Scroll to:

FORMATION OF A CONCEPTUAL MODEL OF SUSTAINABLE DEVELOPMENT OF THE ORGANIZATION: STRATEGY AND DEVELOPMENT PROSPECTS

https://doi.org/10.17747/2618-947X-2022-3-226-233

Abstract

The purpose of this article is to identify possible approaches to the development of an Organizational sustainability conceptual model and to present this model for discussion by the expert community. To achieve this goal, the author suggests defining the structure and description of individual elements of sustainability, as well as establishing the relationship between them. The sustainability model will serve as a conceptual basis for the development of international and national standards aimed at certain aspects of organizational sustainability, will assist organizations in developing and implementing sustainability strategies and goals, managing ESG factors and associated risks and opportunities, as well as preparing non-financial reporting.

For citations:

Vorobyev A.A. FORMATION OF A CONCEPTUAL MODEL OF SUSTAINABLE DEVELOPMENT OF THE ORGANIZATION: STRATEGY AND DEVELOPMENT PROSPECTS. Strategic decisions and risk management. 2022;13(3):226-233. https://doi.org/10.17747/2618-947X-2022-3-226-233

-

Standardisation of sustainable development in Russia

Since 2021, the topic of sustainable development and the ESG agenda has begun to gain popularity in Russia: forums and conferences are held, various information materials appear in print media and on the Internet. However, in the author's opinion, there is a lack of a conceptual standardised approach to activities in the field of sustainable development and ESG.

The term "ESG factors" appeared in the report "Who cares wins. Connecting financial markets to a changing world”, prepared in 2004 under the auspices of the UN Global Compact at the request of UN Secretary-General Kofi Annan. ESG factors (Environmental, Social and Governance factors) are factors related to the environment (including environmental and climate change factors, E), society (social factors, S) and corporate governance factors (G). Sustainable development in a global context is understood as development that meets the needs of the present without compromising the ability of future generations to meet their own needs [Bank of Russia Information Letter No. IN-06-28/96.., 2021].

Russia has never sit on the sidelines from global processes towards the standardisation of sustainable development. Suffice it to say that already more than 10 years ago, namely on June 19, 2012, the Technical Committee for Standardsation "Sustainable Development" (TC 115) was formed, until April 2022 it was called "Sustainable Development of Administrative -Territorial Entities".

On April 5, 2022, the Federal Agency for Technical Regulation and Metrology (Rosstandart) issued Order No. 866 “On organising the activities of the technical committee for standardisation “Sustainable Development””. This order approved the structure of the committee, which includes subcommittees SC 1 "Sustainable cities and communities" and SC 2 "Sustainable organisations" [Order of the Federal Agency.., 2022].

During 2012-2021, the focus of the committee's activities was shifted to the sustainable development of cities and communities, and the concept of sustainable development of organisations received little attention. At the meeting of TC 115 "Sustainable Development" on July 7, 2022, proposals were considered for the development of the activities of TC 115 and the development of national standards, including the management system for the sustainable development of organisations, indicators and their evaluation, reporting on the achievement of sustainable development goals, sustainable supply chain management.

Before proceeding with the development of standards aimed at certain aspects of sustainable development of organisations, it seems appropriate to develop and submit for discussion by the expert community a conceptual model of sustainable development of an organisation.

-

Purpose and structure of the sustainable development model

The conceptual model is a description of the structure and objects, as well as the relationships between them. The model facilitates understanding of the principles of sustainable development and ESG, serves as a basis for the development and implementation of the sustainable development strategy and goals, management of ESG factors and associated risks and opportunities, as well as the preparation of non-financial reporting.

The following elements should be included in the organisation's sustainable development model:

- The structure and functions of the company's management, including management bodies, structural divisions, resources, powers (in relation to ESG).

- Strategy for sustainable development.

- Goals of sustainable development.

- Key financial and non-financial performance indicators and metrics.

- Sustainable development projects (including green, adaptive, social).

- Programs, plans and activities in the field of sustainable development.

- Risk management system, including consideration of ESG factors, risks and opportunities.

- The system for ensuring the continuity of the organisation's activities, including incident management, analysis and prevention of consequences, contingency plans.

- Interaction with stakeholders and ensuring compliance with the requirements for the company's activities.

- Internal control, compliance, internal audit.

- Non-financial reporting, including assessment of the impact of the company's activities on ESG factors and the impact of ESG factors on the company.

- Working with suppliers and accounting for greenhouse gas emissions - direct and indirect (carbon footprint).

Aspects of sustainable development and ESG factors should also be taken into account in:

- the organisation's operations, including management procedures and practices, business processes, plans and activities;

- system of incentives and remuneration of personnel;

- supply chain management.

