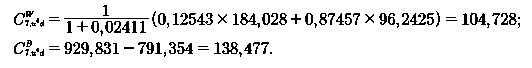

In the situation of a six-fold increase in the rate of bitcoin and the smallest growth in the bitcoin rate the following calculation will be made:

Similarly, the "burned" option is selected. Accordingly, 138,477 is entered in the binominal table

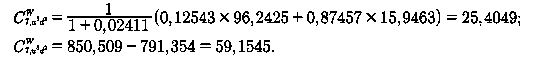

In case of a fivefold largest growth rate and a twofold smallest rate increase:

Similarly, the "burned" option is selected. Accordingly, 59,1545 is entered in the binominal table .

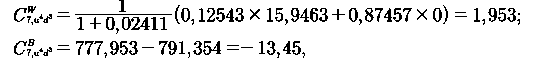

In case of the fourfold greatest growth rate and three times of the smallest growth:

The obtained value is less than 0, so max is selected i.e. 0. Therefore,

The "working" option is more expensive, therefore, it is chosen. In this situation it is better to wait. Accordingly, 1,953 is entered into the binominal table.

The other four situations in the seventh quarter do not need to be calculated, since option prices, which are also used to calculate prices in the sixth quarter, are zero. Similarly, the columns of the binominal tree (see Figure 5) are calculated according to quarters, beginning with the sixth. Each time options are calculated and a more expensive option is chosen - either "working" or "burned out".

Finally, at the beginning of the term:

This is the price of the real option in bitcoins as of the date of the contract’s conclusion. It should be noted that when calculating by half years, not by quarters, as in the case under investigation, input parameters of the model would change: in calculating the risk/risk-free rates it would be necessary to extract the root not of the fourth, but the second degree.

Fig. 4. Binominal tree of changes in the market price of the contract, bitcoin:

S1 - market price of the option contract at the end of each quarter; Kj - the price of execution of an option in each quarter;

The binary tree of price changes of a real option for eight quarters, bitcoin: Ctw- the price of the "working" option; Cb - price "burned" option

Step 4.4. Calculation of the net present value NPV of the project taking into account risks using the real option method with the use of the modified binomial model

It is important to note that the real net cost of the project taking into account risk (NPVro) has a positive value in comparison with the zero traditional one (NPVf) without taking into account the influence of the investigated risk factor. With formula (2) we find:

2,53539 =NPVro-0,

NPVro = 2,53539 bitcoin.

Step 4.5. Formularion of conclusions on quantitative risk assessment

The cost of a real option is the cost for additional research and developing an integrated financial and technological application. The practical value of calculations is that we found the points for choosing an optimal management solution W for FC “Fintech” regarding risk-taking. In these points the "working" option is more expensive and it is better to wait, not to exercise the option. In points B the "burned" option is more expensive, in this case it is better to exercise the option ahead of schedule, it has no more value.

The quantitative analysis of the risks of introducing financial technologies also provides an opportunity to determine the price of a real option on the date of the contract’s conclusion (in any case - for the moment). A valuable practical conclusion is the opportunity to resell the real option to another investor at a price taking into account quantitatively defined risk values.

Therefore, during the approbation of methodological recommendations in the work mode we identified the real options, then, using the advanced FMEA method we selected the most significant uncertainty factors. The risk of volatility of the bitcoin exchange rate, the risk of cybersecurity and the risk of introducing technologies for the Internet of tilings were identified as priorities. The existing risk at the macro level that bitcoin's volatility will affect the project of implementing a new banking application was estimated quarterly in monetary terms with the use of the real options method identifying the added value of the business depending on the made management decision regarding whether to execute a real option. The approbation of methodological recommendations in practice confirmed that the approach is correct, that its use really makes it possible to evaluate the influence of various factors on the company's value in the conditions when financial technologies are used.

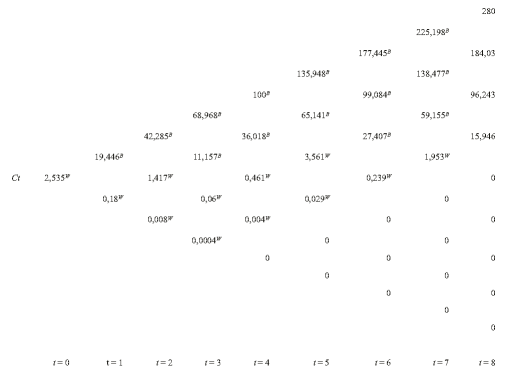

The generalization of the accumulated empirical material and the practical application of a set of improved evaluation methods made it possible to propose a methodology for quantifying the additional value of a business taking into account the impact of the implementation of new financial technologies (Figure 6).

Fig. 6. The final methodology for assessing the value of business taking into account the impact of specific risks of introducing financial technologies

At each stage of risk assessment documentation is prepared.

The cost of the business is estimated taking into account the impact of the risks of implementing new financial technologies on the company's market value. The methodology has the following features:

- identification of previously not covered risks and real options according to the developed algorithm at the initial stage, their preliminary analysis with Descartes square in order to understand the threats and the possible value of identified real options, a new way of ranking of the level of uncertainty;

- quantitative assessment of additional value of the business from the taking of a real option using an improved binominal model of the real options method.

For practicing appraisers the following characteristics of the methodology are valuable:

- low time expenditure;

- no need in special skills in applying the mathematical apparatus;

- transparency of calculations: an easy verification makes it possible to rank uncertainty, to more accurately quantify the added value of the business from taking a real option taking into account previously not covered risks of introducing modem financial technologies;

- the developed mechanism for the accounting of real options in assessing the company’s additional value in the conditions of implementation of modem financial technologies.

The materials of the research are used in practical activities of domestic and foreign companies engaged in the issues of financial technologies: JSC Intercom, EOS LLC, Eagle Rock Resources Group Ltd.

The results of the study on valuation of business are presented and practical recommendations are given that can be useful both narrow specialists in appraisal activity and to a wide range to narrow specialists in appraisal activity and to a wide range of managers who are trying to measure and then influence the value of their businesses in the conditions of implementation of financial technologies.

- the use of specific real options for assessing the additionalvalue of companies introducing new financial technologies;

- modularity’: for specific risks listed in the classification it is permissible to apply only identification and ranking; then the user will have a separate way of calculating the size of adjustment of discount rate for other specific risks in the case of applying classical methods of valuation of business.

If the shares of the company being valued are quoted on the stock market it is additionally proposed to use a comparative approach based on multipliers. We analyzed a number of multipliers, which are usually proposed for use by the leading domestic economists to evaluate companies [Eskindarov M.A., Fedotova M.A., 2016); Ivashkovskaya I.V., 2004], of which we selected the most suitable for use in a high-tech digital environment: the price of one share/book value, the price of one share/eamings per share, the value of the company/ profit before taxes, interest, all depreciation costs. It is also proposed to introduce and to use additional industry multipliers: company value/number of active customers, company value/number of transactions.

PRACTICAL SIGNIFICANCE

The practical significance of the research is that the obtained results can be used in the practice of assessing the value of companies’ business that are subject to the influence of modem financial technologies financial technologies. The results of the work can be used in practice if the valuation of the business is carried out both by the dd method classical methods of income approach and by the method of real options.

Of independent practical significance are:

- the identified specific risks of introducing modem financial technologies can be used by practicing appraisers and consulting companies;

- an algorithm for identifying and ranking specific risks, which allows to identify risks in companies implementing modem financial technologies;

- the author's method of calculating the discount rate with adjustments to the value of specific risks of financial technologies in assessing the business with the income approach in using the discounted cash flow method makes it possible to obtain a more accurate valuation of the company;

References

1. Абрамова М. А., Дубова С. Е., Звонова Е. А. и др. (2017) Основные направления единой государственной денежно-кредитной политики на 2017 г. и период 2018 и 2019 гг.: мнение экспертов // Экономика. Налоги. Право. Т. 10, № 1. С. 6–19.