-

Individual elements of the sustainable development model

- The structure and functions of the company's management, including management bodies, structural divisions, resources, powers (in relation to ESG)

ESG factors and sustainable development issues should be taken into account already at the stage of formation of governing bodies. Many companies form a sustainable development committee under the board of directors, introduce new structural units, such as the chief sustainability officer (CSO), the sustainable development department, etc.

The relevant management bodies and structural units should have the necessary competencies, resources and powers to implement the ESG principles, assess risks and opportunities, make decisions, and allocate resources.

It is recommended to document the responsibility and authority in the organisation in terms of sustainable development and ESG, which can be done both by developing new documents and by amending existing ones. Such documents can be:

- concept or business model of sustainable development;

- documents that form the ESG corporate culture, such as sustainability policy, corporate governance code, personnel policy;

- system of incentives, evaluation of results and remuneration of personnel;

- communication procedures (internal and external interaction) on ESG issues;

- procedures for taking into account ESG factors and associated risks and opportunities;

- control procedures;

- procedures for preparing non-financial reporting.

It is necessary to organise regular review by management bodies of plans and reports on the implementation of ESG principles and functions, while taking into account both quantitative criteria and qualitative assessments.

- Strategy for sustainable development

To take into account all elements of sustainable development, it is recommended to form (or update) the company's business model covering the mission, strategy, business processes and procedures, taking into account ESG factors. The sustainable development strategy itself can be both a separate document and a block as part of a corporate strategy dedicated to ESG and sustainable development issues.

The influence of ESG factors, risks and opportunities on the company's strategy, plans and development scenarios should be taken into account. It is desirable to provide for this in all available blocks of the strategy (product, portfolio, regional, industry, operational), taking into account the appetite for accepted risks and the quality of the risk management system.

The strategic decisions made on the management of activities, taking into account ESG factors, must be specified in the planned performance indicators of departments and employees, in conjunction with the incentive and remuneration system, with reflection in accounting and reporting.

- Sustainable Development Goals

Strategic decisions in the field of ESG must be specified in the performance targets of departments and employees, followed by monitoring and reporting on the implementation of plans.

The company's sustainable development goals should be linked with the Sustainable Development Goals (UN SDGs), the goals of the Paris Climate Agreement, and the national goals enshrined in state strategic planning documents. The sustainable development goals need to be linked to business processes, projects and activities.

- Key financial and non-financial performance indicators and metrics

It is necessary to develop and link indicators that reflect the participation of divisions and personnel of the company in achieving corporate sustainable development goals, progress in ESG development, indicators of ESG risks and opportunities, direct and indirect emissions, and other significant indicators.

It is important to establish metrics and formulas for calculating indicators, organise the management of financial and non-financial performance indicators, analyse their dynamics, and regularly assess the compliance of performance results with the planned key indicators.

- Sustainable development projects (including green, adaptive, social)

It is important to organise the accounting of projects in the field of sustainable development, the formation of a register of sustainable projects of the company. When initiating and launching projects, it is necessary to correlate them with the criteria of green, adaptation, social projects (based on the relevant taxonomies), and also adhere to the principles of responsible investment.

The definition of green and adaptation projects is established by the goals and main directions of sustainable development of the Russian Federation (approved by the Decree of the Government of the Russian Federation dated July 14, 2021 No. 1912-r) [Government Decree .., 2021], the criteria for green and adaptation projects are approved by the Decree of the Government of the Russian Federation dated September 21 .2021 No. 1587. The specified resolution defines the areas of activity in which green projects can be implemented: waste management, energy, construction, industry, transport and industrial equipment, water supply and sanitation, natural landscapes, rivers, water bodies and biodiversity, agriculture. There are six areas for adaptation projects: waste management, energy, sustainable infrastructure, industry, transport and industrial equipment, and agriculture [Government Decree.., 2021].

For each of the areas of activity, specific qualitative and quantitative criteria for project compliance have been developed, allowing them to be classified as green or adaptive. Among the criteria, much attention is paid to compliance with resource and energy efficiency indicators according to information and technical reference books on the best available technologies.

The taxonomy of social projects, which VEB.RF is developing jointly with the Ministry of Economic Development of the Russian Federation, should be adopted by the end of 2022. The taxonomy project contains 10 main areas for the implementation of social projects: health care, education, employment, affordable housing, sports, culture, art and tourism, food availability, infrastructure.

- Programs, plans and activities in the field of sustainable development

The sustainable development agenda needs to be integrated into the daily activities of all involved departments and ensure their interaction on ESG issues.

There should be clear procedures for the formation, coordination and approval of programs and plans, setting goals (measures) in the field of sustainable development and monitoring their implementation with an assessment of effectiveness.

- Risk management system, including consideration of ESG factors, risks and opportunities

Let's define ESG risks (opportunities) based on [Vysokov, 2021]: these are environmental, social or management events or conditions that can have a significant impact (negative or positive) on the assets, financial position, profit and reputation of the company. For environmental risks, it is recommended to use the more precise term “climate and environmental risks”, which are subdivided into physical risks and transitional risks.

ESG risks are grouped in the following areas:

E - climate and environmental risks, including physical risks: catastrophes (hurricanes, floods, fires, heat waves), chronic changes (temperature changes, sea level rise, reduction of water resources, loss of biodiversity and changes in land productivity and soils), transitional risks (legislative changes, technological progress, changes in consumer behavior, prices, tariffs, taxes, regulation of a low-carbon economy);

S - social risks, including the impact of changes in social proportions (equality, health, safety, labor relations, migration, communities), the quality and safety of the products, services and working conditions provided;

G - managerial risks, including the procedures for making managerial decisions (subordination, fairness, honesty, transparency, rights, obligations, remuneration of managers) [Vysokov, 2021].

The company should have procedures for identifying, managing and controlling ESG risks: it is desirable that they could be integrated into the overall risk management system, but they can be separate, and their interaction with other risks will need to be taken into account.

It is necessary to organise the identification and accounting of ESG factors, ensure their integration into the company's business model and mechanisms for the relationship of ESG factors with risks and opportunities. Relationships of risks and opportunities with the company's operations (business processes), projects, products (services), supply chain, relationships with counterparties should be established.

It is necessary to develop mechanisms for assessing the impact of the company's activities on the environment (including the climate), the social sphere (including the observance of human rights) and the economy. On a regular basis, the impact of ESG risks on the current operating activities of the company and future investment projects should be assessed and analysed, ESG risks and opportunities should be assessed and reassessed, and a strategy for managing them should be determined. Convenient tools include ESG risk dashboards and interactive ESG risk reports.

- System for ensuring the continuity of the organisation's activities, including incident management, analysis and prevention of consequences, contingency plans

The company must implement a mechanism for identifying potential events (incidents) that can lead to business disruption, material or other losses, emergency or crisis.

Business continuity plans and procedures need to be in place to capture past incidents and minimise their impact, including timely disaster recovery of physical assets, IT systems, personnel security and work environment.

It is recommended to create in advance templates for contingency plans and responses to unforeseen events that cannot be predicted and prevented, but which need to be promptly responded to, including a structured exchange of information with emergency services and a list of restoration work.

- Stakeholder Engagement and Ensuring Company Compliance

It is necessary to organise the identification and accounting of mandatory requirements for the company's activities (which include legislative, regulatory, regulatory) and obligations voluntarily accepted by the company. Voluntary standards include international, national and industry standards, standards in the field of sustainable development and corporate governance, standards in the field of environmental protection, energy efficiency, health and safety, social responsibility, quality management.

It will be useful for the company to maintain a database of internal and external documents containing ESG requirements. It is important not only to identify the various environmental, social and governance aspects of the company's activities, but also to establish the relationship between them, as well as with the financial and non-financial performance of the company.

- Internal control, compliance, internal audit

Compliance should monitor and control compliance with the requirements of stakeholders, internal control services check the accounting of ESG factors, the implementation of established control procedures. Internal audit checks how ESG risks and opportunities are managed, and makes proposals for revising the organisational structure and specific functions. Mechanisms for fixing inconsistencies (violations) and conducting analysis, developing corrective measures and monitoring their implementation should be put into practice.

- Non-financial reporting, including assessment of the impact of the company's activities on ESG factors and the impact of ESG factors on the company

The results of the company's work on the implementation of environmental, social and managerial responsibility should be reflected in the financial statements and non-financial information for stakeholders.

Interested parties in obtaining ESG reporting are shareholders, investors, customers, partners, employees, the media, social groups, professional and scientific circles. Along with general questions, each of the stakeholders pays attention to specific aspects of ESG reporting.

ESG reporting should disclose information on environmental, social and governance issues, compliance with regulatory requirements and legislation necessary to understand the development and the business model used.

ESG reporting should be: Substantial, Reliable, Balanced (include positive as well as negative facts), Clear, Comprehensive but concise, Forward looking, Stakeholder oriented, Consistent, Comparable and Accessible (one click maximum).