2. Абрамова М. А., Гончаренко Л. И., Дубова С. Е. и др. (2017) Текущее состояние и перспективы развития финансовой системы России // Экономика. Налоги. Право. Т. 10, № 2. С. 6–21.

3. Бакулина А. А. (2015) Реальный капитал как объект оценки // Экономика и предпринимательство. № 11-1 (64-1). С. 785–788.

4. Брейли Р., Майерс С. (2009) Принципы корпоративных финансов. М.: ЗАО «Олимп-бизнес». 1008 с.

5. Бусов В. И. (2007) Сущность и место управления стоимостью в управлении компанией // Вопросы оценки. № 4. С. 10–18.

6. Грязнова А. Г., Федотова М. А. (2009) Оценка бизнеса. 2-е изд., перераб. и доп. М.: Финансы и статистика. 736 с.

7. Гусев А.А. (2009) Реальные опционы в оценке бизнеса и инвестиций. М.: ИД Риор. 118 с.

8. Дамодаран А. (2017) Инвестиционная оценка. Инструменты и методы оценки любых активов. М.: Альпина паблишер. 815 с.

9. Демьянова Е. А. (2017а) Актуальные вопросы идентификации рисков и специфических реальных опционов при оценке стоимости бизнеса в условиях внедрения новых финансовых технологий // Банковское право. № 6. С. 47–52.

10. Демьянова Е. А. (2017б) Критерии оценки рисков развития компаний в условиях внедрения финансовых технологий // Финансы: теория и практика. Т. 21, № 4. С. 182–190.

11. Демьянова Е. А. (2017в) Развитие компаний в современных условиях внедрения финансовых технологий // Имущественные отношения в Российской Федерации. № 7. С. 104–113.

12. Достов В. Л., Шуст П. М. (2017) Новые европейские технические стандарты по усиленной аутентификации и открытым API – основные положения и актуальные проблемы // Банковское дело. № 7. С. 48–52.

13. Достов В. Л., Шуст П. М., Козырева А. Д. (2017) Новые концепции в осуществлении процедур идентификации // Эффективное Антикризисное Управление. № 6. С. 16–21.

14. Достов В.Л., Шуст П.М., Рябкова Е. С. (2016) Институт «регулятивных песочниц» как инструмент поддержки финансовых инноваций // Деньги и кредит. № 10. С. 51–56.

15. Ивашковская И. В. (2004) Управление стоимостью компании: вызовы российскому менеджменту // Российский журнал менеджмента. Т. 2, № 4. С. 113–135.

16. Козырь Ю. В. (2009) Стоимость компании: оценка и управленческие решения. 2-е изд., перераб. и доп. М.: Альфа-Пресс. 372 с.

17. Коупленд Т. (2005) Стоимость бизнеса: оценка и управление / Пер. с англ. М.: Олимп-бизнес. 569 с.

18. Курс на финтех. Перспективы развития рынка в России (2018) // Ernst&Young. URL: http://www.ey.com/Publication/vwLUAssets/EY-focus-on-fintech-russian-market-growth-prospects-rus/$File/EY-focus-on-fintech-russian-market-growth-prospects-rus.pdf.

19. Лаврушин О. И. (2017) Риски банковских технологий и облик банка // Банковское право. № 4. С. 33–35.

20. Лосева О. В. (2011) Оценка человеческого интеллектуального капитала региона (на примере ПФО). Пенза: Пензенский гос. пед. ун-т. 116 с.

21. Лукасевич И. Я., Львова Н. А. (2017) Концепция стабильности компаний и направления ее развития // Менеджмент и бизнес-администрирование. № 4. С. 144–155.

22. Лыков А. А., Сидоренко Э. Л. (2017) Подходы к правовому определению криптовалют в российском праве // Вестник Северо-Кавказского гуманитарного института. № 1(21). С. 263–266.