ESG reporting allows you to more reasonably formulate a strategy, monitor and manage ESG risks based on a broad dialogue with stakeholders, and strengthen social reputation [Practical recommendations.., 2021].

Non-financial reporting should show, on the one hand, the extent of the organisation's impact on the environment (including the climate), the social sphere (including the observance of human rights) and the economy; on the other hand, how the organisation takes into account the impact of ESG factors and associated risks and opportunities on the organisation’s performance, its development and market position [Bank of Russia Information Letter No. IN-06-28/49.., 2021].

When setting up an ESG reporting system, you can be guided by the recommendations of the World Business Council for Sustainable Development (WBCD), methods of rating agencies and regulatory standards (decrees of the Government of the Russian Federation, recommendations of the Bank of Russia, SASB, GRESB, CDP, GRI, EU Taxonomy Regulation, etc.).

This process will be greatly facilitated by automated systems that generate reports using predefined templates that include relevant ESG data and information. Collecting and presenting ESG data to internal and external stakeholders can be done using a library of generic and custom ESG metrics and built-in analytics. It will be useful for corporate governance bodies and stakeholders to visualise the impact of ESG factors on the management system, strategy, risk management, results achieved and the system of indicators used.

- Working with suppliers and accounting for direct and indirect greenhouse gas emissions (carbon footprint)

It is necessary to organise a record of the suppliers (contractors, performers) involved in the supply chain in the context of the company's products (services) with the identification of the ESG risks and opportunities associated with them.

It is recommended to evaluate the sustainability practices and ESG of partners, suppliers and sub-suppliers (including from the point of view of their potential harm to the environment, including their carbon footprint) and plan actions to eliminate the risk they pose to the company. Mechanisms should be implemented to account for greenhouse gas emissions - direct and indirect, for calculating the carbon footprint both for the company as a whole and for the products (services) produced by the company along the entire supply chain.