23. Маслеников В. В., Федотова М. А., Сорокин А. Н. (2017) Новые финансовые технологии меняют наш мир. // Вестник Финансового университета. Т. 21, № 2. С. 6–11.

24. Набиуллина Э. С. (2017) Выступление на XXVI Международном финансовом конгрессе 13 июля 2017 года // Вестник Банка России. № 57. С. 2–9.

25. Найт Ф. (2003) Риск, неопределенность и прибыль / Пер. с англ. М.: Дело. 360 с.

26. Недосекин А. О. (2003) Методические основы моделирования финансовой деятельности с использованием нечетко-множественных описаний. Дис. … д-ра экон. наук. СПб. 302 с.

27. Основные направления развития финансовых технологий на период 2018–2020 годов (2018) // Банк России. URL: http://www.cbr.ru/Content/Document/File/35816/ON_FinTex_2017.pdf.

28. Путин В. В. (2014) Послание Федеральному собранию // Президент России. URL: http://www.kremlin.ru/events/president/news/47173.

29. Распоряжение Правительства РФ от 28.07.2017 № 1632-р «Об утверждении программы «Цифровая экономика Российской Федерации»» // Консультант Плюс. URL: http://www.consultant.ru/document/cons_doc_LAW_221756/2369d7266adb33244e178738f67f181600cac9f2/.

30. Рубцов Б. Б., Анненская Н. Е. (2017) Влияние информационных технологий на качество современного финансового рынка // Банковские услуги. № 12. С. 14–23.

31. Рудакова О. С. (2017) Информационно-технологическое отставание банковского сектора как фактор риска // Наука и практика. № 2(26). С. 48-57.

32. Ручкина Г. Ф. (2017) Банковская деятельность: переход на новую модель осуществления, или «Финтех» как новая реальность // Банковское право. № 4. С. 55-62.

33. Тазихина Т. В., Сычева Е. А. (2017) Нематериальные активы и их стоимость в различных системах финансовой отчетности // Имущественные отношения в Российской Федерации. № 4 (187). С. 53–59.

34. Трачук А. В., Голембиовский Д. Ю. (2012) Перспективы распространения безналичных розничных платежей // Деньги и кредит. № 7. С. 24–32.

35. Трачук А. В., Линдер Н. В. (2017а) Инновации и производительность российских промышленных компаний // Инновации. № 4 (222). С. 53–65.

36. Трачук А. В., Линдер Н. В. (2017б) Инновации и производительность: эмпирическое исследование факторов, препятствующих росту, методом продольного анализа // Управленческие науки. Т. 7, № 3. С. 43–58.

37. Трачук А. В., Линдер Н. В. (2017в) Перспективы применения мобильных платежных сервисов в России: теоретический подход к пониманию факторов распространения // Вестник факультета управления СПбГЭУ. № 1-1. С. 322–328.

38. Трачук А.В., Линдер Н. В. (2017г) Распространение инструментов электронного бизнеса в России: результаты эмпирического исследования // Российский журнал менеджмента. Т. 15, № 1. С. 27–50.

39. Трачук А. В., Линдер Н. В., Антонов Д. А. (2014) Влияние информационно-коммуникационных технологий на бизнес-модели современных компаний // Эффективное Антикризисное Управление. № 5. С. 60–69.

40. Трачук А. В., Линдер Н. В., Убейко Н. В. (2017) Формирование динамических бизнес-моделей компаниями электронной коммерции // Управленец. № 4. С. 61–74.

41. Трифонов Ю. В., Кошелев Е. В., Купцов А. В. (2012) Российская модель метода реальных опционов // Вестник Нижегородского университета им. Н.И. Лобачевского. Экономические науки № 2 (1). С. 238–243.

42. Федеральный закон от 29.07.1998 № 135-ФЗ «Об оценочной деятельности в Российской Федерации» // Консультант плюс. URL: http://www.consultant.ru/document/cons_doc_LAW_19586/.

43. Хитчнер Дж. (2008) Три подхода к оценке стоимости бизнеса. М.: Маросейка. 307 c.