-

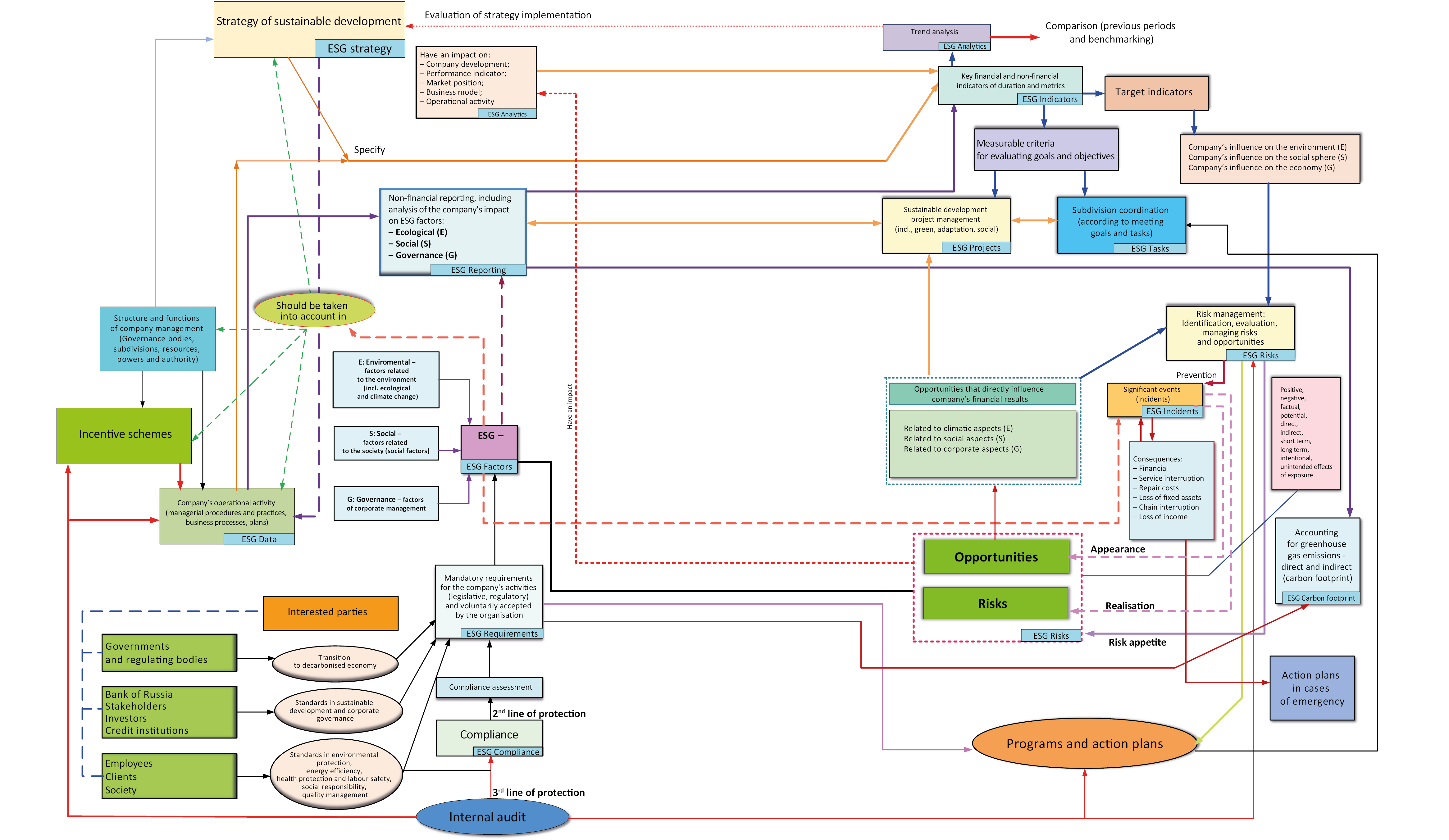

Visualisation of the conceptual model of sustainable development

For a better understanding of the conceptual model of sustainable development, it is necessary not only to give a list of its structural elements with their brief description, as was done above, but also to display the relationship and interaction between these elements. Thus, we get a visual representation of the conceptual model of sustainable development of the organisation (see Figure).

Let it be hoped that the model presented by the author will help companies understand and structure their activities in the areas of sustainable development and ESG, organise joint work of staff and manage ESG data, generate reports and share their success in the field of sustainable development with stakeholders. The next step is to build an integrated platform for managing sustainable development and ESG in order to quickly take into account the impact of ESG factors on the results of the company's financial and economic activities, as well as the impact that the company's activities have on the environment, social sphere and economy.

References

1. Vysokov V.V. (2021). Flexible digitalization of ESG banking: A scientific and practical guide. Rostov-on-Don, Rostov State University of Economics. (In Russ.)

2. Information letter of the Central Bank of the Russian Federation No. IN-06-28/49 dated July 12, 2021 “On recommendations for public joint-stock companies to disclose non-financial information related to the activities of such companies” (2021). (In Russ.)

3. Information letter of the Central Bank of the Russian Federation No. IN-06-28/96 dated December 15, 2021 “On recommendations for the board of directors (BoD) of a public joint-stock company to take into account ESG factors, as well as sustainable development issues” (2021). (In Russ.)

4. Decree of the Government of the Russian Federation dated September 21, 2021 No. 1587 “On Approval of Criteria for Sustainable (including Green) Development Projects in the Russian Federation and Requirements for the System for Verification of Sustainable (including Green) Development Projects in the Russian Federation” (2021). http://static.government.ru/media/files/3hAvrl8rMjp19BApLG2cchmt35YBPH8z.pdf. (In Russ.)

5. Practical recommendations of the banking community on the implementation of ESG banking in Russia (2021). https://asros.ru/upload/iblock/160/PRAKTICHESKIE-REKOMENDATSII-BANKOVSKOGO-SOOBSHCHESTVA-PO-VNEDRENIYU-ESG_BANKINGA-V-ROSSII.pdf. (In Russ.)

6. Order of the Federal Agency for Technical Regulation and Metrology dated April 5, 2022 No. 866 “On organizing the activities of the Standardization Technical Committee ‘Sustainable Development’” (2022). https://law.tks.ru/document/705923. (In Russ.)

7. Decree of the Government of the Russian Federation dated July 14, 2021 No. 1912-r “On approval of the goals and main directions of Sustainable (including green) Development of the Russian Federation” (2021). https://legalacts.ru/doc/rasporjazhenie-pravitelstva-rf-ot-14072021-n-1912-r-ob-utverzhdenii/. (In Russ.)

About the Author

A. A. VorobyevRussian Federation

Managing partner of FINEX Consulting Group (Ekaterinburg, Russia); member of the Technical Committee ISO/TC 279 “Innovation Management”; member of TC 115 “Sustainable Development”, PC 2 “Sustainable organizations”. Research interests: business models of organizations, business process management, risk management, sustainable development, innovation management, quality management, energy efficiency management.

Review

For citations:

Vorobyev A.A. FORMATION OF A CONCEPTUAL MODEL OF SUSTAINABLE DEVELOPMENT OF THE ORGANIZATION: STRATEGY AND DEVELOPMENT PROSPECTS. Strategic decisions and risk management. 2022;13(3):226-233. https://doi.org/10.17747/2618-947X-2022-3-226-233